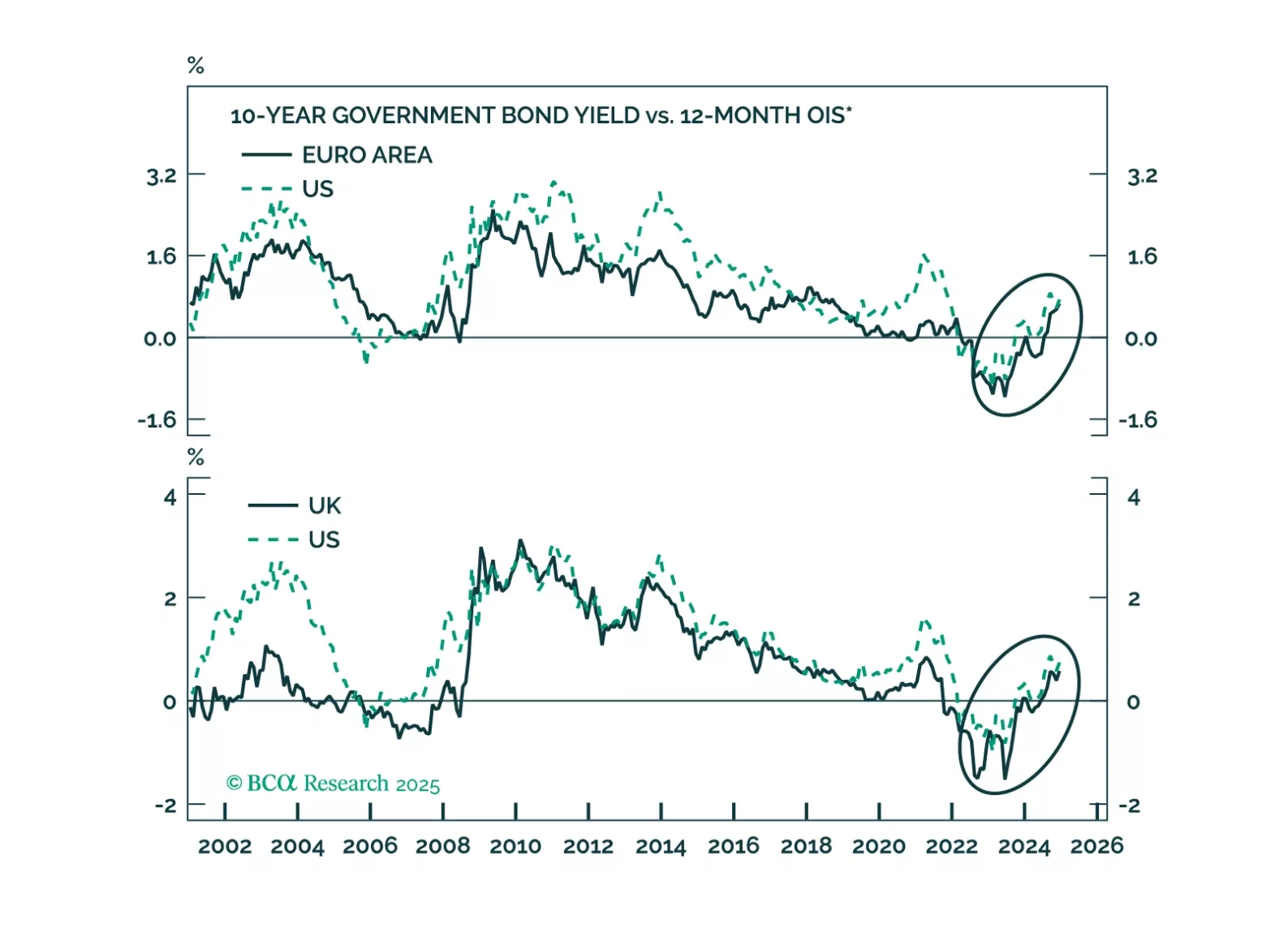

UK and German bonds are victims of the global bond market riots. Will European yields continue to move higher and will the euro and the pound find a floor anytime soon?

