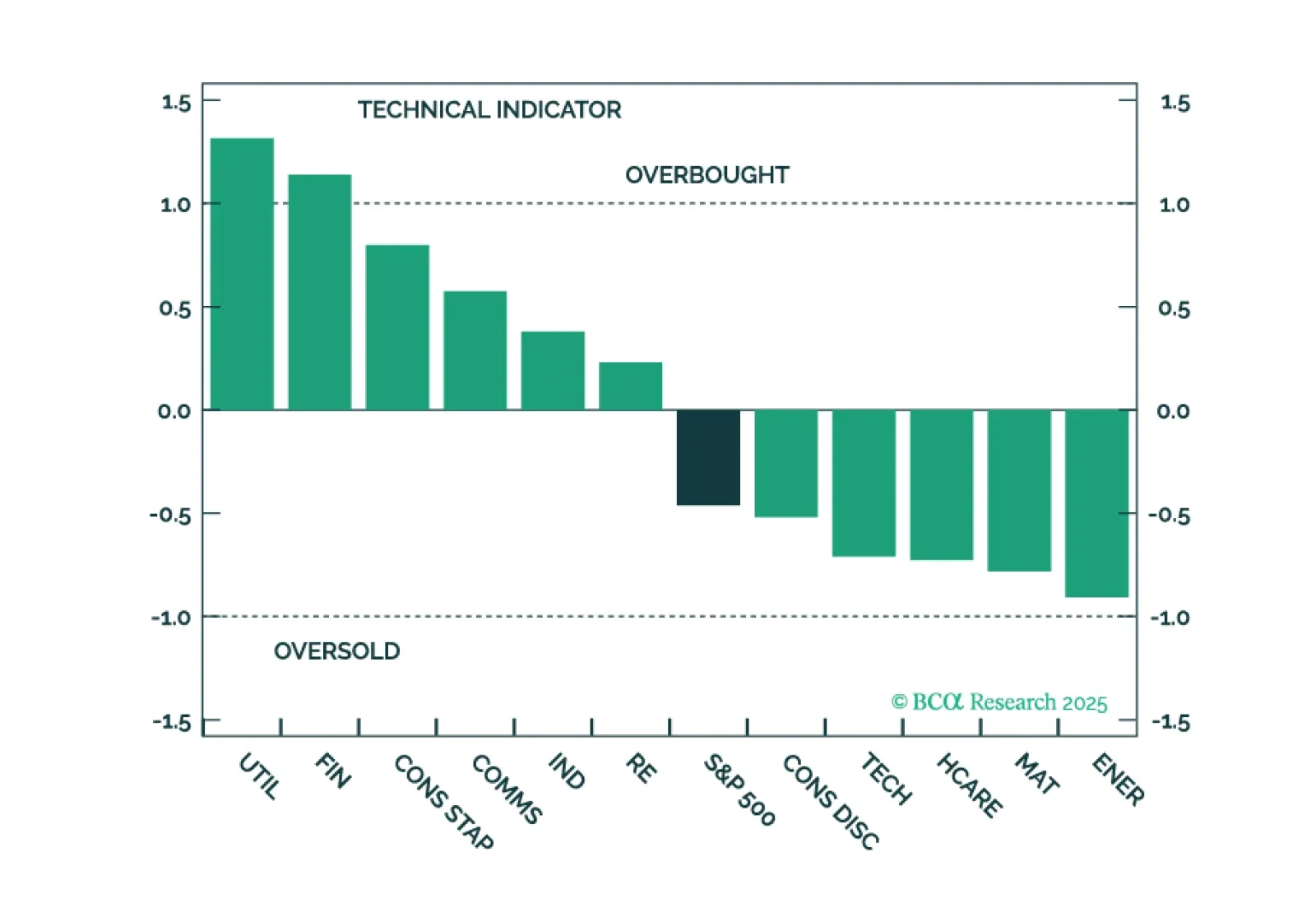

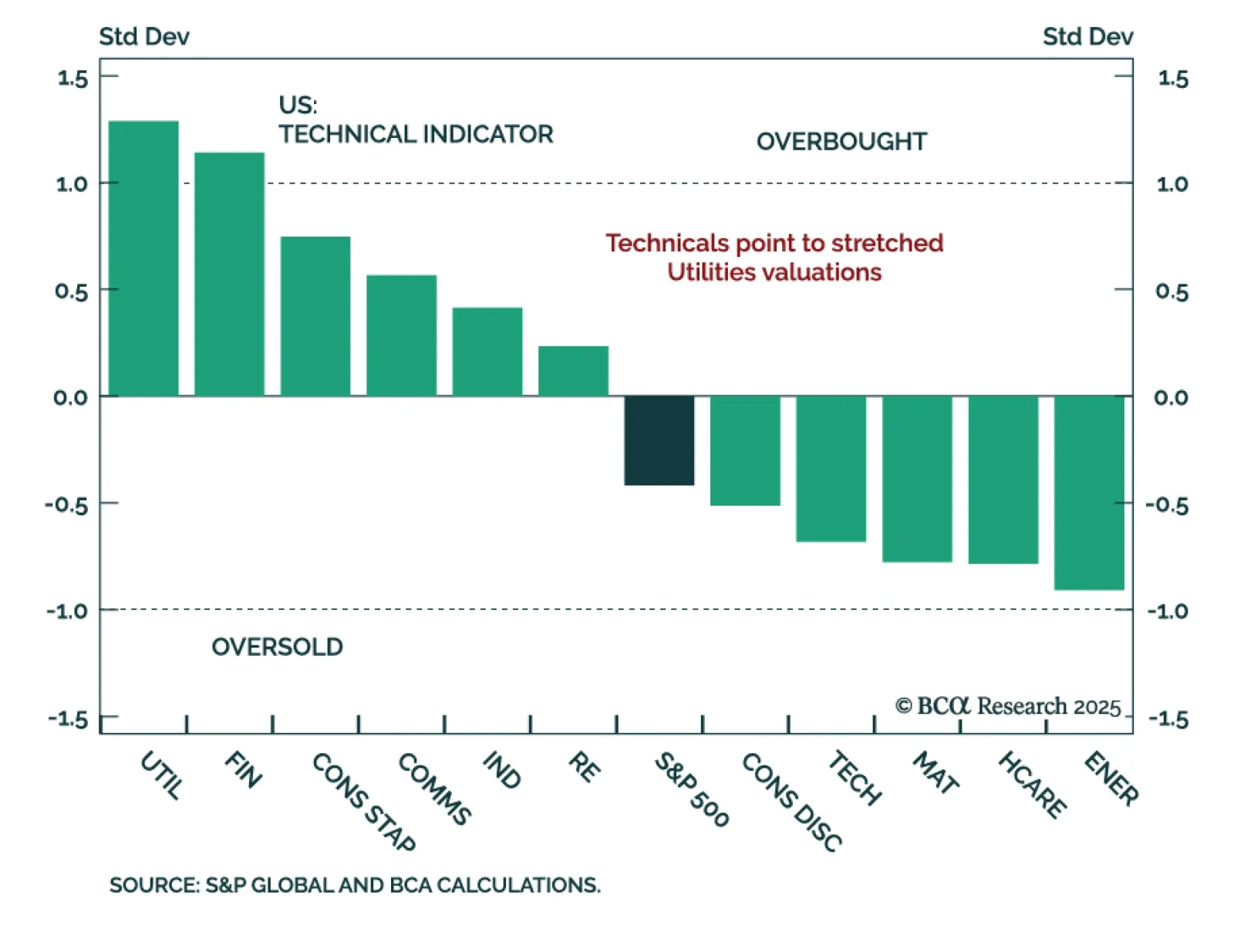

Our US Equity strategists are closing their tactical overweight in Utilities, as the trade is now crowded and priced for perfection. While the long-term outlook