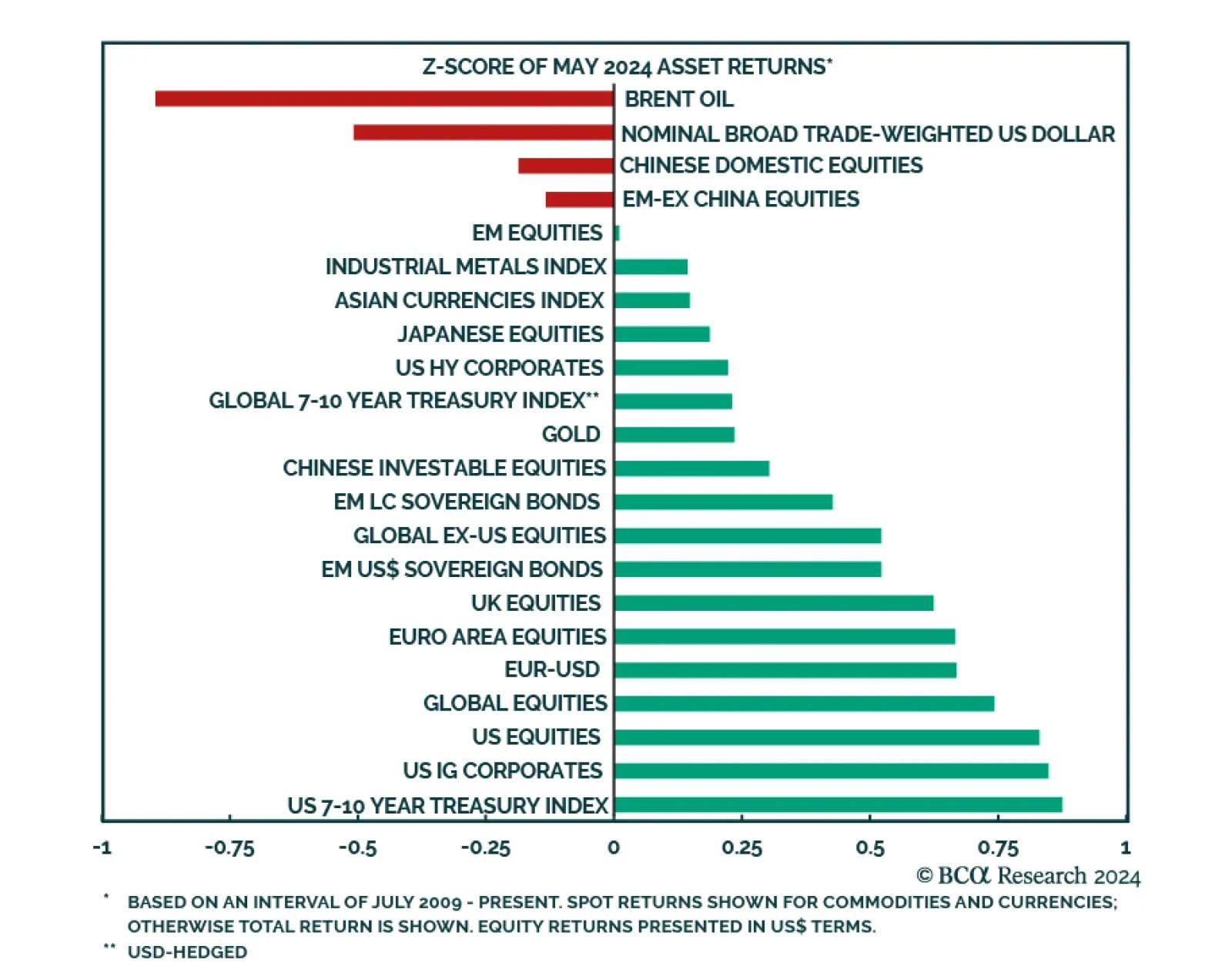

The risk-on soft-landing narrative dominated markets in May, with both equities and bonds rallying throughout the month. Meanwhile, the counter-cyclical US dollar slumped, and the cyclical euro appreciated against the greenback…

