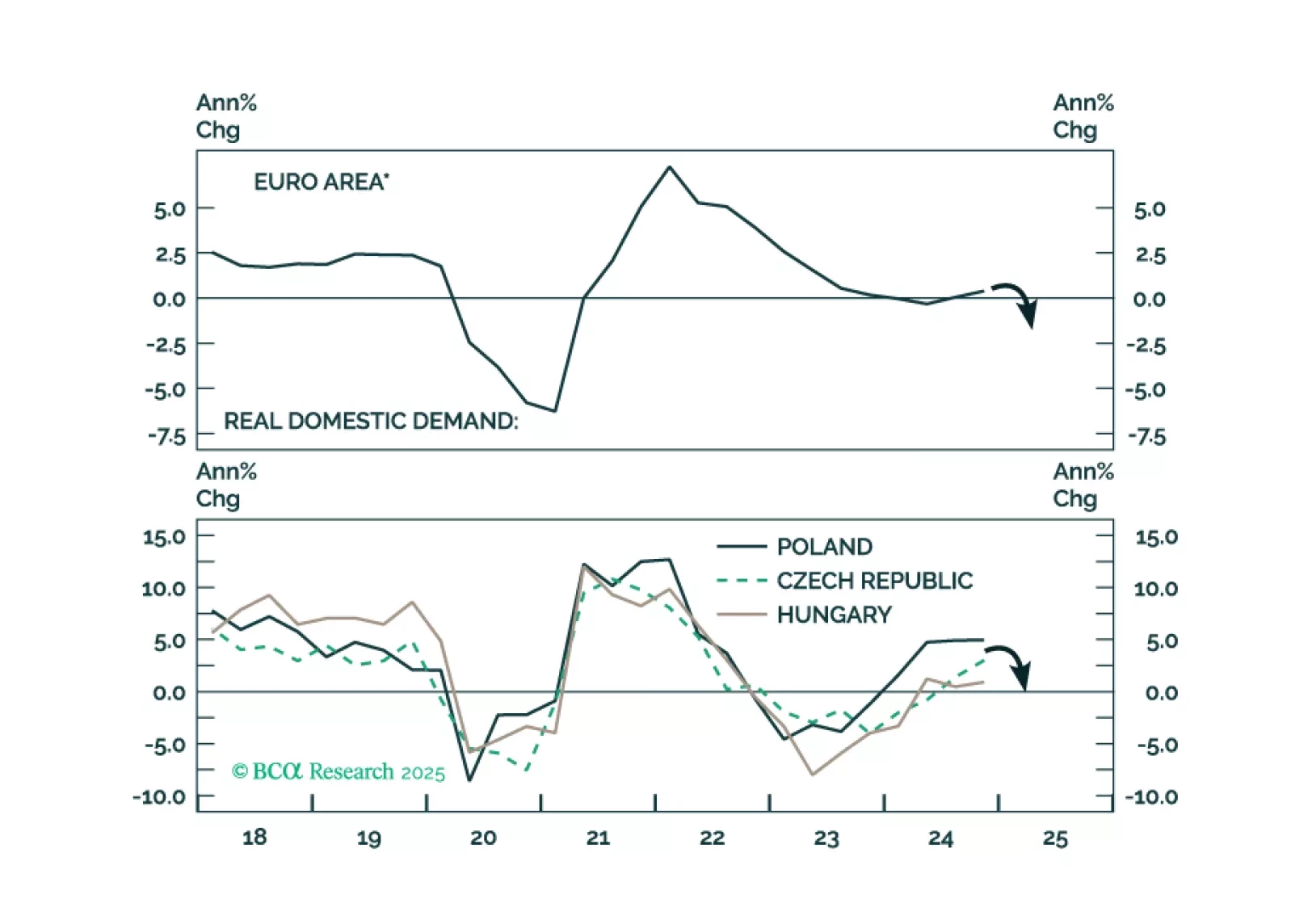

The European economies are facing a major deflationary shock. We recommend that investors stay long a basket of Central European (CE3) domestic bonds. They should also upgrade CE3 bonds and stocks in their respective EM portfolios.

