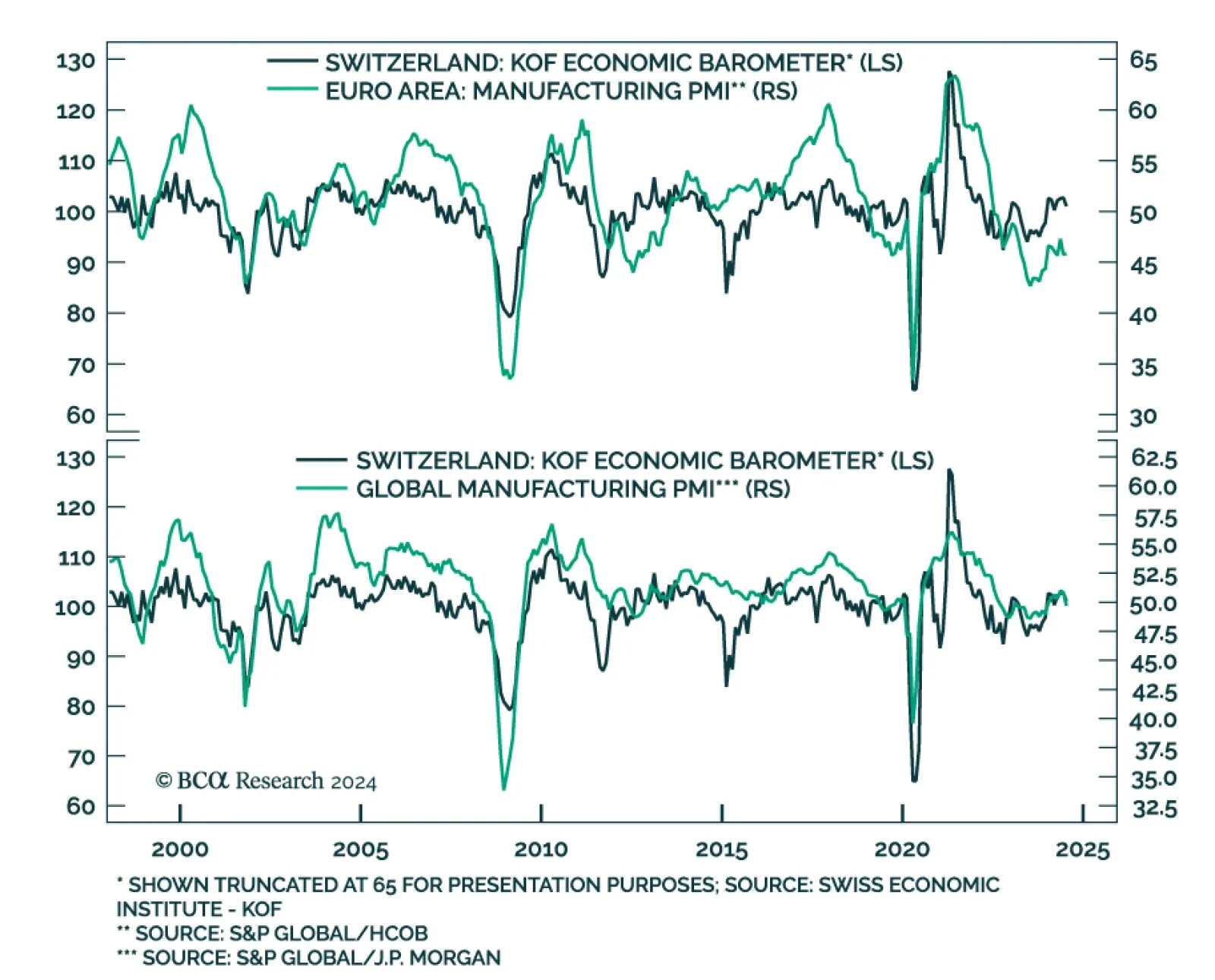

US economic news has stolen the spotlight in the past several days but economic developments in the rest of the world have also been uninspiring. The JPM Global Manufacturing PMI dipped into contraction territory in July,…

