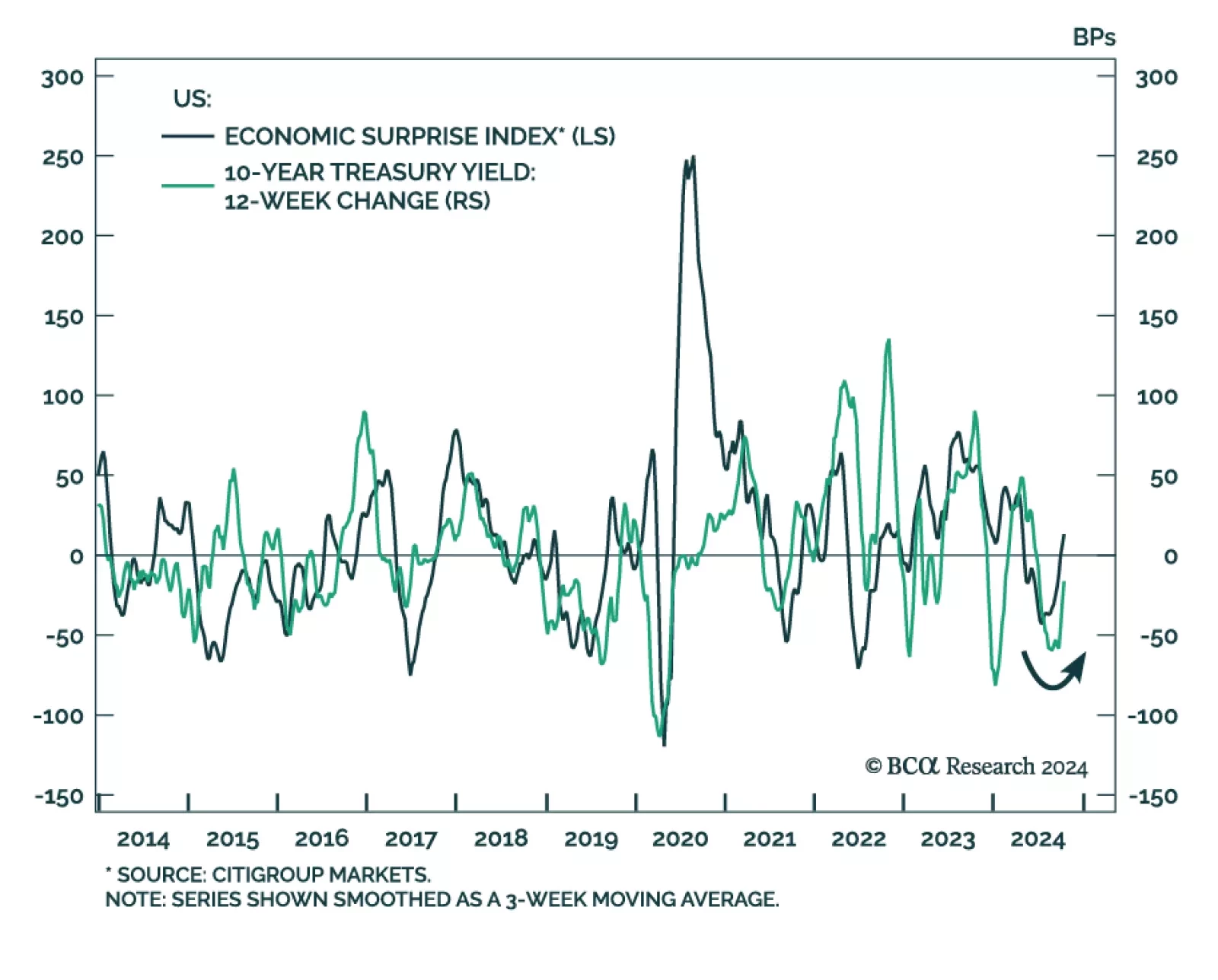

US Treasury yields rose nearly 60 bps since their September lows, with the 10-year maturity recently reaching 4.2%. This move was a bear steepening, the front of the curve did not rise as much. Positive economic surprises mainly…

