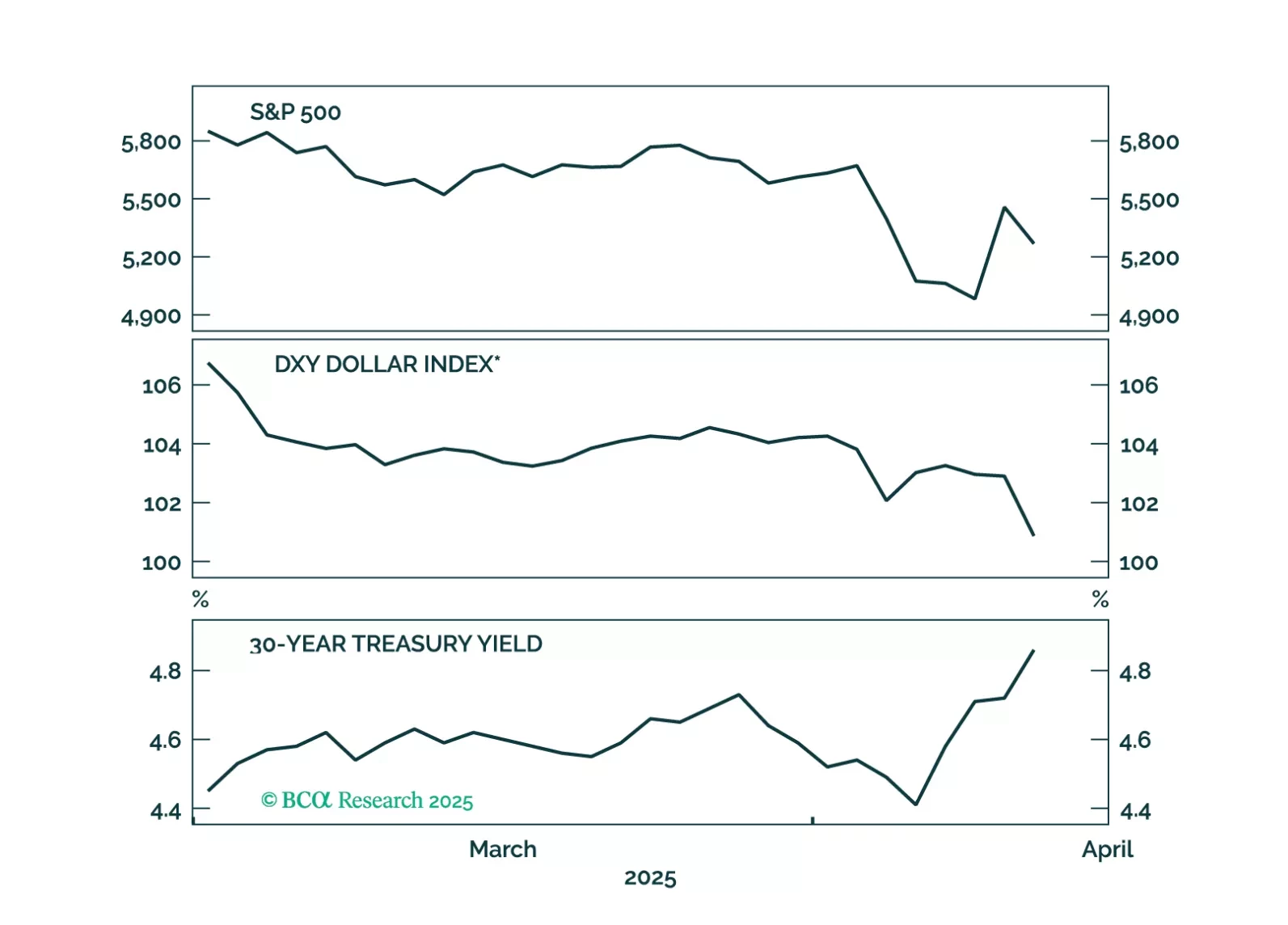

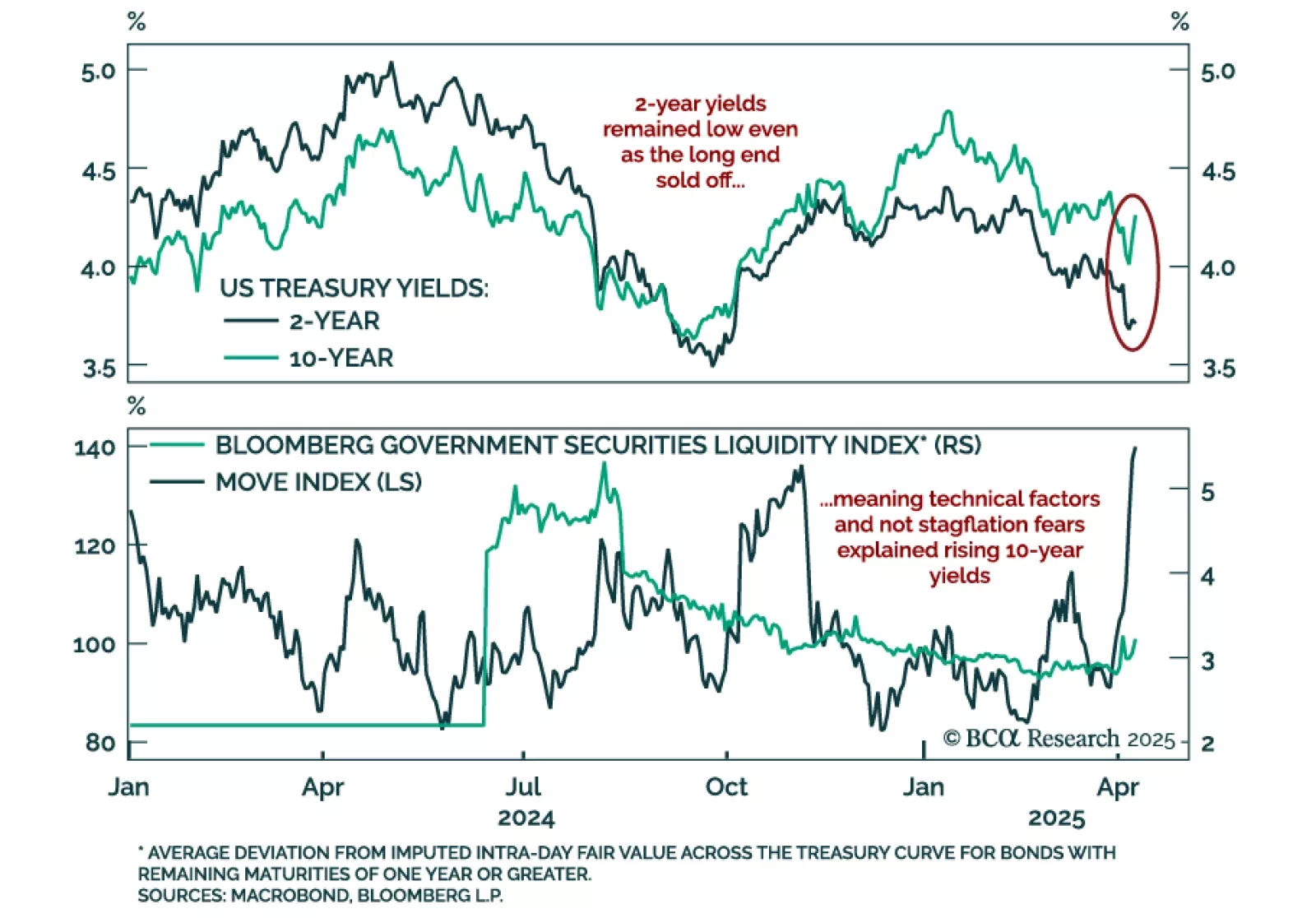

The combination of dollar weakness and rising US yields suggests global investors are questioning the safe-haven status of US Treasuries.