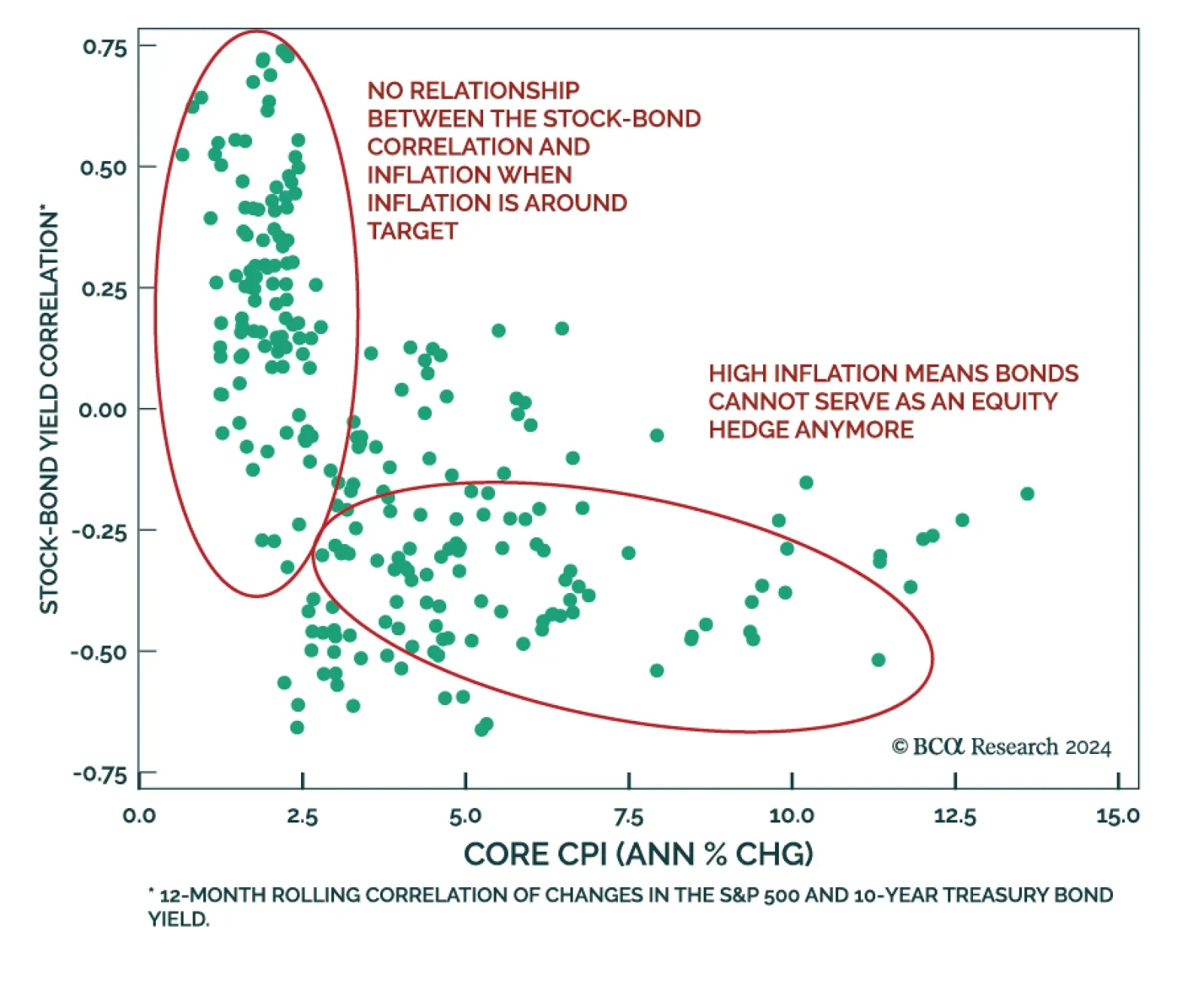

According to BCA Research’s Global Asset Allocation service, while the market action of the past few weeks is pointing to a return to a negative stock-bond correlation, more prints will be needed to confirm things are…

August’s selloff has featured a rotation out of Big Tech. The Nasdaq shed 8% across Thursday, Friday, and Monday, led by concentrated selling among several Mega caps. Nvidia, Tesla, Microsoft and Amazon shed 14%, 14%, 6%…

