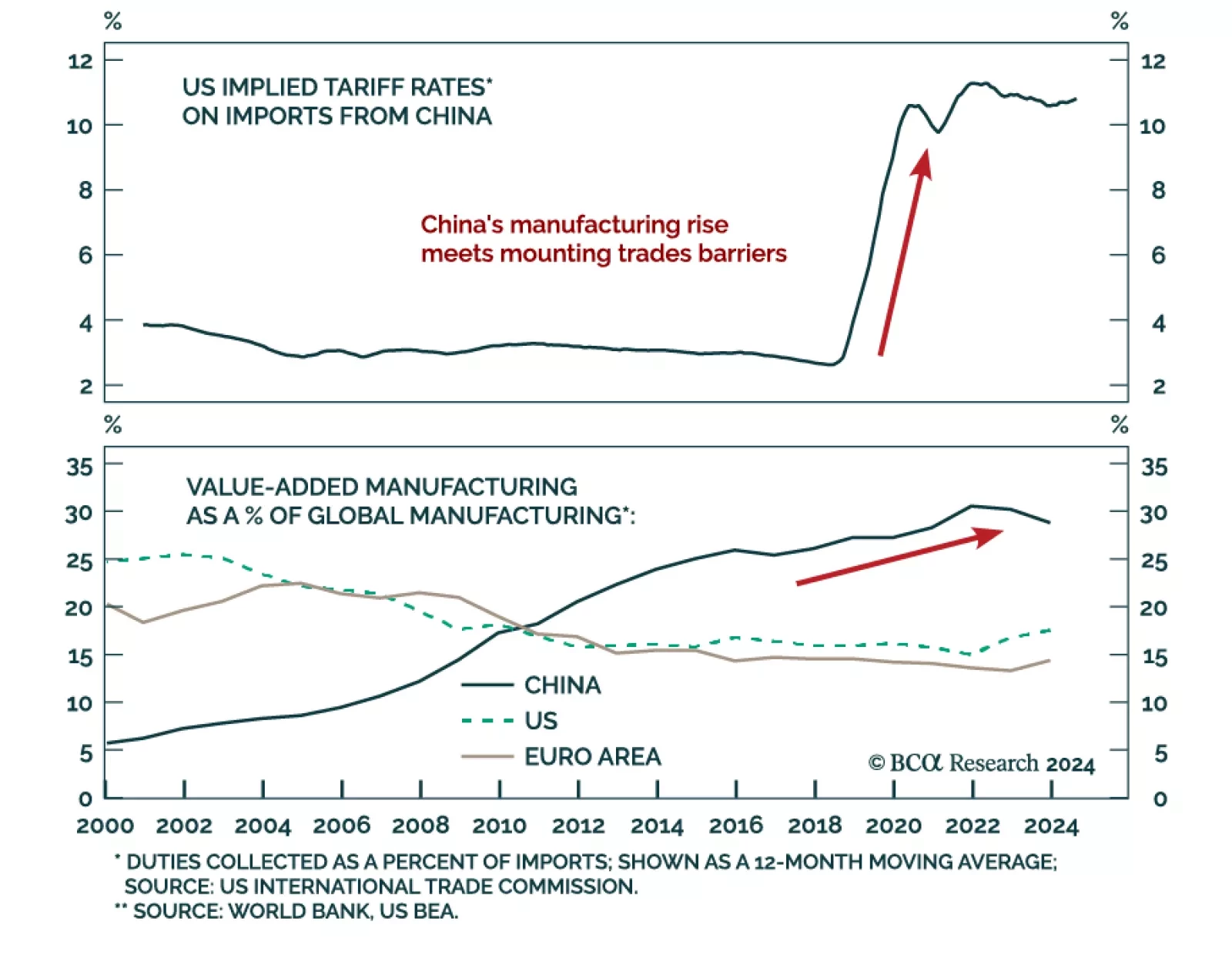

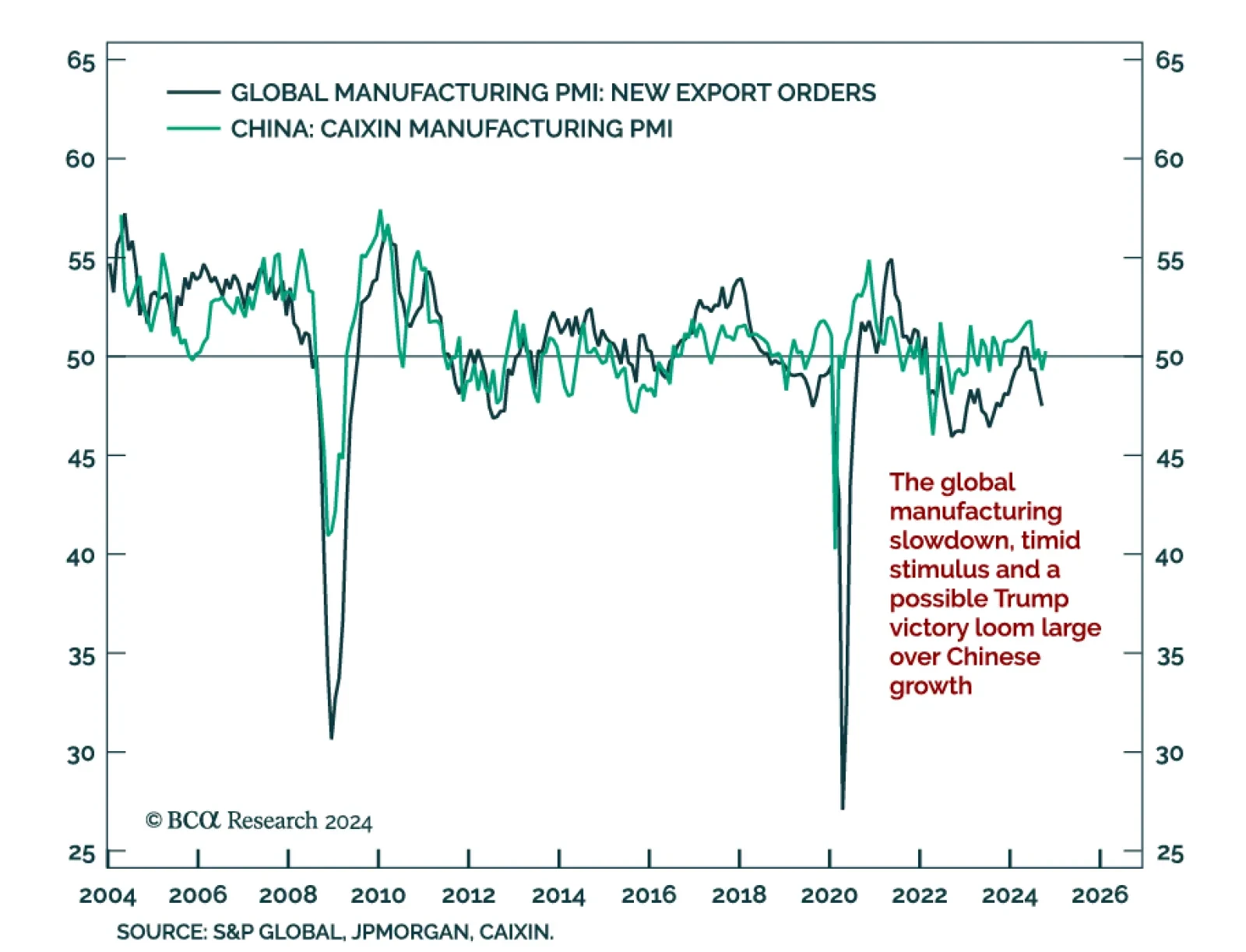

Our China Investment Strategy team assessed the country’s outlook in a context of underwhelming stimulus and rising trade tensions. Trump’s re-election raises the likelihood of tariff hikes on Chinese exports…

