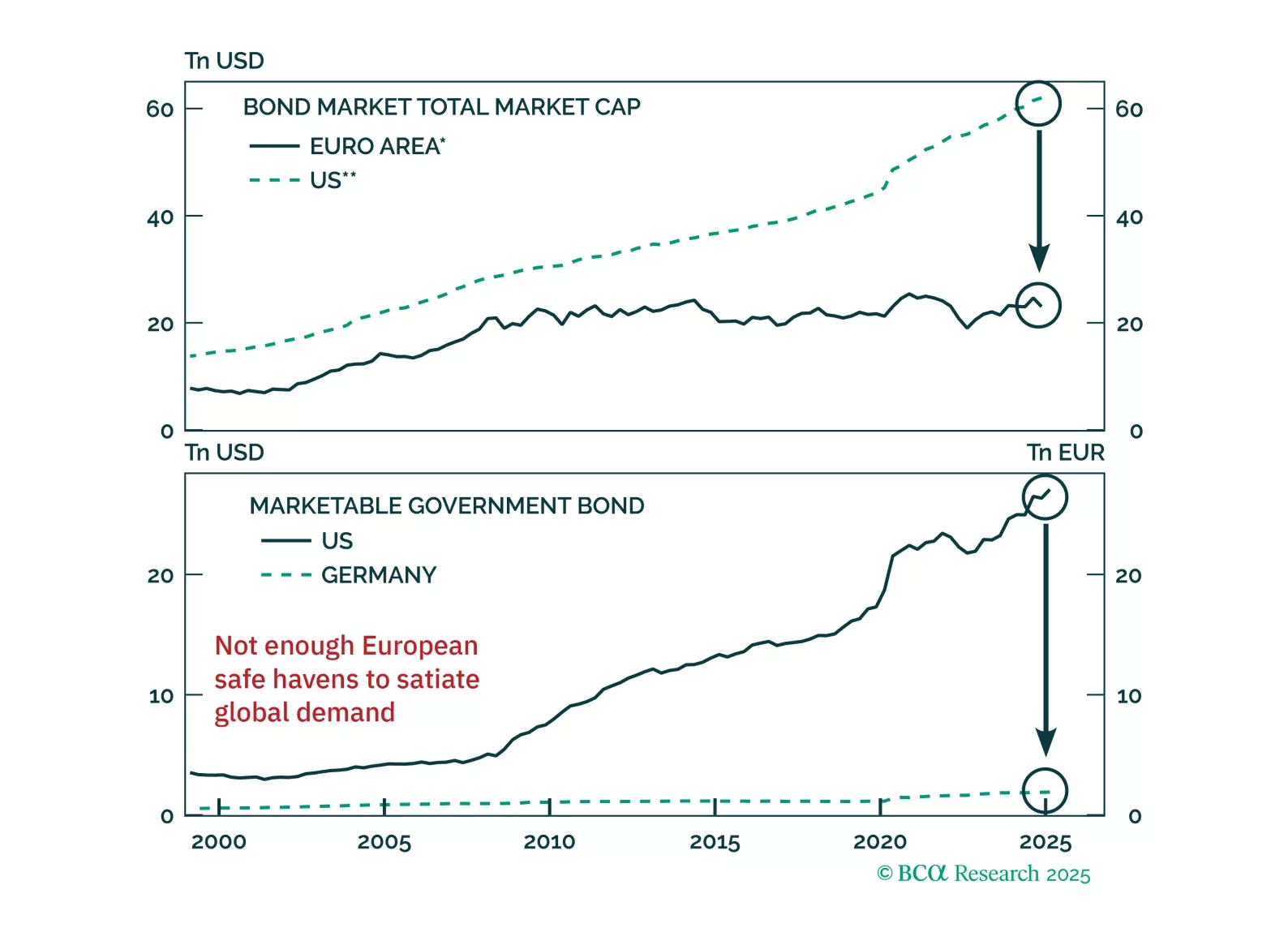

Are bunds the new Treasurys? The euro and German debt are gaining favor as safe havens, but markets may be overplaying the shift. Our latest report dissects what's durable, what's not, and how to trade the dislocation.

