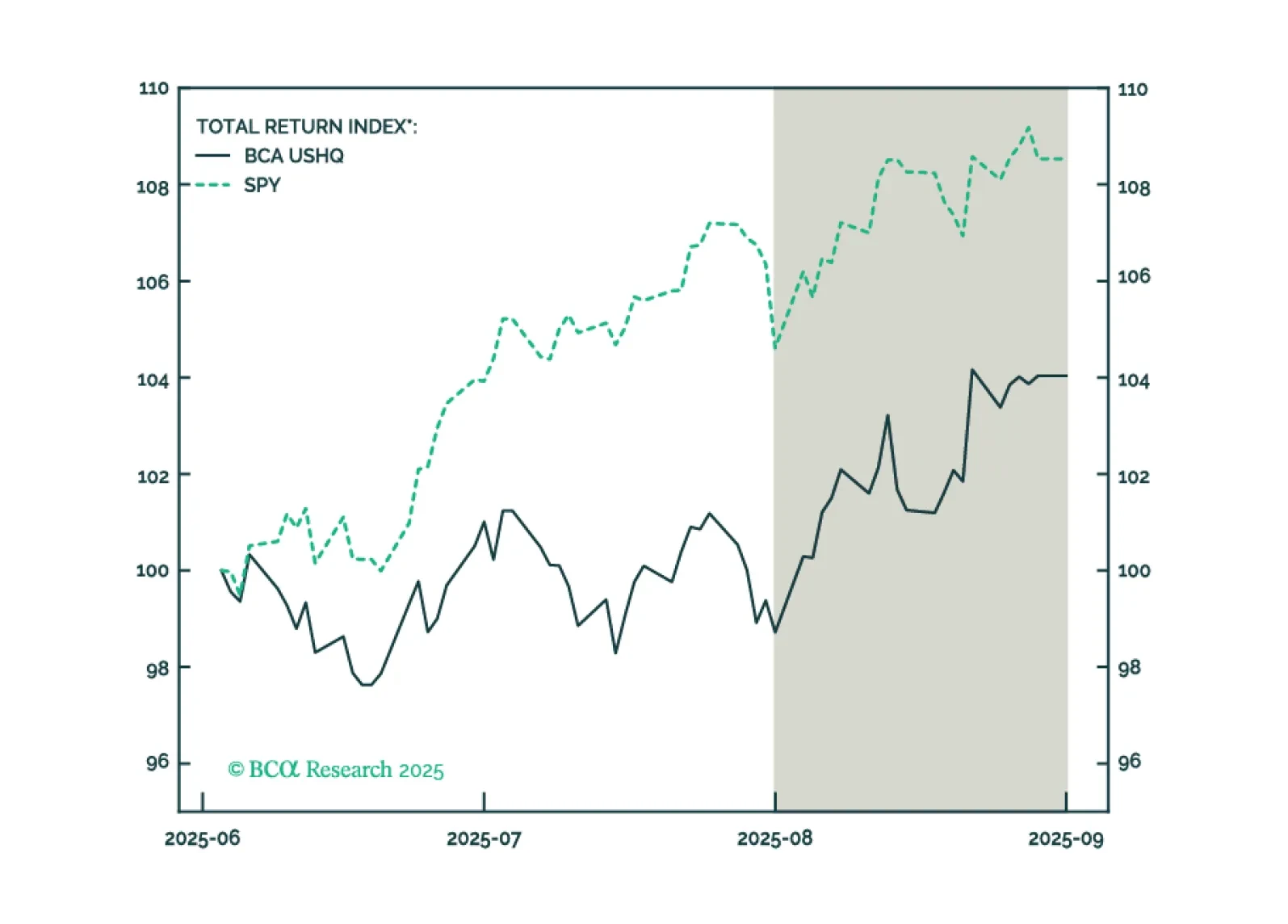

The US High Quality (USHQ) portfolio outperformed its benchmark through August, returning 5.39%, whilst its SPY benchmark returned 3.75%. On a trailing three-month basis, the USHQ portfolio’s performance was weaker than the benchmark…

