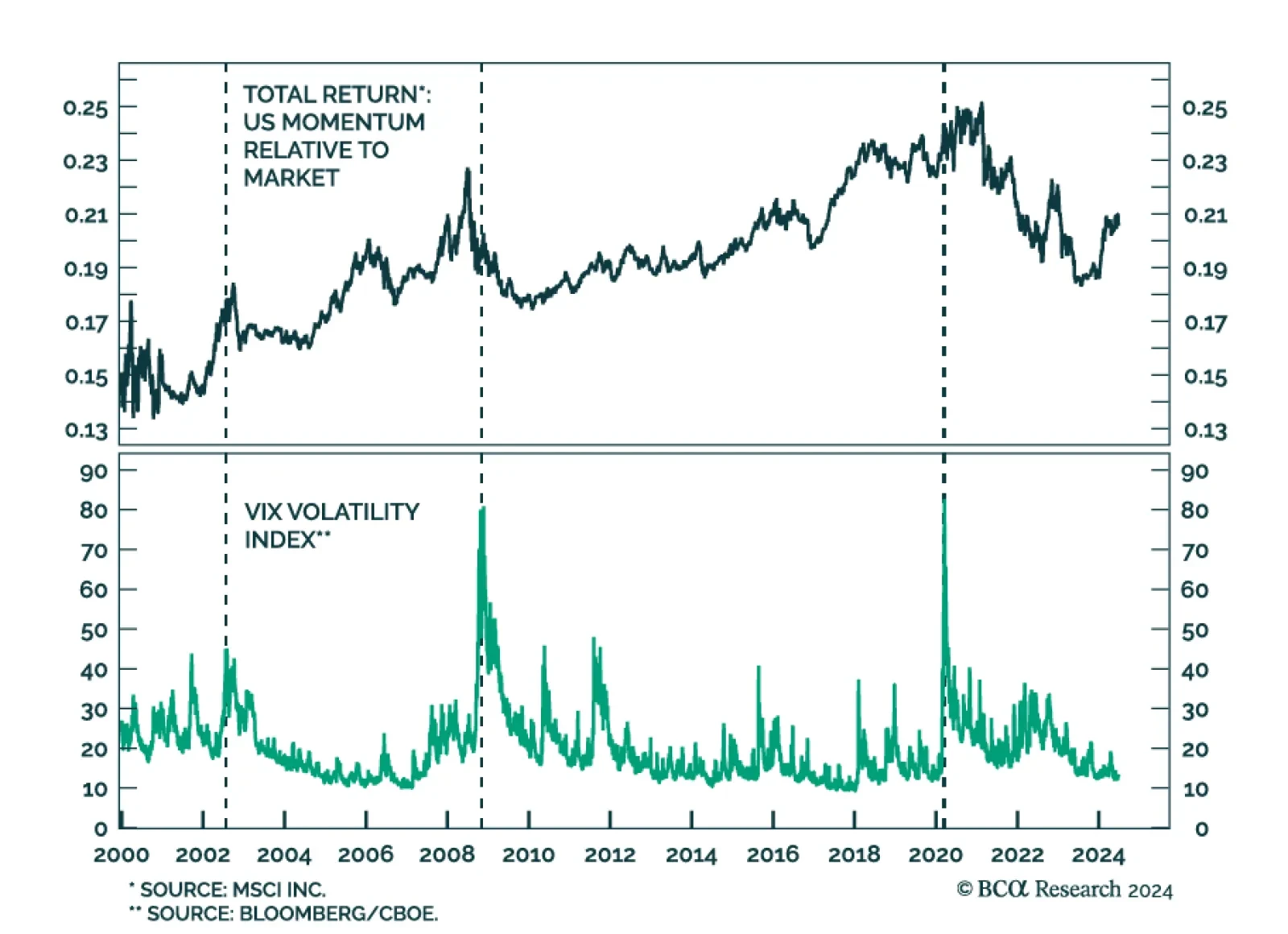

Volatility is usually a poor predictor of stock returns. It has no leading properties on the overall equity market. High volatility is contemporaneous with big drawdowns, while low volatility is contemporaneous with bull markets…

