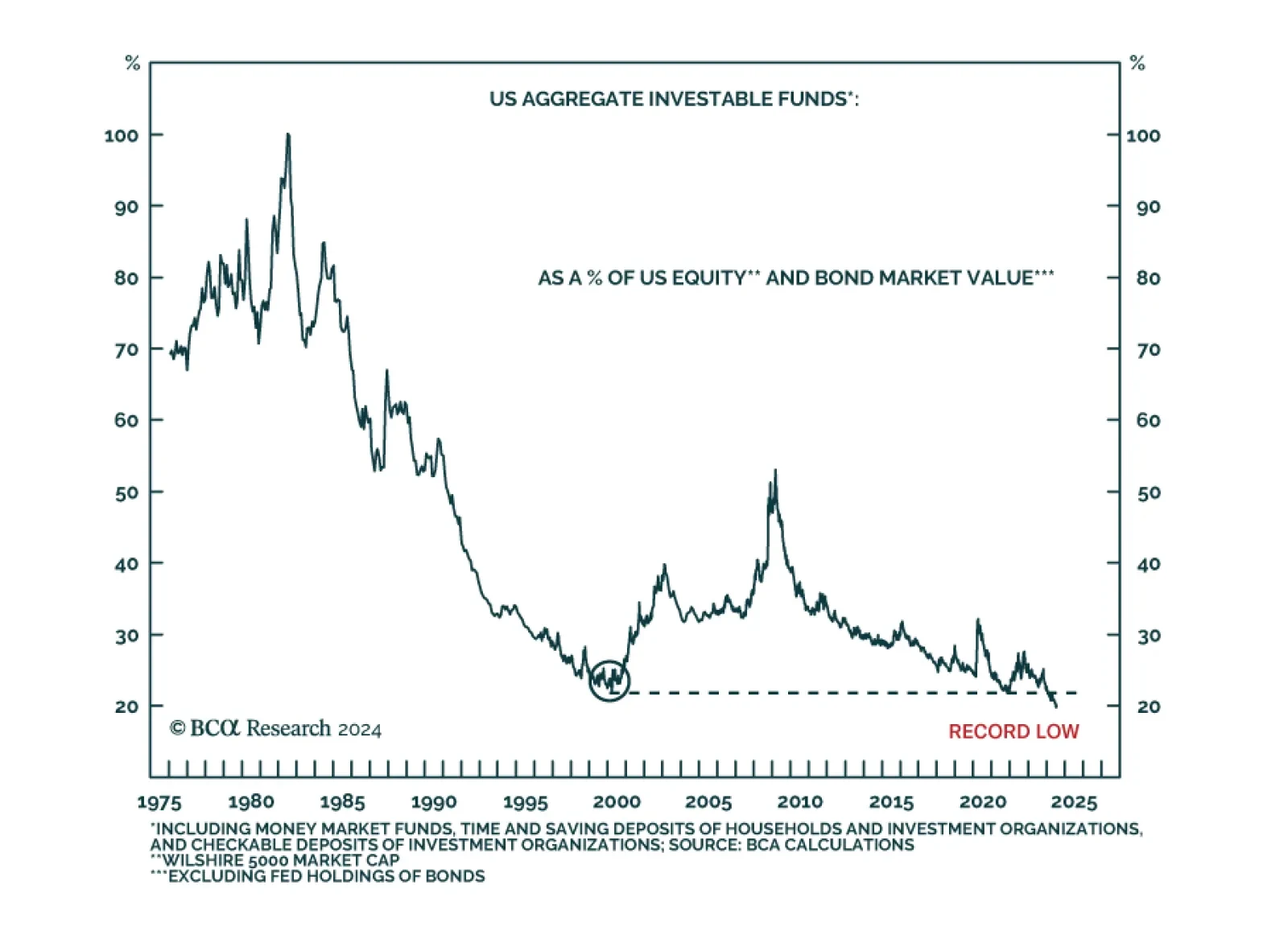

According to BCA Research’s Emerging Markets Strategy service, there is little firepower left to sustain the US equity rally much further. The ratio of aggregate investable funds of US households and investment…