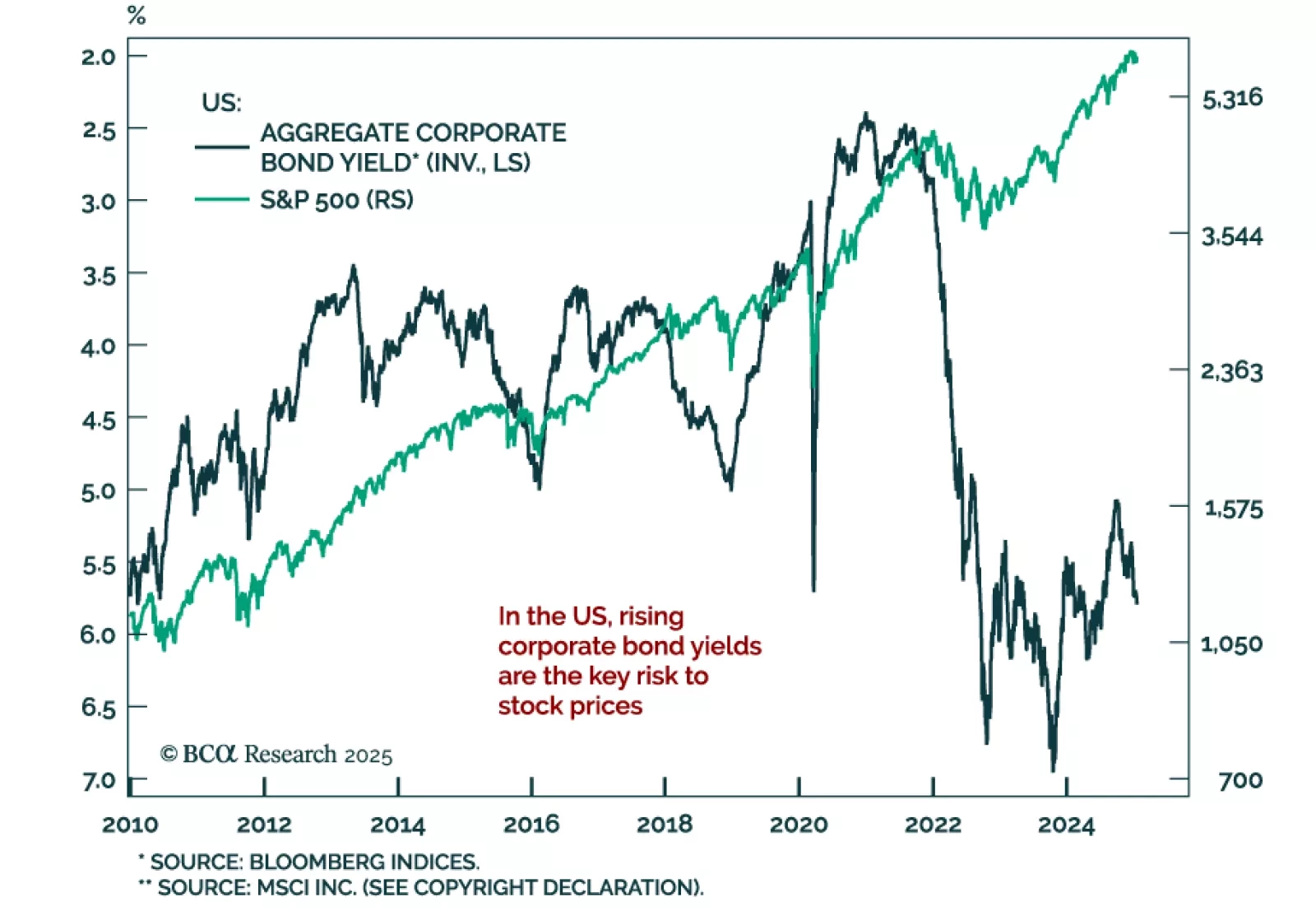

Our Chart Of The Week comes from Arthur Budaghyan, Chief Strategist for our Emerging Markets Strategy service. Arthur discusses the relationship between corporate bond yields and stock prices. Historically, US stocks suffer when…