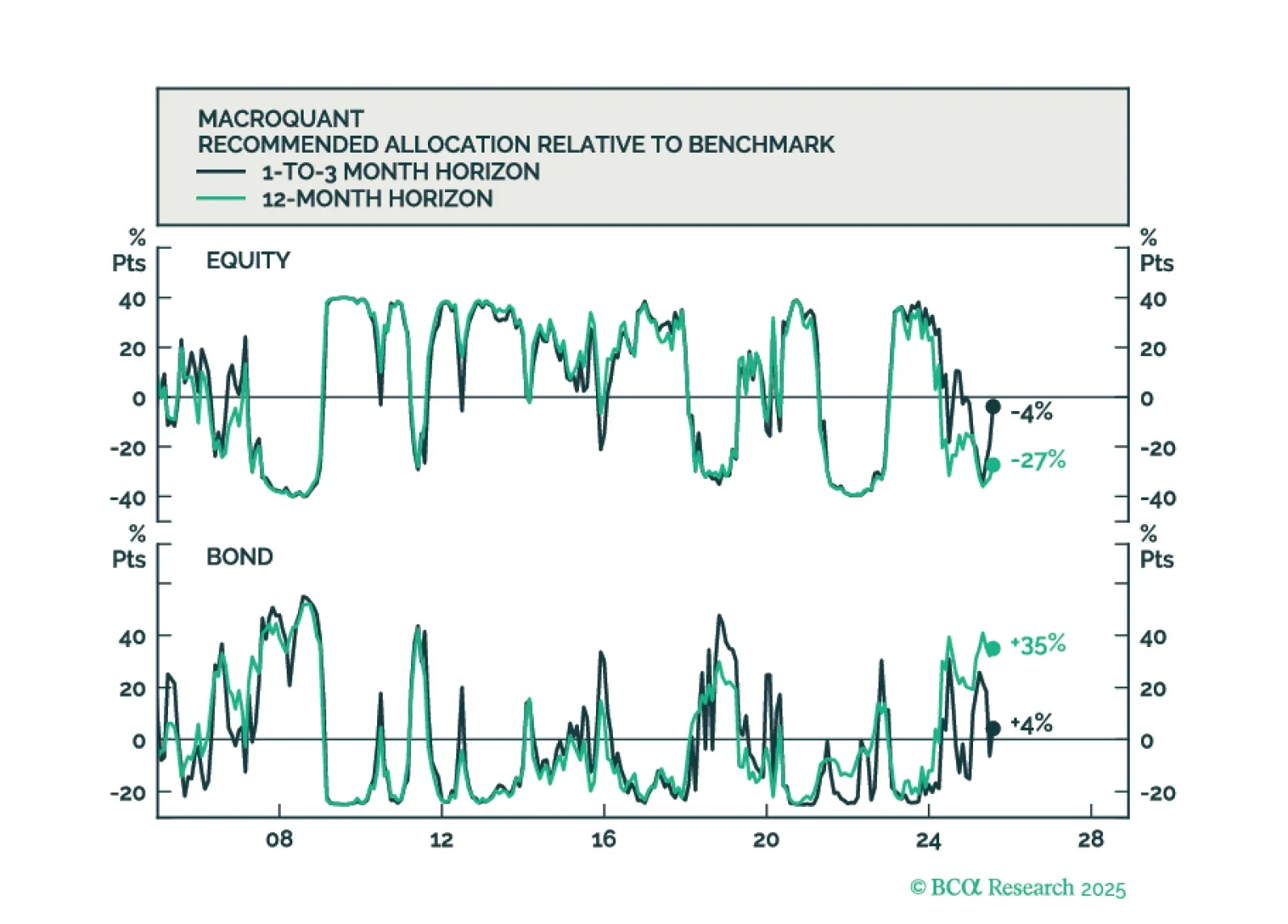

MacroQuant sees downside risks to stocks over a long-term horizon but is not yet saying that we are at imminent risk of an equity bear market.

