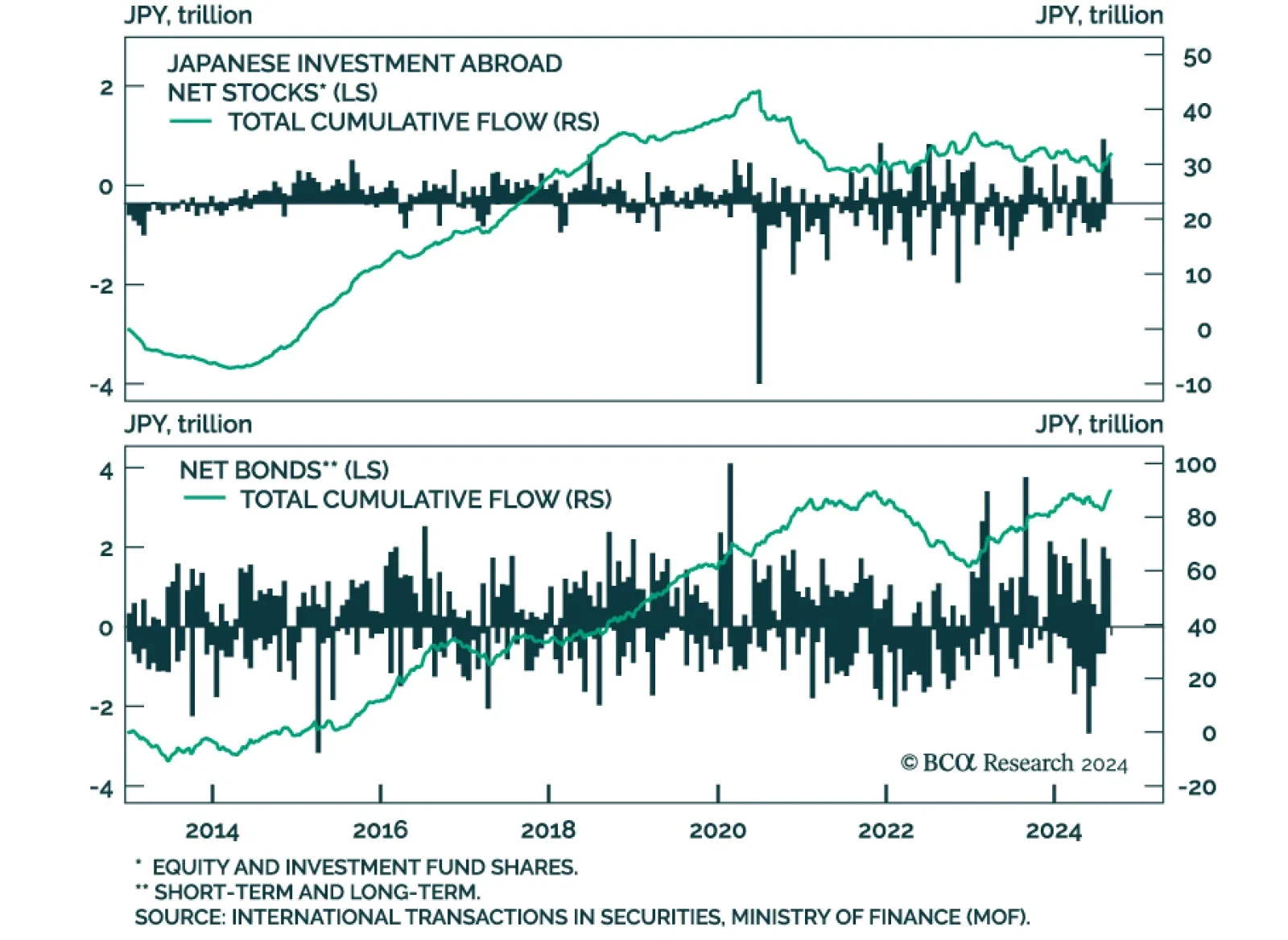

According to BCA Research’s Foreign Exchange Strategy and Global Investment Strategy services, most carry investors have covered their positions. Away from day-to-day noise, the longer-term trajectory of yen exchange rates…

One key takeaway from Wednesday’s post-FOMC press conference is the Fed’s unshaken conviction that it can avoid a recession. A risk-on mood dominated markets on Thursday, with the S&P 500 breaching new all-time…