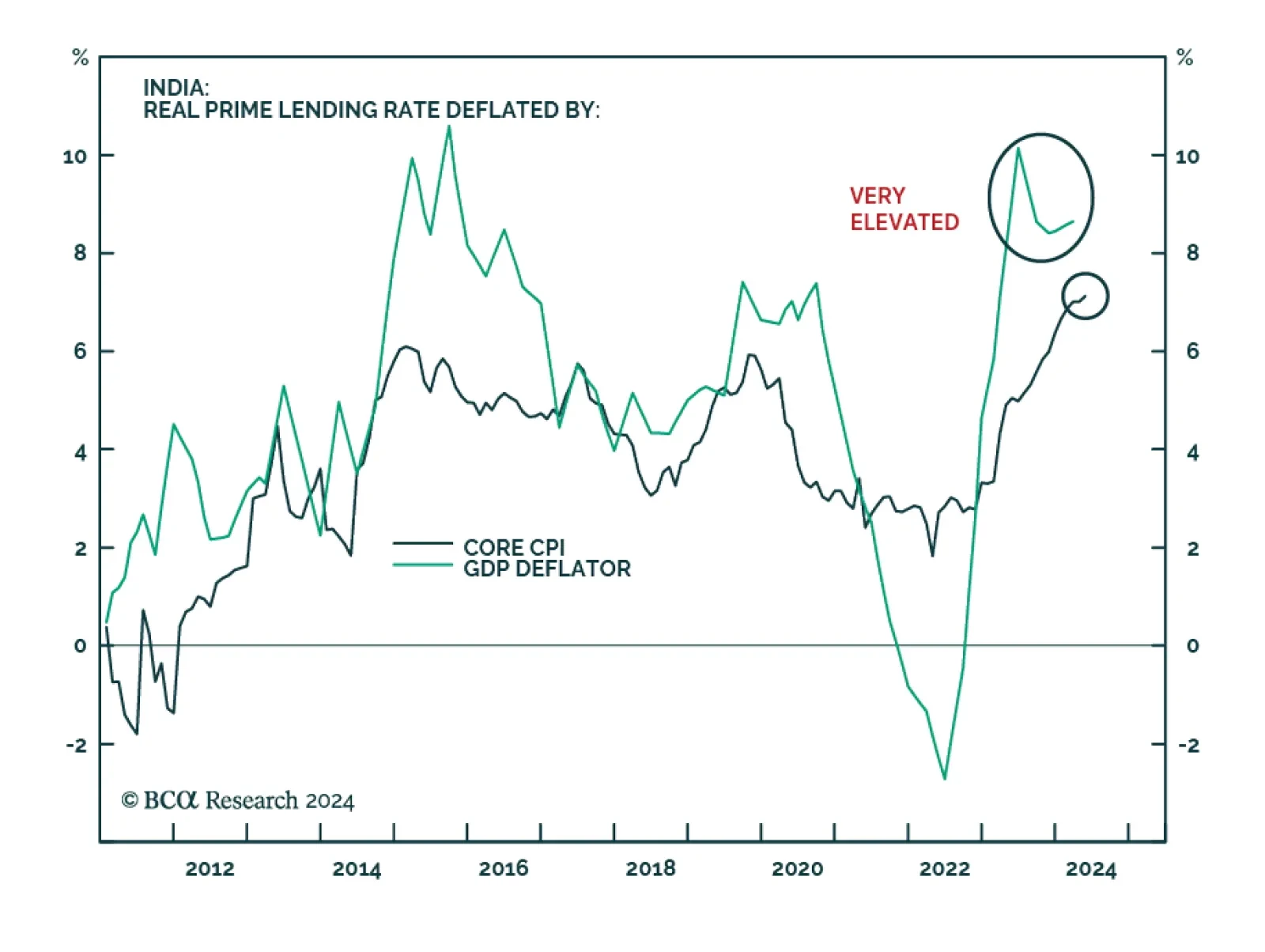

BCA Research’s Emerging Markets Strategy team posits that the BJP's loss of majority in India’s parliament could be a blessing in disguise for India. The new BJP-led coalition with the National Democratic…

