First Republic Bank’s earnings report showed how its struggles have exaggerated the perception of other banks’ distress. Ex-FRC, the banking system appears to be coping with the post-Silicon Valley Bank turmoil pretty well.

Inflation is hot, but inflation expectations are not. We explain the answer to this apparent puzzle and discuss the investment implications. Plus we identify two commodities that are at imminent risk of reversal.

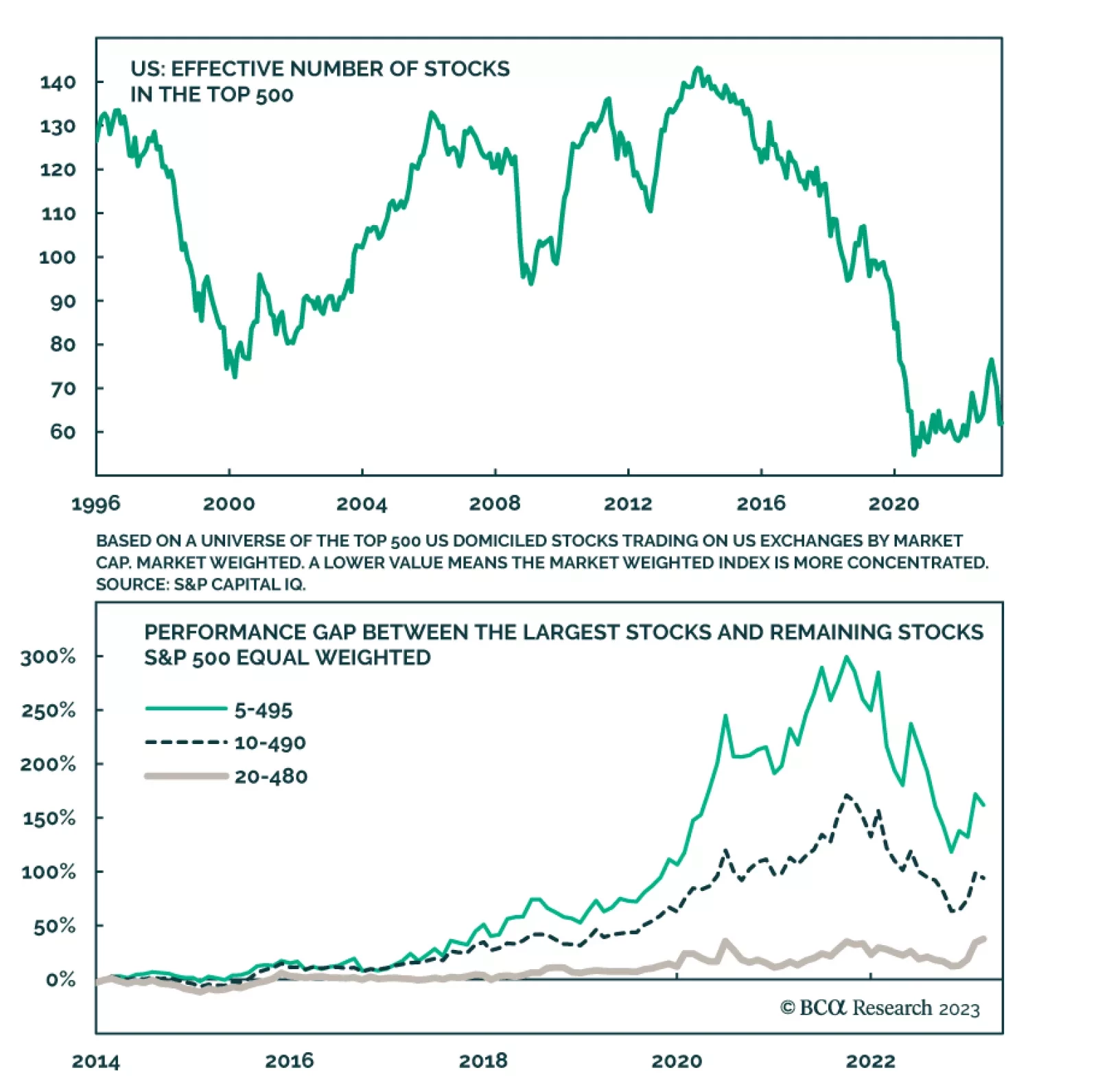

The S&P 500’s index concentration has been on investors’ radar for a while now. The chart above illustrates that the effective number of stocks in the S&P 500 has been declining steadily since its February…