Dear client, We are launching a new type of Daily Insight titled “Cross-Asset Focus”, where we delve into the dynamics between multiple asset classes, tying them to the current macro and market regimes. The inaugural entry…

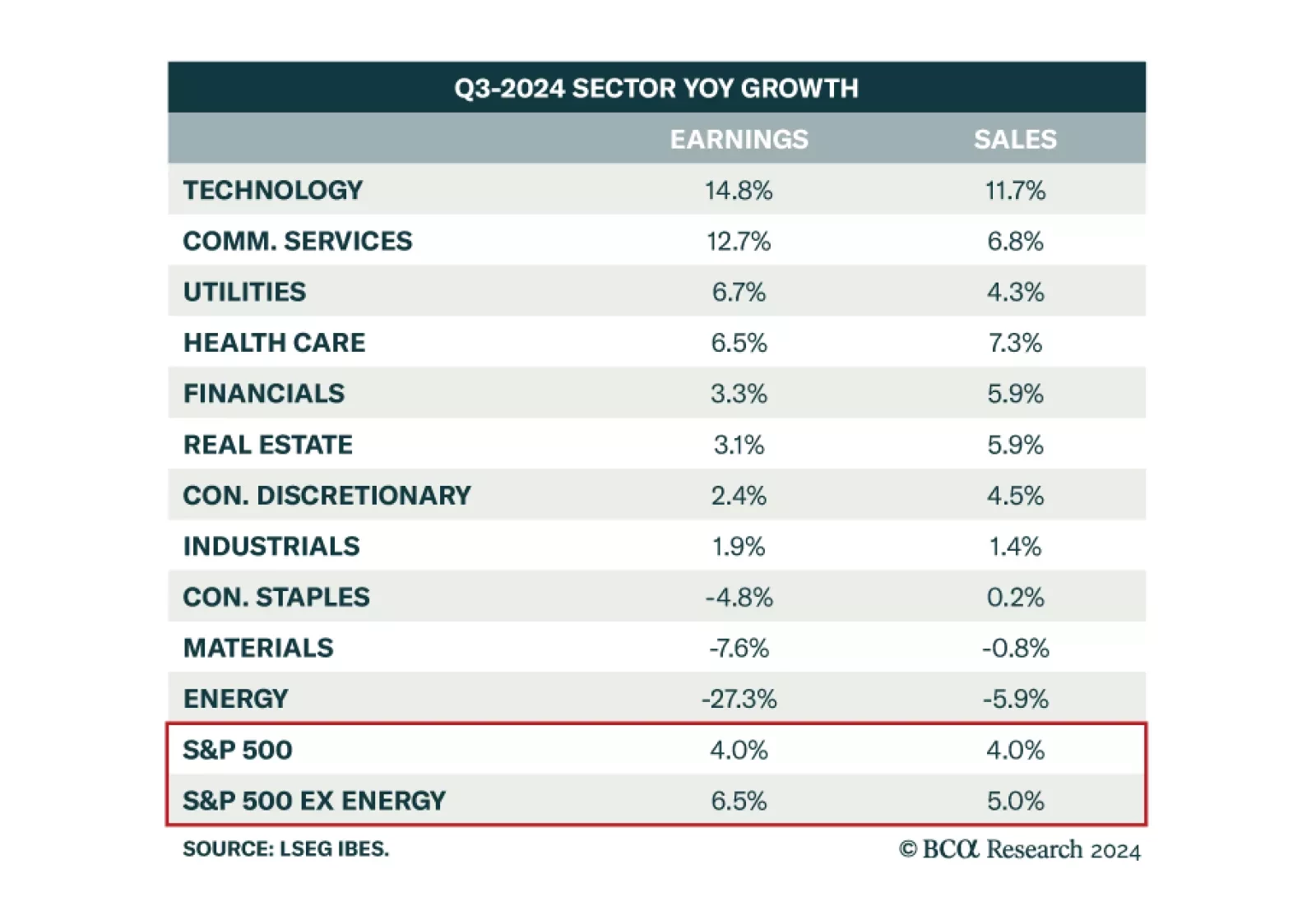