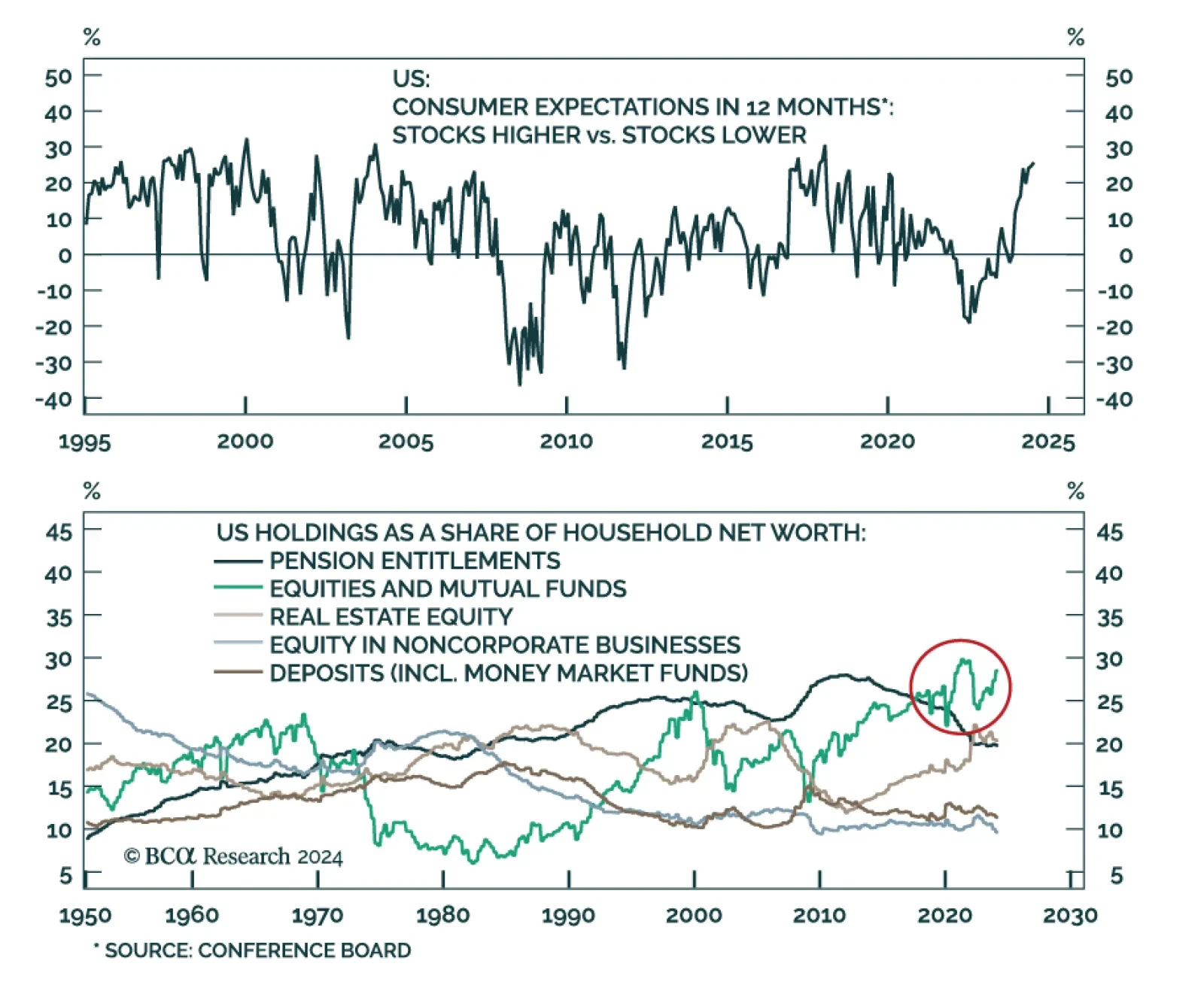

The latest Conference Board measure of consumer confidence suggested that consumers were increasingly downbeat about current economic conditions. Notably, their fading optimism about labor market conditions drove the jobs-…

