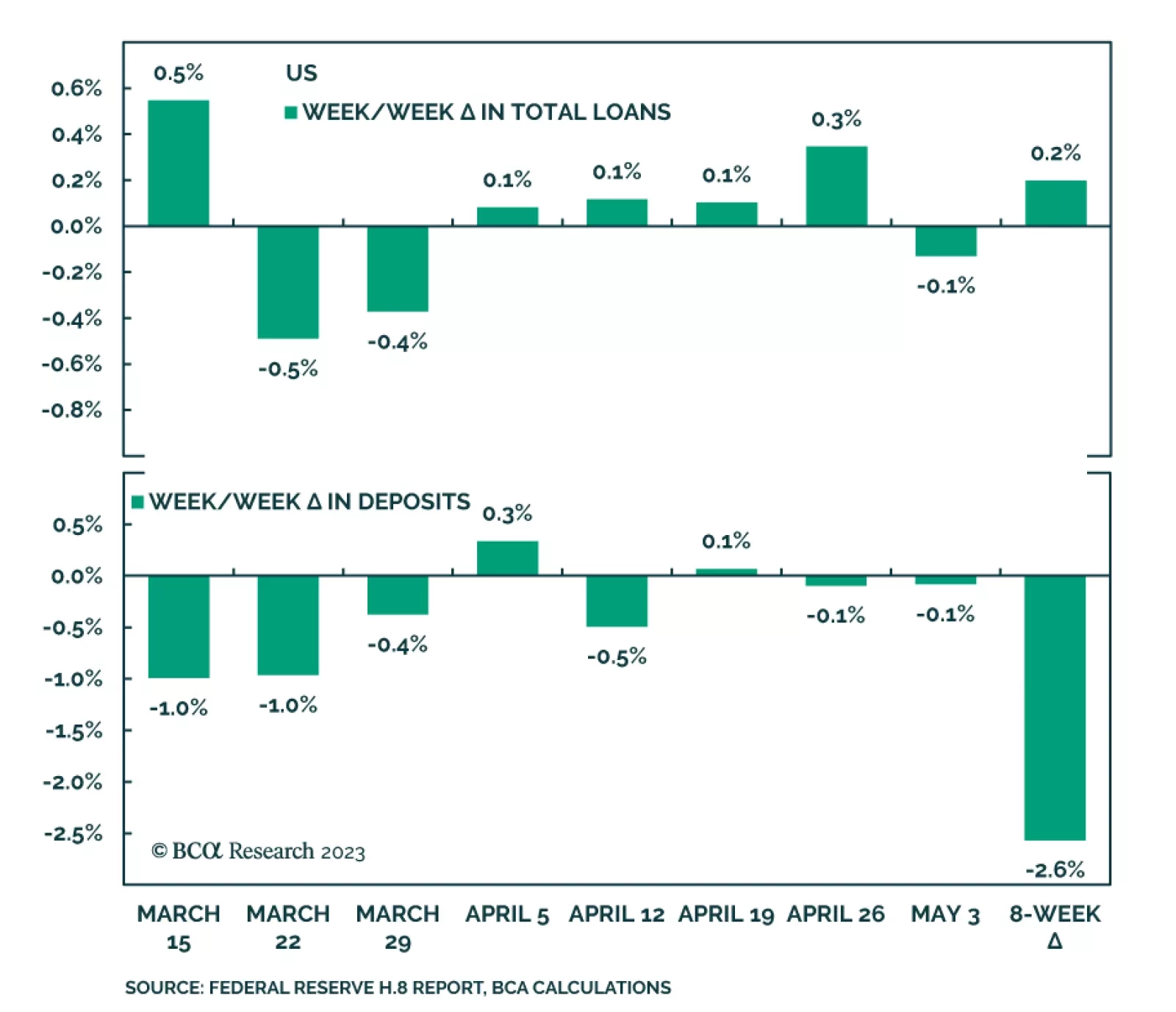

According to BCA Research’s US Equity Strategy service, investors should stay underweight banks on a tactical investment horizon as the banking turmoil is far from over, and the industry’s profitability will be under…