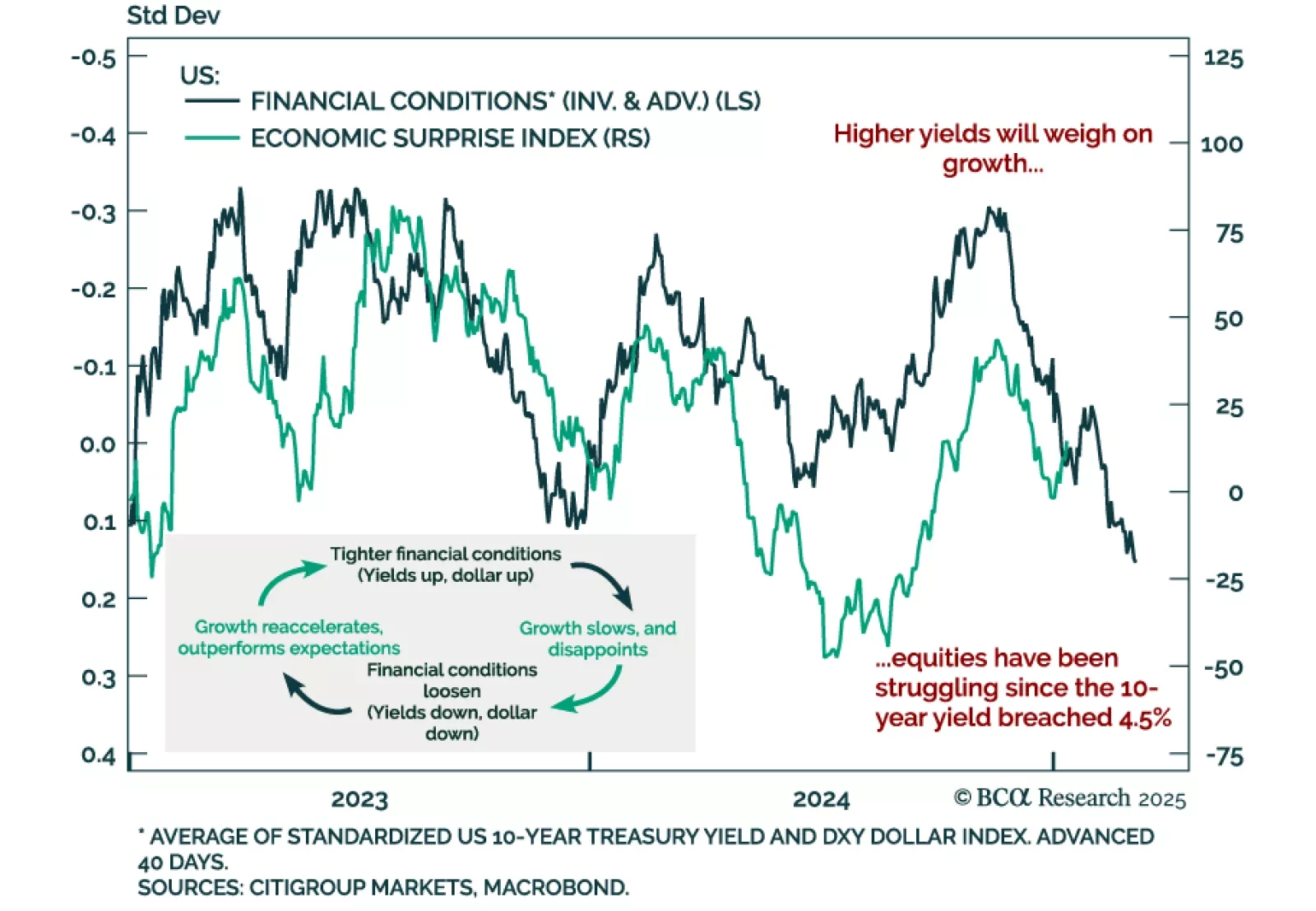

The global economy is subject to numerous cycles displaying reflexivity and feedback loops. One of these is the relationship between financial conditions and growth. Given this relationship, economic strength can plant the seeds of…