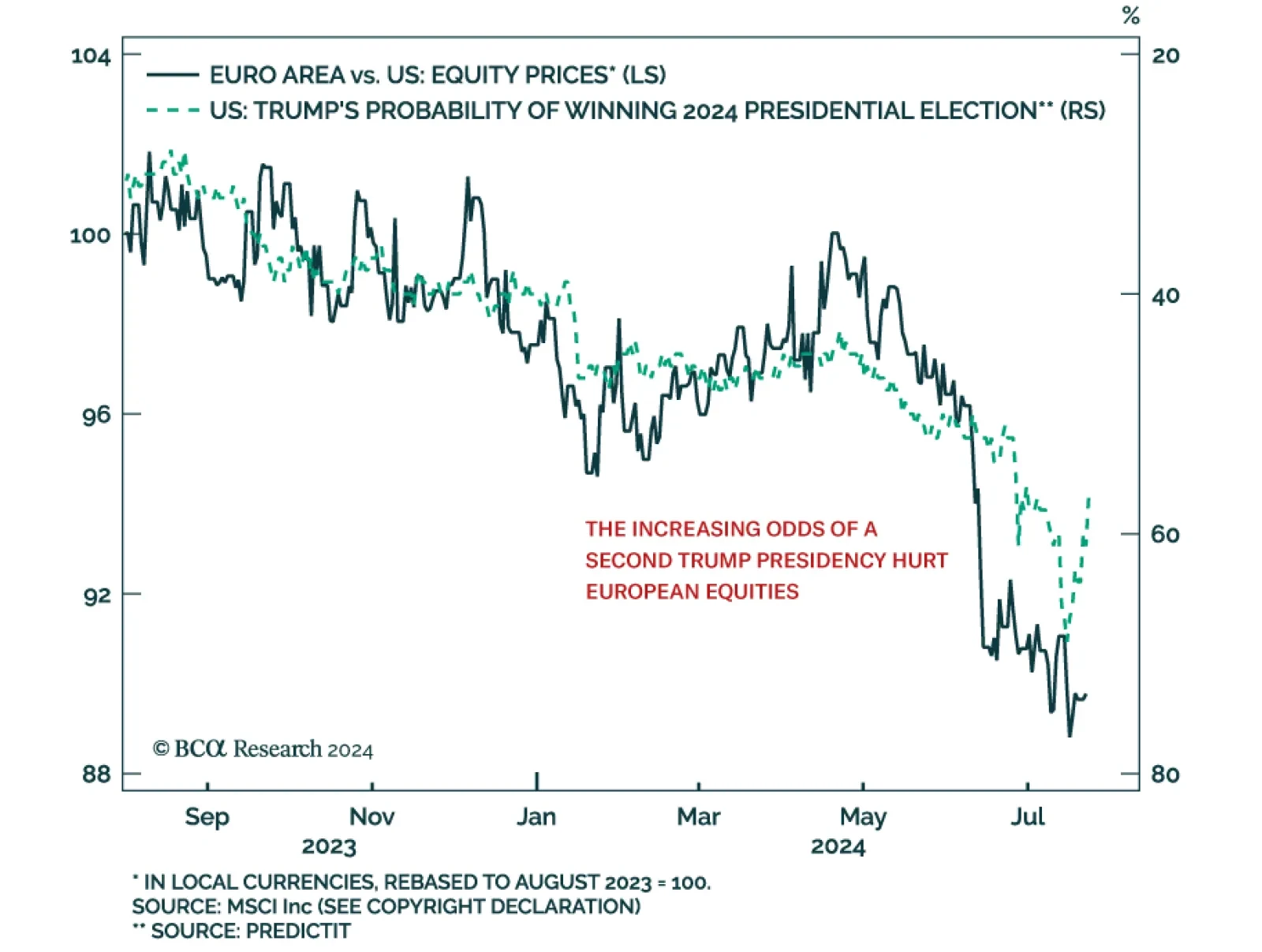

According to BCA Research’s European Investment Strategy service, the impact on global trade from another round of tariffs under a potential Trump administration is an emerging risk to Europe. The underperformance of…

