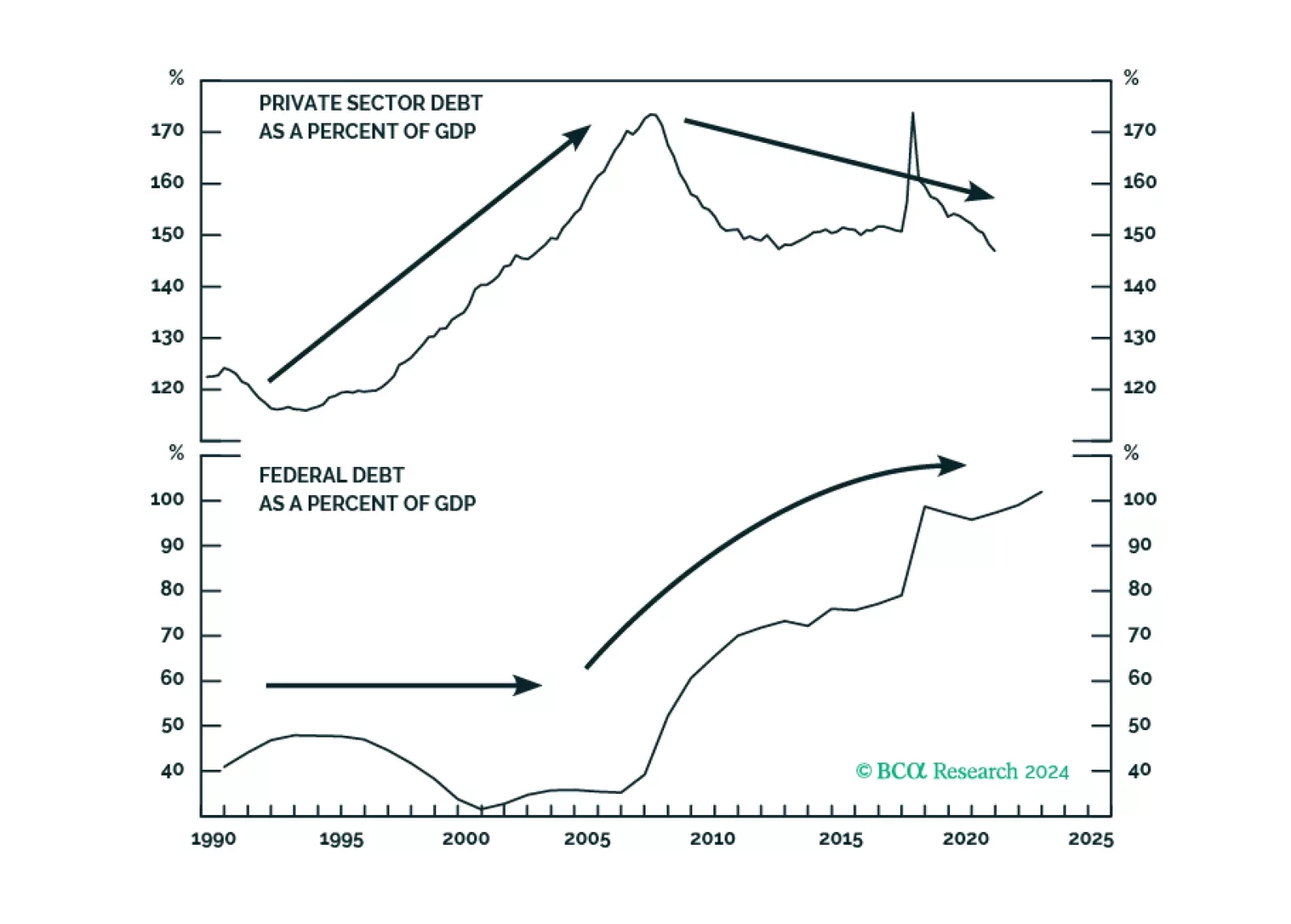

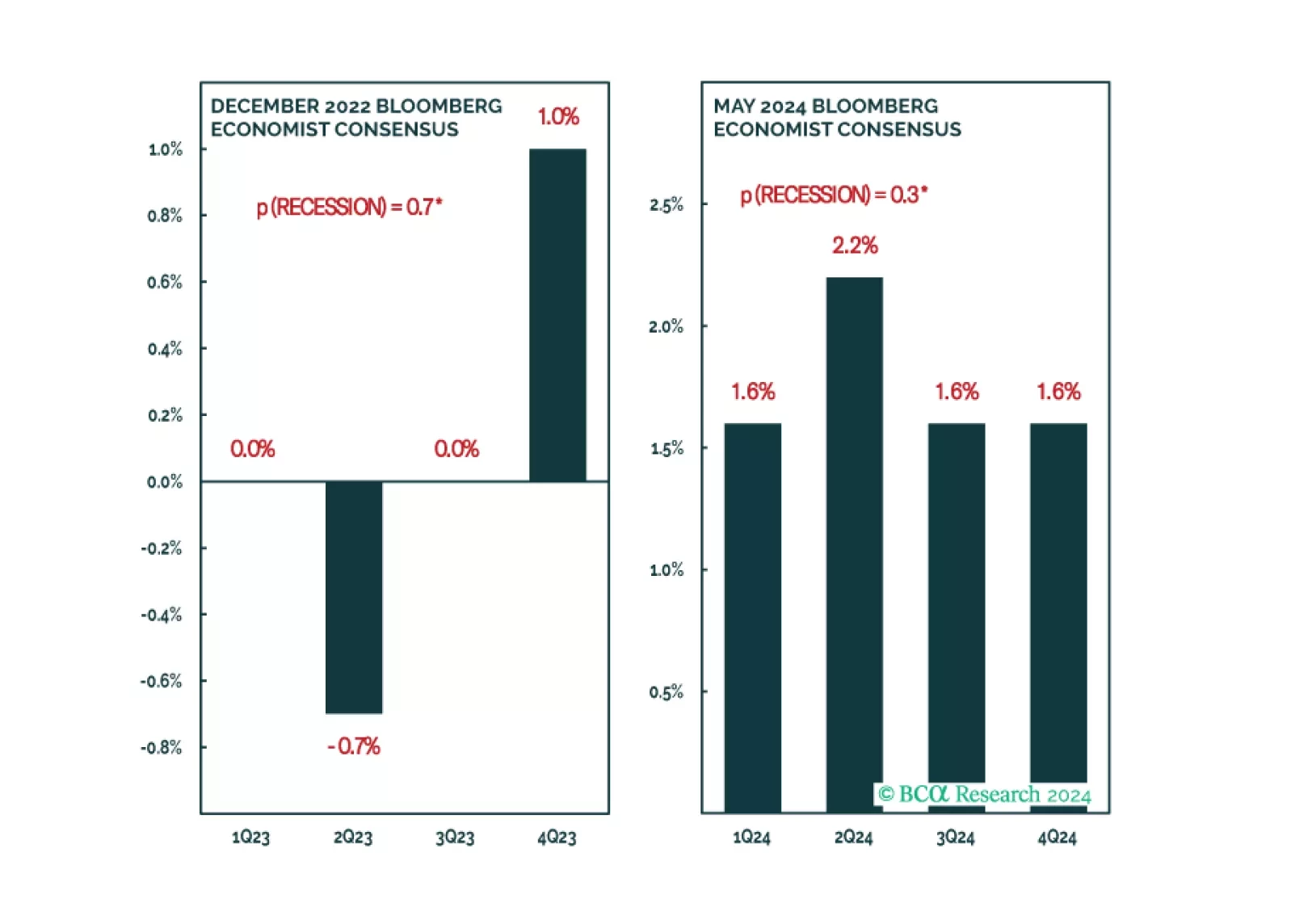

In Section I, we argue that global investors have been lulled into a false sense of security concerning the resiliency of the US economy. Tight monetary policy means that something must change for a recession to be avoided, and…