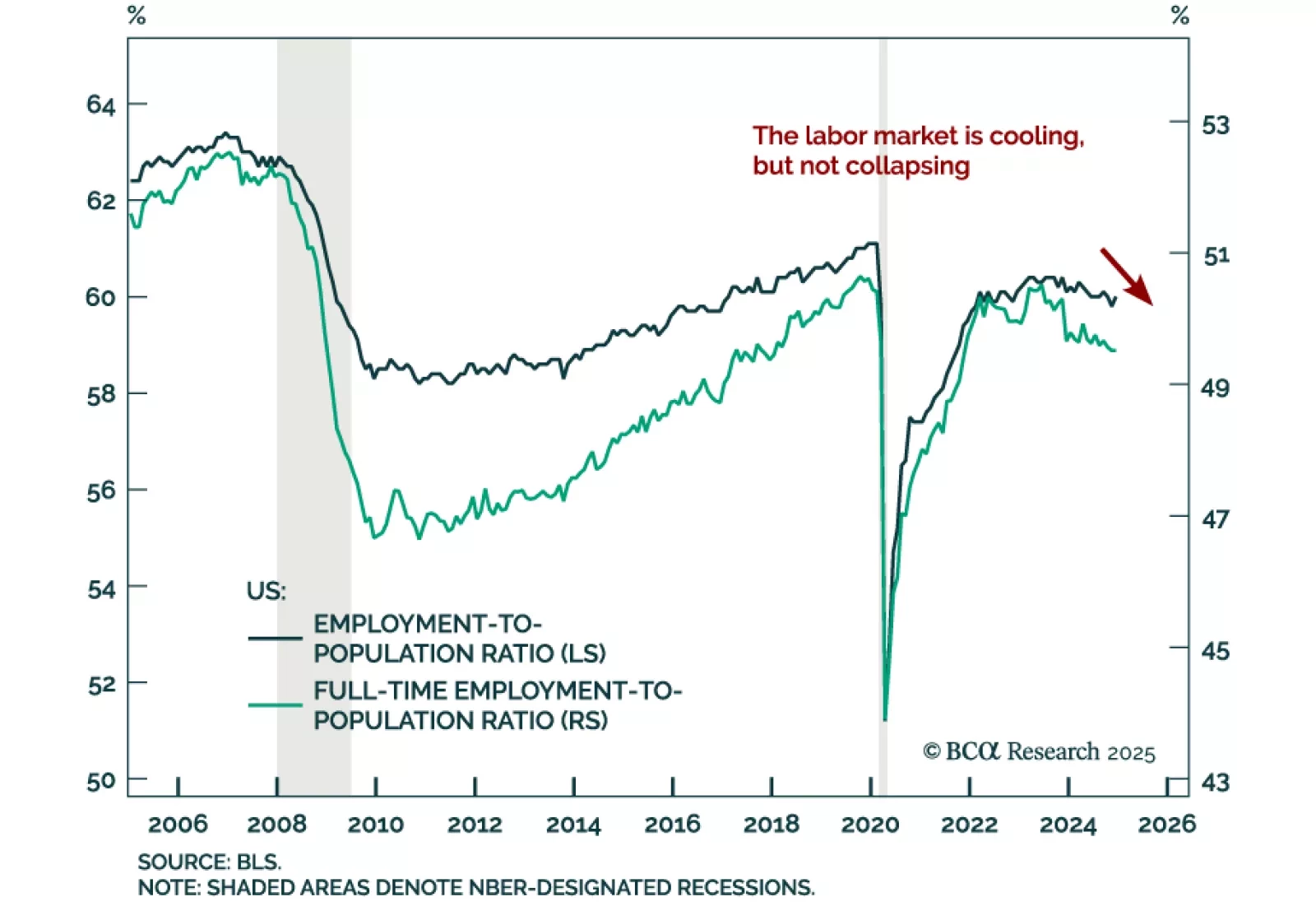

The US December jobs report came in stronger than expected. Payrolls rose by 256k vs. a downwardly revised 212k in November, leaving the 3-month moving average at about 170k. The unemployment and underemployment rates decreased to 4.…