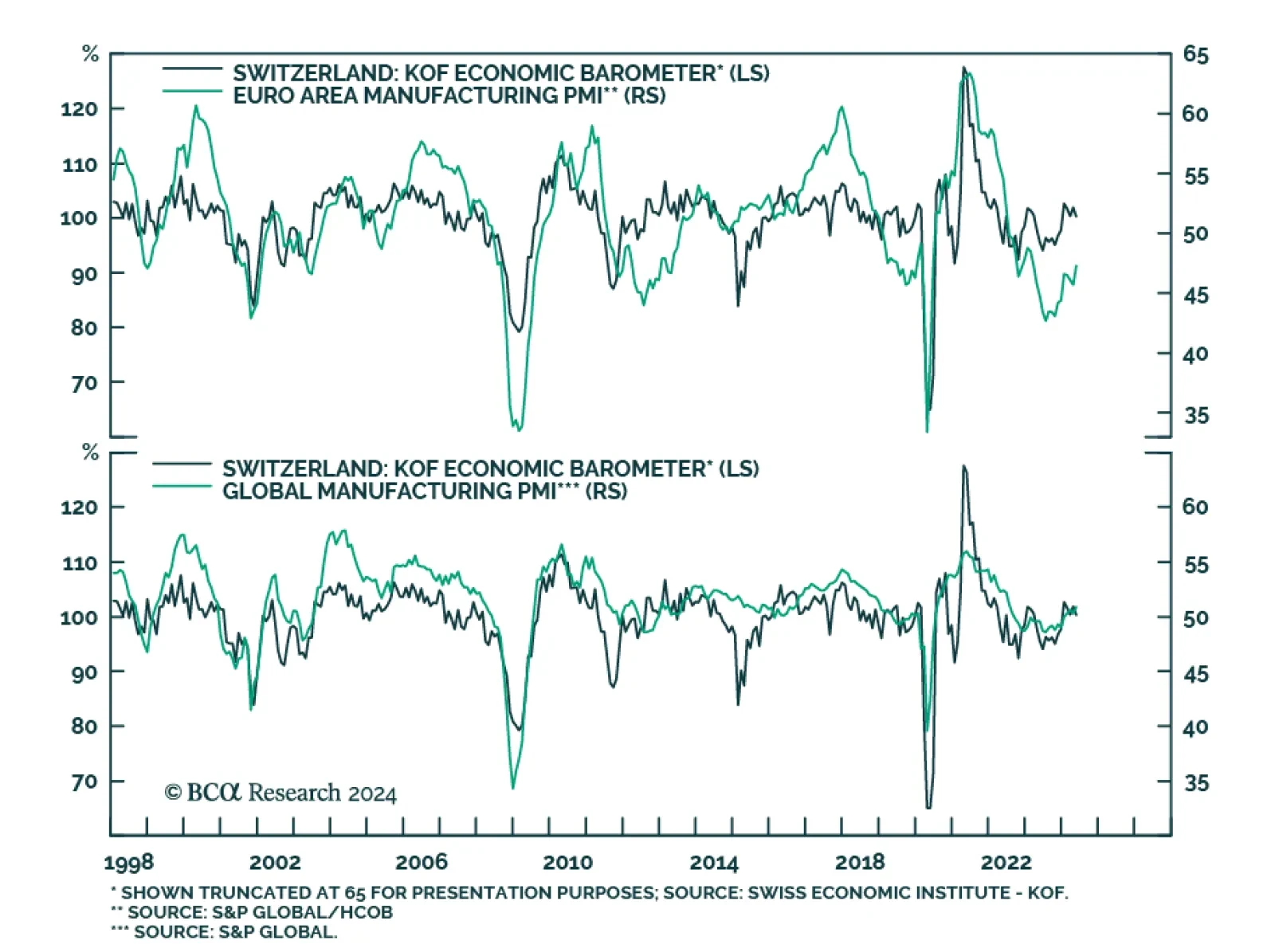

The Swiss KOF Barometer is a composite leading indicator of the Swiss economy. It surprised to the downside in May, coming in at 100.3 from 101.9, below expectation of an acceleration to 102.1. Switzerland’s economy is…