remains attractive, near-term upside is limited given elevated…

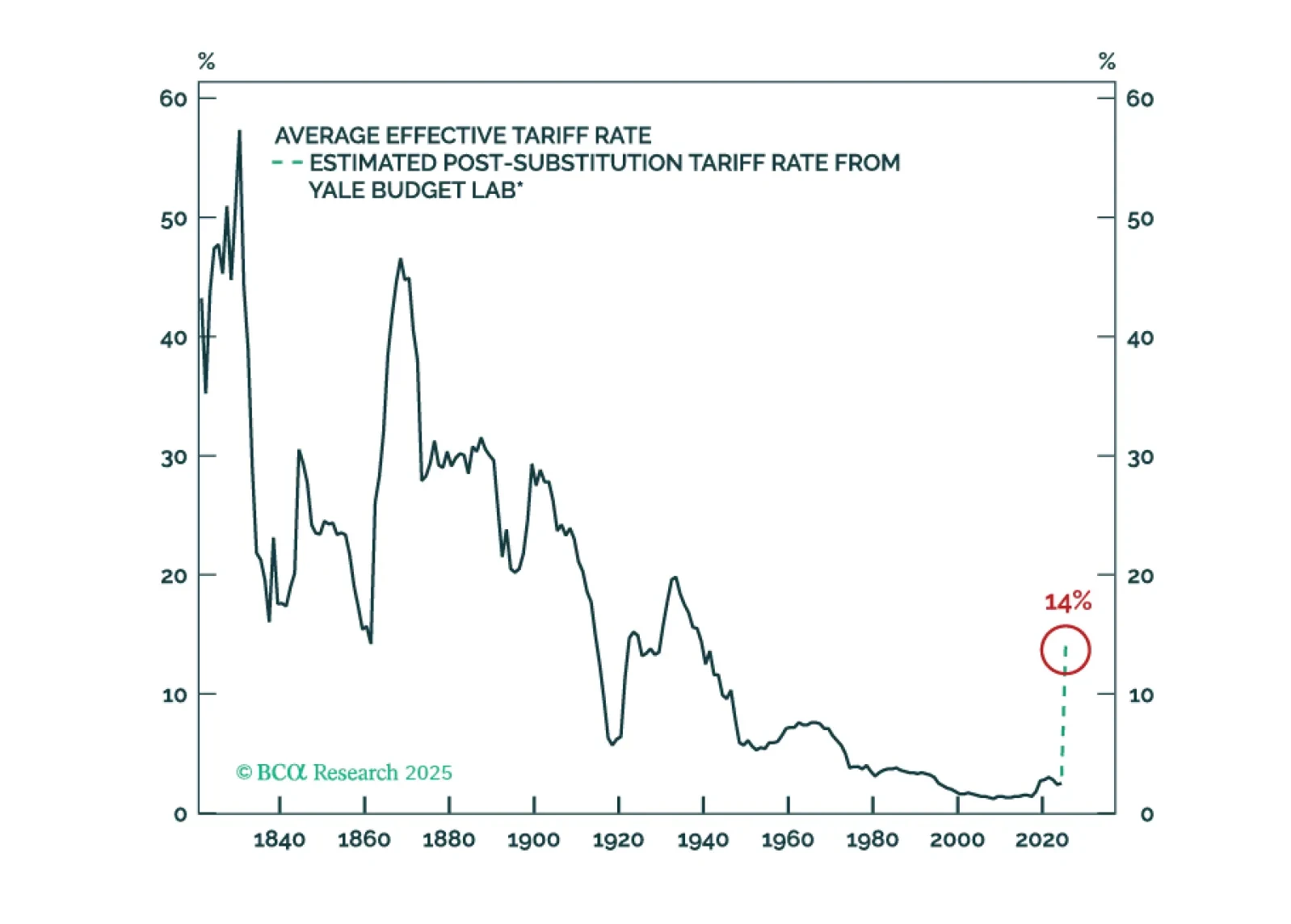

Markets are pricing out the worst trade policy fears, and while tariffs will still dent earnings, the impact looks smaller than initially