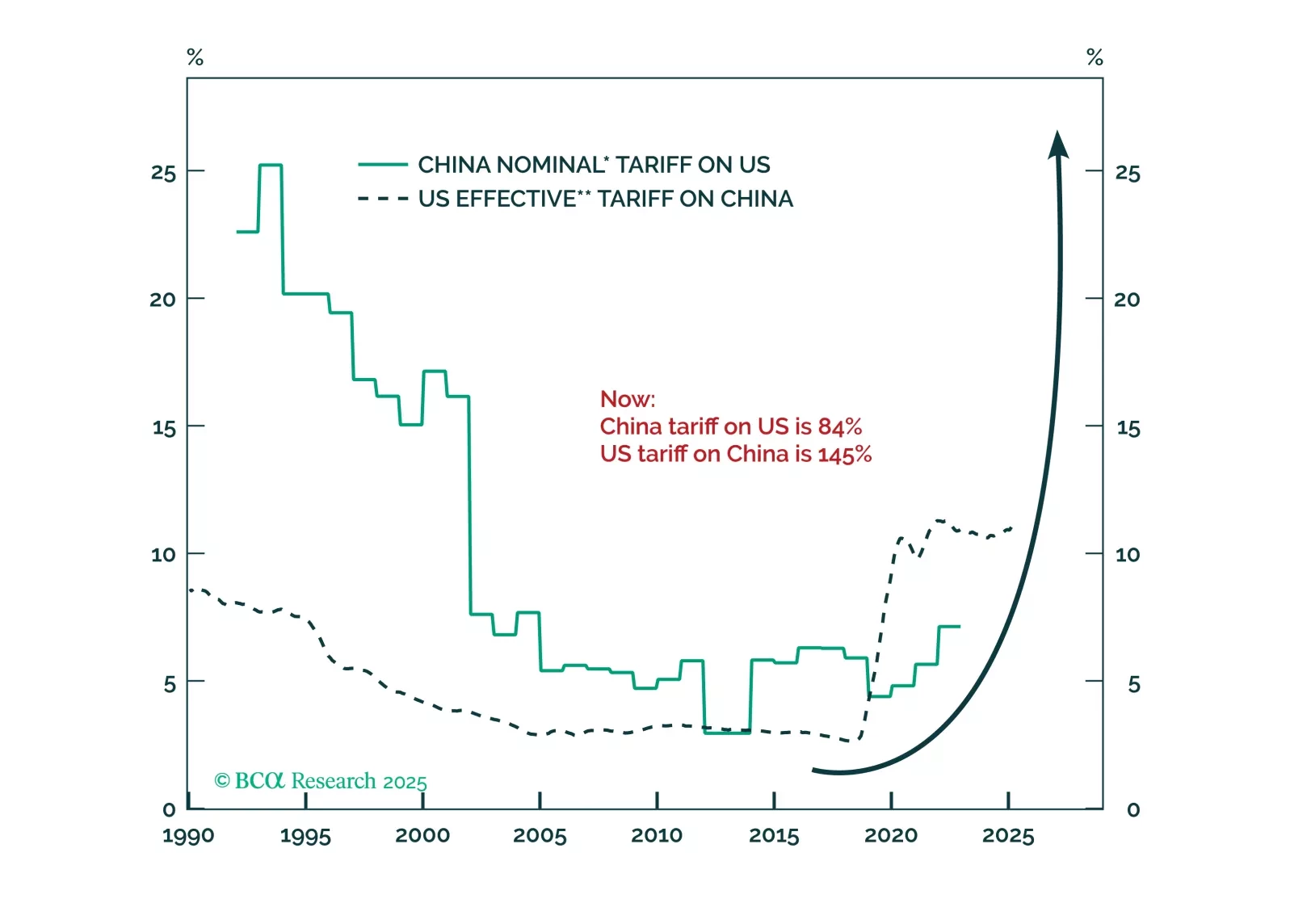

China’s aggressive retaliation against U.S. tariffs will enable President Trump to shift from punishing allies and redirect the trade war toward China. If Beijing does not react to the latest tariffs by doubling its fiscal stimulus,…

We maintain an overweight in government bonds, as recent yield spikes appear technical and unsustainable. US 10-year Treasury yields have surged even as global markets were selling off on growth fears. The move has spread to higher-…

