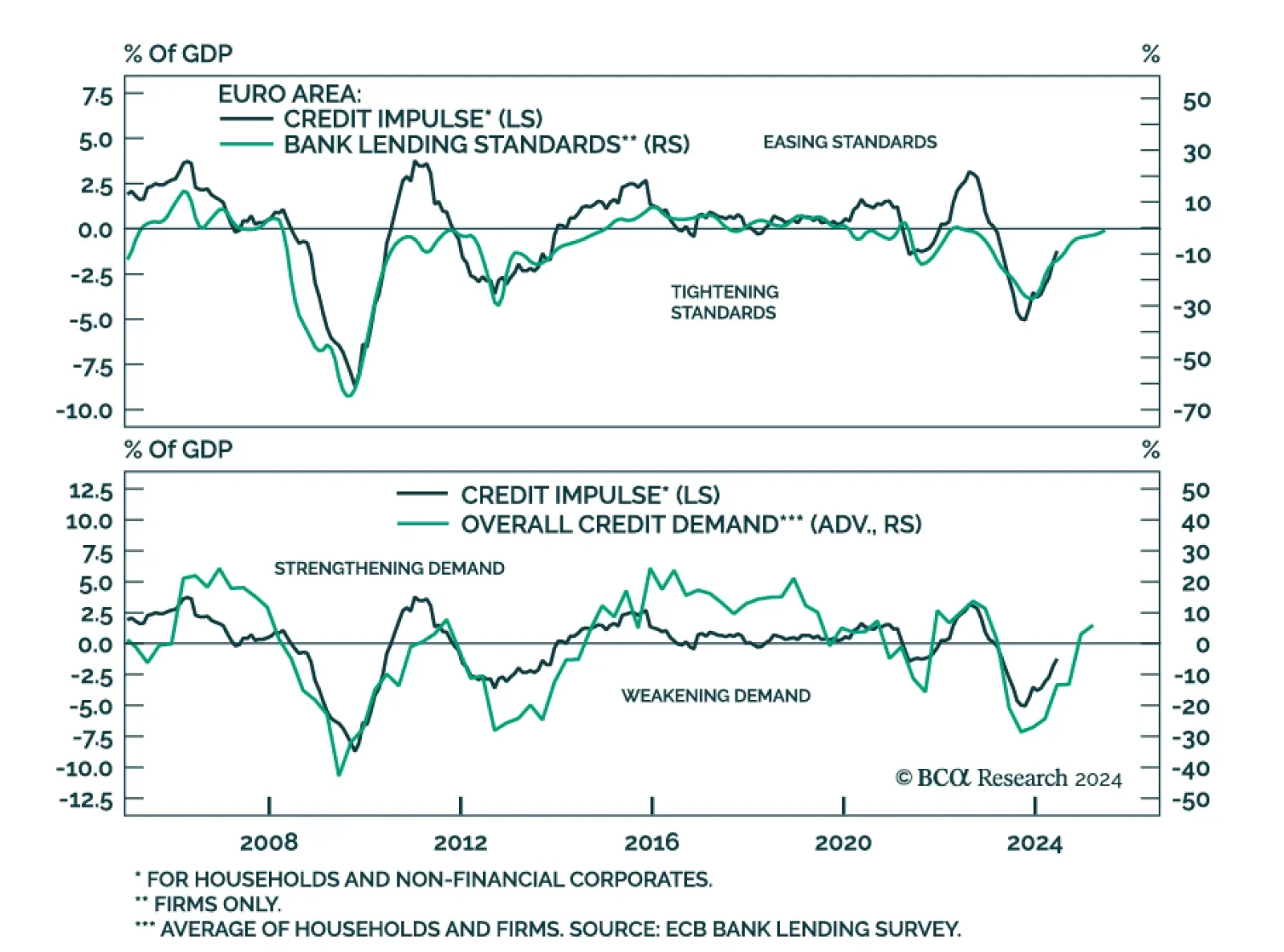

Banks reported an increase in loan demand from both firms and households in the European Central Bank’s Bank Lending Survey, marking the first rise since 2022. This demand increase occurred as lending standards for firms…

