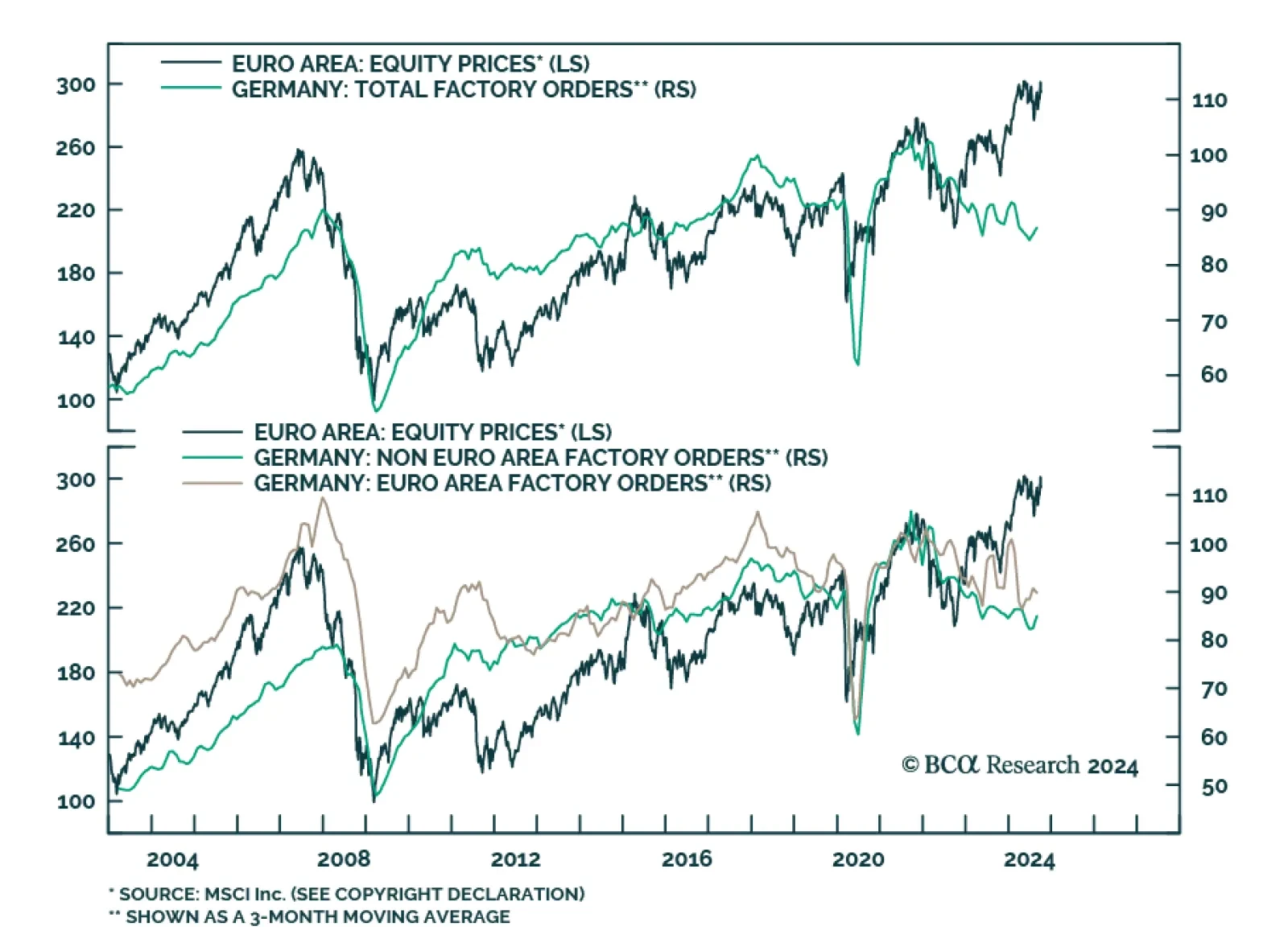

German factory orders contracted by a larger-than-anticipated 5.8% m/m (3.9% y/y) in August, from a 3.9% expansion (4.6% y/y). Domestically, Germany is constitutionally bound to maintain a balanced budget. The emergency…