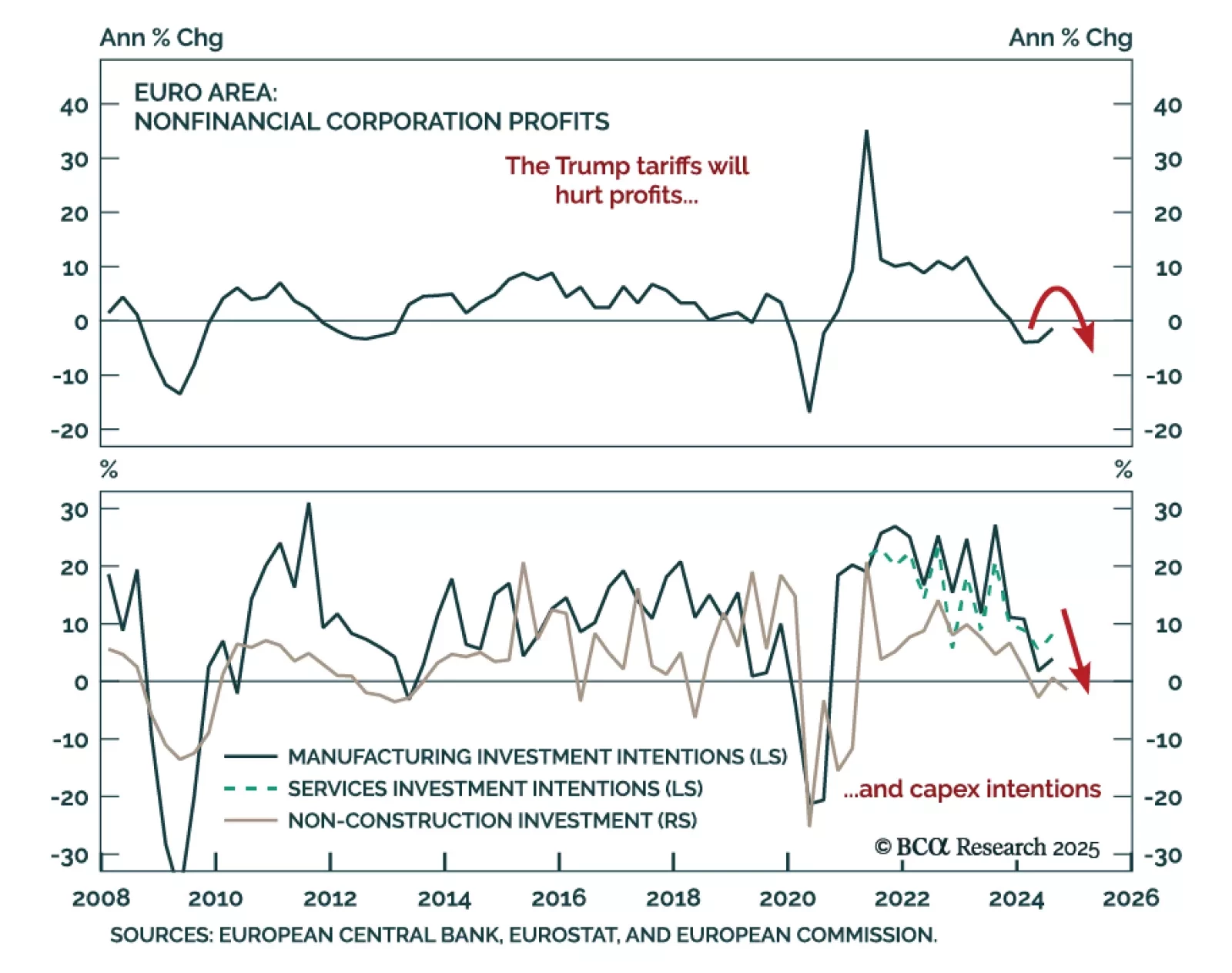

Our European strategists recommend staying defensive in the near term. Favor bonds over equities and defensives over cyclicals, as President Trump’s tariffs are set to push the Eurozone into recession by mid-2025. Industrial…