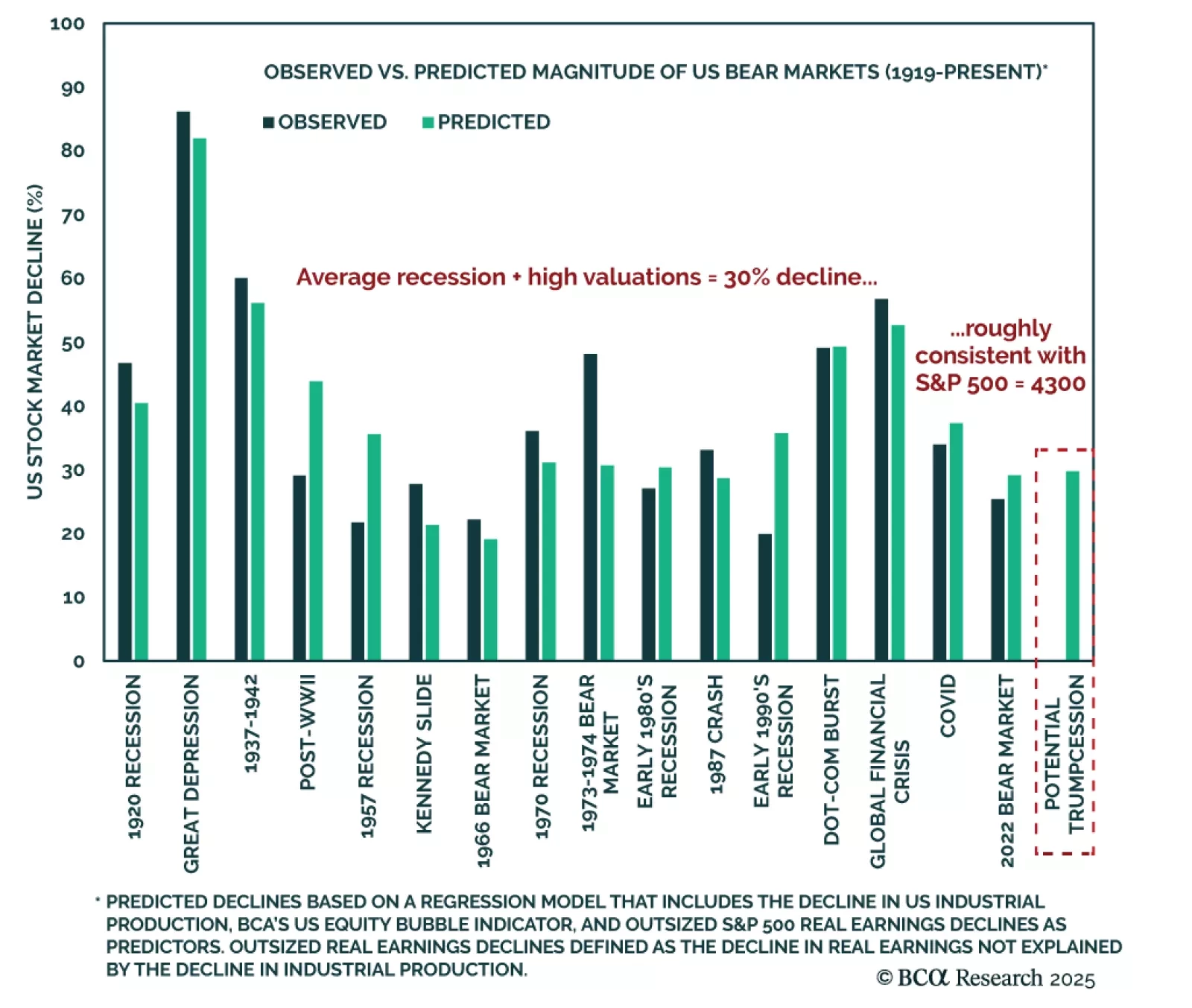

Based on valuations, equities have not yet bottomed. Our Chart Of The Week comes from Jonathan LaBerge, Chief Strategist for our Special Reports Unit. Jonathan builds on his recent work on equity bubbles to model the expected…