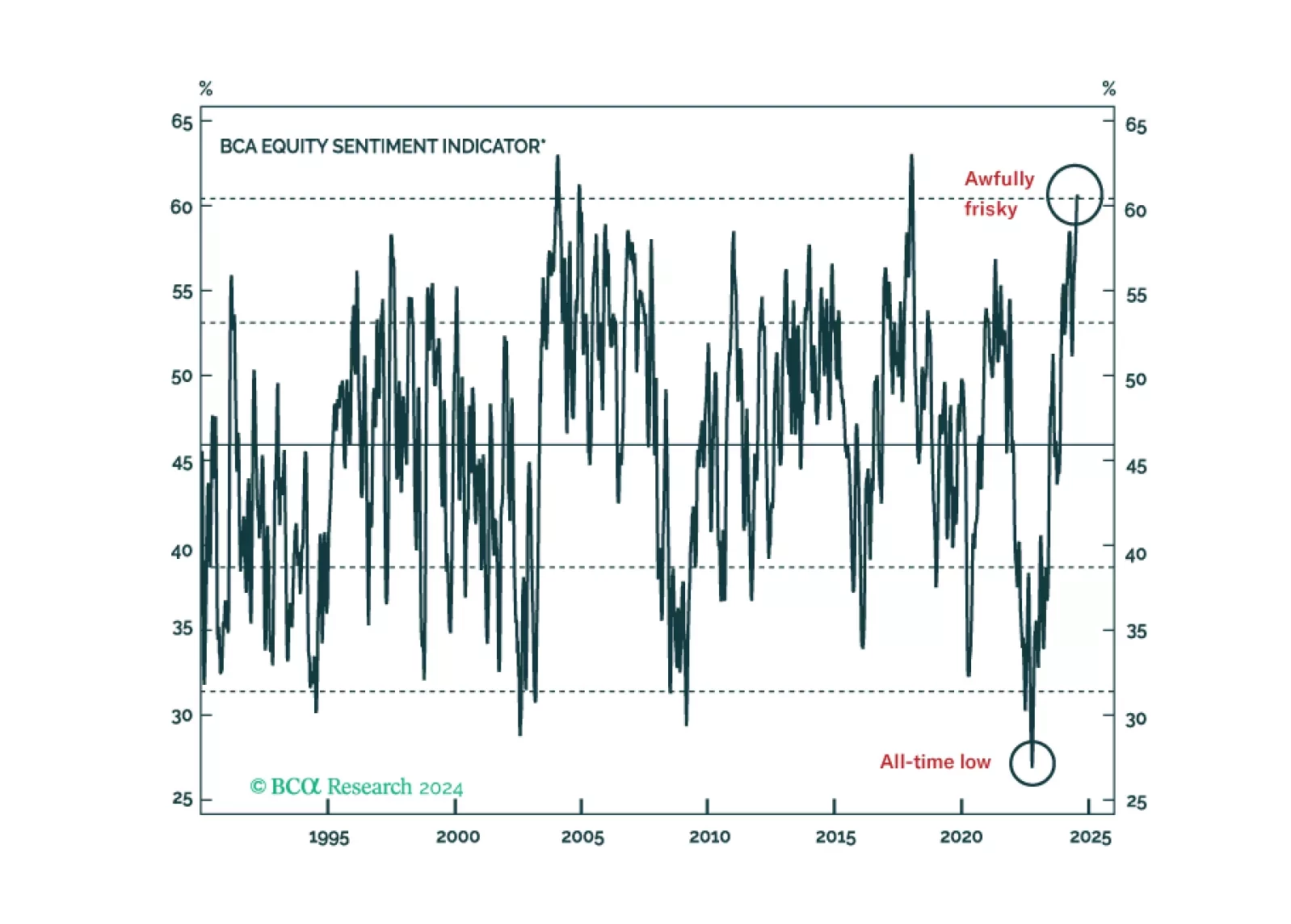

Mounting evidence that the labor market is on its way to cracking checked two more boxes on our checklist, driving us to tactically downgrade equities to underweight while upgrading fixed income to overweight. Our tactical and…