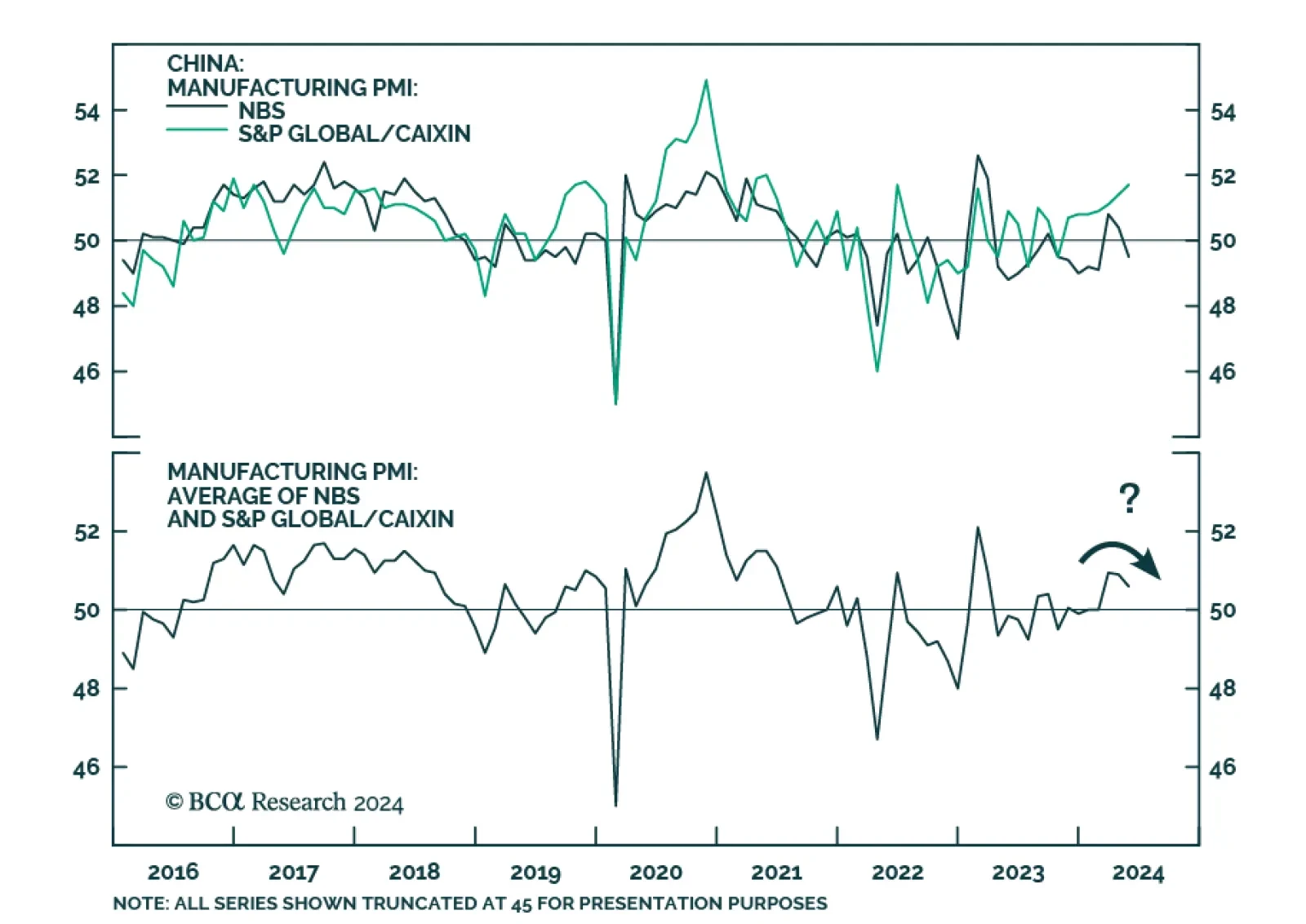

The Caixin Chinese manufacturing PMI reached a two-year high in May, expanding at a larger-than-expected rate from 51.4 to 51.7. The Caixin figure thus contrasts with the alternative NBS manufacturing PMI, which unexpectedly…