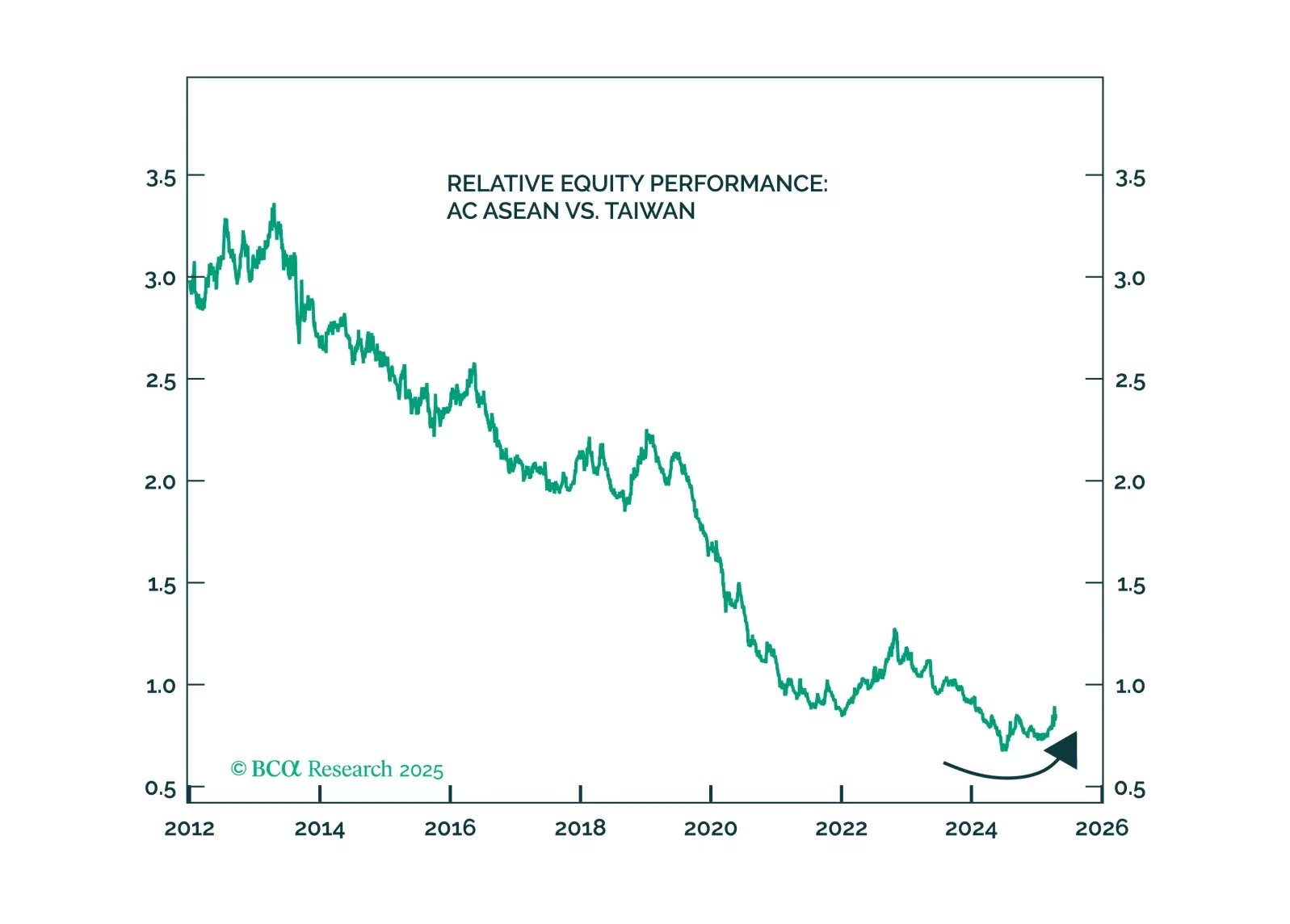

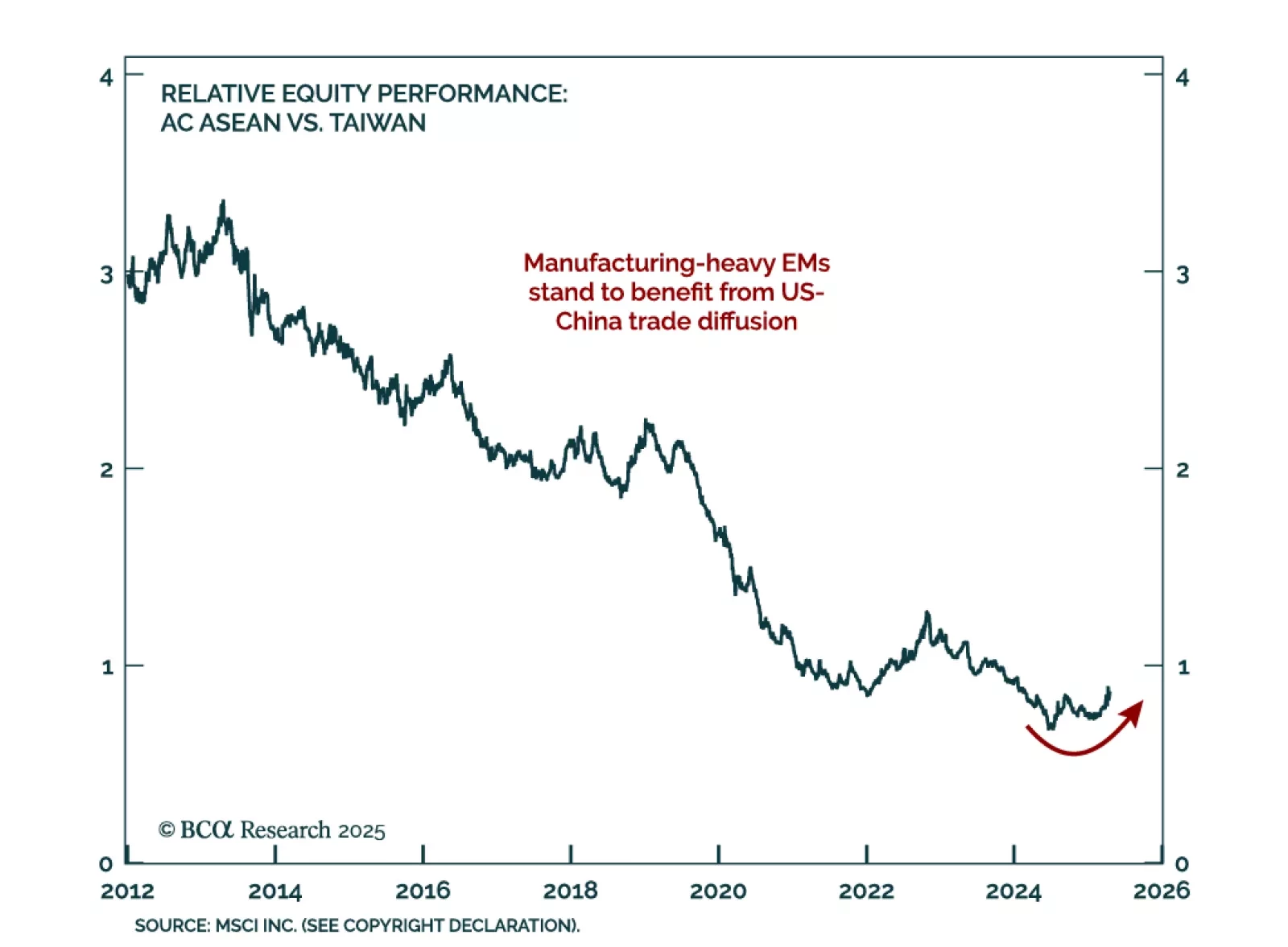

Our Geopolitical and GeoMacro strategists recommend buying tail-risk protection and adding exposure to manufacturing-oriented EMs as the risk of US-China military escalation rises. They now see a 10% chance of full-scale war over…