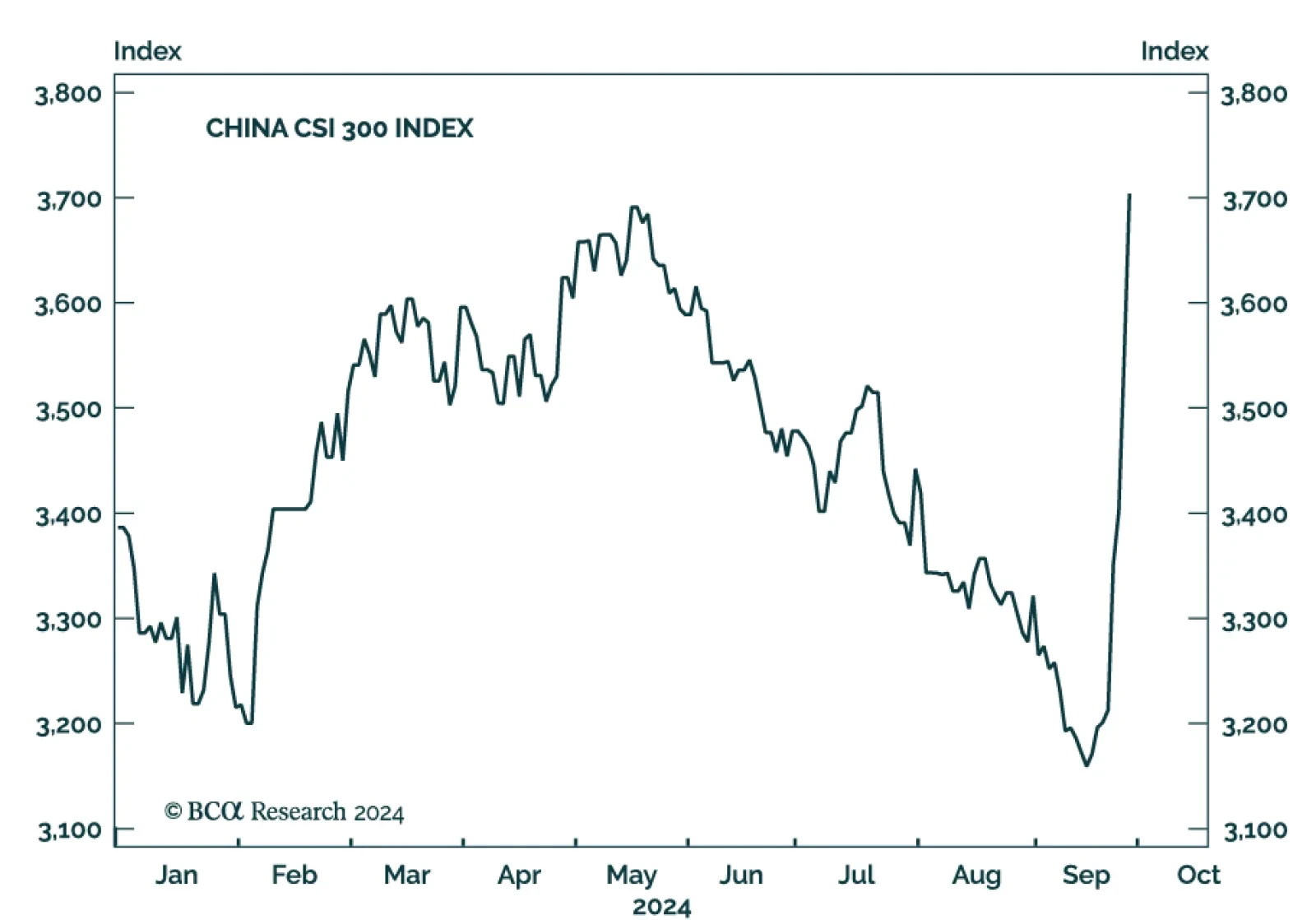

In response to the Chinese stimulus announced in late September, our Emerging Market strategists upgraded EM equities to no more than neutral. Indeed, while these measures have triggered a sentiment-fueled rally from depressed…