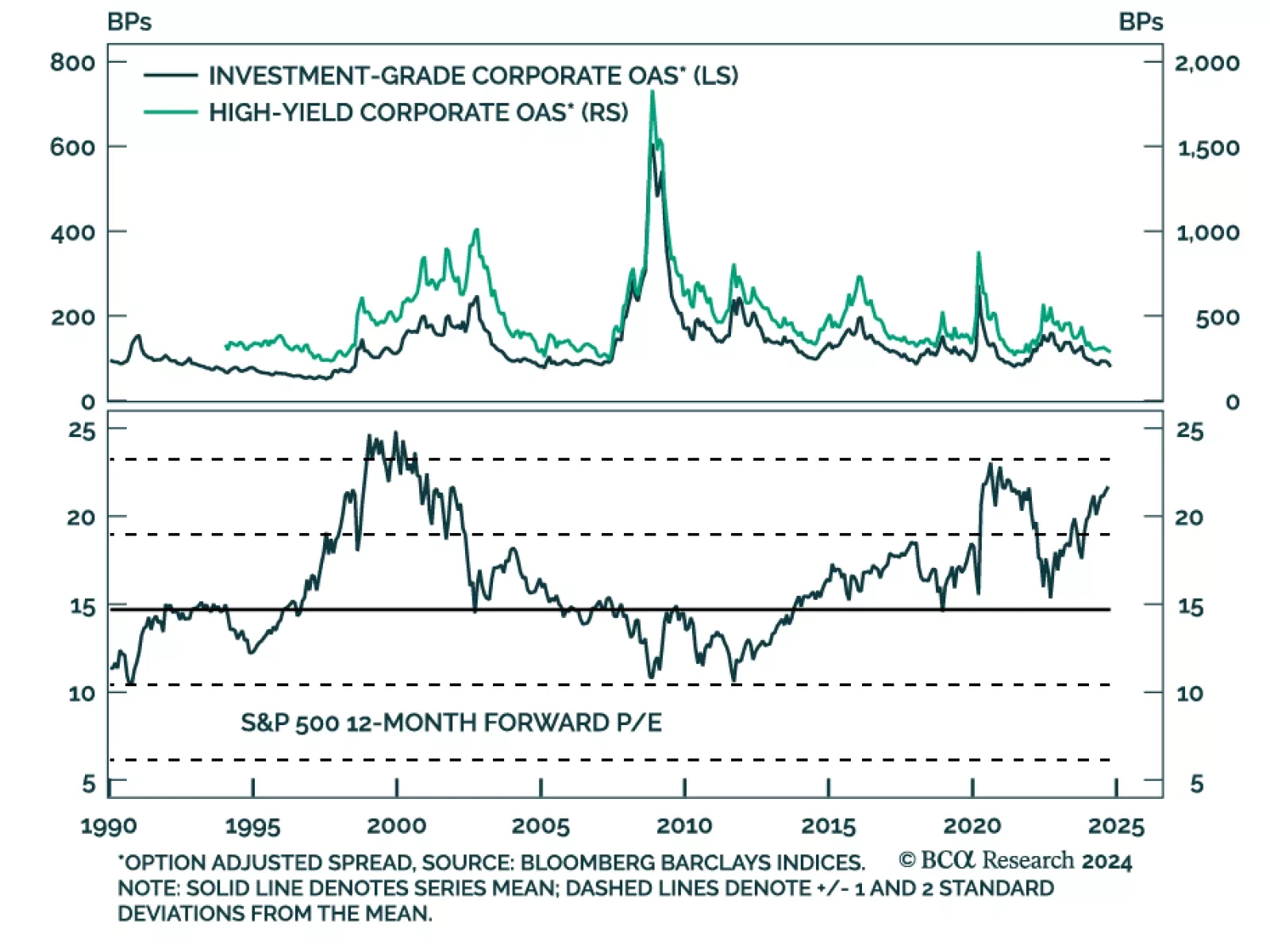

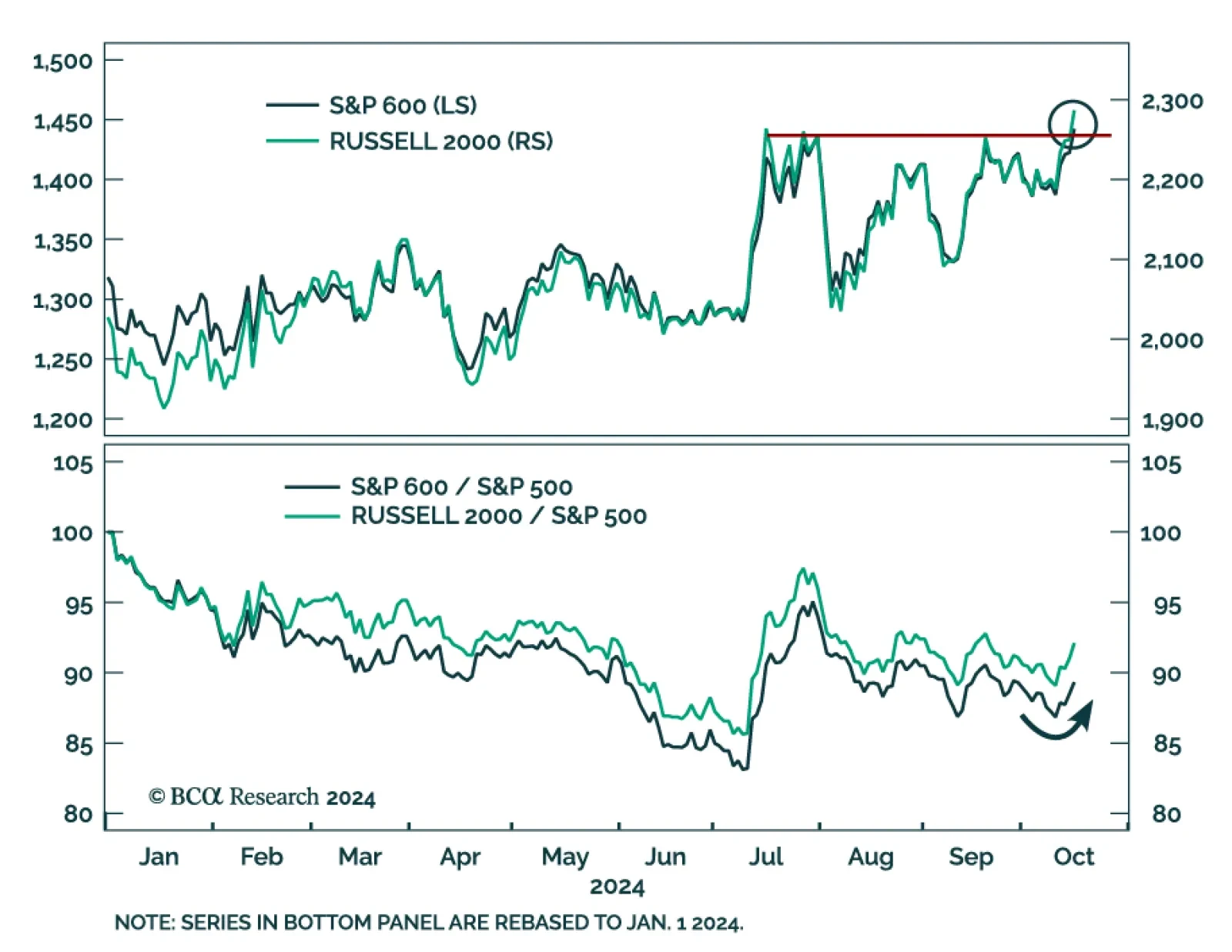

Our US Equity Strategy colleagues expect Q3 earnings to be strong enough to fuel the soft-landing narrative. Analysts expect S&P 500 earnings growth to be 4.0% year-over-year, with sales growth of 4.0% too. Yet, with…

The war in Ukraine has ended in late 2022… for markets at least. This is the conclusion from our GeoMacro team’s latest report, which aims to dispel five crucial myths surrounding the conflict. The myths are the…