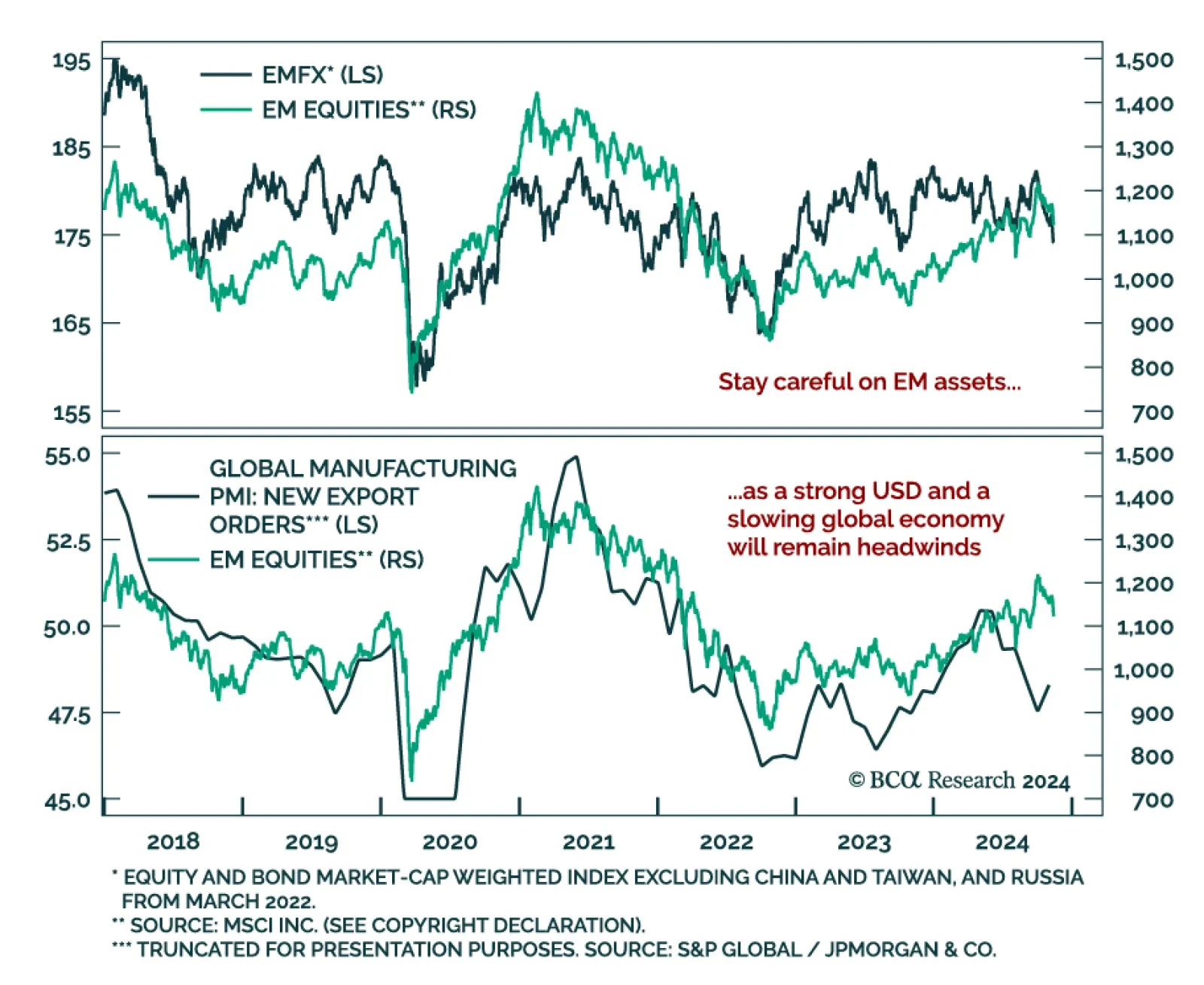

The flipside of the recent US dollar rally has been weakness across both DM and EM FX. The USD rally has legs and will have cross-asset reverberations. EM equities will be affected. A key determinant of EM returns is the…

The force of the post-election momentum leads us to believe we could be stopped out of our defensive positioning before the week is out, but we still believe in our recession call. If we are eventually stopped out, we will seek a…