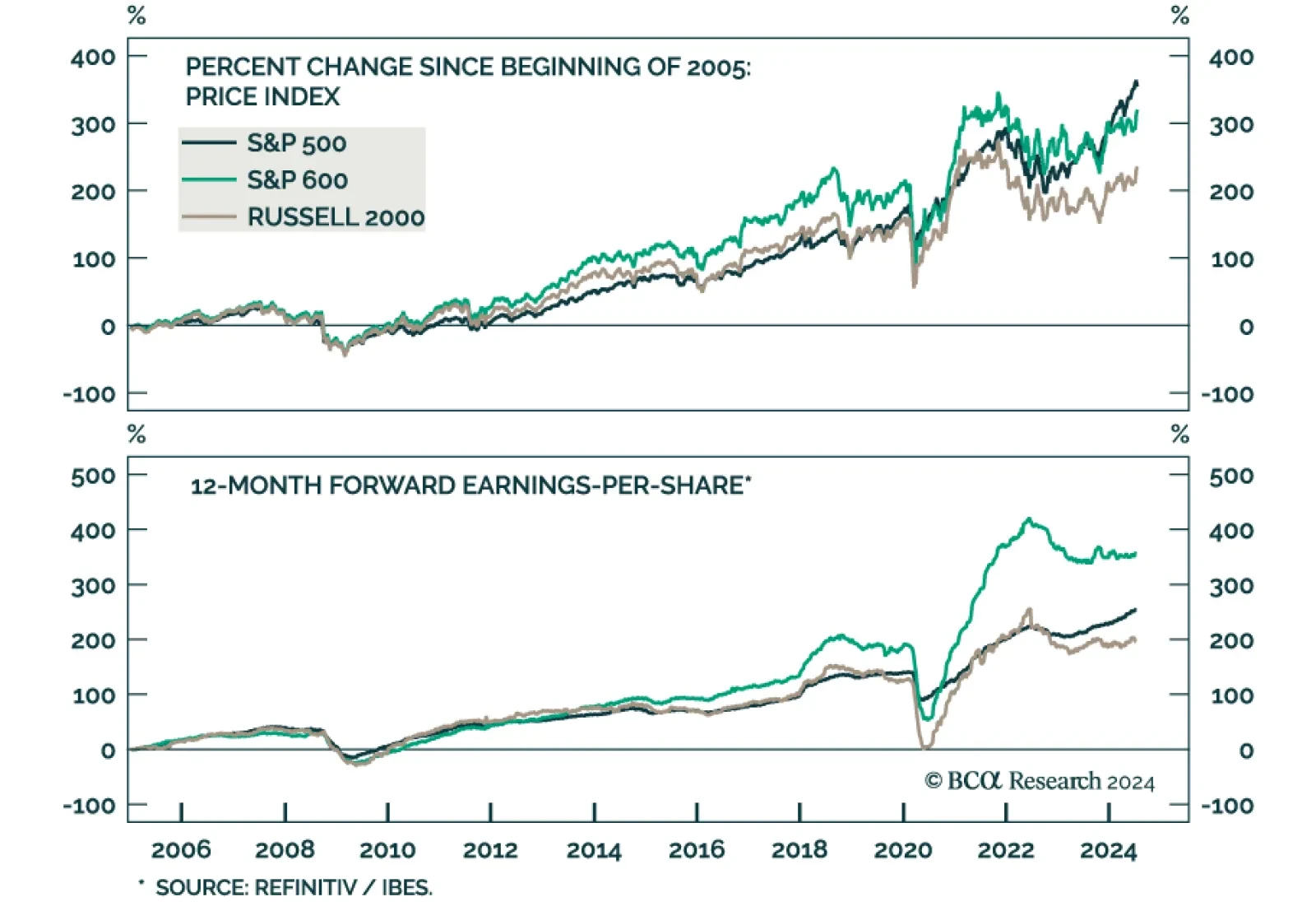

The S&P 600 and Russell 2000 have outperformed the S&P 500 by close to 10% since July 9. Small caps typically outperform in the early stages of economic expansions when growth is accelerating, demand-driven inflation is…