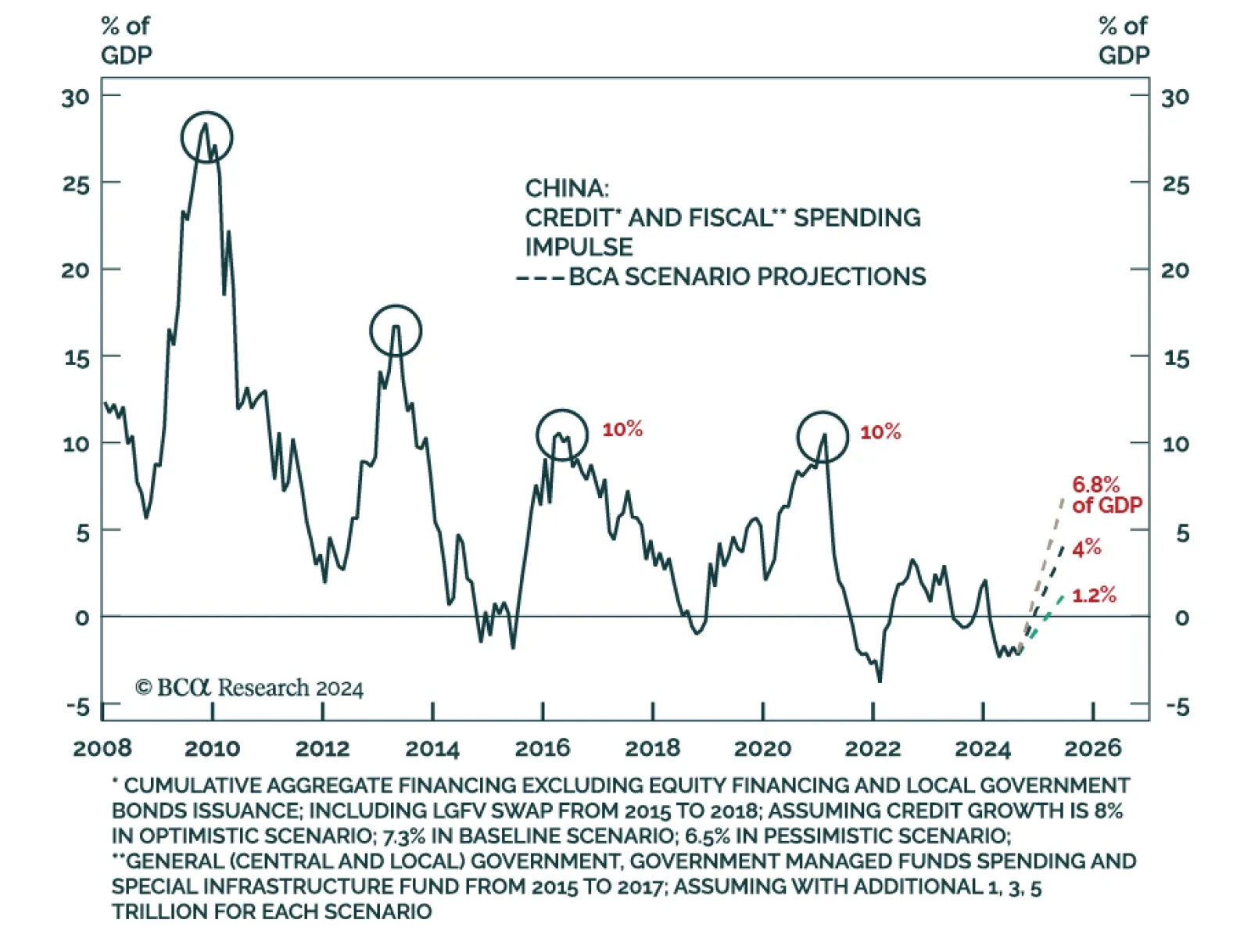

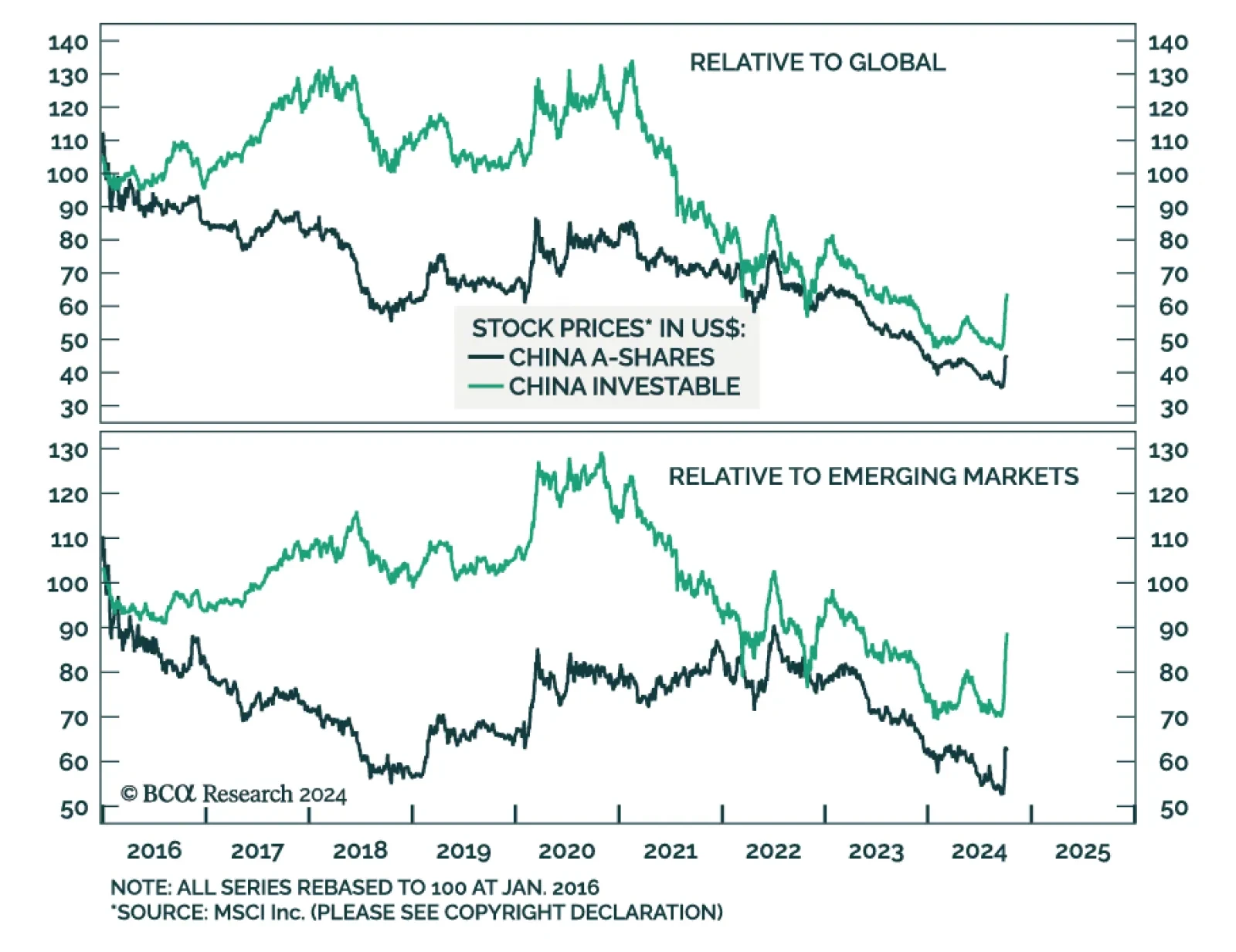

Our China and Emerging Market strategy teams analyzed this weekend press conference by the China’s Ministry of Finance (MoF), that provided additional details on the recently announced fiscal stimulus plan. Our…

