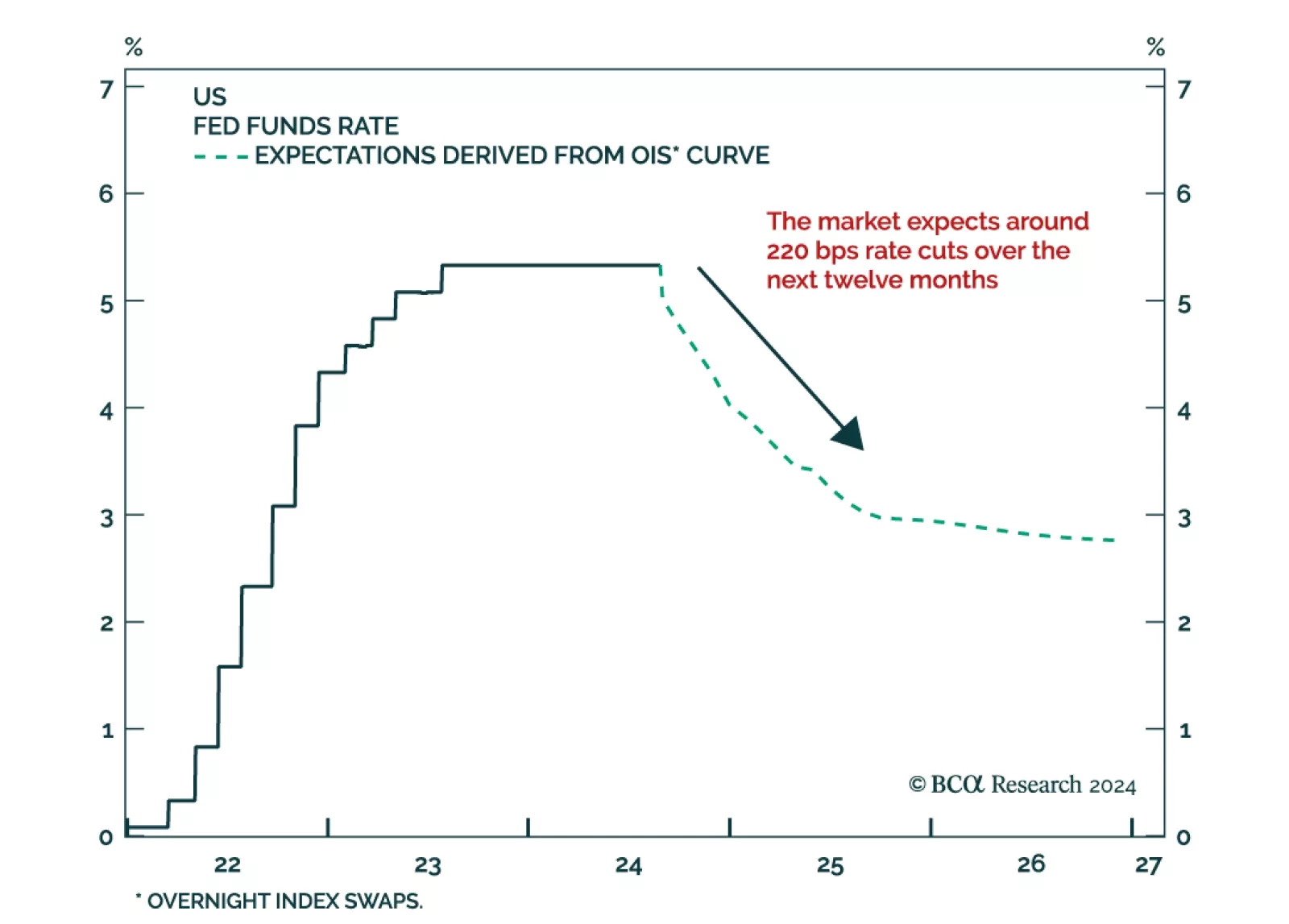

The market is currently expecting the Fed to cut rates by 100 bps over the course of 2024 and by another 120 bps throughout the first eight months of 2025. However, our Global Investment strategists expect the extent of 2024…