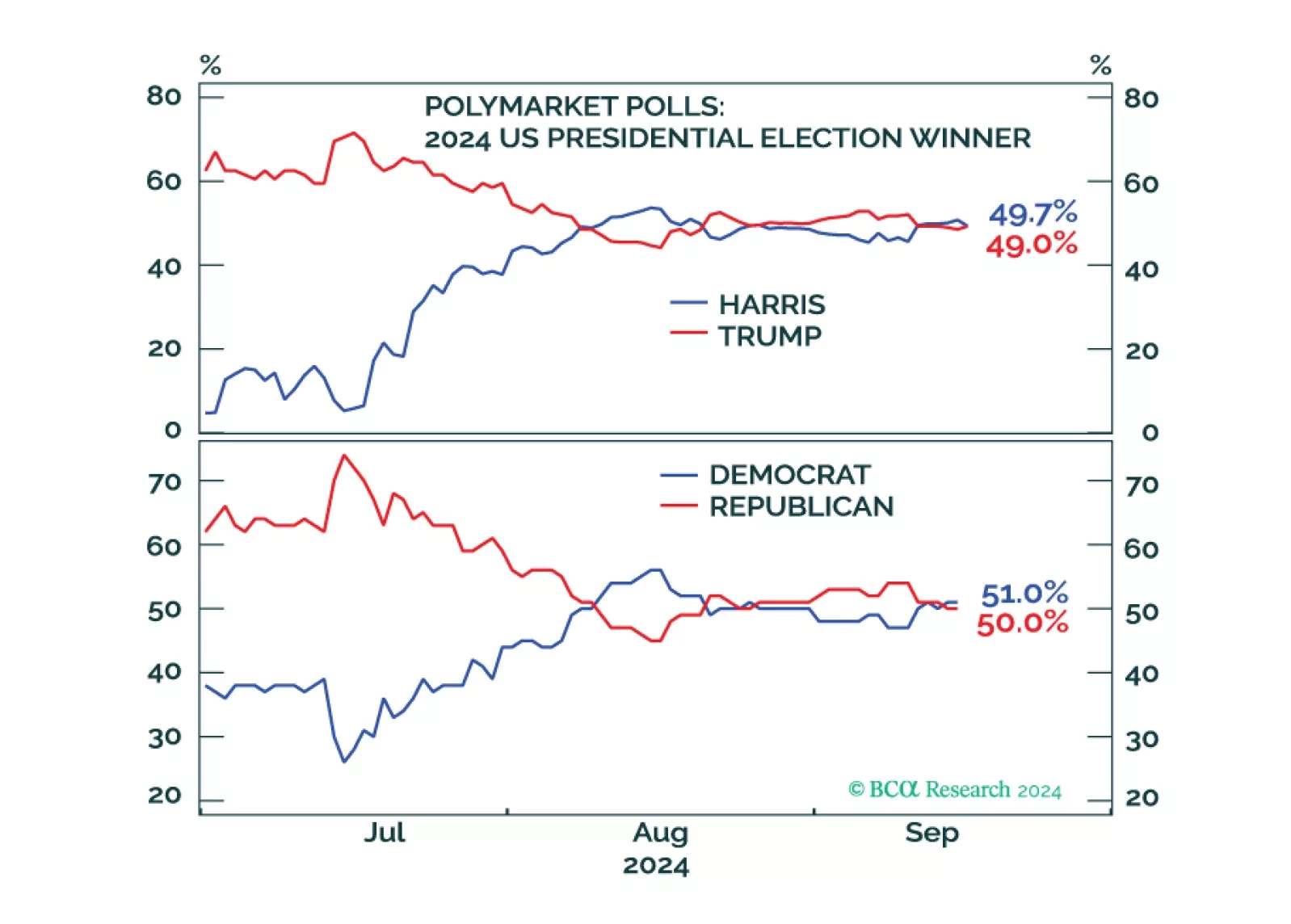

According to BCA Research’s Geopolitical Strategy service, seven surprises with non-negligible odds could tip the scale in favor of Republicans for the White House by November 5. One of them is a war between Israel and Iran…