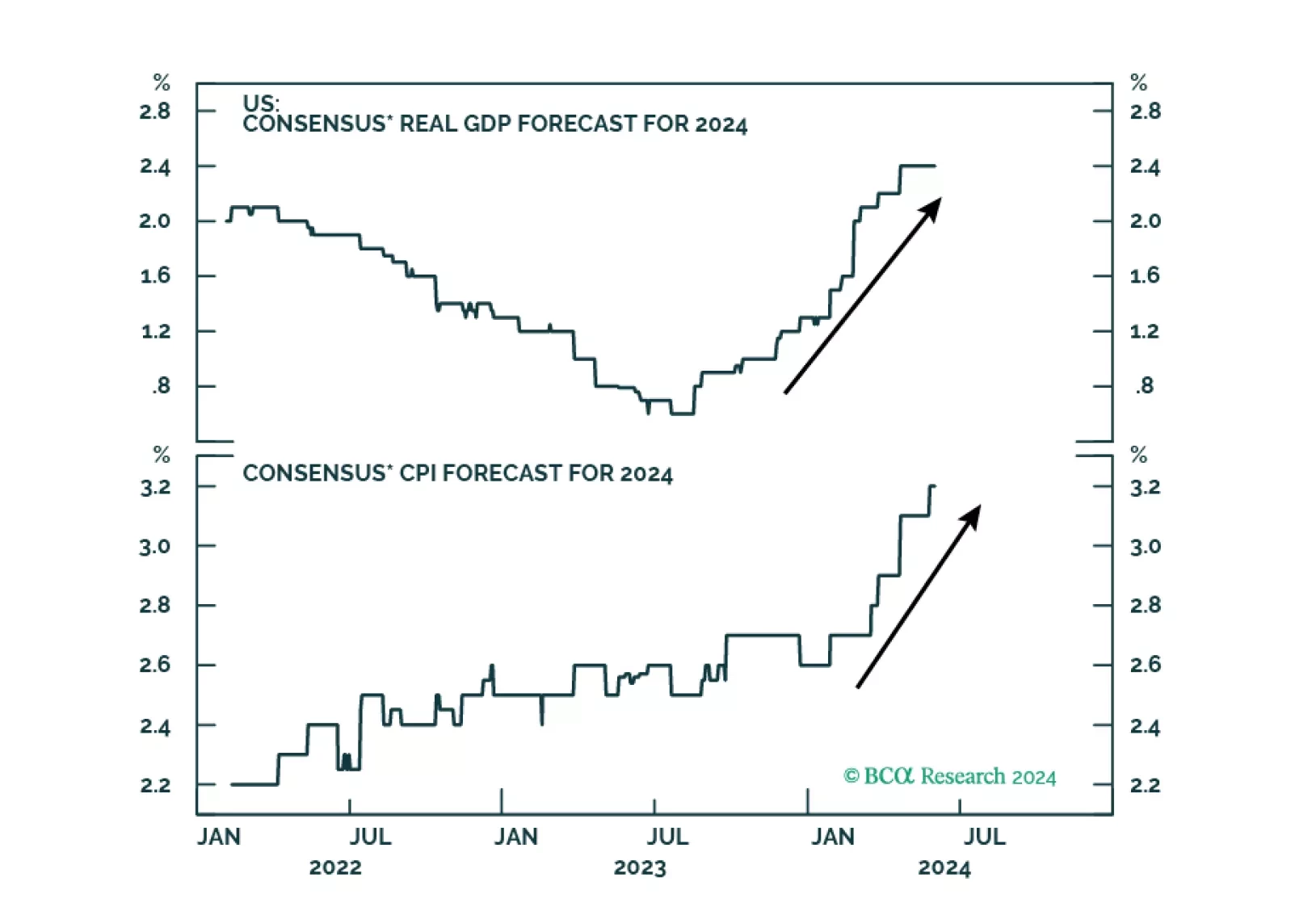

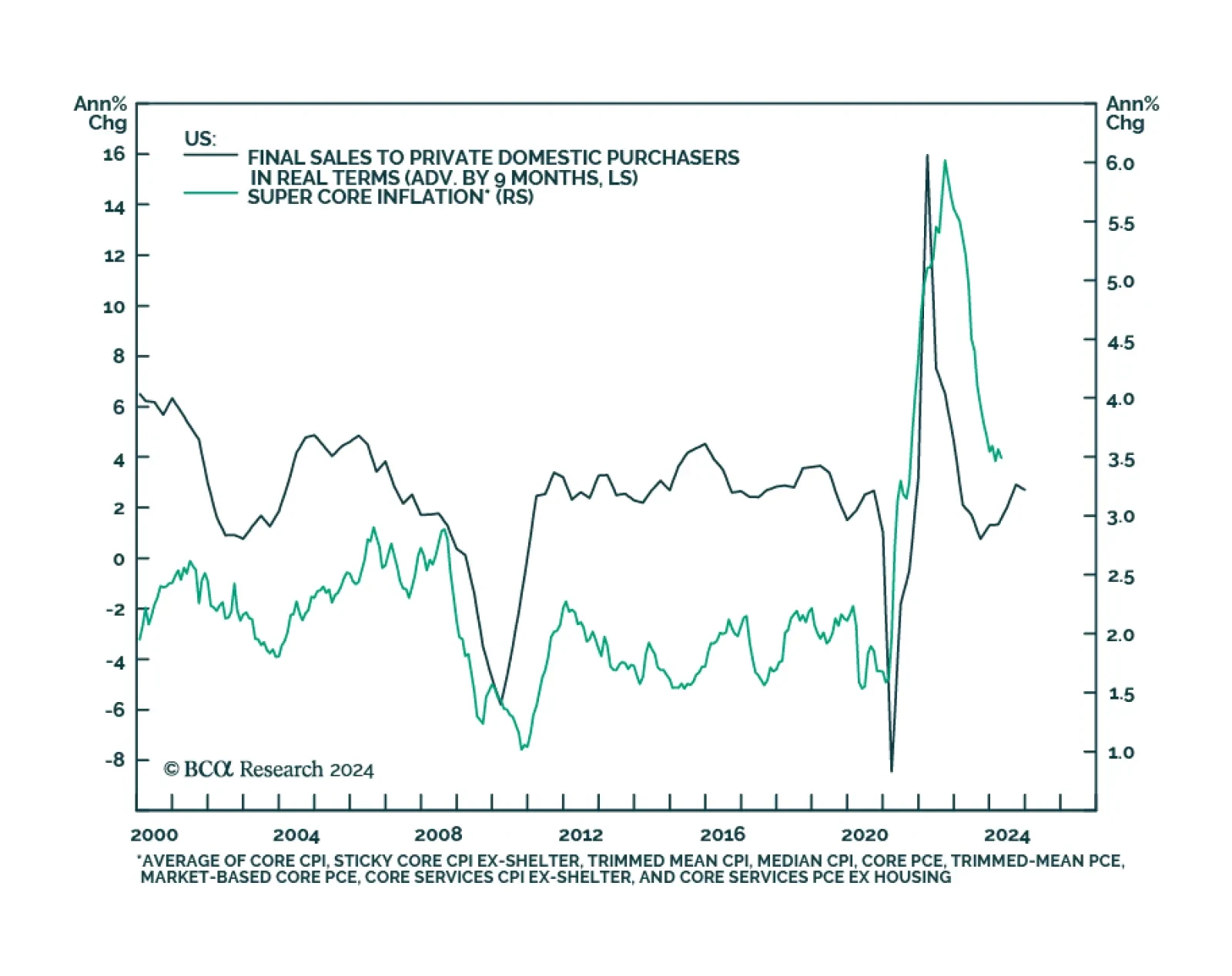

The US economy is in the “Overheating” phase, so stronger growth brings higher inflation. Tight monetary policy means recession is still likely over the next 12 months. Stay defensive.