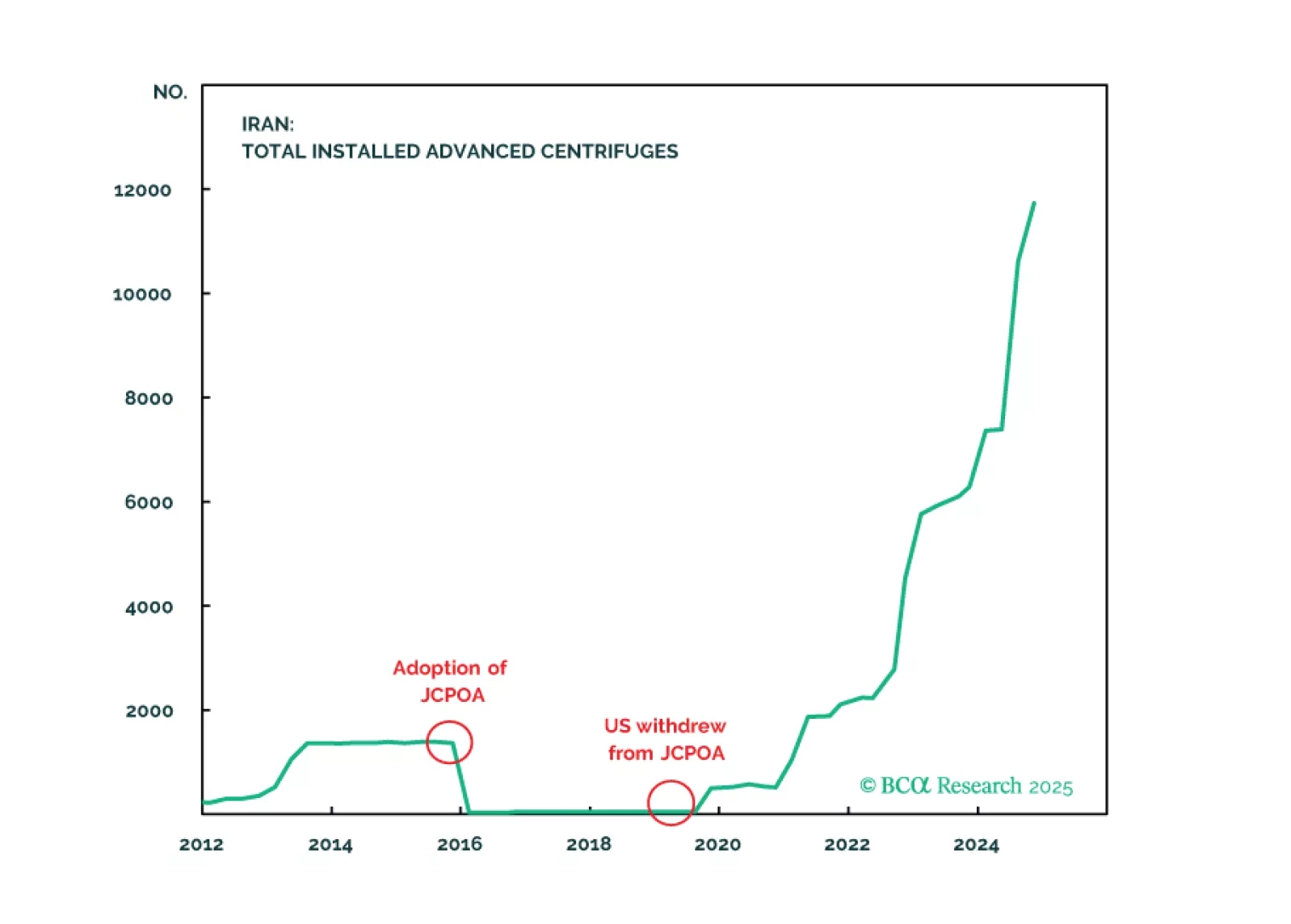

Every year we highlight five low-odds scenarios that would have a major impact on global financial markets if they happened. This year we contemplate a total reversal of Chinese policy, a US-Iran nuclear deal, a breakdown of NATO, US…

