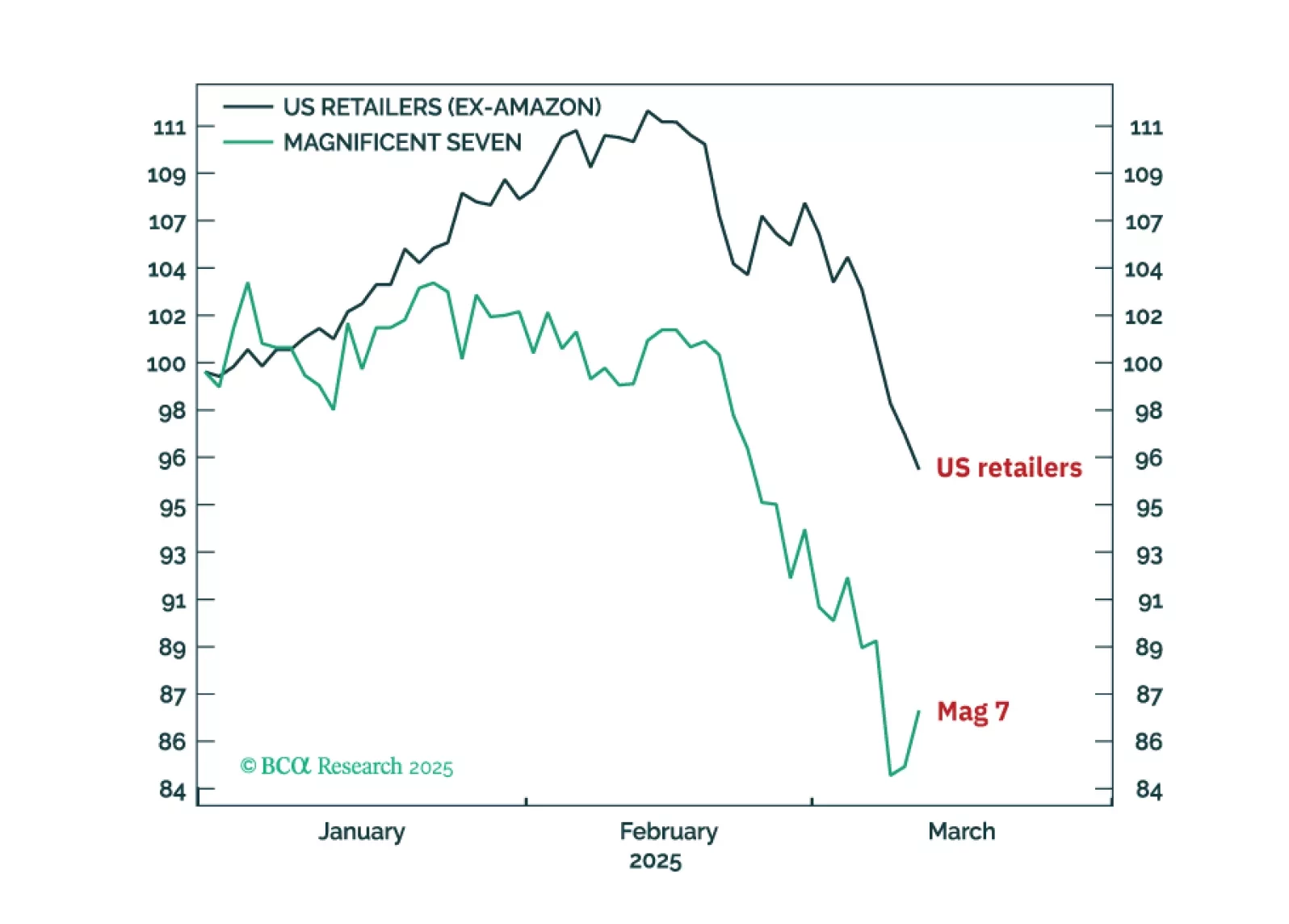

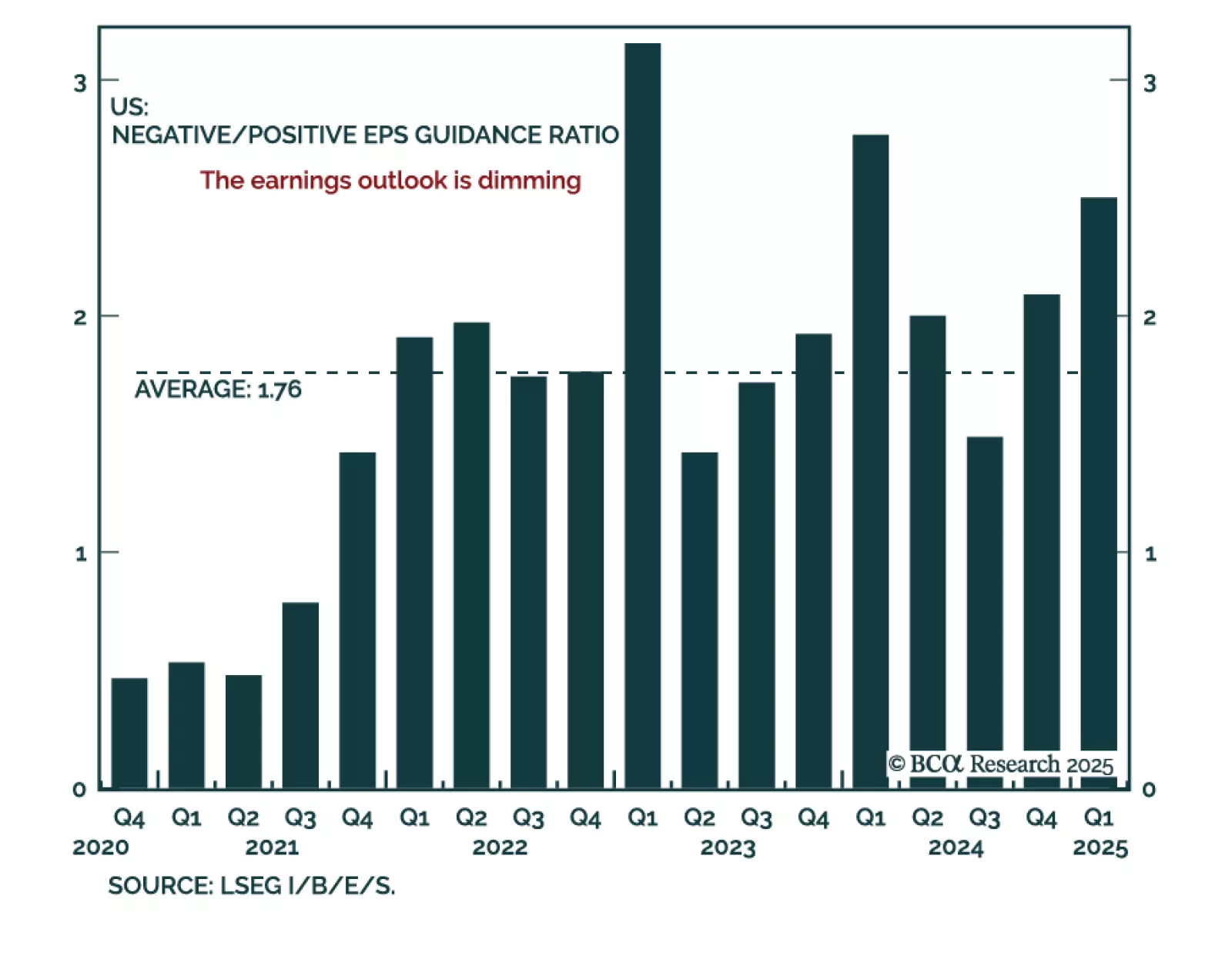

Our US Equity strategists assessed what companies are saying about tariffs, the US dollar, and the US consumer during their latest earnings calls. Q4 earnings were strong, with earnings and sales growth exceeding expectations.…