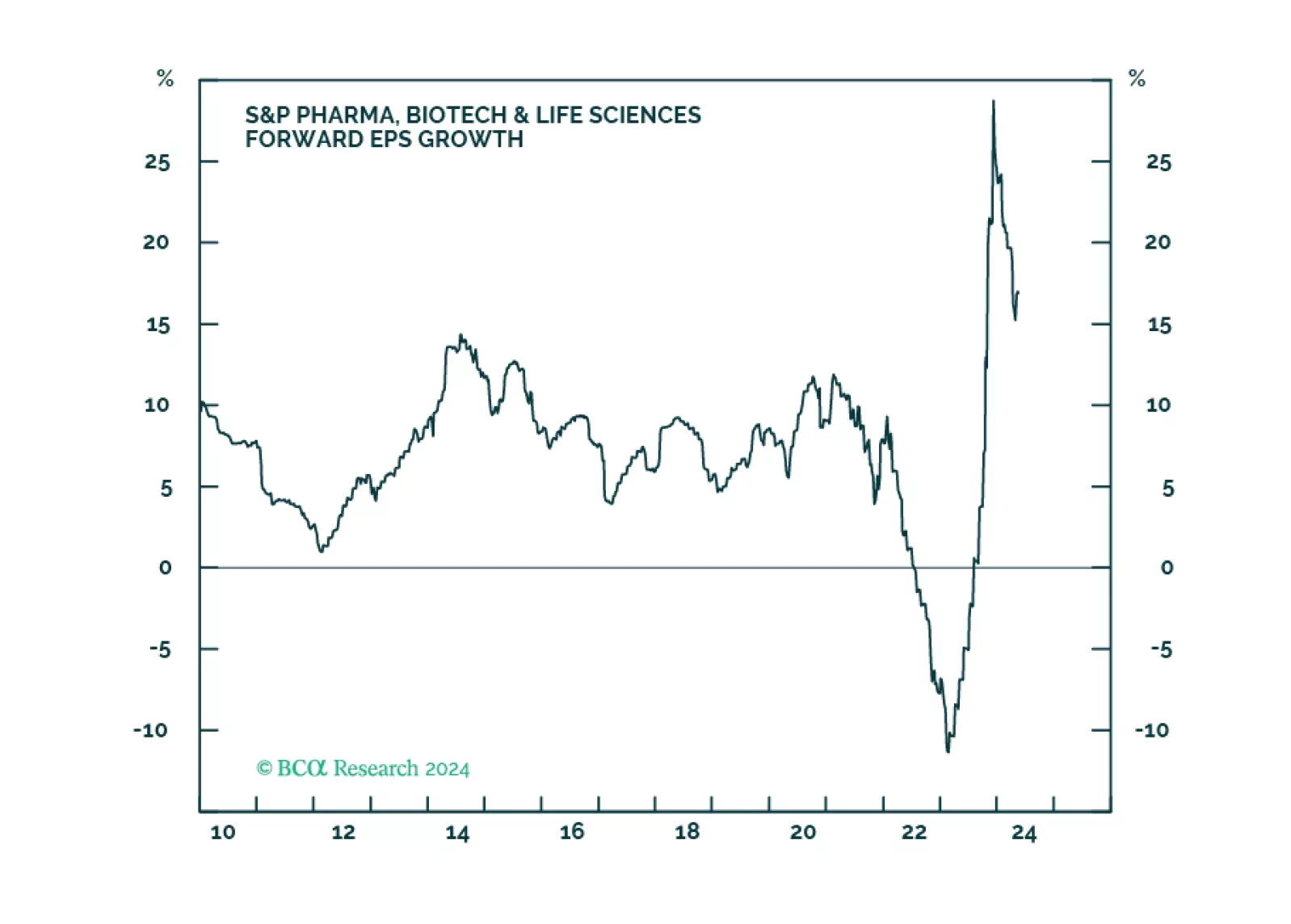

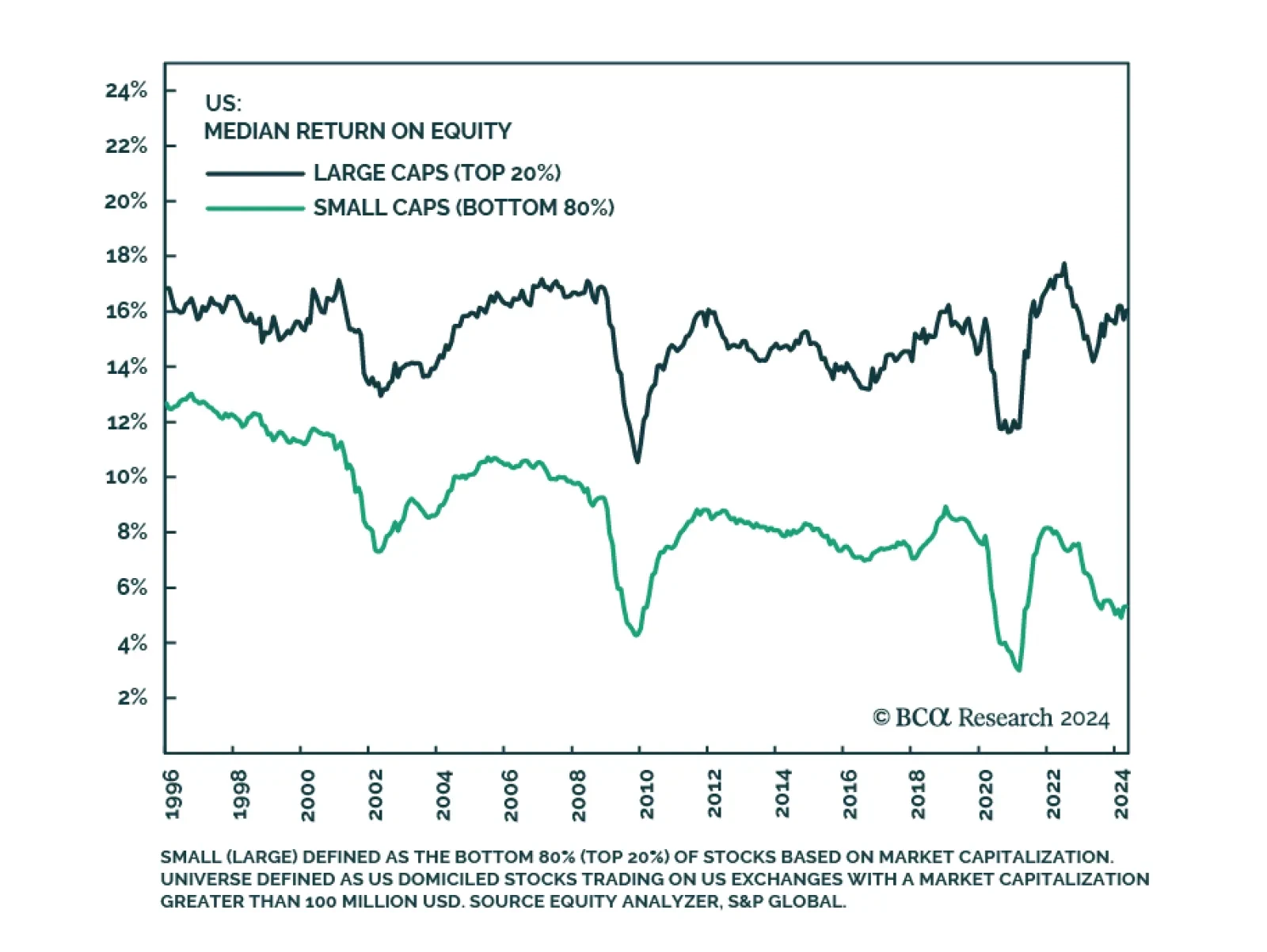

Our Global Asset Allocation strategists caution that US small-cap stocks’ deep discount relative to the S&P 500 is not the generational buying opportunity it may appear to be on its face. While the size premium…