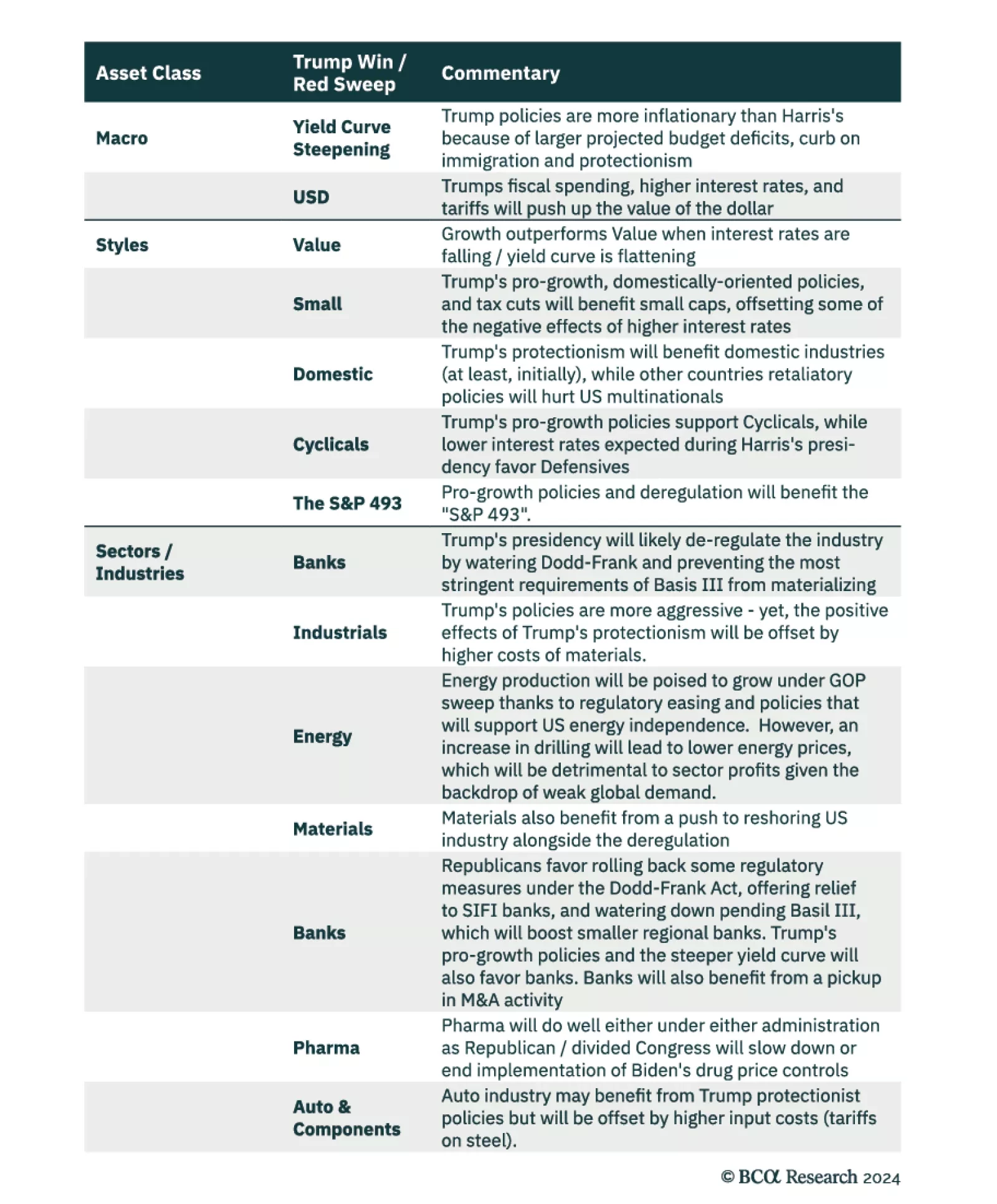

Our US Equity strategists prepared a Post-Election US Equity Cheat Sheet. Here are highlights of their recommended positioning for a US equity portfolio in a Red Sweep scenario. Protectionism and pro-growth domestic policies will…