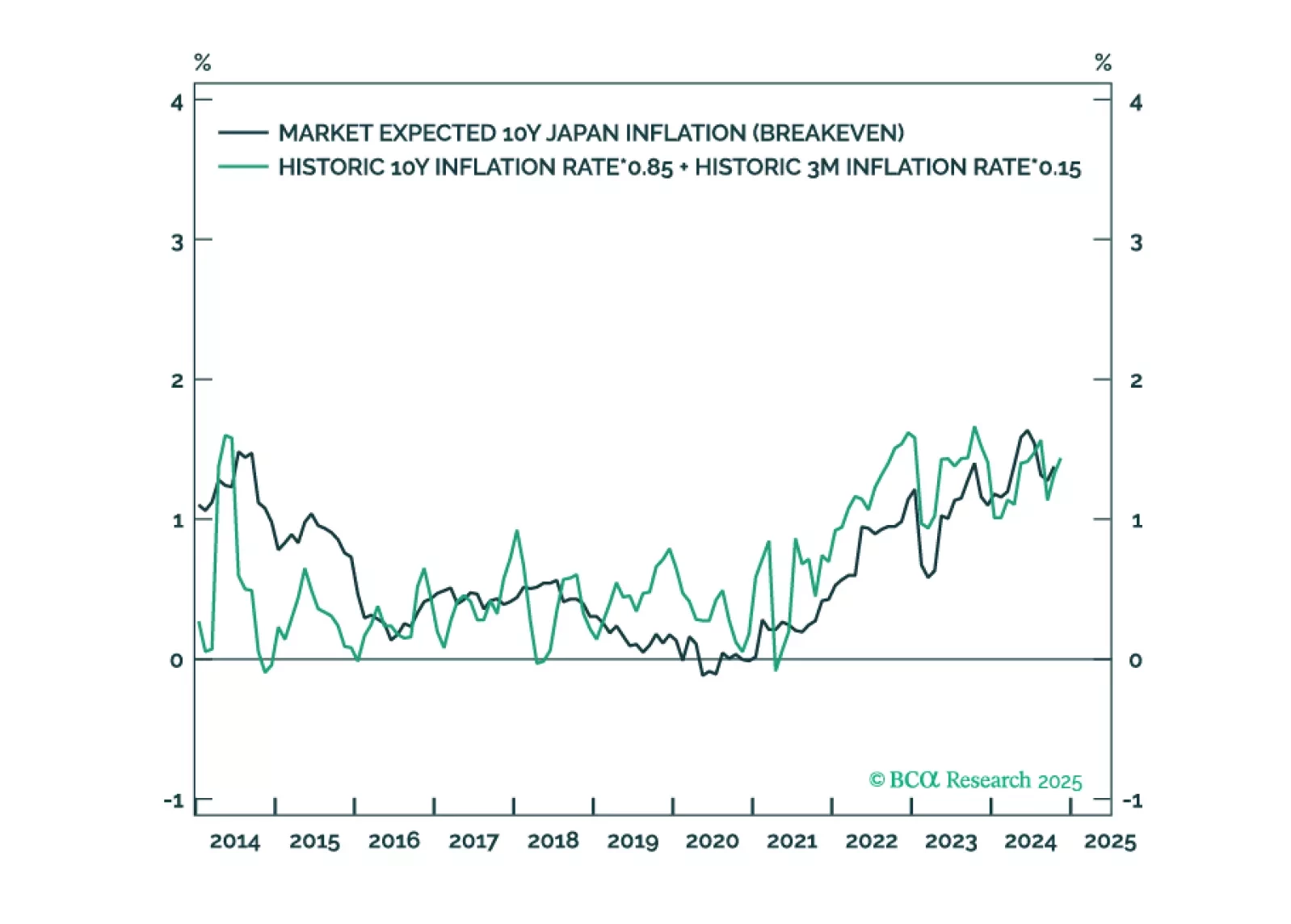

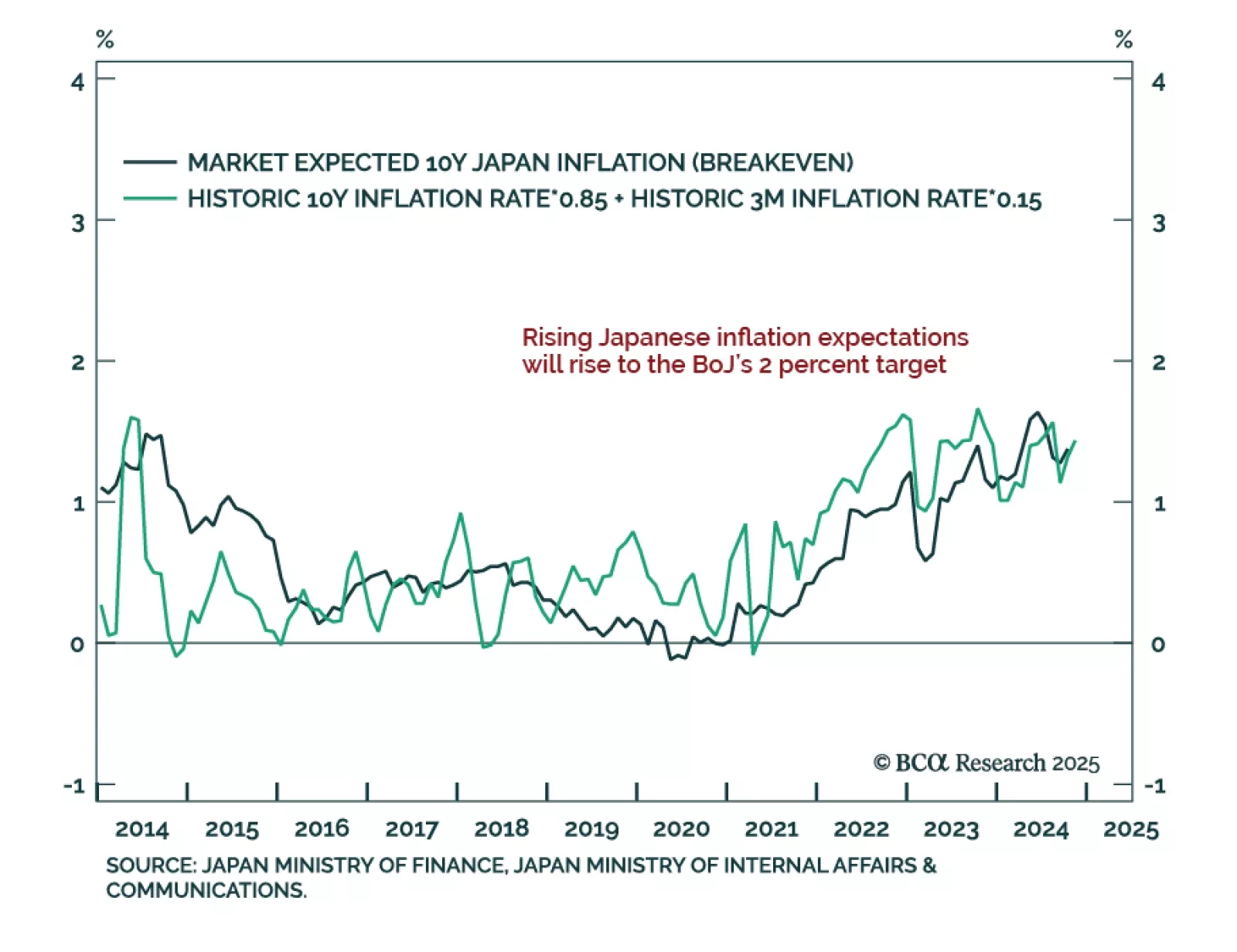

Our Counterpoint Strategy team sees Japanese real yields as the key risk to global equities. Rising inflation expectations in developed markets, excluding Japan, will keep inflation above target and limit further rate cuts.…

Chinese December CPI and PPI releases show deflationary pressures are not abating. CPI slowed to a 0.1% y/y pace from 0.2% in November, while producer prices fell 2.3%. The Chinese economy has not meaningfully changed course…