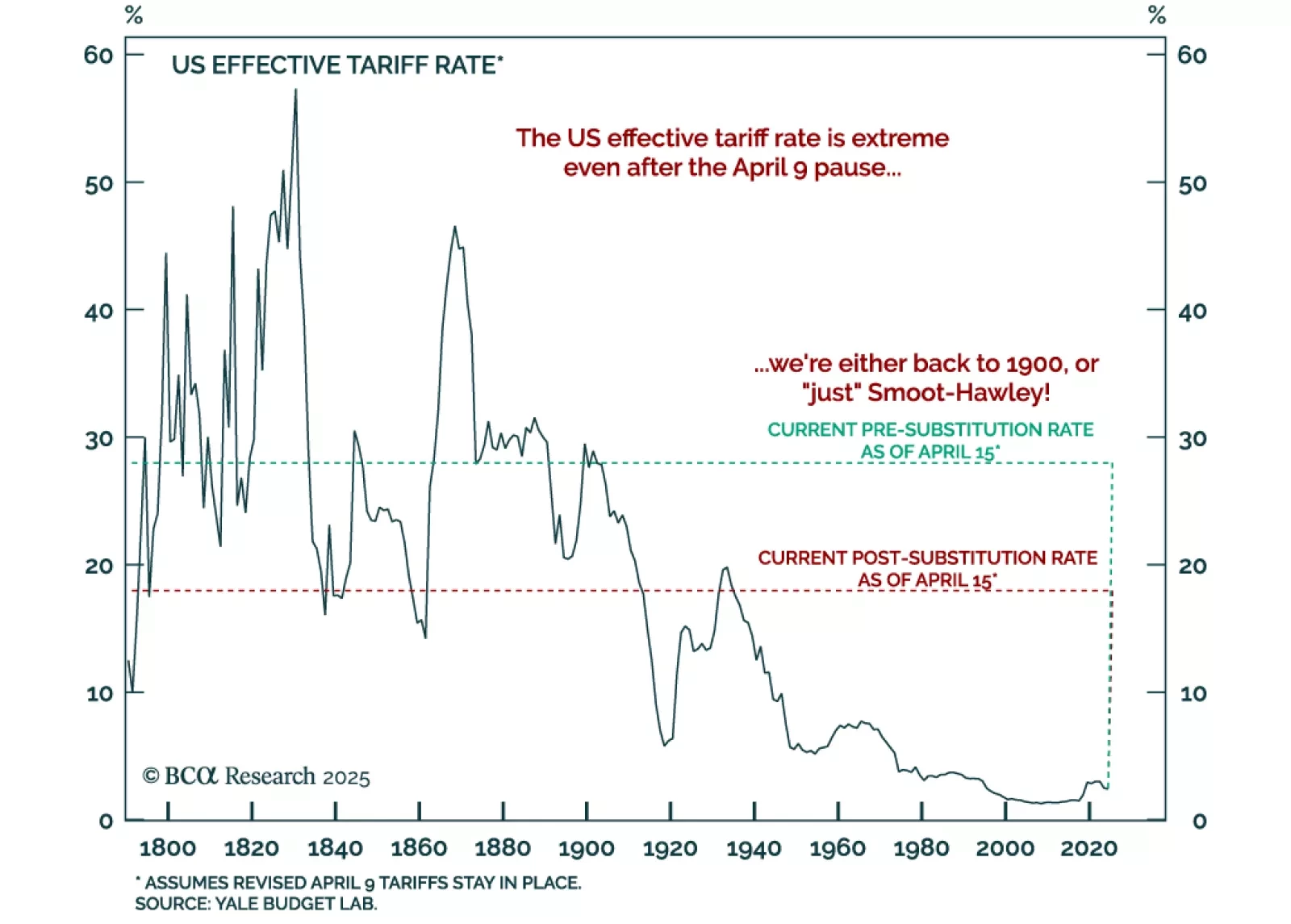

BCA’s House View recommends staying underweight stocks versus bonds, even in a stagflationary scenario. The US and global economies are likely to enter a recession this year unless tariffs are swiftly reversed or meaningful fiscal…

