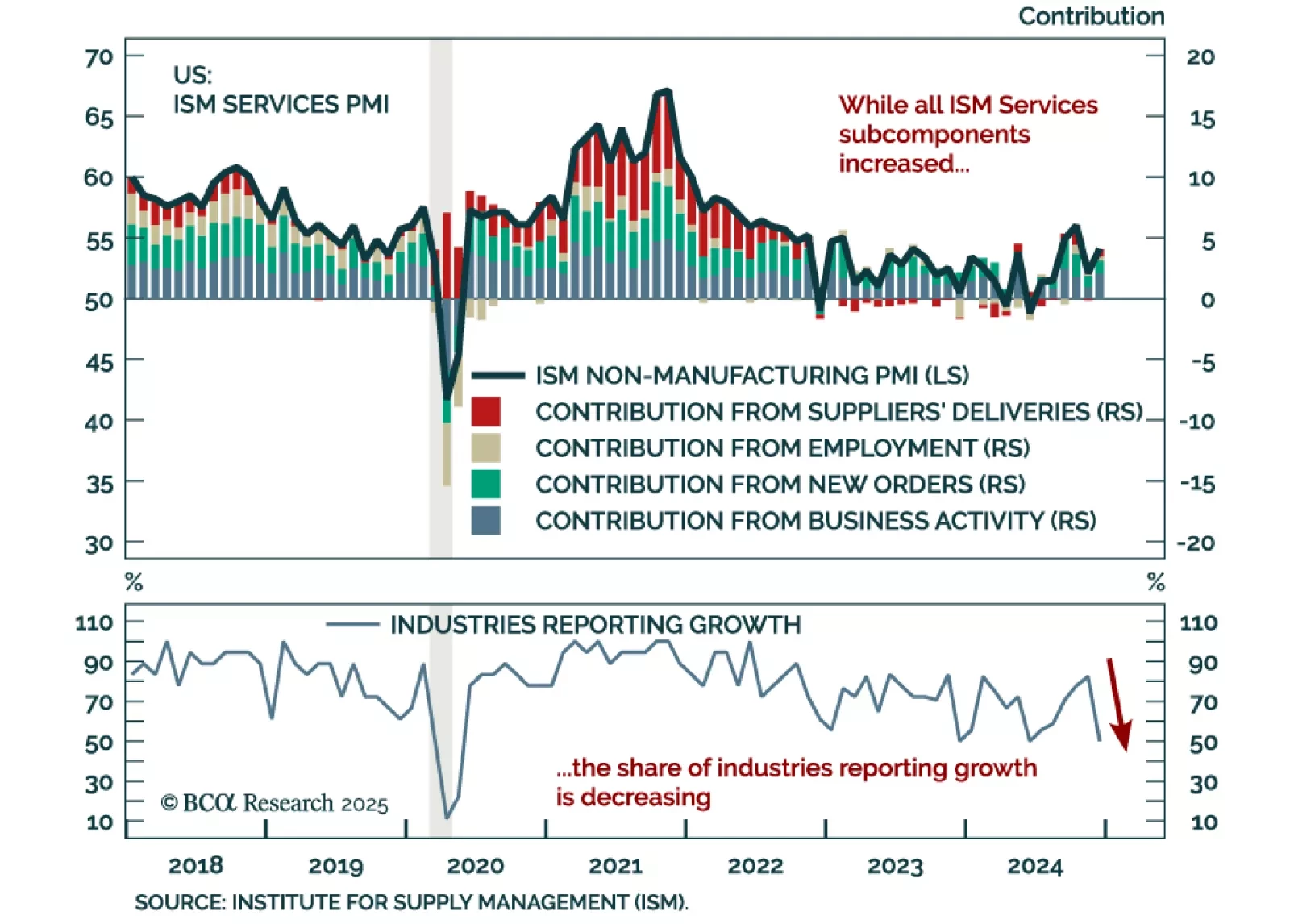

The December ISM Services PMI beat estimates, increasing to 54.1 from 52.1 in November. All subcomponents increased except for employment, which nonetheless remains in expansion. The prices paid component was especially strong,…