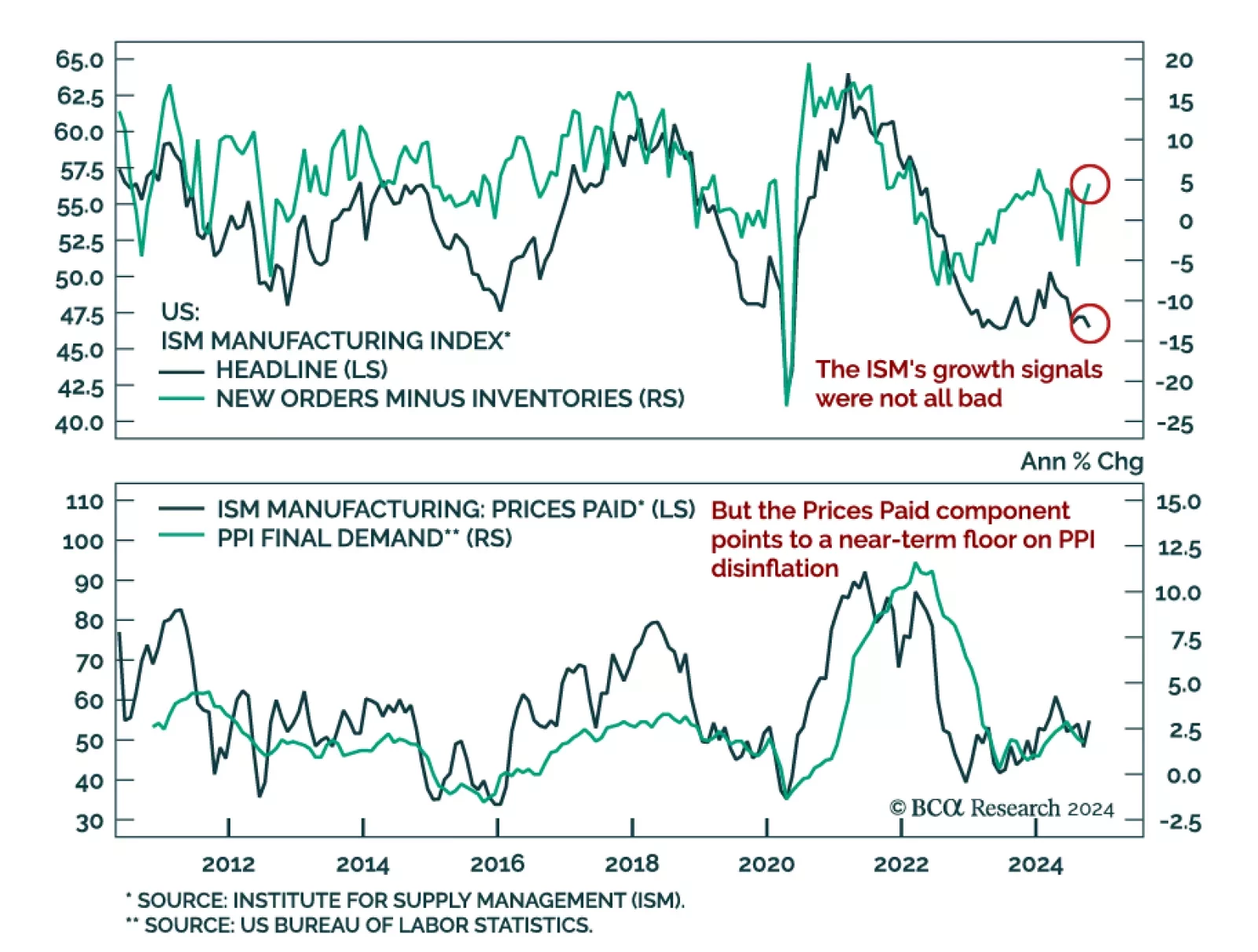

The October ISM Manufacturing missed expectations, decreasing to 46.5 from 47.2 in September. The Prices Paid component jumped, rising to 54.8 from 48.3 the month prior. New Orders showed a small upside surprise at 47.1, up 1…

