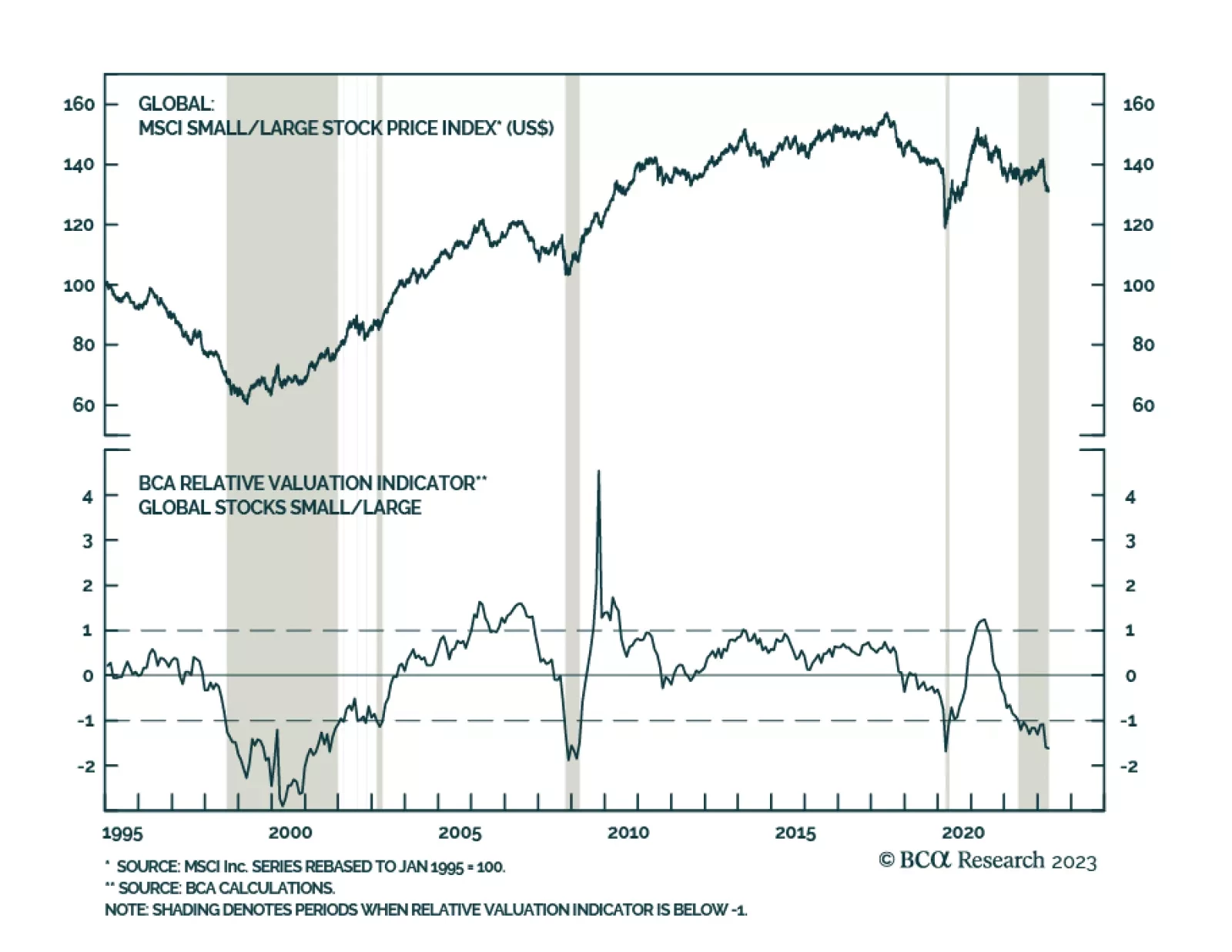

Global small cap stocks have underperformed large caps by roughly 7% since the beginning of March, in response to concerns about the global banking system. Smaller firms are generally less able to access funding through capital…

As the Fed meets today, we explain what it did wrong in 1970, 1974, and 1980 that prevented inflation from being exorcised, and the lessons for 2023-24. Plus, we identify a currency cross that could rebound in the next year.