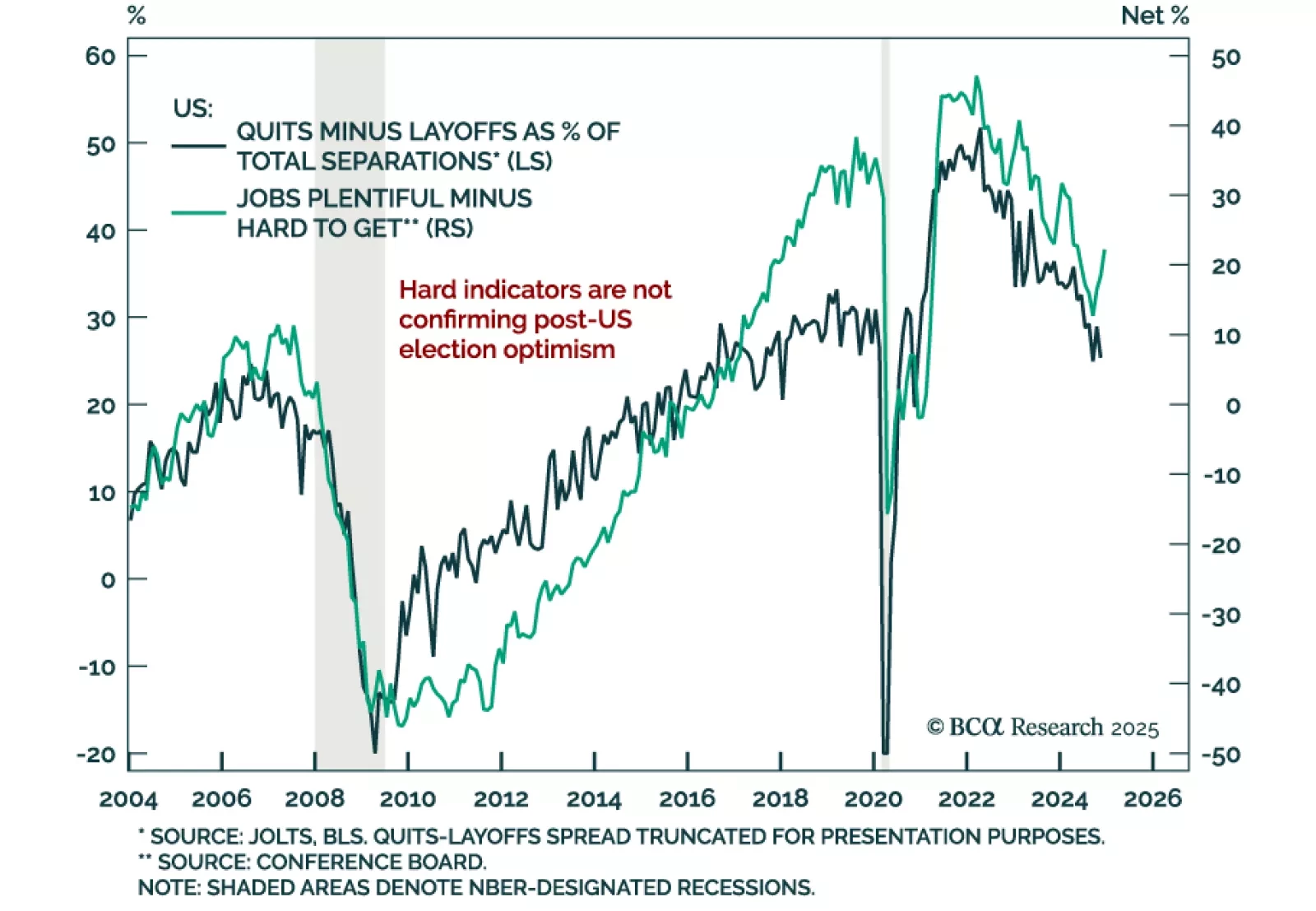

Job openings once again beat expectations in November, increasing to 8.1m from 7.8m in October. However, hires and quits decreased and layoffs increased. The gap between quits and layoffs, a leading indicator of labor market demand,…