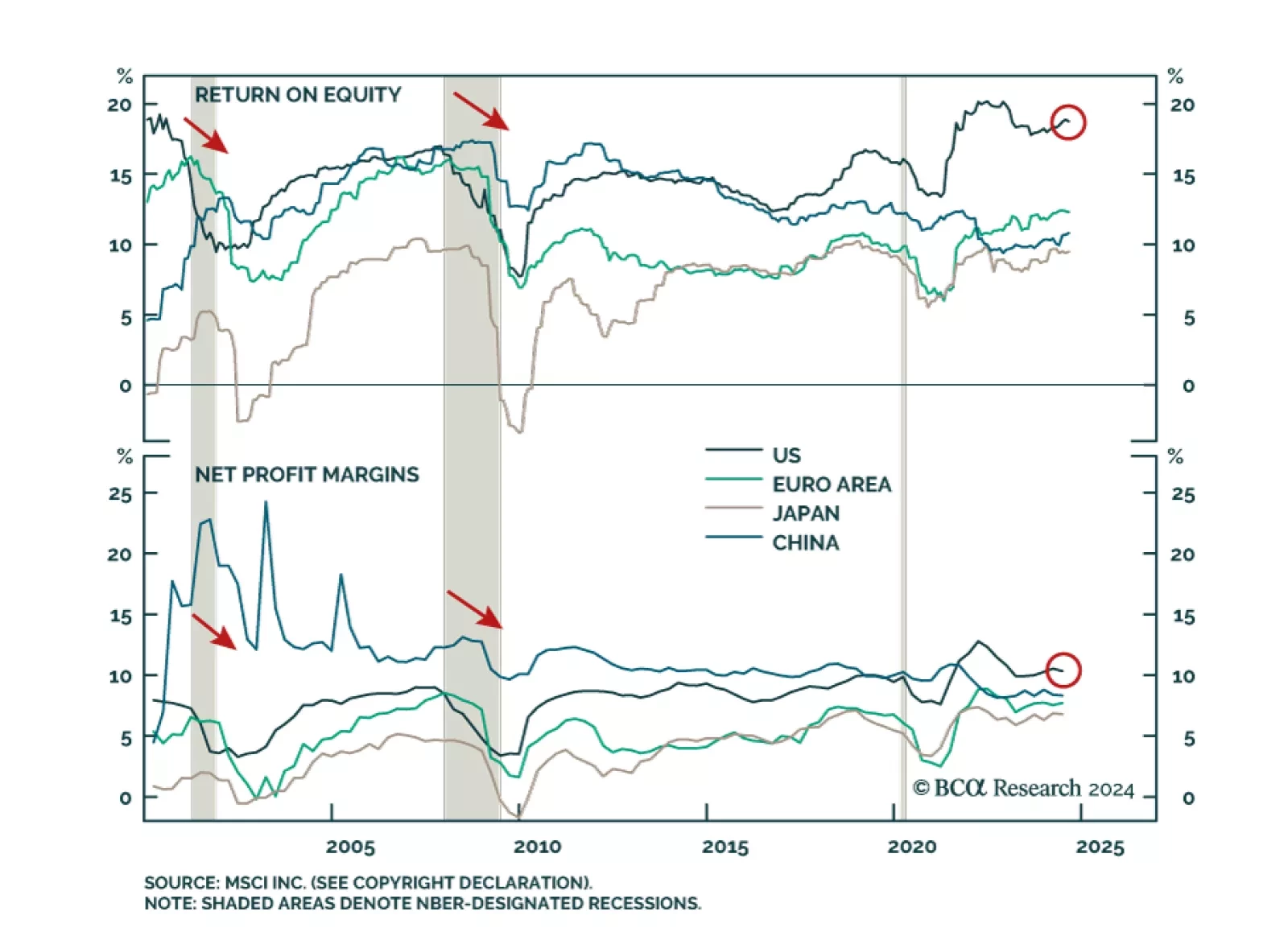

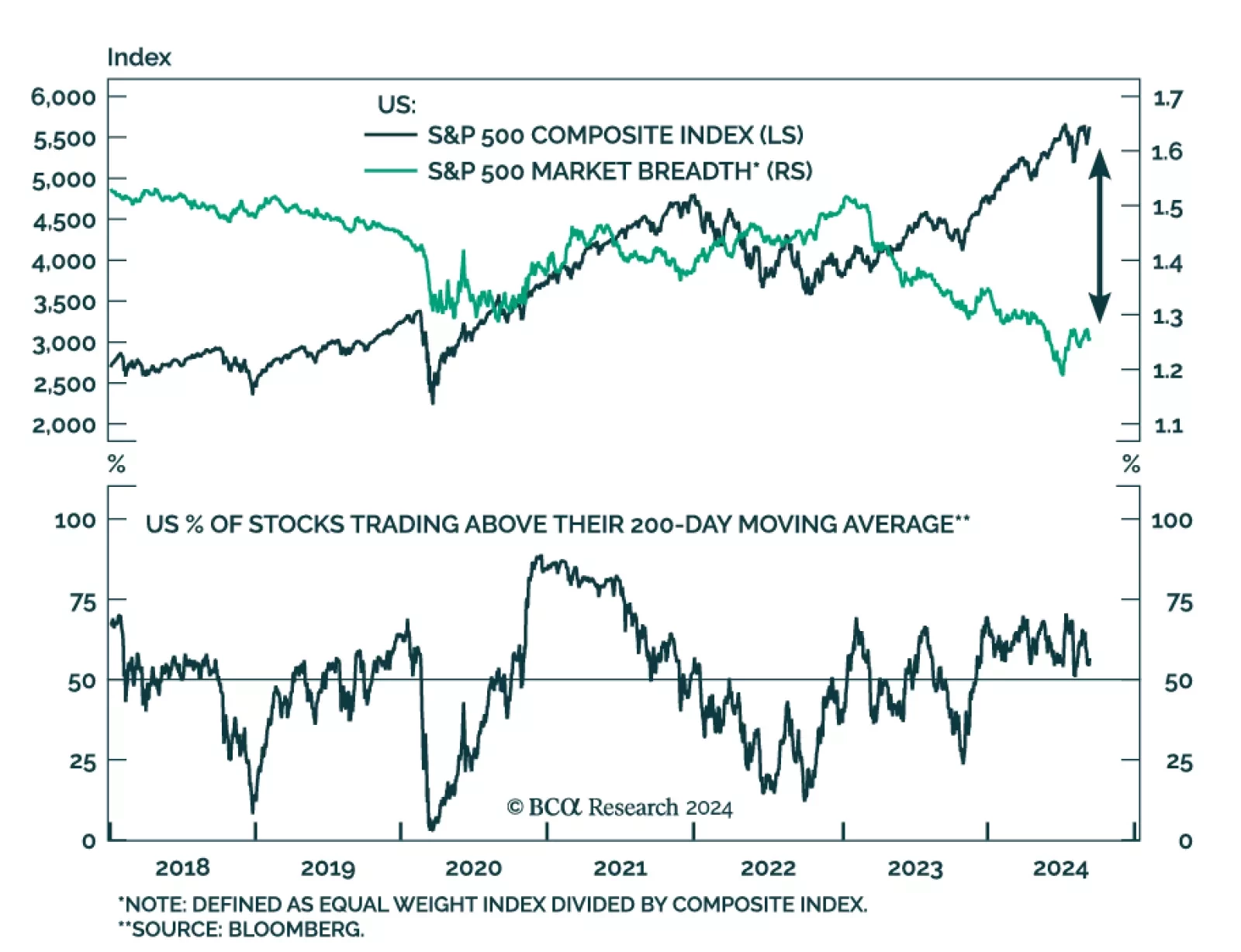

Despite the recent correction, US equity leadership remains intact. The MSCI US index has outperformed global markets by 3.8% in 2024YTD. A 7.8% expansion in forward earnings drove the MSCI US index’ 2024YTD gains which was…