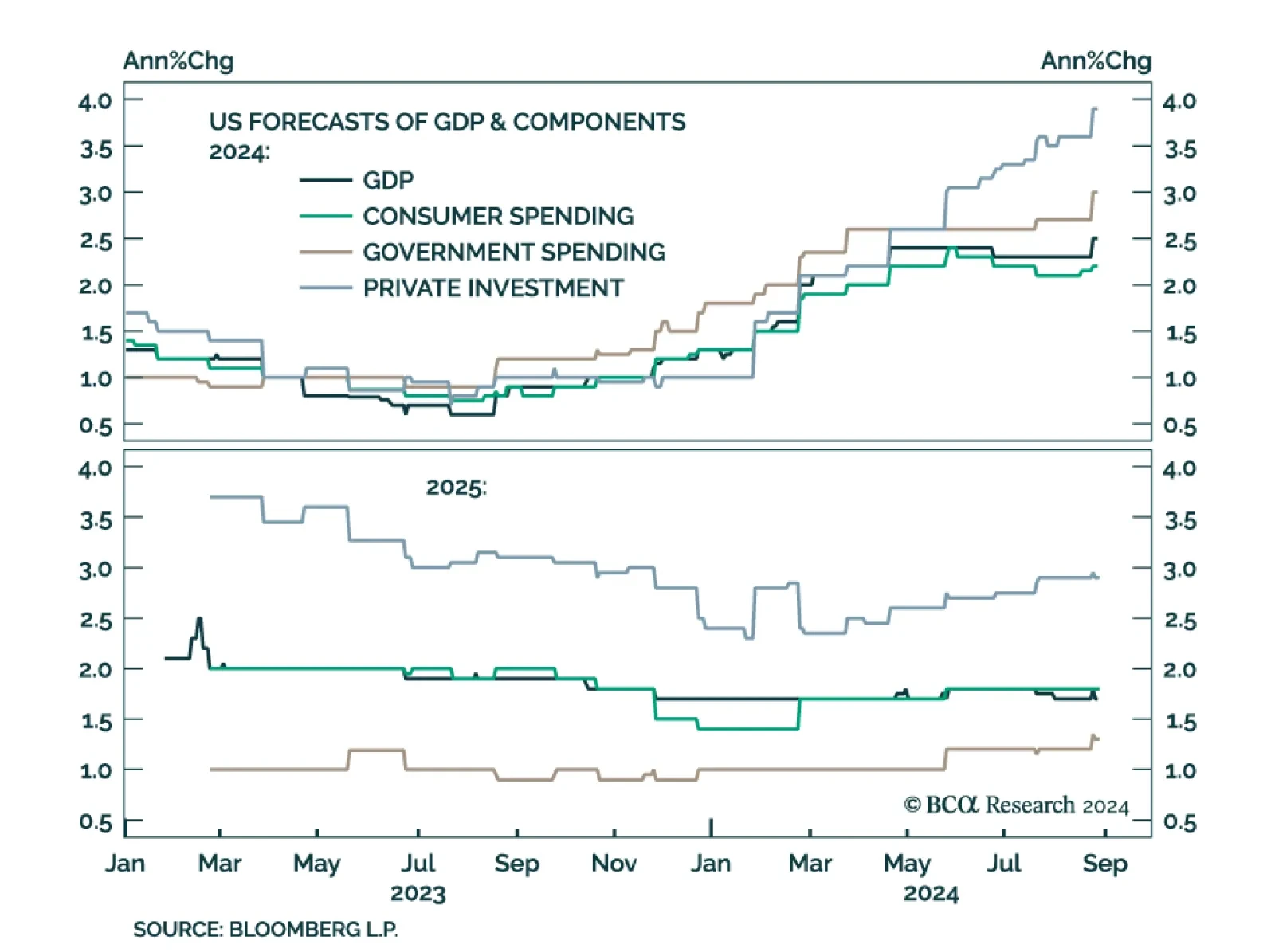

Last week, economists polled by Bloomberg revised their consensus 2024 US GDP forecasts upwards, from 2.3% to 2.5%. Government spending and private investment were both revised 0.3 ppts higher to 3.0% and 3.9%, respectively,…