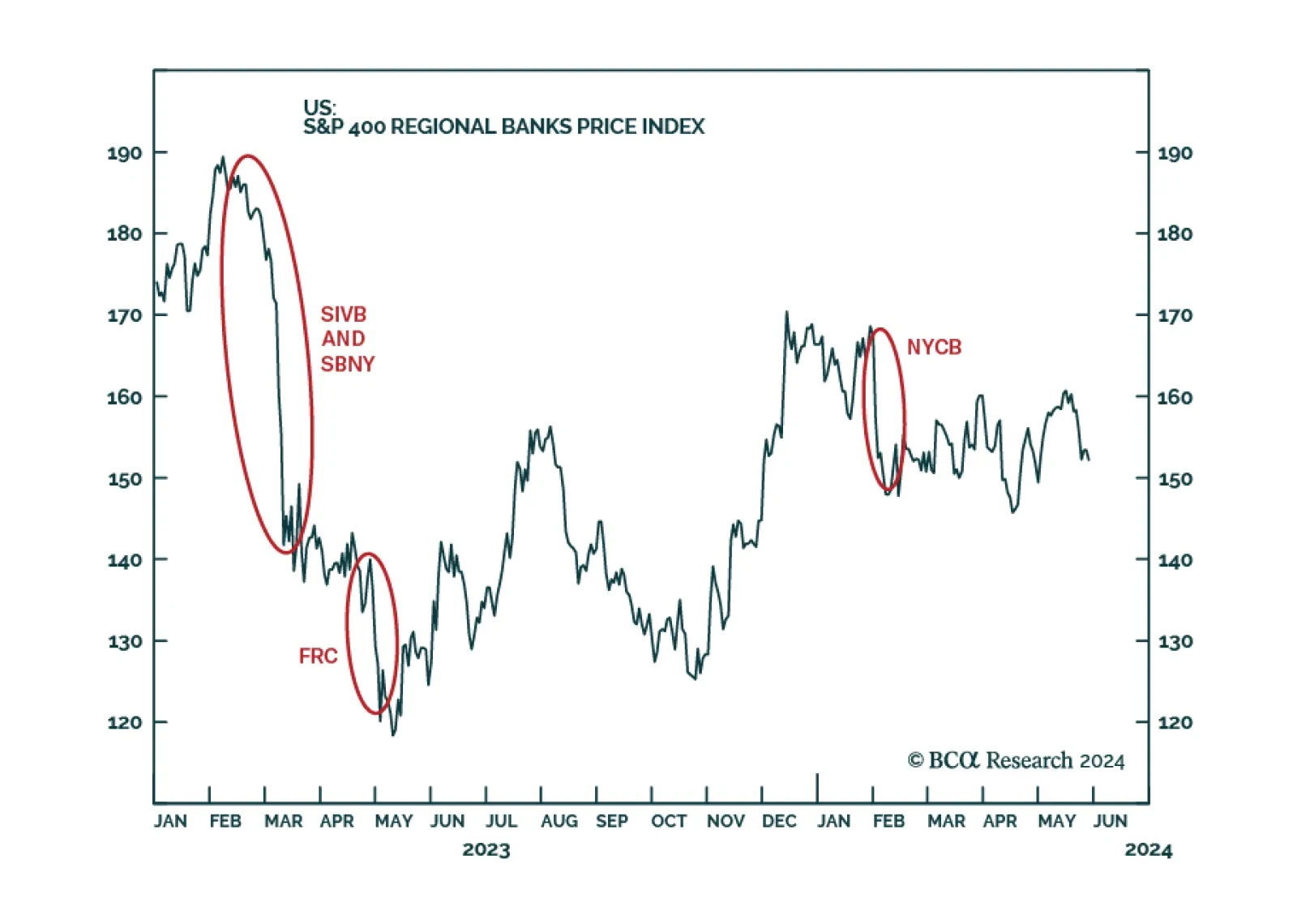

Bank OZK (ticker: OZK, née Bank of the Ozarks) declined nearly 17% at its low on Wednesday, following a double downgrade from buy to sell by an analyst that also slashed his price target for the stock by a third. The…