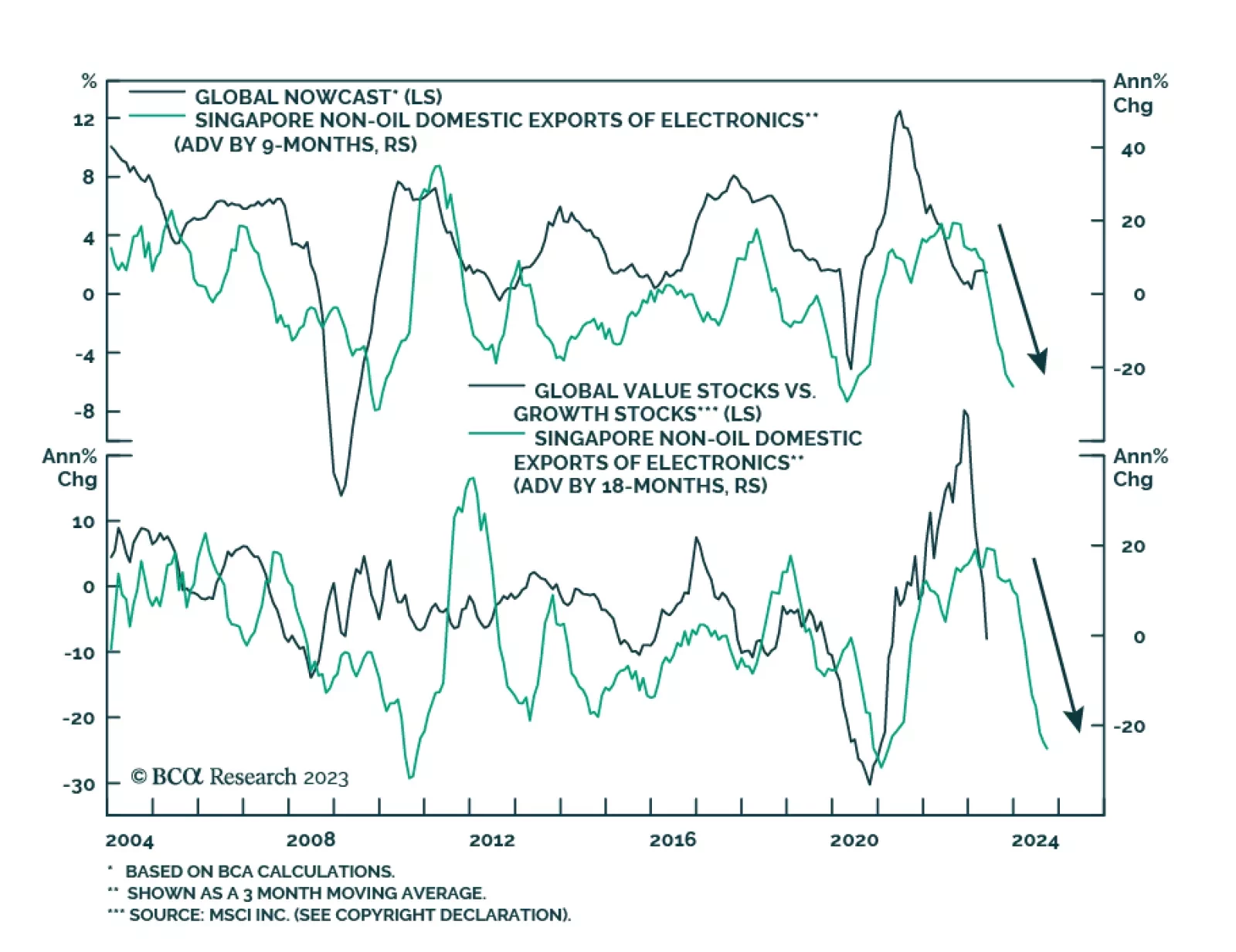

Singapore’s trade numbers continue to send a warning for the global economy. The year-on-year pace of decline in non-oil domestic exports deepened in April after slowing in the prior two months. Importantly, the weakness…