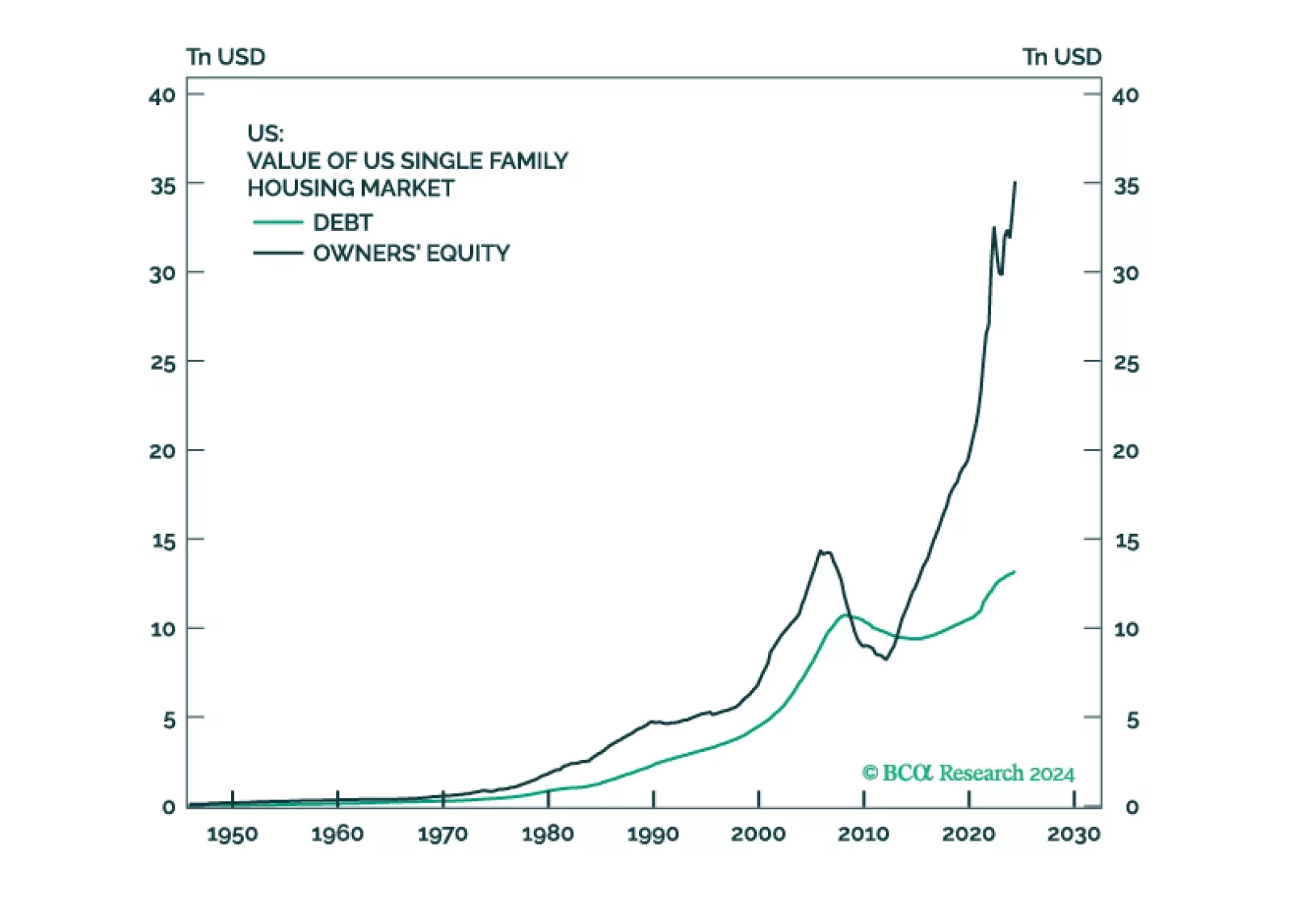

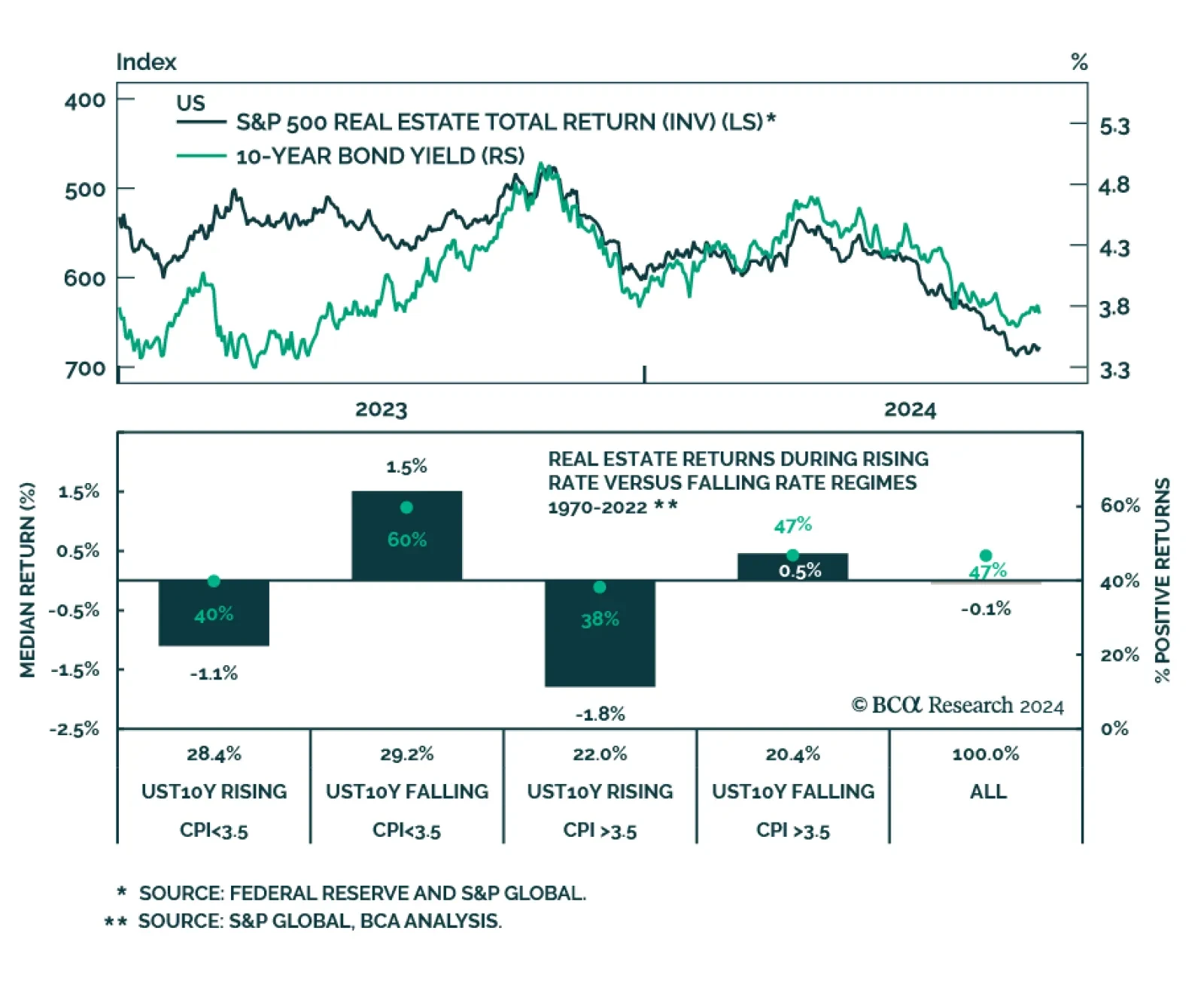

The prospects of Fed rate cuts powered the S&P 500 Real Estate index’s rally. Real estate was the best-performing sector in Q3, outperforming the S&P 500 by nearly 12%. Can this sector pursue its lead now that…