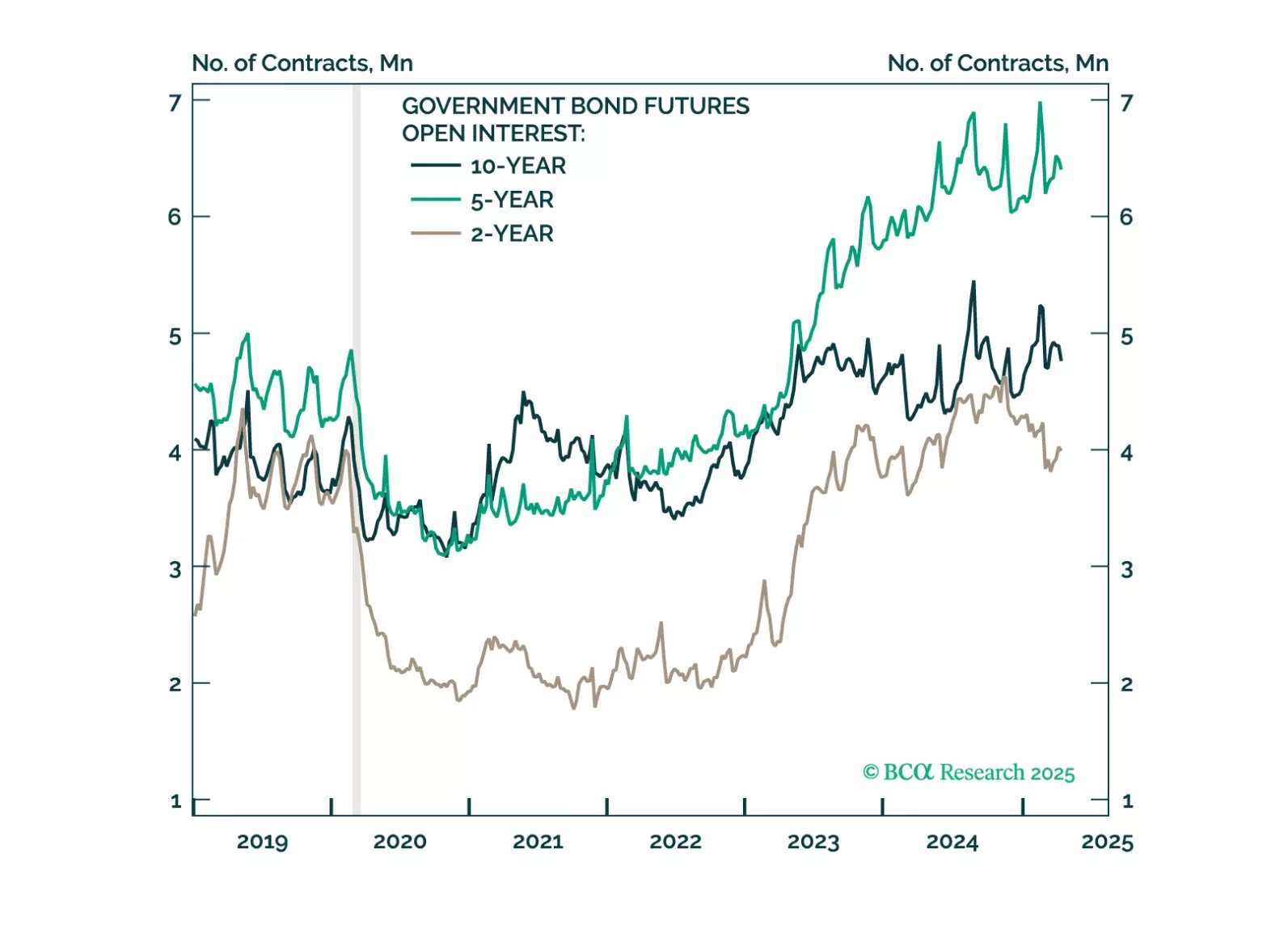

US Treasuries typically outperform both equities and global government bonds during downturns. Recent political shifts could lessen that outperformance this cycle, but we doubt it will disappear completely.