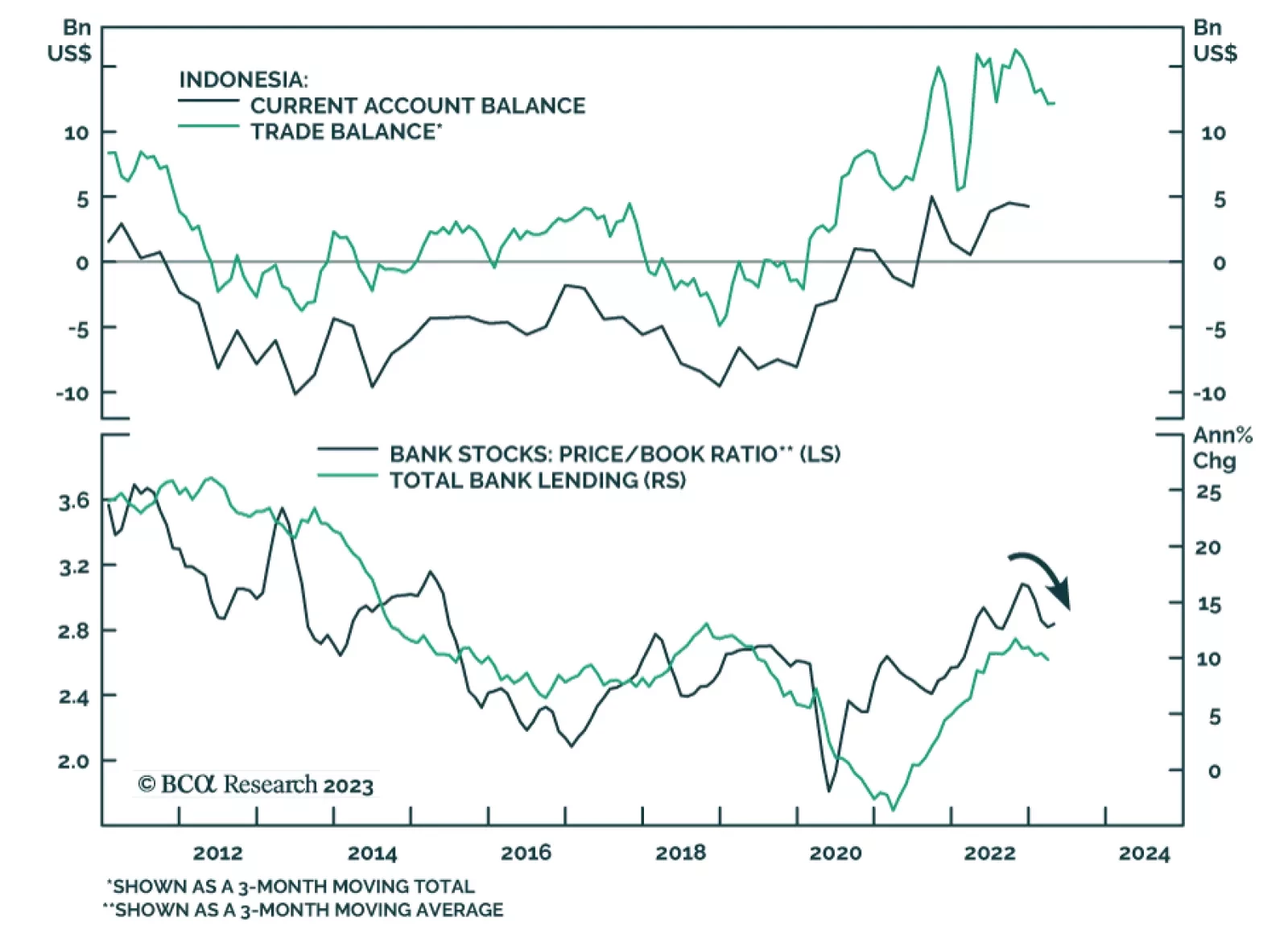

According to BCA Research’s Emerging Markets Strategy service, investors should stay underweight Indonesian equities within Emerging Market and Emerging Asian equity portfolios. Unprecedented export earnings have pushed…