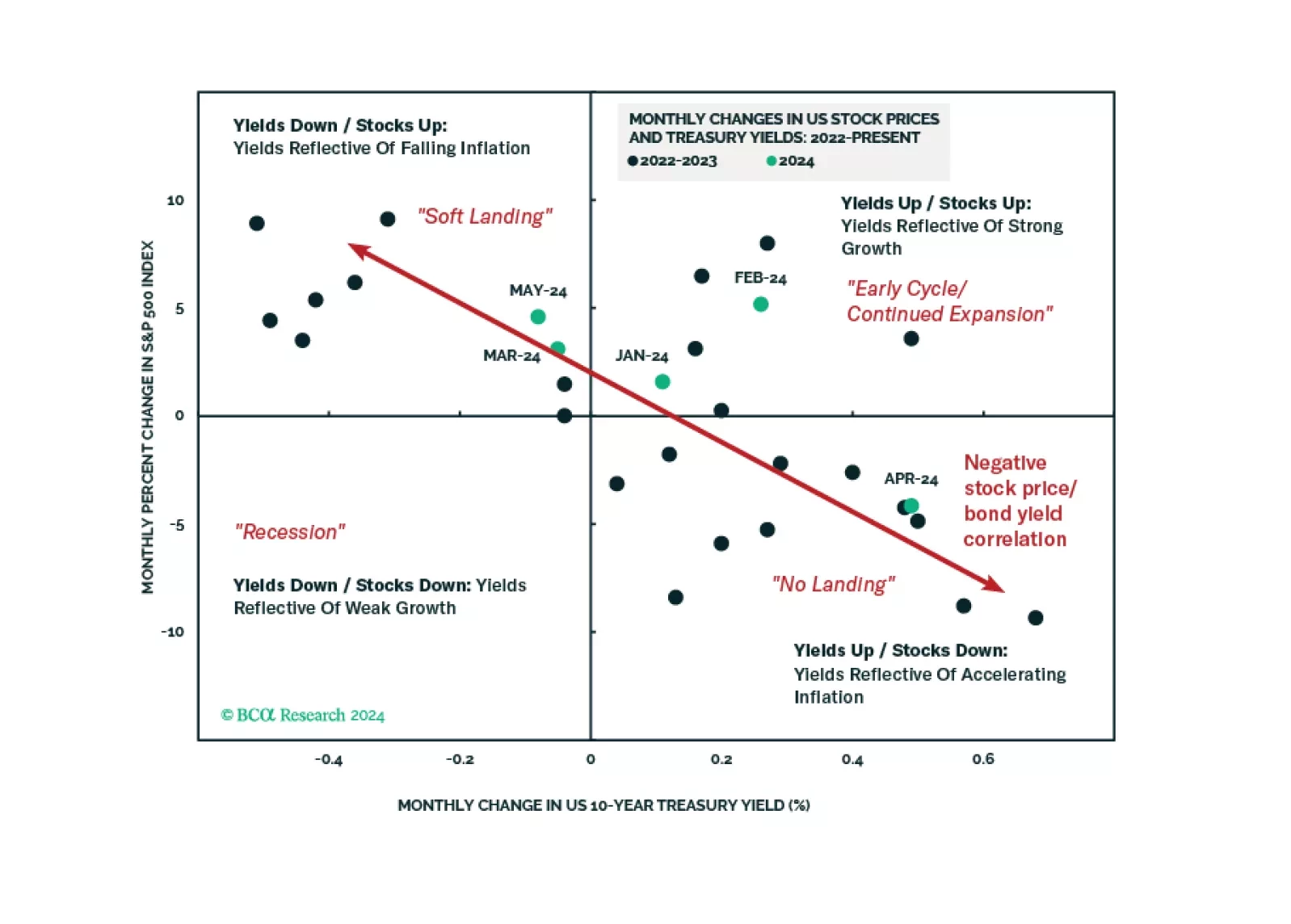

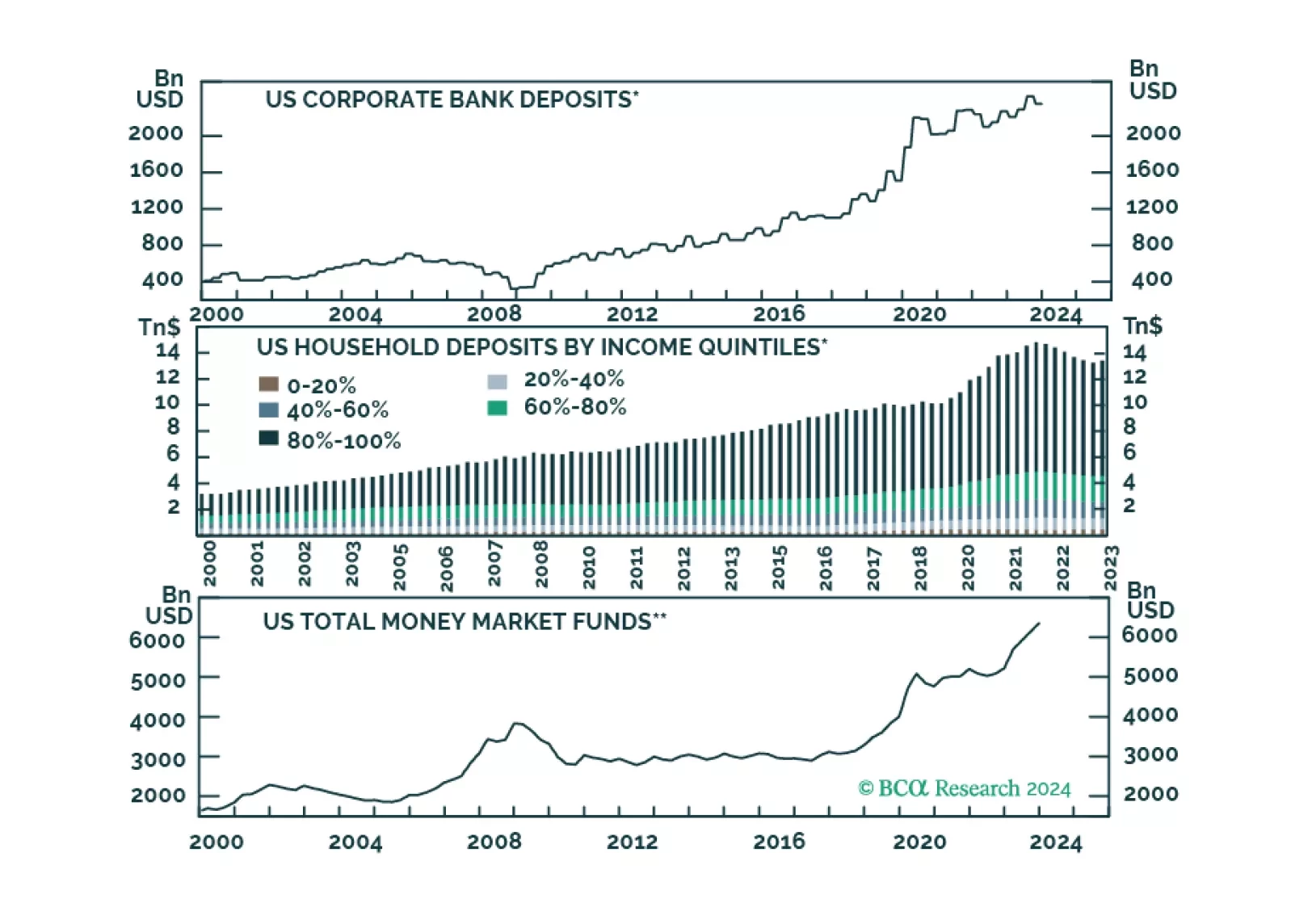

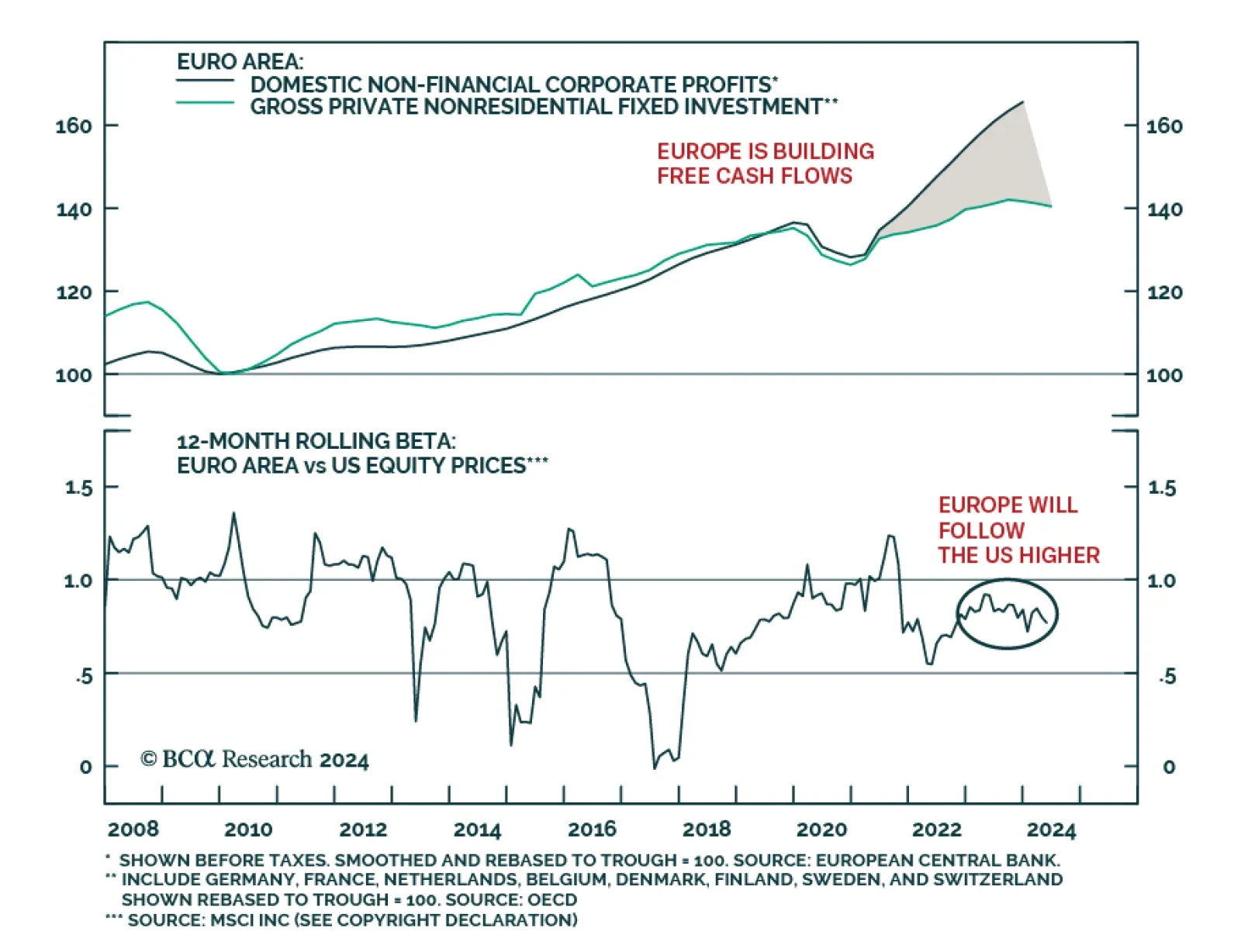