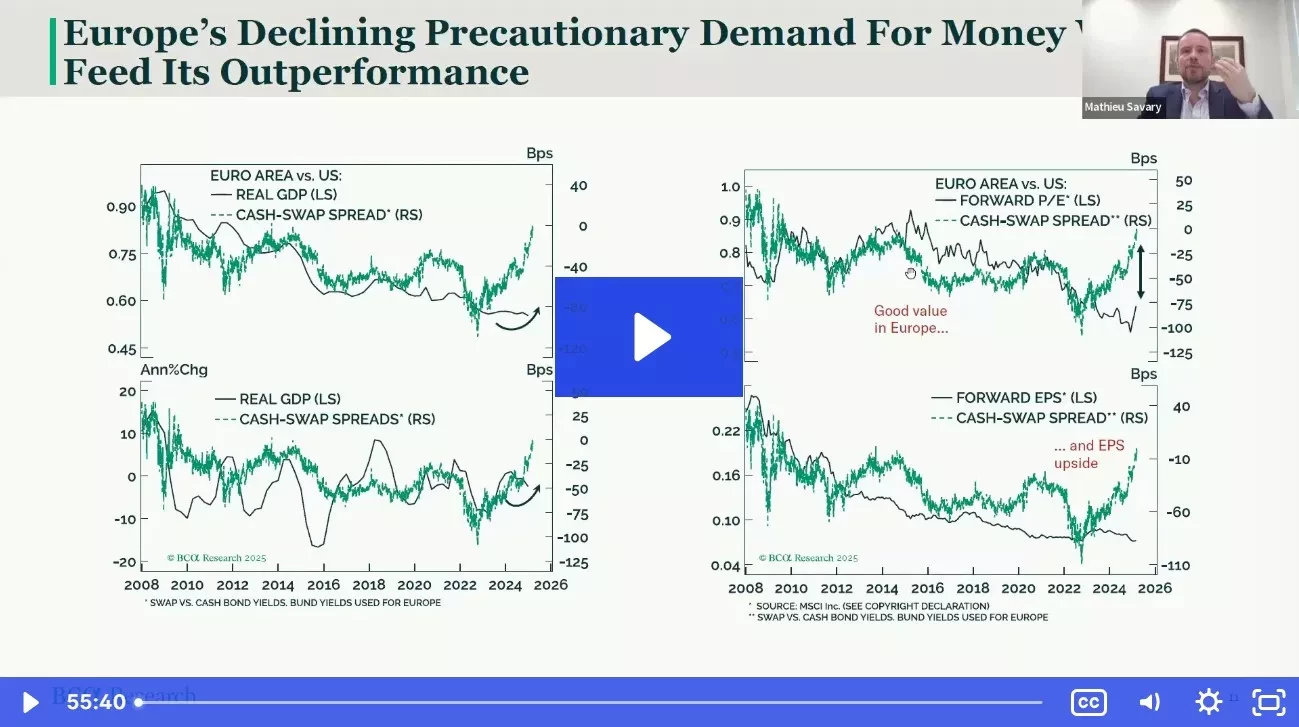

Join our webcast as we break down what’s next for European vs. U.S. equities—and where the best opportunities lie.