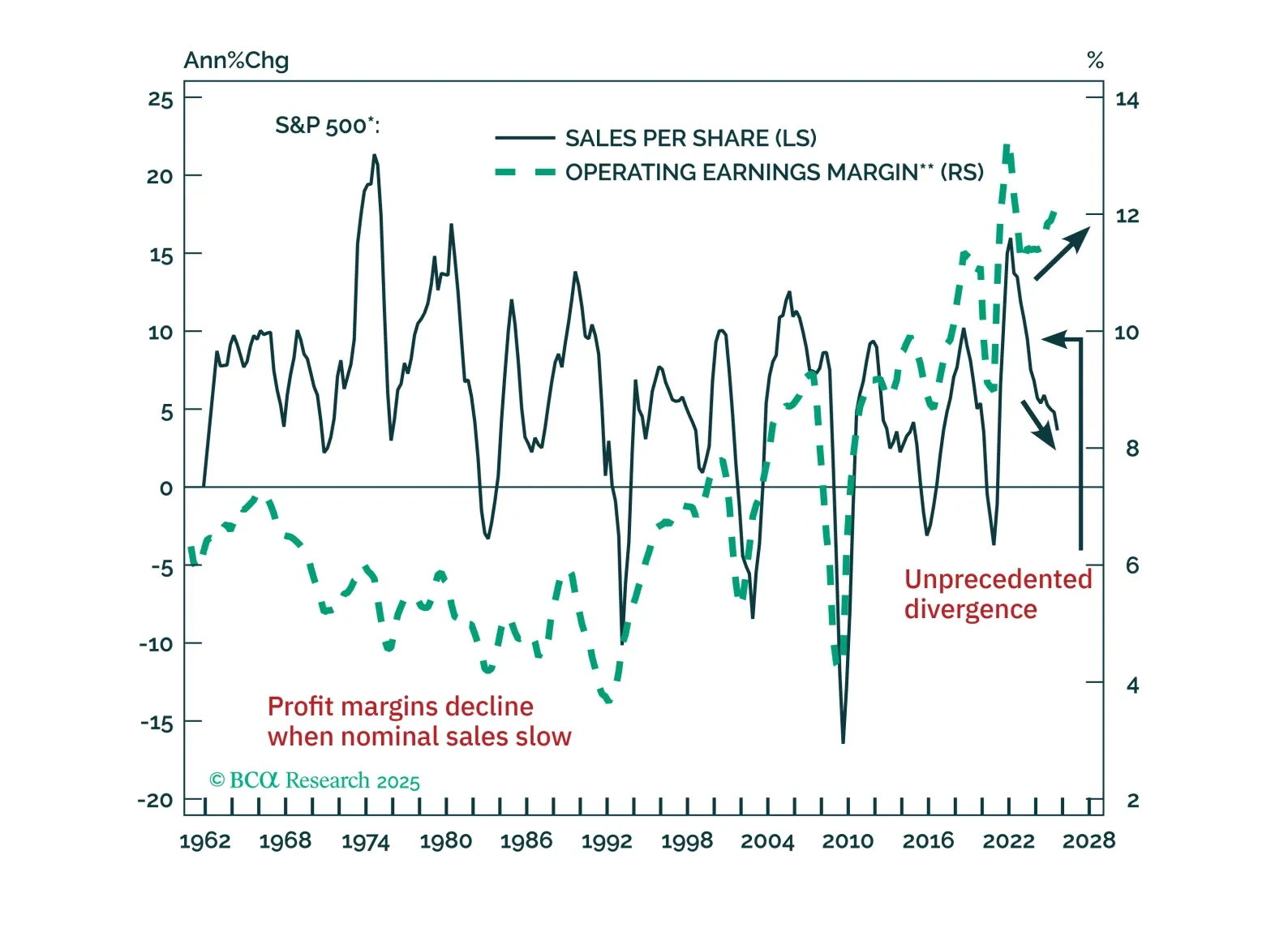

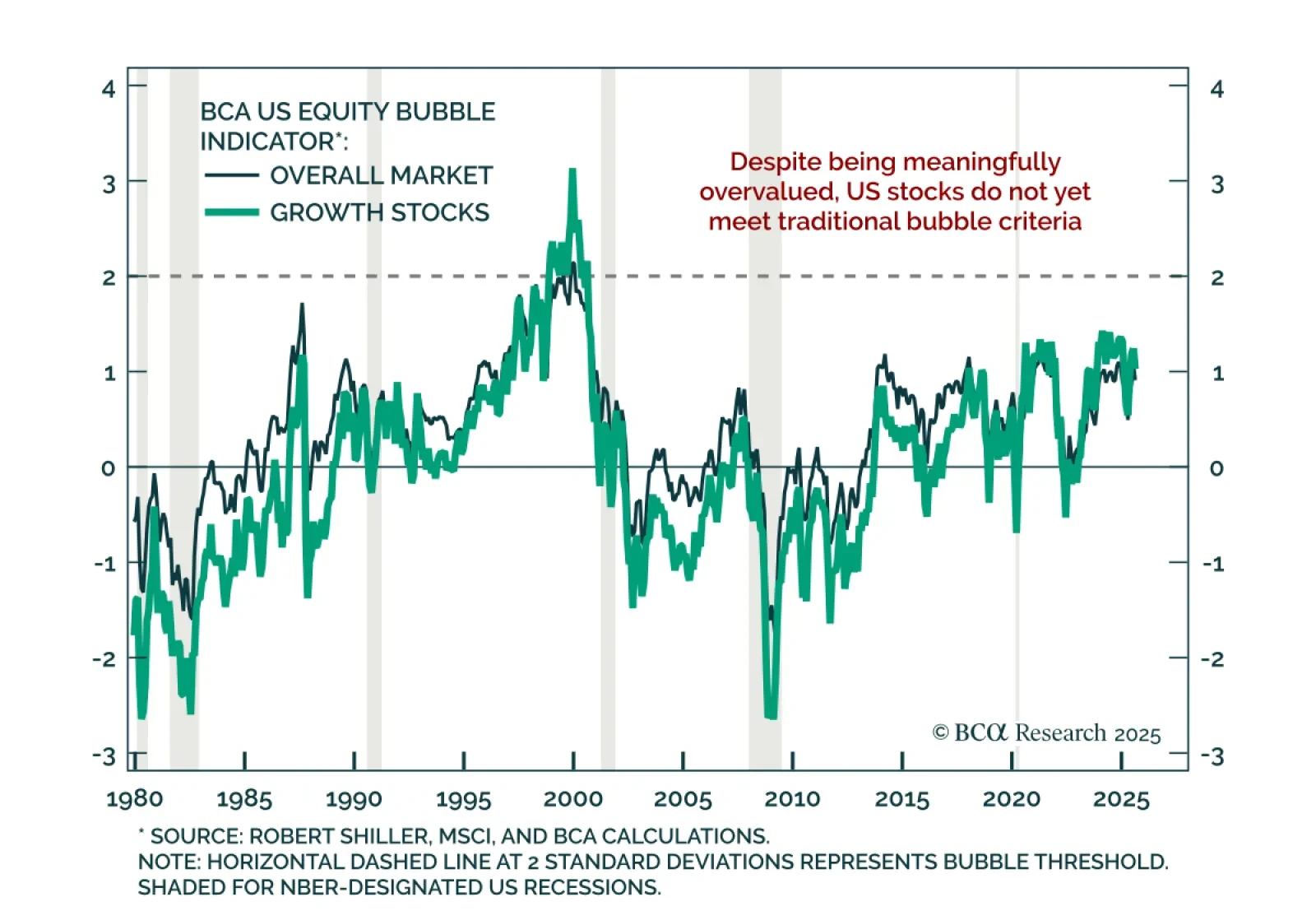

US equities remain significantly overvalued but fall short of classic bubble conditions. Our Chart Of The Week comes from Jonathan LaBerge, Chief Strategist of our Special Reports Unit.As the S&P 500 flirts with all-time highs,…