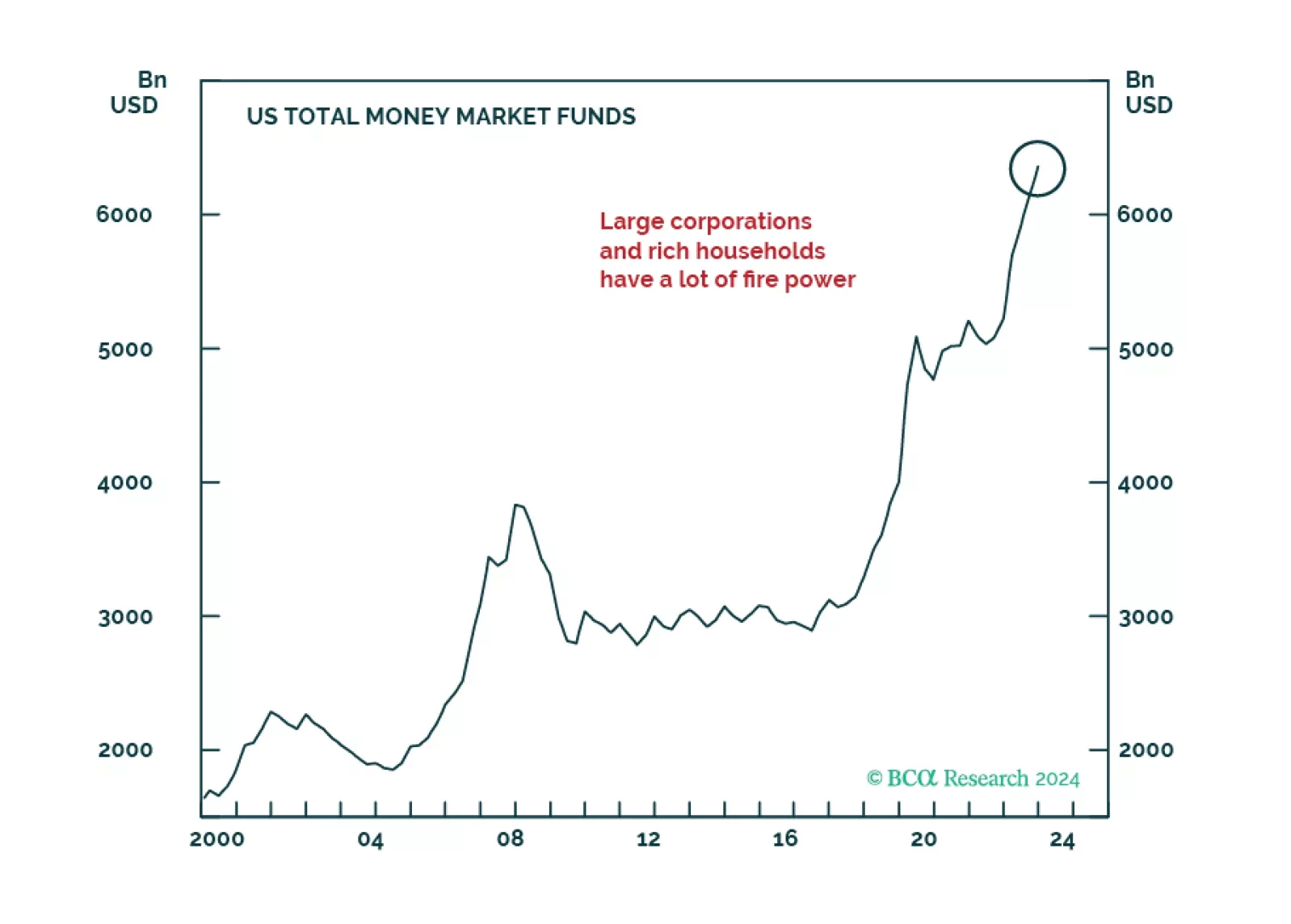

Generative AI-related rally resumed in May. Much of the recent market gains are down to excess liquidity that was begotten by the massive pandemic stimulus, creating a dichotomy between multiple economic challenges and exuberant…

