Concerns about the global economy have shifted from sticky inflation to faltering growth. Tight monetary policy is finally starting to bite. We suggest increasing portfolio defensiveness.

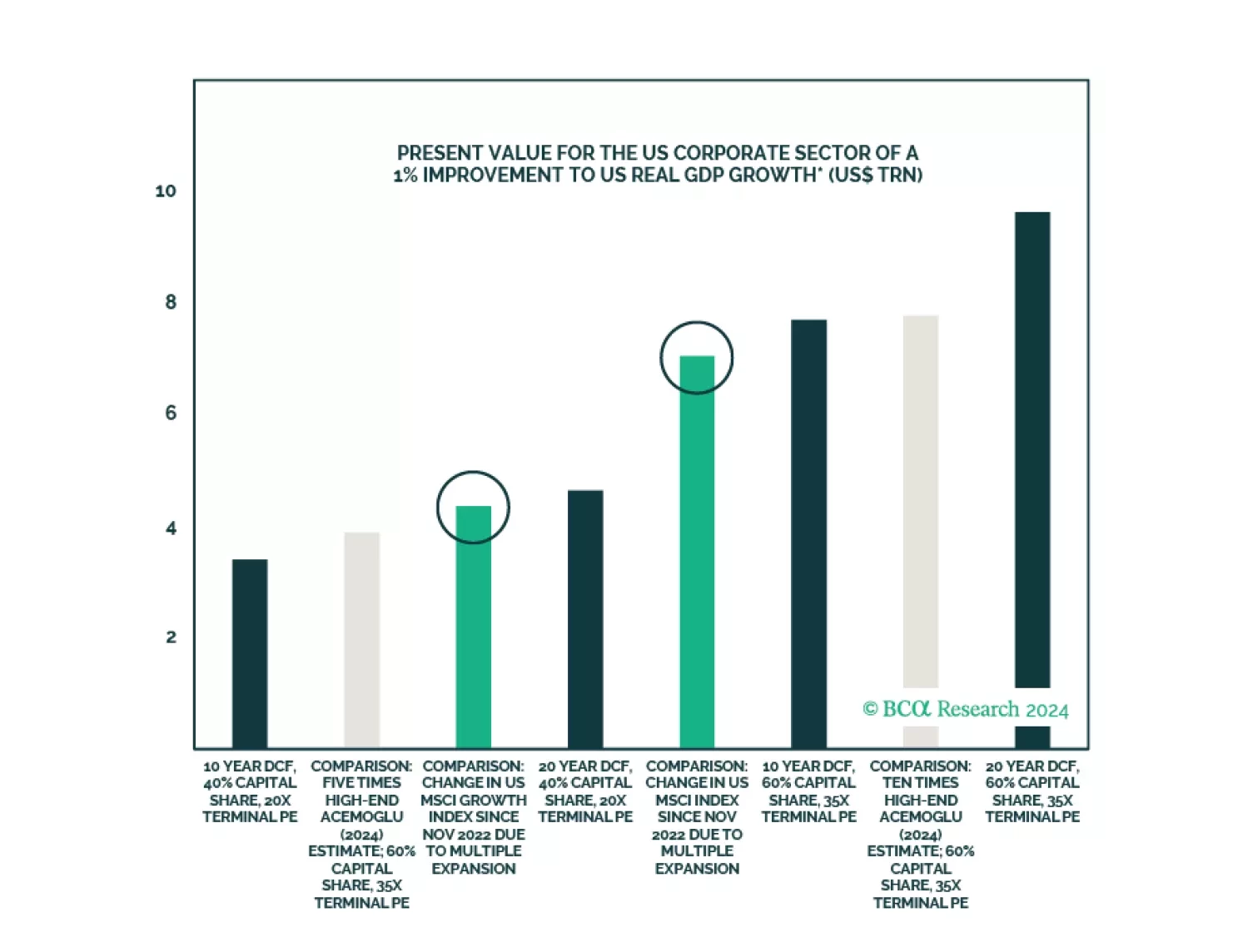