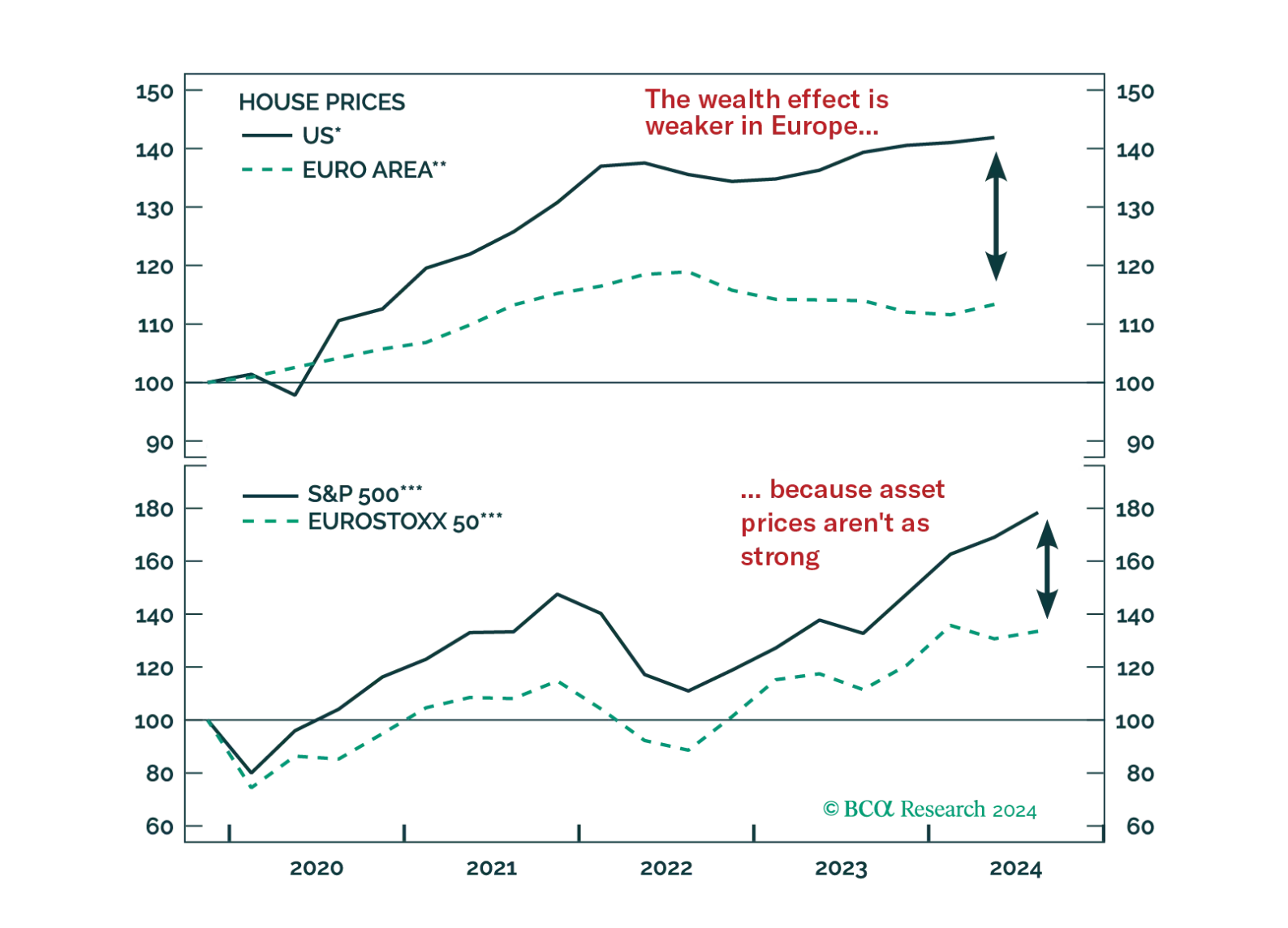

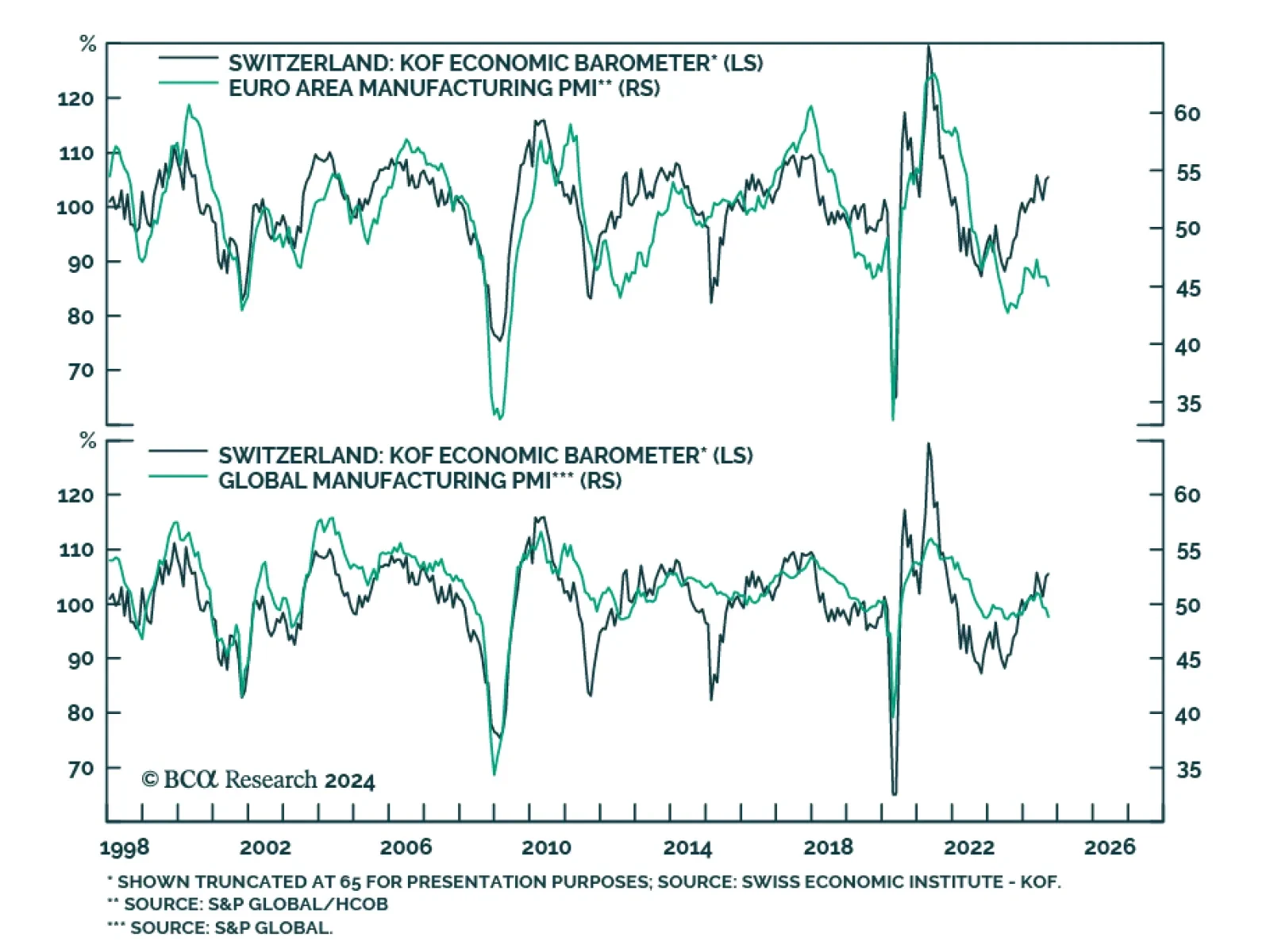

This week, we cover the main questions we fielded during our latest client trip in Europe. Among the many topics broached are Europe’s recession odds, the impact of China’s stimulus, and the outlook for European markets.