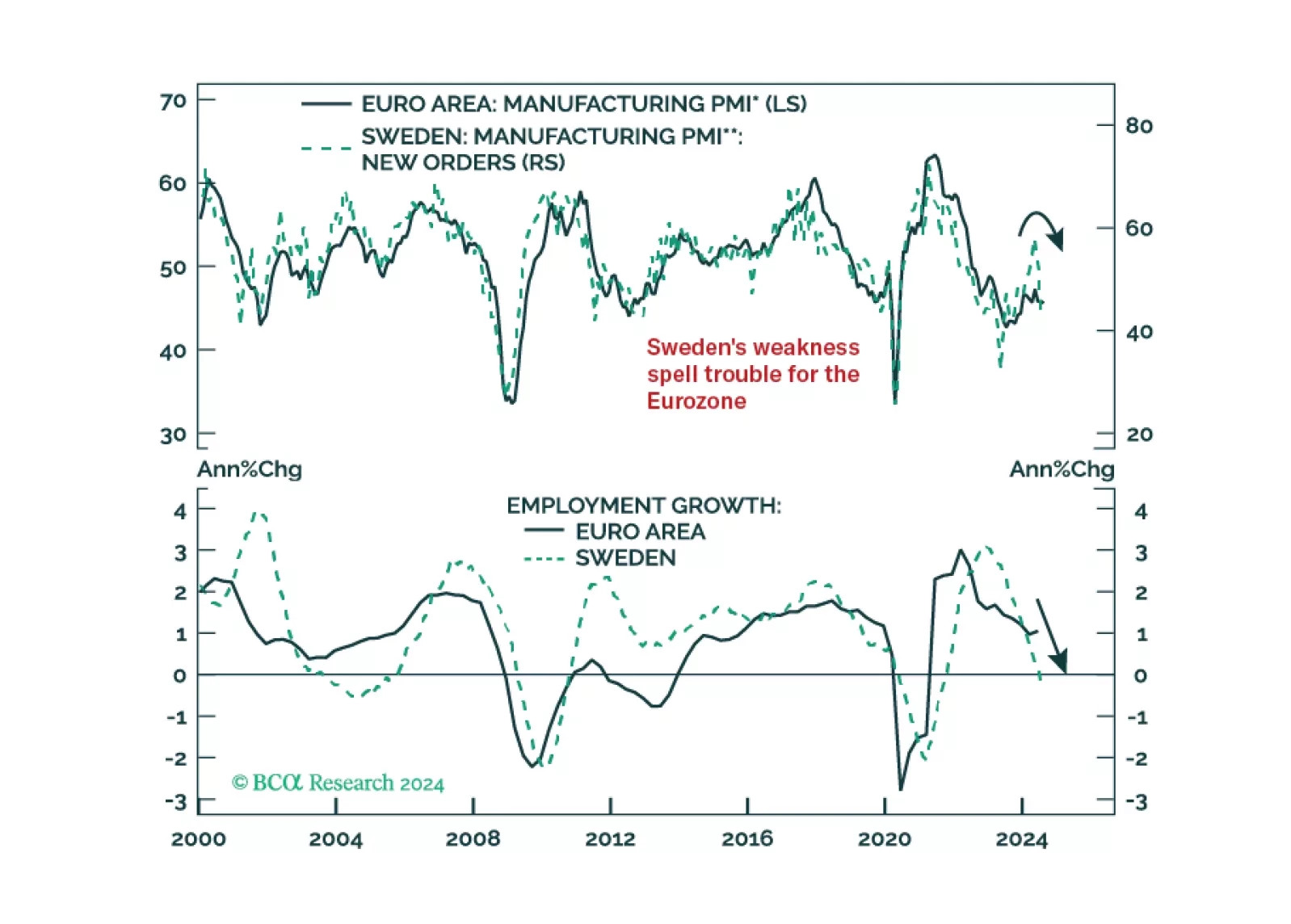

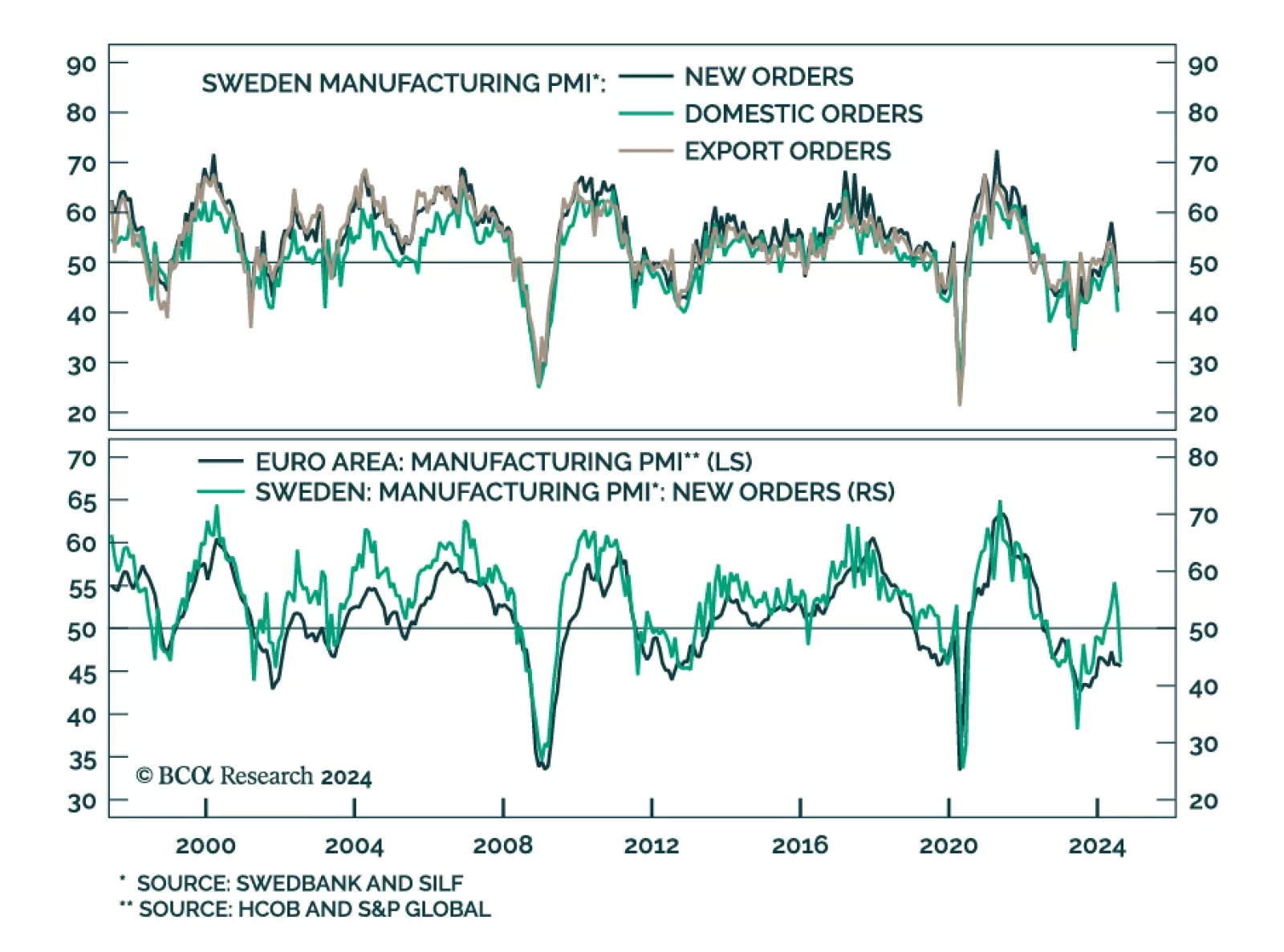

According to BCA Research’s European Investment Strategy service, Sweden, which acts as a bellwether for the global economy, will offer early insight into whether our base-case late 2024/early 2025 recession scenario will…