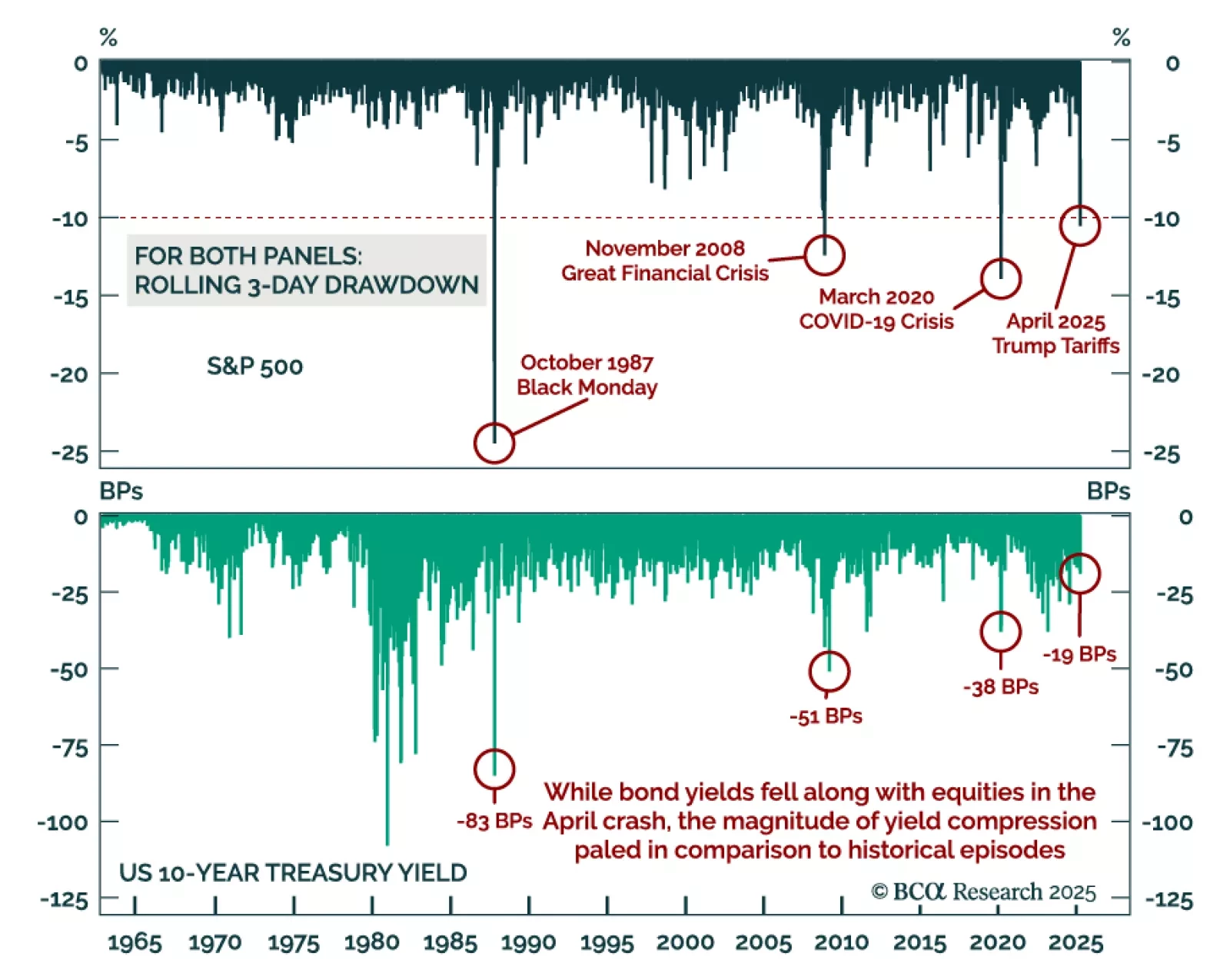

Equities’ post-Liberation Day selloff was historic, but cross-asset signals make it an anomaly. The post-Liberation Day S&P 500’s three-day, 10%+ drawdown joined a list of major episodes that includes the March 2020 COVID-19…