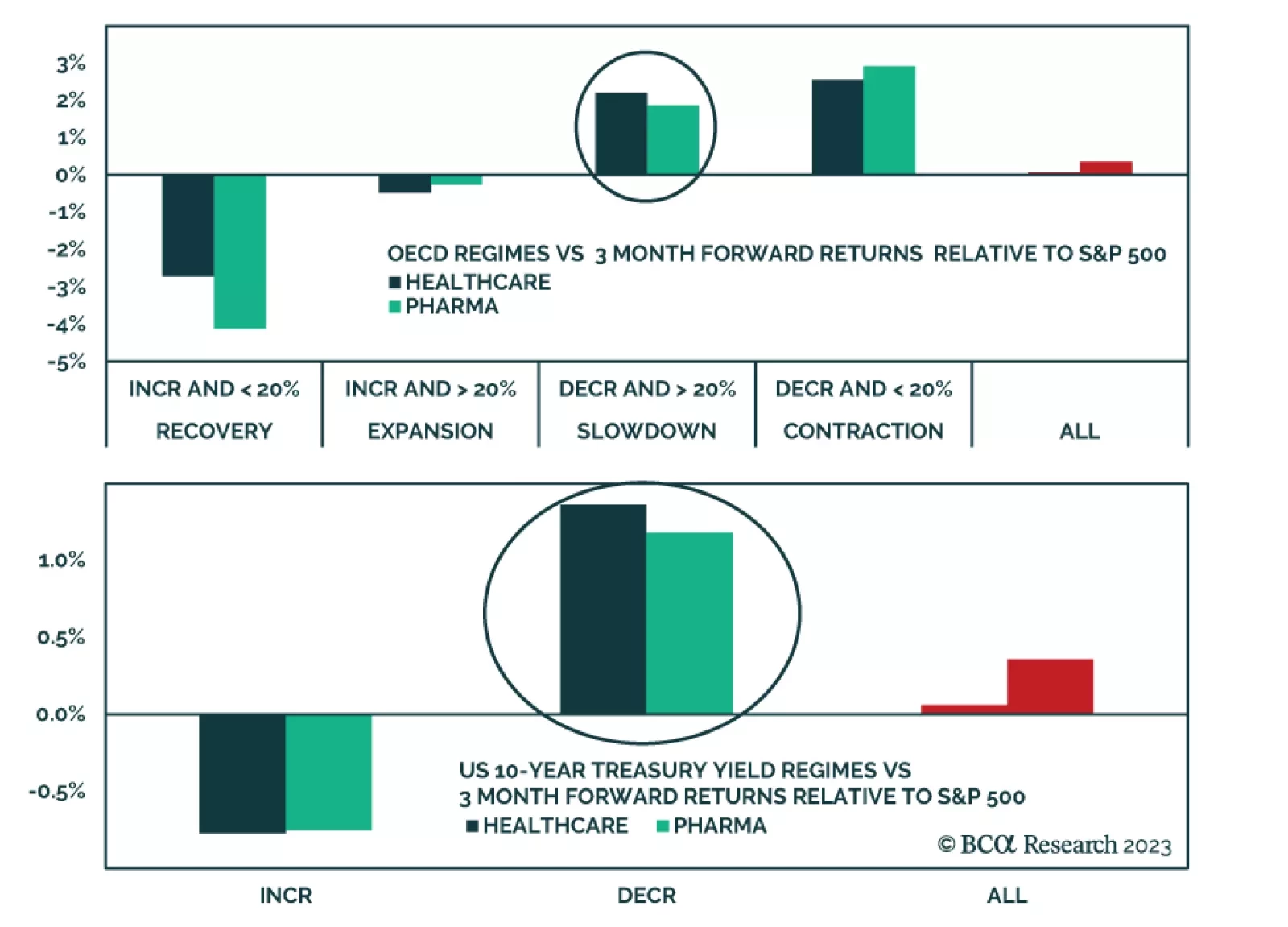

According to BCA Research’s US Equity Strategy and US Political Strategy services, the macro backdrop is favorable for Pharma. as it tends to outperform the market during the slowdown and contraction stages of the business…

Macro and geopolitical risks may spoil the narrow window for a stock market rally before recessionary trends rise to the fore.