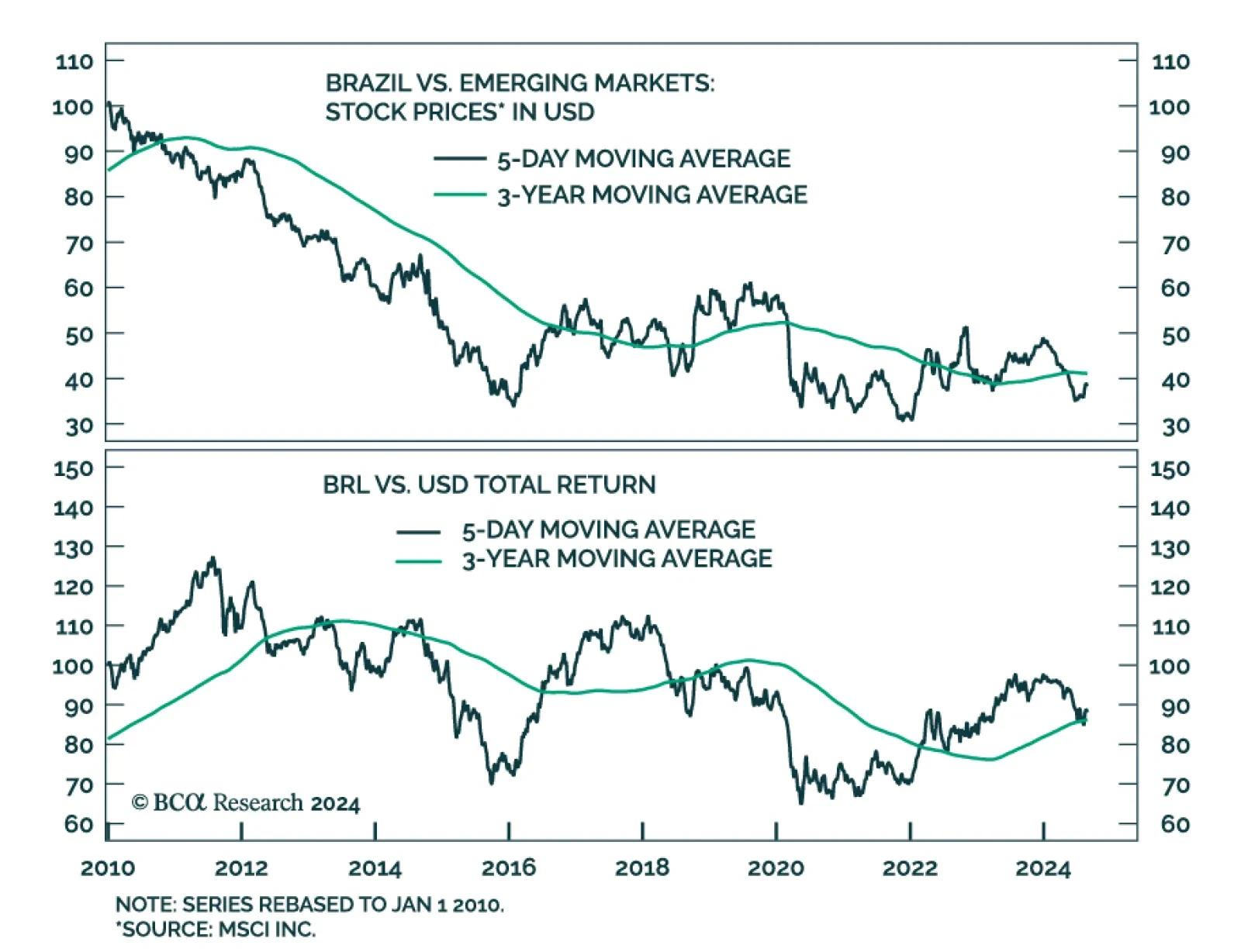

Brazilian equities have largely underperformed their EM peers in USD terms since the beginning of the year. Rising public debt and inflation are the two main forces weighing on the Brazilian bourse. Our Emerging Market…