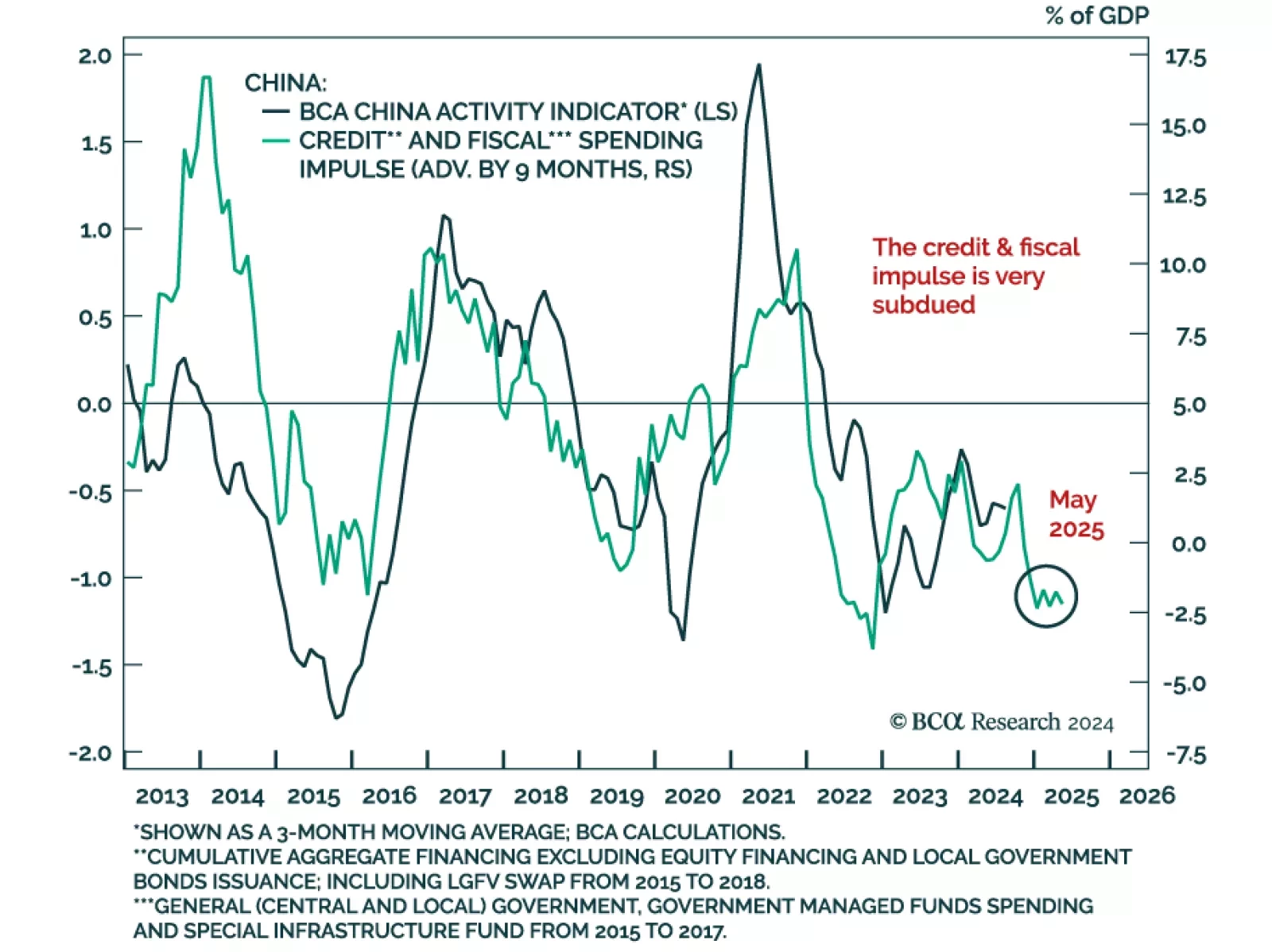

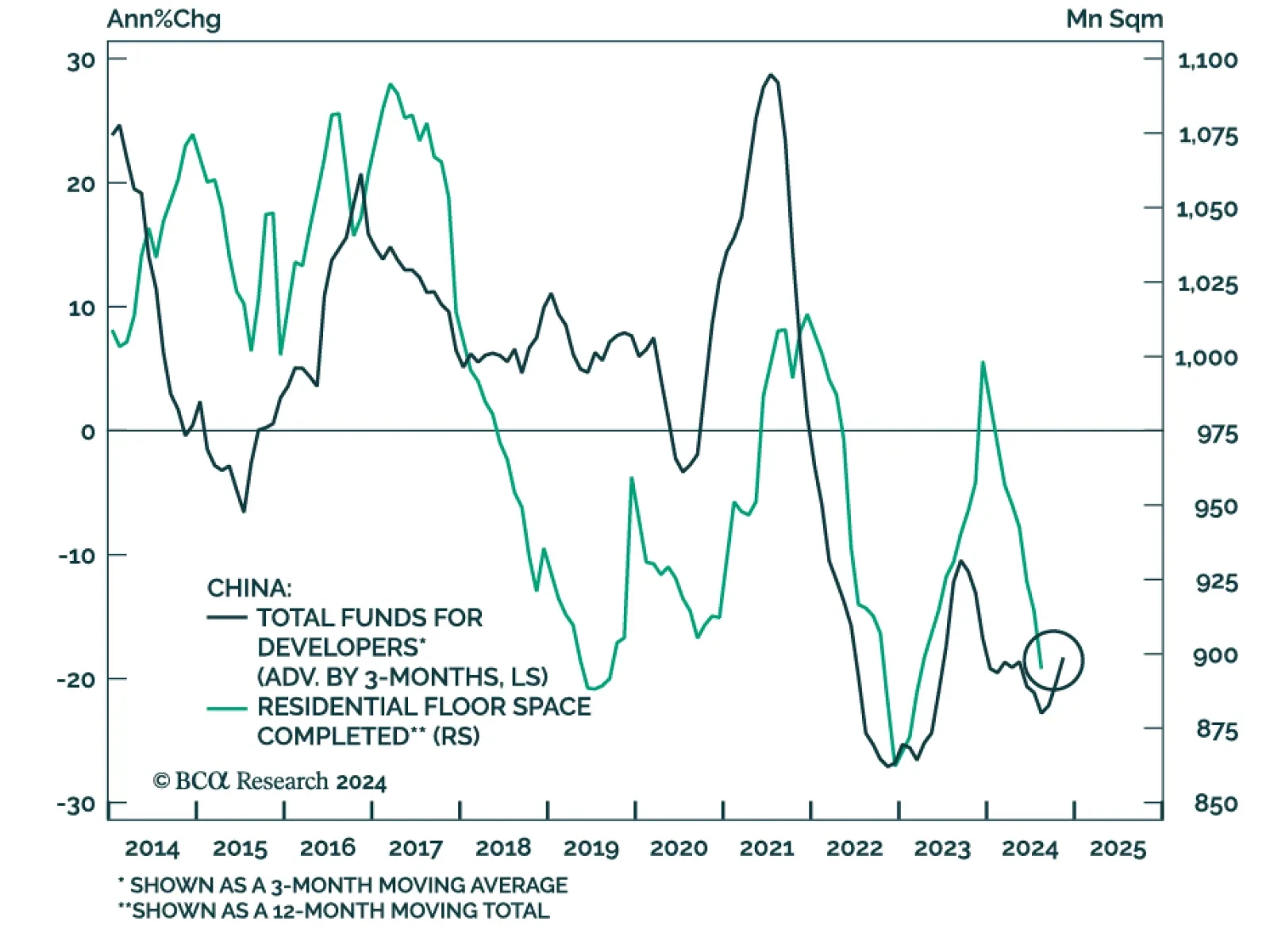

Chinese activity data met expectations, with Q3 GDP printing at 4.6% year-on-year, decelerating from 4.7% in Q2 but below the 5% 2024 growth target. Other metrics such as industrial production and retail sales beat expectations…