feared. With sector rotation gaining traction and oversold names rebounding, we are adjusting…

A weakening economy will apply downward pressure to Treasury yields, but the Trump term premium will keep long-dated yields higher than they would otherwise be. This makes Treasury curve steepeners the most attractive trade in US…

Utilities remain a long-term structural investment theme thanks to the tailwinds from GenAI, EV, and onshoring. However, there is little upside left over the tactical investment horizon as all the positives are priced in. We…

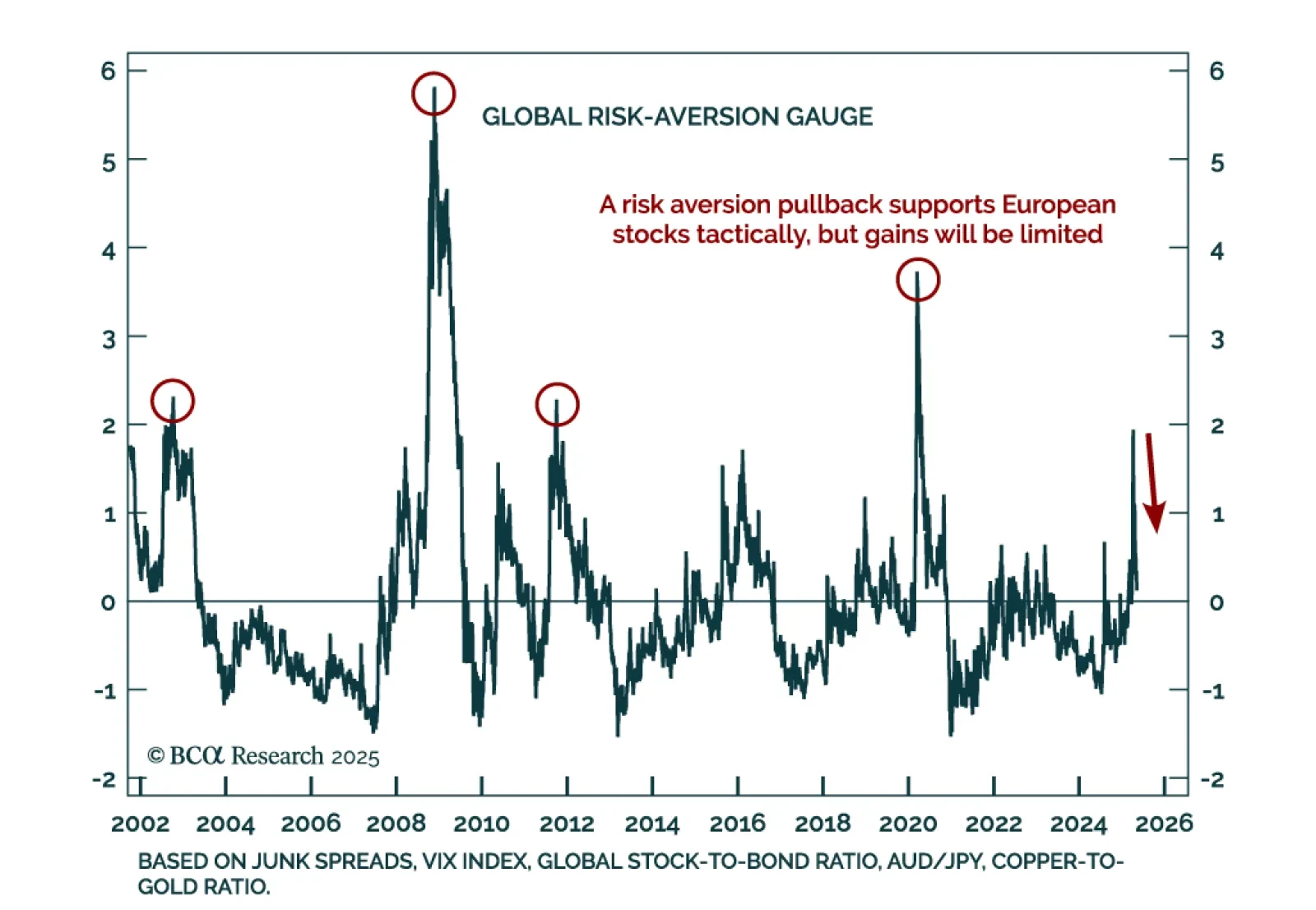

European equities have some short-term support, but global growth risks will cap gains. Our Chart Of The Week comes from Mathieu