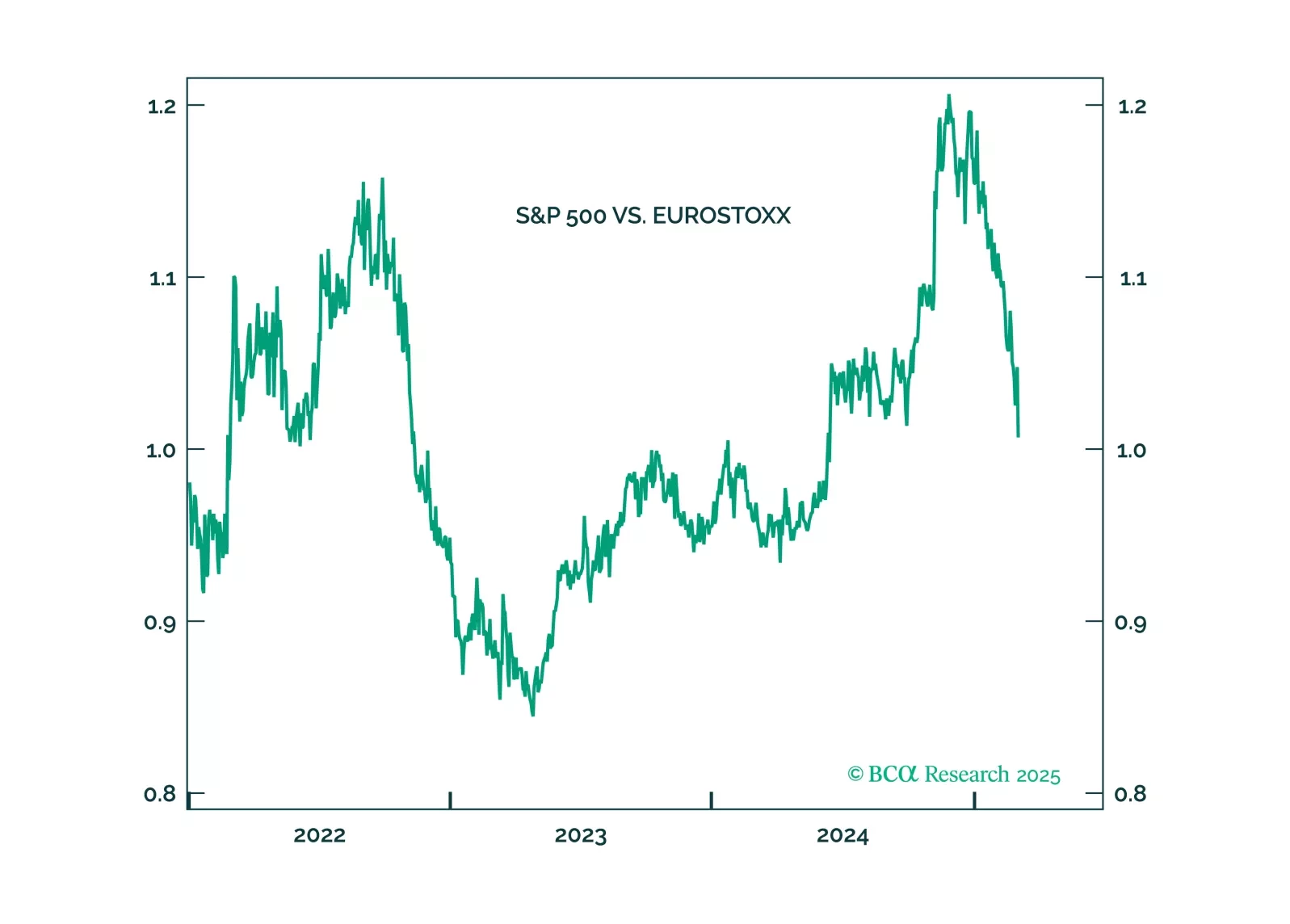

Trump will pull back from the trade war when stocks approach bear market territory. He will not withdraw from NATO. Favor European stocks on fiscal policy.