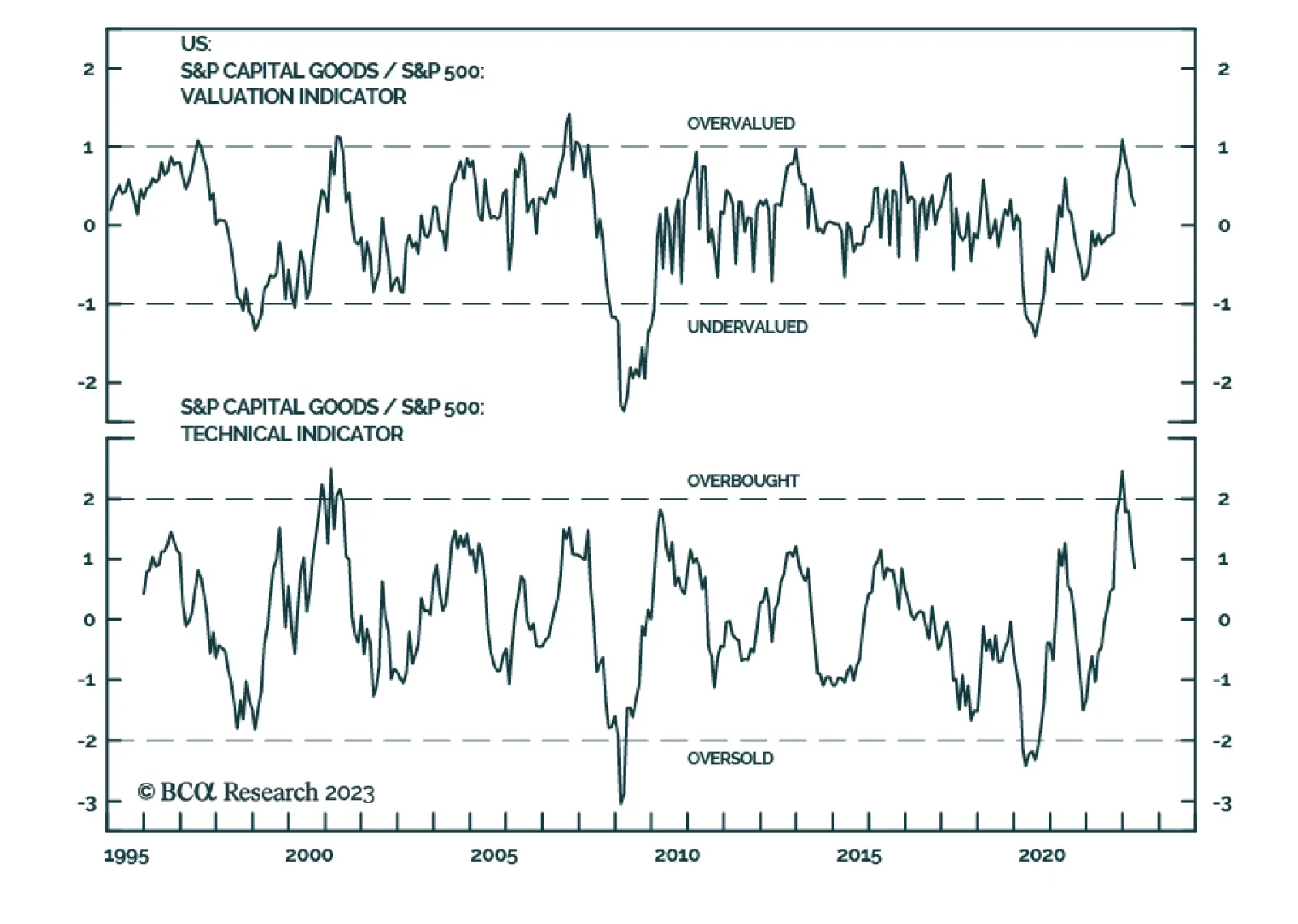

The US Capital Goods industry was relatively resilient last year, ending 2022 roughly unchanged. In particular, a rally in the second half of the year led to a 20% gain vis-à-vis the S&P 500. Multiple long-term…

European equities continue to inch closer to record highs, yet, their earnings outlook is deteriorating. How can investors build hedging portfolios using the message from earnings and valuations to protect themselves against the…

The latest round of earnings calls from the systemically important banks was encouraging on balance. Households are still flush and still spending and consumer and business delinquencies remain remarkably low. Though a recession is…

The dollar has entered a structural bear market. Although the greenback could get a temporary reprieve during the next recession, investors should position for a weaker dollar over the long haul.