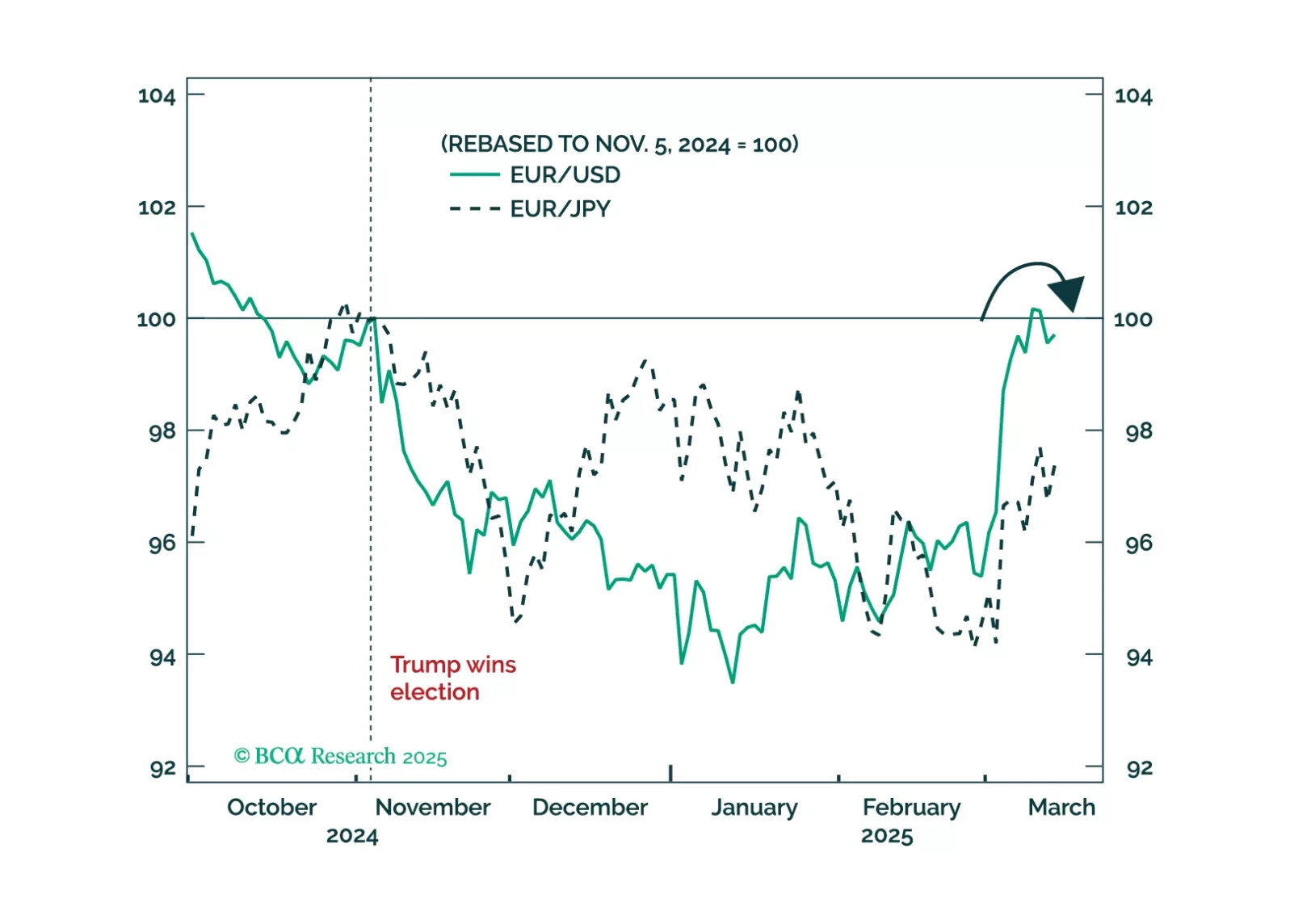

Trump’s foreign policy can be explained by rational US interests, but it requires settling the trade war with allies sooner rather than later. Book gains on EUR-USD for now.