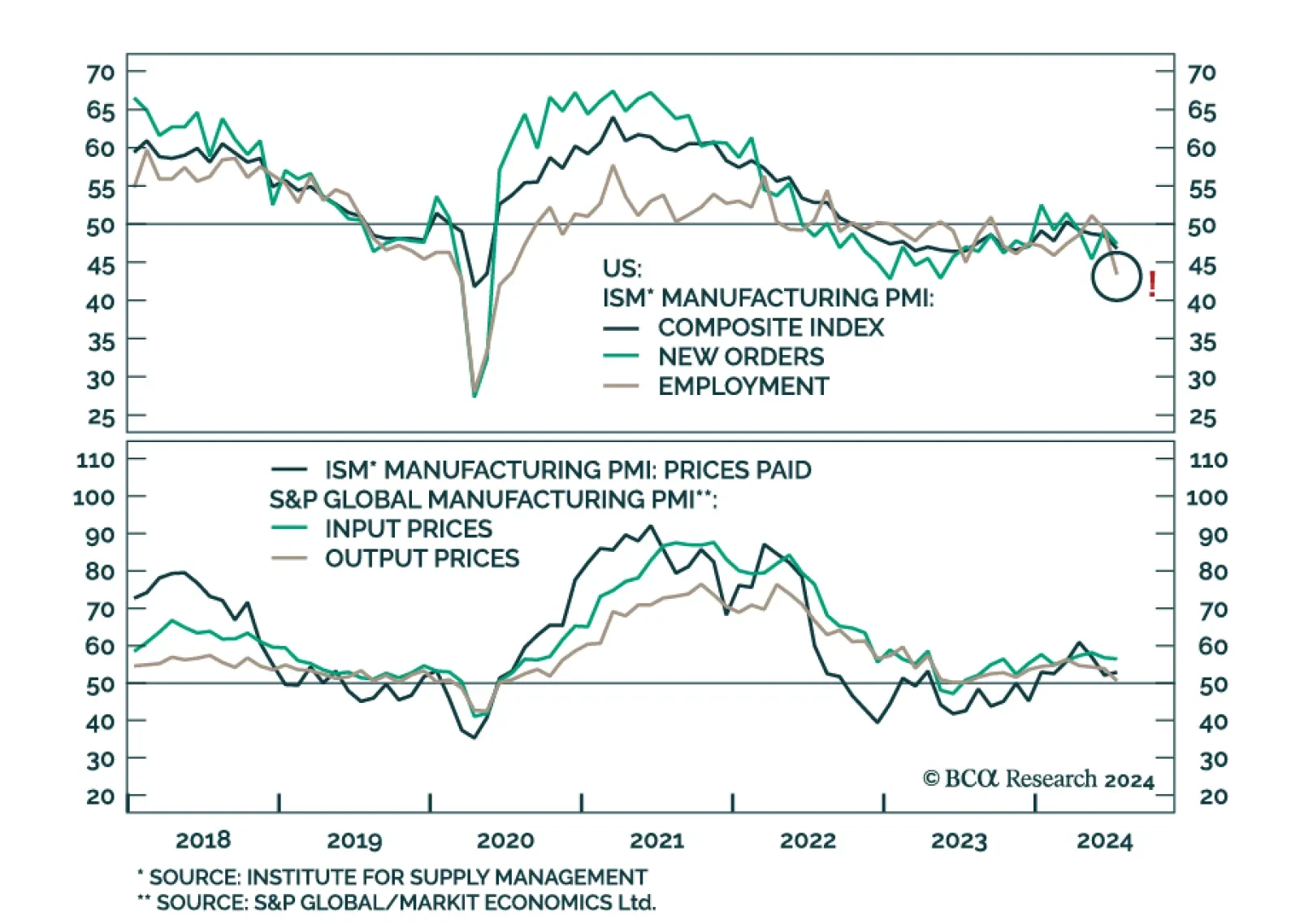

The ISM Manufacturing PMI disappointed in July. The headline index declined at a faster pace, from 48.5 to 46.8, disappointing expectations and extending a four-month contraction streak. Details were uninspiring. New orders…