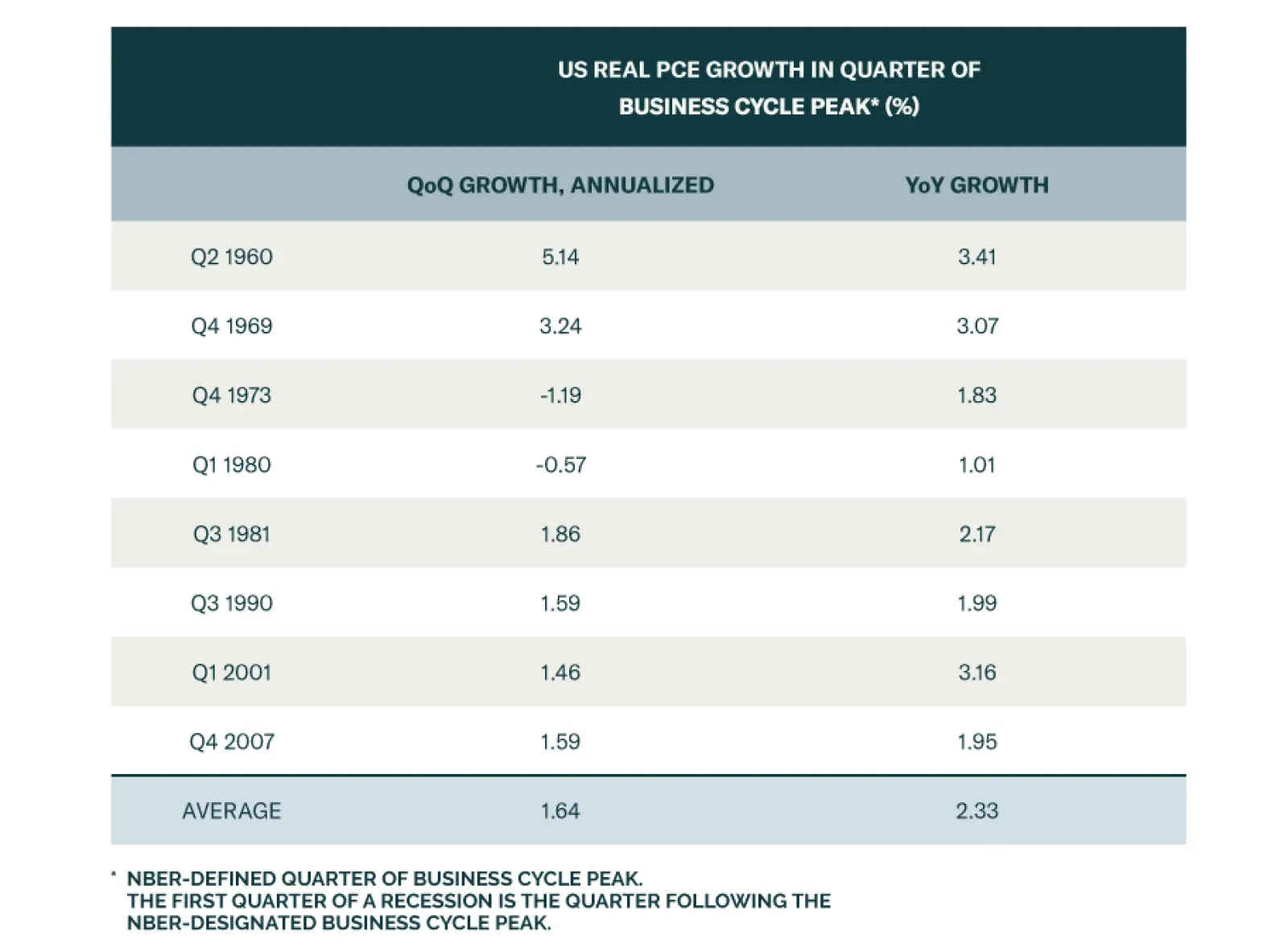

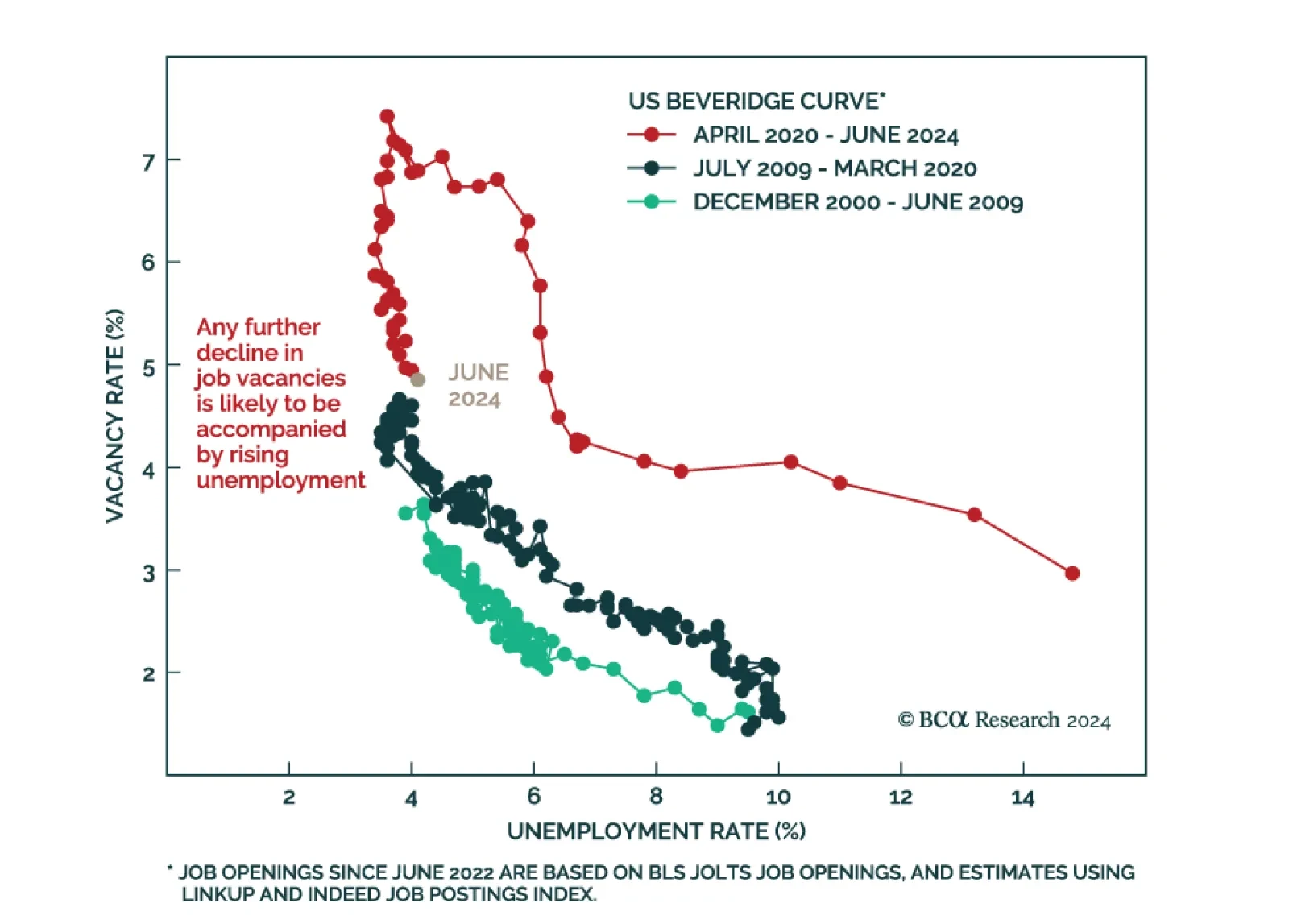

The US economy has clearly cooled from its above-trend pace of growth in 2023. The consensus view among BCA Research’s strategists project that this deceleration will eventually culminate in a recession by year-end or early…