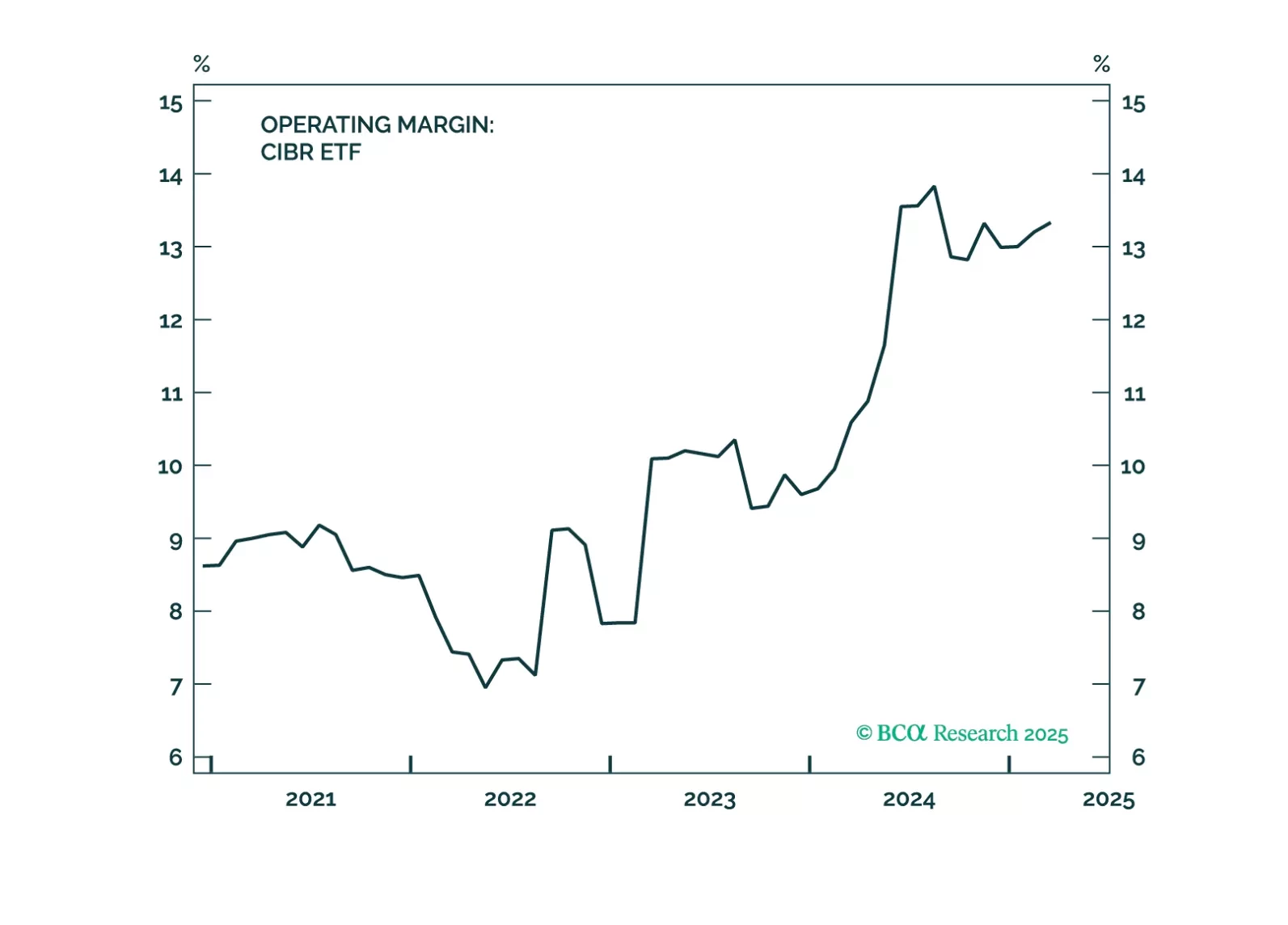

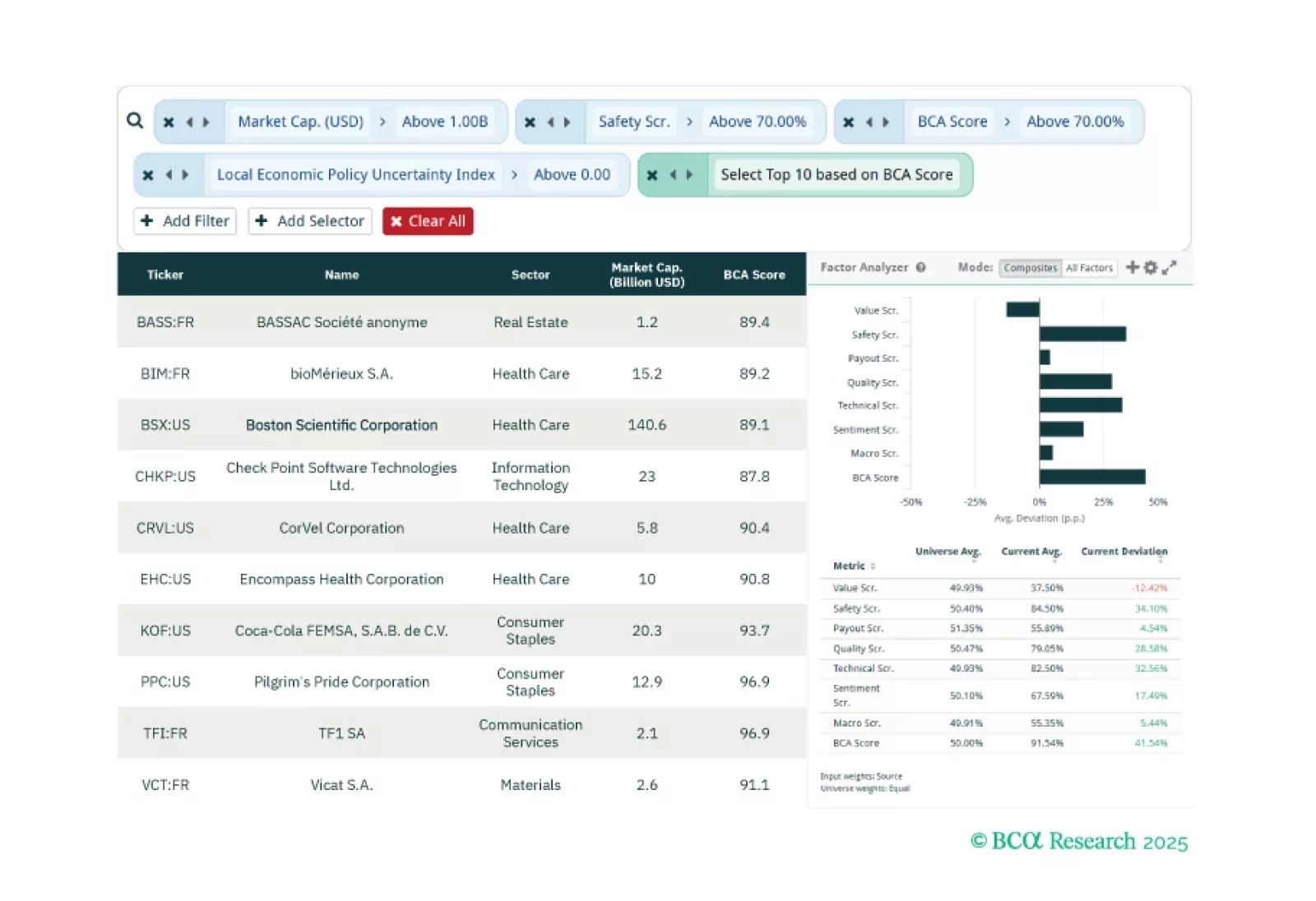

This week, our three screeners all cover equity plays centered around safe stock selection within Equity Analyzer.