In most developed economies, rising inflation expectations will lift them further above the 2 percent target, limiting the scope for further interest rate cuts. But in Japan, rising inflation expectations will lift them up to the BoJ…

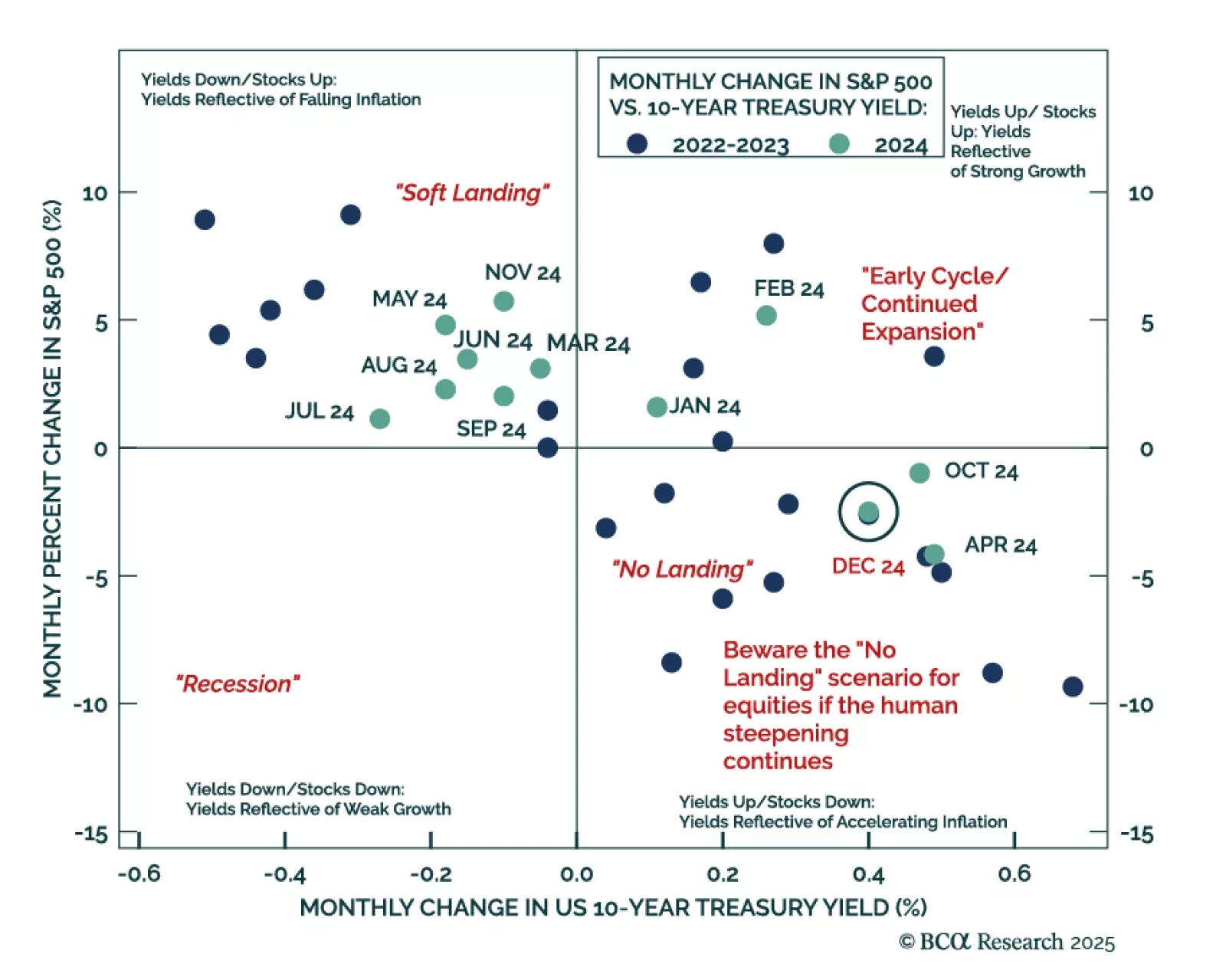

Our GeoMacro strategists published their Alpha Report, outlining their view that President Trump will have to pare back his fiscal ambitions to avoid a bond market riot. The long end of the US bond market continues to sell off,…