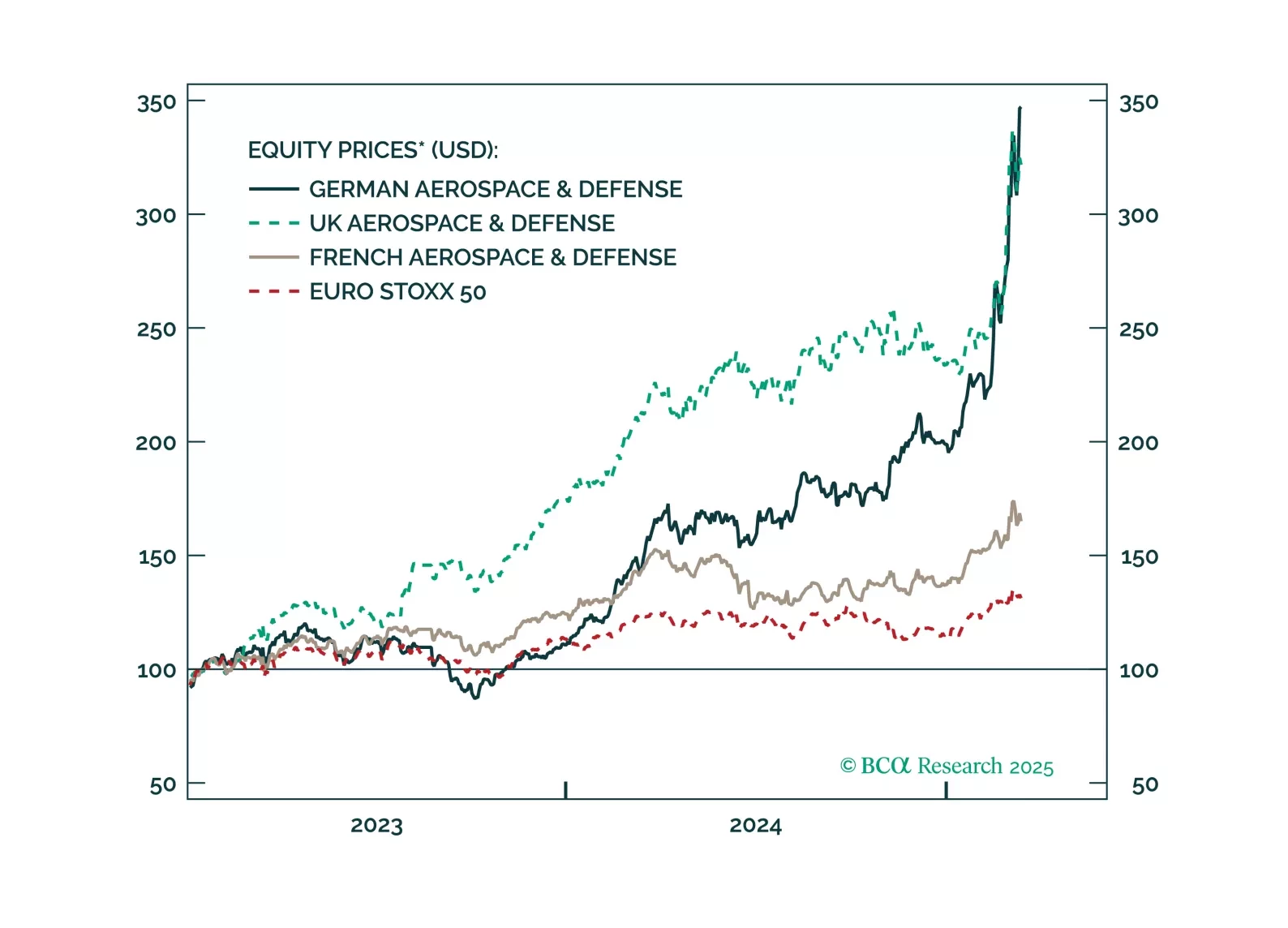

Investors should not chase the rally in European defense names any further. Too much good news has been priced in too quickly.

Despite our Global Investment strategists’ bearish stance, their latest report reviews scenarios that could be bullish for equities. Our colleagues remain bearish on equities, expecting a US recession this year. However, several…