China’s Caixin Manufacturing PMI rebounded one point in October to 50.3. This was in line with the NBS PMIs from earlier this week, which also showed a modest rebound. We are looking for a turning point in China as the…

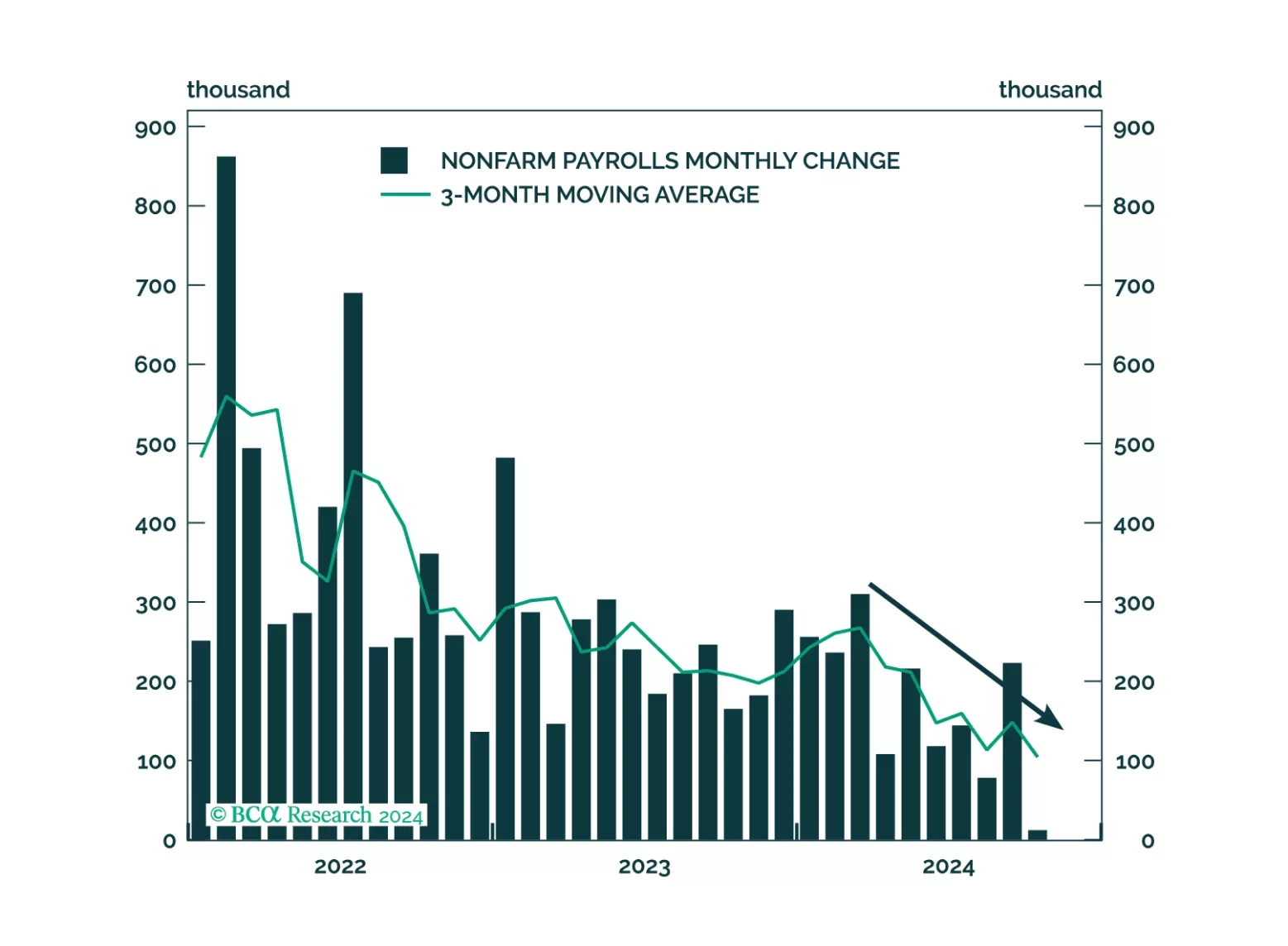

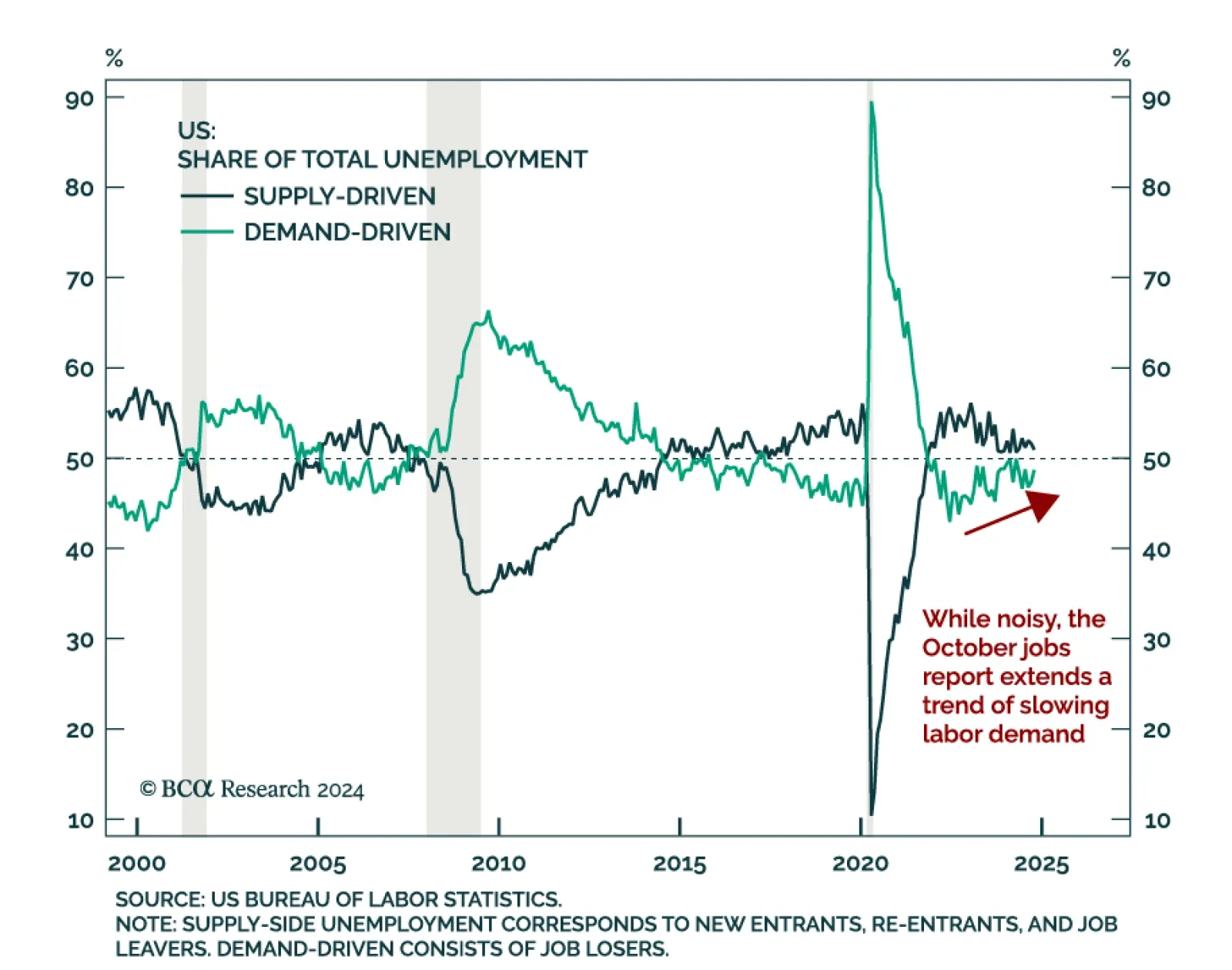