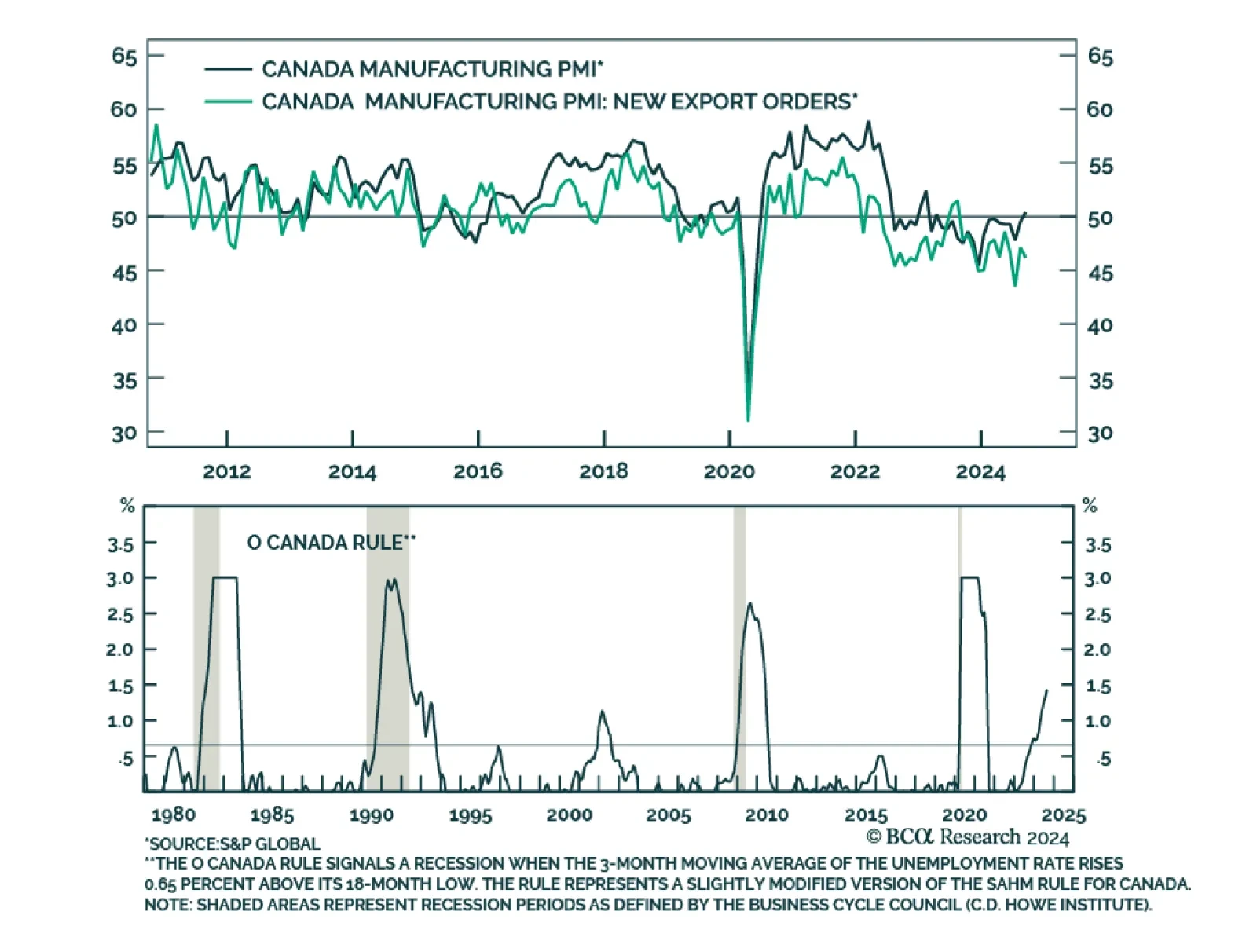

The S&P Global Canada Manufacturing PMI improved from 49.5 to 50.4 in September, breaking a 17-month contraction streak. It corroborated solid broad-based retail sales growth in July and August. Confidence in the outlook also…

October seasonality tends to be negative for stocks in an election year. That is the only thing that has stayed our hand from shifting out of our tactical underweight on US equities, initiated – poorly – in July.