Pent-up demand for services is keeping the global economy going, but we still expect recession over the next 12 months. Investors should keep a cautious portfolio stance.

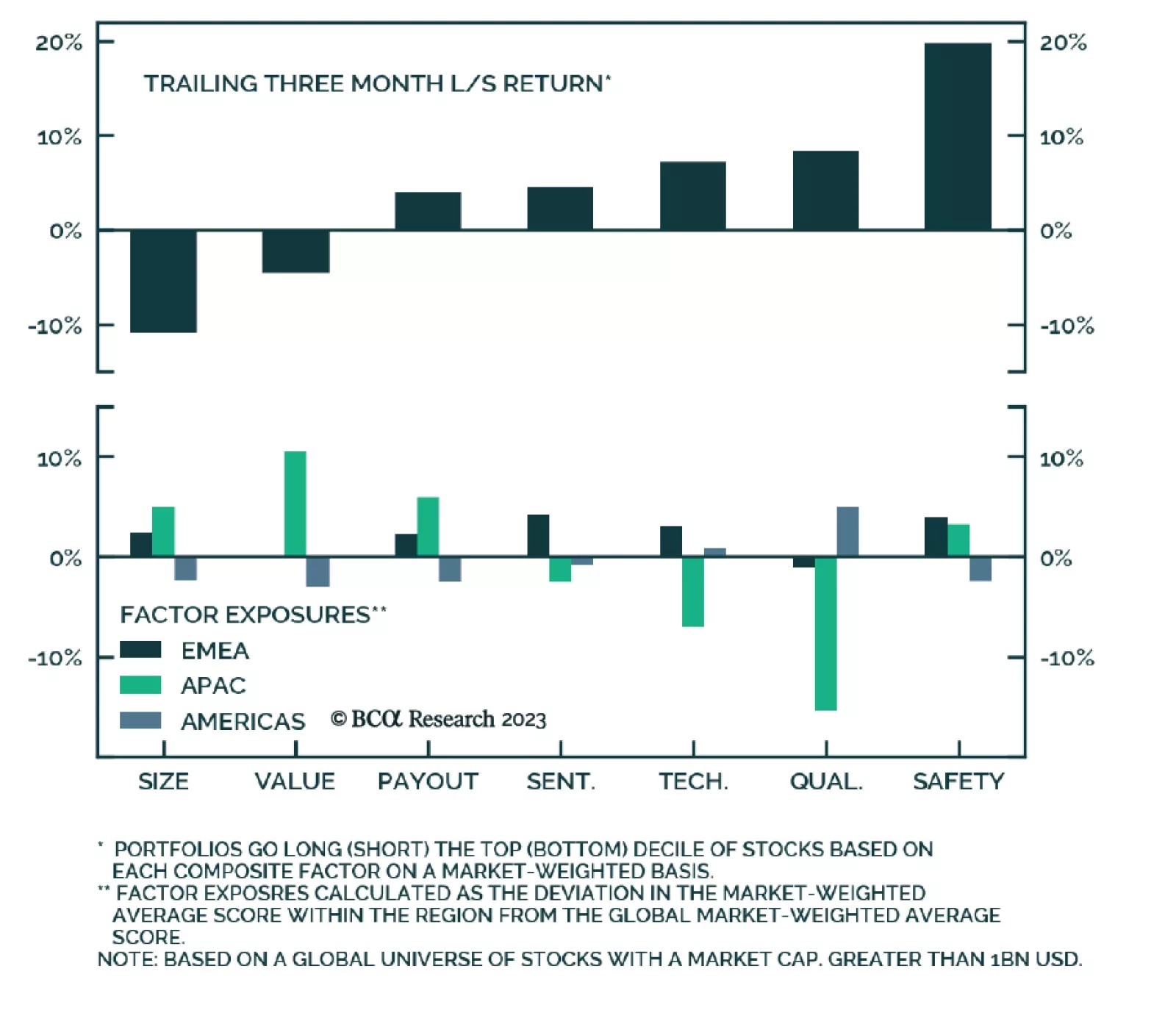

The core of our Equity Analyzer team’s stock selection platform is the BCA Score, a 30-factor model which provides a rating for each stock in their universe. A 0% score is the most bearish signal and a 100% score is the…

