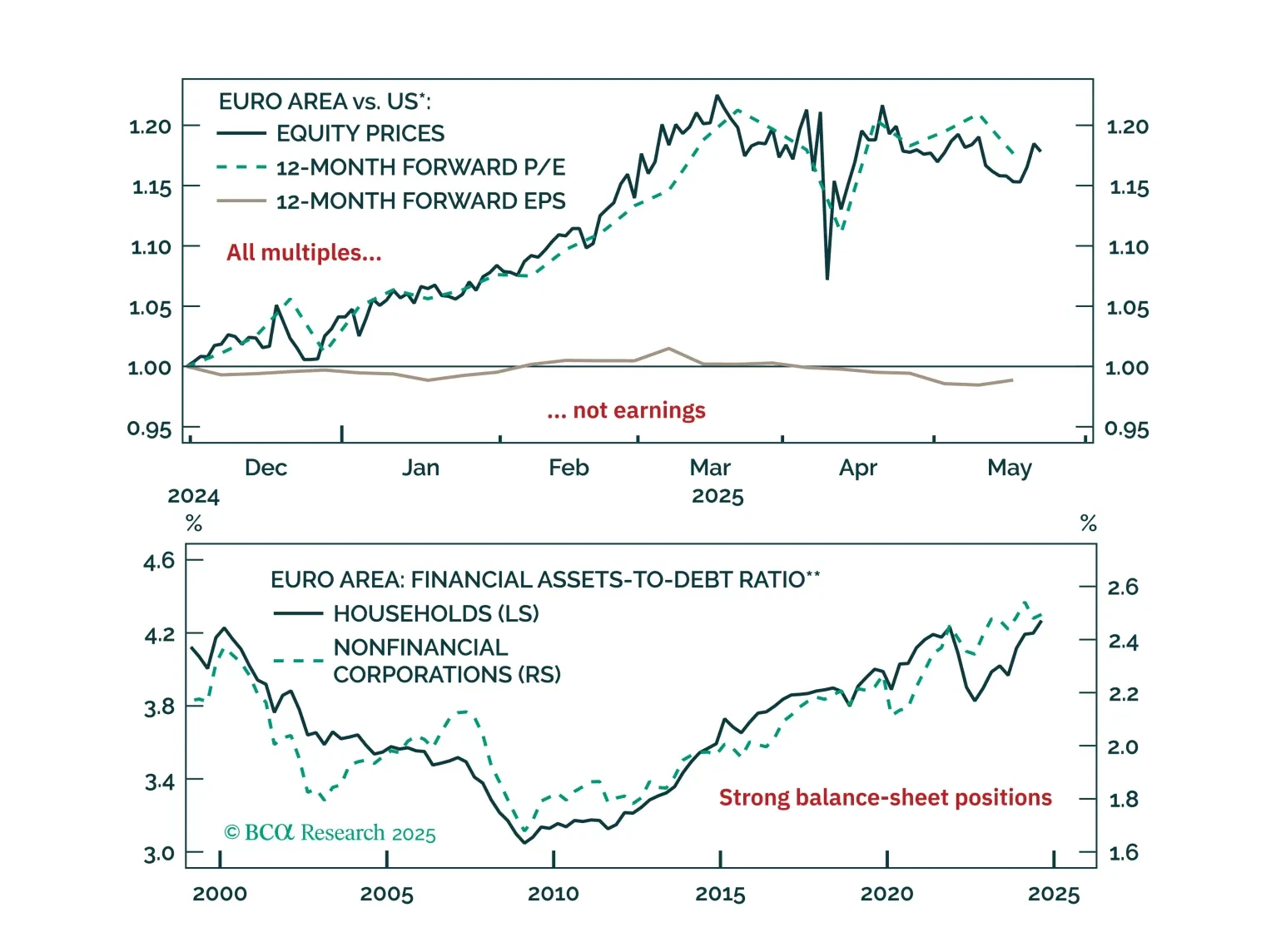

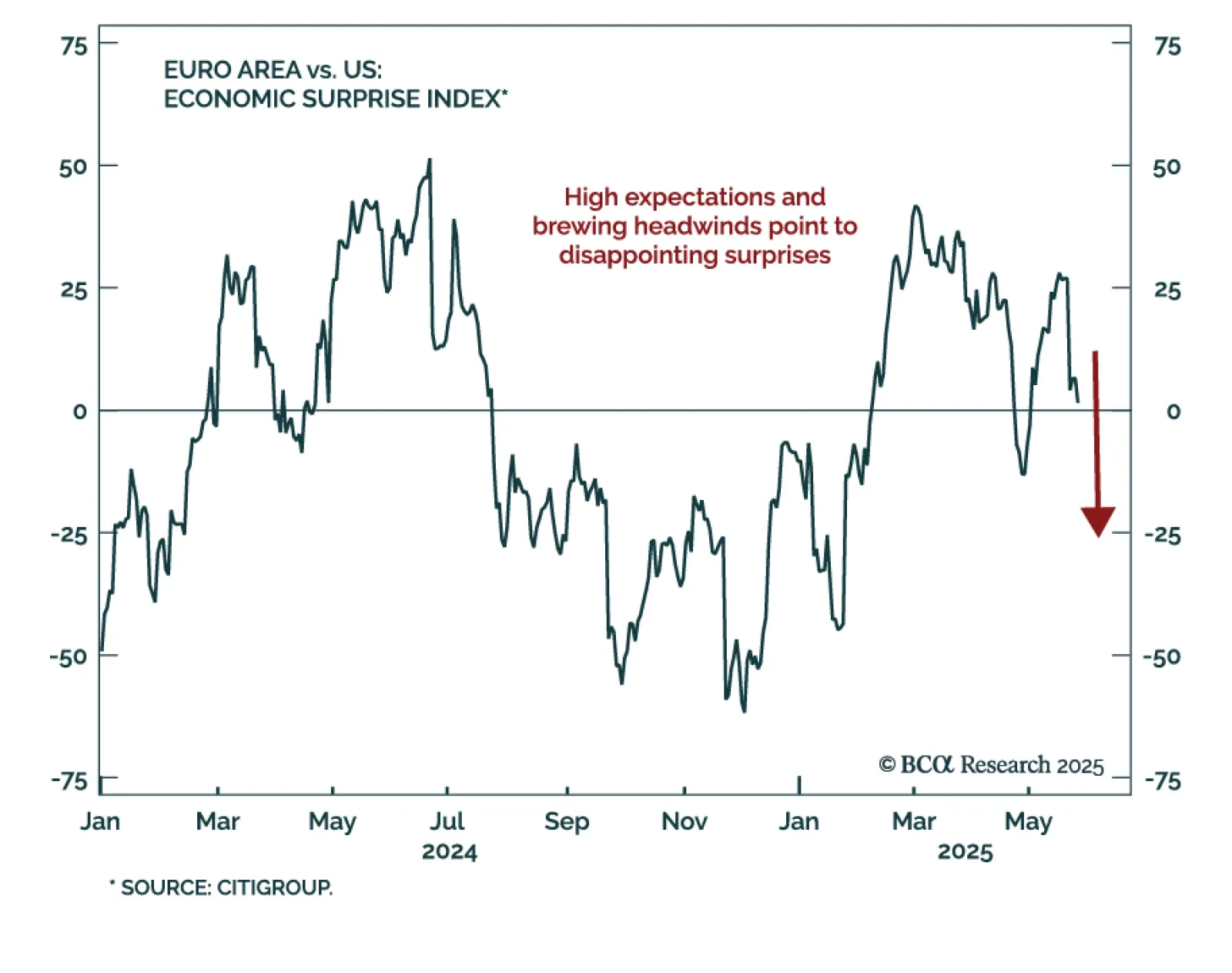

The structural outlook for European assets remains bright, but near-term headwinds argue for longer duration and caution on equities. Here are three takes that call for a temporary pullback in European assets, and two that explore…