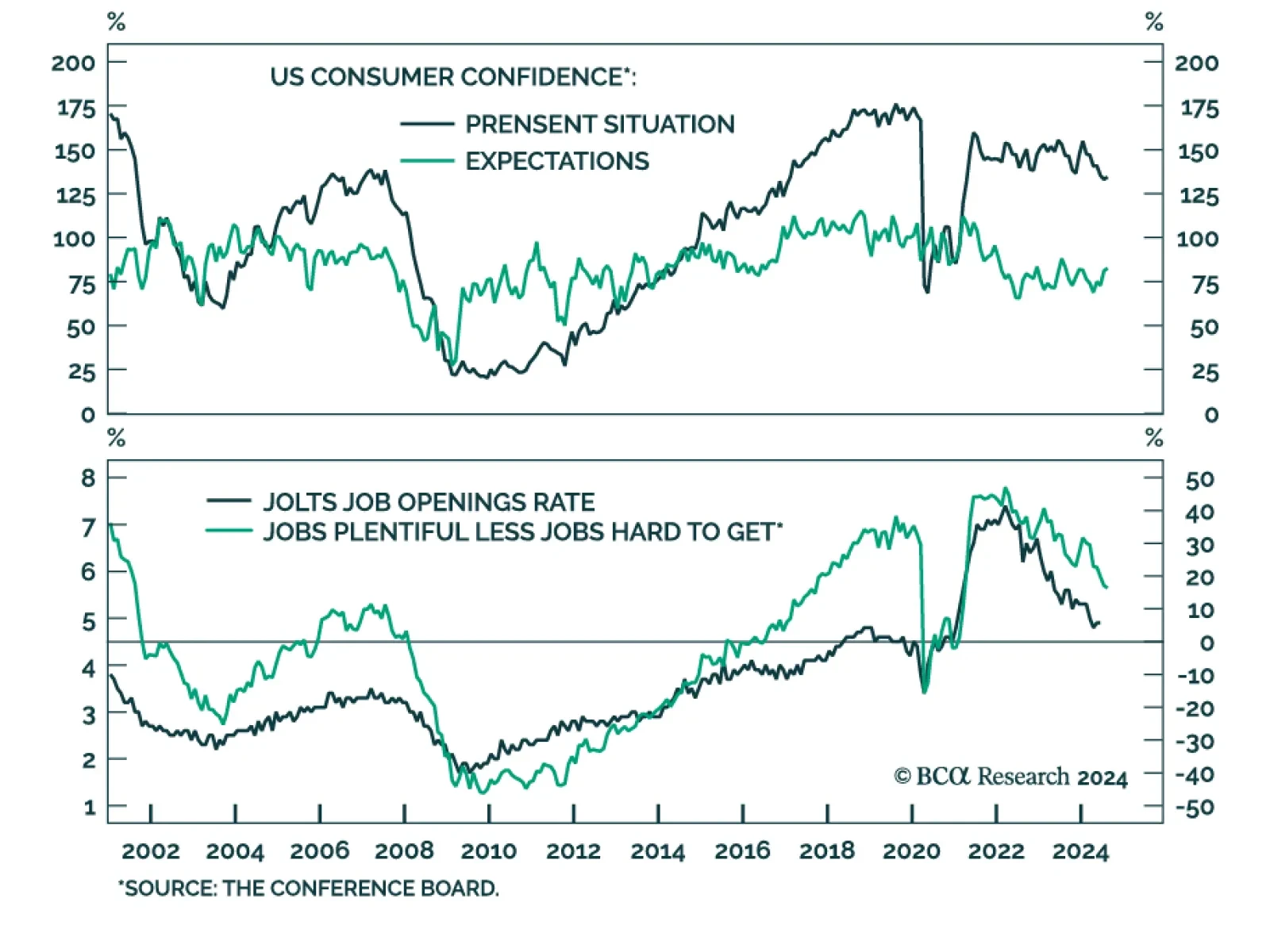

The Conference Board’s Consumer Confidence measure surprised to the upside in August, rising from 100.3 to 103.3, above expectations of 100.7. Consumers’ assessment of present economic conditions climbed 0.8 points to…