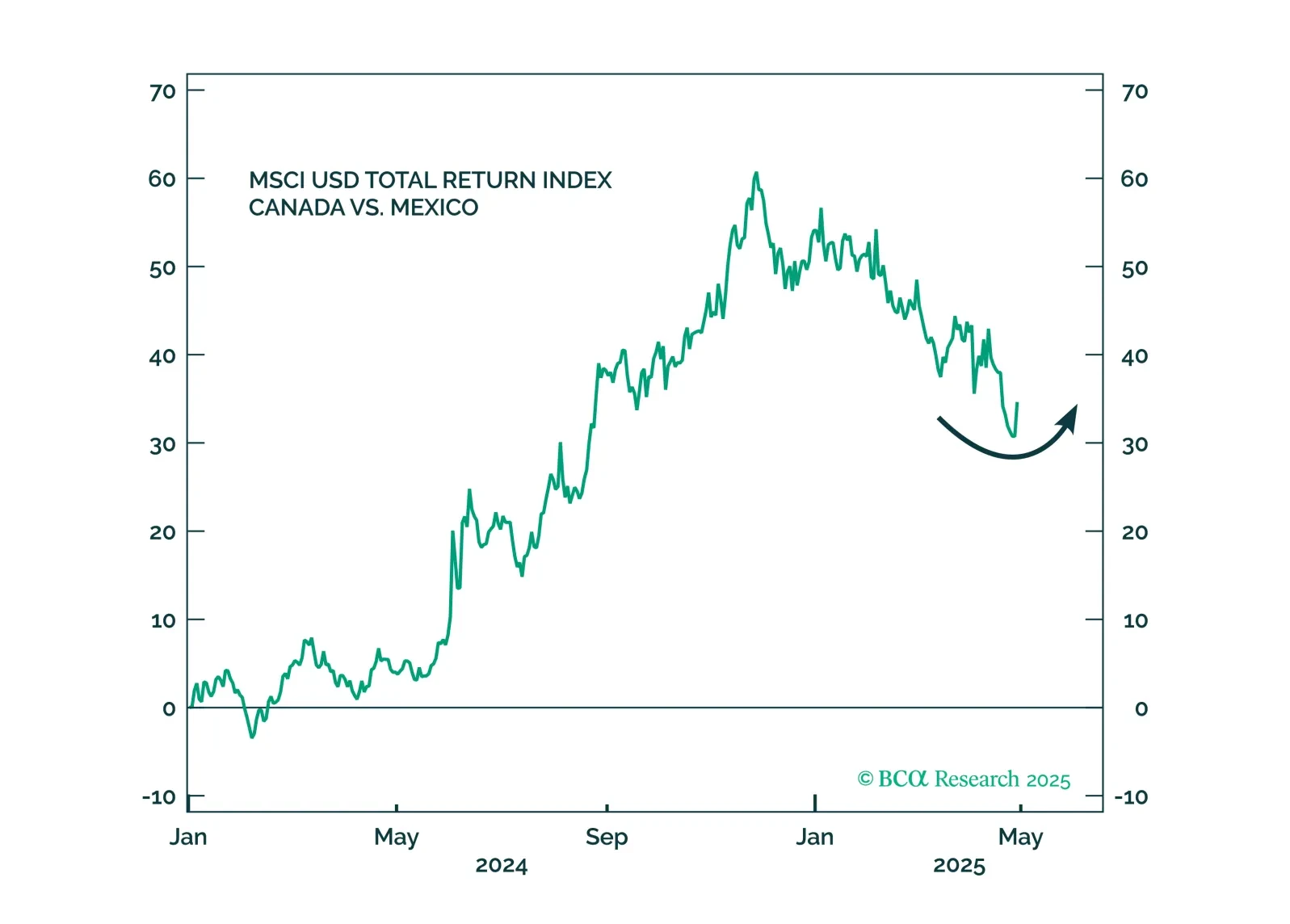

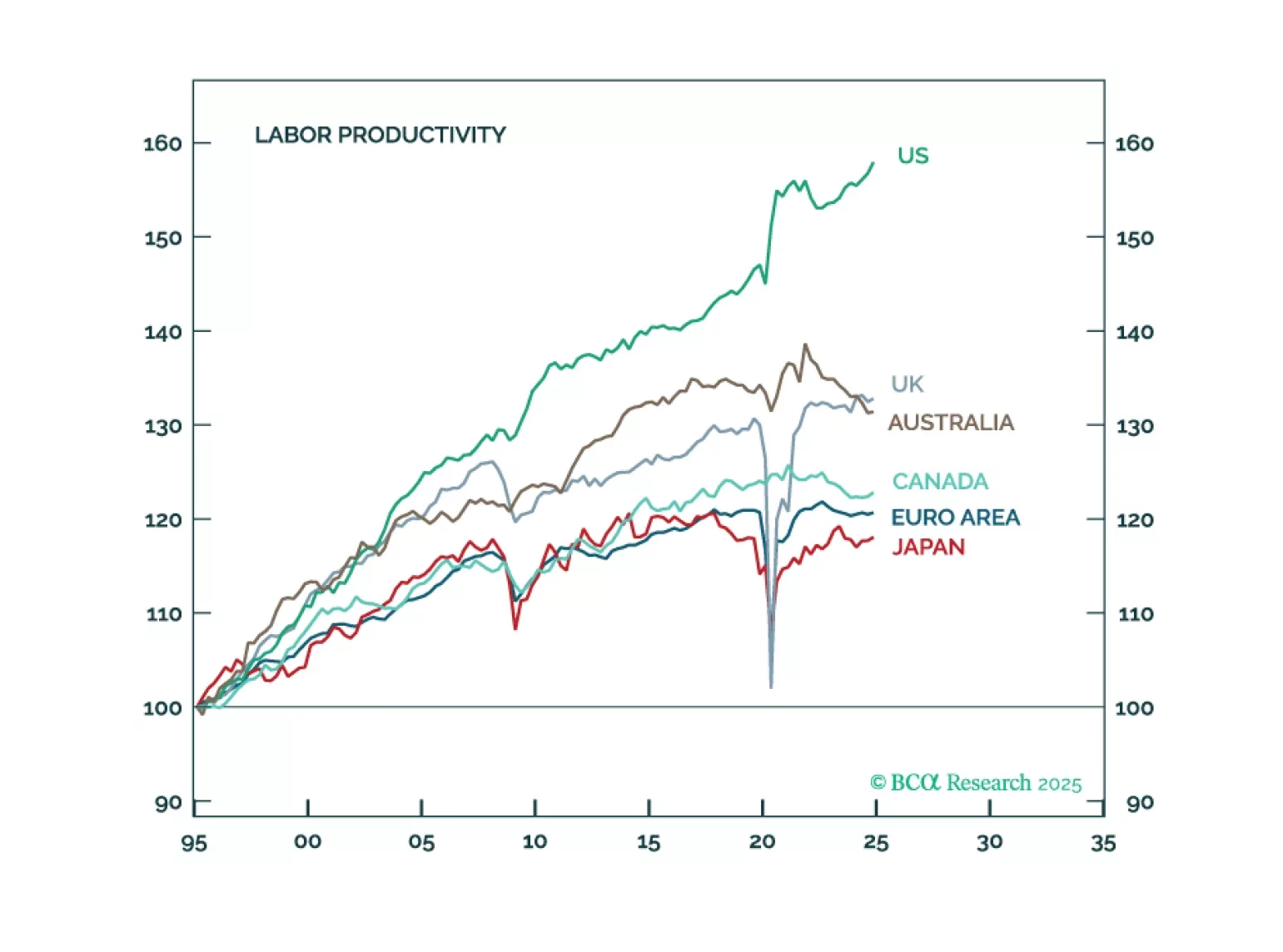

Although the sell-off in the US dollar and relative outperformance of non-US stocks will pause over the coming months as a global recession begins, the fading of US exceptionalism will still cause the dollar to weaken and US stocks…