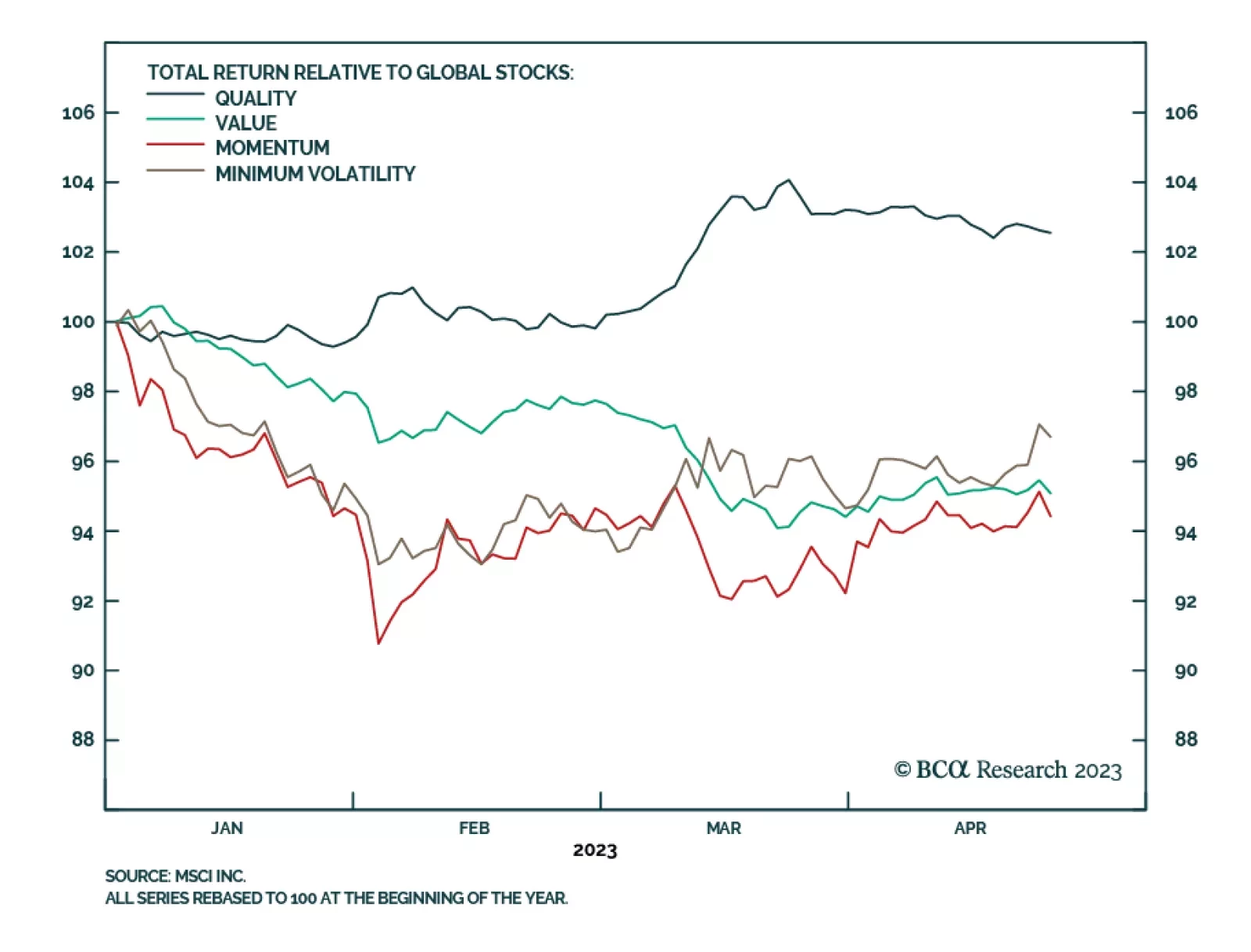

Many investors have been wondering why big tech stocks like Microsoft and Apple have done so well this year. One reason might be their quality. The quality factor has been the best performing equity factor this year. Most of…

In Section I, we discuss why the rally in stock prices over the past month reflects the soft-landing view, and why that is not a likely economic outcome. US inflation is slowing, but target inflation remains elusive. Meanwhile,…