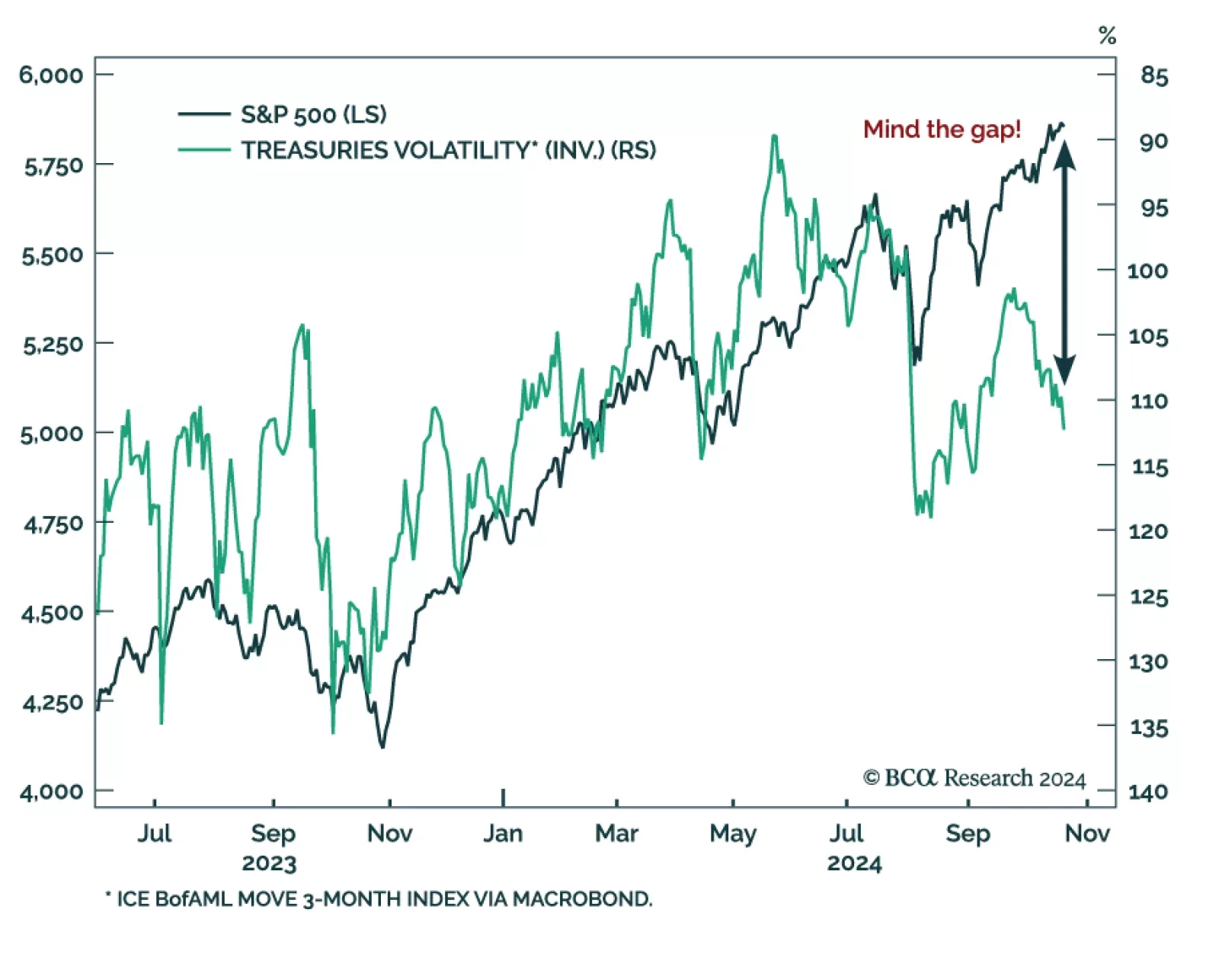

Recent economic data surprises drove equities and bond yields higher, putting our US Investment Strategy team’s bearish views to the test. They recently published a piece assessing their views considering these bullish…

US retail sales beat expectations in September, rising 0.4% from August when growth was essentially flat. The control group also beat expectations at 0.7% month-on-month, accelerating from 0.3%. Growth was however somehow weak on…

China’s Housing Administration Chief held a press conference yesterday to unveil two property-sector stimulus plans. According to our China strategists, the details were underwhelming and led to a decline in Chinese…