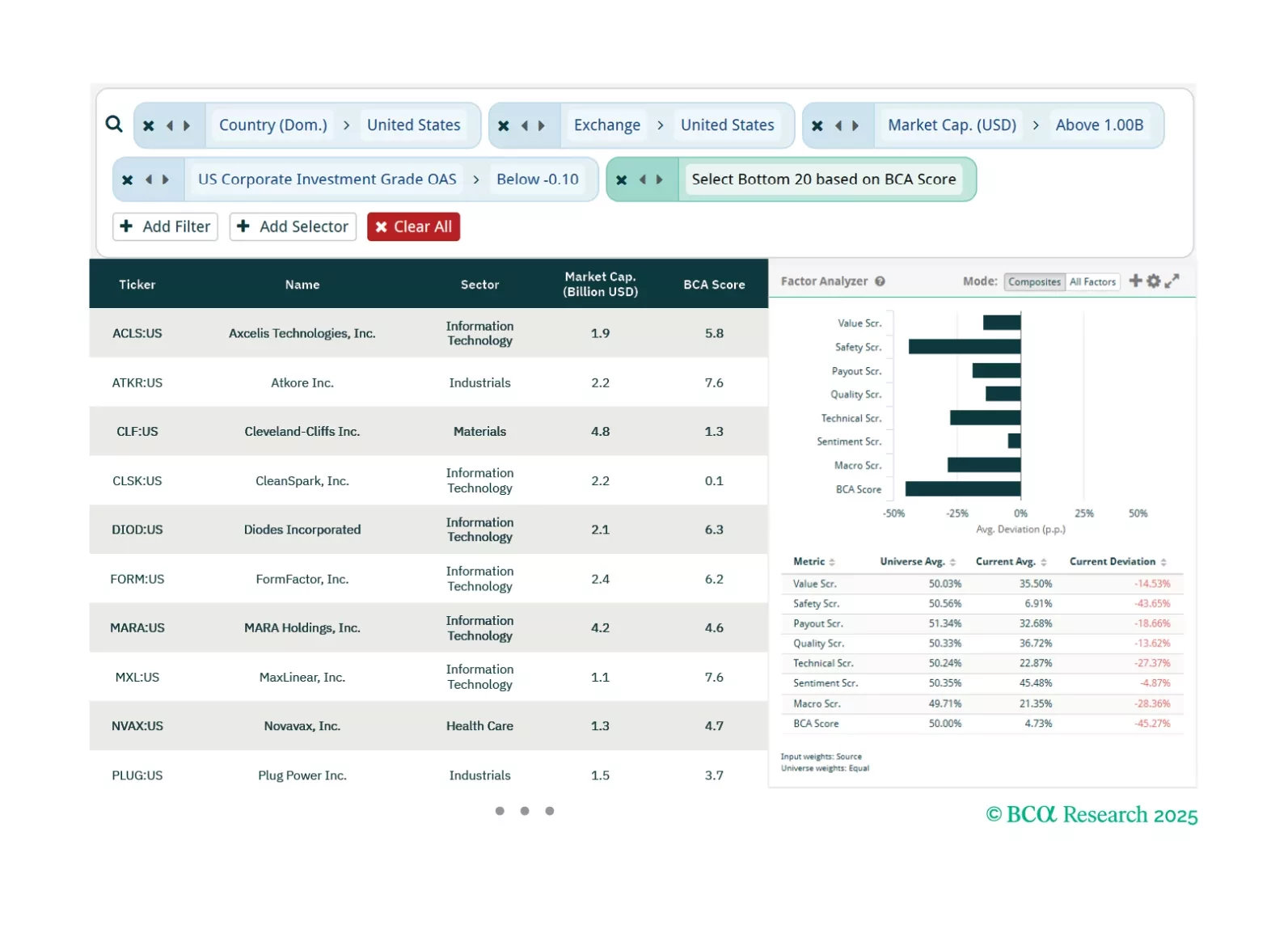

This week, our three screeners cover equity plays in US OAS Spreads, US Exceptionalism, and “DIVE”.