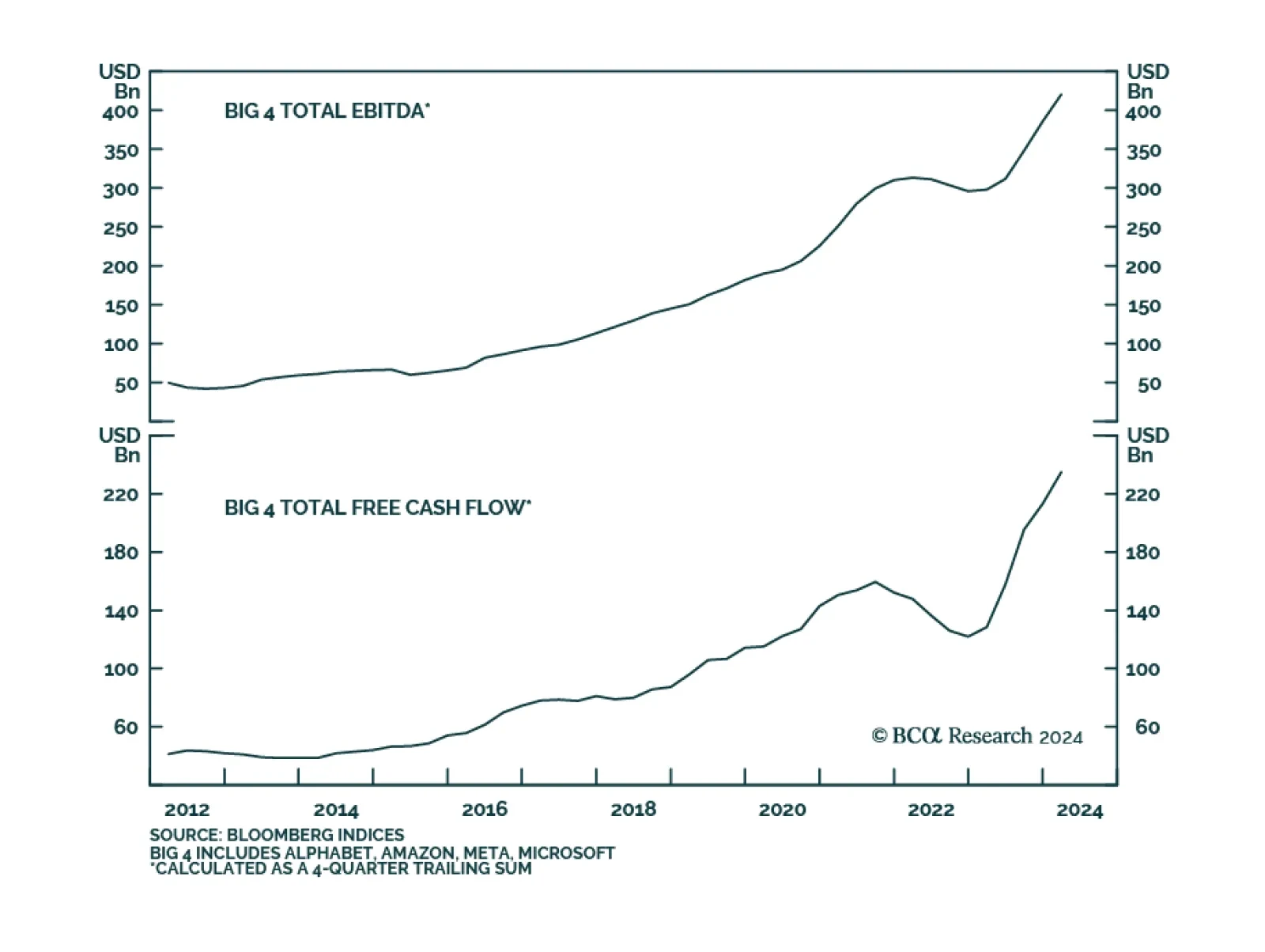

According to BCA Research’s Bank Credit Analyst service, if the US stock market is indeed grossly overvalued, then it is important for investors to identify triggers that might pop the bubble. A starting point is to ask…