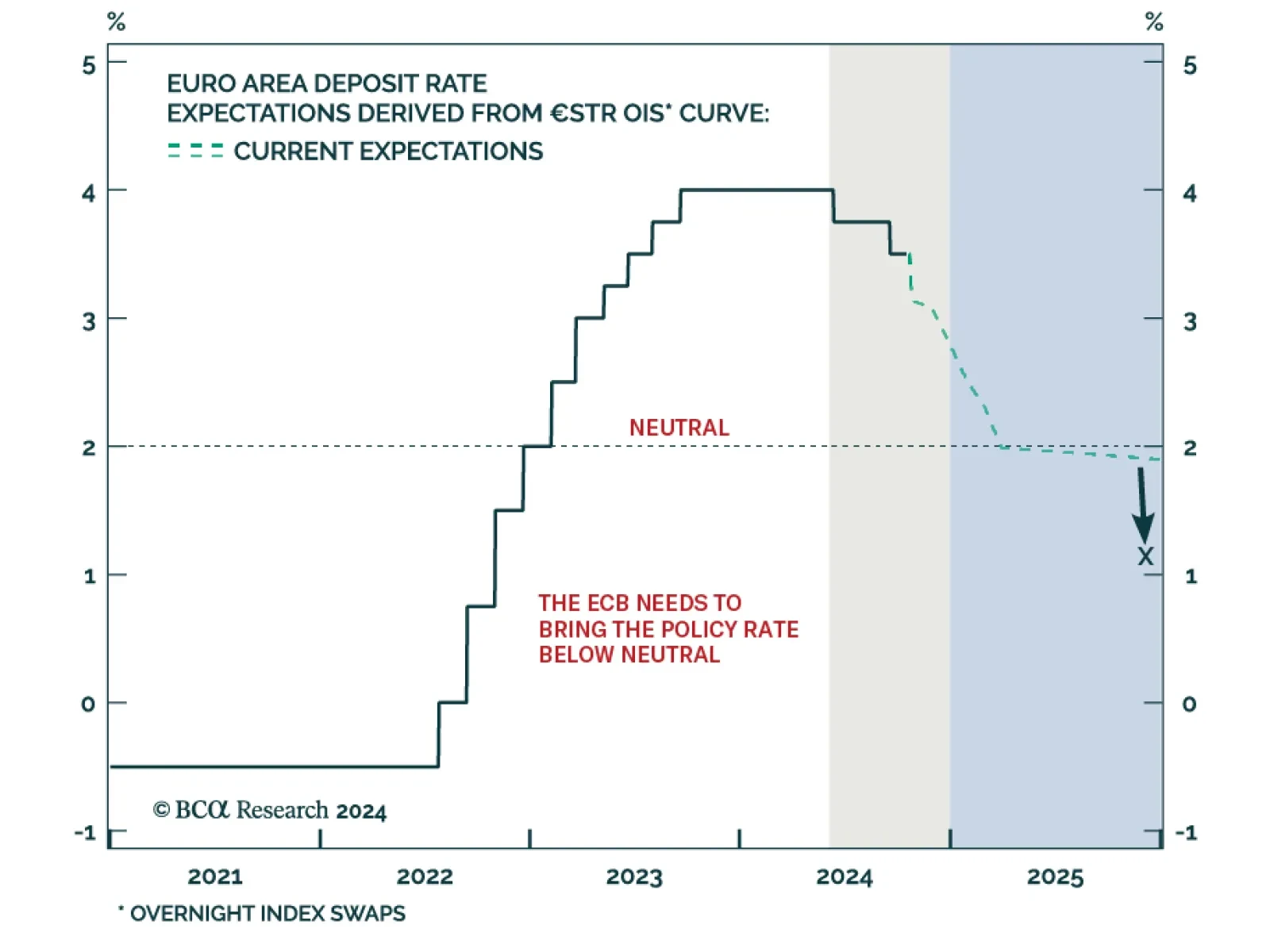

The ECB cut interest rates by 25 bps for the third time this year, lowering the deposit facility rate from 3.5% to 3.25%. While the ECB is avoiding explicitly committing to a path for policy, President Lagarde’s repeated…