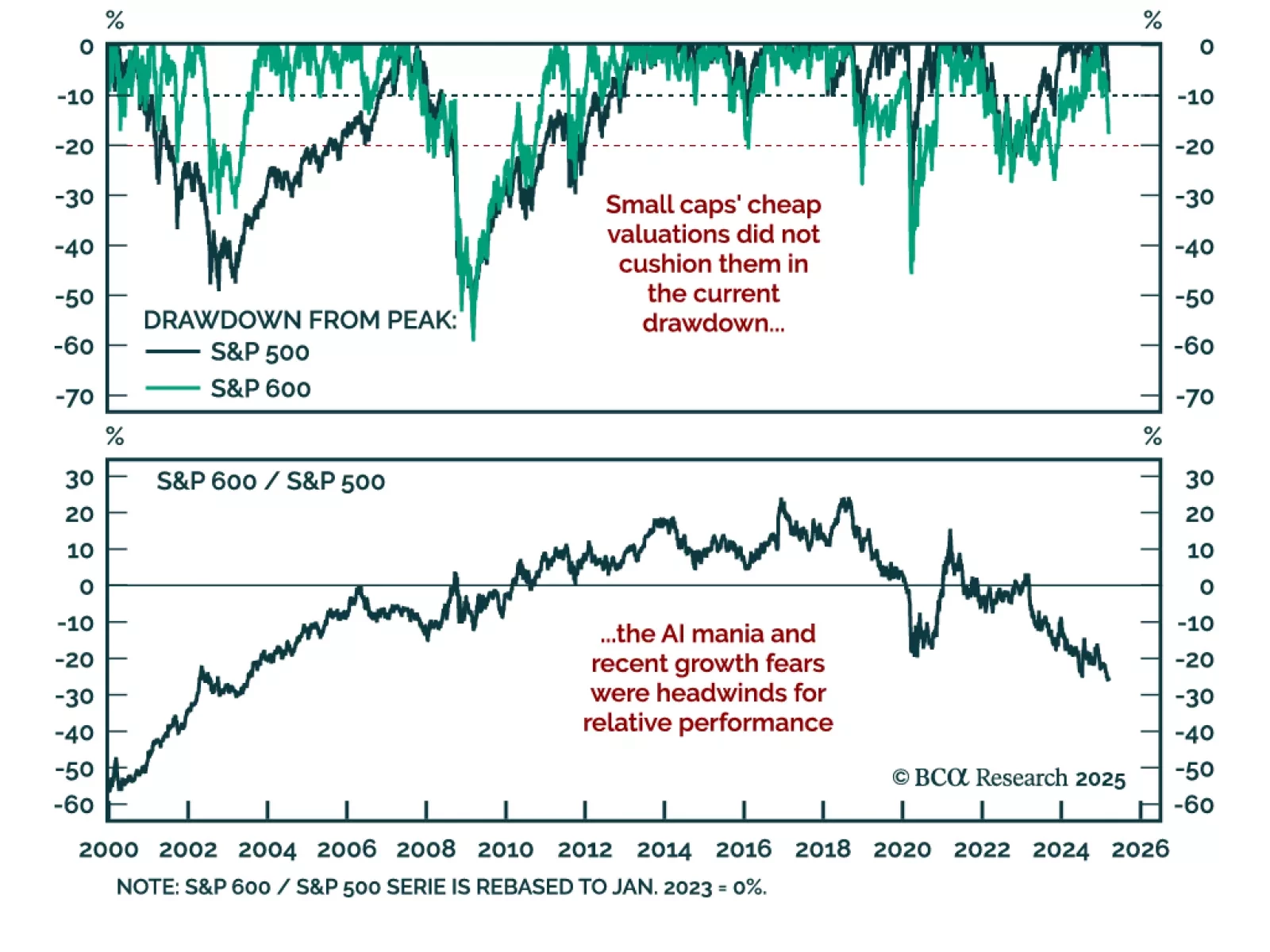

A reoccurring theme in client discussions has been how cheap US small-cap equities could siphon allocation away from their richly-valued large-cap peers. But valuations are no one’s friend in a drawdown. While the S&P 500 is in…

The Trump slump is nearing a temporary reprieve, with a playable countertrend rally in stocks and a tactical rebound in the dollar. Go tactically long USD/SEK. For long-term investors though, the AI bubble still has a lot of air to…