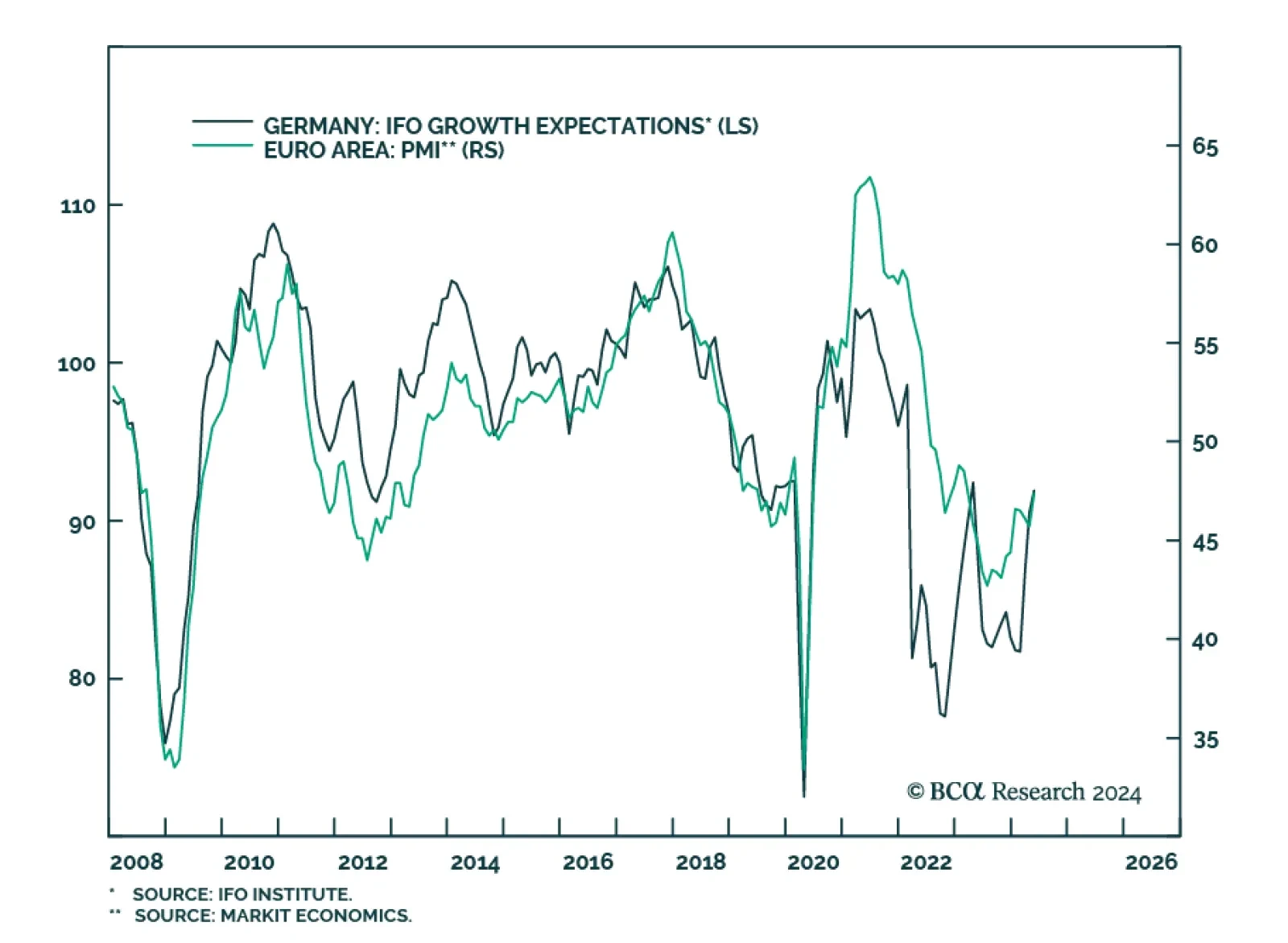

According to BCA Research’s European Investment Strategy service, the money sloshing around the financial system from pandemic-era stimulus measures disconnects near-term prospects for growth from risk asset prices. As a…

