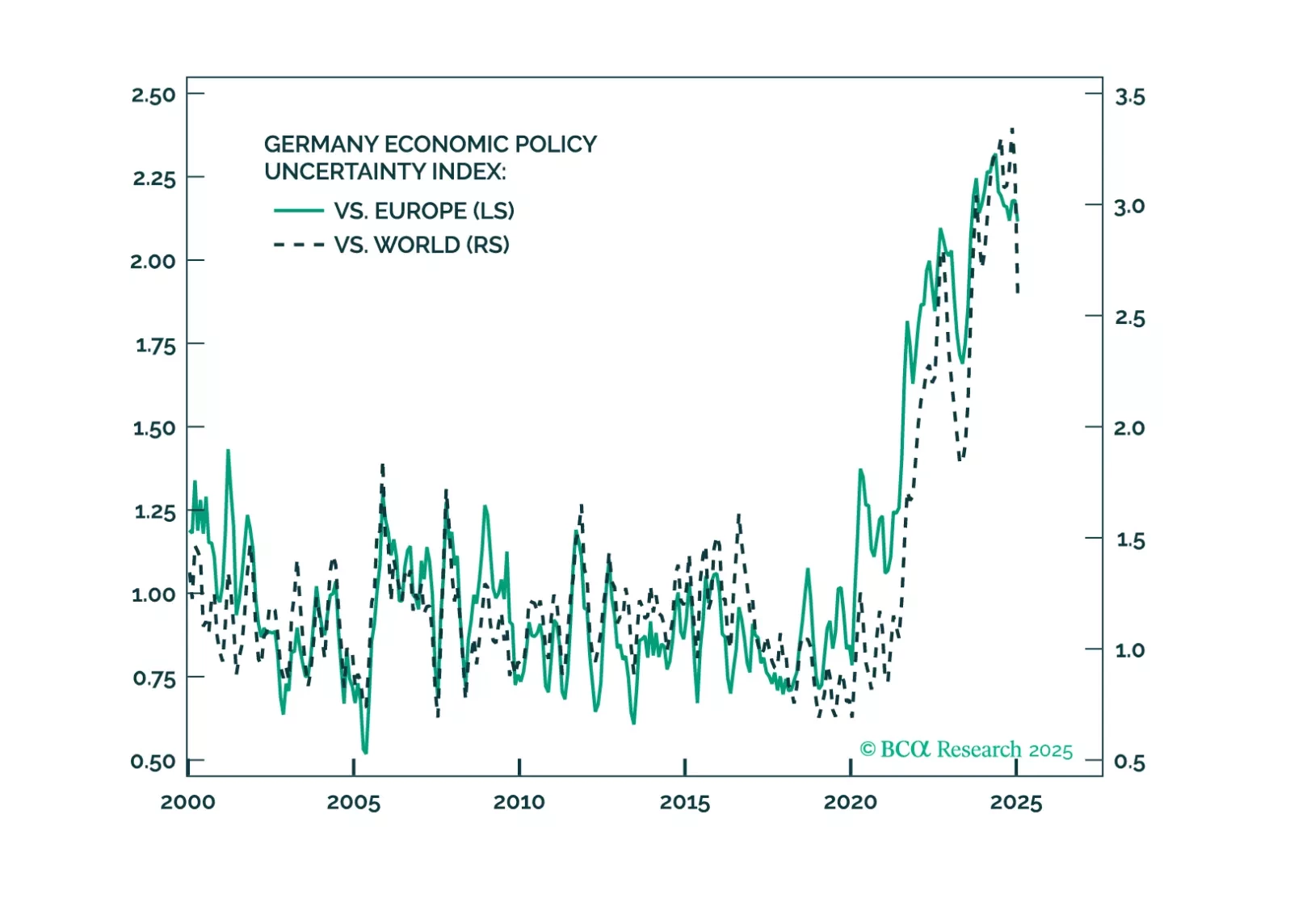

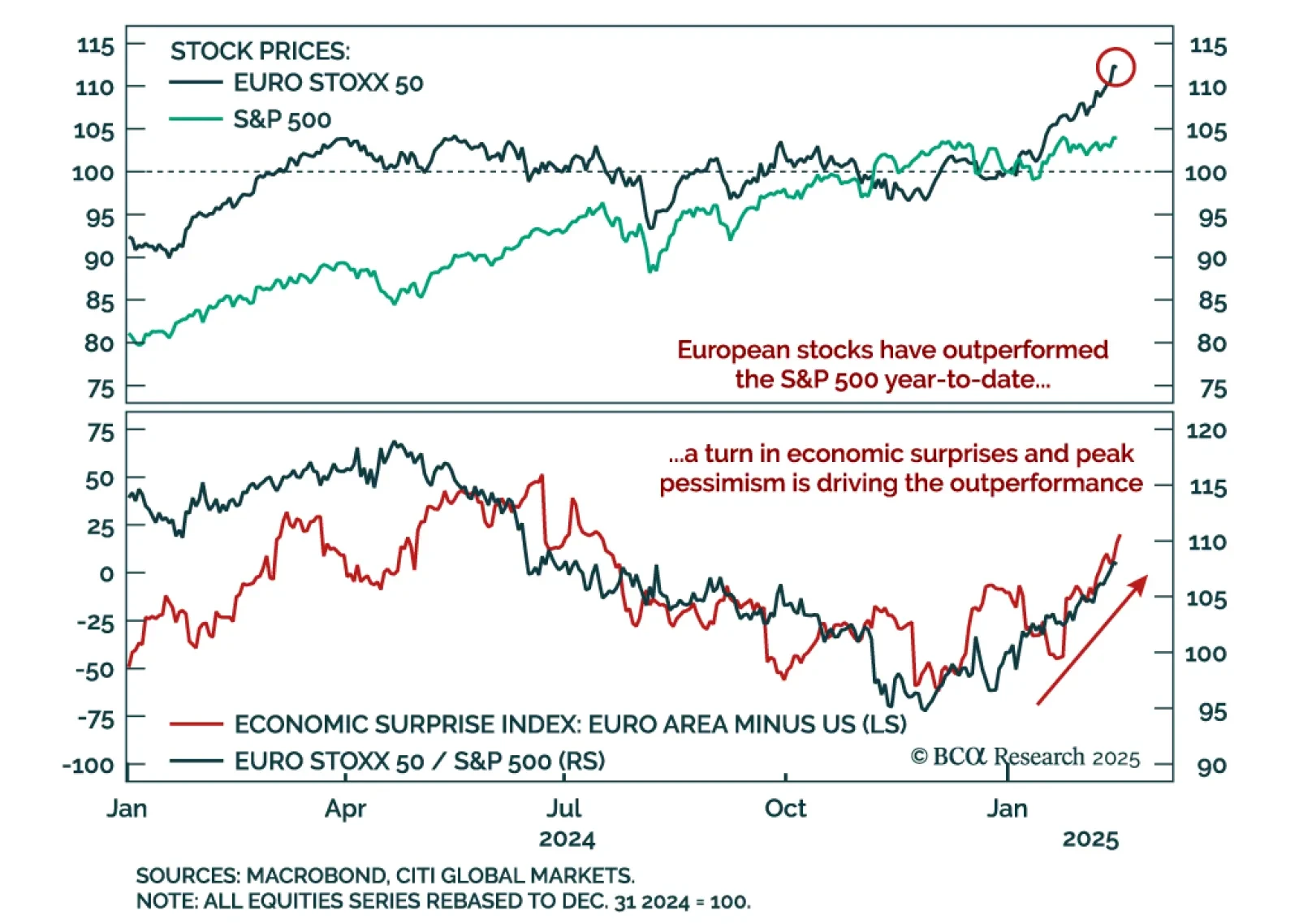

While the main Q1 2025 theme has been “America First”, the year-to-date market story has been more nuanced. “America