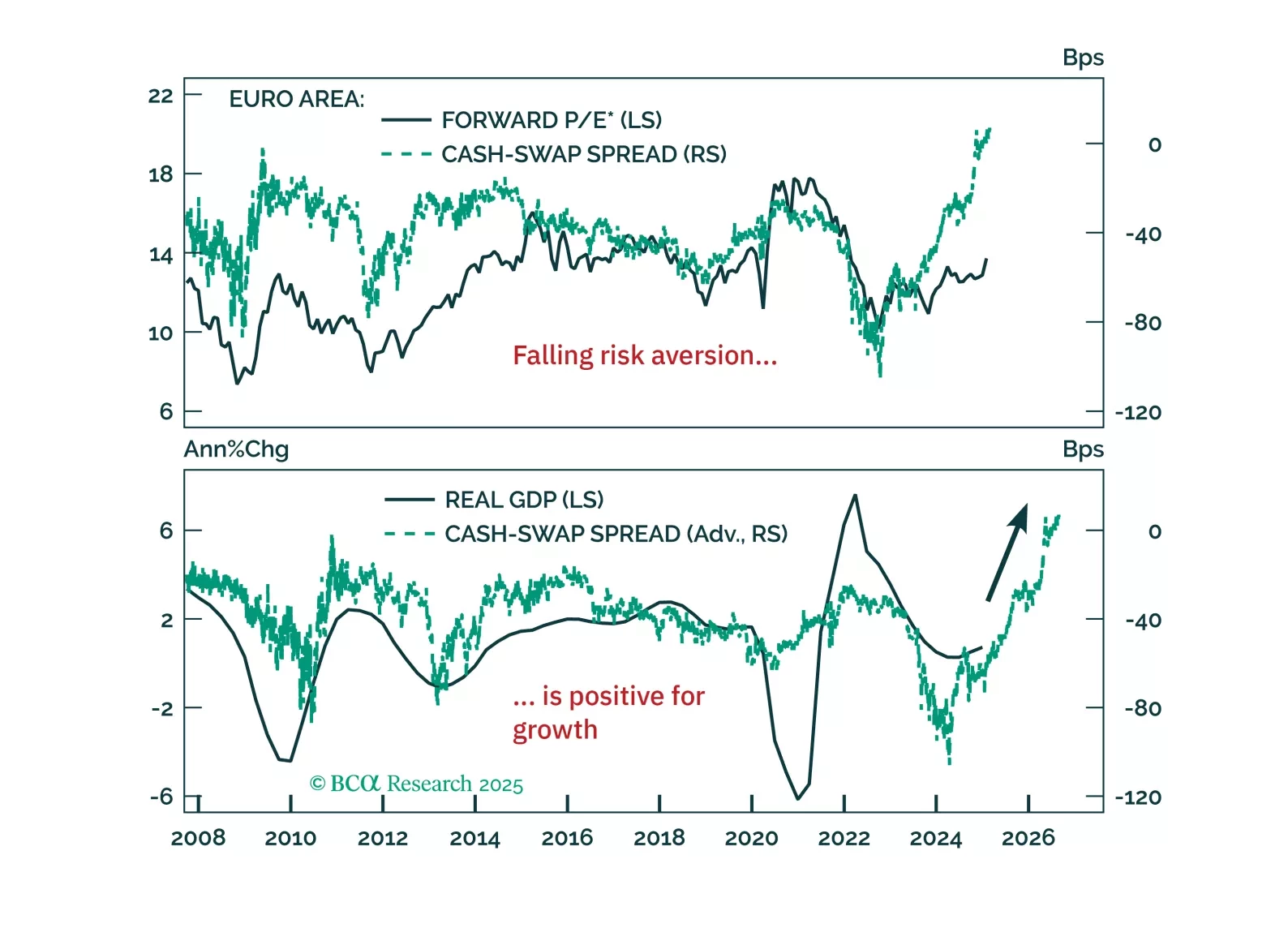

Investors see Europe as a museum: A continent stuck in the past, with no ability to innovate, much less generate profits. But is this view accurate? In this report we argue that the structural headwinds to European profitability are…