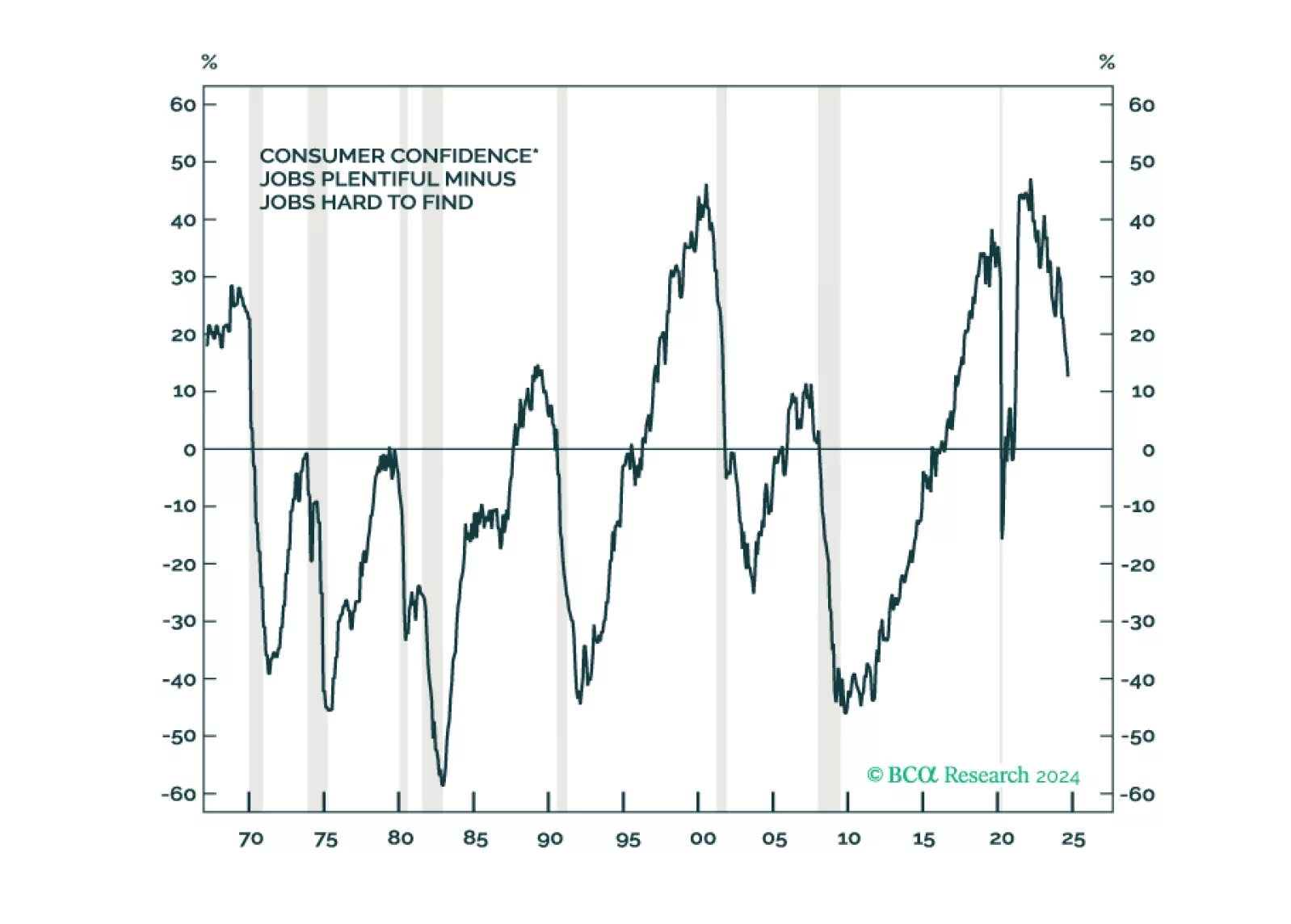

Rising stock prices and improving economic data have us re-examining our bearish thesis, but we still see deterioration in leading labor market indicators and expect it will eventually culminate in a recession. We reiterate our…

China’s National Development and Reform Commission (NDRC) provided no insights Tuesday on the size or nature of the fiscal stimulus Beijing promised in late September. The key takeaway of the authorities' first briefing…