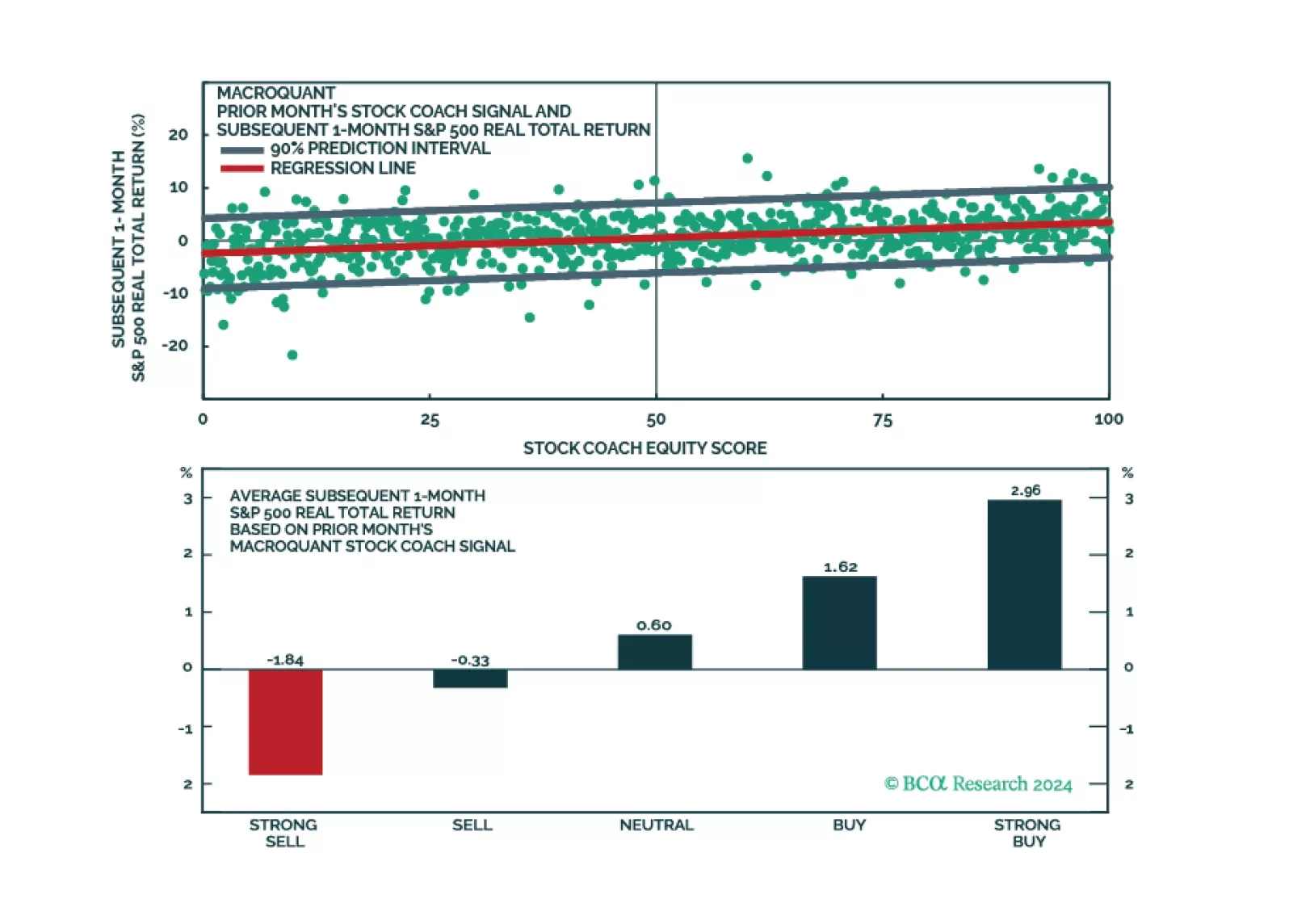

MacroQuant sees significant downside risks to stocks over a 1-to-3 month horizon and suggests increasing allocation to long-term bonds. The model favours defensive equity sectors but is also hedging its bets by overweighting…