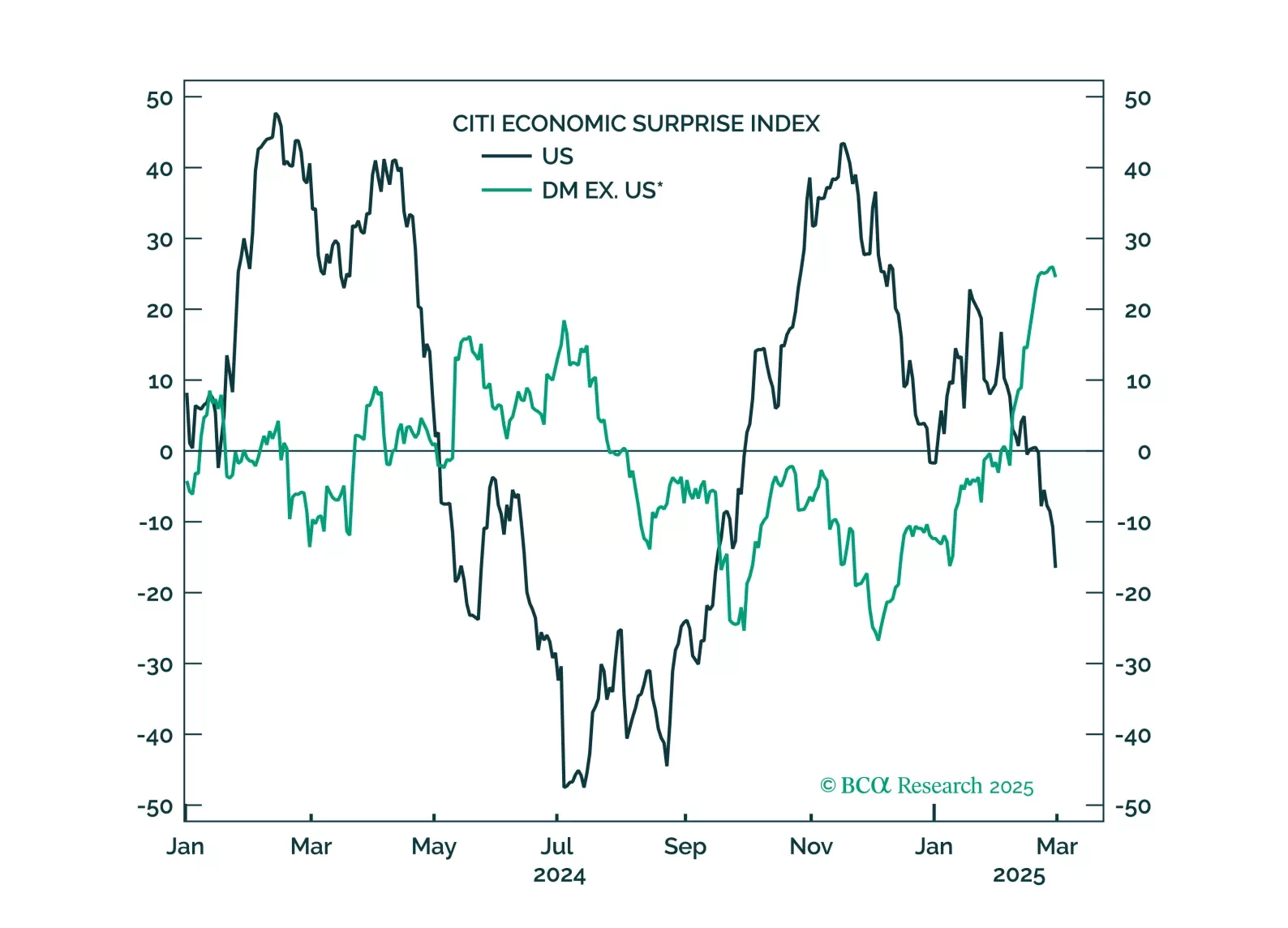

Europe’s resilience to global liquidity deterioration isn’t a fluke—it signals a structural shift. Our latest report explains why the decline in precautionary money demand marks the end of Europe’s liquidity trap and what it means…