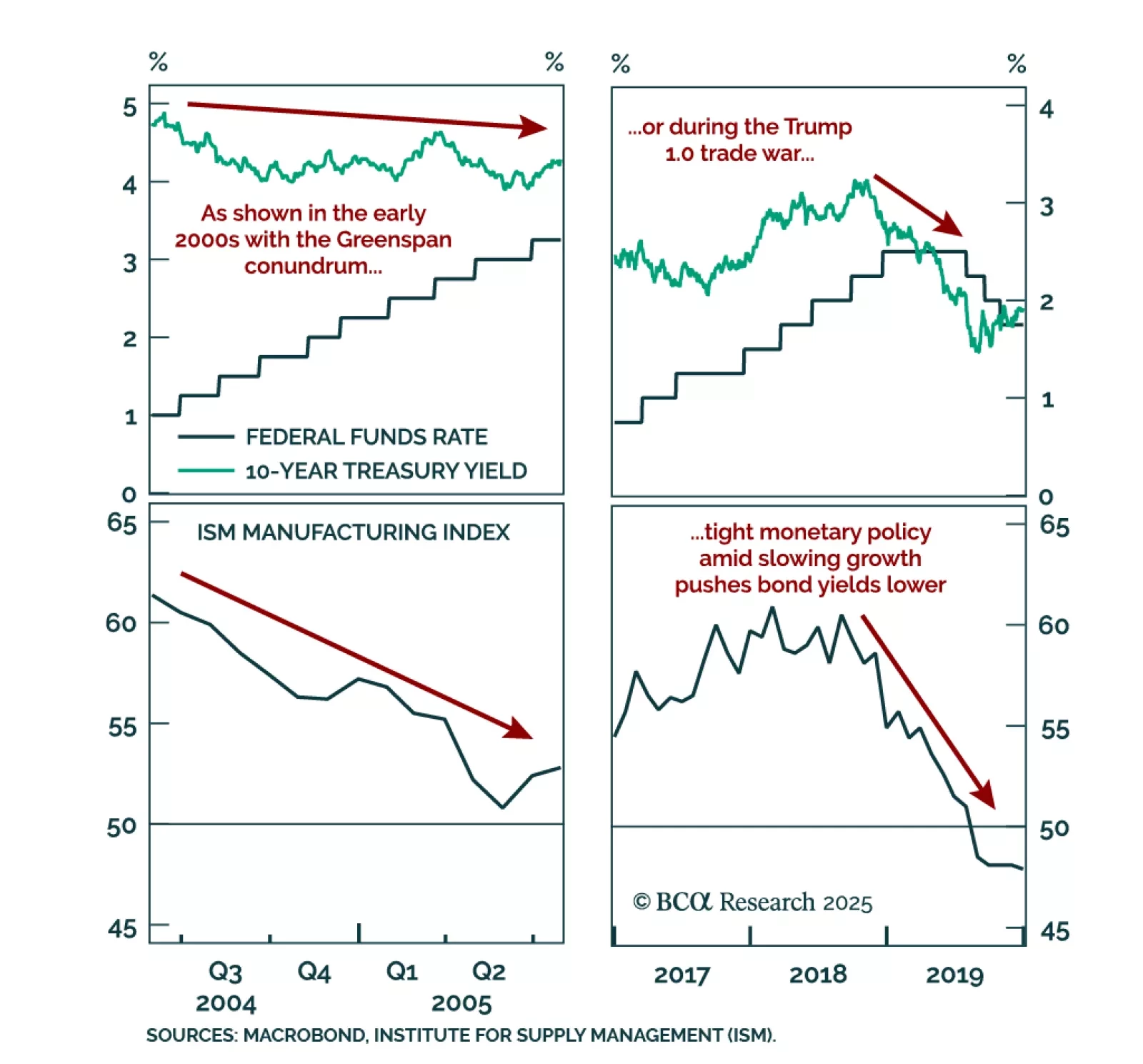

President Trump's pressure on Fed Chairman Powell is intensifying, but keeping Powell in place offers the administration political cover while keeping bond yields contained. Removing Powell would be legally difficult and risk…