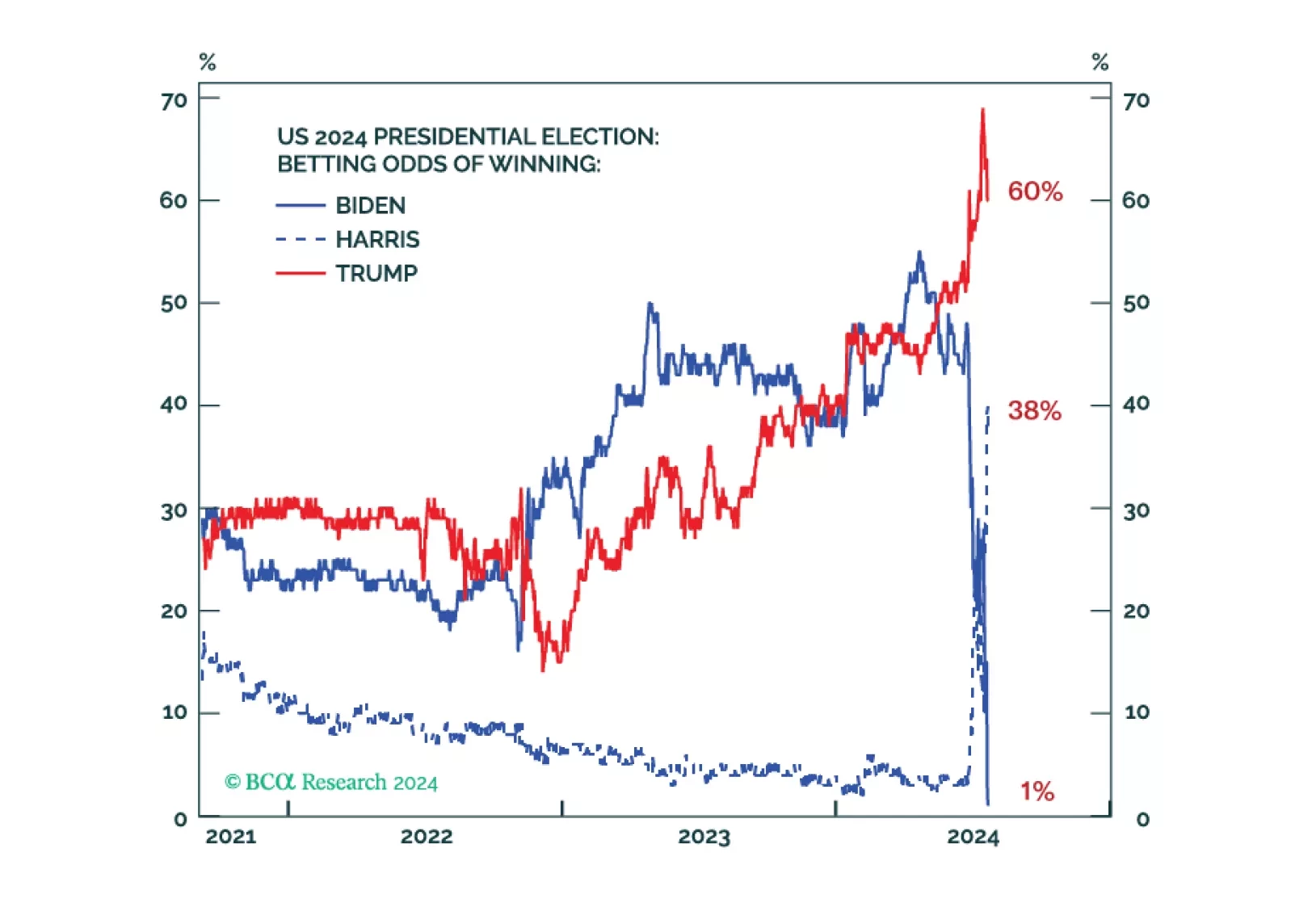

Investors should focus on growth concerns rather than the “Trump trade.” Bond yields will fall in the short run due to cyclically disinflationary economic slowdown, rather than rise in anticipation of a Republican full sweep and…

As Trump’s victory odds rise, the underperformance of European equities deepens. How negative would a global trade war be for European assets?