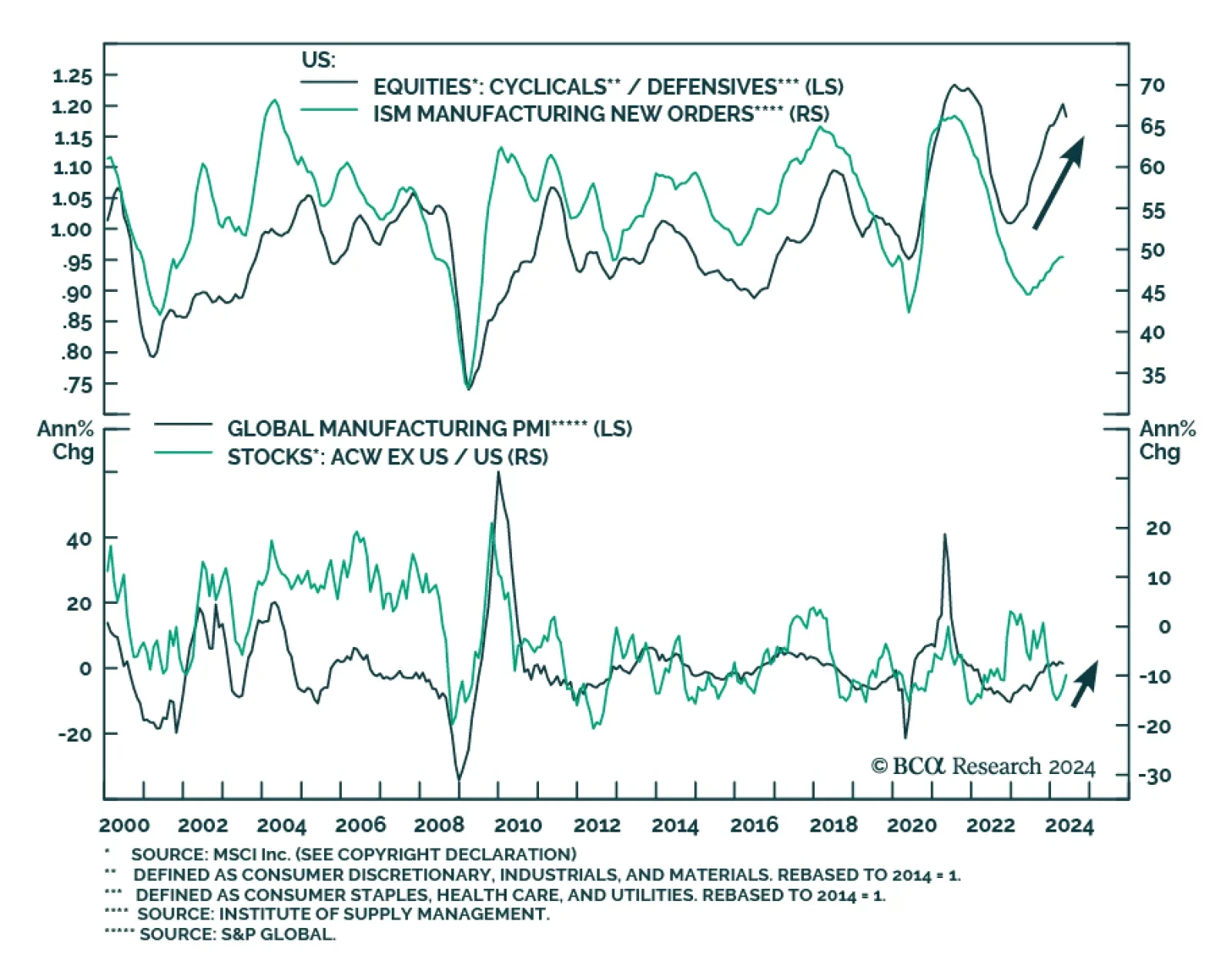

The US manufacturing cycle has followed a surprisingly stable pattern for over seven decades. History suggests that this cycle tends to last for about 36 months, with a down leg spanning 18 months, followed by an up leg…

Sentiment among German companies stalled in May, after having firmed for 3 consecutive months. The IFO Business Climate came in at 89.3, unchanged from April, disappointing expectations of further strengthening to 90.4. Although…

Looking at economic activity, global monetary policy seems restrictive, however, the behavior of financial markets tells a different story. What gives?

The signs of an approaching recession are starting to emerge. We will turn tactically defensive once they all fall into place.