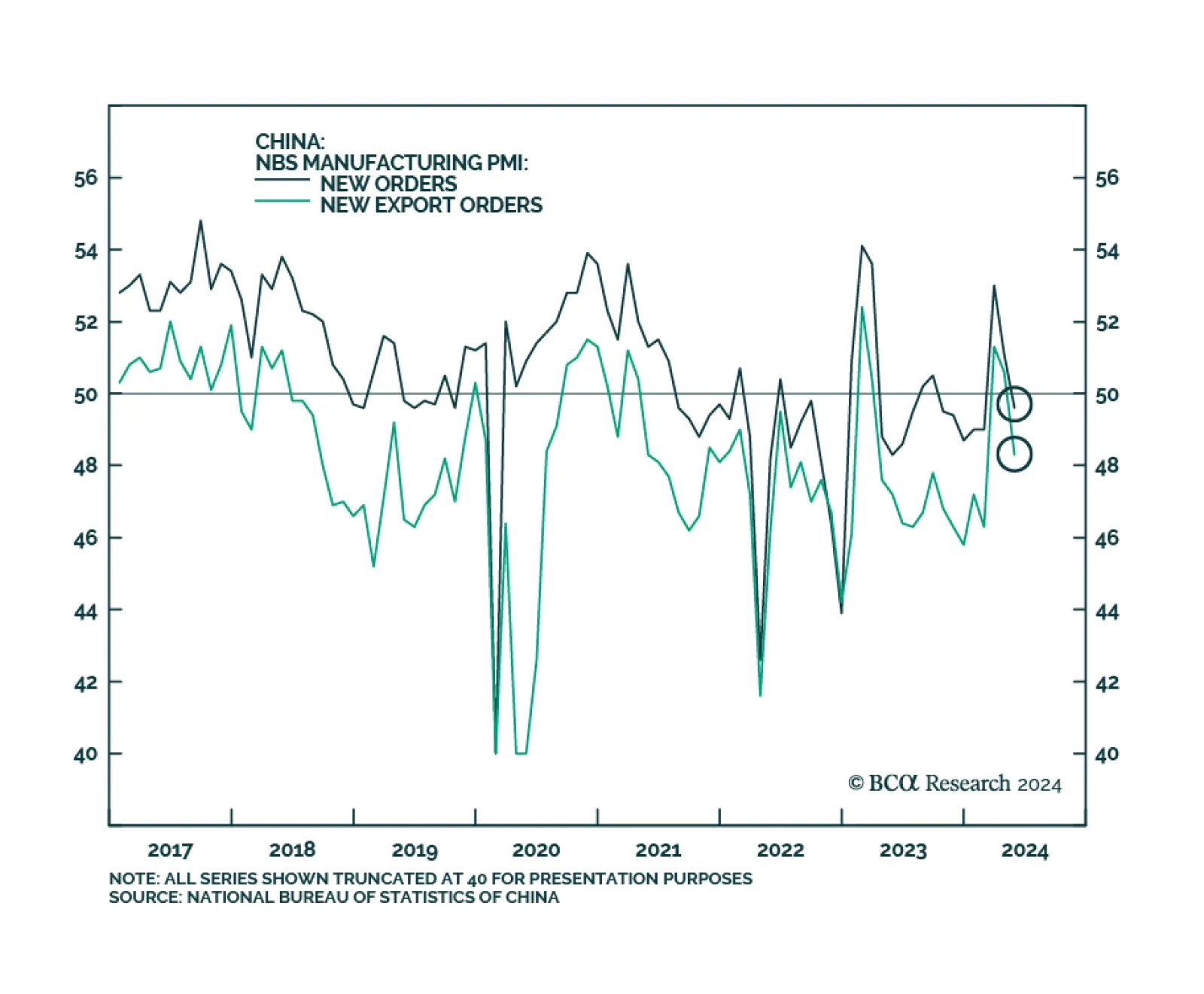

Chinese PMIs from the National Bureau of Statistics (NBS) disappointed in May. The manufacturing PMI contracted in May (49.5), breaking a two-month expansion streak and disappointing expectations of continued growth. Meanwhile…