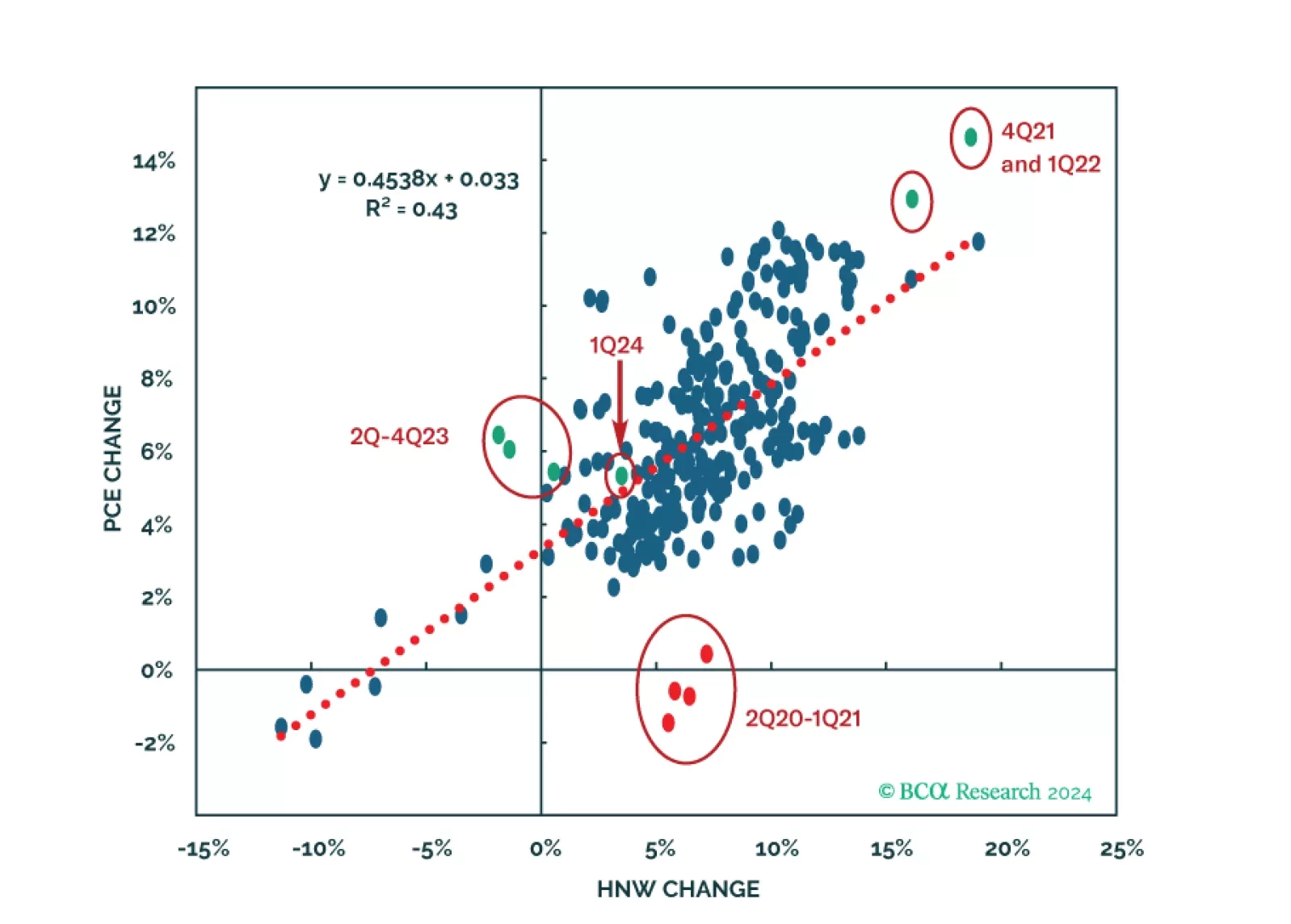

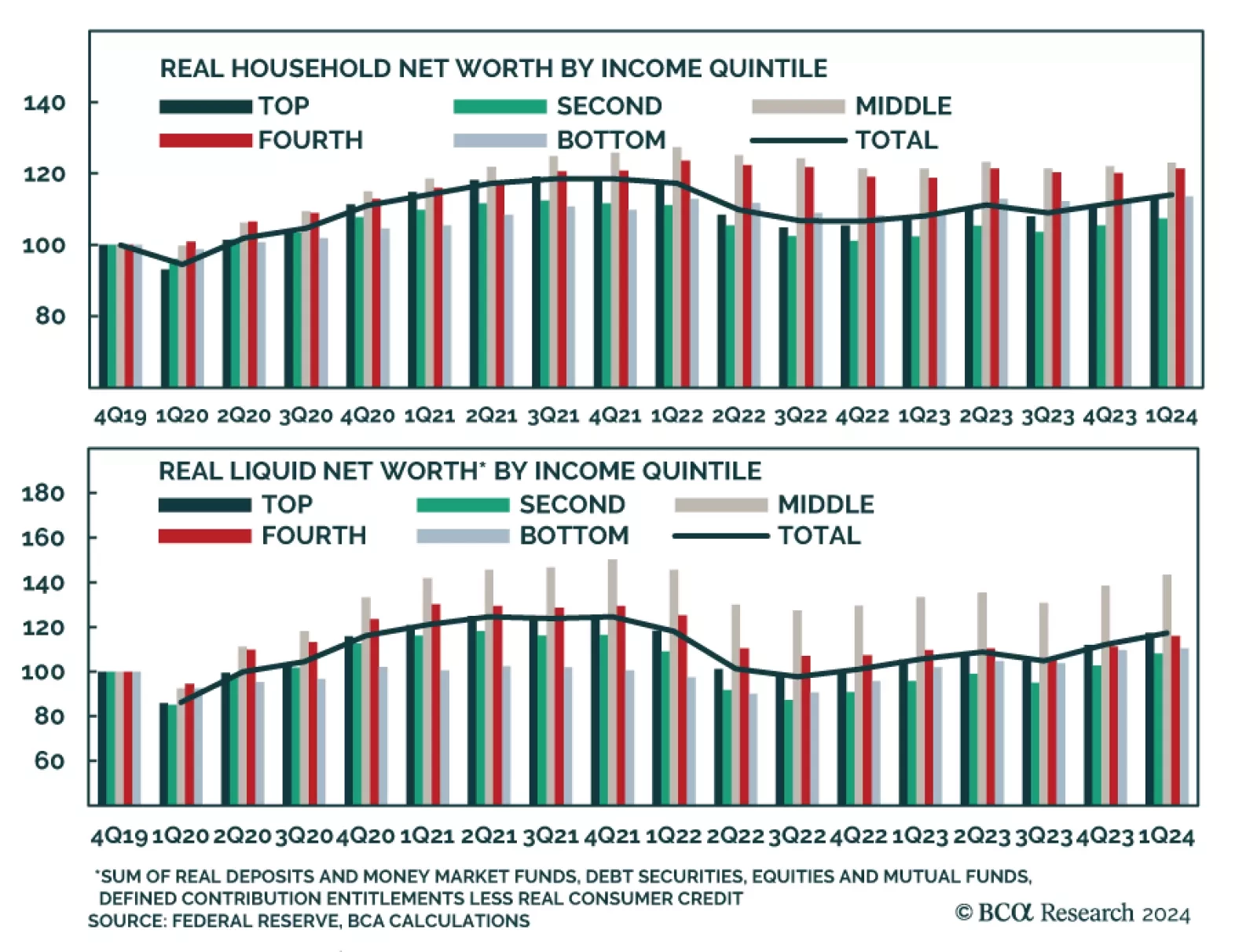

Stress among lower-income households is often cited as an early indication of deteriorating aggregate consumer fundamentals. The data indeed suggests that this cohort’s cash holdings are depleting. However, the Fed…