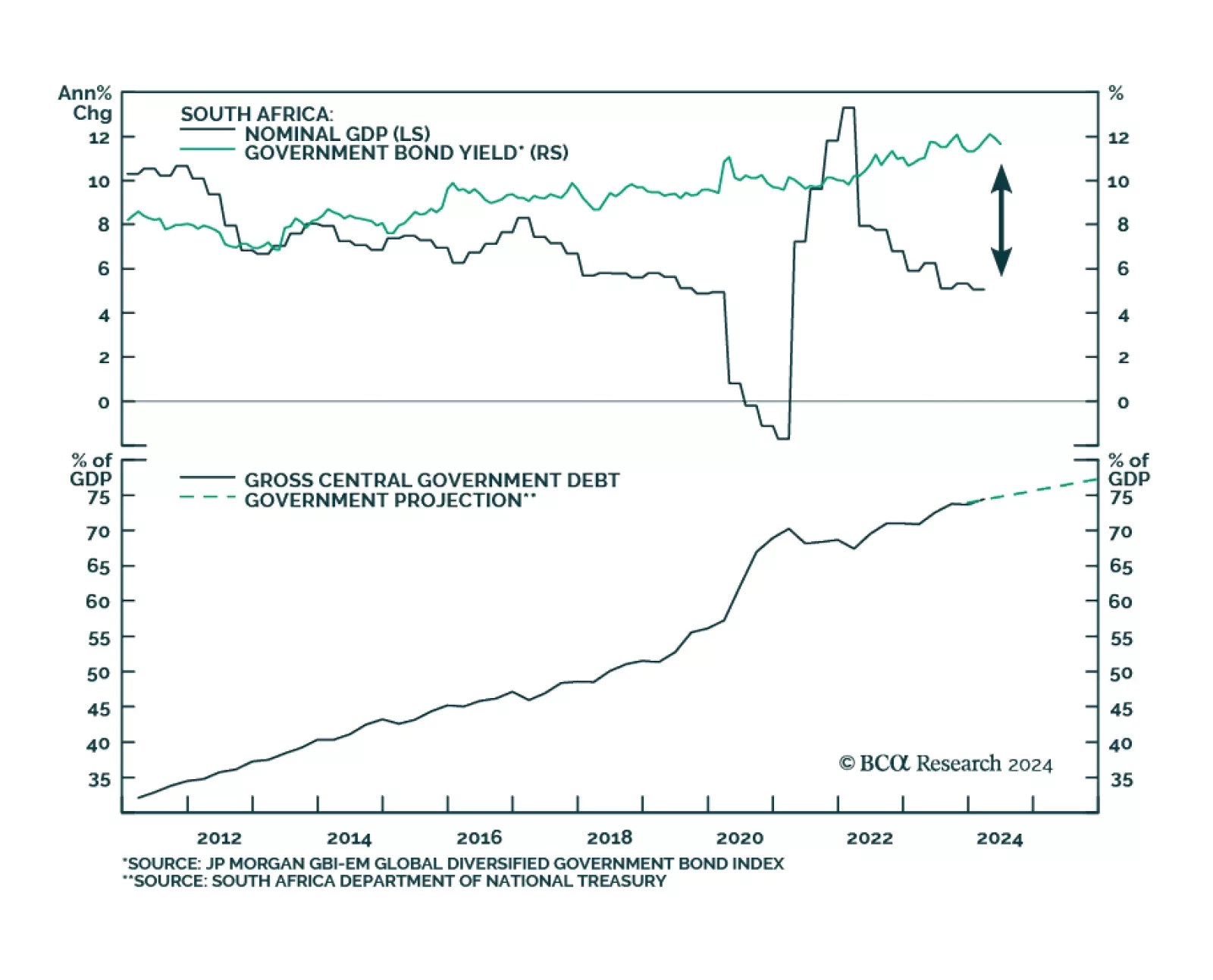

In a recent report, BCA Research’s Emerging Markets Strategy team recommended upgrading South African assets. The team argued that the new national unity government has an opportunity to ease the restrictive policies and…

In Section I, we examine some concerning signs of US economic weakness that emerged in June. We also discuss portfolio positioning in the face of falling interest rates and cross-check our recommended US equity overweight in the face…