Savary, Chief European Investment Strategist. Mathieu sees probable but limited upside for European…

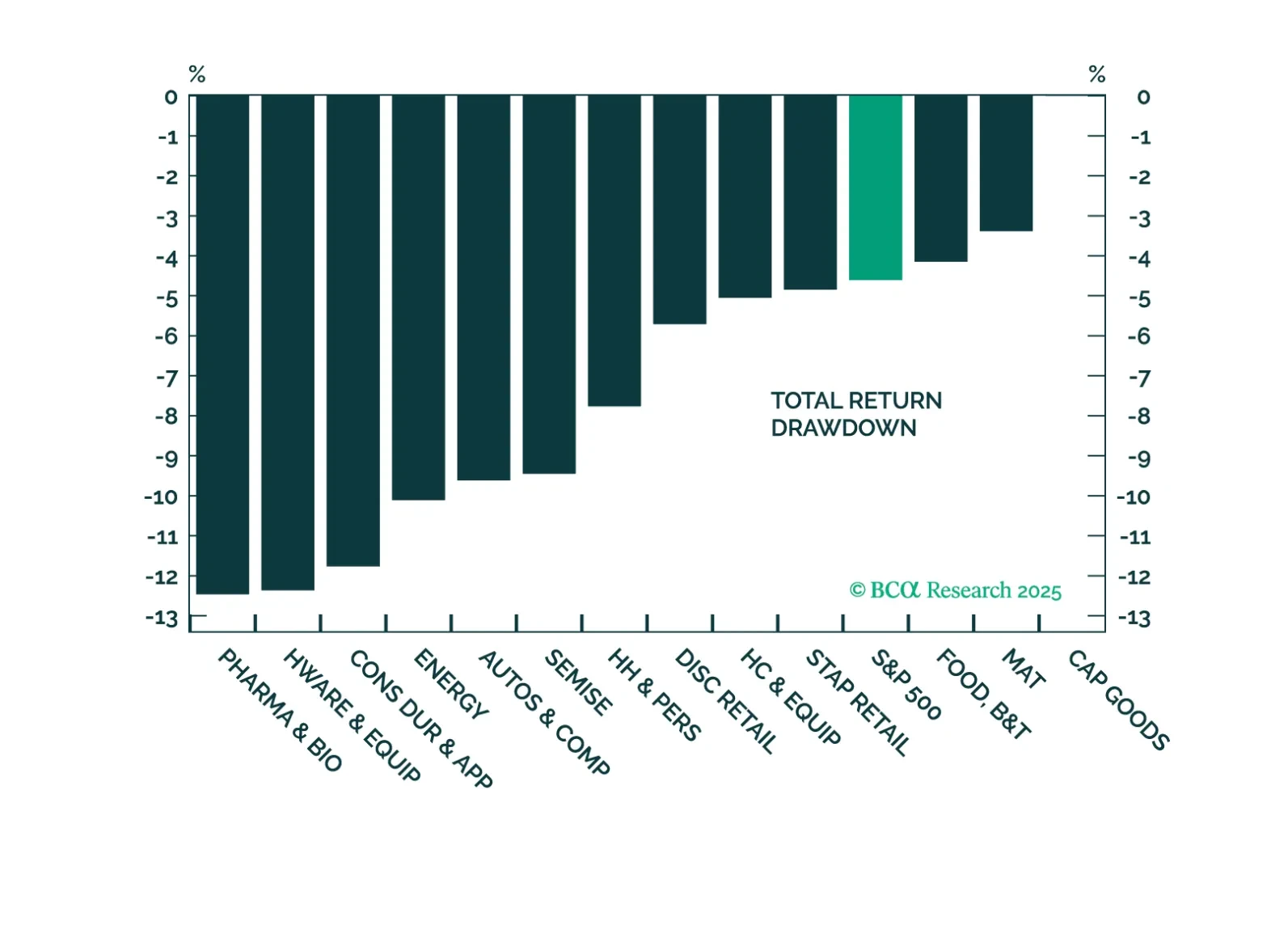

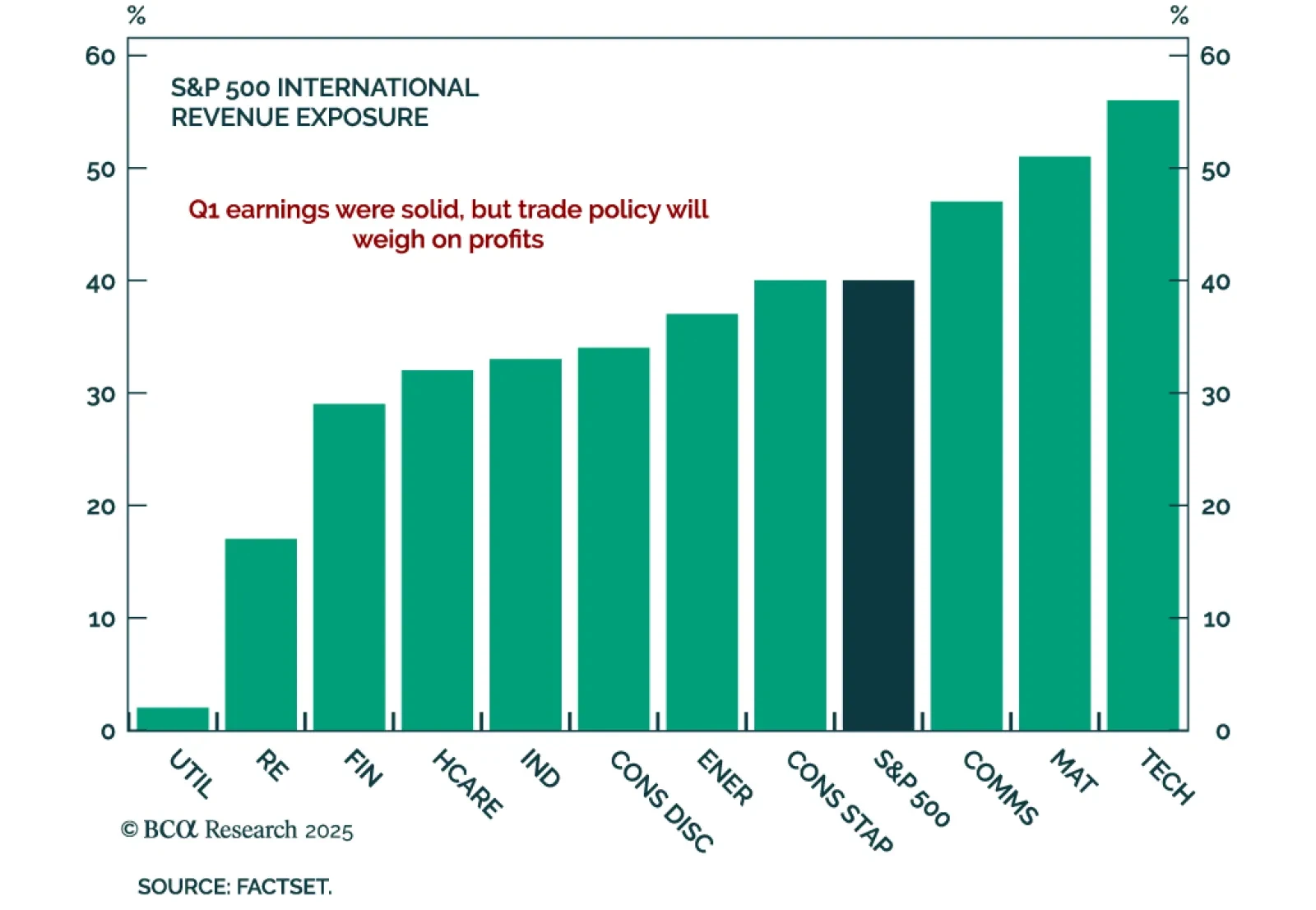

Q1 earnings point to risks for goods-focused