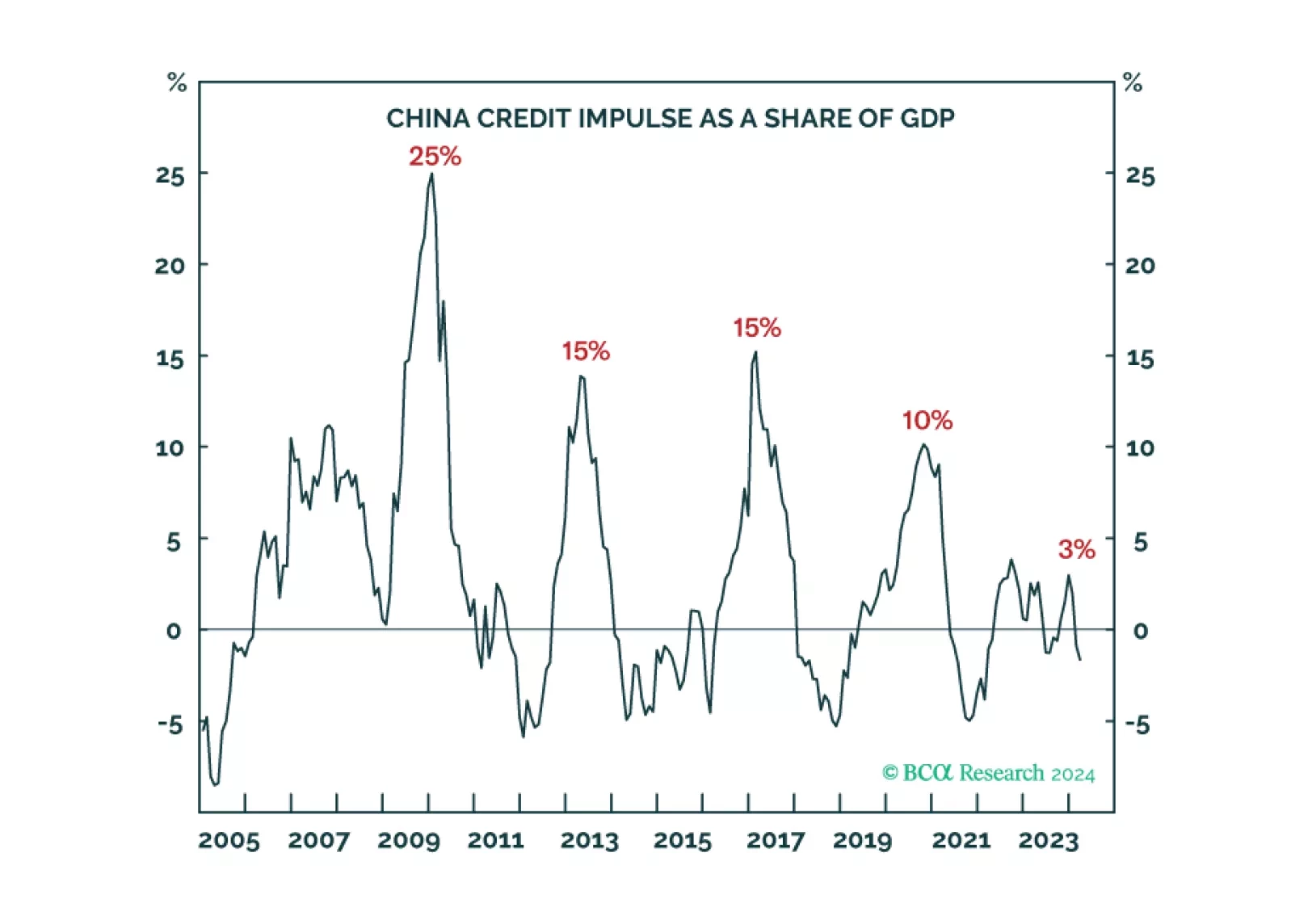

The end of China’s exponential credit growth will impede structural rallies in Chinese stocks and commodities, but US superstar stocks’ bubble-like valuations will impede them too. Leaving European stocks as the likely structural…

BCA Research’s US Investment Strategy service remains tactically neutral with a defensive cyclical bias. The team is resisting the impulse to turn prematurely defensive ahead of the coming recession. Our colleagues…