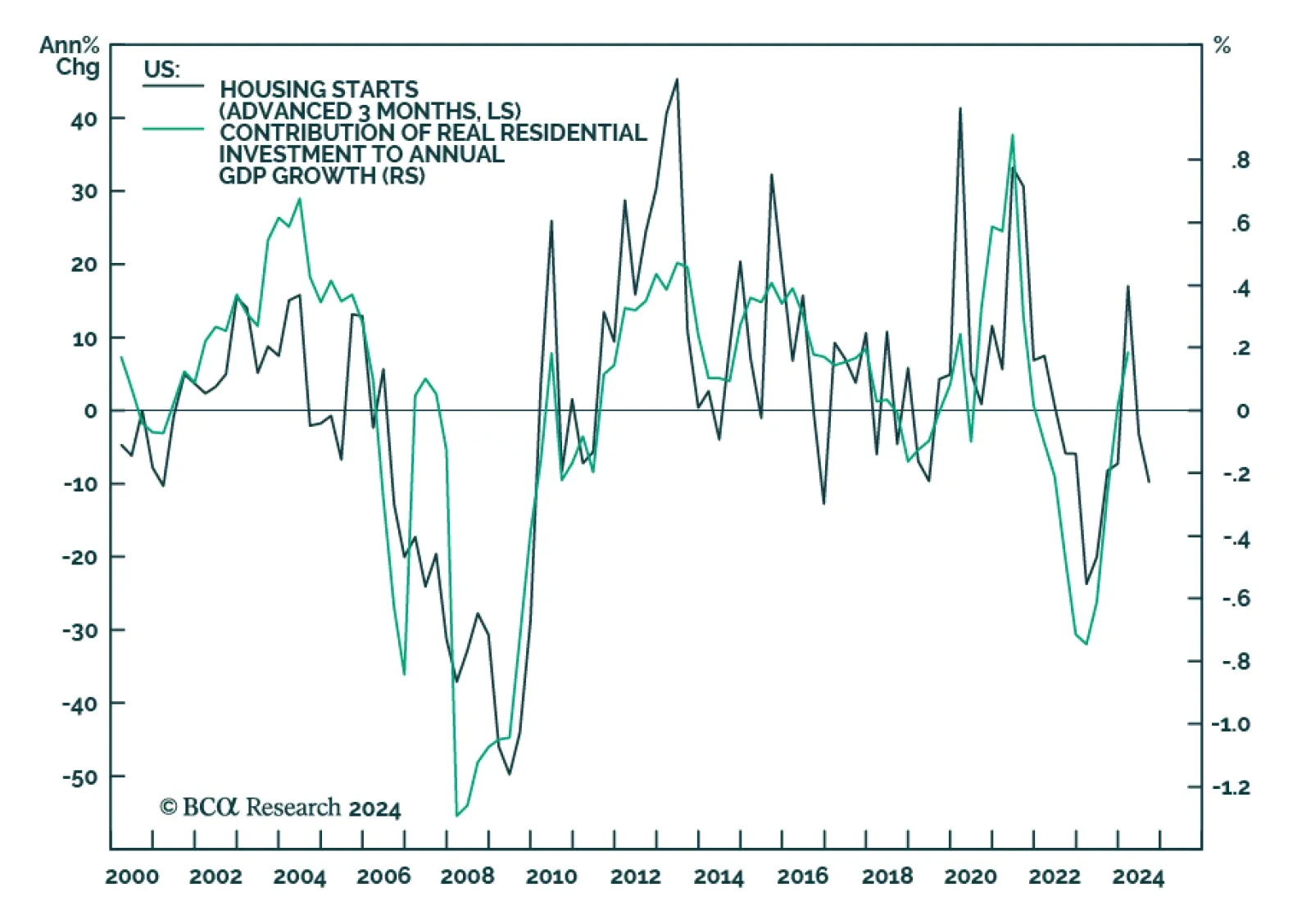

Right after the pandemic, many US homeowners locked in mortgages at extremely low rates. When interest rates rose, these homeowners refused to sell, as moving to a new home would result in an interest rate reset. In turn this…