First” would suggest an outperformance of US assets, but it is European assets that have started the year on a…

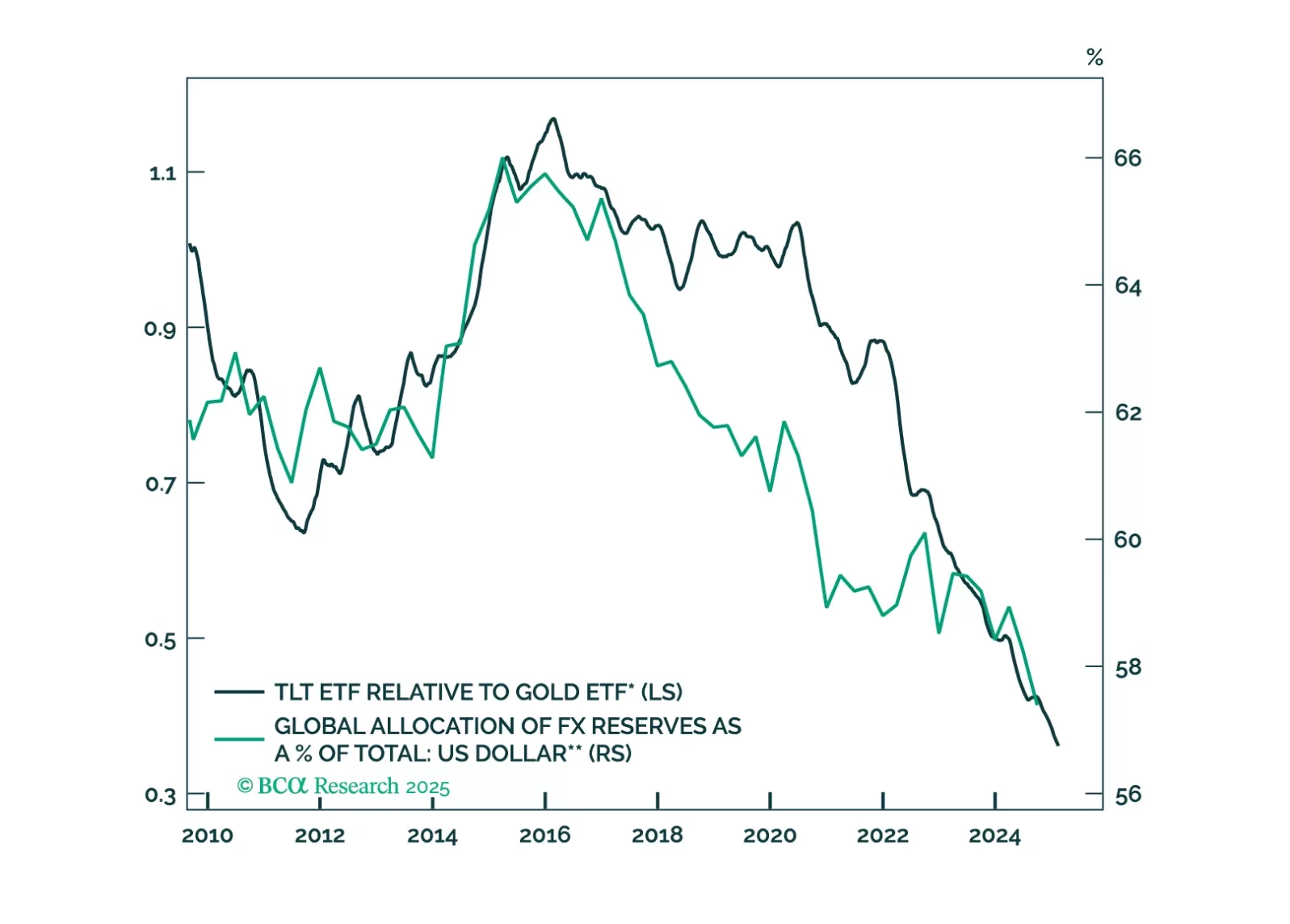

In lieu of all the geopolitical and