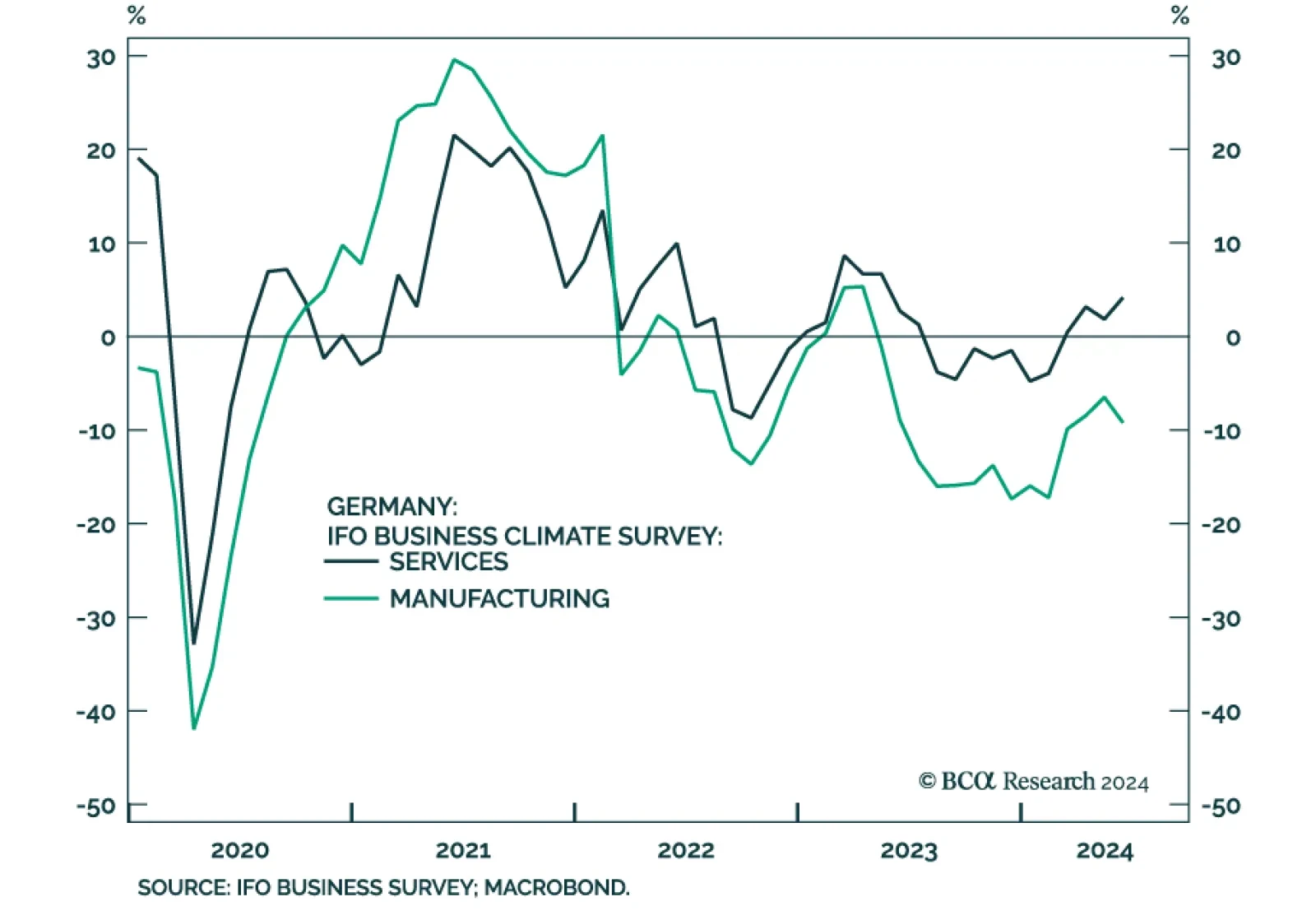

According to the results of the latest German IFO survey, overall sentiment deteriorated slightly in June. The IFO Business Climate index declined from 89.3 in May to 88.6 in June, disappointing expectations of a modest…

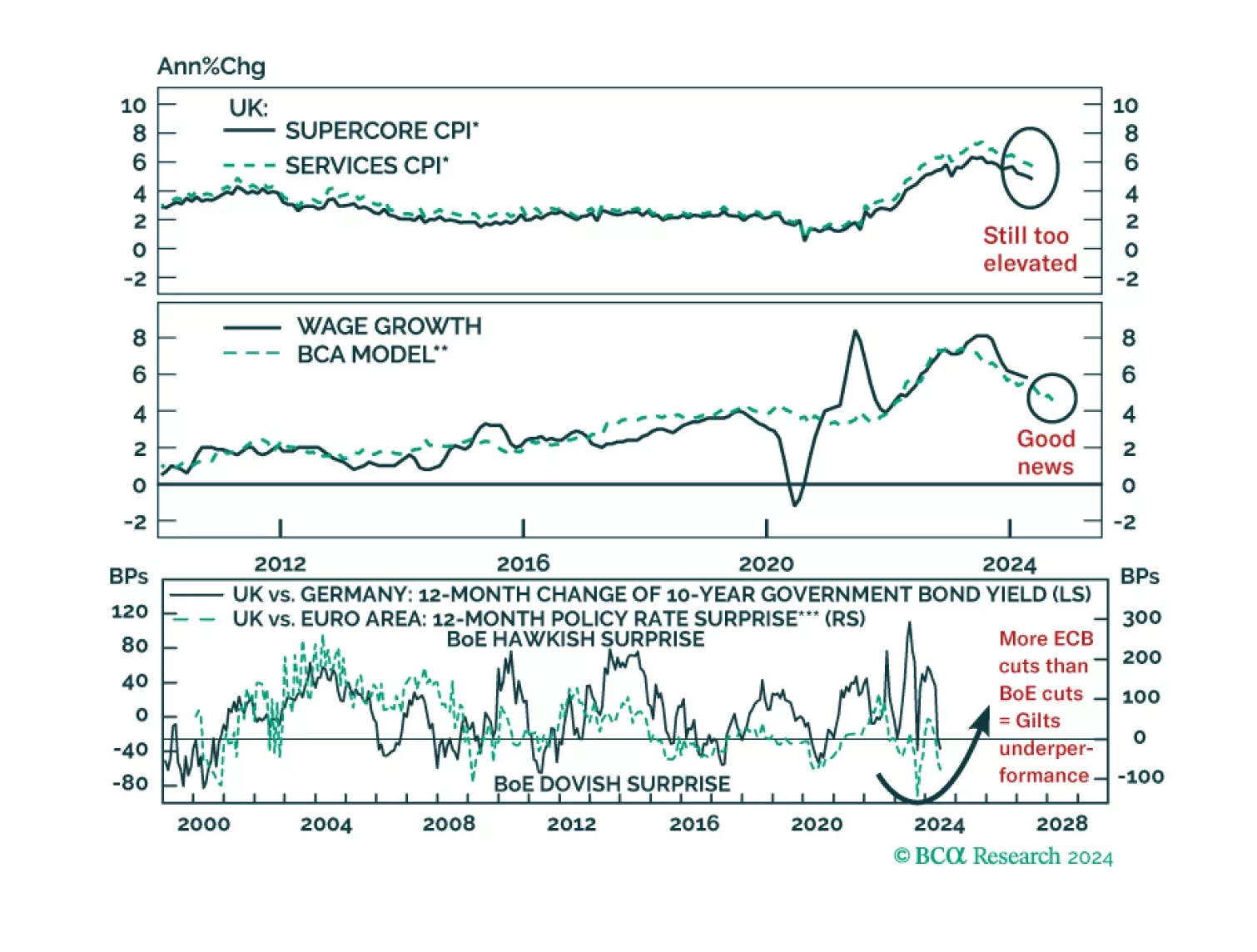

Is the BoE making a mistake moving toward rate cuts before the end of the summer? What would such a move mean for UK asset prices?