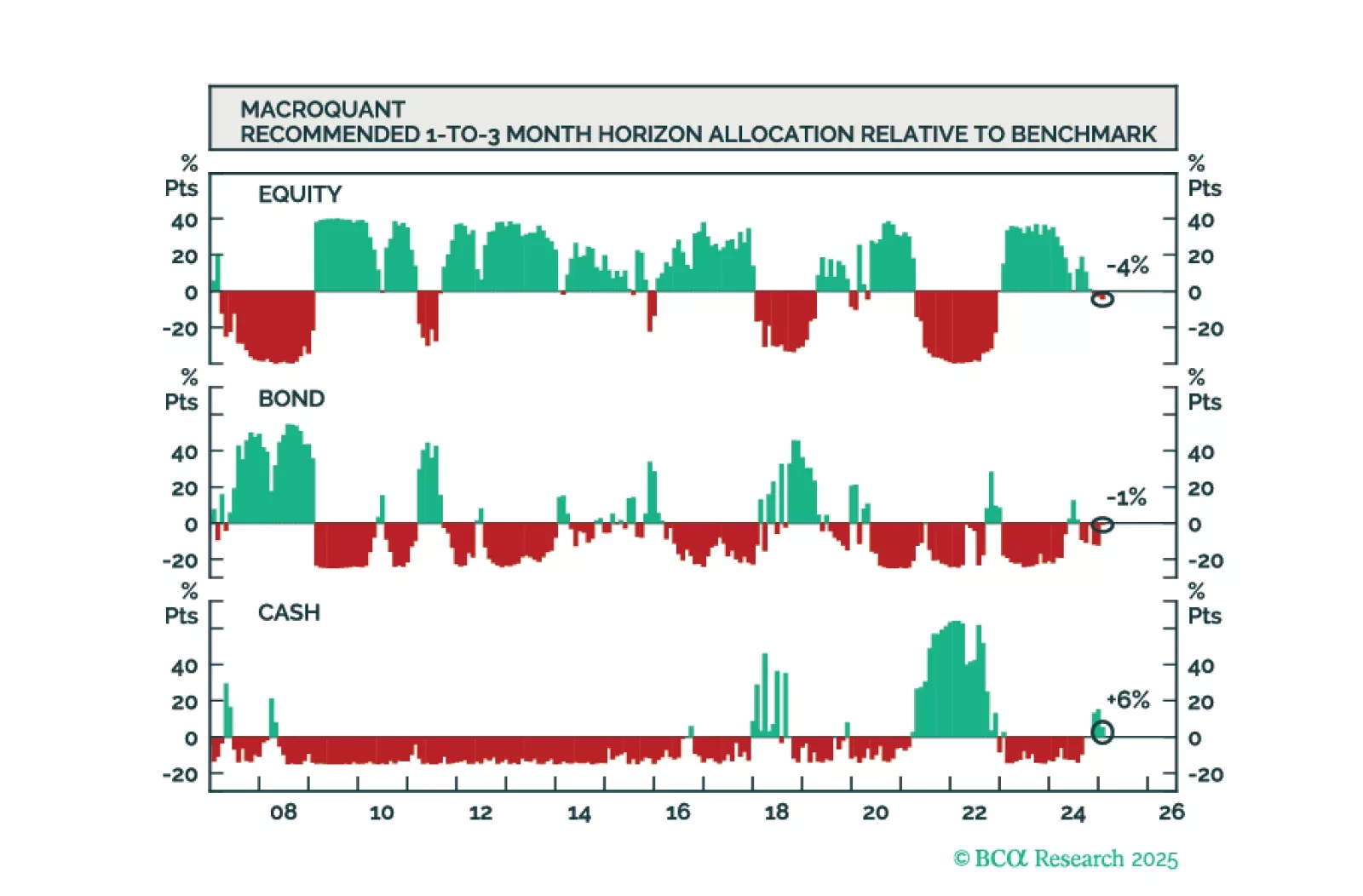

The MacroQuant model is no longer bullish on stocks but is not yet prepared to turn underweight. Subjectively, the Global Investment Strategy team is more bearish on equities than the model.

This week, our three screeners cover equity plays in European Banks, US Financials, And US Stocks that are “Grave Diggers”.