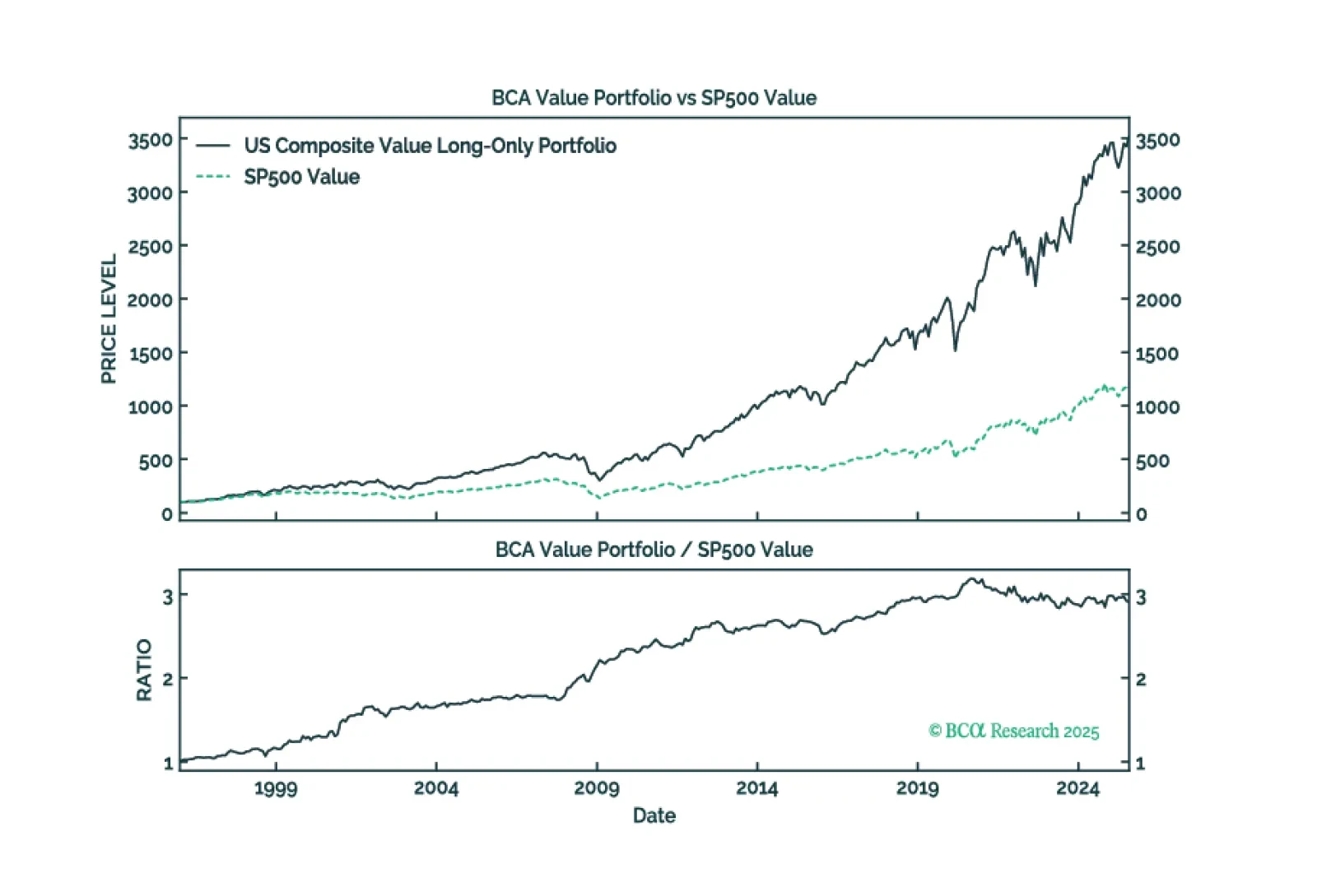

Commercial indices’ limitations have made Value a fertile ground for stock pickers. Our Composite Value model has shown promise in circumventing these flaws and capturing alpha.