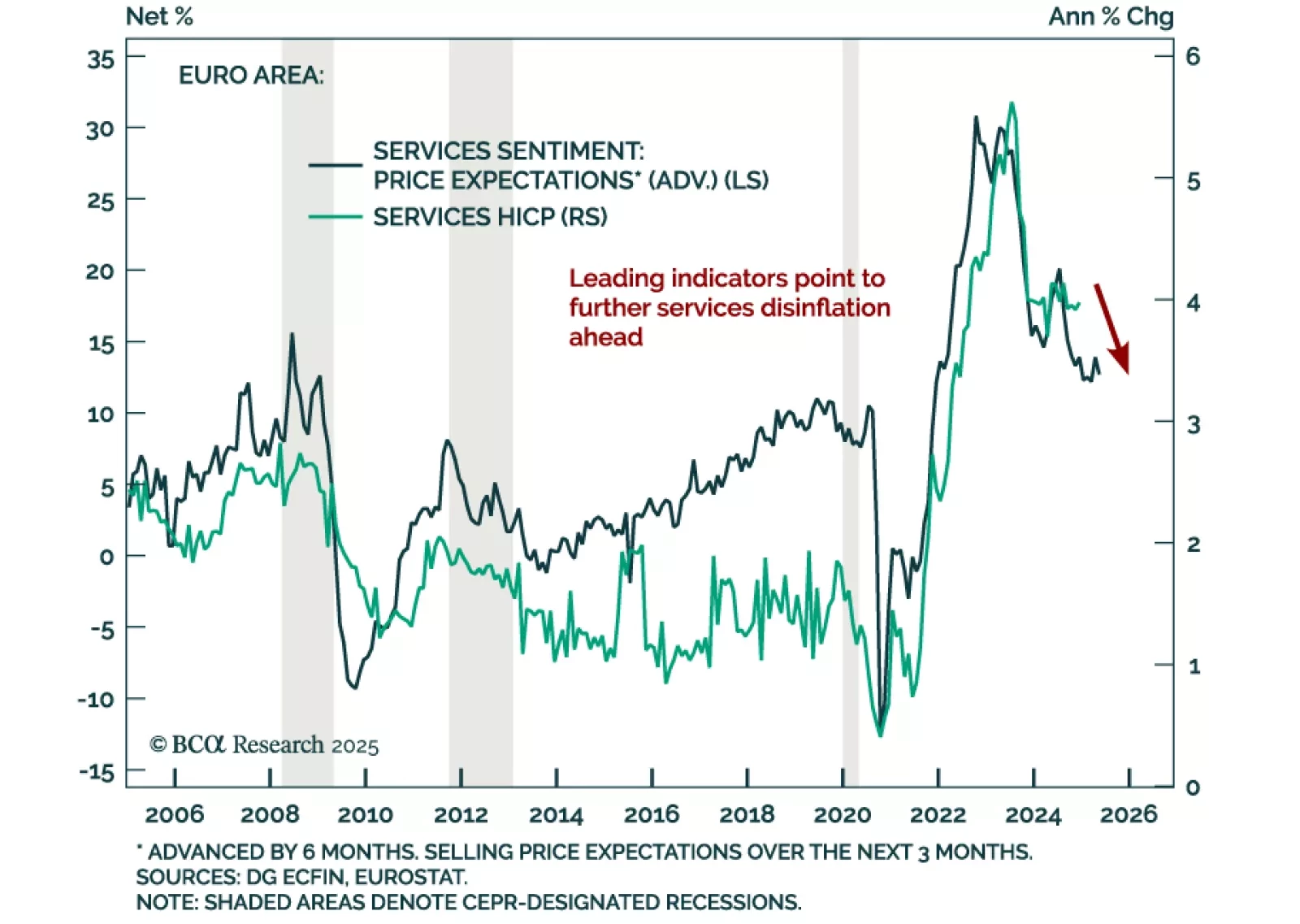

December euro area inflation met expectations, with headline HICP printing at 2.4% y/y from 2.2% in November, and core steady at 2.7%, above the ECB’s target. Services inflation remains elevated at 4.0% y/y, up from 3.9% a month…