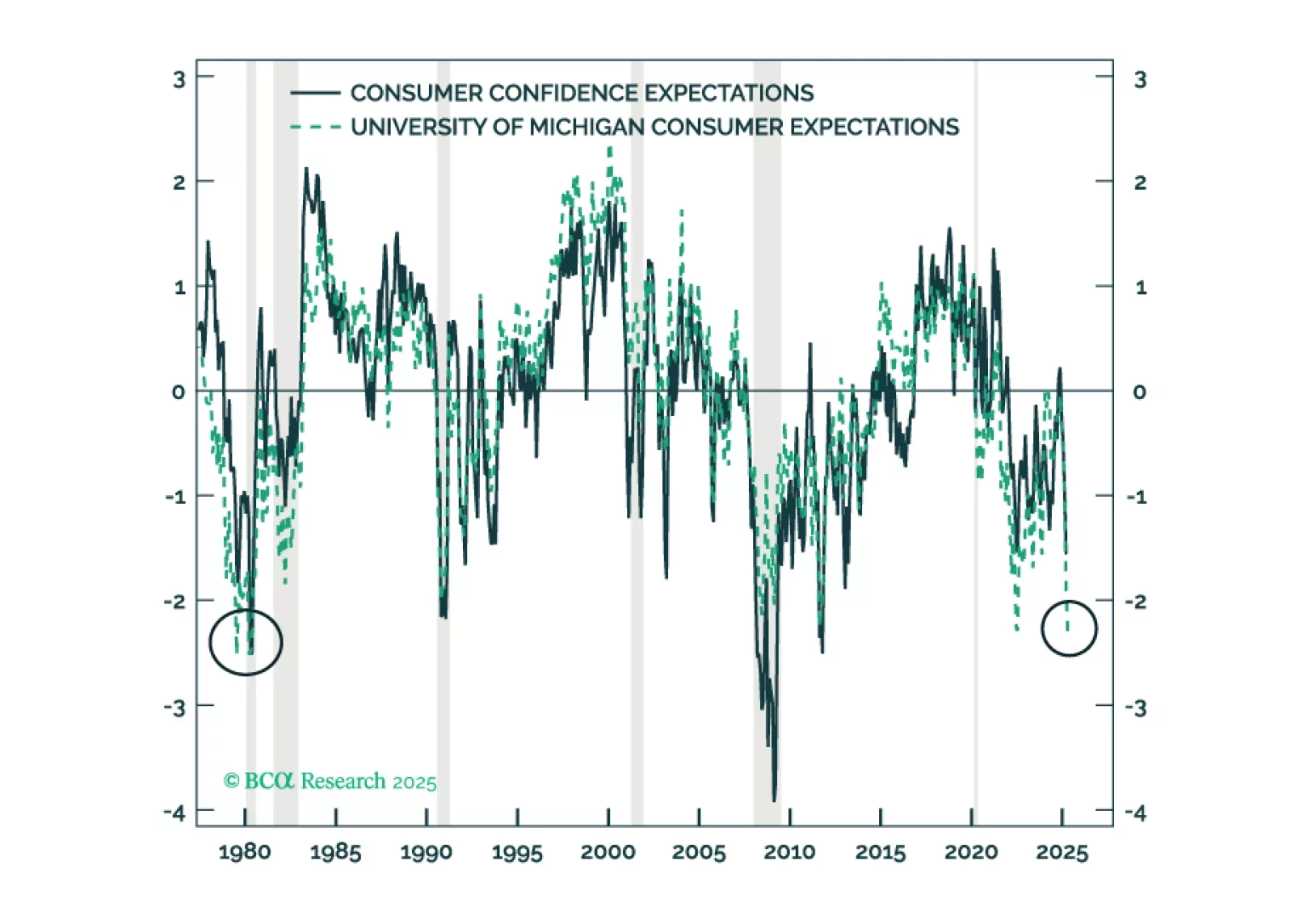

The policy-induced decline in consumer confidence has spread to businesses and investors, increasing the probability of a recession even if the administration reverses field on its aggressive tariff measures. We reiterate our…