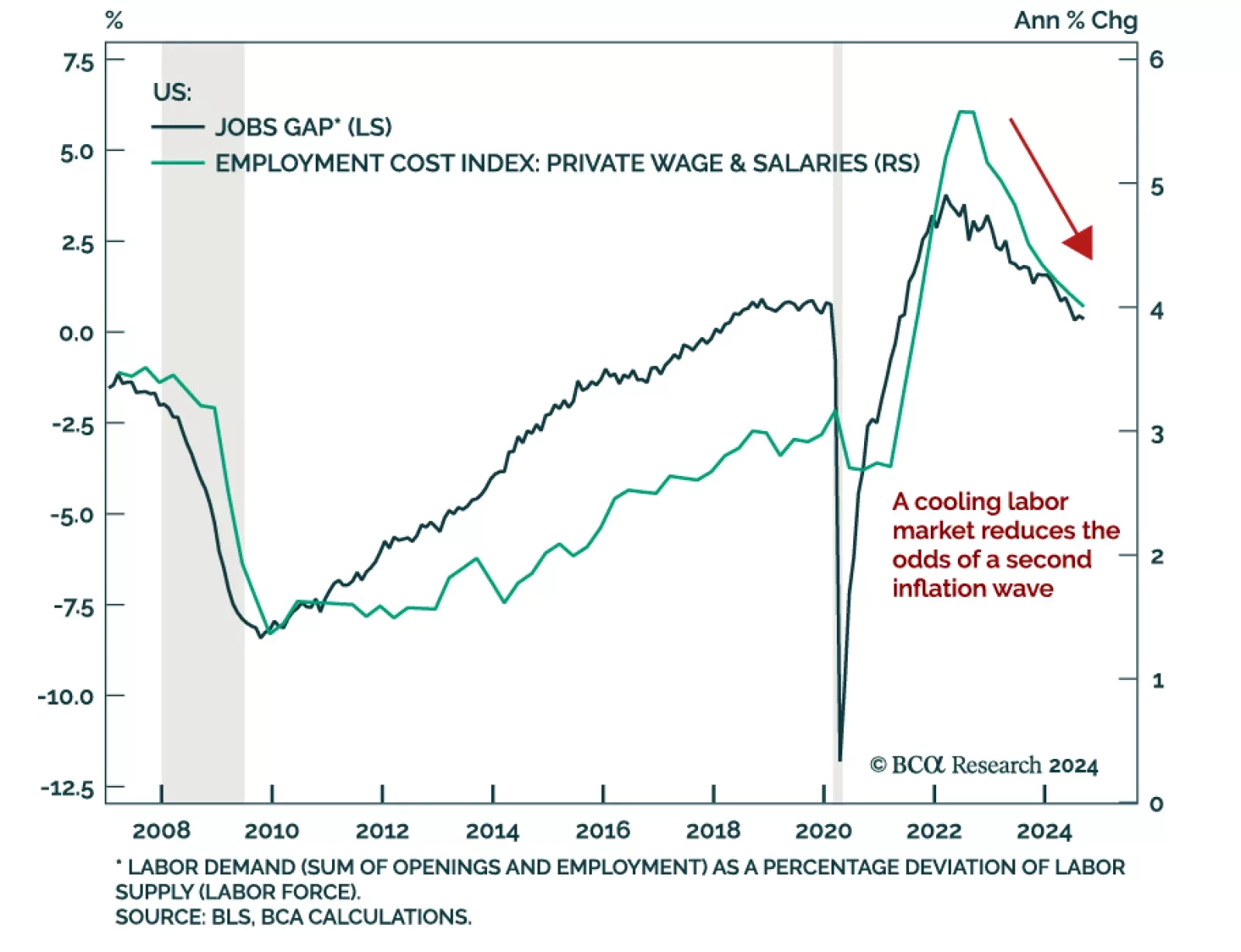

The October US jobs report had mixed signals and was skewed by hurricanes and industrial strikes. Unemployment met expectations by staying unchanged at 4.1%, although it rose nearly 0.1 percentage point on an unrounded basis.…