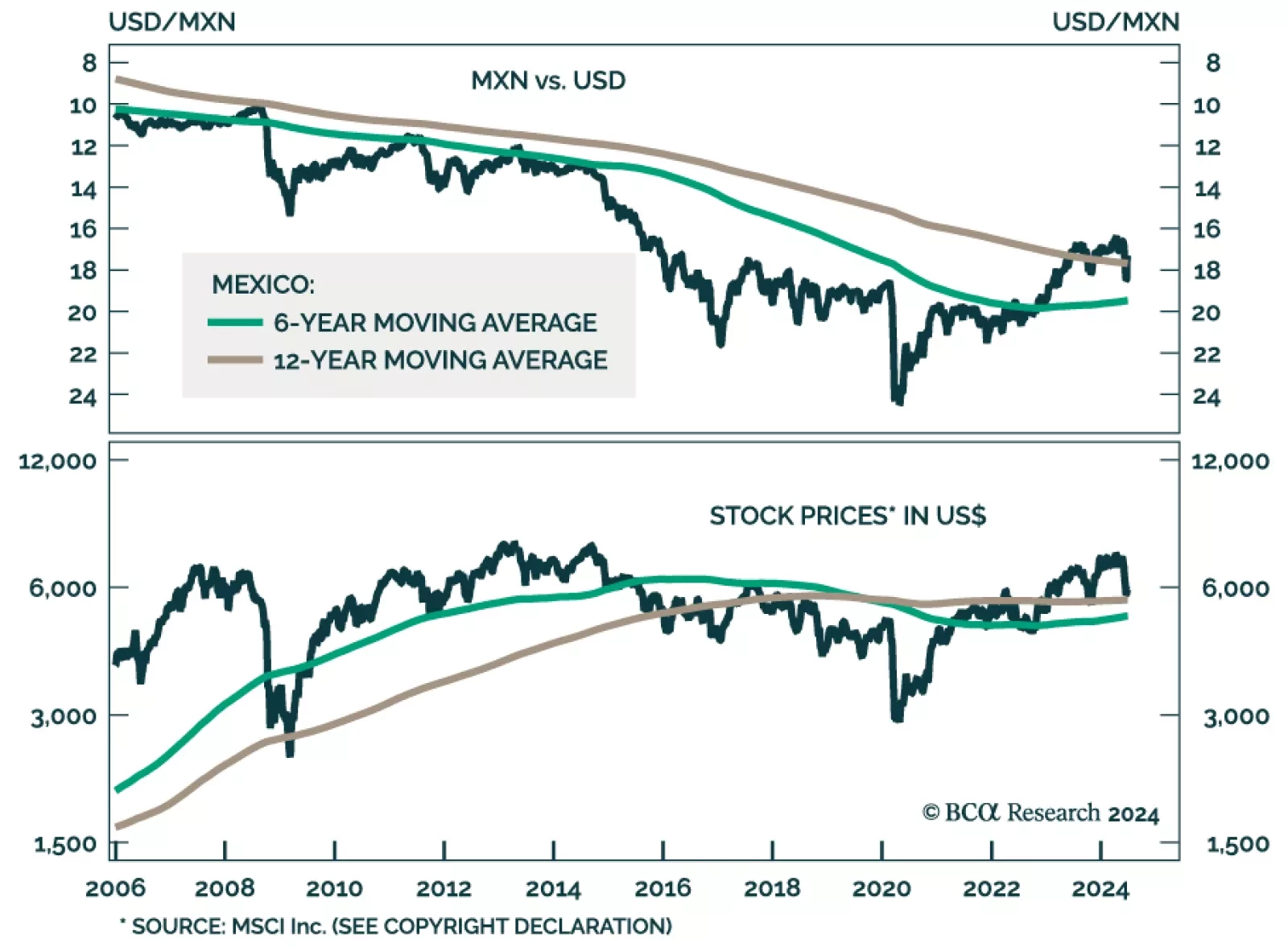

Mexico has gone from investor darling to massive underperformer within the EM space in the past month. In the eyes of our Emerging Markets Strategy team, the near-term outlook for Mexican risk assets remains poor in absolute…