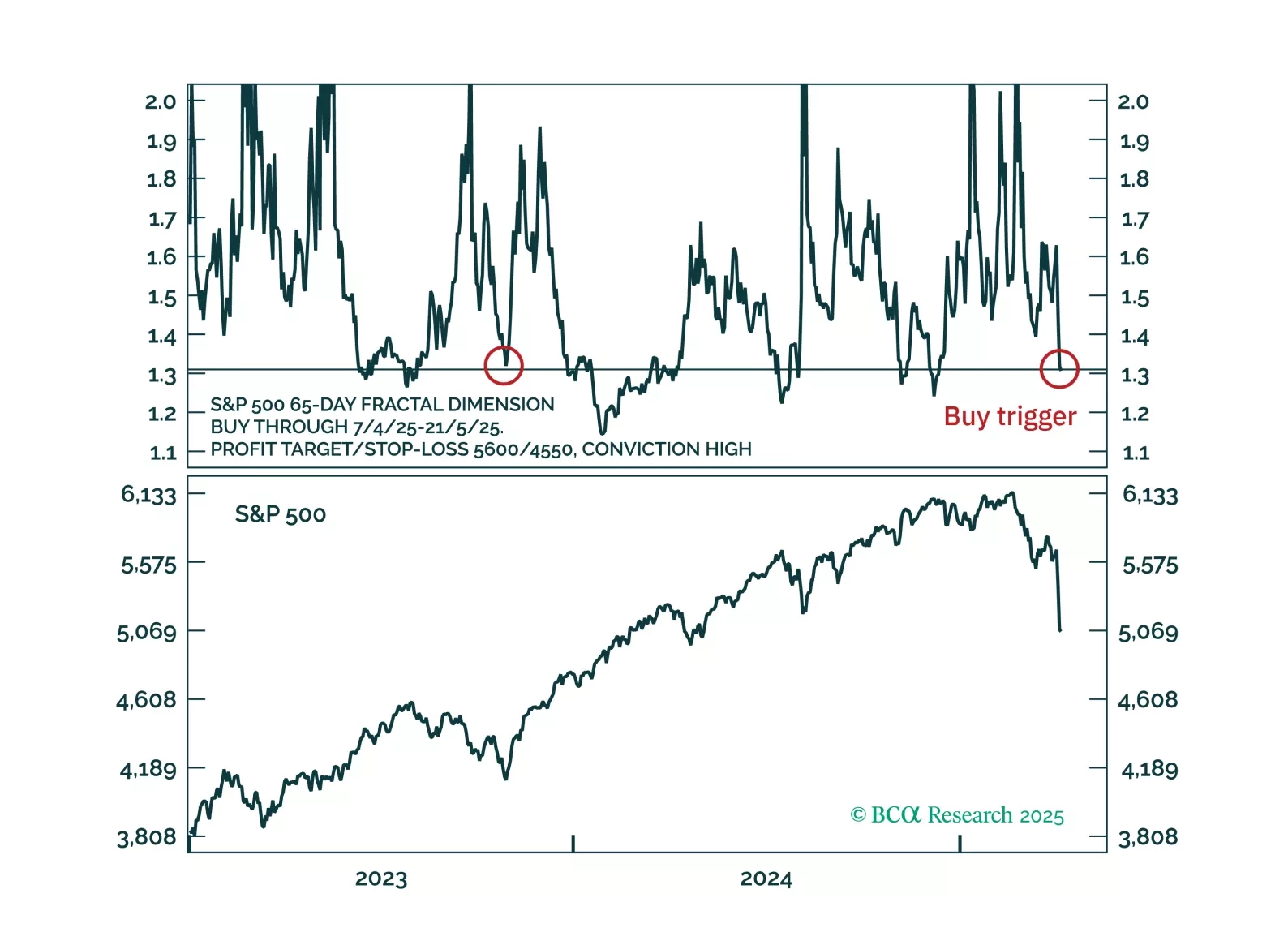

Countertrend buy triggers have been activated for the S&P 500, Nasdaq and Nasdaq versus 30-year T-bond.