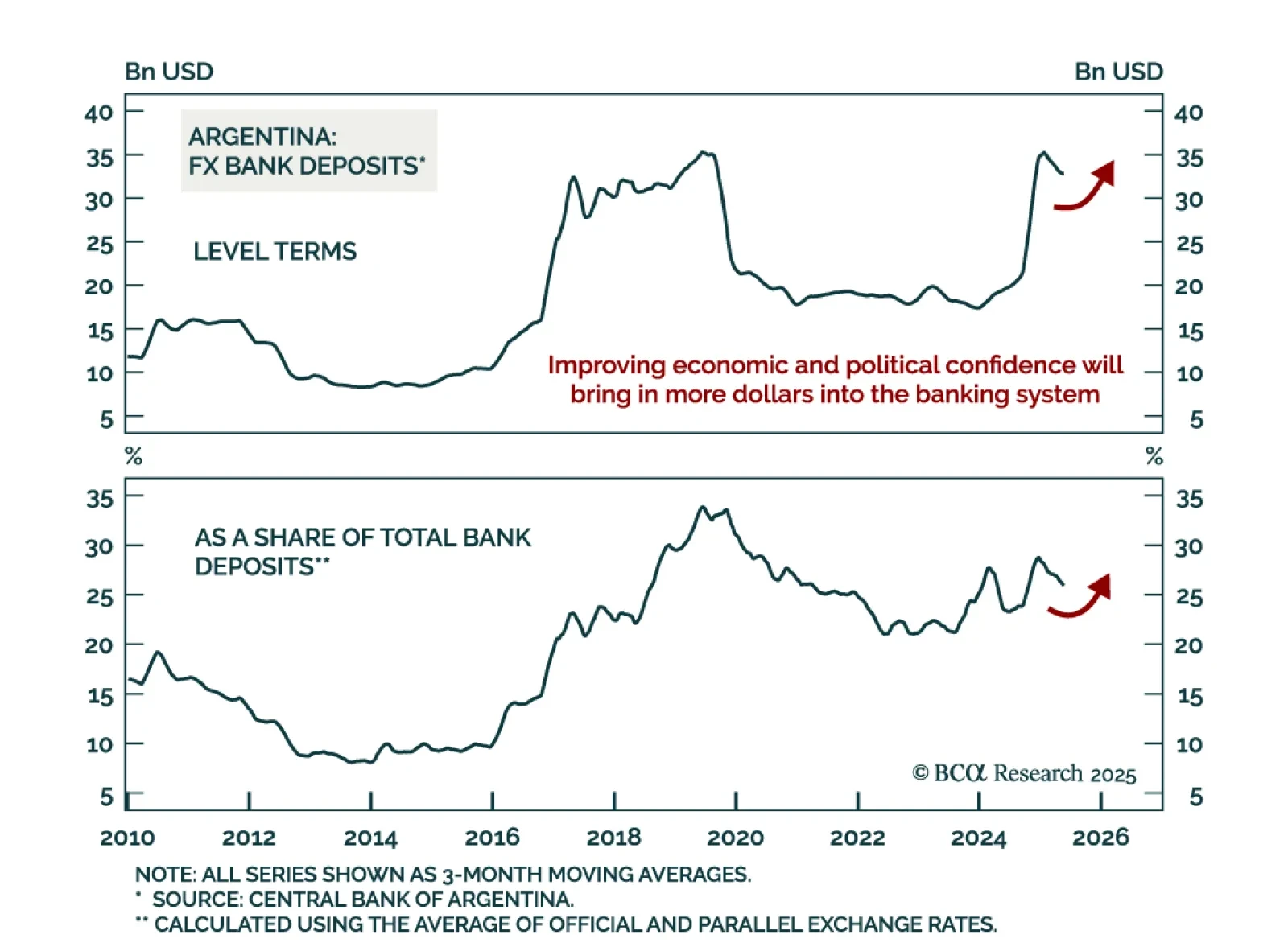

The latest political developments in Argentina increase the odds of further liberalizing reforms and solidify the economy’s structural upside. First, the libertarian governing party came out on top in Buenos Aires’ legislative…

Five questions, five answers from the road. We unpack what Europe’s biggest investors are worried about right now, from trade‑war whiplash to bund‑versus‑Treasury positioning; and where the real opportunities still lie.