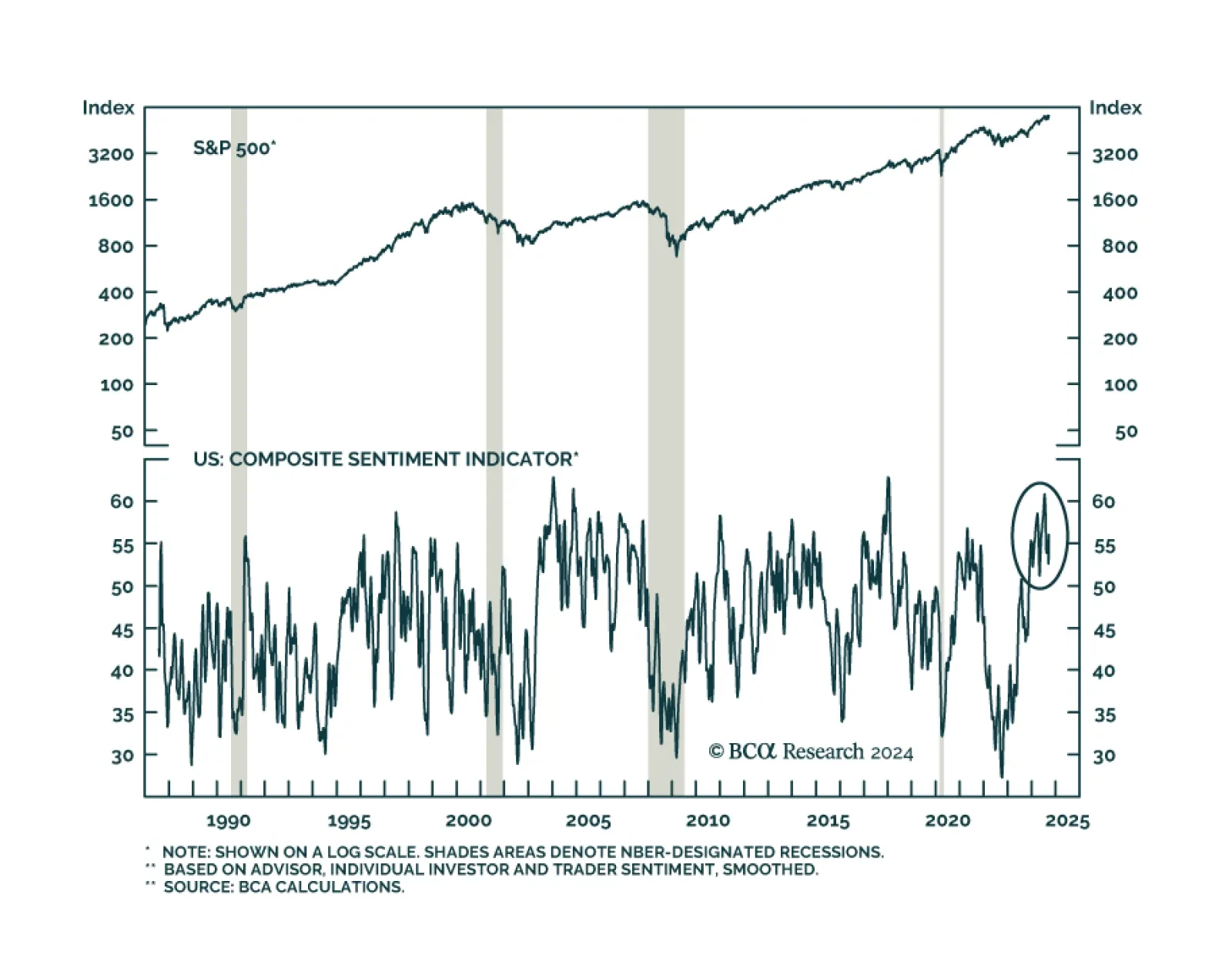

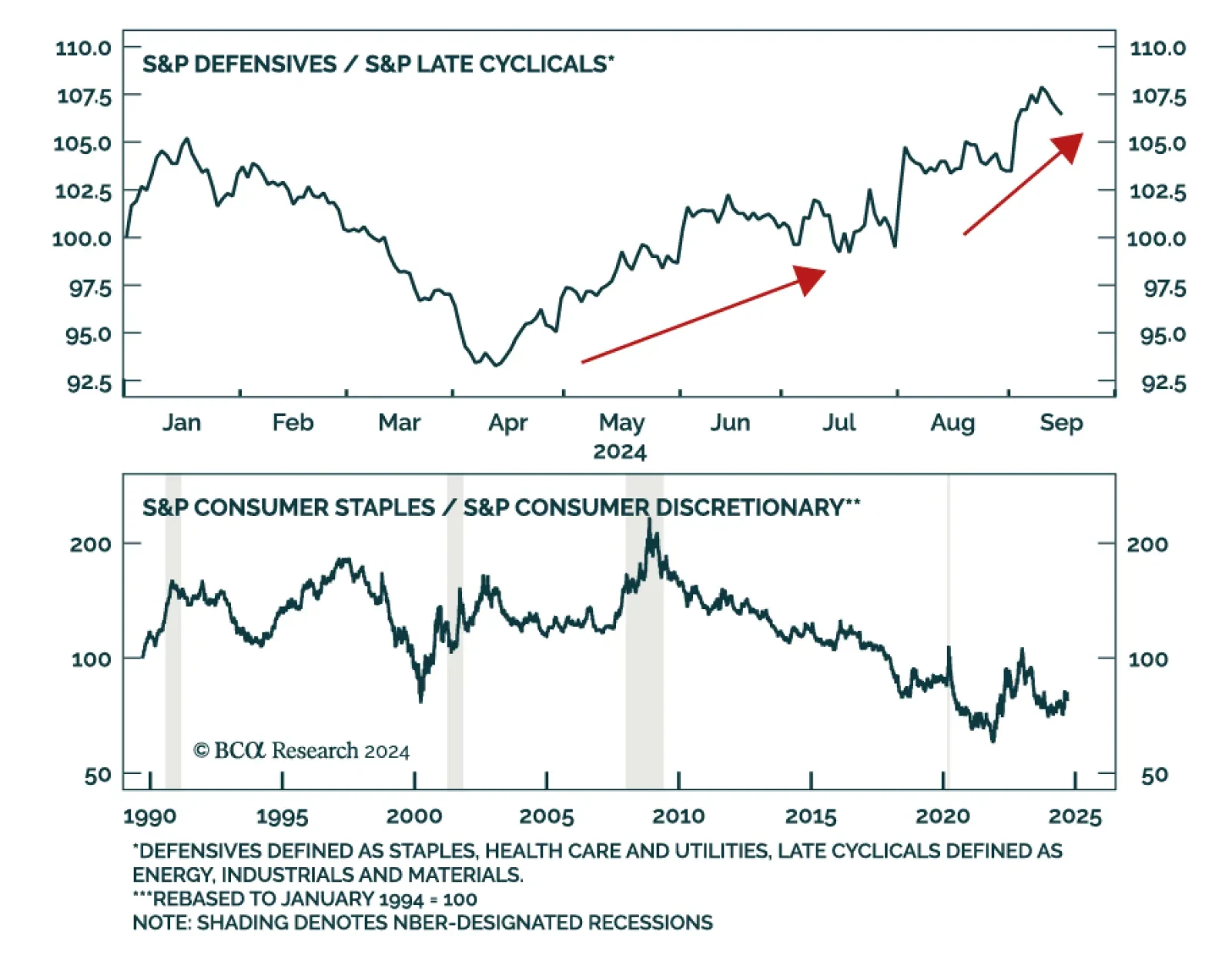

Stocks are a forward discounting mechanism and routinely top before recessions begin, even if they typically do not swoon until the recession has taken hold. According to BCA Research’s US Investment Strategy service, if…