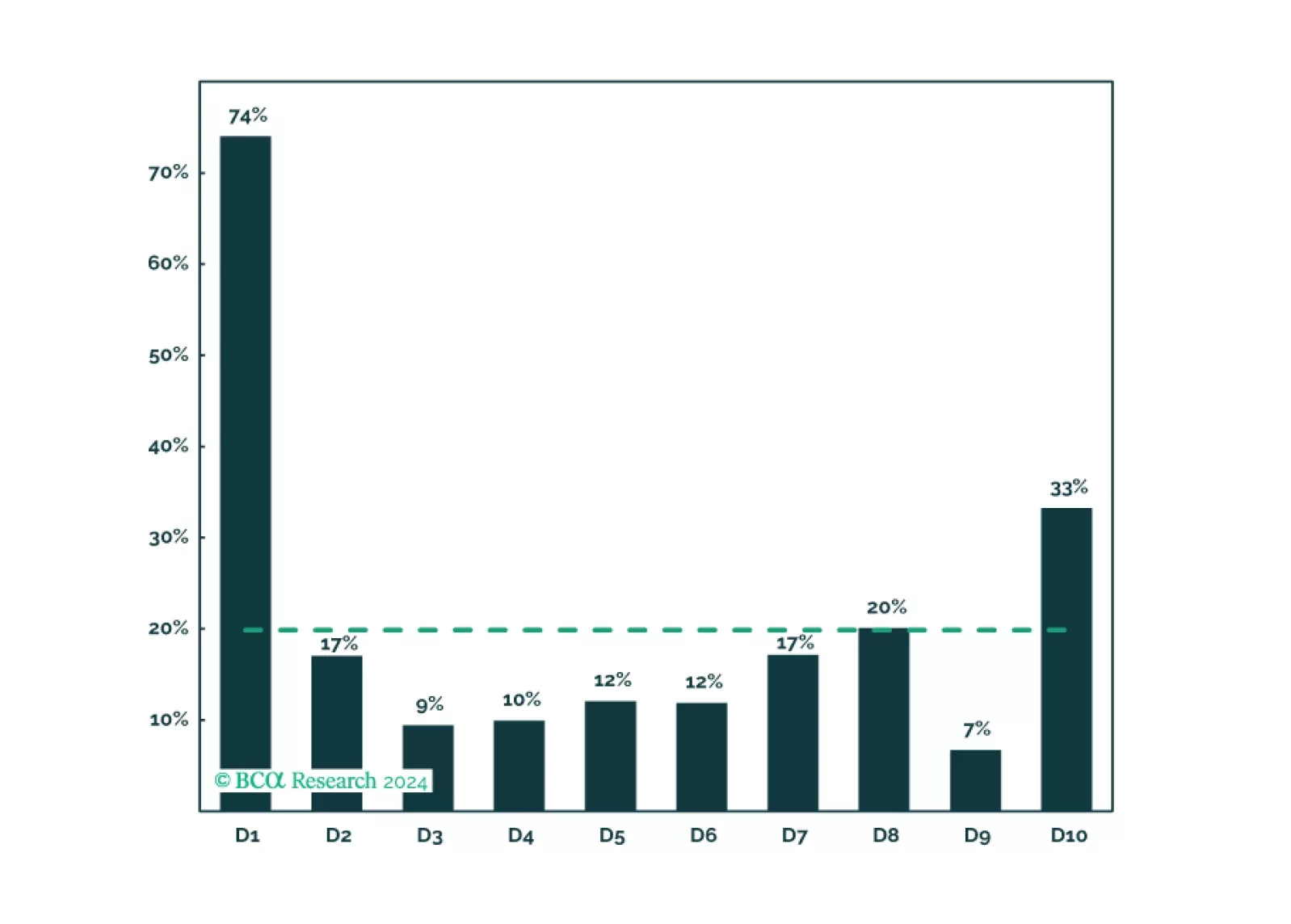

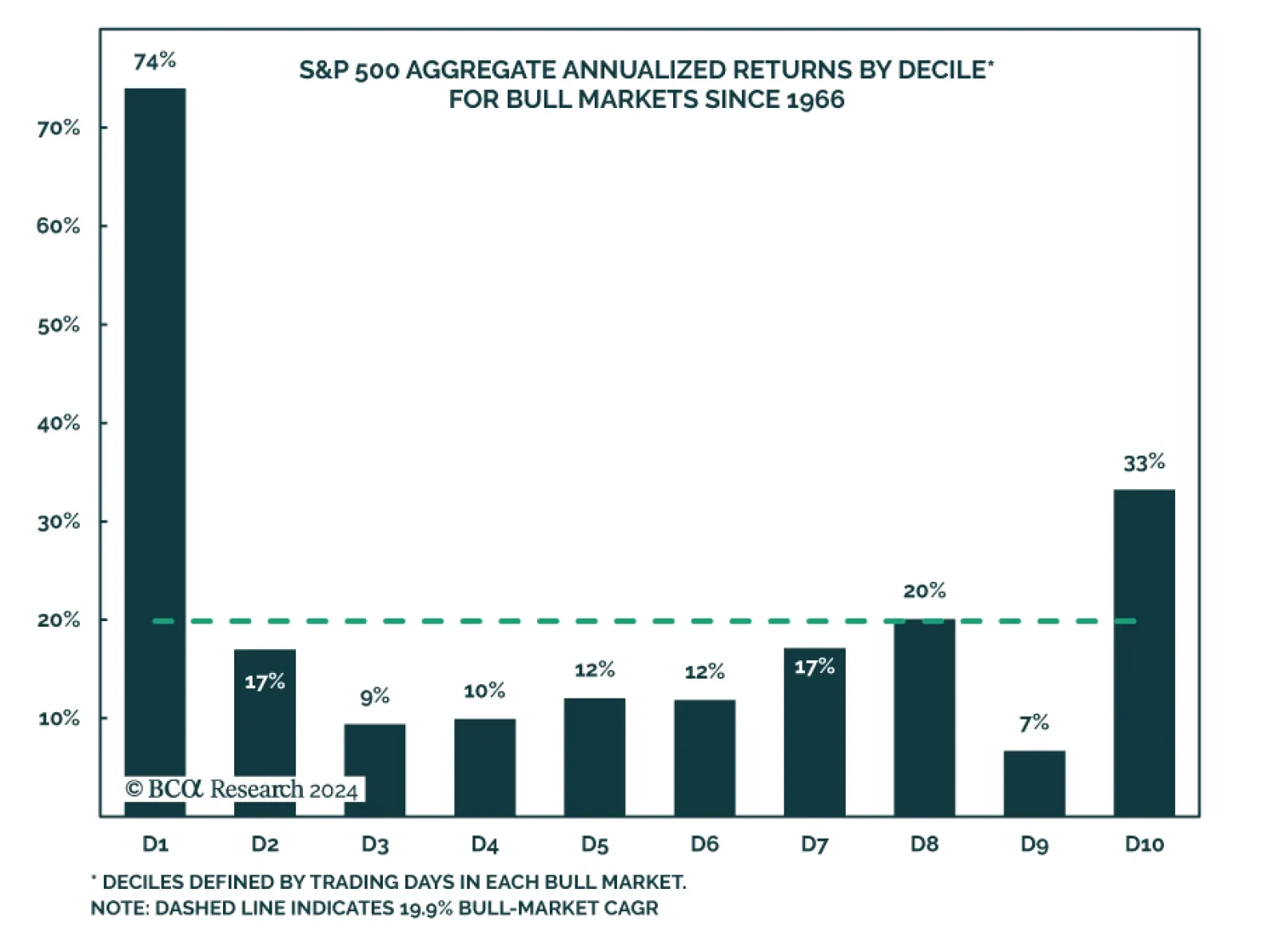

Today’s report recaps last week’s webcast and elaborates on its themes, delving into the empirical evidence underpinning our conviction that asset allocators should underweight equities sparingly and fleetingly. We remain tactically…