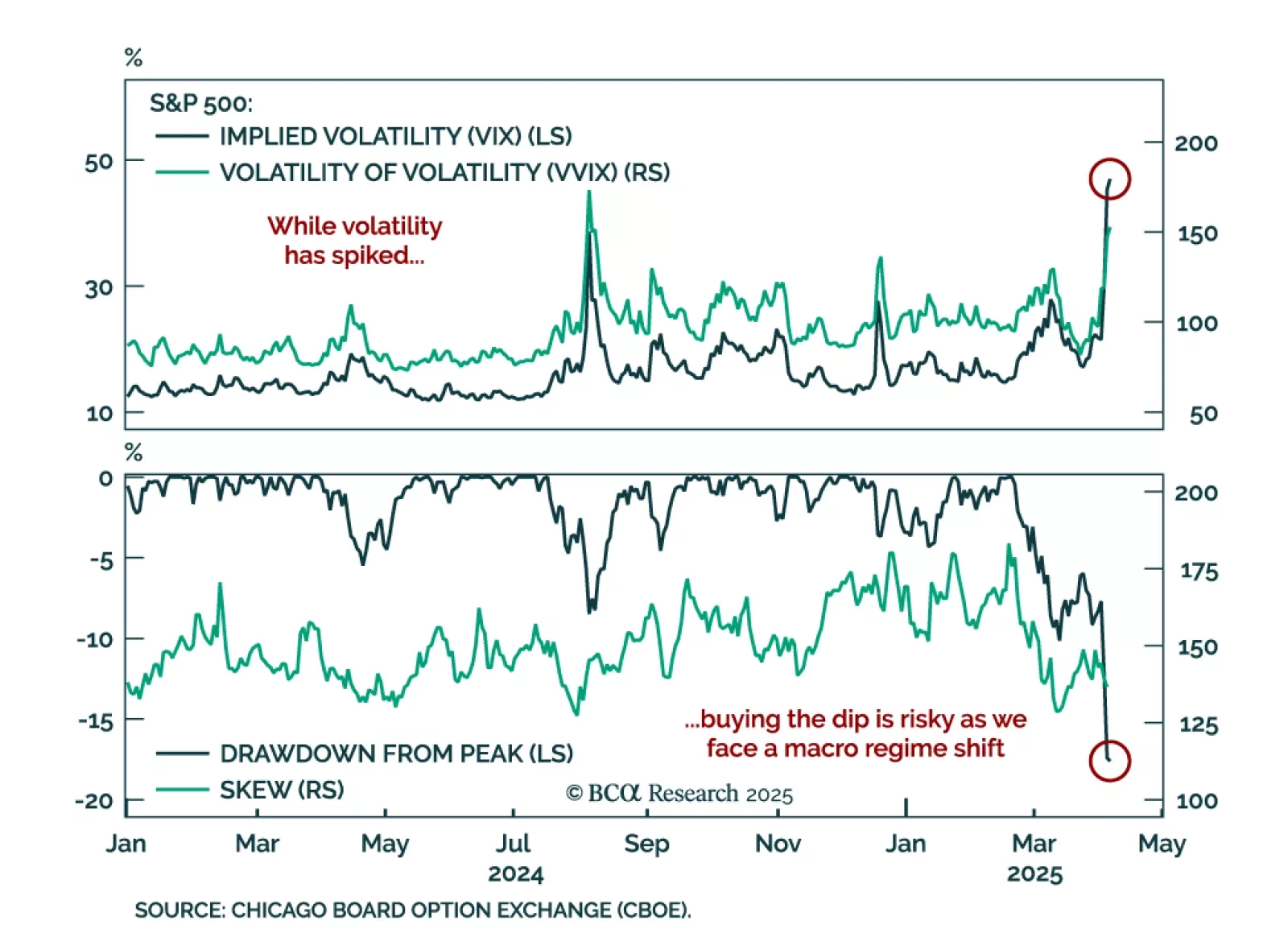

We maintain our defensive positioning as risk assets remain in a lose-lose situation. Monday’s trading session was volatile, and saw a brief rebound on a false headline about a 90-day tariff pause excluding China. The rally partially…