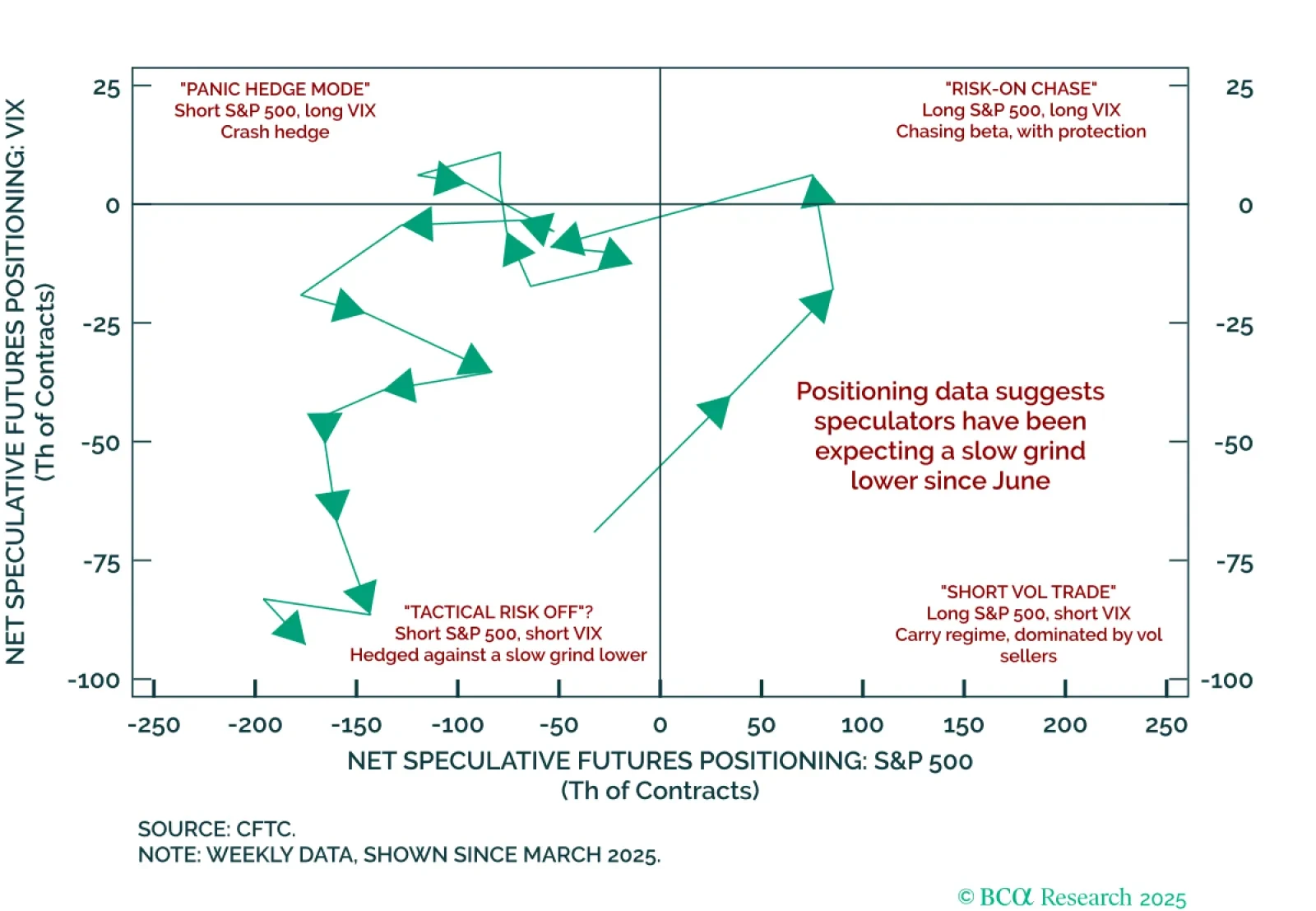

Volatility has fallen to 2025 lows even as positioning data show caution despite the S&P 500’s steady rebound. US equities have climbed back to all-time highs with minimal drawdown, steadily compressing realized…