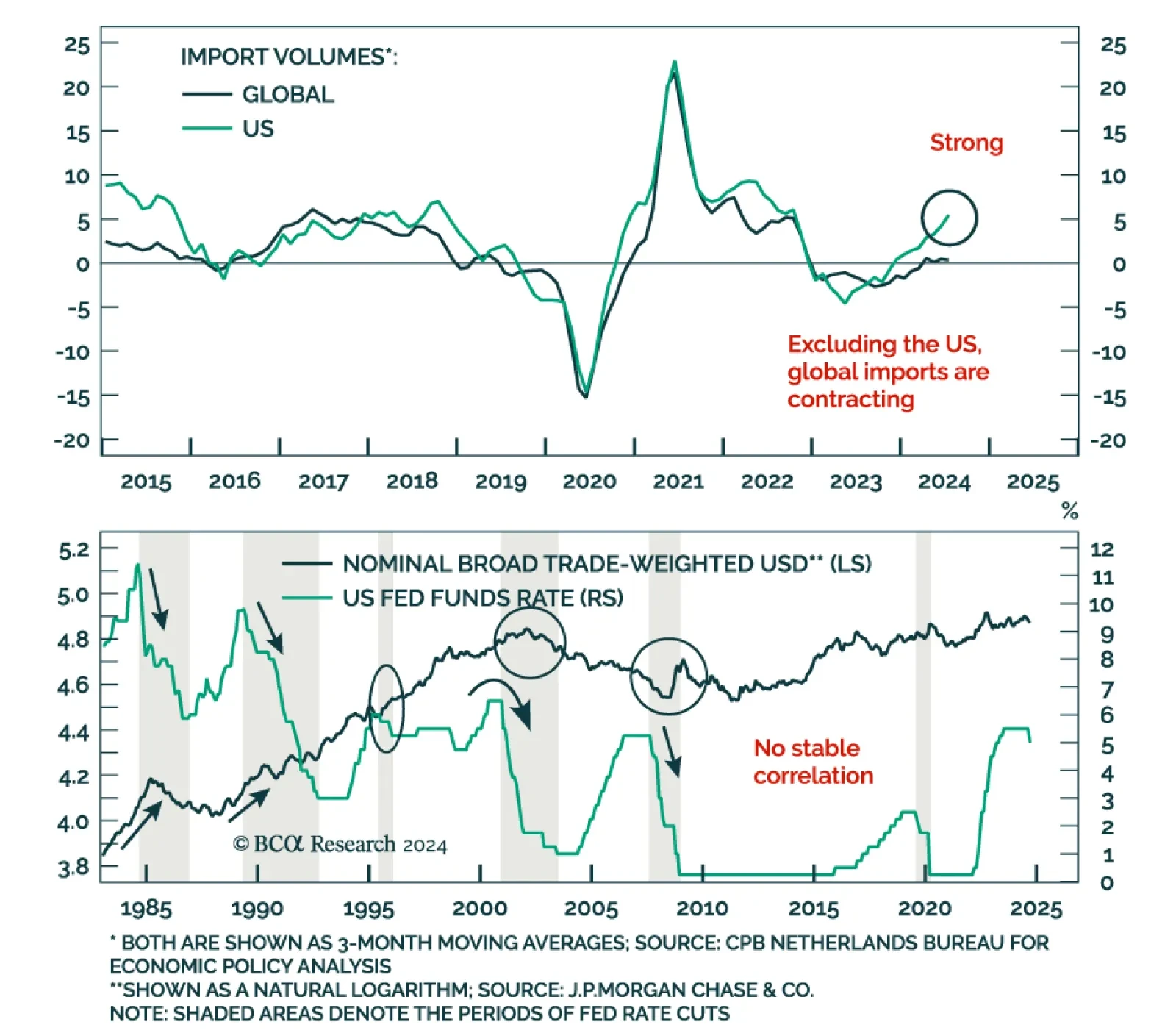

But the big macro…

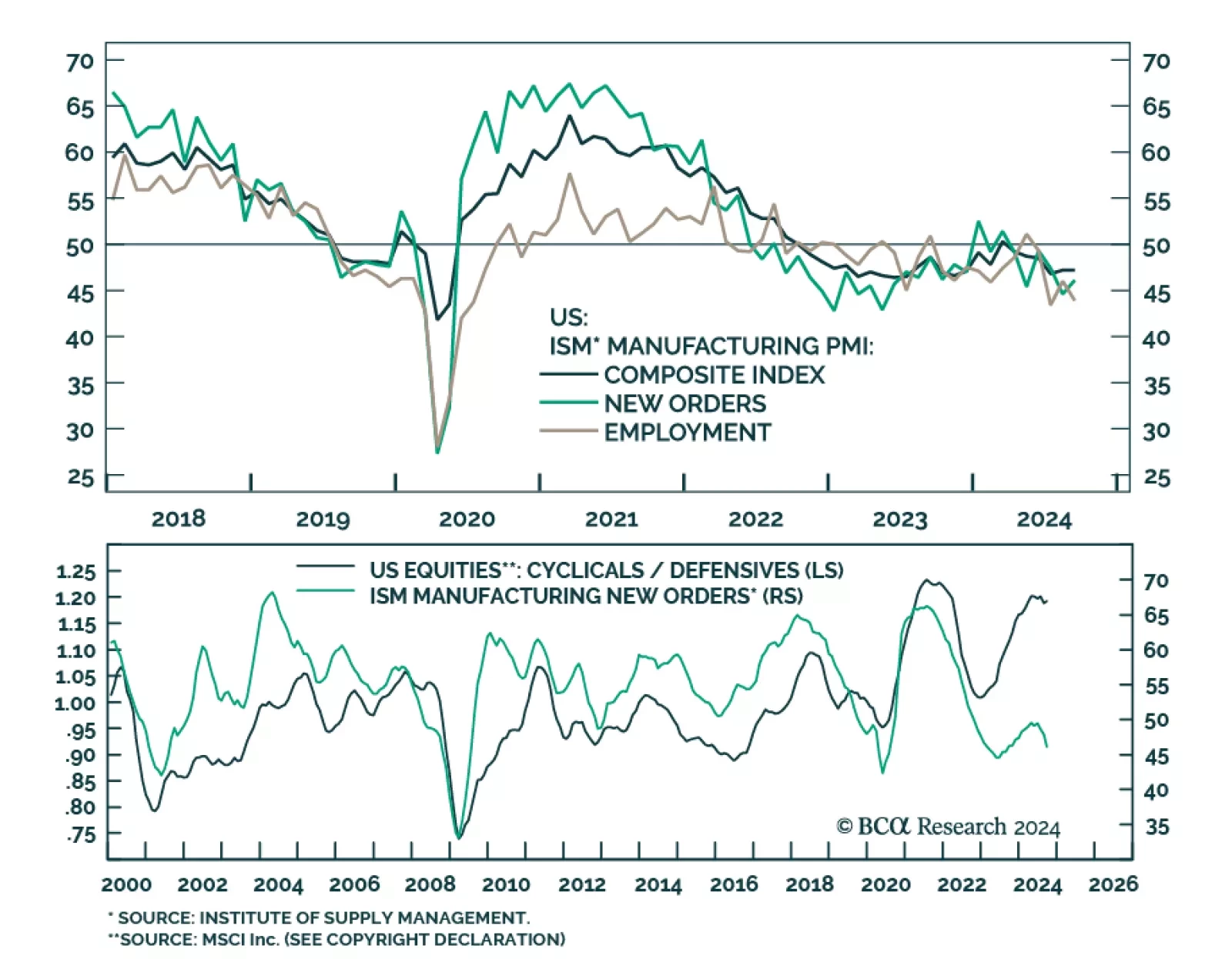

The ISM manufacturing PMI remained constant in September at 47.2, against expectations of a slower pace of decline and extending a six-month contraction streak. Measures of production and domestic demand decelerated at a…