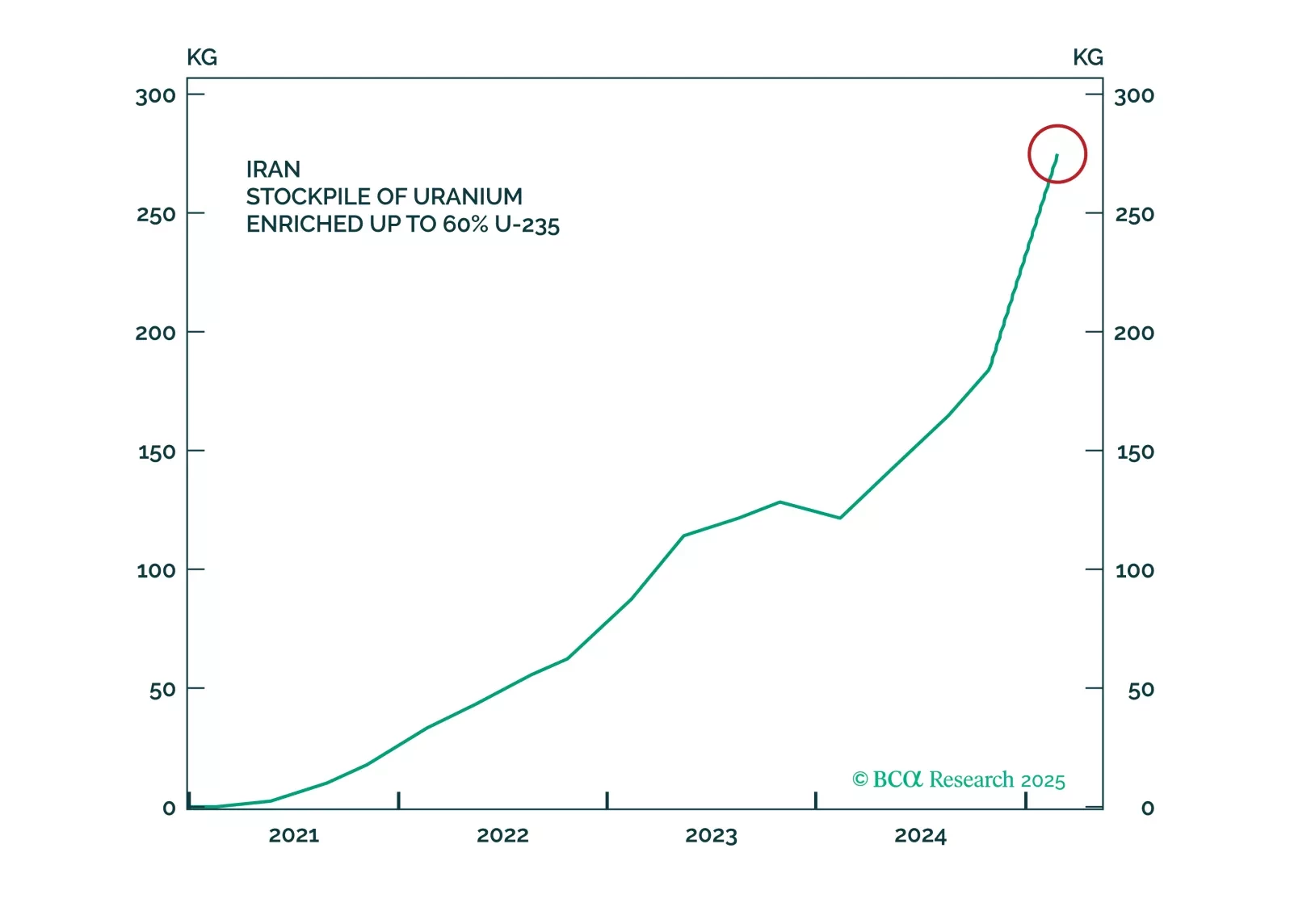

The tariffs on Canada and Mexico will come into effect as scheduled while the tariffs on China will be doubled. In the Middle East, Iranian response to any attack will threaten Middle Eastern oil supply. Meanwhile, Chinese fiscal…

The MacroQuant model is no longer bullish on stocks but is not yet prepared to turn underweight. Subjectively, the Global Investment Strategy team is more bearish on equities than the model.