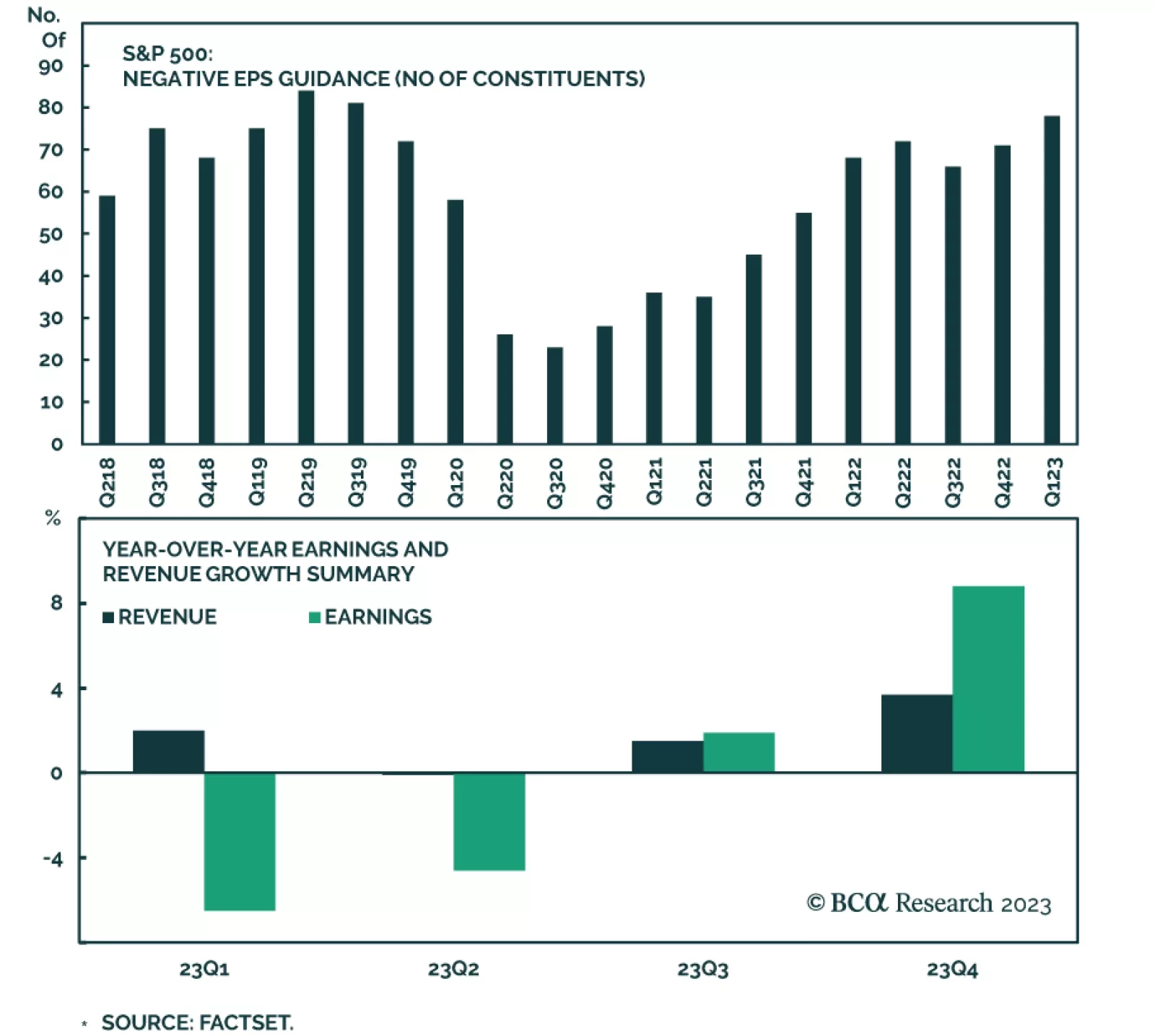

The Q1-2023 US earnings season started last Friday. As companies report, we will gauge the effects of the Fed’s monetary campaign on corporate profitability. With inflation declining, and demand faltering, sales growth is…

China's recovery will be driven by consumer spending in general and on services in particular, while industrial sectors will disappoint.