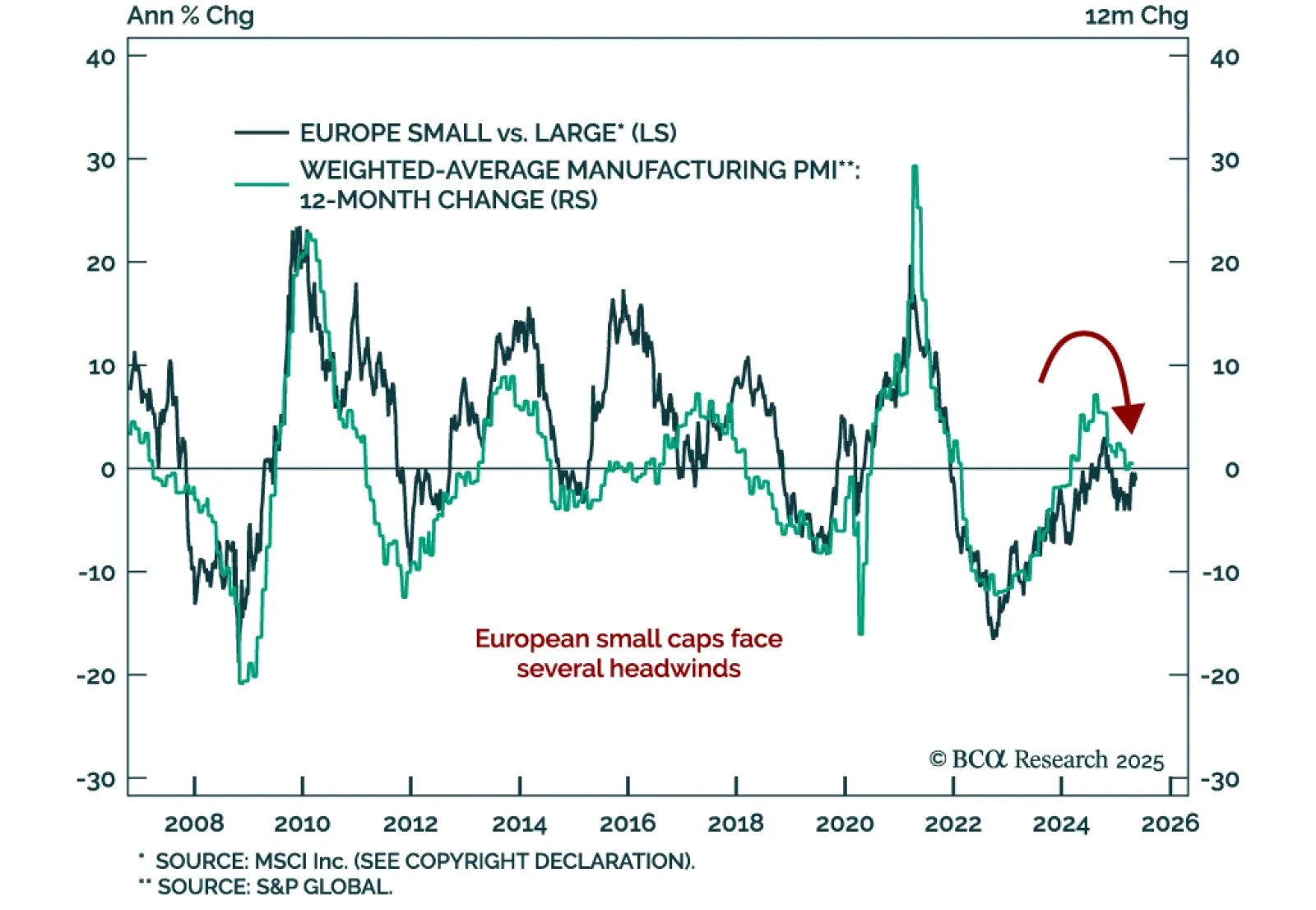

The outperformance of European small caps is coming to an end. Our Chart Of The Week comes from our European Investment Strategy team.The team identifies several headwinds for small caps in Europe in the near term. Small caps’…