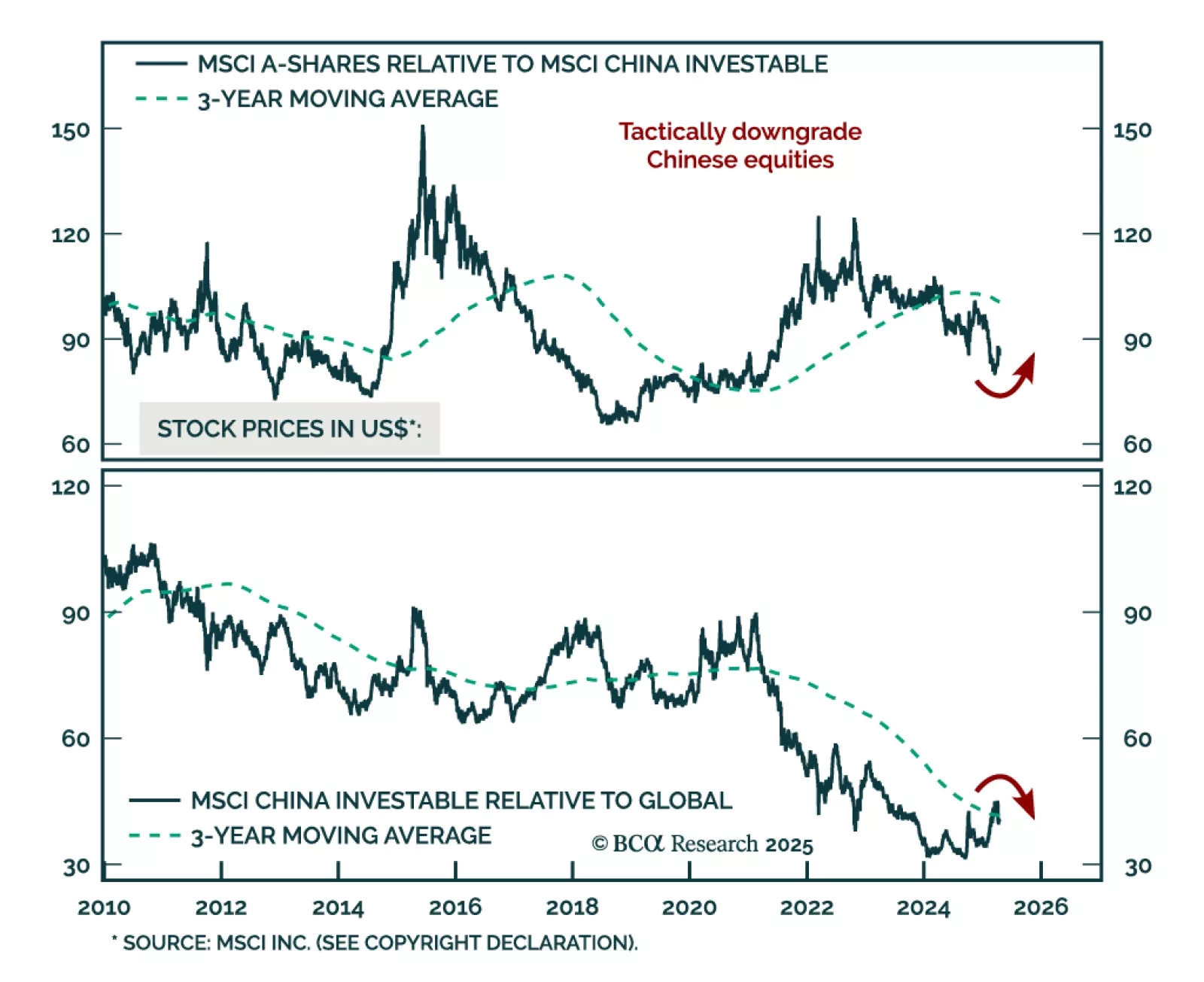

Our China strategists remain defensive and tactically downgrade MSCI China to underweight, citing escalating US China tariff tensions and subdued domestic demand. Favor government bonds over equities, defensive sectors, and A-Shares…