economic news in media, this report looks at where next the dollar is likely to trend in the next one-to-three months. Our view is down, though on a cyclical horizon (six-to-twelve months), we…

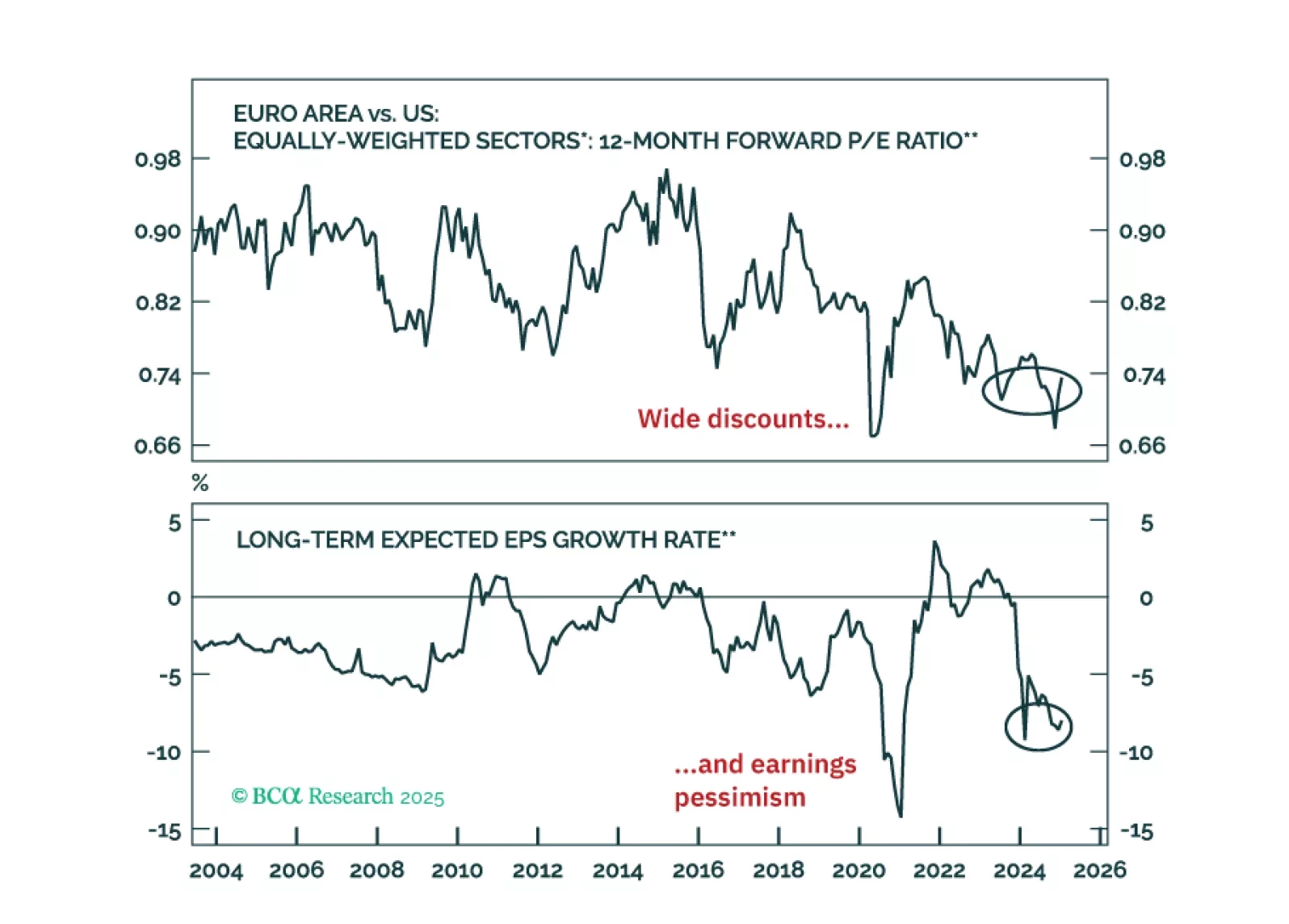

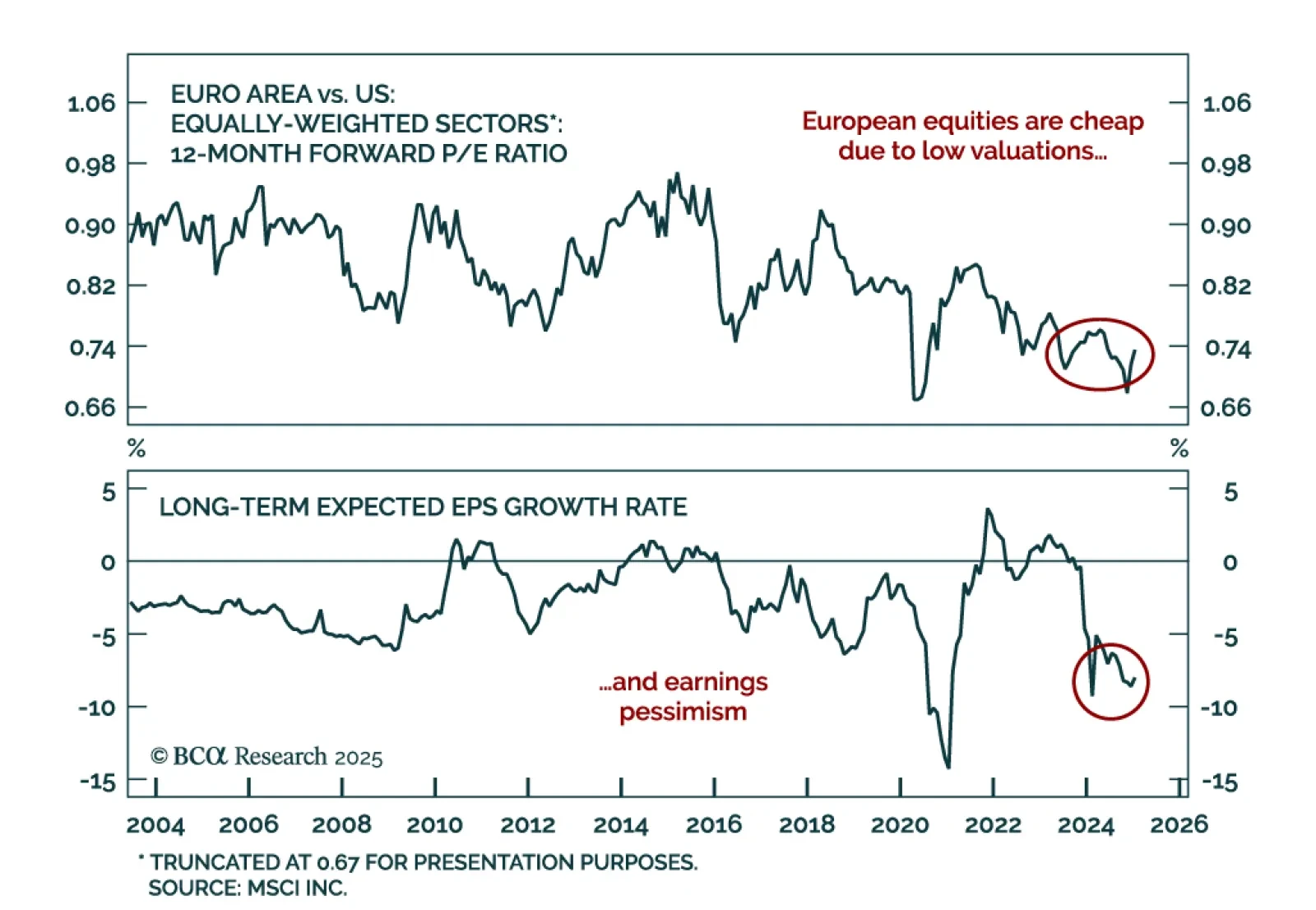

Our European strategists look at European equities after they garnered attention due to their low valuations. European