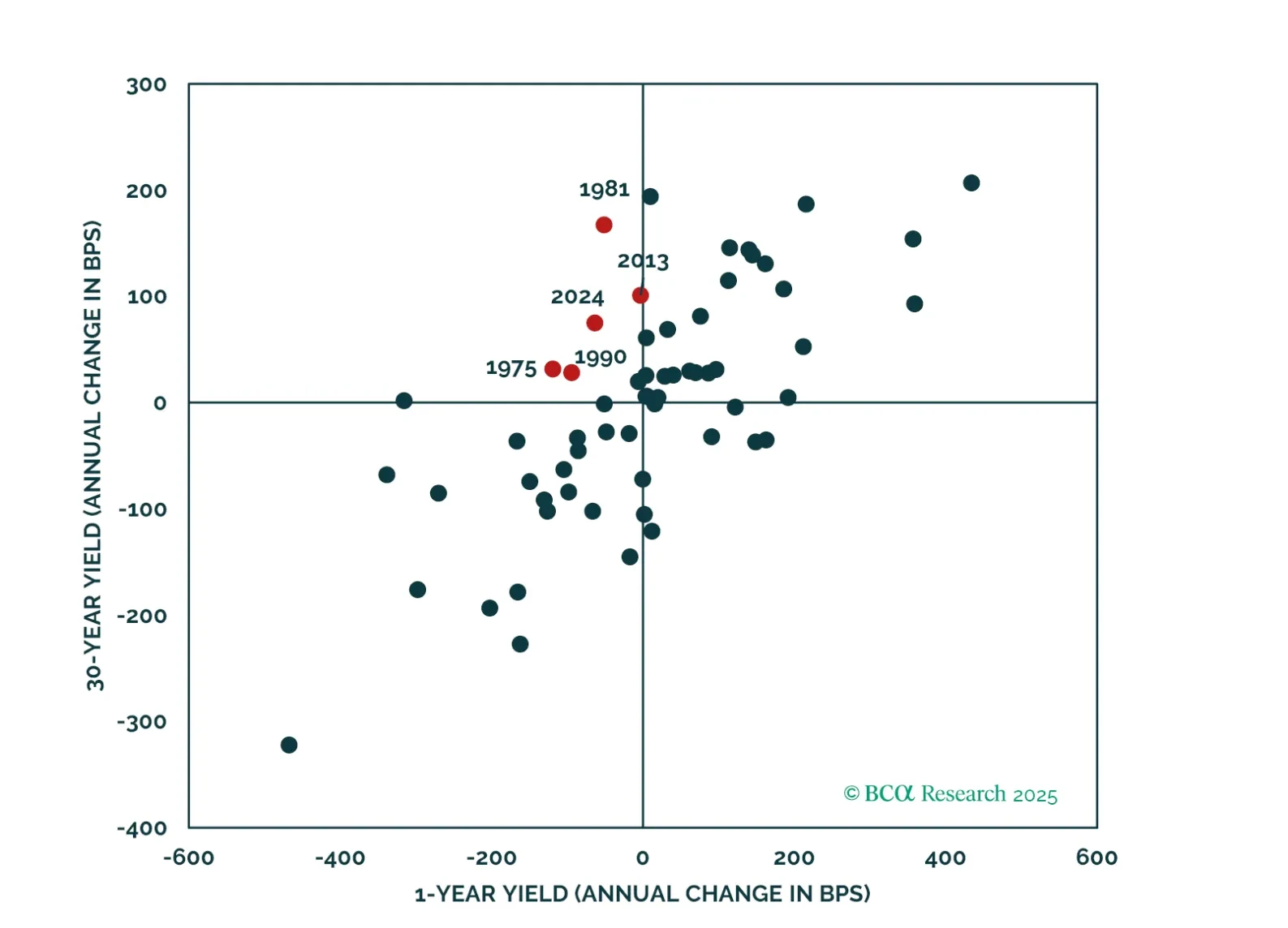

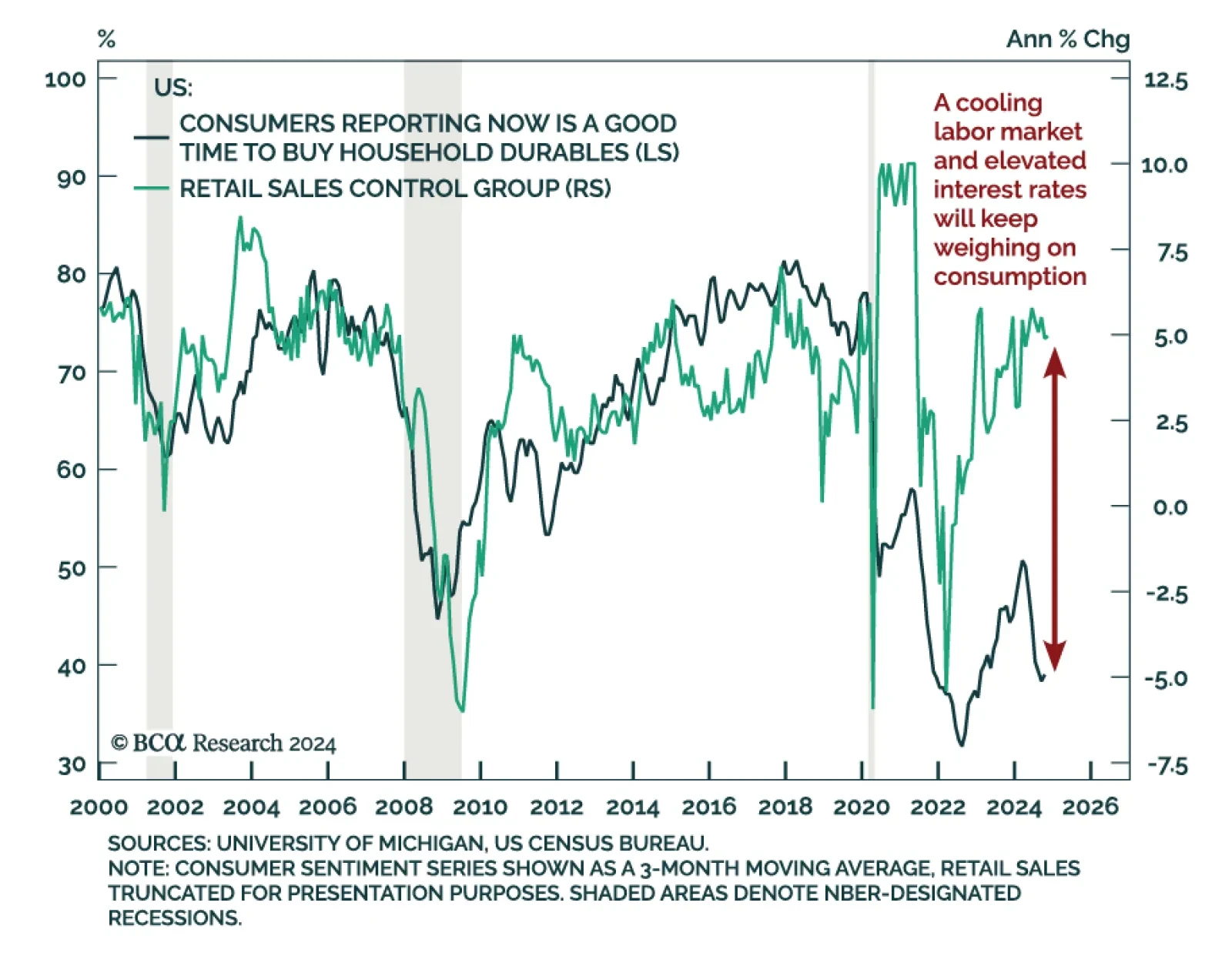

Paradoxically, raging optimism on the US economy is making a reacceleration in growth less likely in 2025. The reaction of the bond market has made the Fed rethink its cutting campaign. Markets are also constraining Trump’s agenda.…

Our Global Asset Allocation strategists upheld their yearly tradition of putting together reading or listening recommendations for the holiday period. This year, our strategists and research teams sent their best recommendations for…