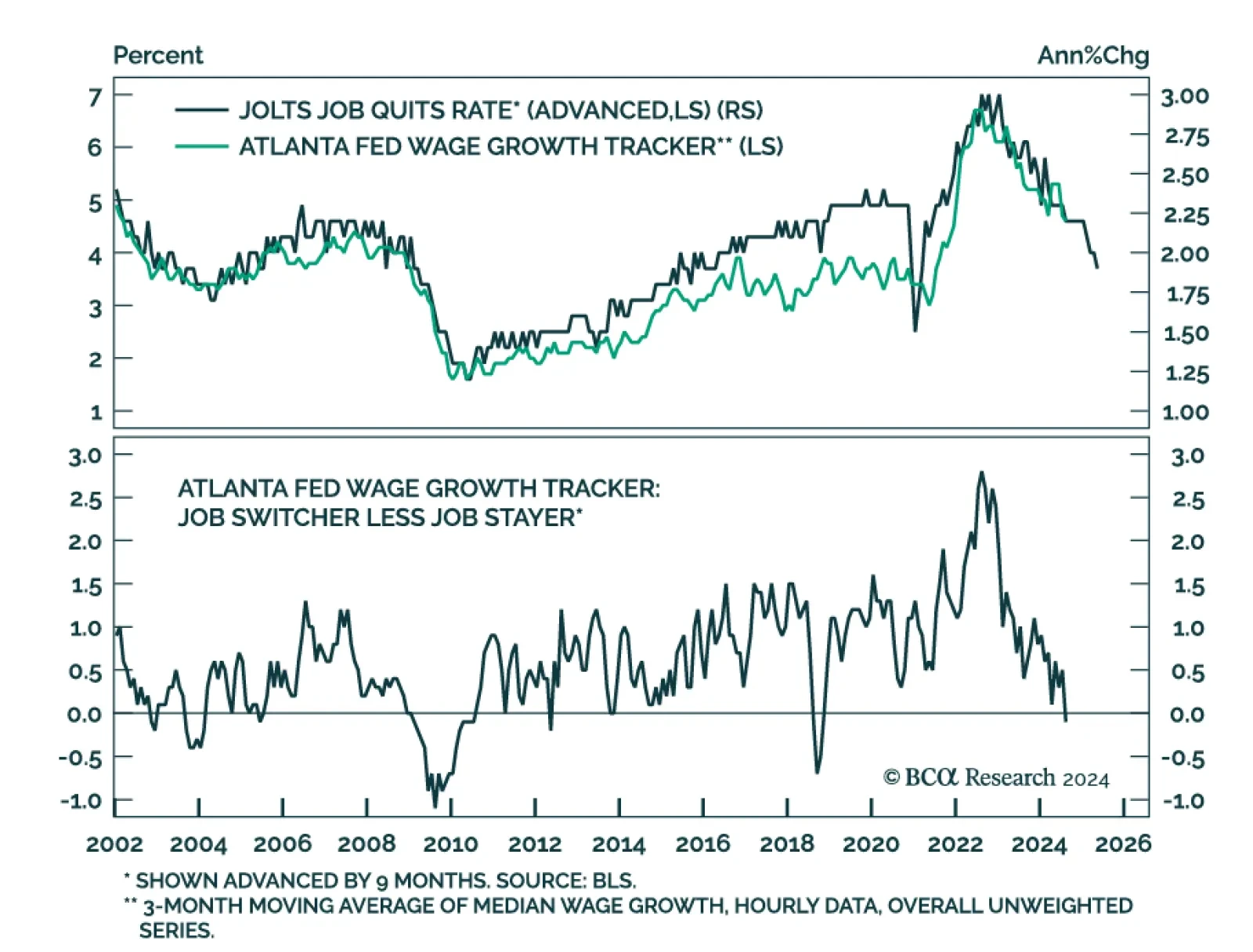

US job openings grew by a larger-than-expected 8.04 million jobs in August from 7.71 million. July’s openings were also revised 38 thousand higher. However, despite the upside surprise, the August hires rate fell to 3.3…