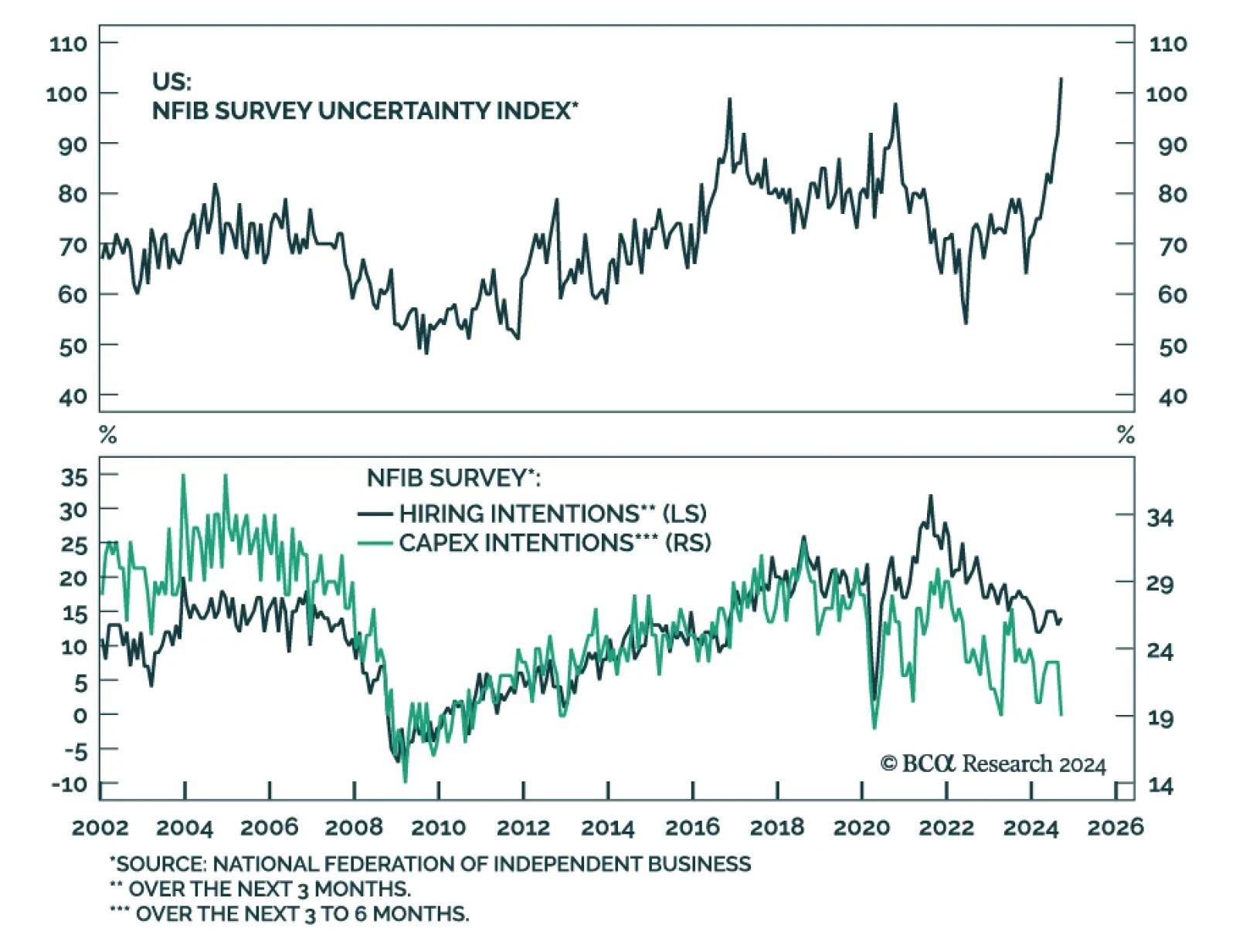

The NFIB Small Business Optimism index was mostly flat in September, ticking a mere 0.3 points higher to 91.5 in September, below expectations of a more meaningful improvement to 92.0. The NFIB Small Business Optimism has…

The month of October ahead of a US general election tends to be a volatile month with negative outcome for equities. As such, it is prudent to remain on the sidelines until after the election.