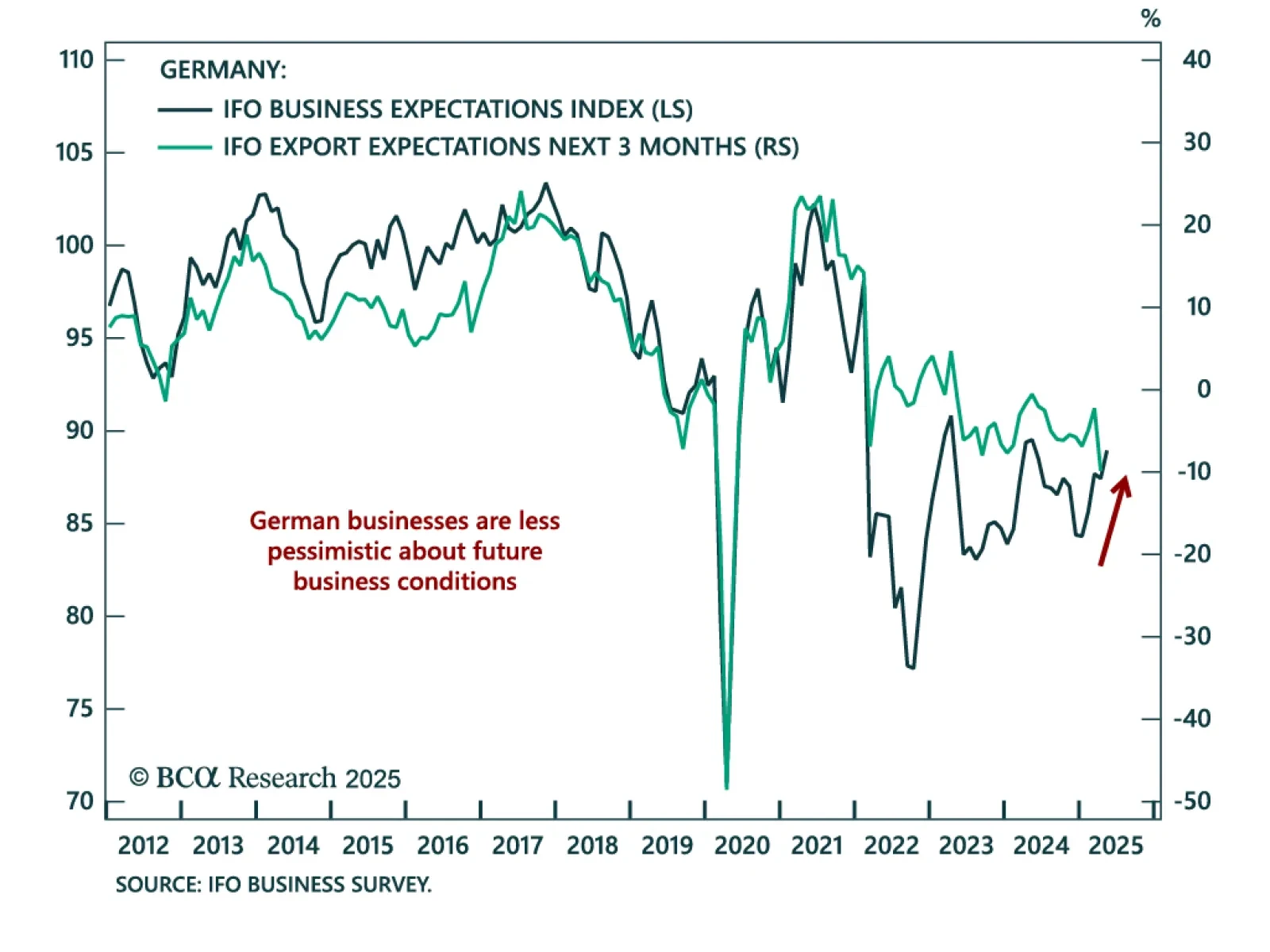

Business sentiment improved slightly in May, corroborating the message from other soft-data indicators of Eurozone business activity, which remain weak but are not plummeting. The increase in the future expectations index to 88.…