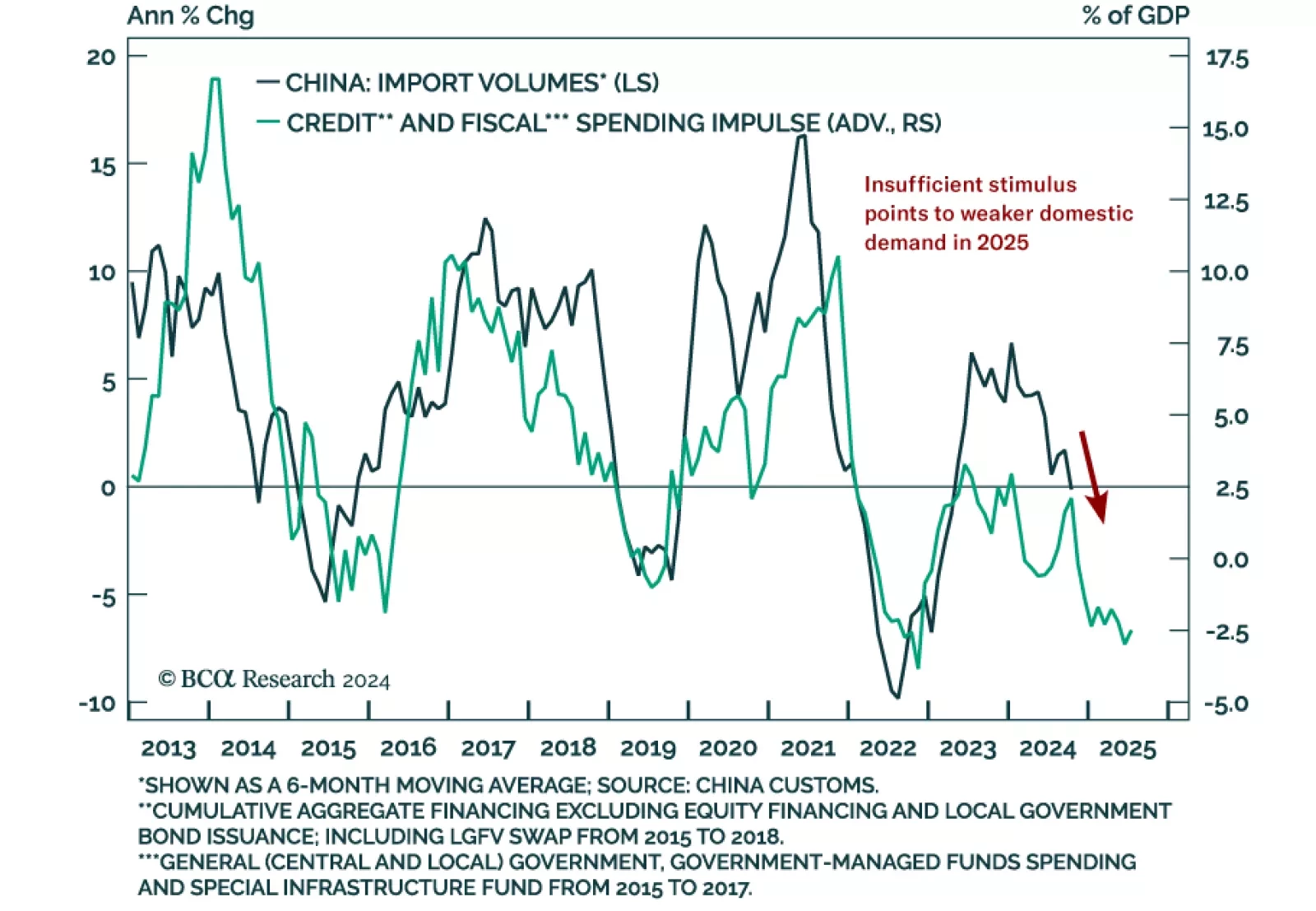

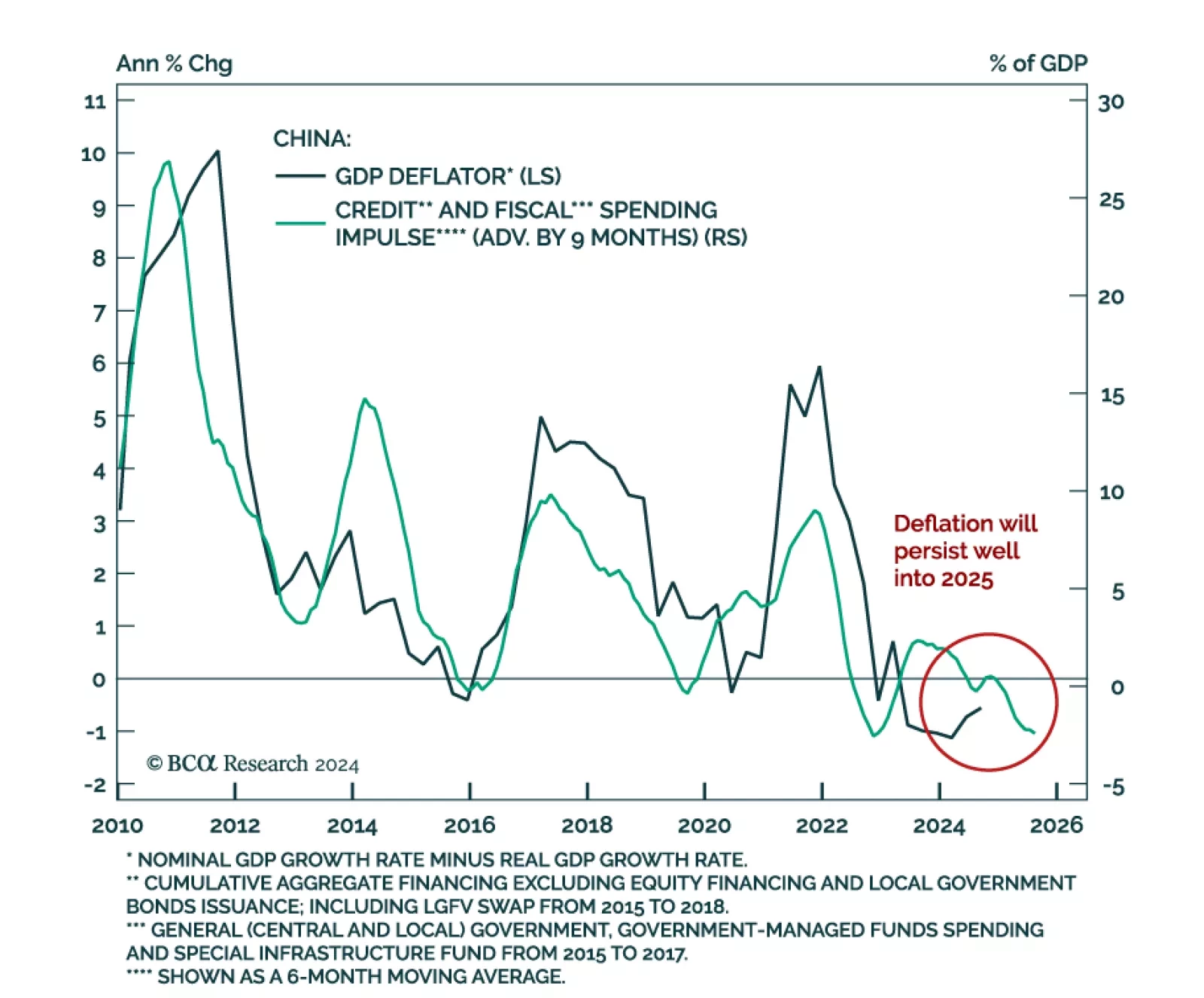

China’s November monetary and credit data were disappointing. New yuan loans increased by 580 bln, nearly half the expected amount. Total social financing rose by 2.3 tln instead of the expected 2.7 tln. Finally, M2 growth slowed to…

November retail sales were roughly in line with expectations, with headline growth