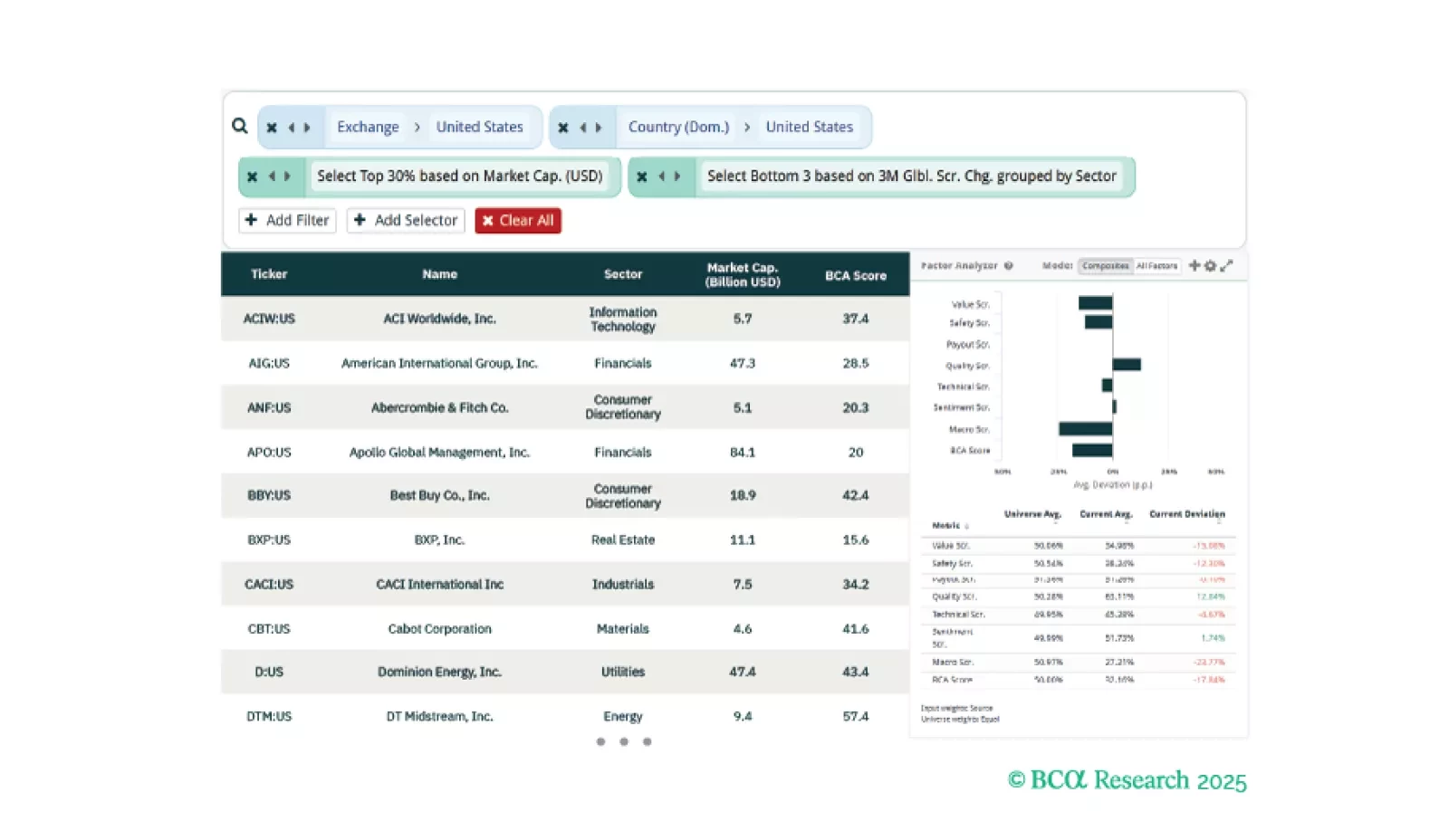

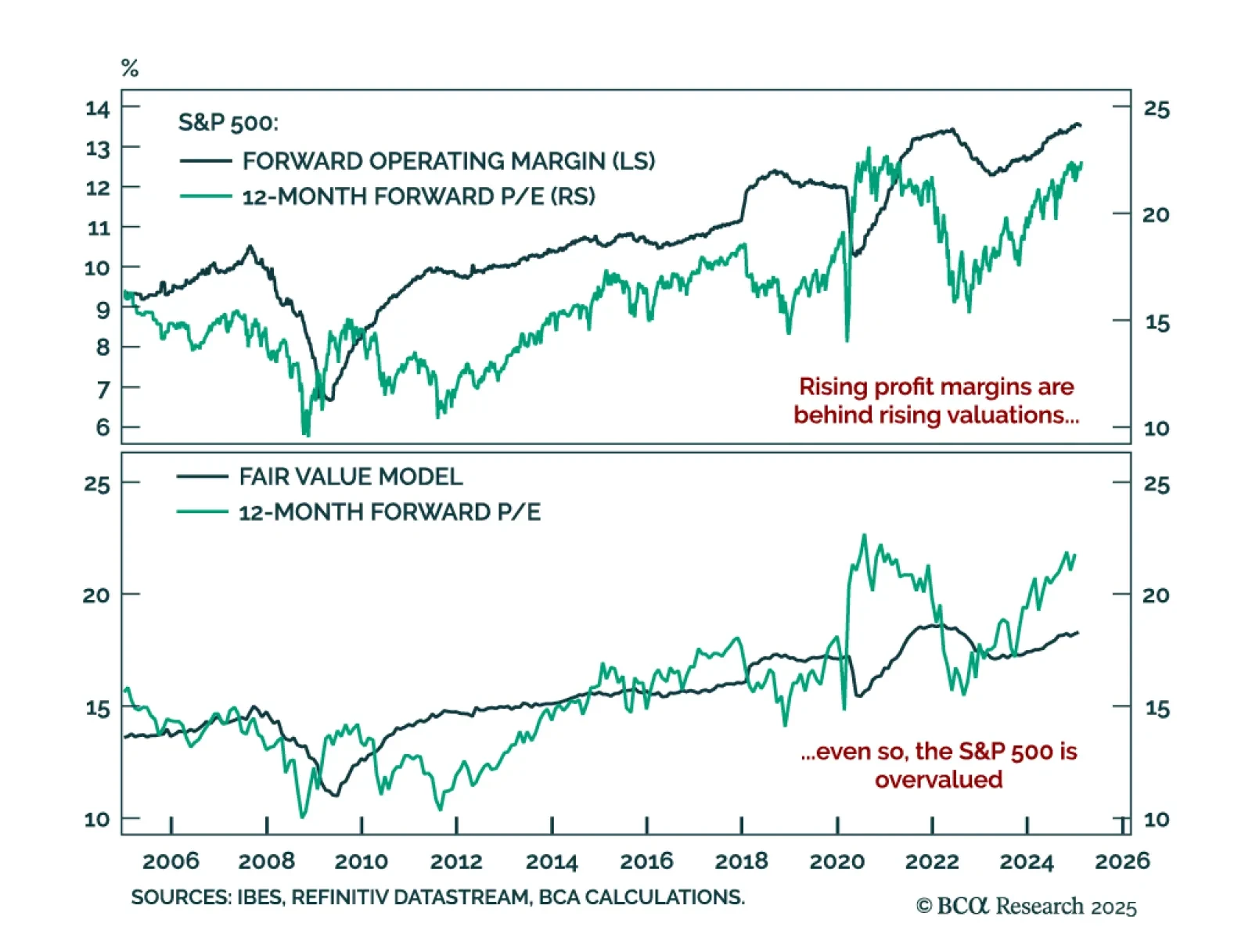

Our Equity Analyzer team used their platform to find value plays in a richly-valued US stock market. US equities remain in a bull market, but valuations are stretched, with investors heavily concentrated in large, trending…