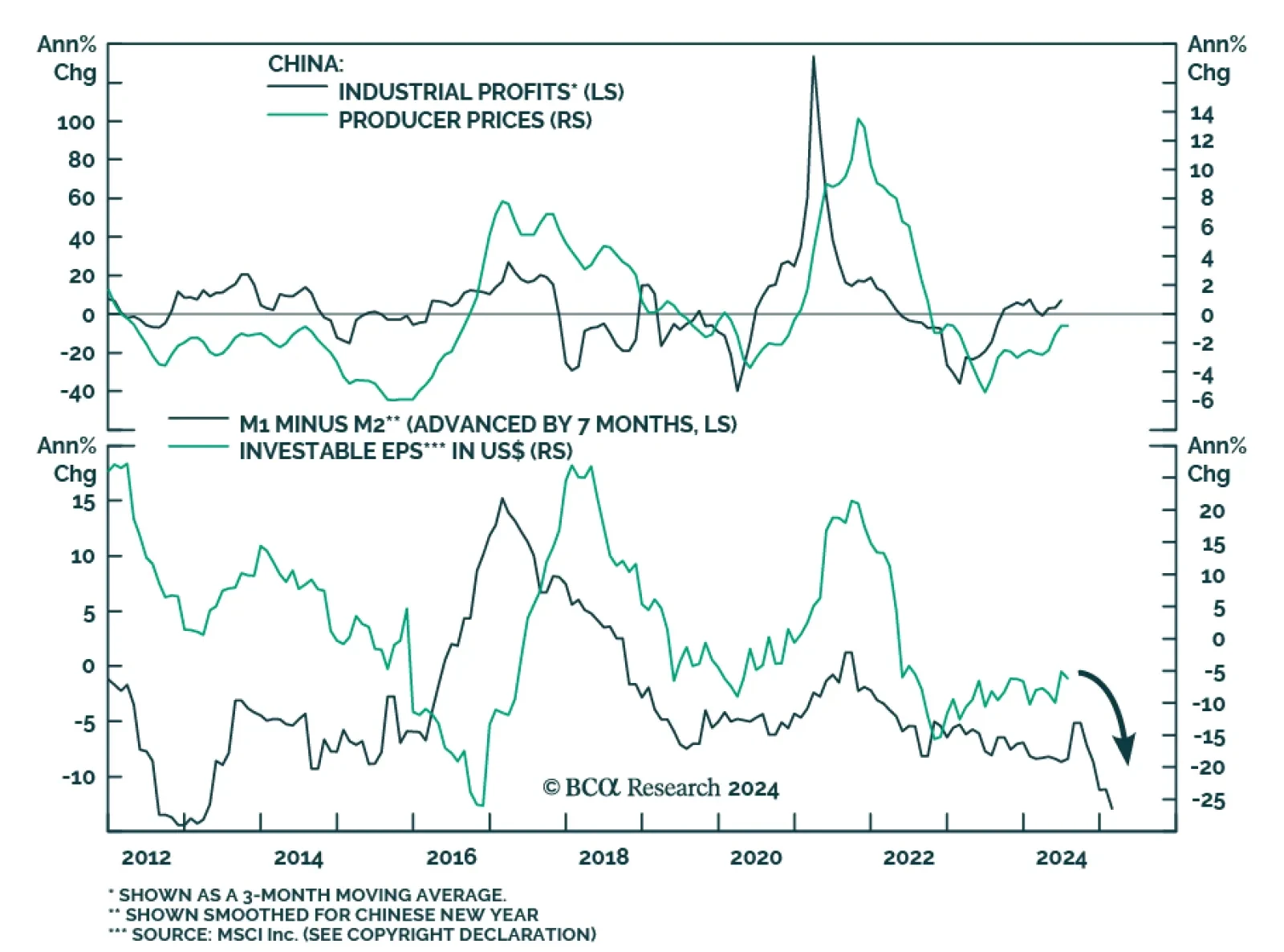

Chinese industrial profits rose by 4.1% y/y (3.6% YTD y/y) in July, from 3.6% (3.5%) in June. Upstream mining industries’ profits contracted 9.5% from January to July 2024, whereas downstream manufacturing sectors’…