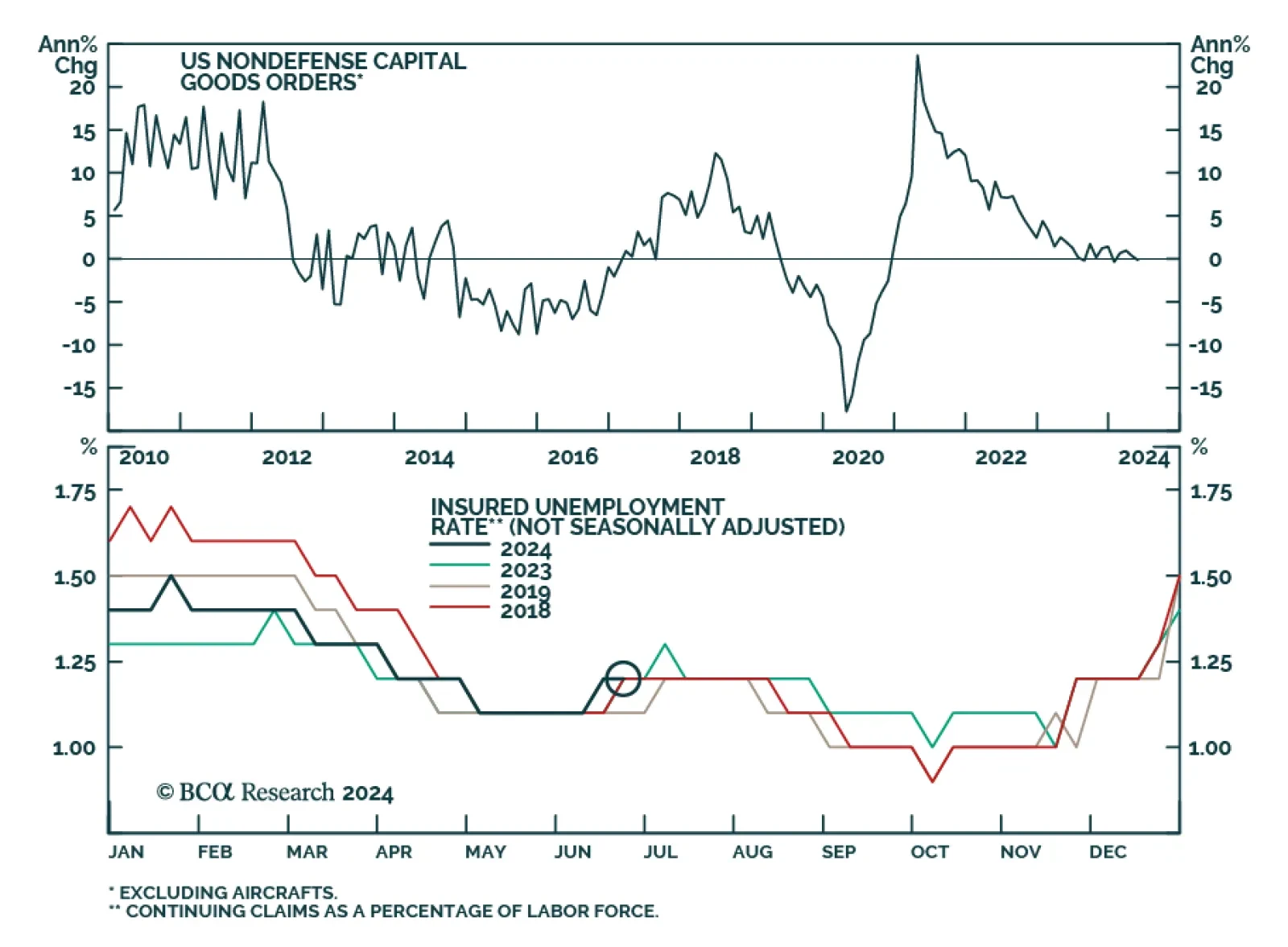

Several pieces of data were released for the US on Thursday. US durable goods orders growth slowed from 0.2% to 0.1% in May, beating expectations of a 0.5% contraction. However other components of the report disappointed…