at 0.7% m/m vs. 0.4% in October. Vehicle sales were solid. Excluding auto and gas, sales rose a more modest 0.2% m/m, below expectations. The…

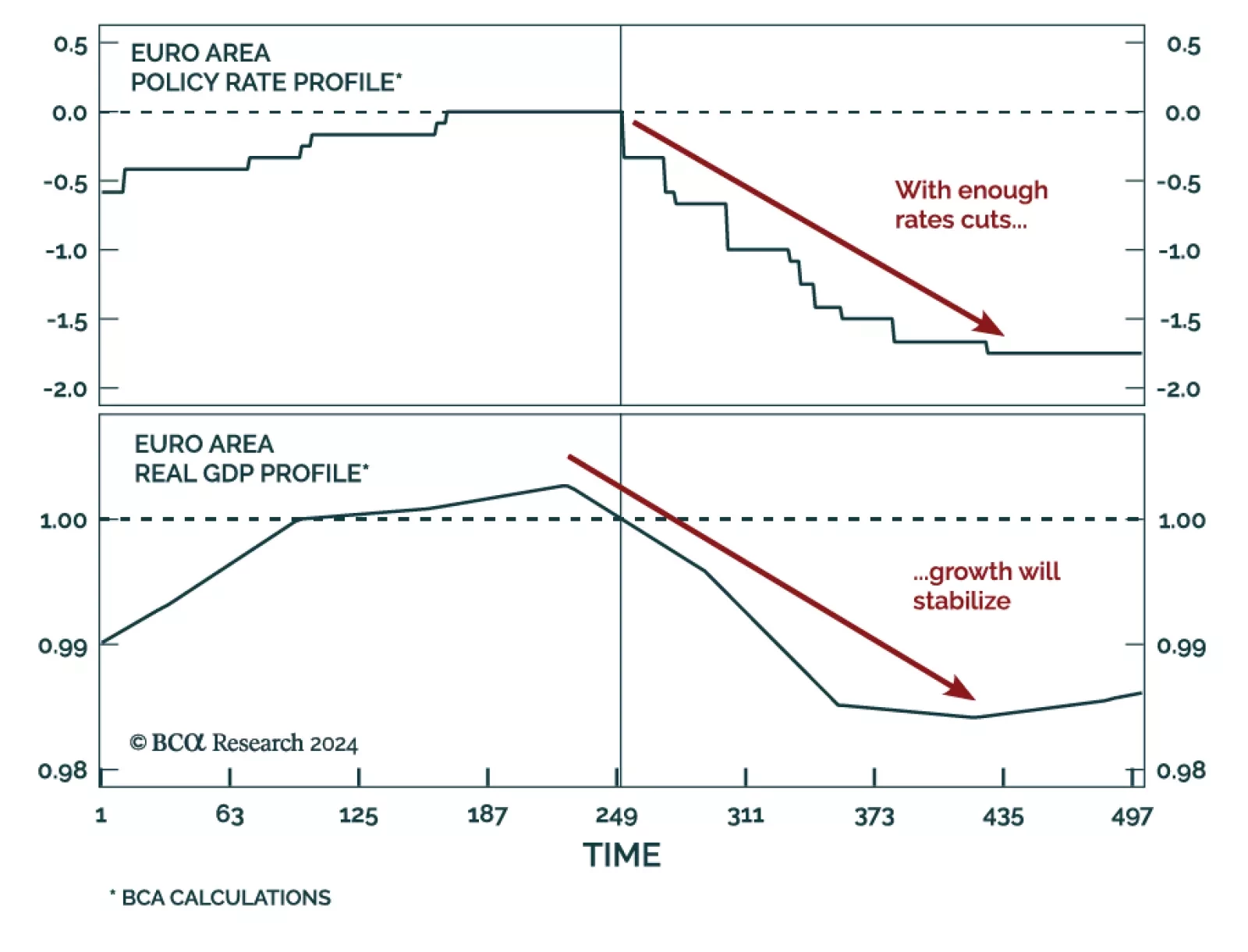

Our European Investment Strategy team published their annual outlook, outlining five key themes that will shape Europe’s economy and markets in 2025. Europe will enter a mild recession in H1 2025, but growth is…