equities are attracting interest primarily due to low valuations rather than strong growth expectations. Key…

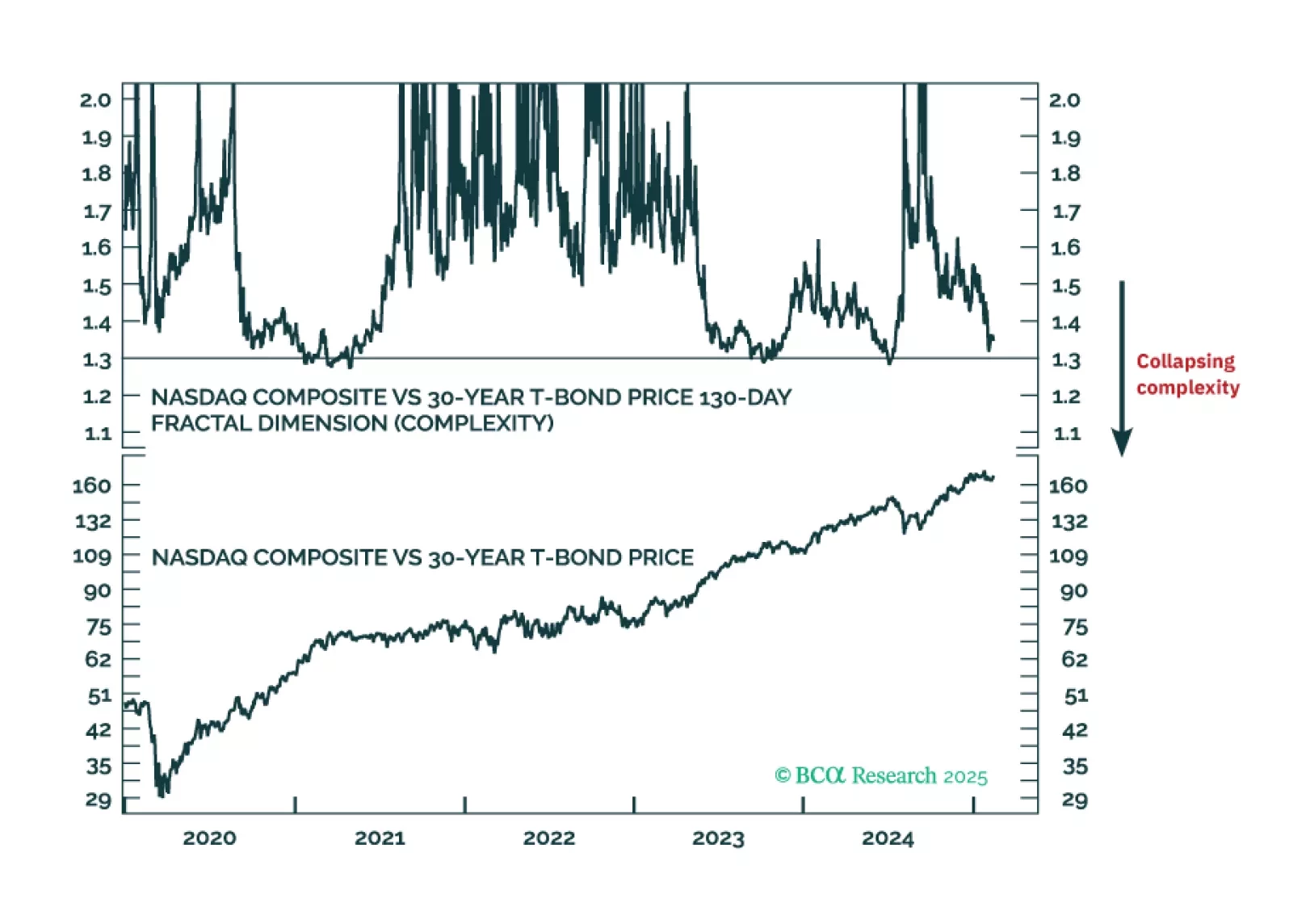

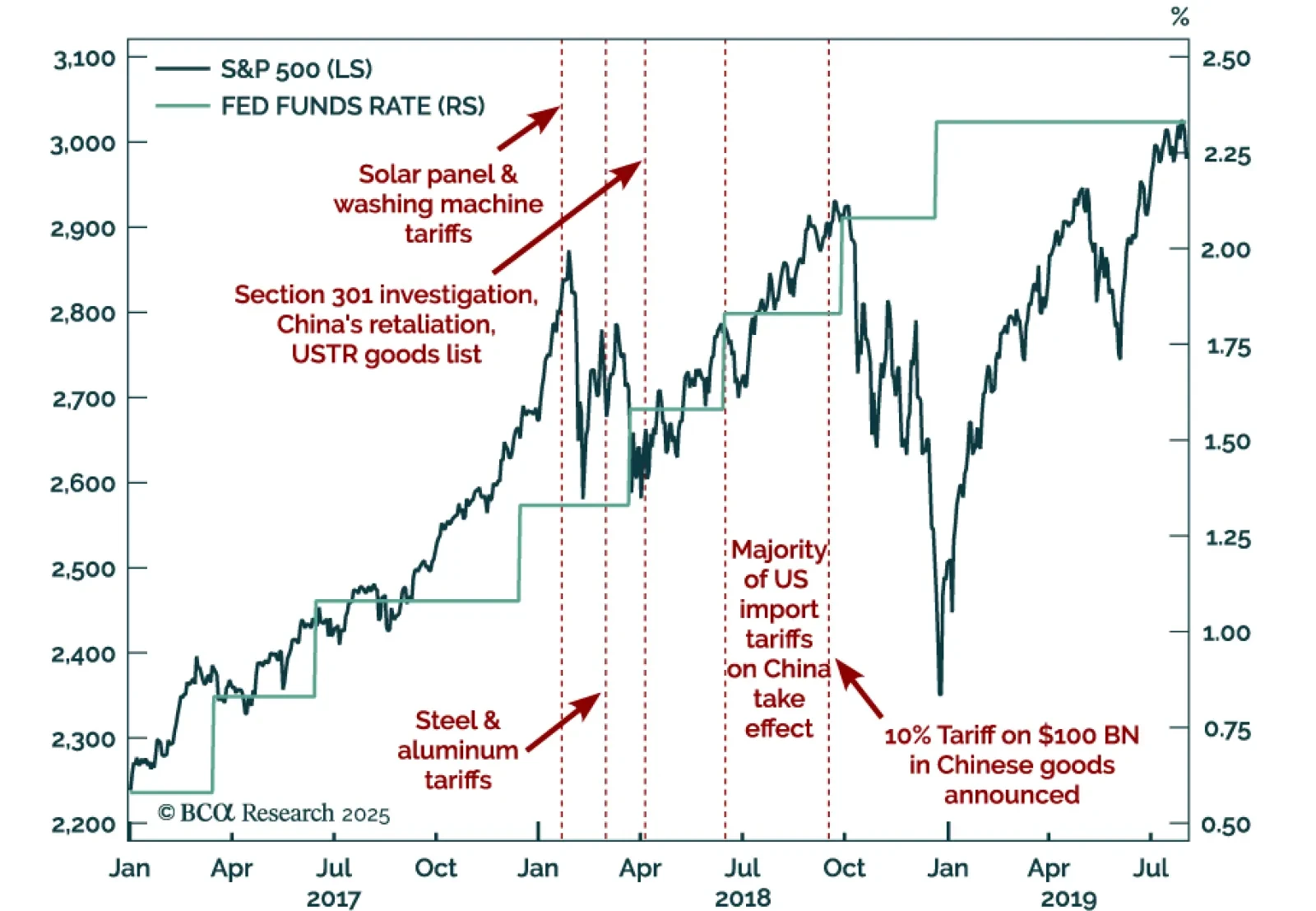

Our Chart Of The Week comes from Jonathan LaBerge, Chief Strategist for our Special Reports Unit. Jonathan asks whether investors should be encouraged by the fact stocks are shrugging off US tariffs. The answer is no, because…

This week, our three screeners cover equity plays on the run-up in gold prices, a hotter-than-expected US inflation print, and calling the top in Bitcoin.