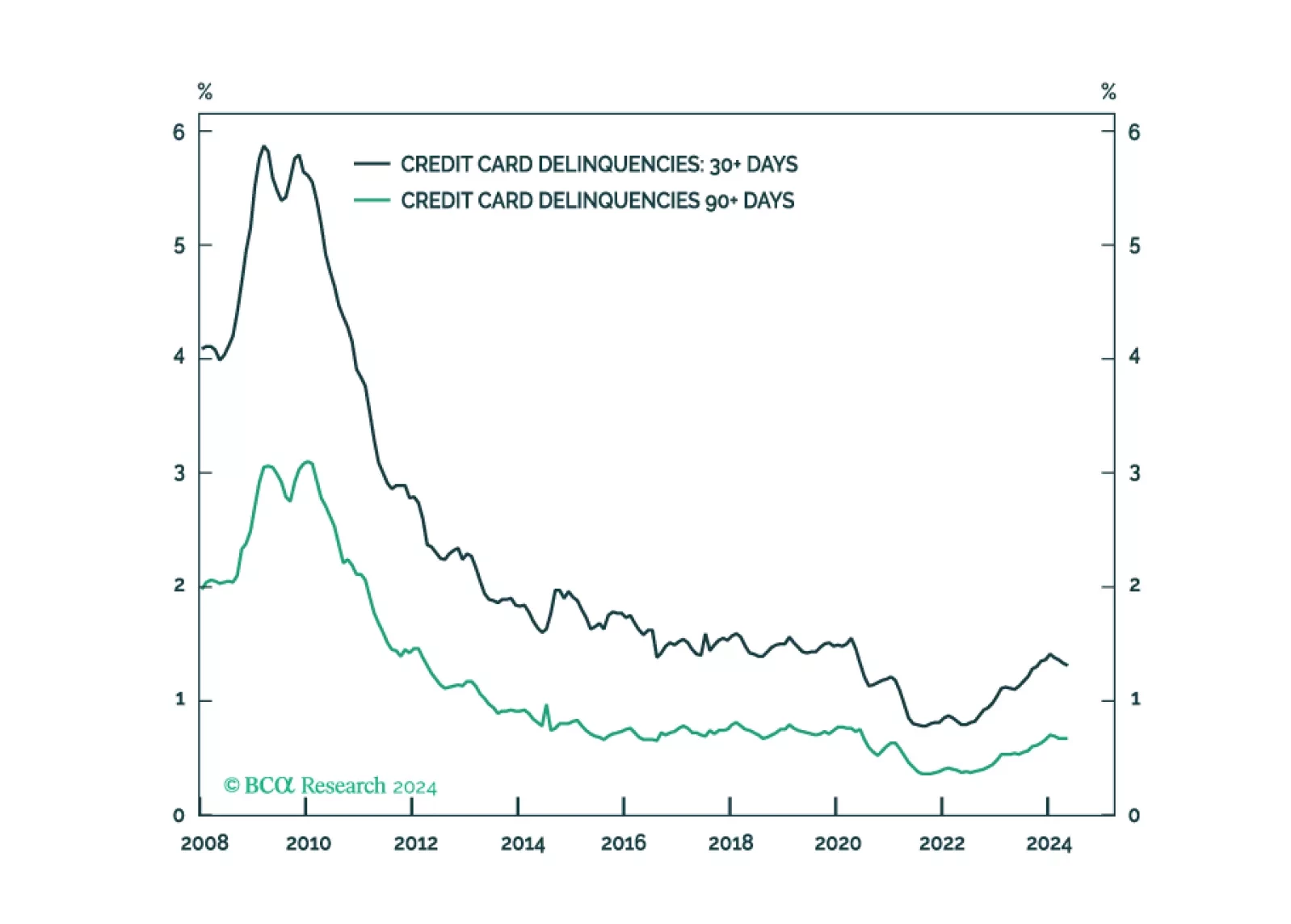

It’s status quo for the SIFI banks, as they don’t see consumer credit performance materially worsening from now-normalized levels and they are not meaningfully exposed to commercial real estate losses.