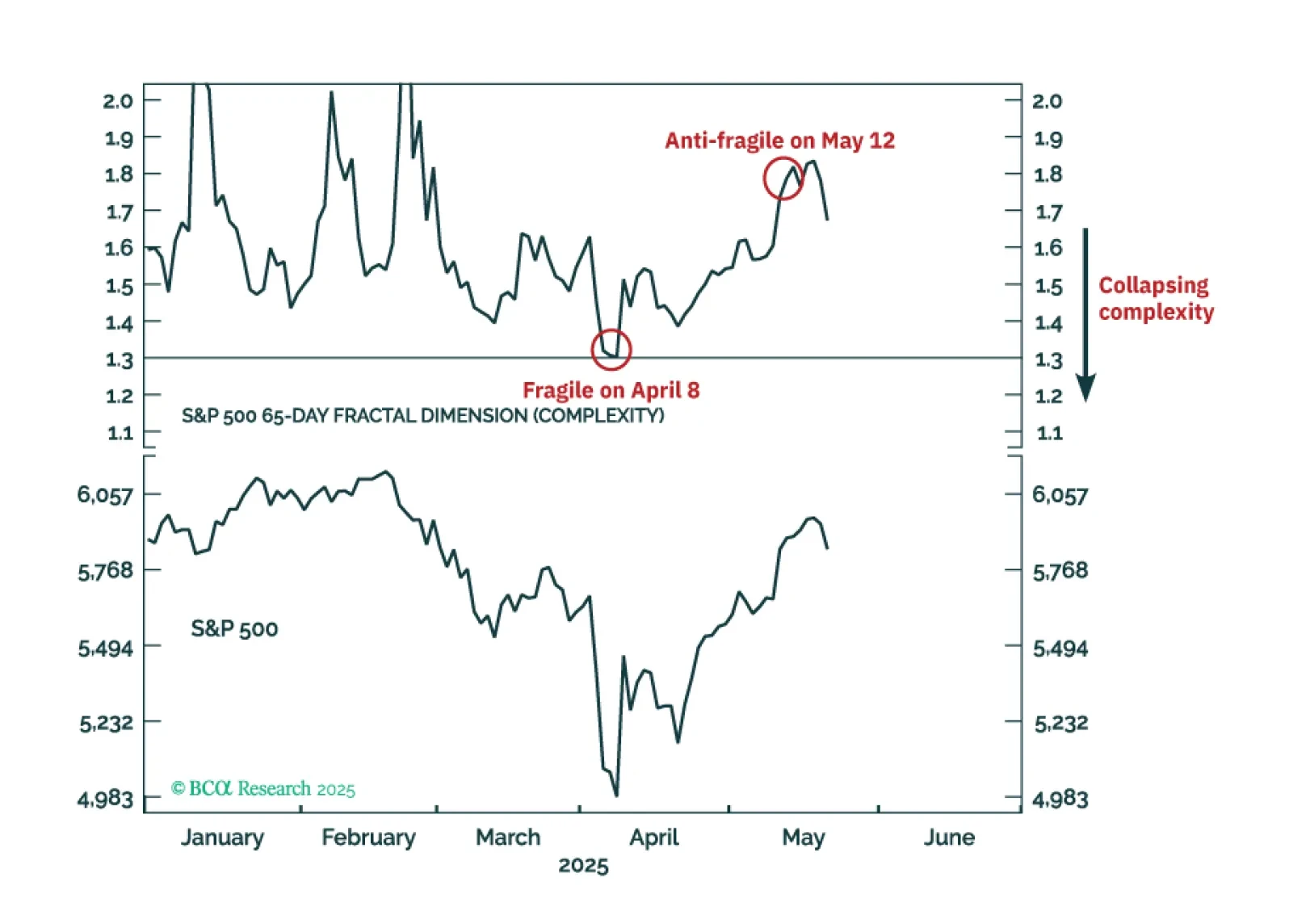

Right now, the major stock and bond markets are more ‘anti-fragile’ than fragile, and the Joshi rule recession indicators signal that a US recession is not imminent. This justifies a neutral, or default, tactical weighting to both…