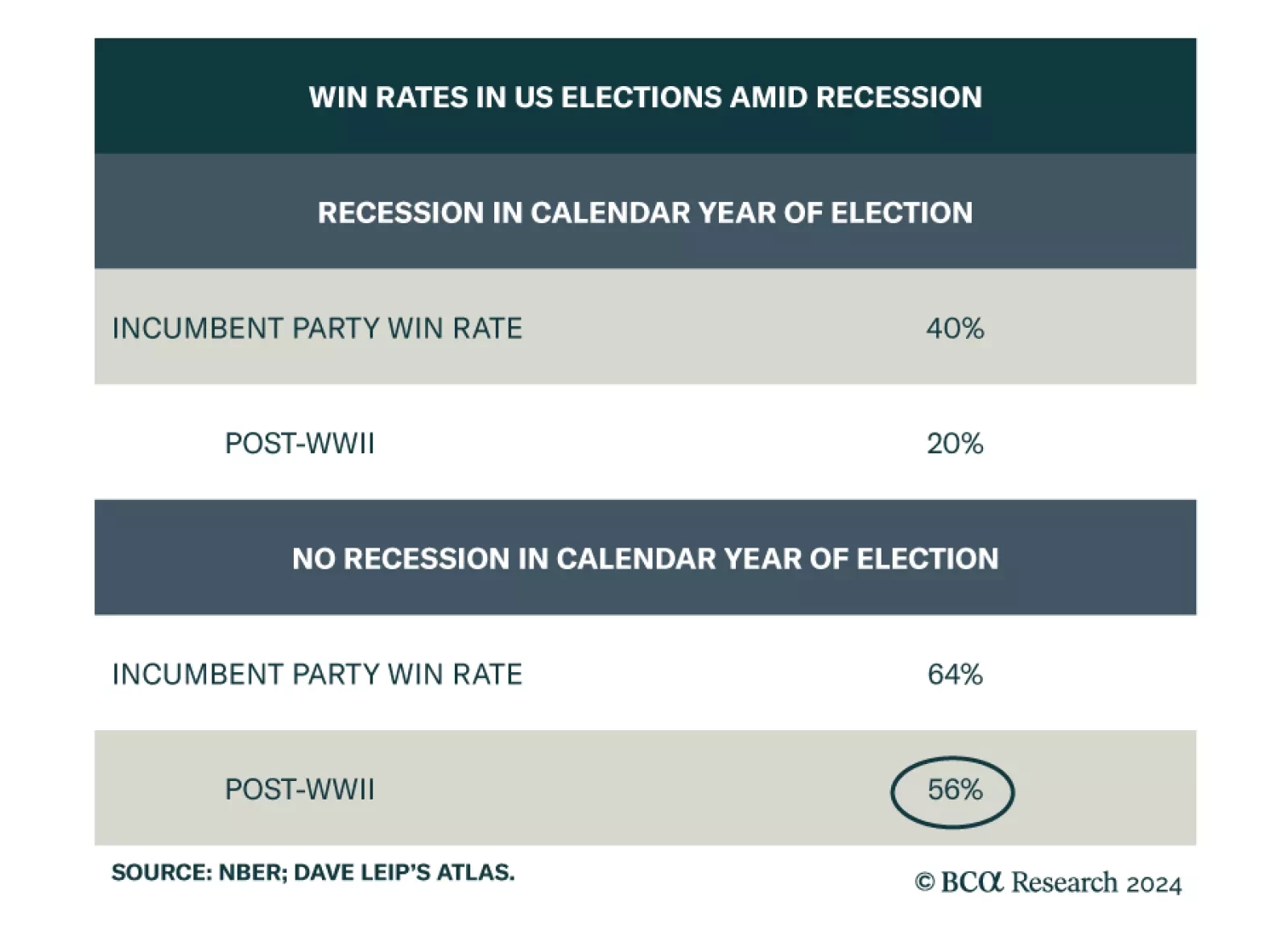

Investors should de-risk tactically in expectation of shocks and surprises ahead of the US election and an uncertain aftermath. Democratic victory with a gridlocked Congress is our base case but would bring minor tax hikes and…

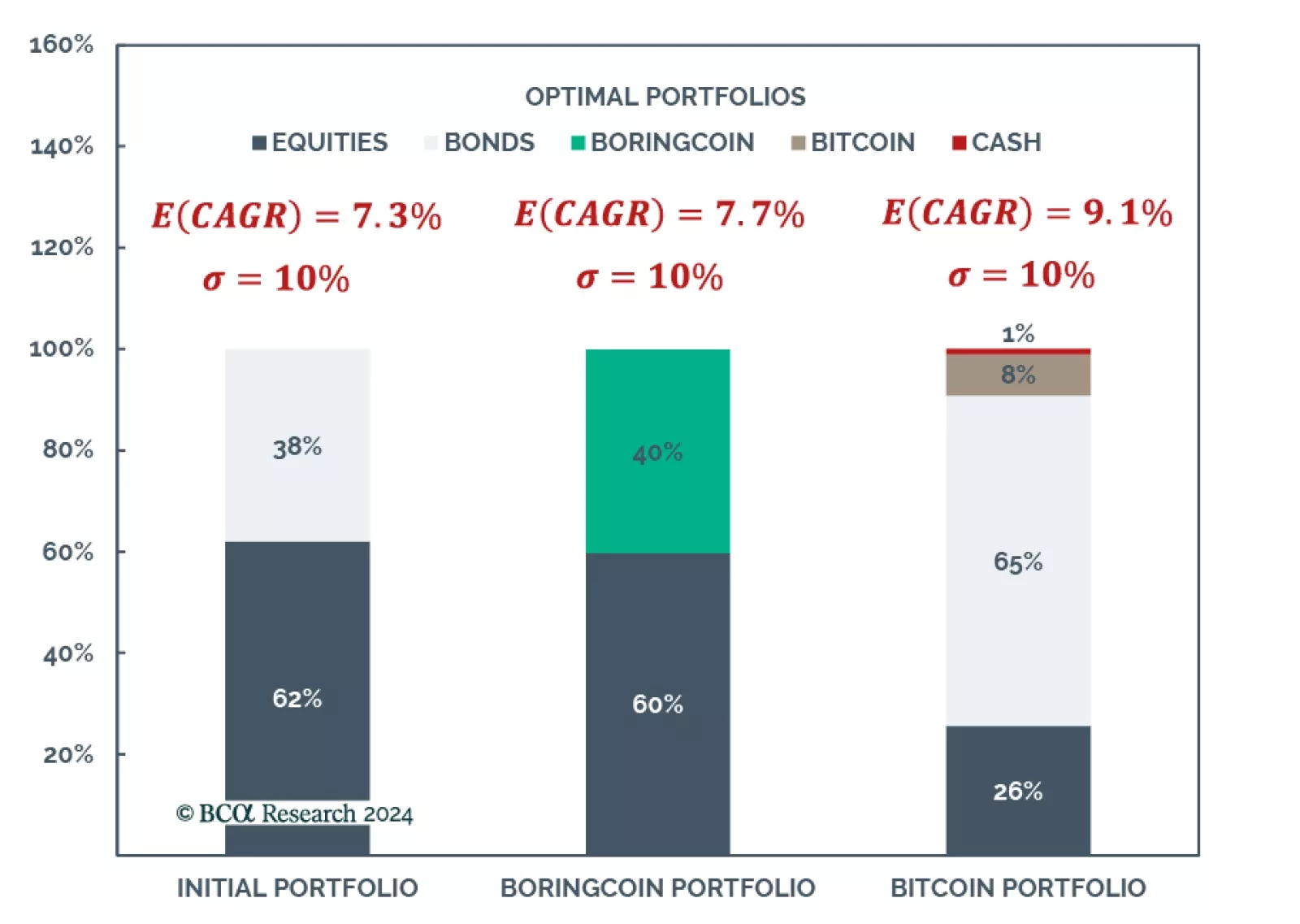

According to BCA Research’s Global Asset Allocation Strategy service, a common objection to buying Bitcoin raised by traditional investors is that it is too volatile. In the past it has been argued that this is irrelevant,…

Investors are pricing in a soft landing in the US. Notably, we noted that pro-cyclical assets topped the performance ranking in August. At the same time, the S&P 500 is currently trading only 1% below its all-time highs.…