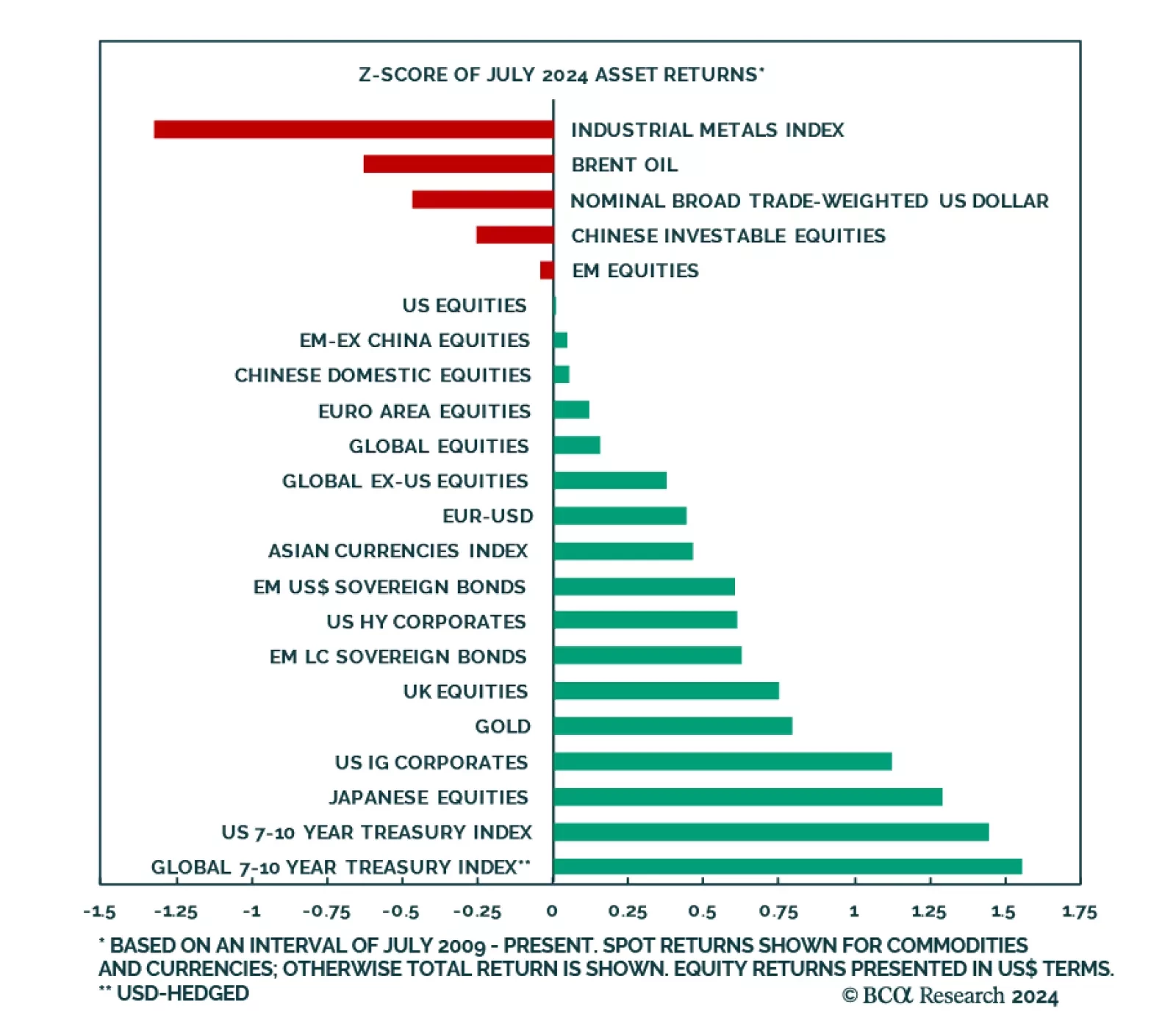

No clear risk-on/risk-off pattern emerged from July’s market performance data. On the one hand, consistent with a risk-off environment, US bonds ranked highest in the monthly return distribution, while pro-cyclical…