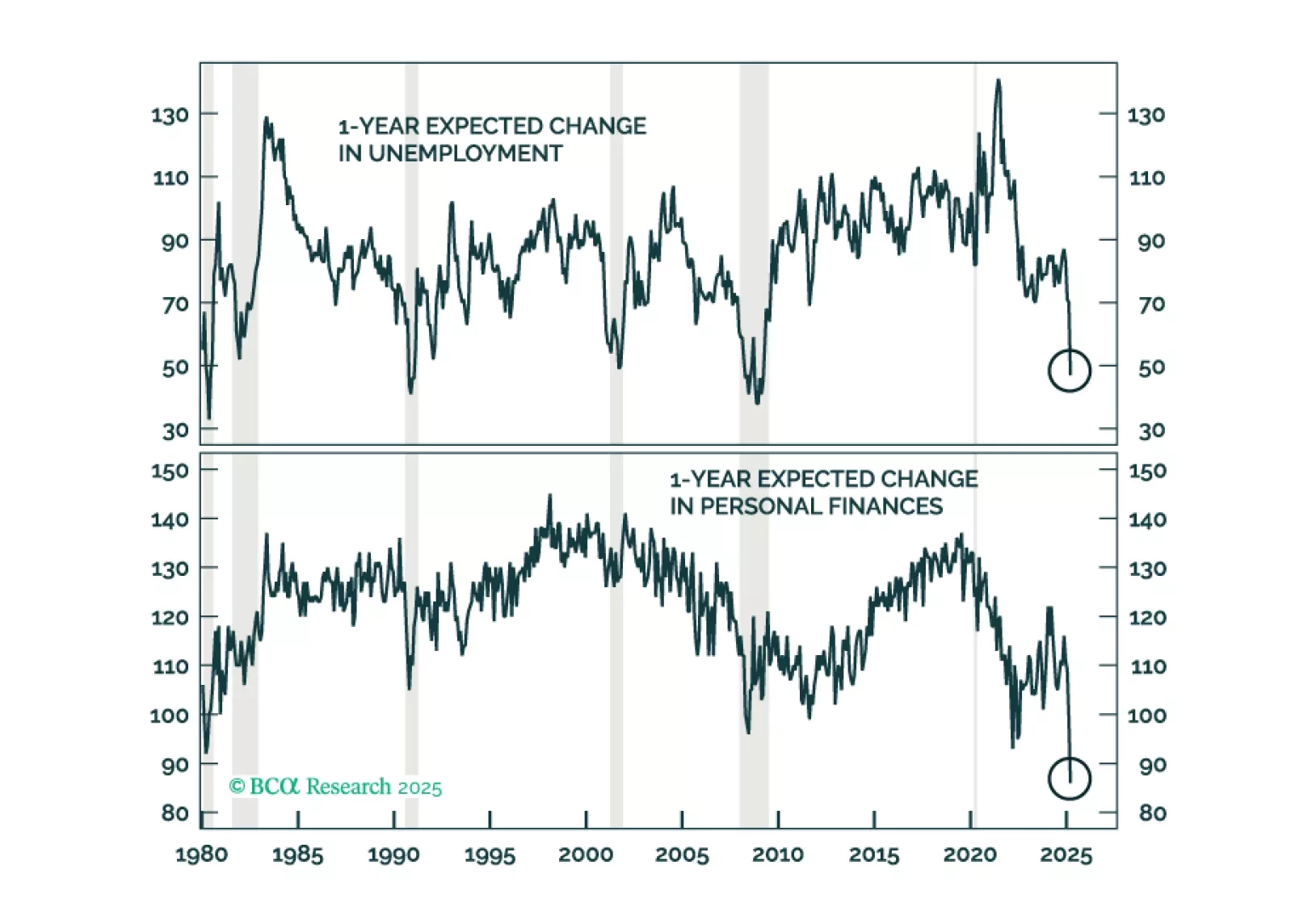

President Trump imposed tariffs on the world in his first 100 days, as we expected. Tariffs may have catalyzed a recession in the US, given the weakness in consumer sentiment and demand. Trump will soon backpedal and grant exemptions…