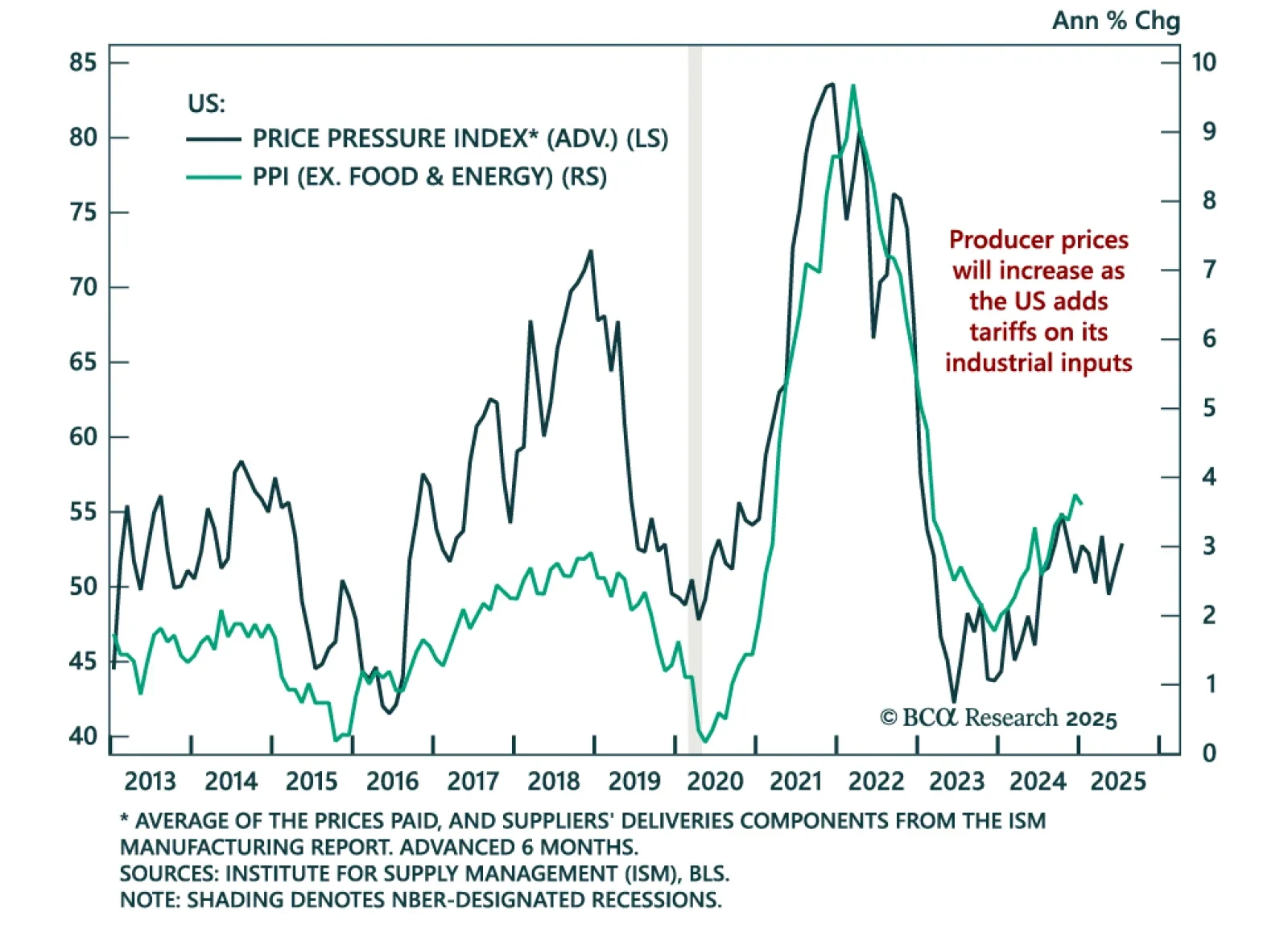

The January US Producer Price Index came in slightly hotter than estimates, but decelerated to 0.4% m/m (3.5% y/y) from an upwardly-revised 0.5% in December. Core PPI, excluding food, energy, and trade services, was also stronger…

If the 130-day complexity of the Nasdaq versus 30-year T-bond collapsed to 1.30, it would signal the risk of a -20 percent market slump. This indicator, at 1.37, is not yet at critical, but we recommend that you keep a close eye on…