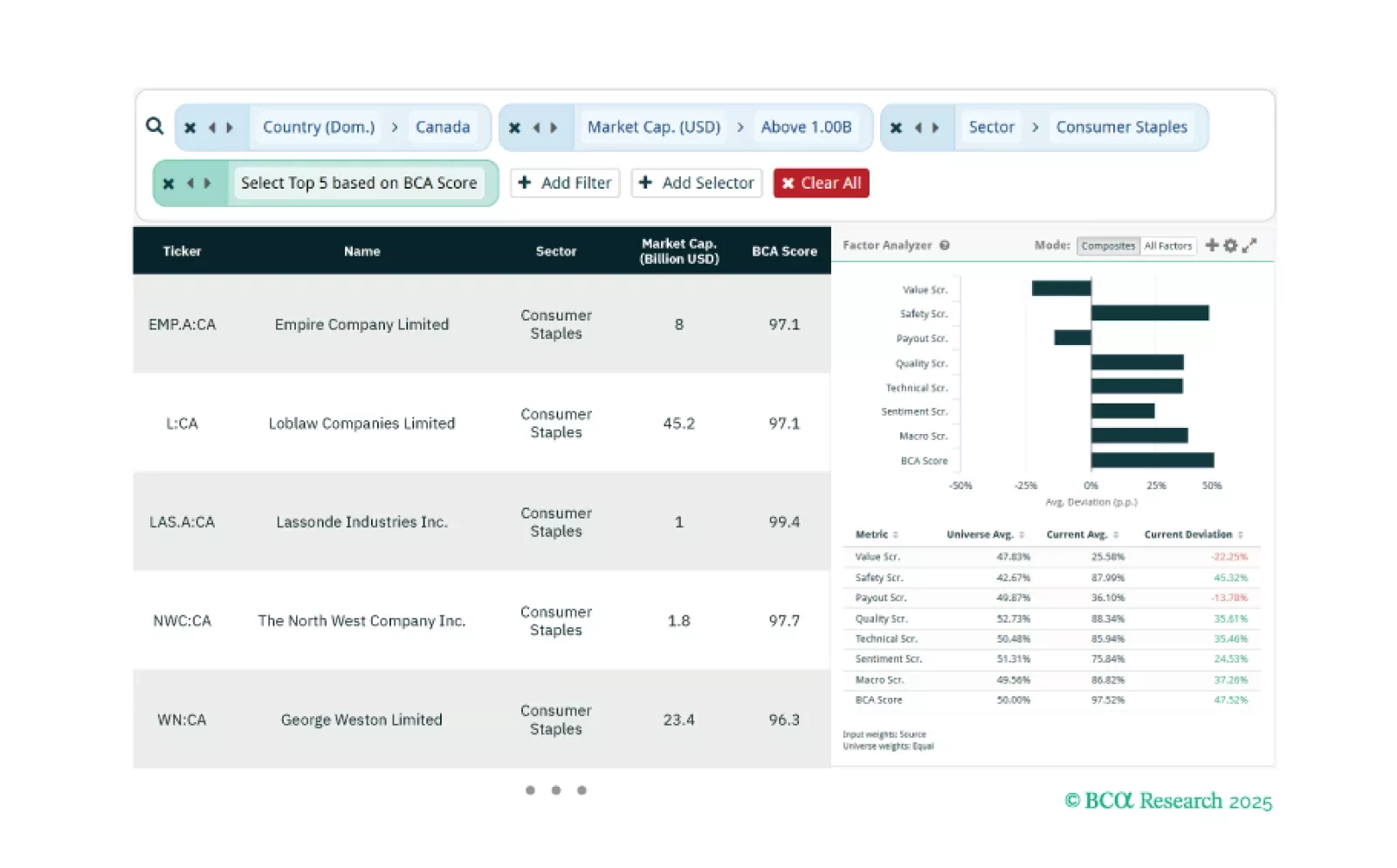

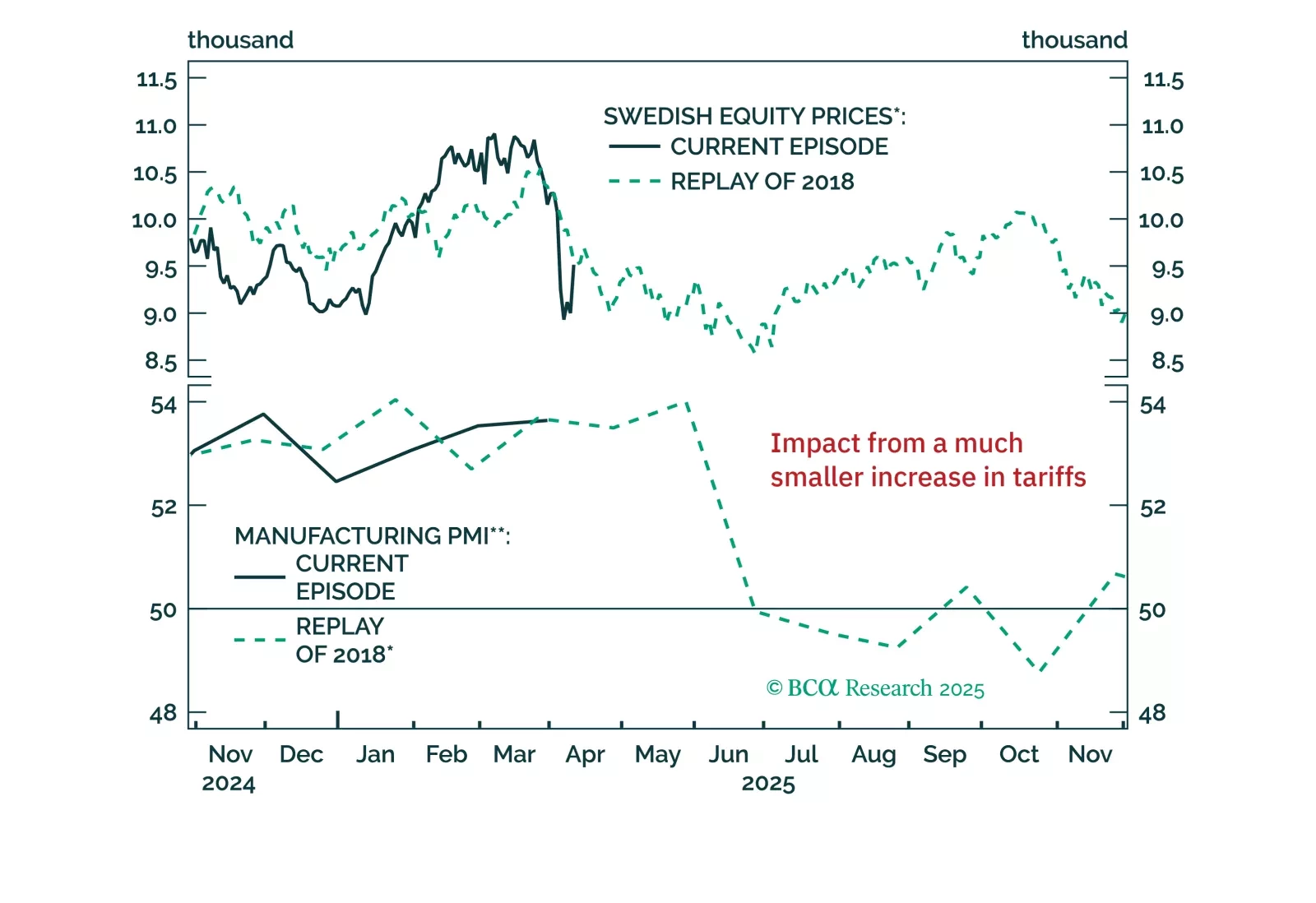

This week, our three screeners cover equity plays in: Canadian Consumer Staples, high-beta Swedish equities, and factor plays across global equities.