sectors, reinforcing our US Equity strategists’ call to overweight services, upstream names, and domestic plays. With most S&P 500 companies having reported Q1 2025 earnings, the…

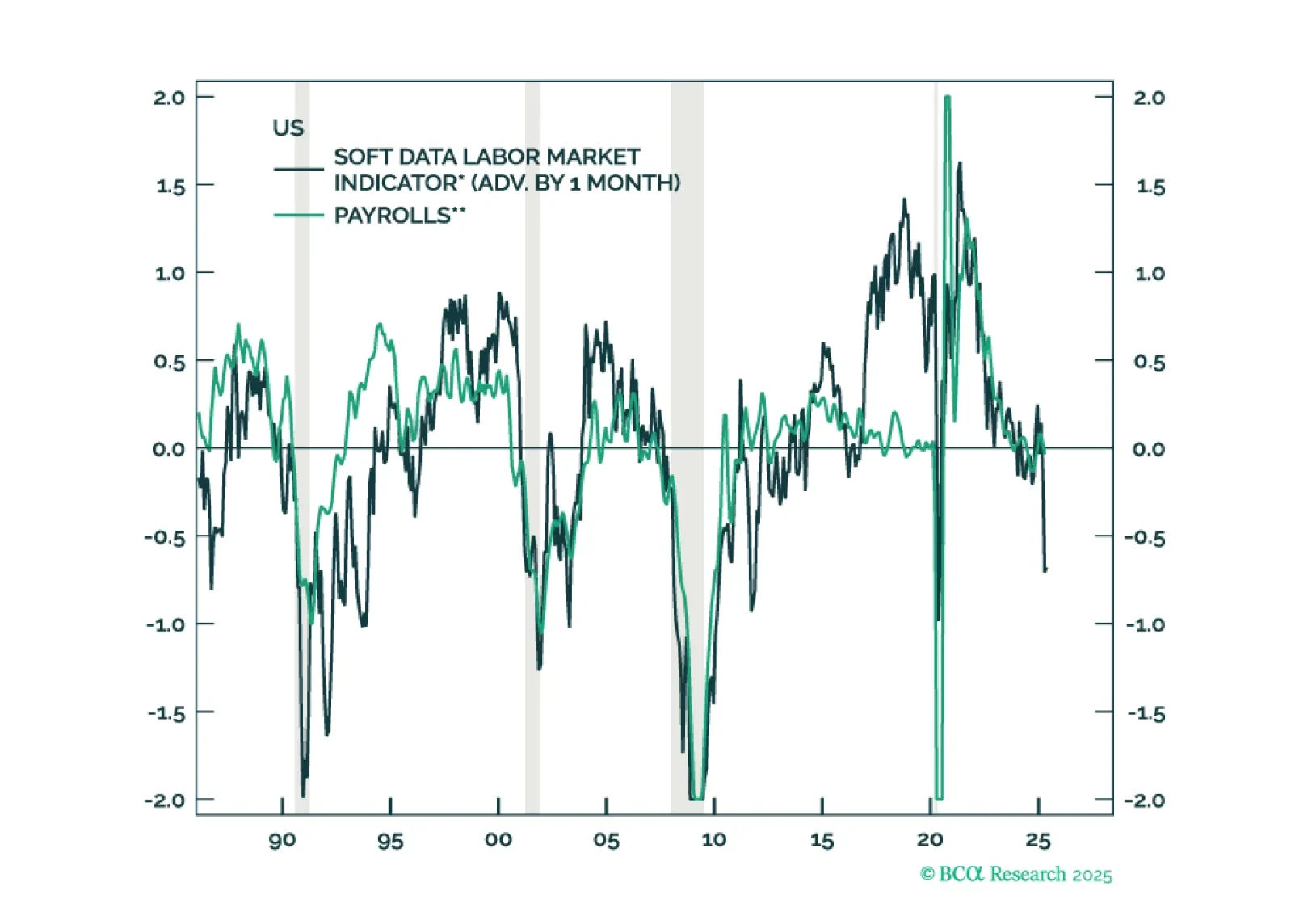

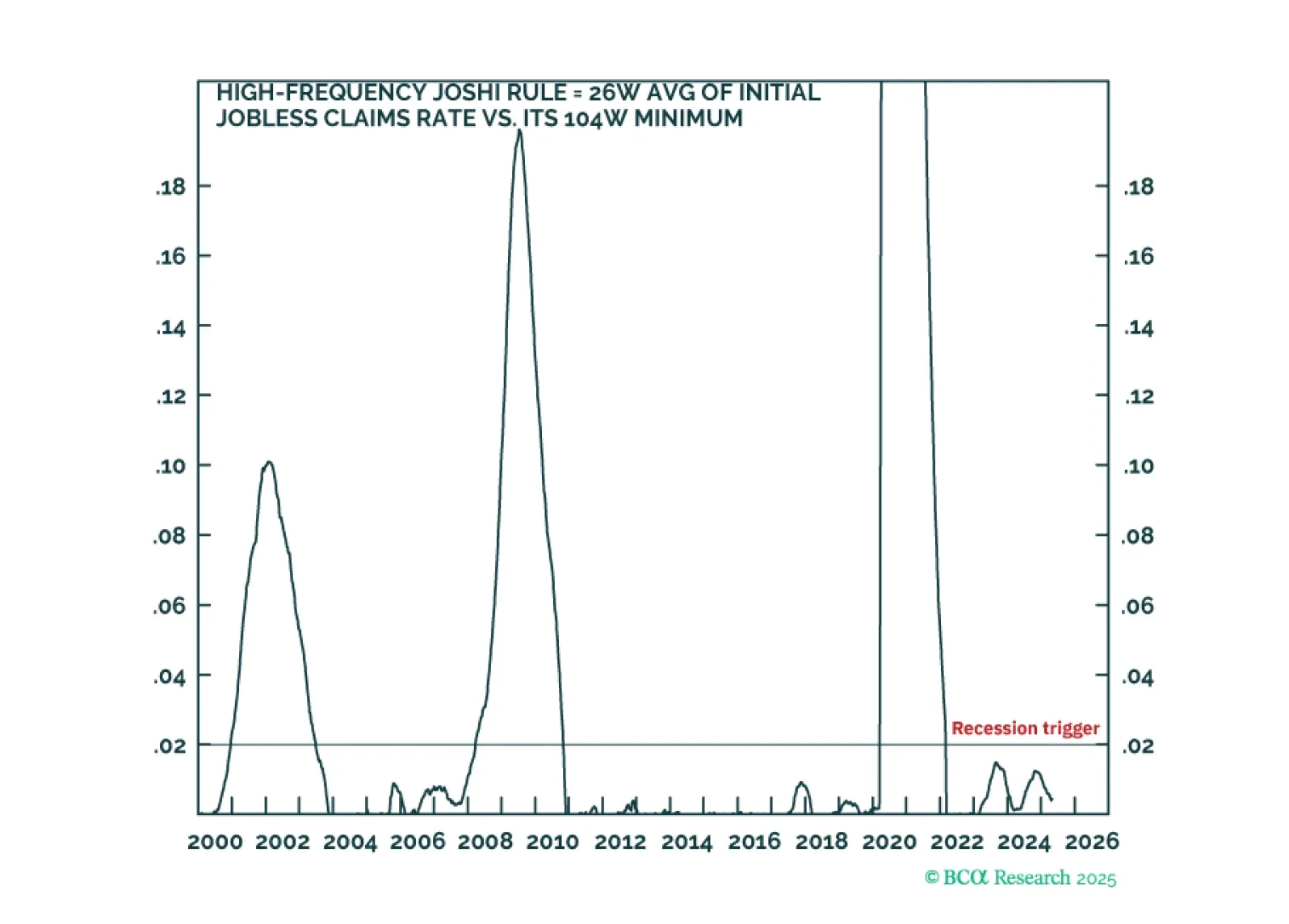

Today, we are introducing an additional ‘high-frequency Joshi rule’ which is updated weekly. The Joshi rules tell us that a US recession is not imminent. Until the Joshi rules are triggered, overweight non-US government bonds, and…