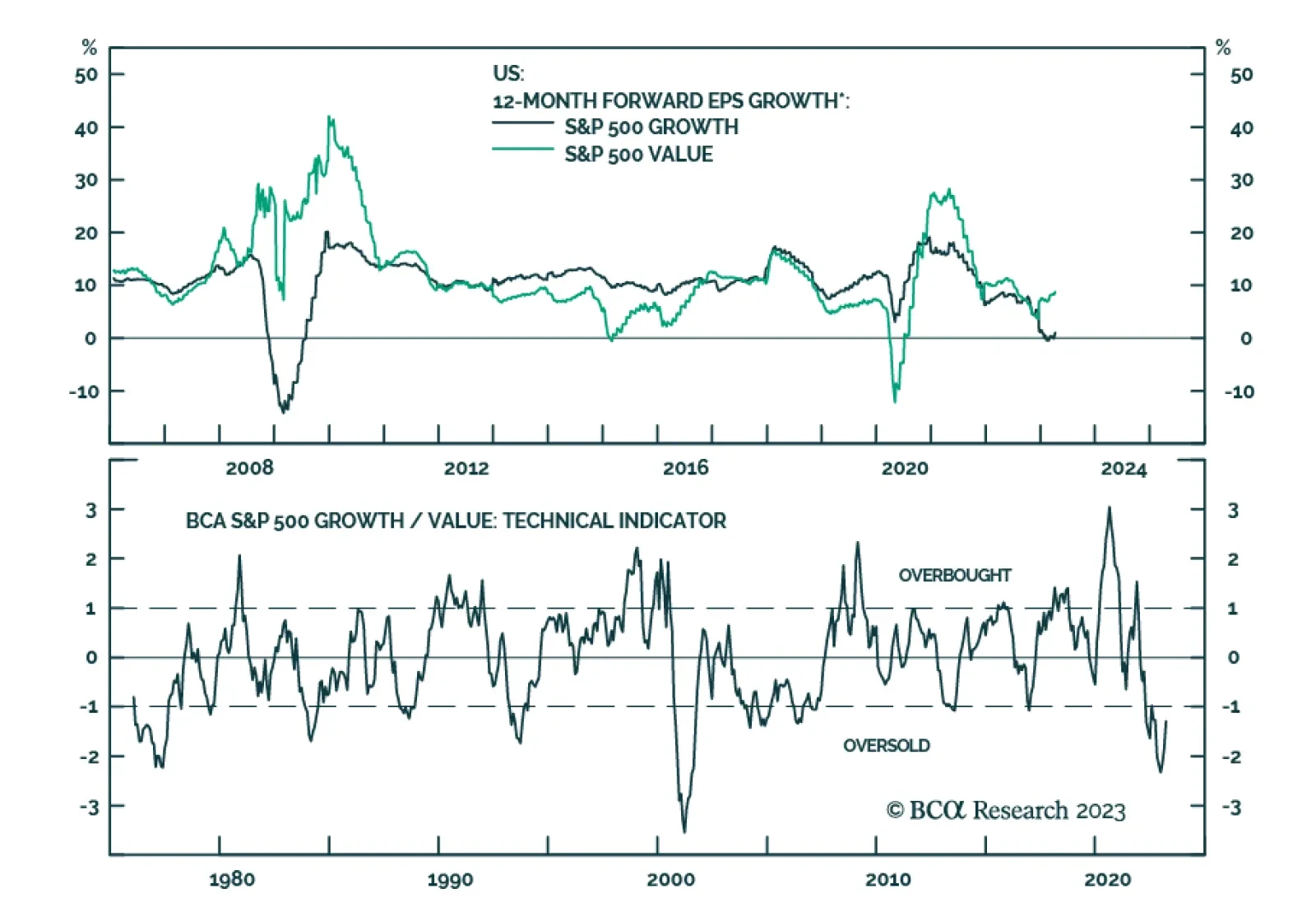

BCA Research’s US Equity Strategy service upgraded Growth to overweight and downgrade Value to underweight on a tactical investment horizon. Many growth stocks have recently disappointed investors as their sales…