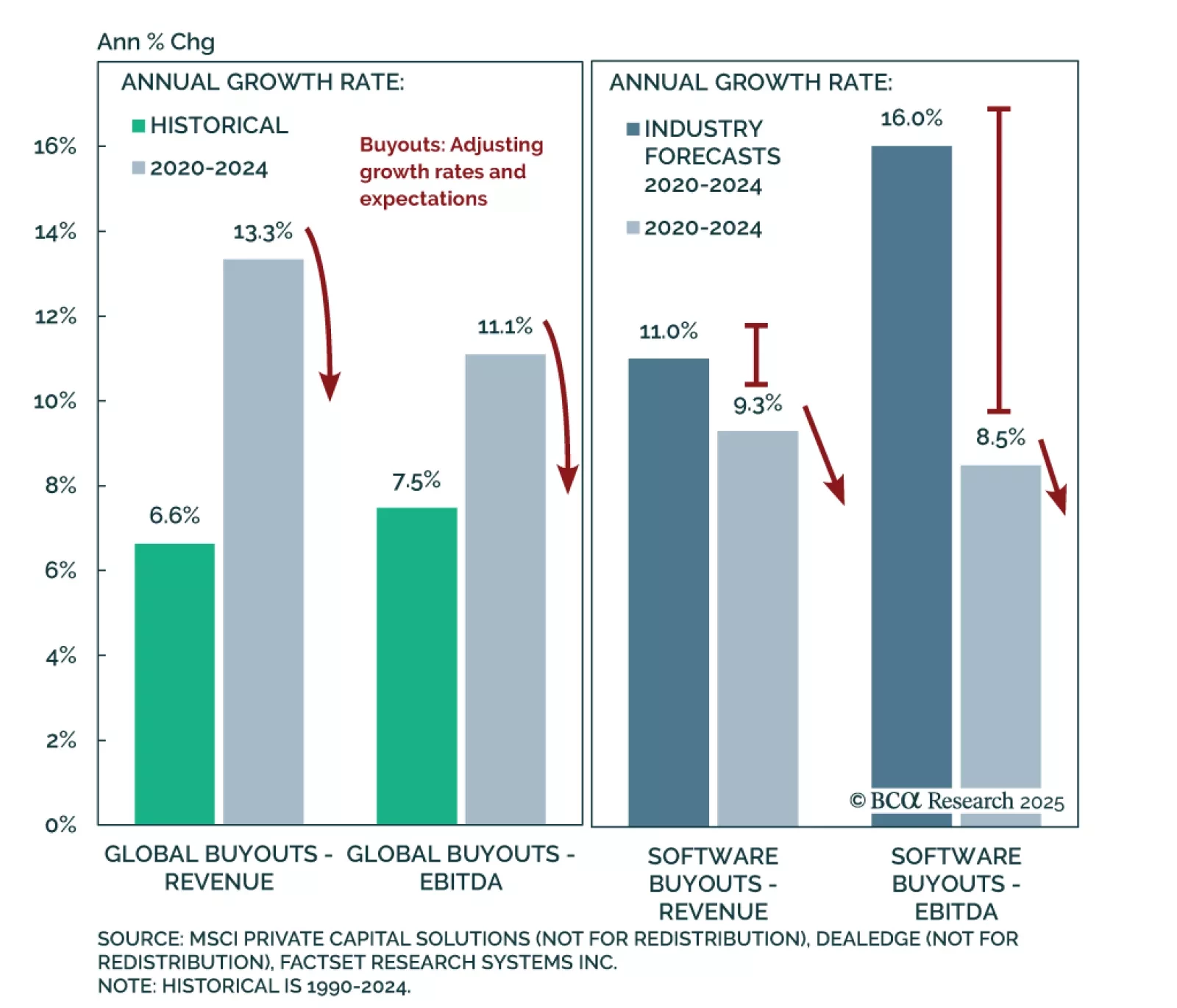

Our Private Markets & Alternatives strategists remain positioned for a downturn. Private Equity is most threatened as tariffs intensify existing recession risks. Buyout