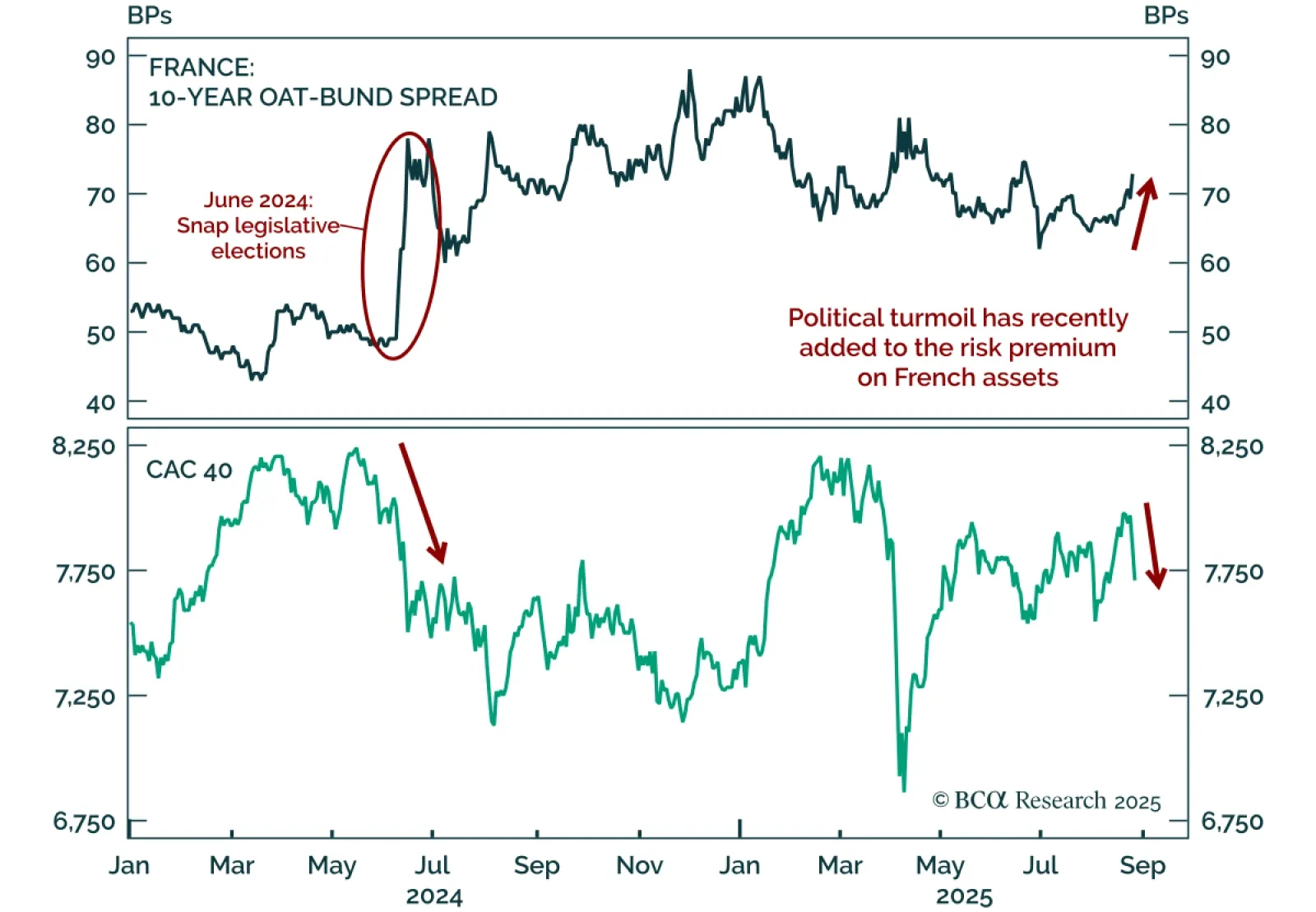

France’s renewed political turmoil highlights fiscal risks for OATs, but creates opportunities to buy French equities on dips. PM Bayrou has called a September 8 confidence vote over his deficit-cutting budget proposals,…

The post-Liberation Day rally has broadened, reducing skepticism and strengthening the case for US outperformance versus Europe. The S&P 500’s climb to all-time highs has been unusually smooth, compressing realized…

Our Global Investment strategists caution that AI’s economic impact remains limited, and investor patience may wane before fundamentals catch up to valuations. While AI has dominated equity narratives in recent years, its…

US housing data remain weak, reinforcing a fragile growth backdrop and the need for equity downside protection. July housing starts rose 5.2% m/m (annualized), but building permits fell 2.8% following a small June decline. The…