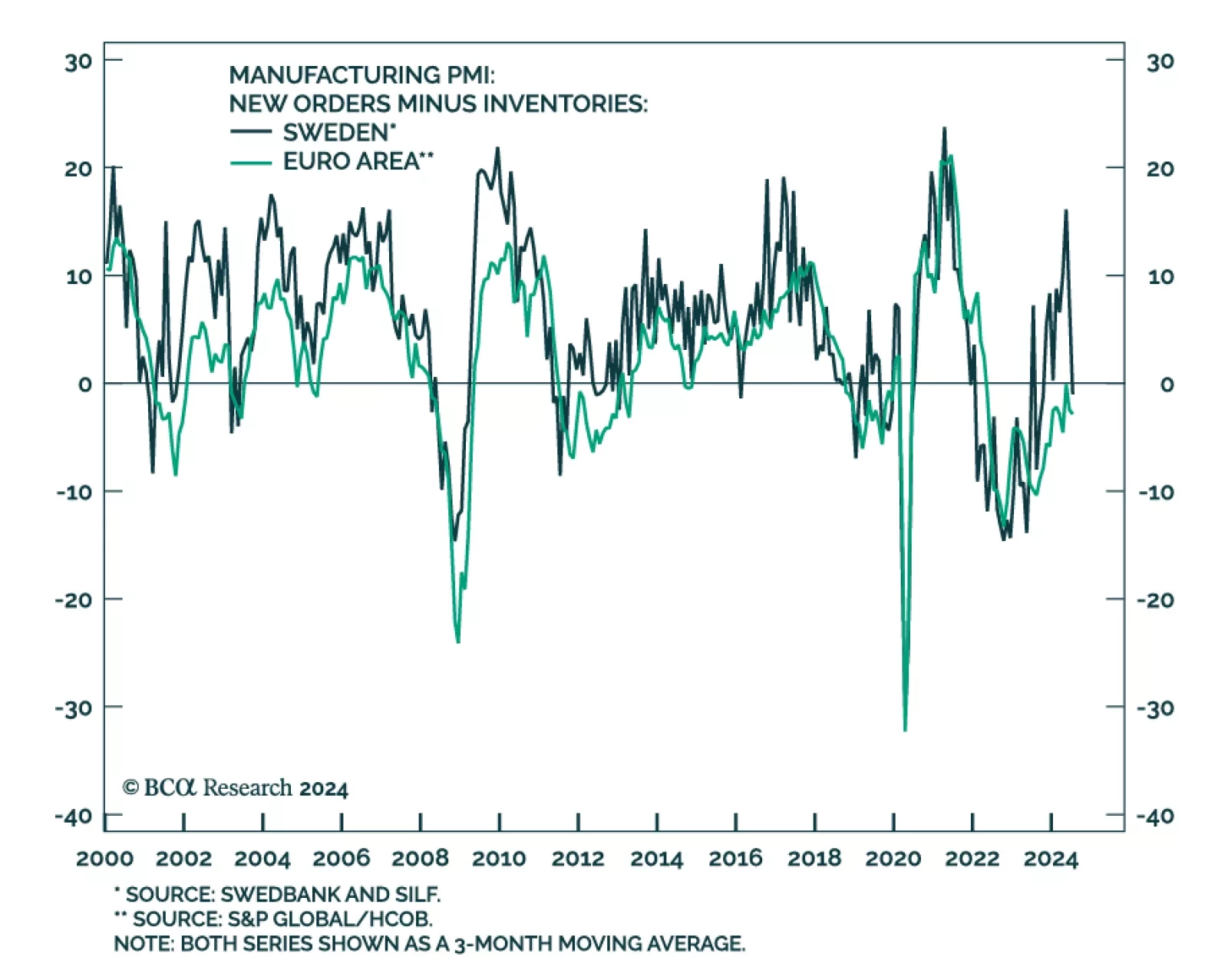

Sweden’s manufacturing PMI started contracting in July, plummeting from 53 to 49.2, falling far short of expectations that growth would broaden. Weakness was broad-based. Notably, new orders and new export orders plunged…

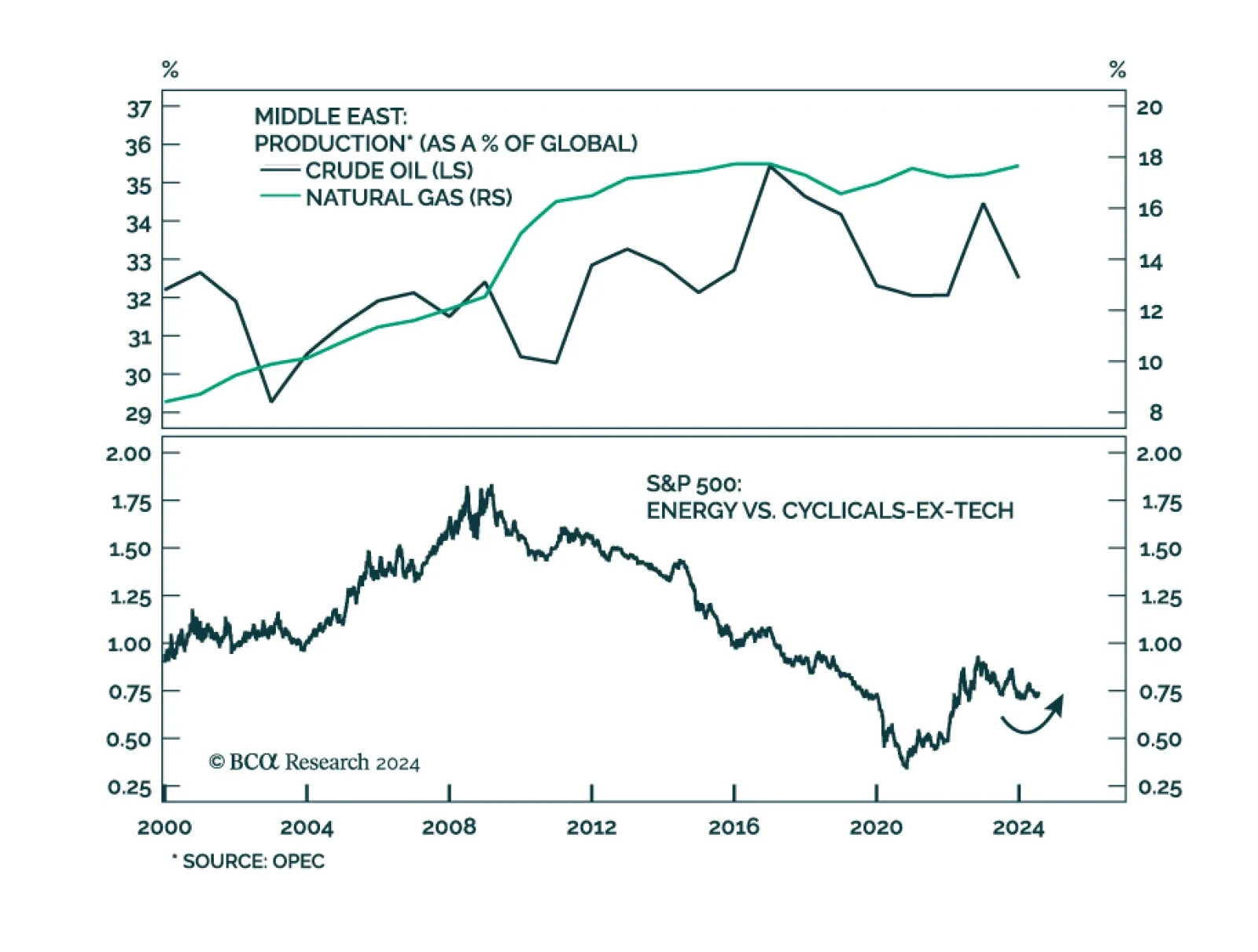

Following the recent escalation in the Middle East conflict, BCA Research’s Geopolitical Strategy service upgrades its subjective odds of a major oil supply shock to 37%. Volatility should spike again as investors…