strategies face stress from record-low distributions…

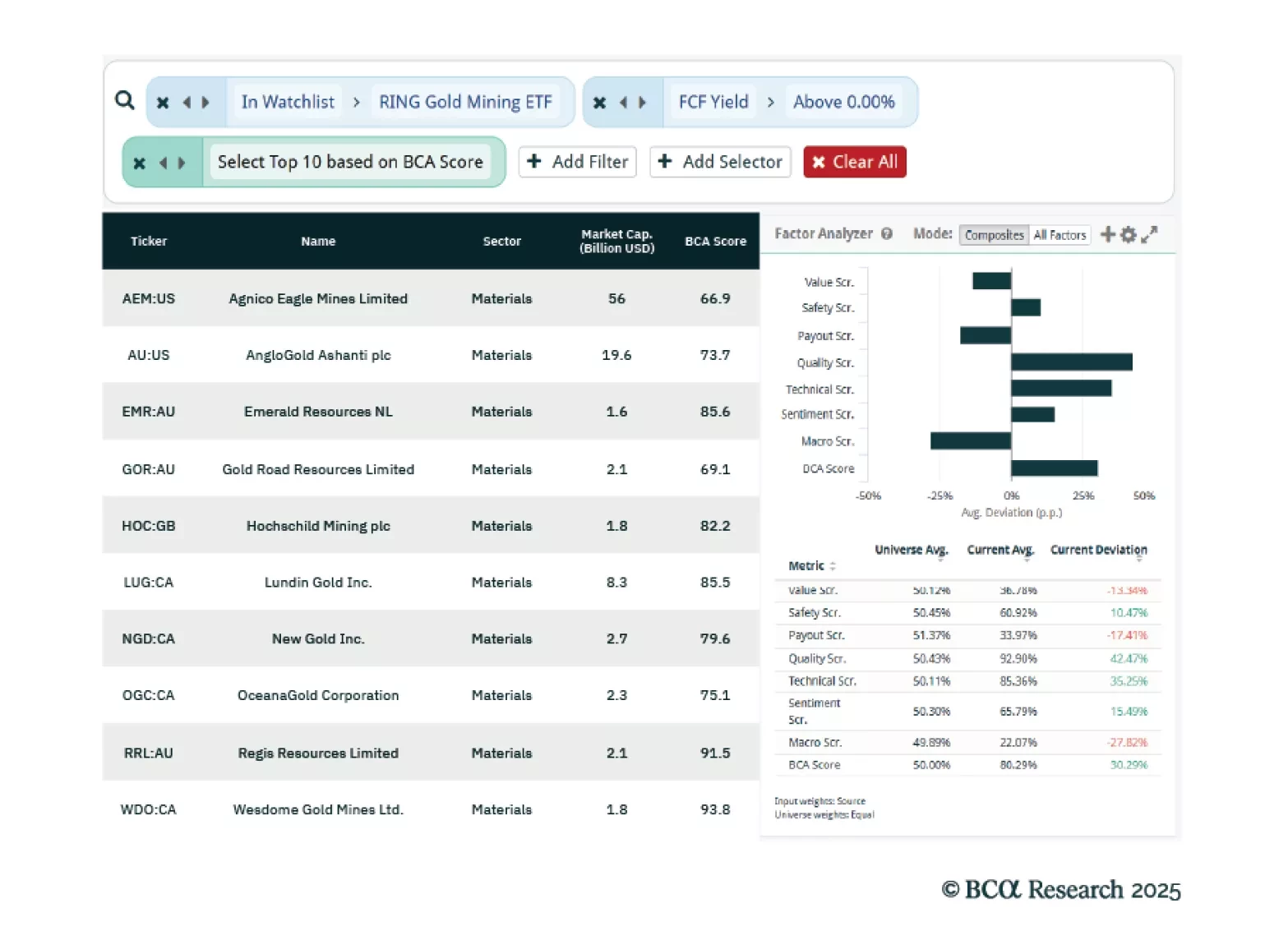

This week, our three screeners cover equity plays in: Gold mining stocks, Japanese Staples, and Implicit Dividend Yield.