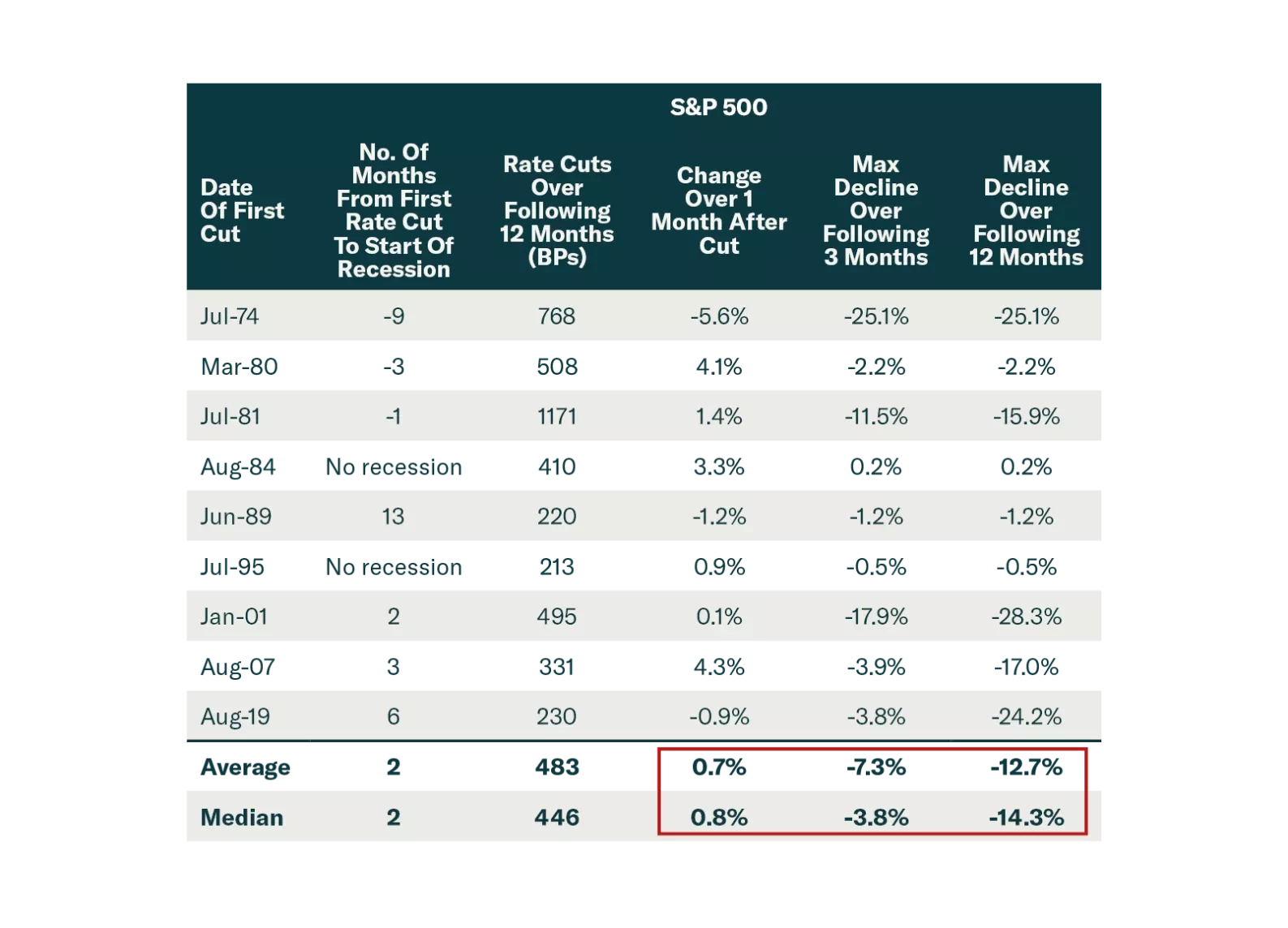

The market got excited by the 50 bps Fed cut and China stimulus. But these are a recognition that economies are slowing significantly. Stocks often rally after the first Fed cut, before falling sharply. Investors should stay…

September’s Chinese PMIs were uninspiring. The Caixin manufacturing PMI dipped into contraction territory (50.4 to 49.3) despite expectations it would modestly improve. The alternative NBS manufacturing PMI improved from 49…