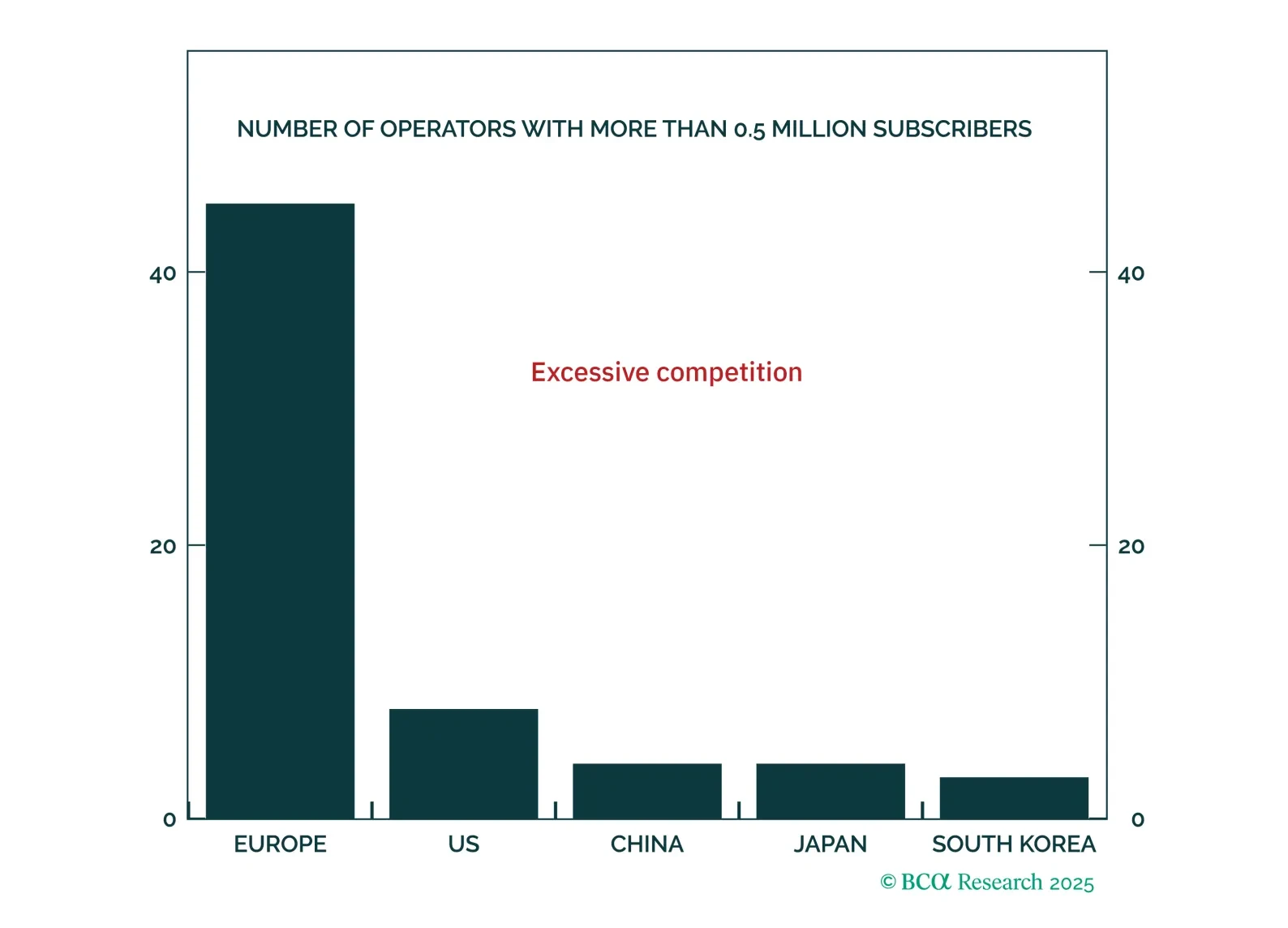

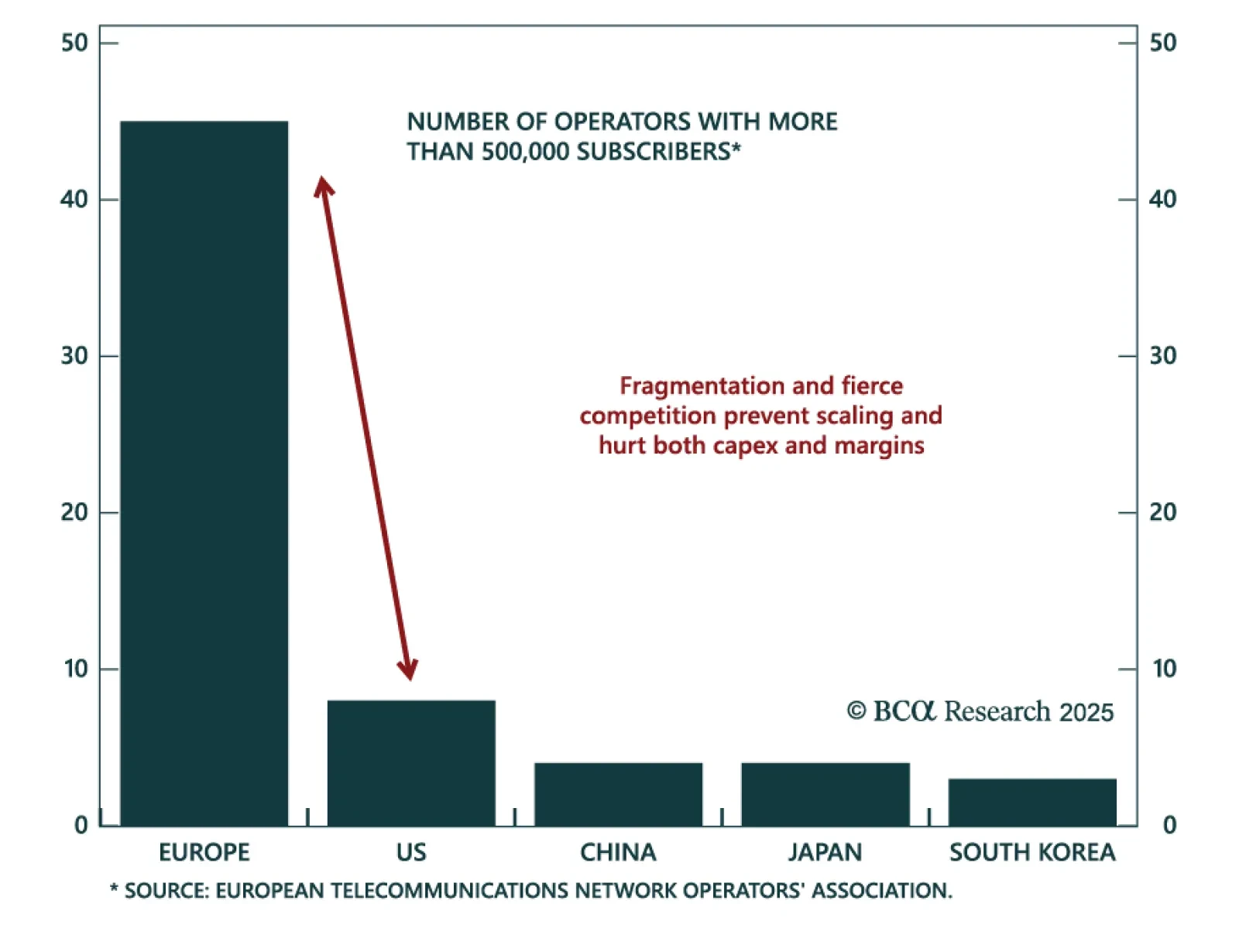

Our European strategists are upgrading the communication services sector to overweight on a structural investment horizon. In March, they highlighted the sector's near-term attractiveness. Since the Great Financial…

Tariff front-running behavior makes the April hard economic data difficult to interpret, but we take the strong reading from Food Services spending as a signal that the US consumer has not yet buckled.