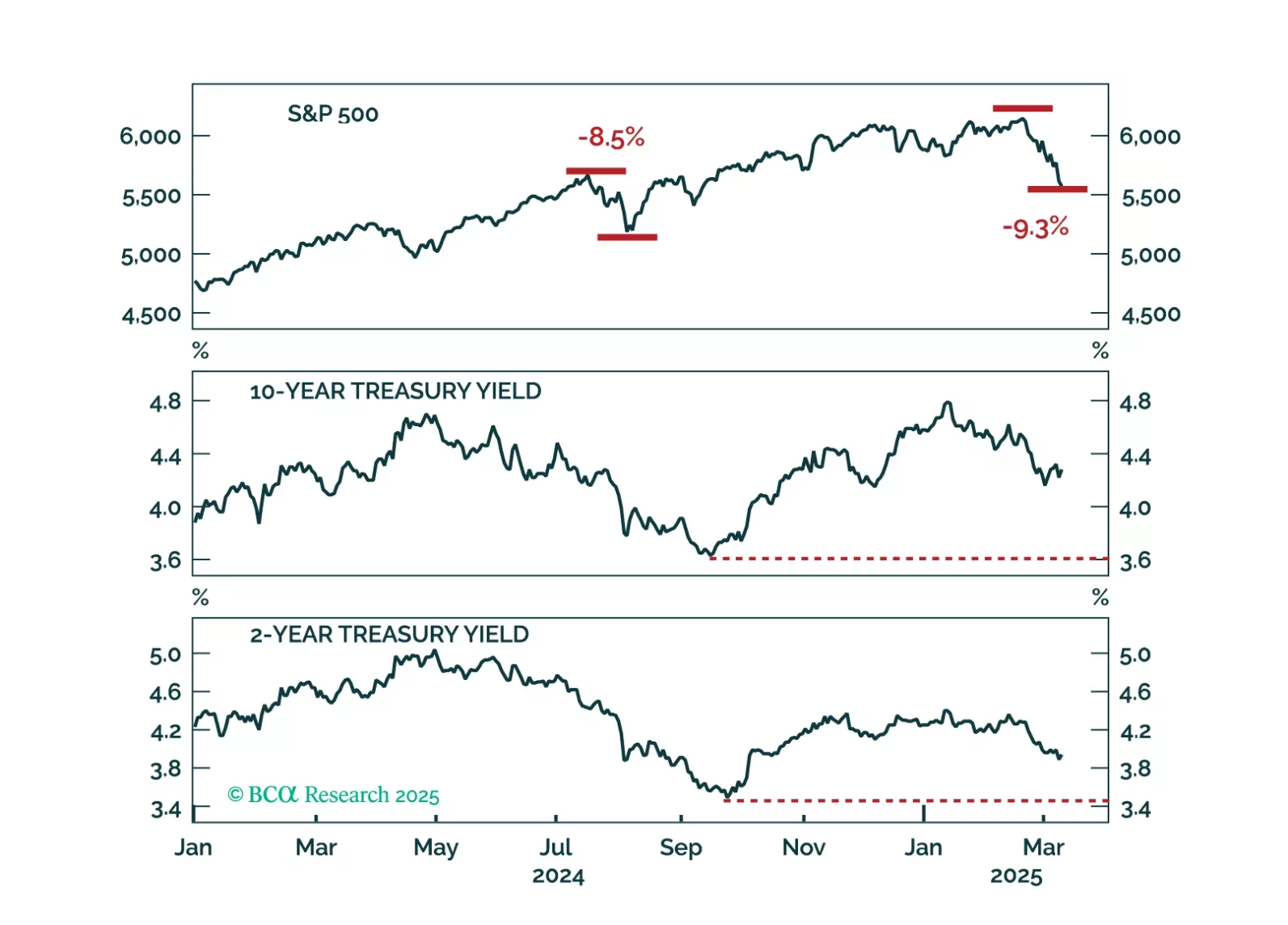

A falling stock market and sticky bond yields represent the worst of both worlds for investors. We interrogate why bond yields haven’t dropped more given the large selloff seen in equities.

Our US investment strategists believe the Trump administration’s resolve to cut spending as well as tariff uncertainty have increased the probability of a recession.The Department of Government Efficiency’s sweeping cuts may…