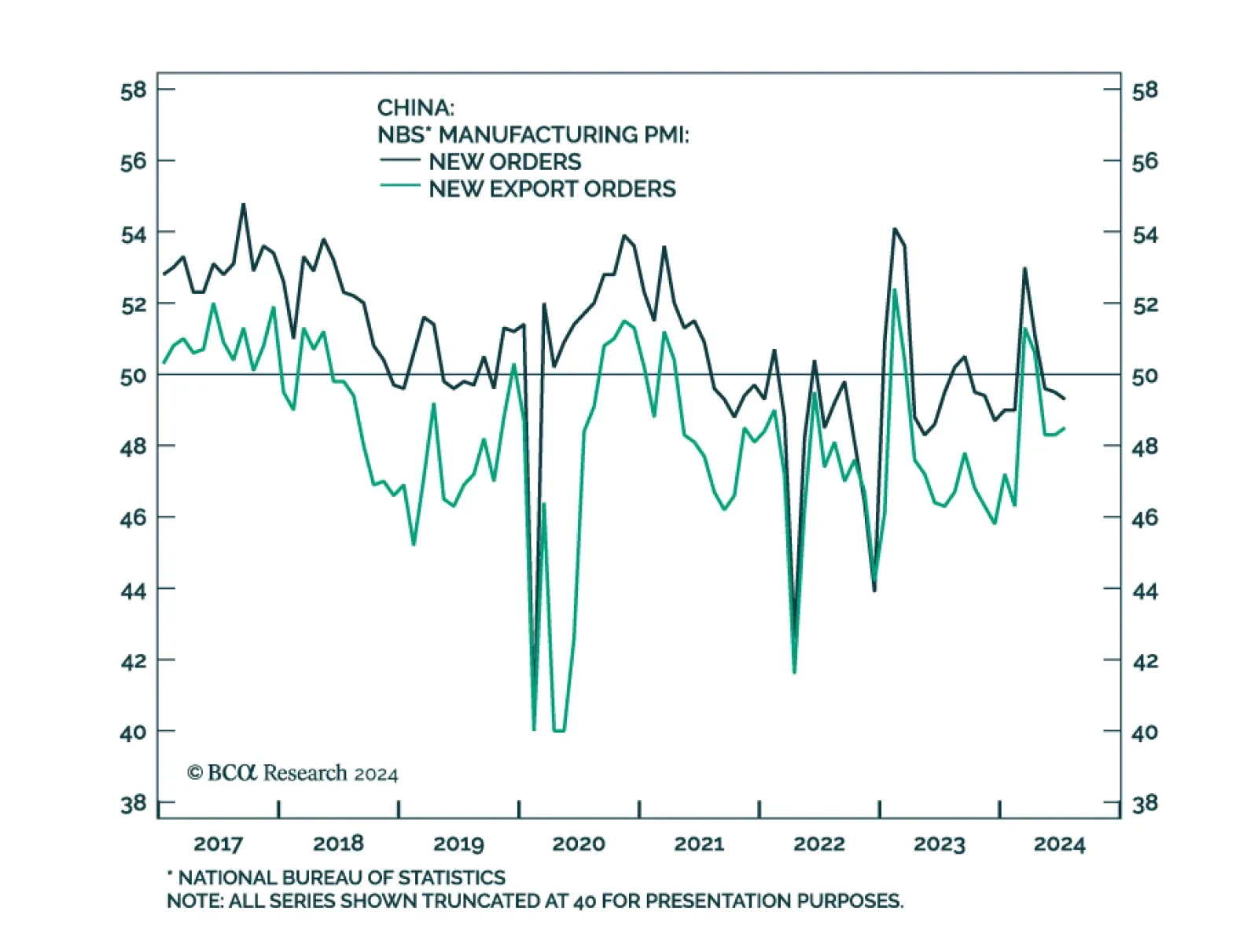

China’s NBS manufacturing PMI declined further in July, from 49.5 to 49.4, marking a third consecutive month of contraction. New orders and new export orders underscored continued weakness in both domestic and foreign…