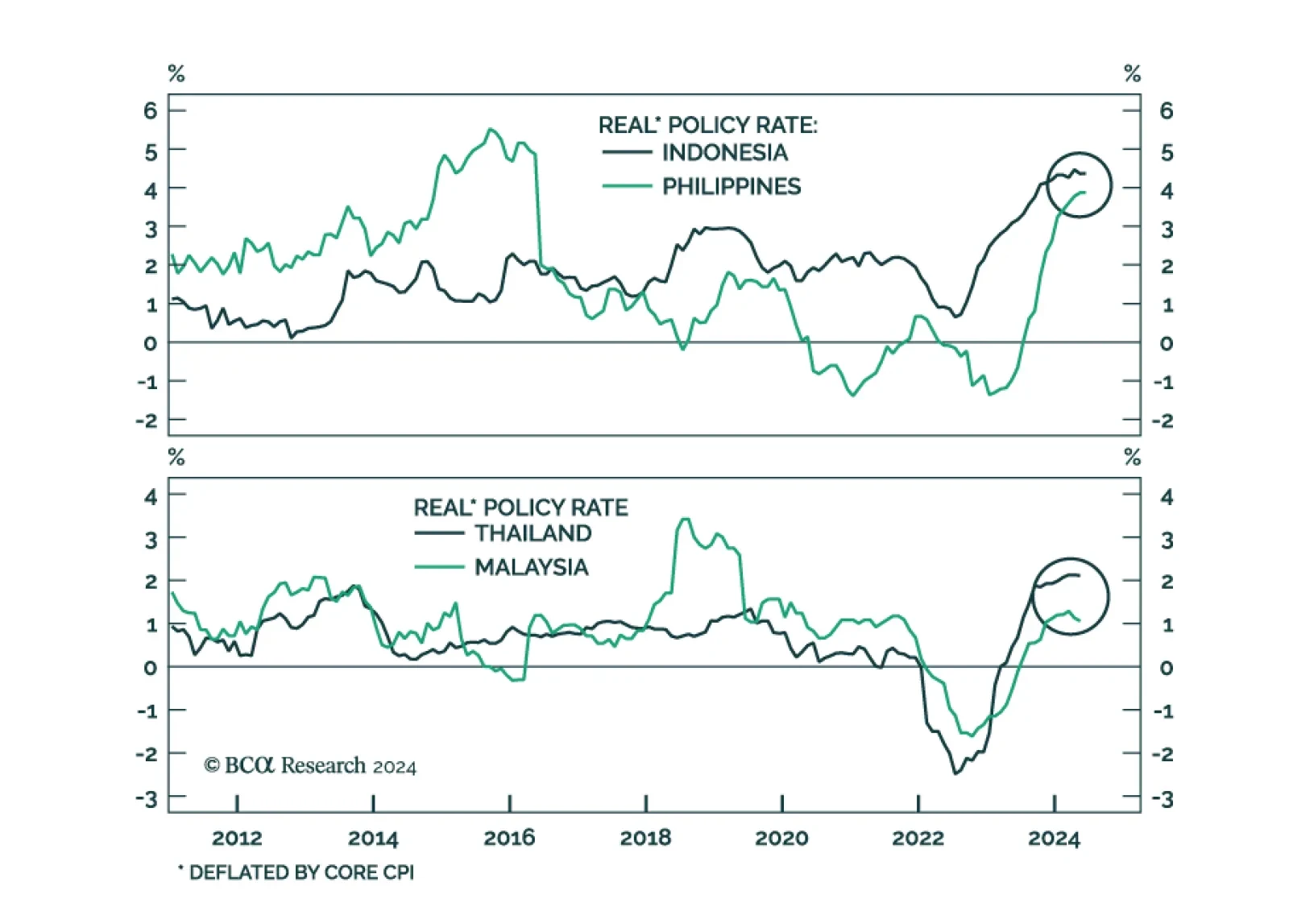

The four ASEAN stock markets (Indonesia, Malaysia, Thailand, and the Philippines) have fallen in absolute terms over the past year despite the powerful rally in the developed markets. They have also underperformed their EM…