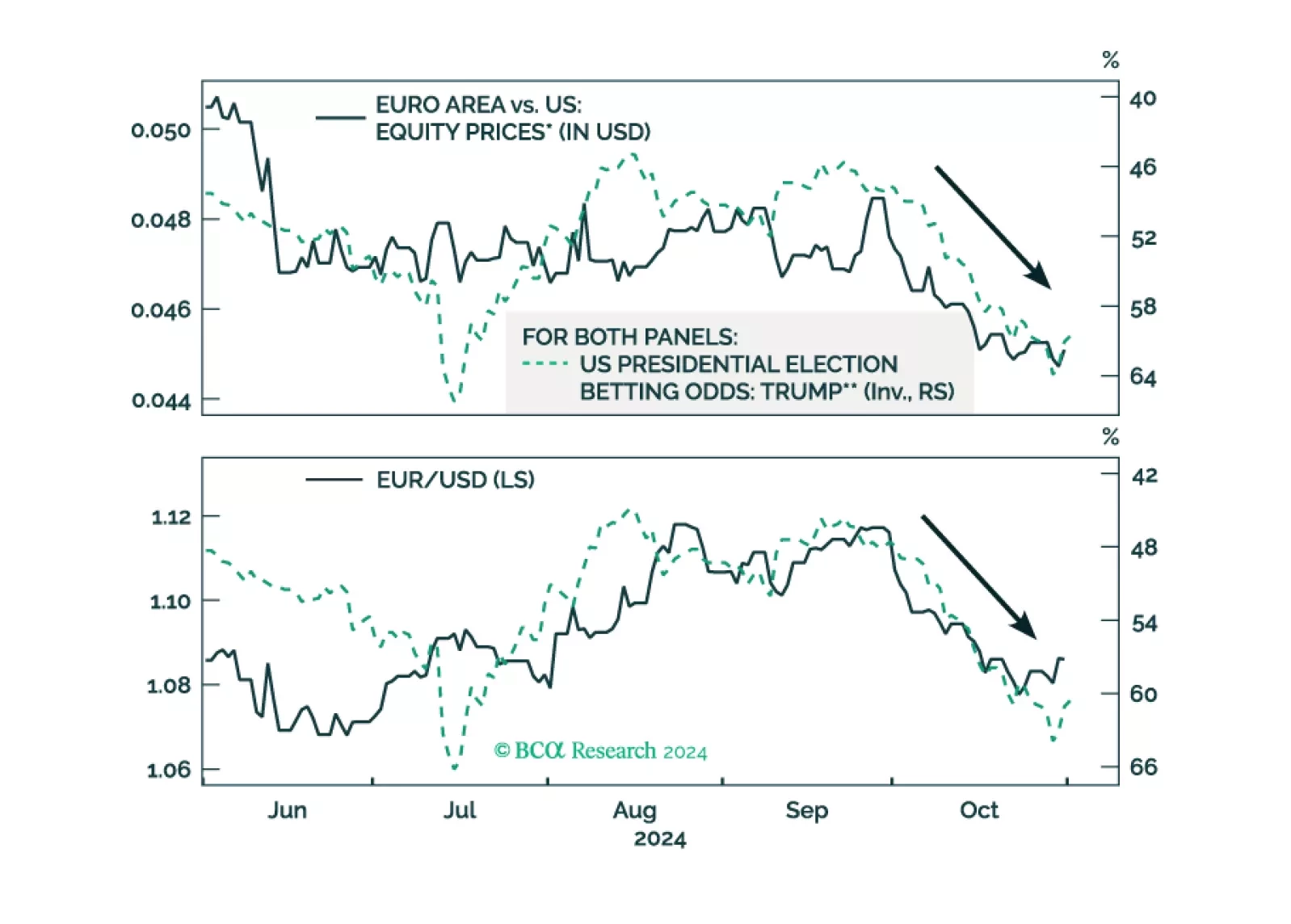

As the odds of a Trump victory rise, European assets underperform US ones. What would be the immediate impact of a Trump victory on European stocks?

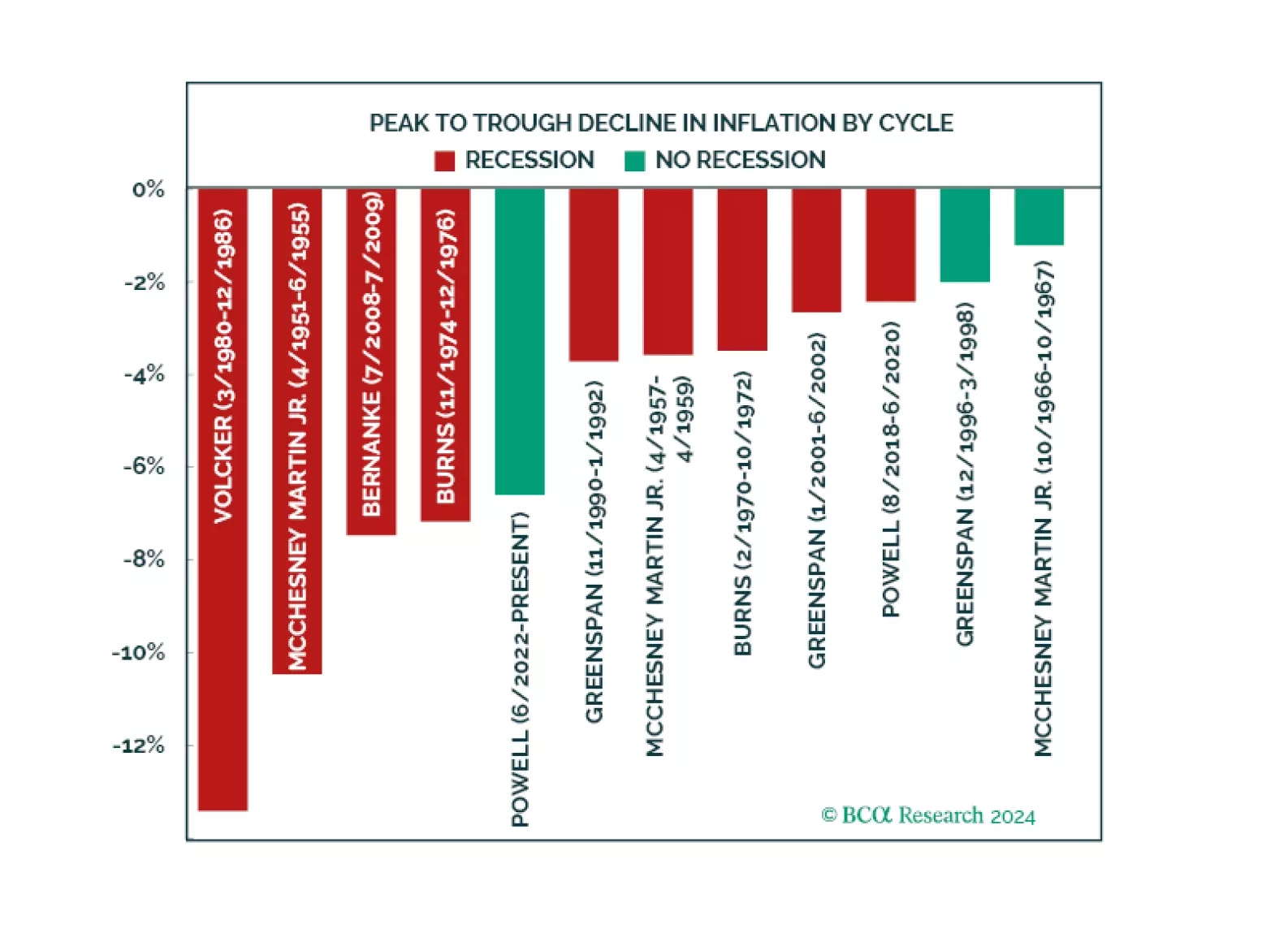

Can Powell achieve a soft landing? There are some indications he is doing it. We examine why our negative stance was wrong and analyze the four growth engines that kept recession at bay. Half of these forces remain while the other…

The Fed’s preferred measure of inflation, core PCE, met expectations of a reacceleration to 0.3% month-on-month, and reached 2.7% year-over-year. The rest of the Personal Income and Outlays report showed solid…