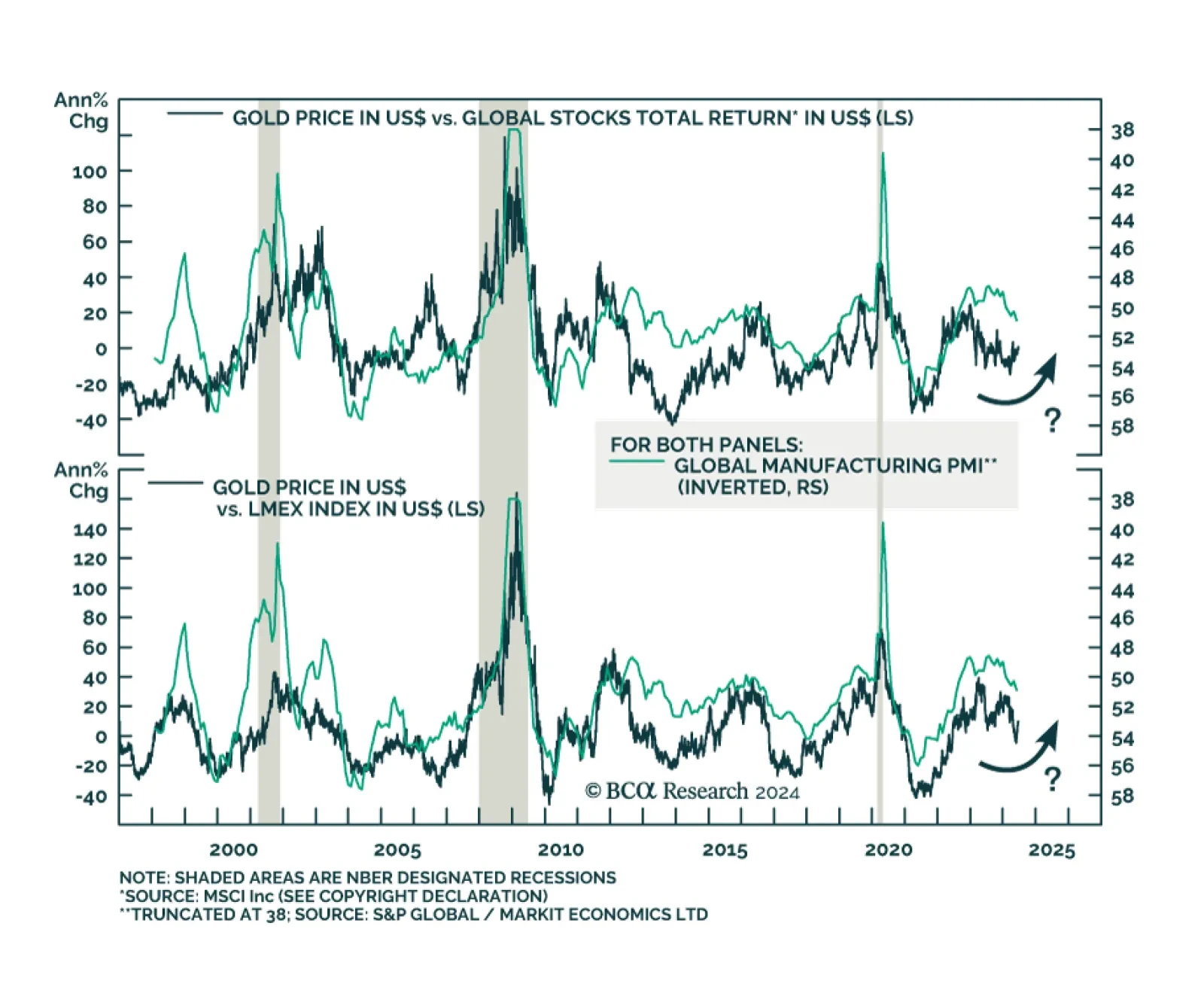

Gold spot prices have returned a whopping 25% YTD, with the bulk of this performance having occurred in the last three months. Interestingly, these gains have occurred despite the rise in real yields, with which they are…