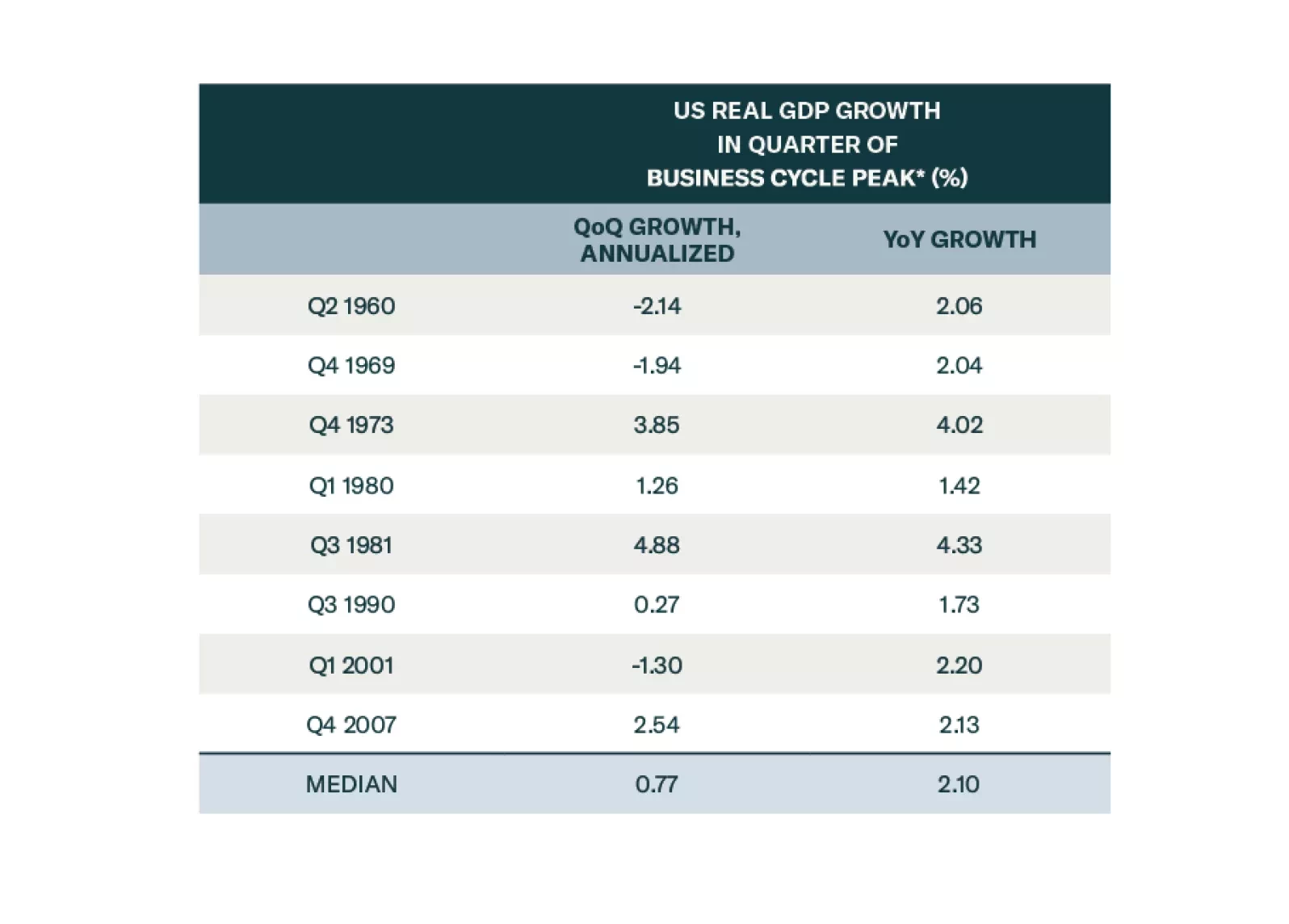

The consensus soft-landing narrative is wrong. The US will fall into a recession in late 2024 or early 2025. We were tactically bullish on stocks most of last year, turned neutral earlier this year, and are going underweight today.…