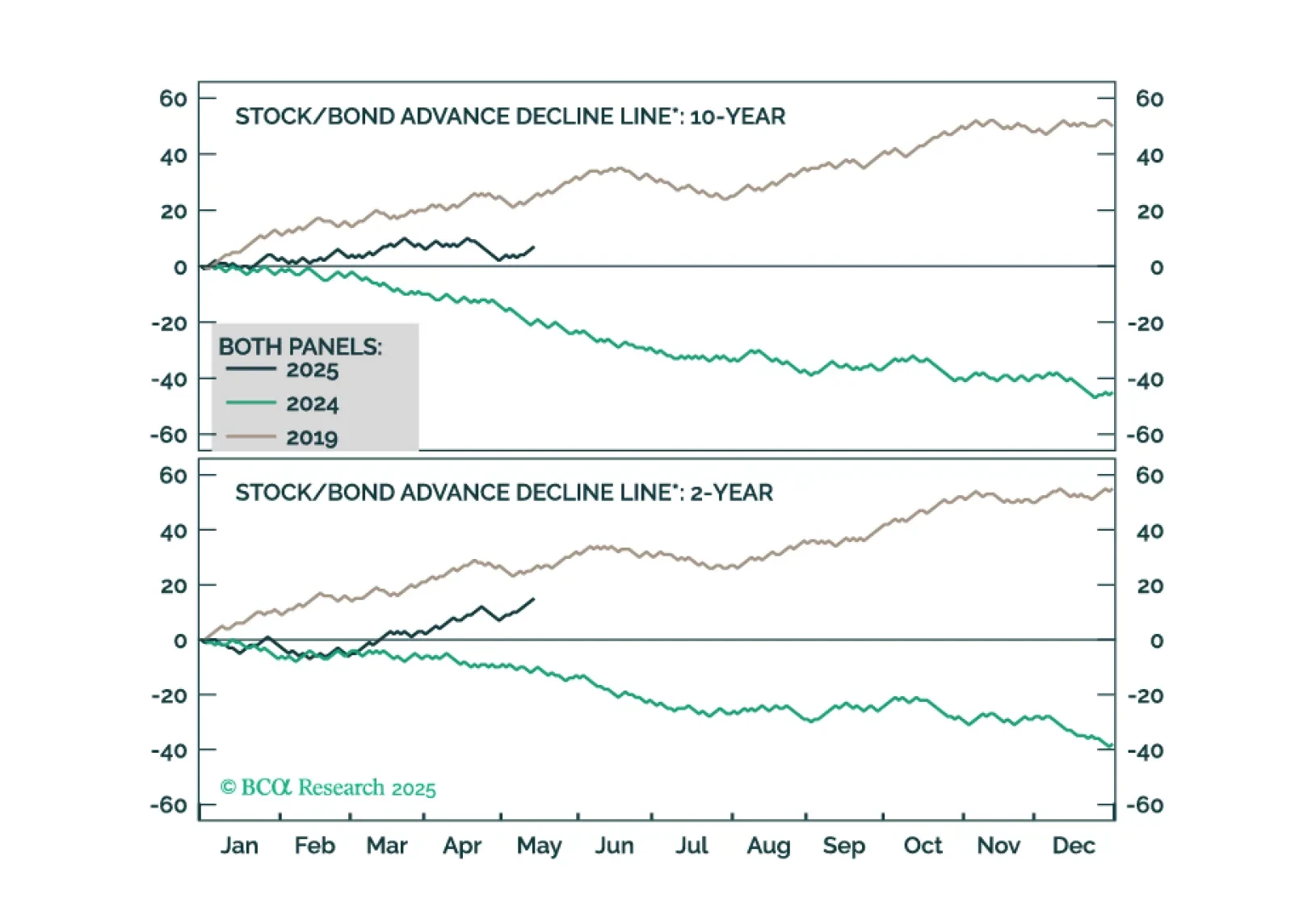

The stock-bond yield correlation is stabilizing after months of jitters, setting the stage for renewed Treasury demand as recession risks build. A negative correlation typically points to inflation concerns, while a positive one…