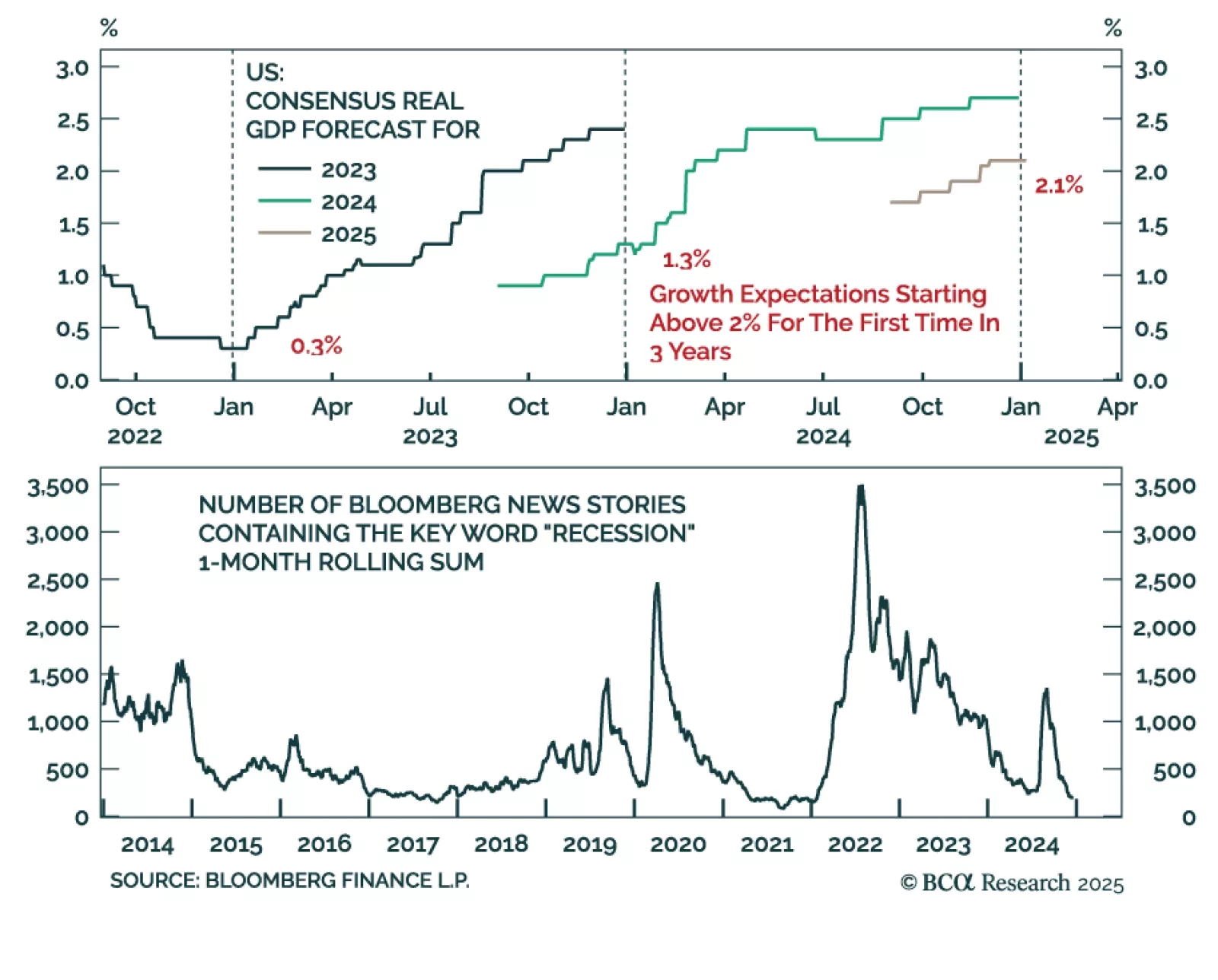

Our Global Asset Allocation strategists published their monthly tactical asset allocation report, where they illustrate booming expectations in the US will be self-limiting. For the first time since 2022, US GDP growth is…