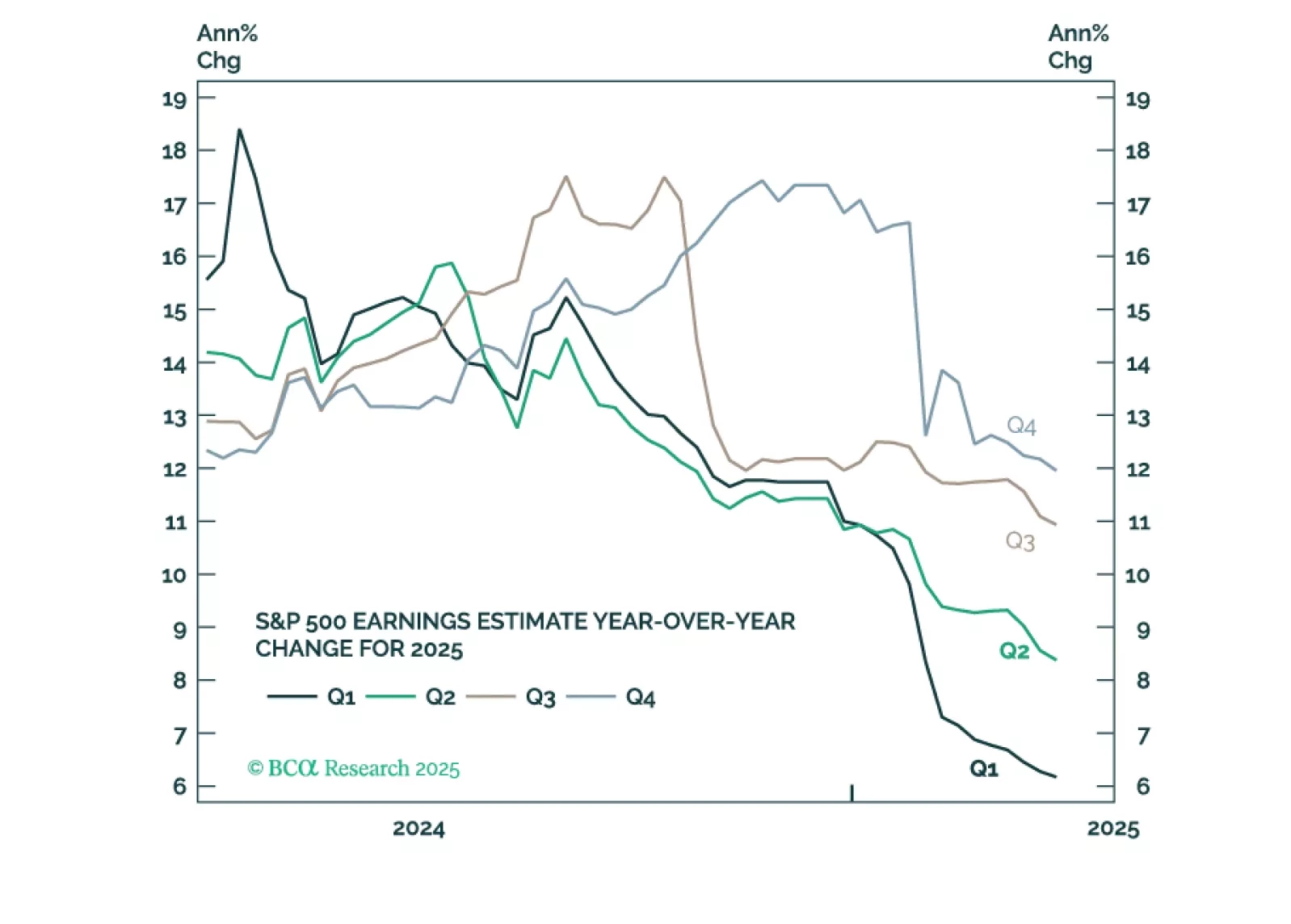

Equities will find a bottom when the full effects of tariffs on earnings and economic growth are priced in. The bottom of the market appears a long way away, and the S&P 500 may end up as low as 4,300, barring any reversals in…

The stimulus measures driving the post-COVID expansion were beginning to wane after five years and pointing the economy in the direction of an organically occurring recession. Now that DOGE and the multi-front trade war have sped up…