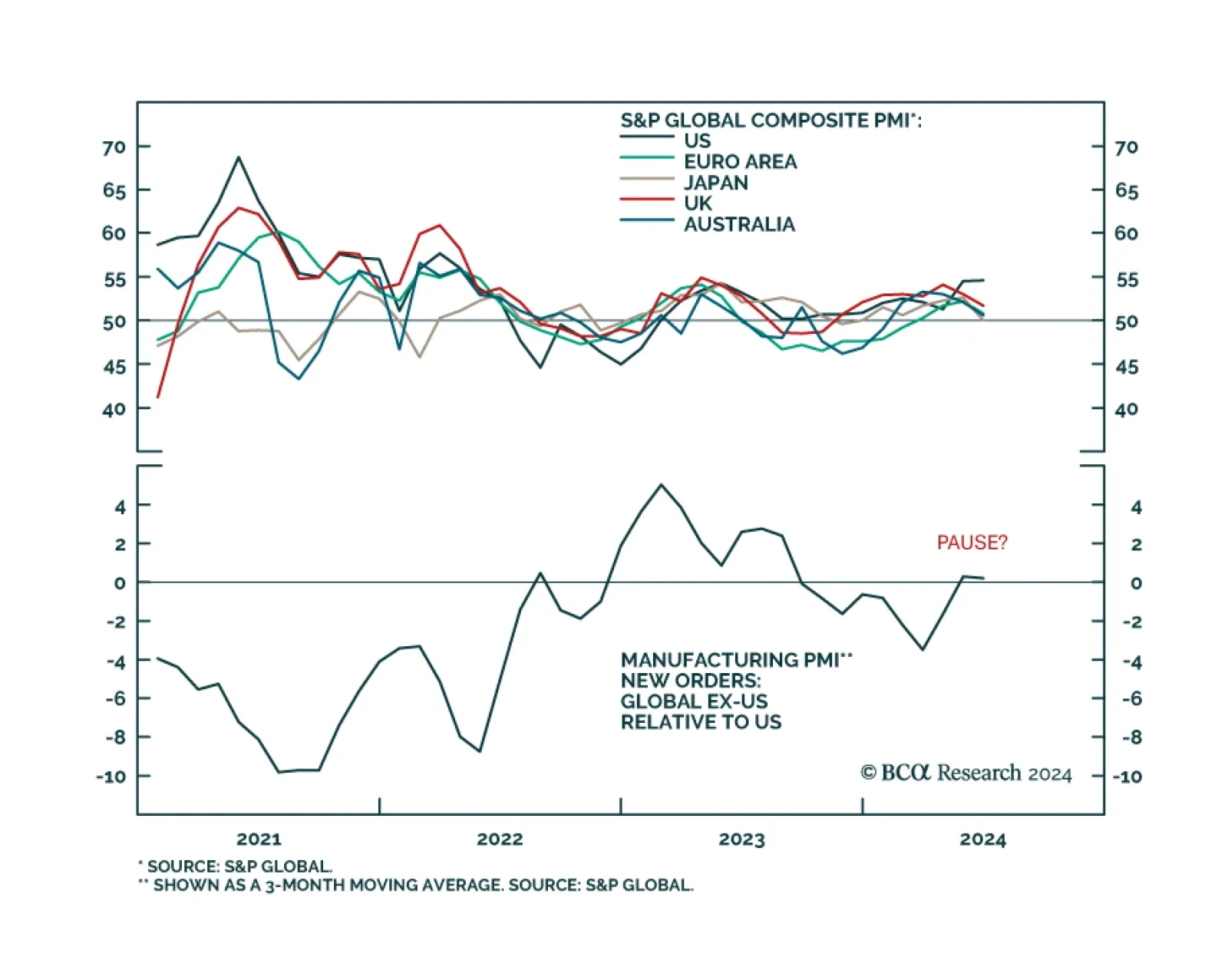

Preliminary PMI estimates suggest that US economic leadership remained intact in June, despite previous signs that it was passing the global growth baton to the rest of the world. US manufacturing, services and composite PMIs…