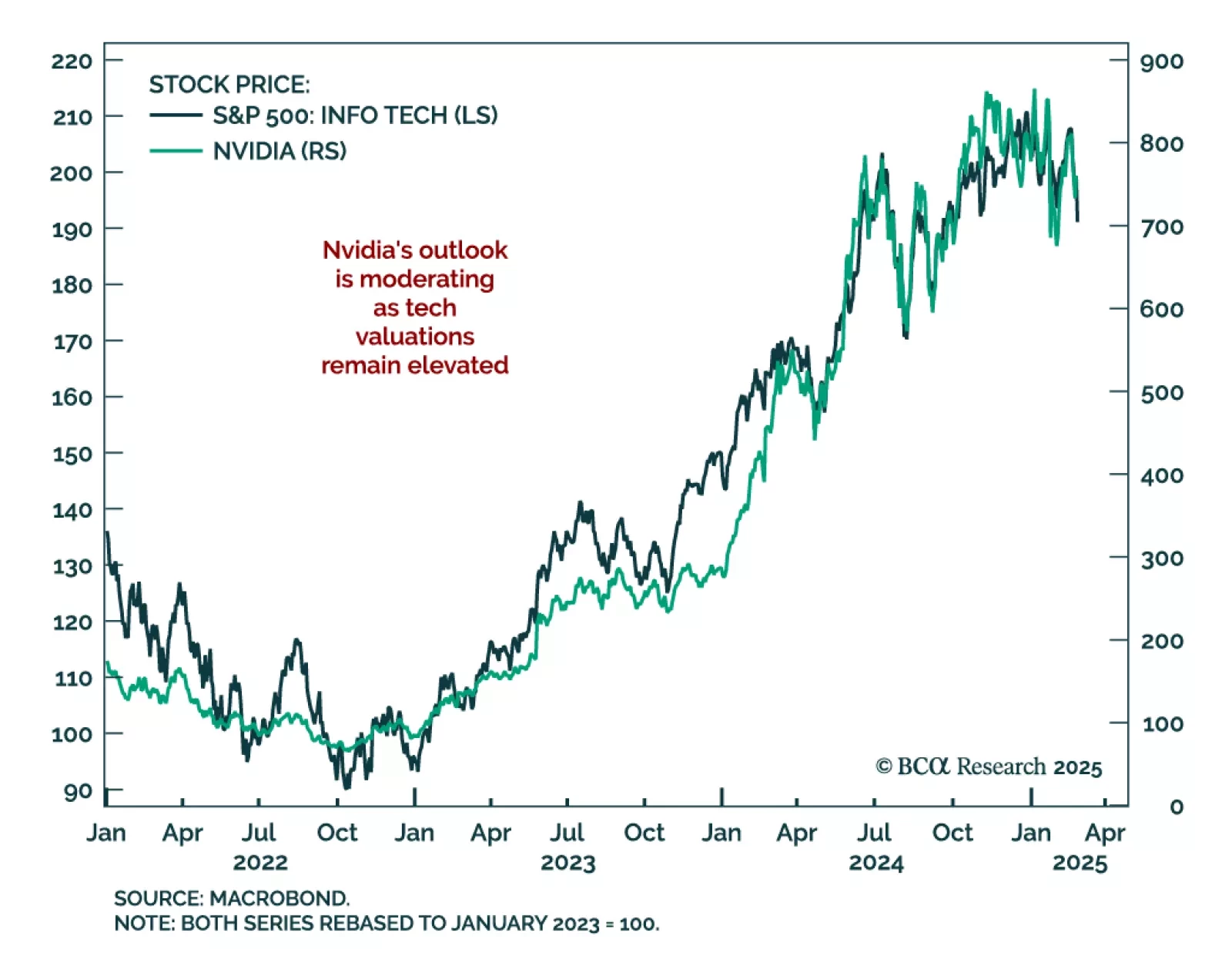

Nvidia announced good results, but Q1 sales guidance fell short of expectations. The numbers point to growth normalization as investors have been accustomed to blowout numbers. Nvidia’s meteoric rise means investors think about…

Our US Equity strategists held a roundtable, which led to many client questions addressed in the team’s latest report. Long-term interest rates will decline if disinflation persists, deficits shrink, or economic growth…