The US election underscores three long-term trends of Generational Change, Peak Polarization, and Limited Big Government. Investors should expect more volatility around the election and should assess the results before adding more…

The Swiss KOF Barometer is a composite leading indicator of the Swiss economy. It surprised to the upside in September coming in at 105.5 against expectations of 101.0. The August reading was also significantly revised higher,…

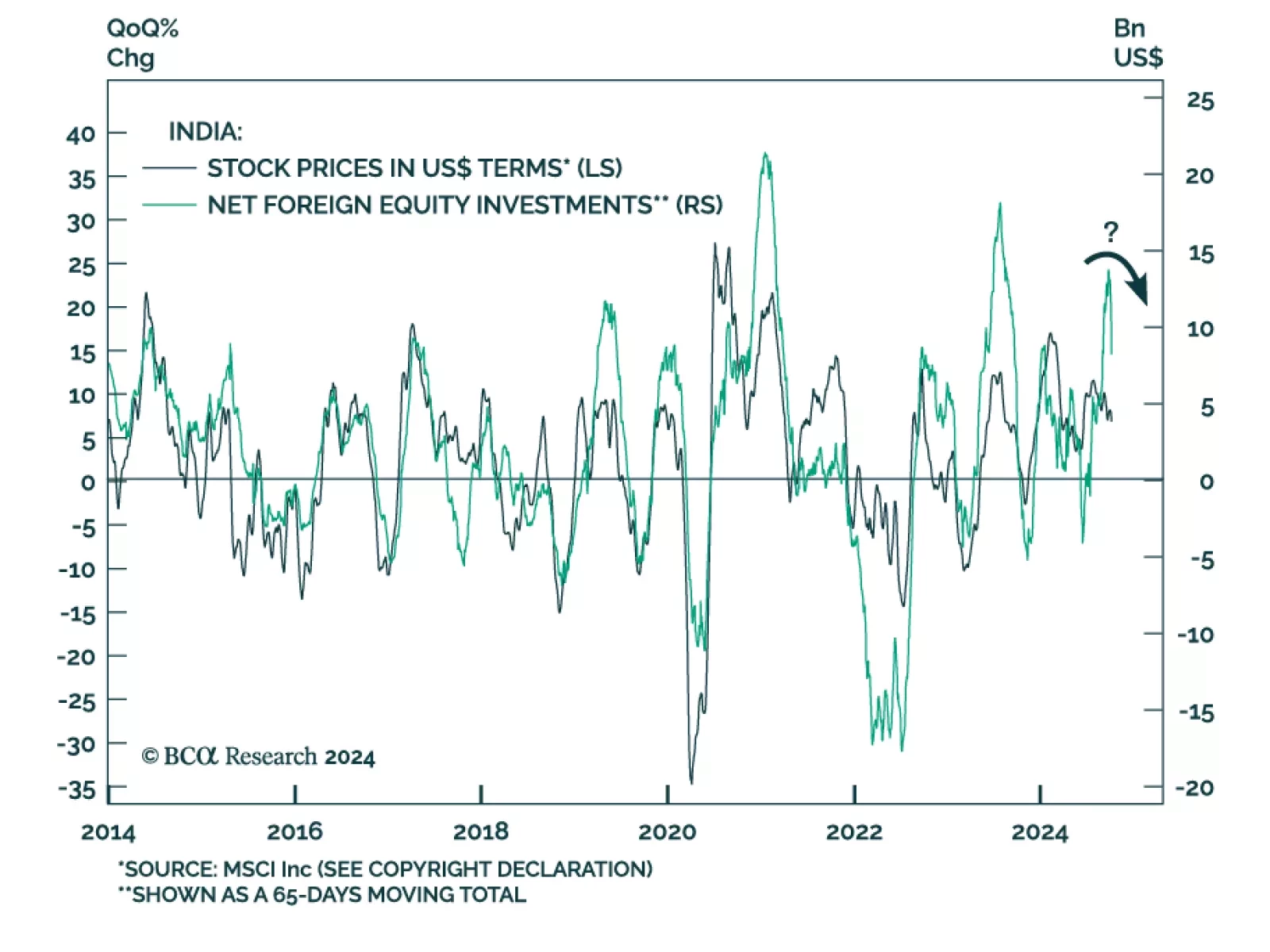

Indian equities reached new highs in late September. Our Emerging Market strategists recommend dedicated EM investors use these gains as an opportunity to reduce Indian equity allocations from neutral to underweight. They expect both…