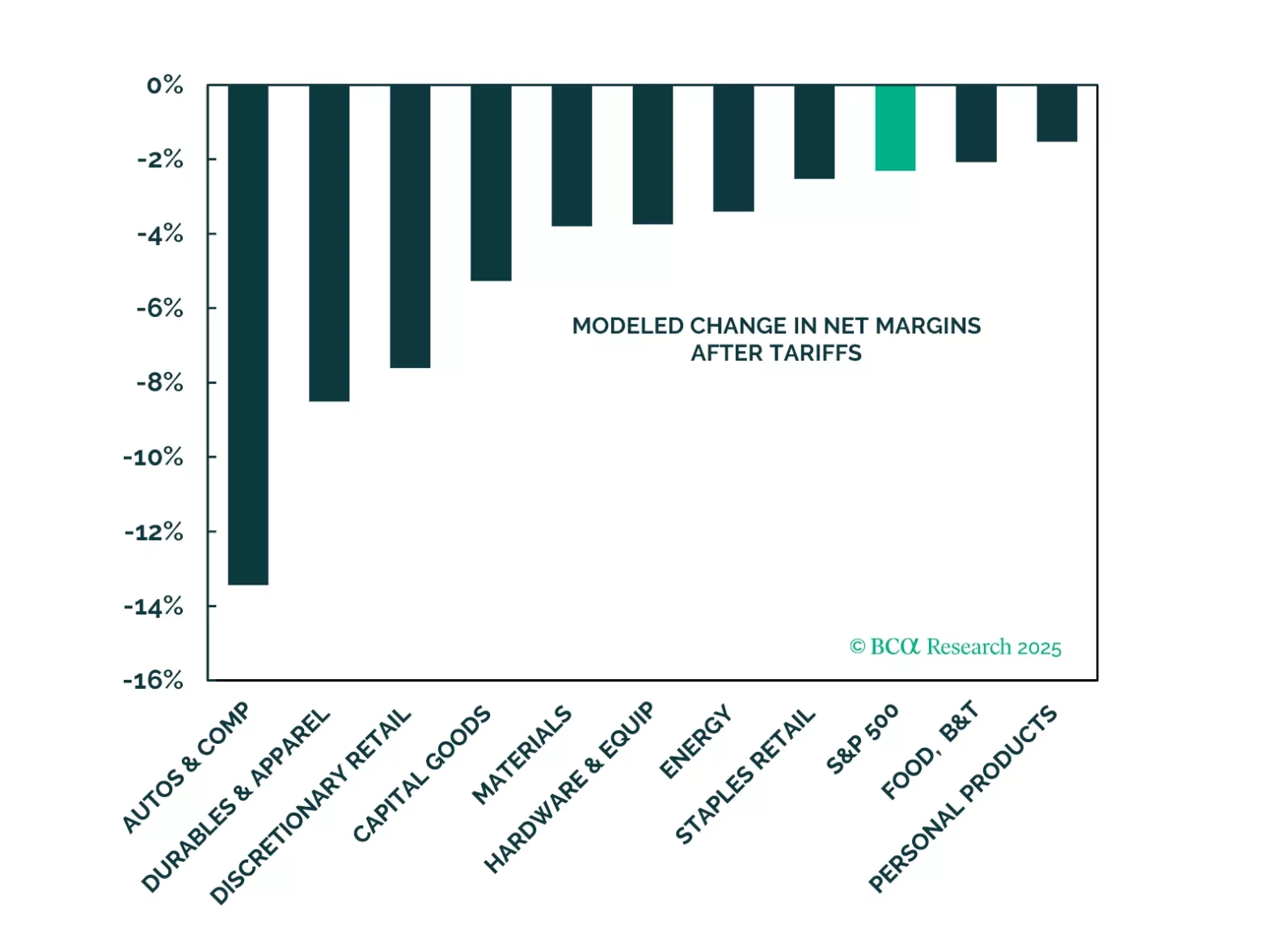

Last week, we hosted two webcasts for our clients globally to discuss the effects of tariffs on US equity sectors, preview the Q1 earnings season, and map out the trajectory of S&P 500 price performance. We also asked the webcast…