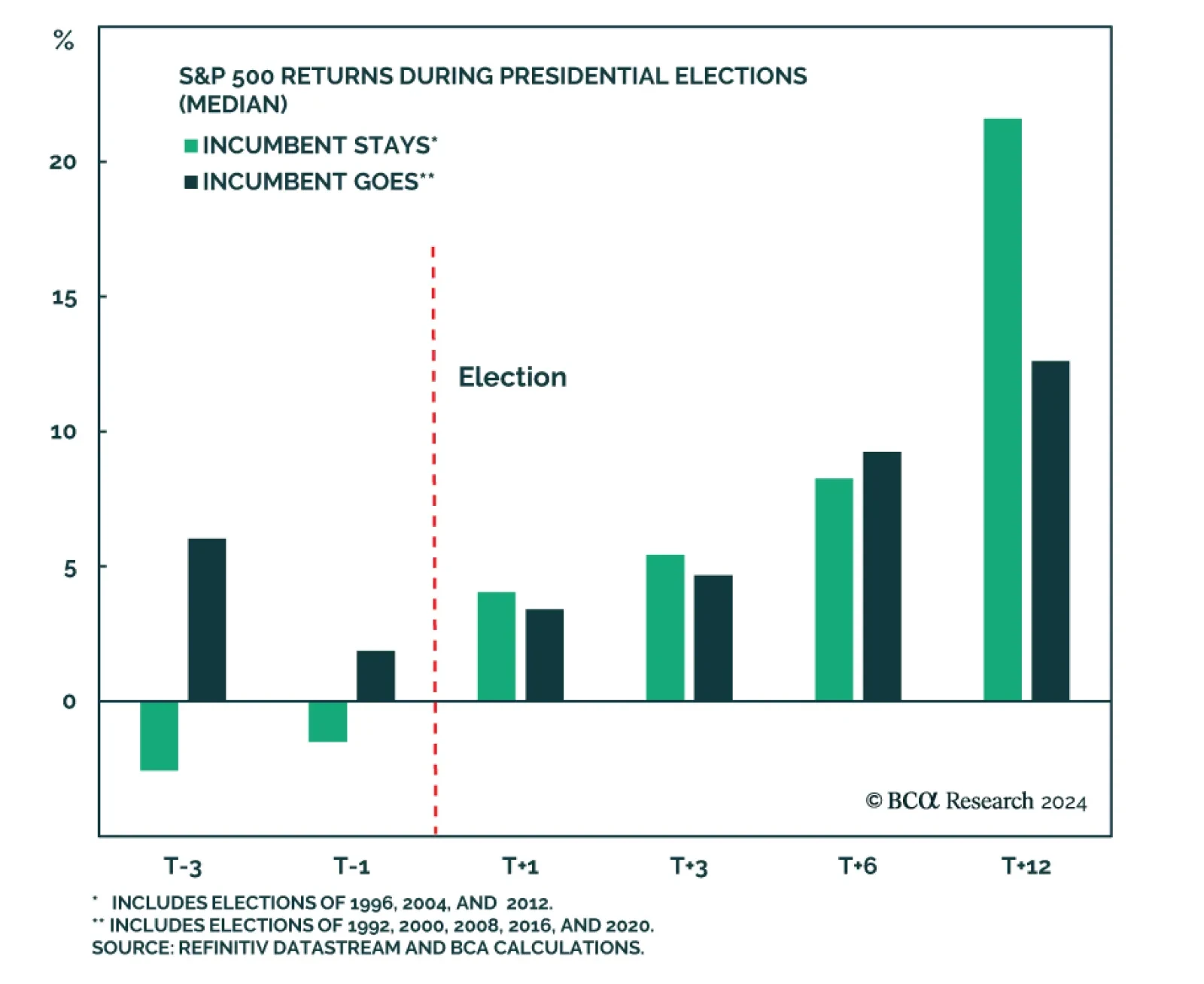

According to BCA Research’s US Political Strategy service, in the final months of an election cycle, equities underperform relative to non-election years. This extends further into Q1 of the following year due to…