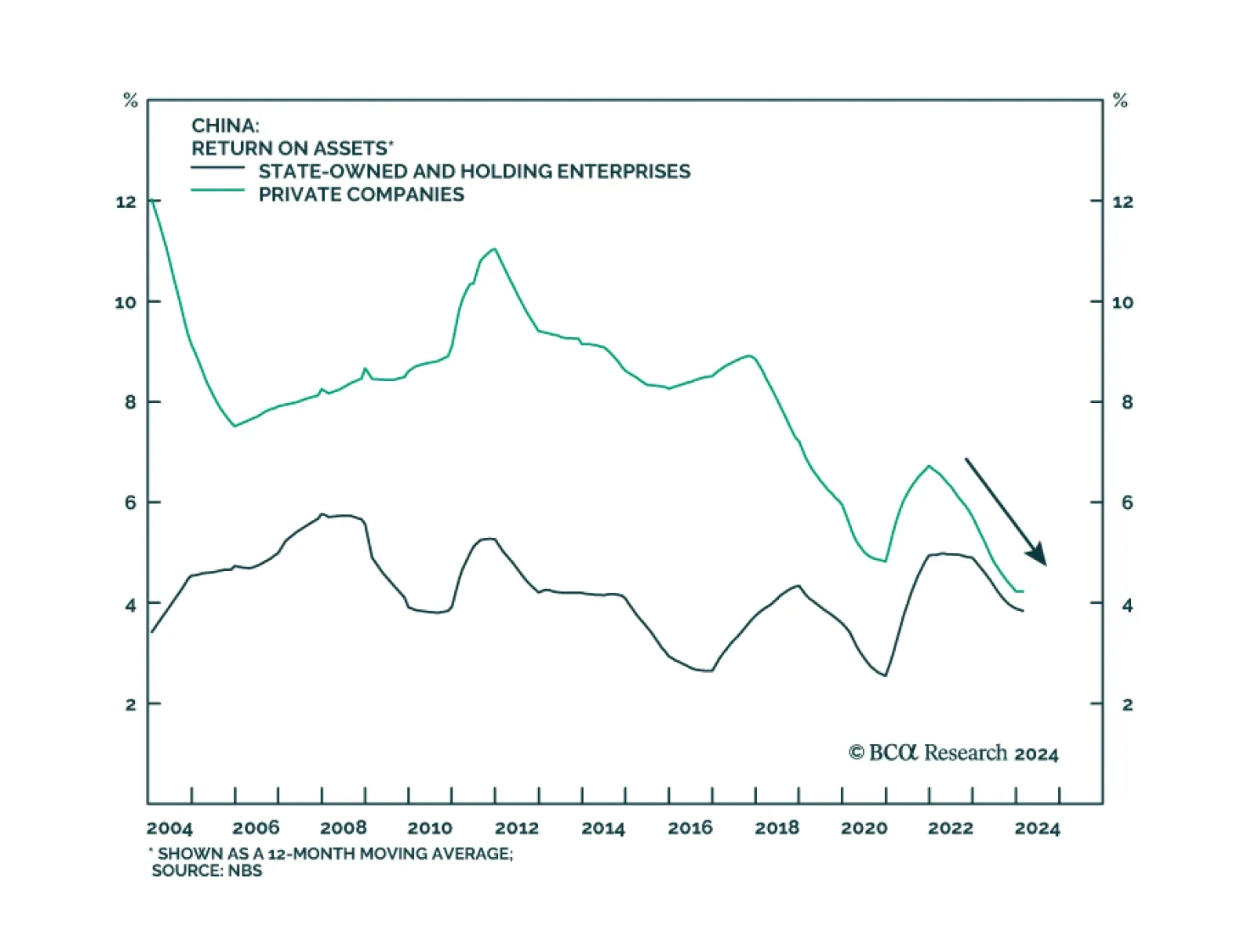

Though hope springs eternal among global investors for big-bang stimulus from Beijing, the closely watched Third Plenum adjourned without any specific prescriptions to reverse China’s economic slump. The communiqu…

BCA Research’s Global Investment Strategy service remained tactically bullish on stocks for most of 2023, but shifted to neutral at the start of 2024, and downgraded stocks to underweight in late June. Its latest report…