US Q1 GDP was revised lower from 1.6% q/q annualized to 1.3%. Notably, the downward revision to personal consumption was higher than expected, from 2.5% q/q annualized to 2.0%. Investment and government spending were revised…

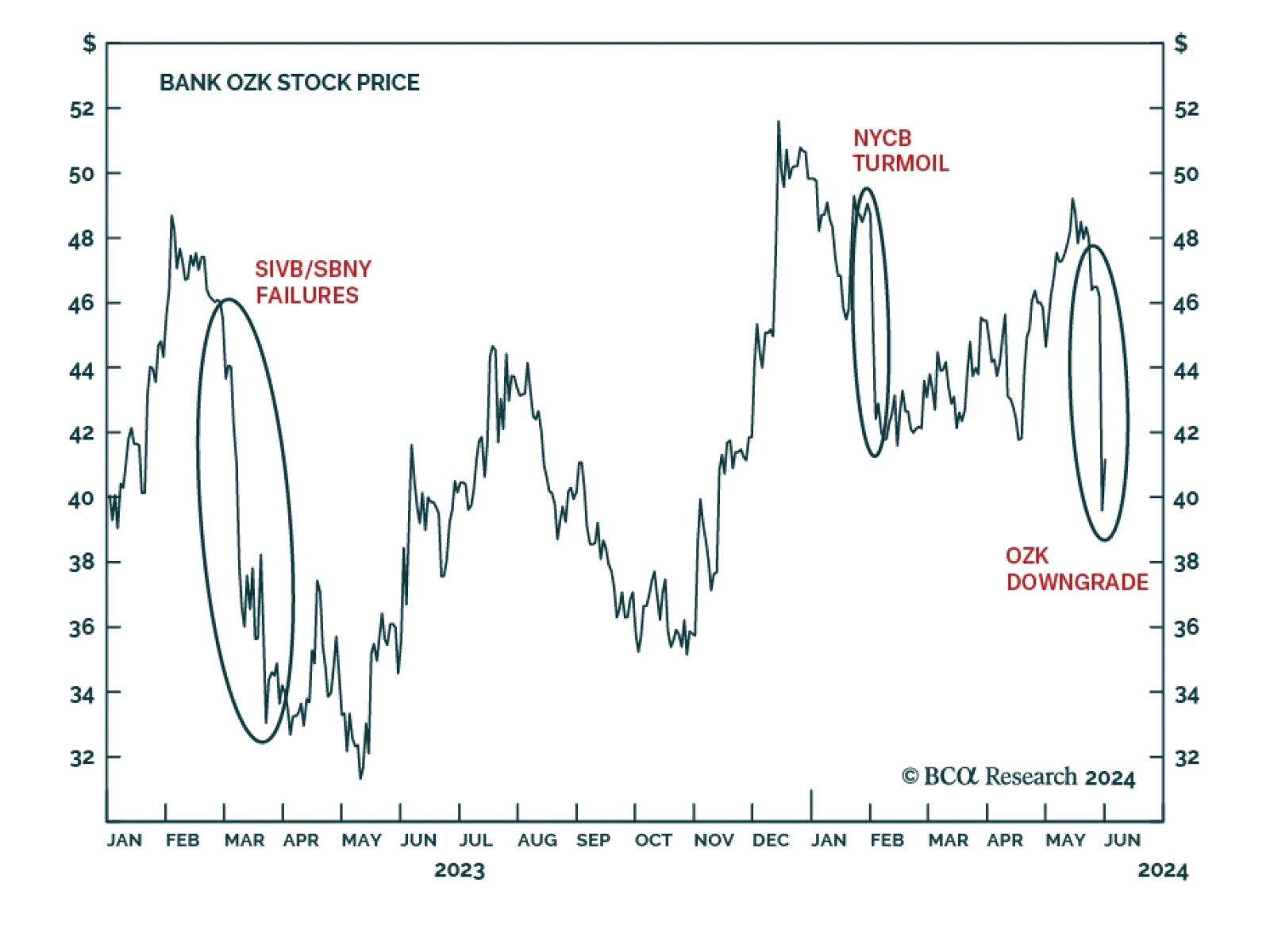

Bank OZK (ticker: OZK) ended Wednesday’s session down over 14%, following a double downgrade from buy to sell by an analyst who raised concerns about loans on two specific development projects. OZK is known for its…