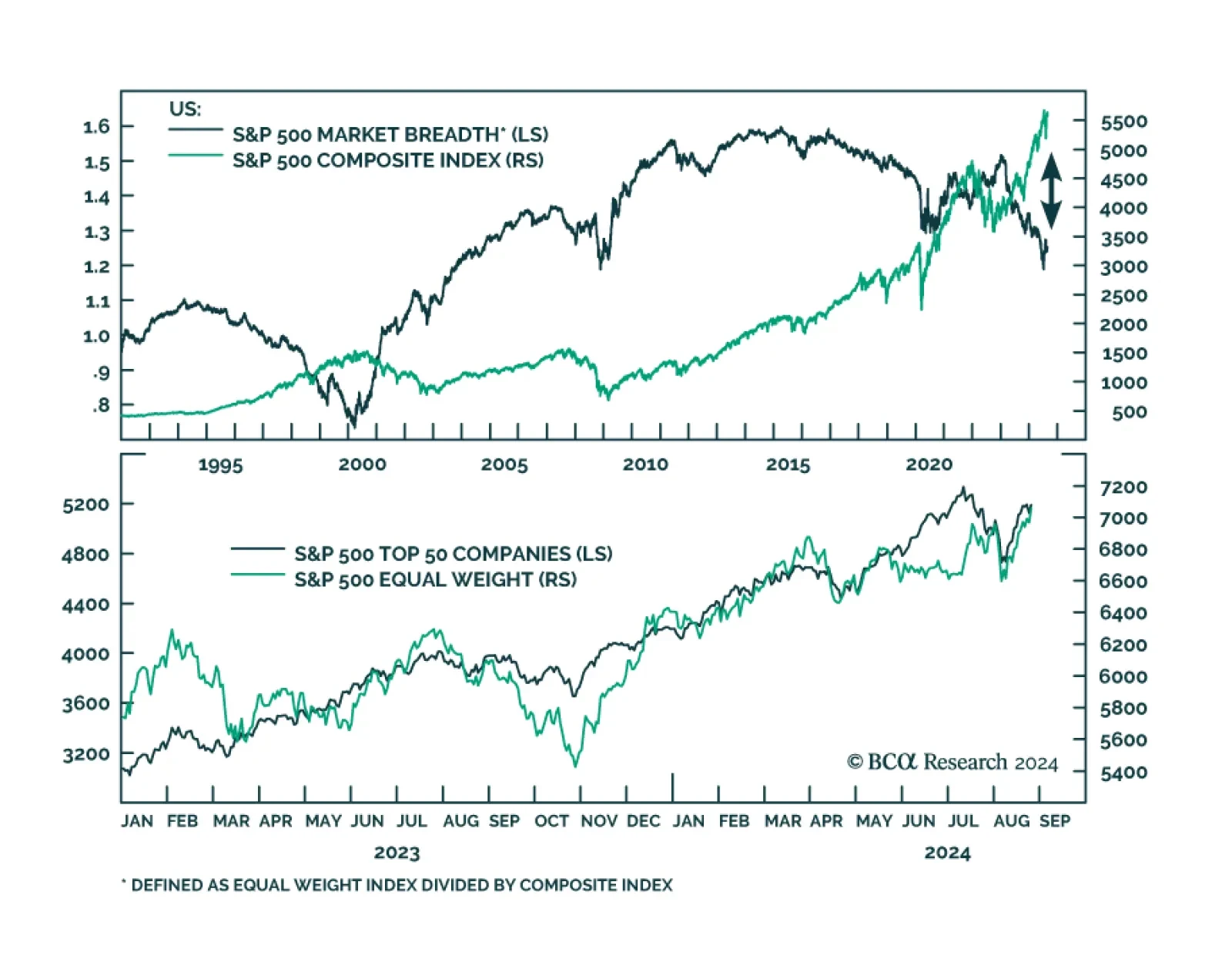

The equal-weighted S&P 500 index reached a new all-time high of 7,096.12 on Monday. Chair Powell’s comments at the Jackson Hole Symposium last week dispelled any remaining doubt about a September rate cut and sent…

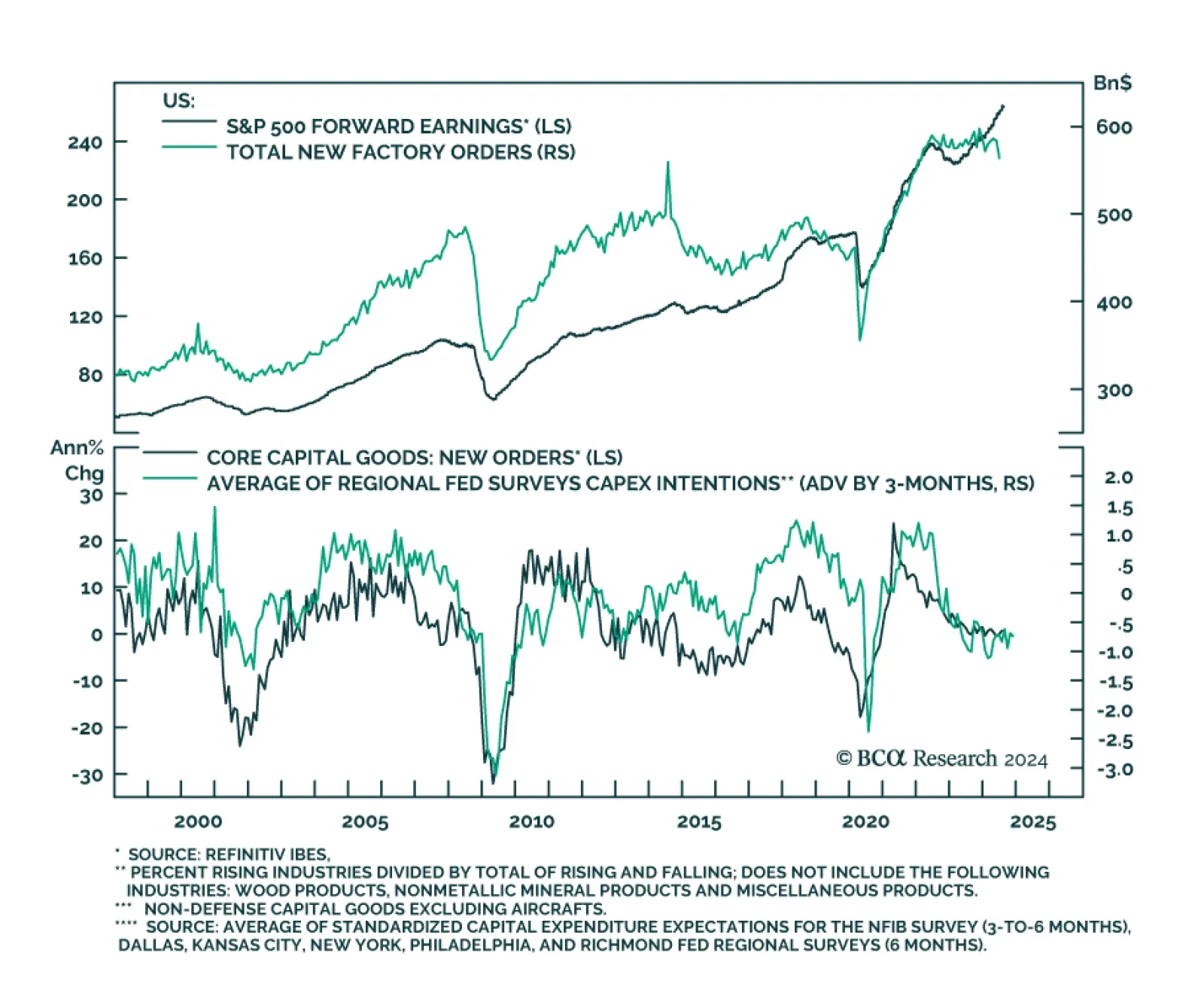

Preliminary estimates suggest that US durable goods orders growth rebounded sharply from a 6.9% m/m contraction to 9.9% growth in July, upending expectations of a more muted 5.0% monthly increase. However, a 34.8% m/m rise in…

Our negative stance on European growth and assets is not devoid of risks. To gauge whether these risks warrant upgrading our growth outlook, we monitor Sweden closely. So, what is the current message from this Nordic economy?