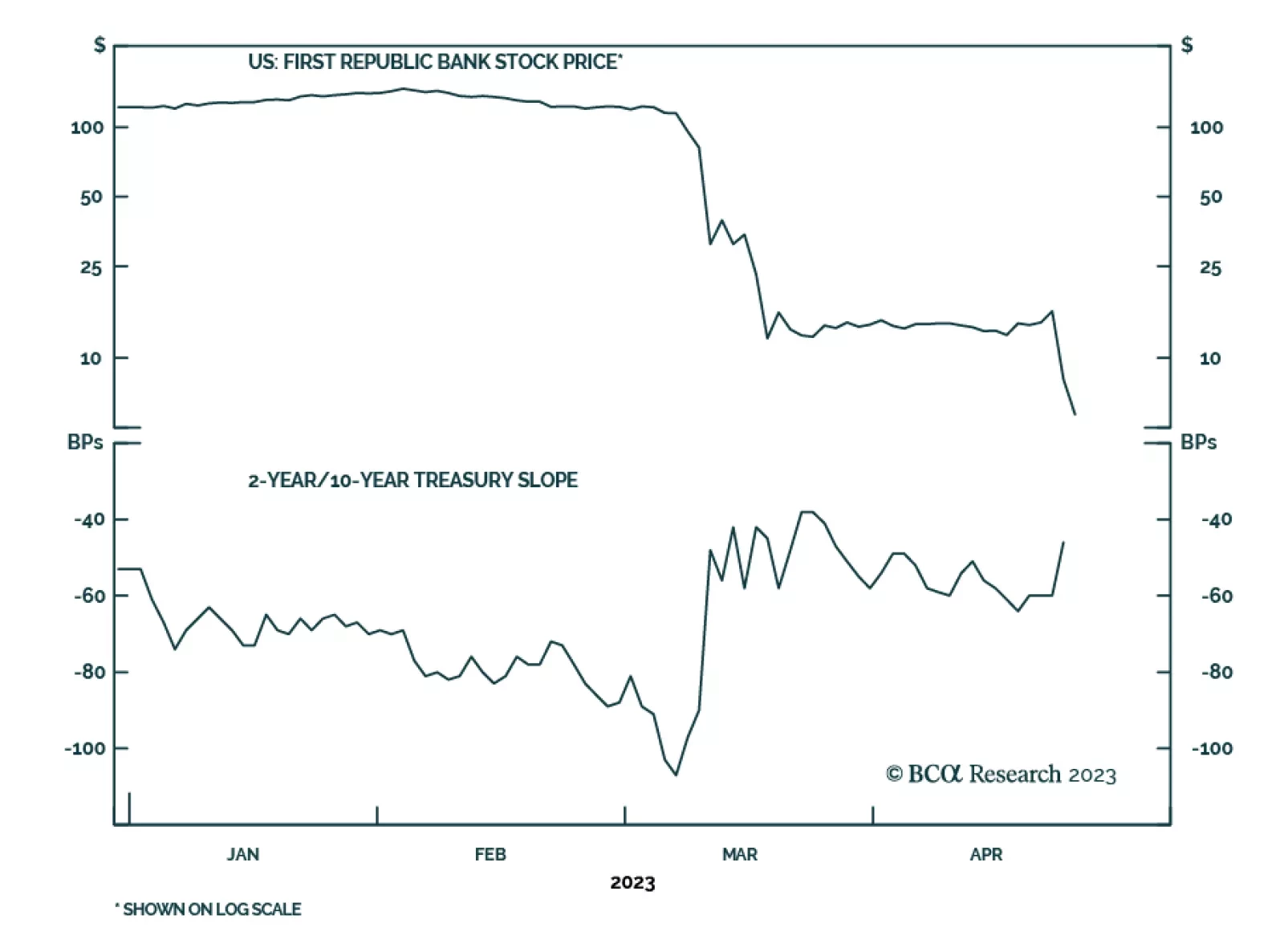

This week’s release of Q1 earnings for First Republic Bank re-focused market attention on stresses in the US banking sector. First Republic’s quarterly results showed a bigger-than-expected drop in deposits for the…