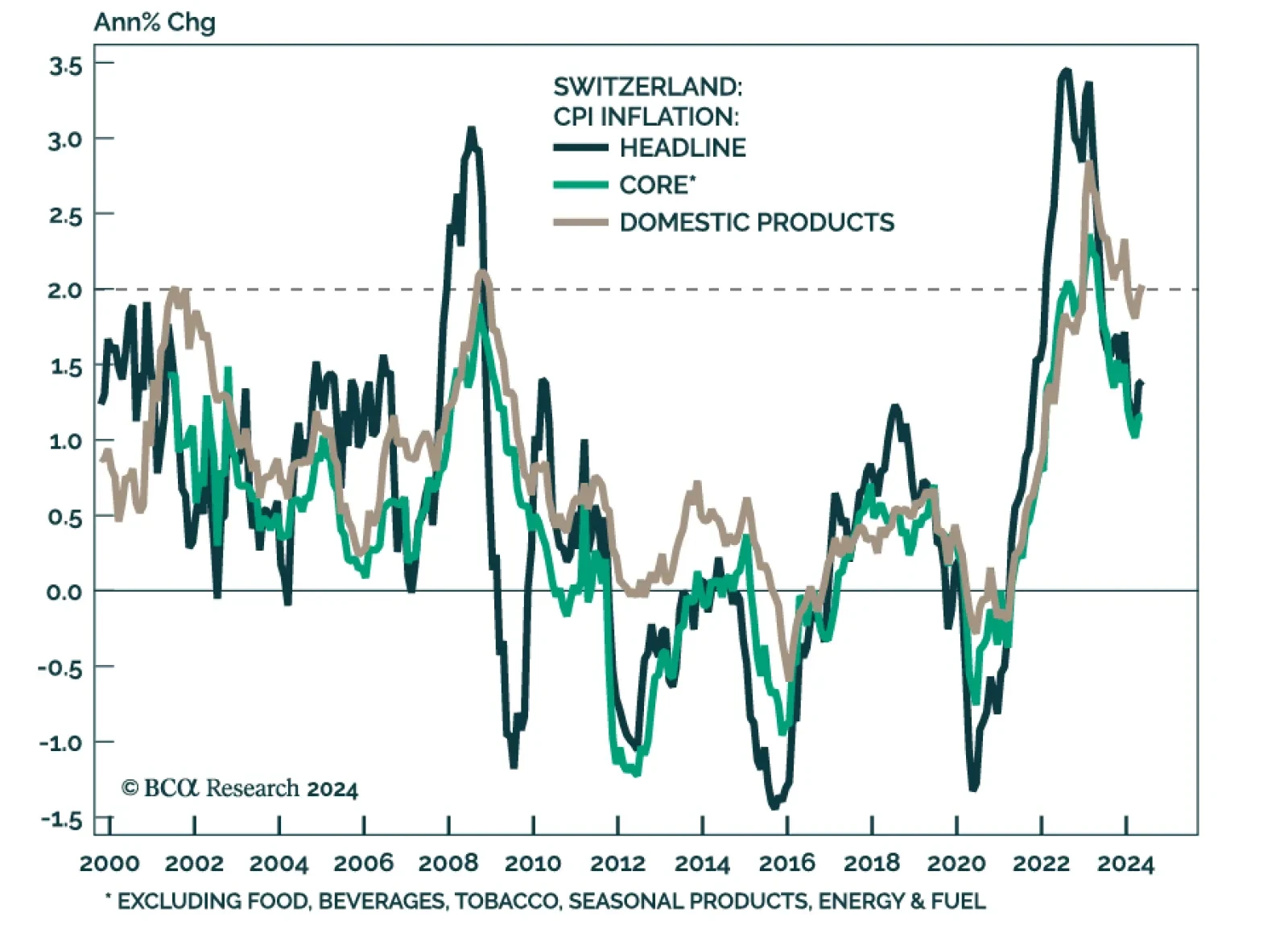

The Swiss National Bank (SNB) was the first major central bank to embark on a dovish pivot back in March. It lowered borrowing costs Thursday for a second consecutive meeting, from 1.5% to 1.25%, despite expectations that…