Our Emerging Markets, China, and Commodities strategy teams published their 2025 joint outlook. Our colleagues remain bullish on the US dollar for now but see rising odds of the Trump administration actively pursuing greenback…

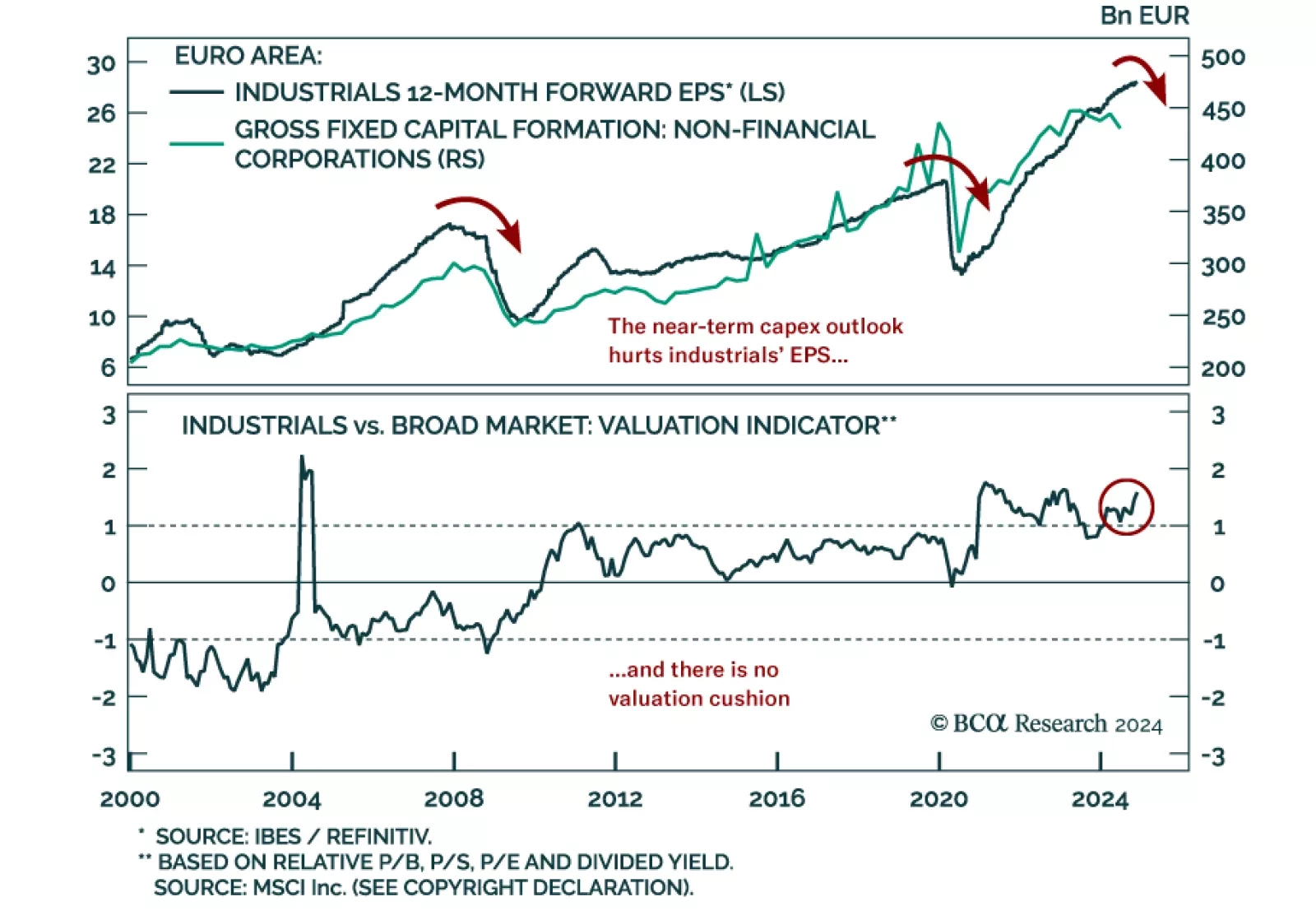

Our Chart Of The Week comes from Mathieu Savary, Chief Strategist of our European Investment Strategy service. Mathieu sees a dimming outlook for European industrial stocks in the near term.The sector has been one of the strongest…