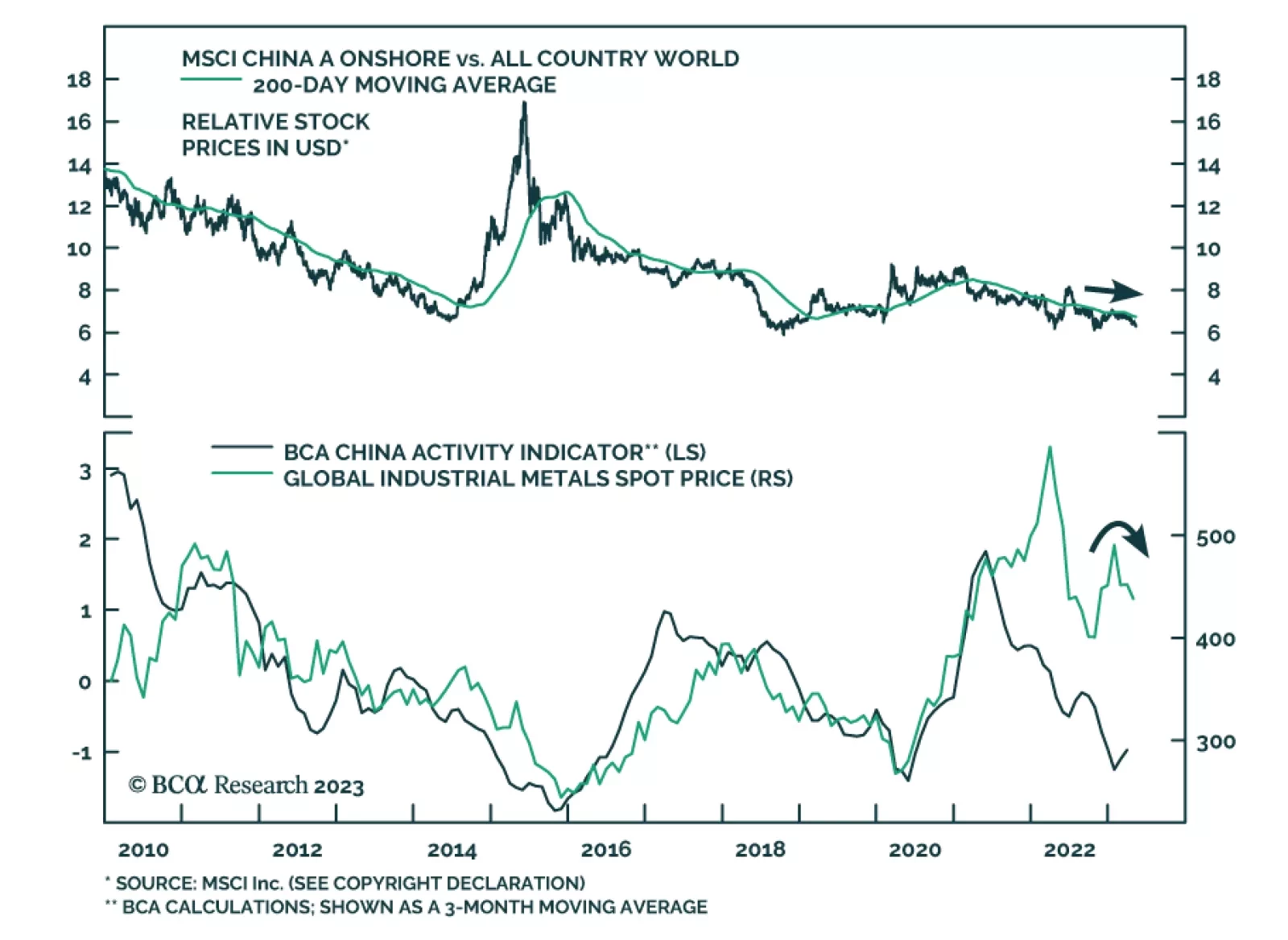

The latest Chinese economic data releases for April signal a disappointing domestic recovery. Weak economic conditions during the Shanghai lockdown last April created a low base effect which boosted the annual comparison.…

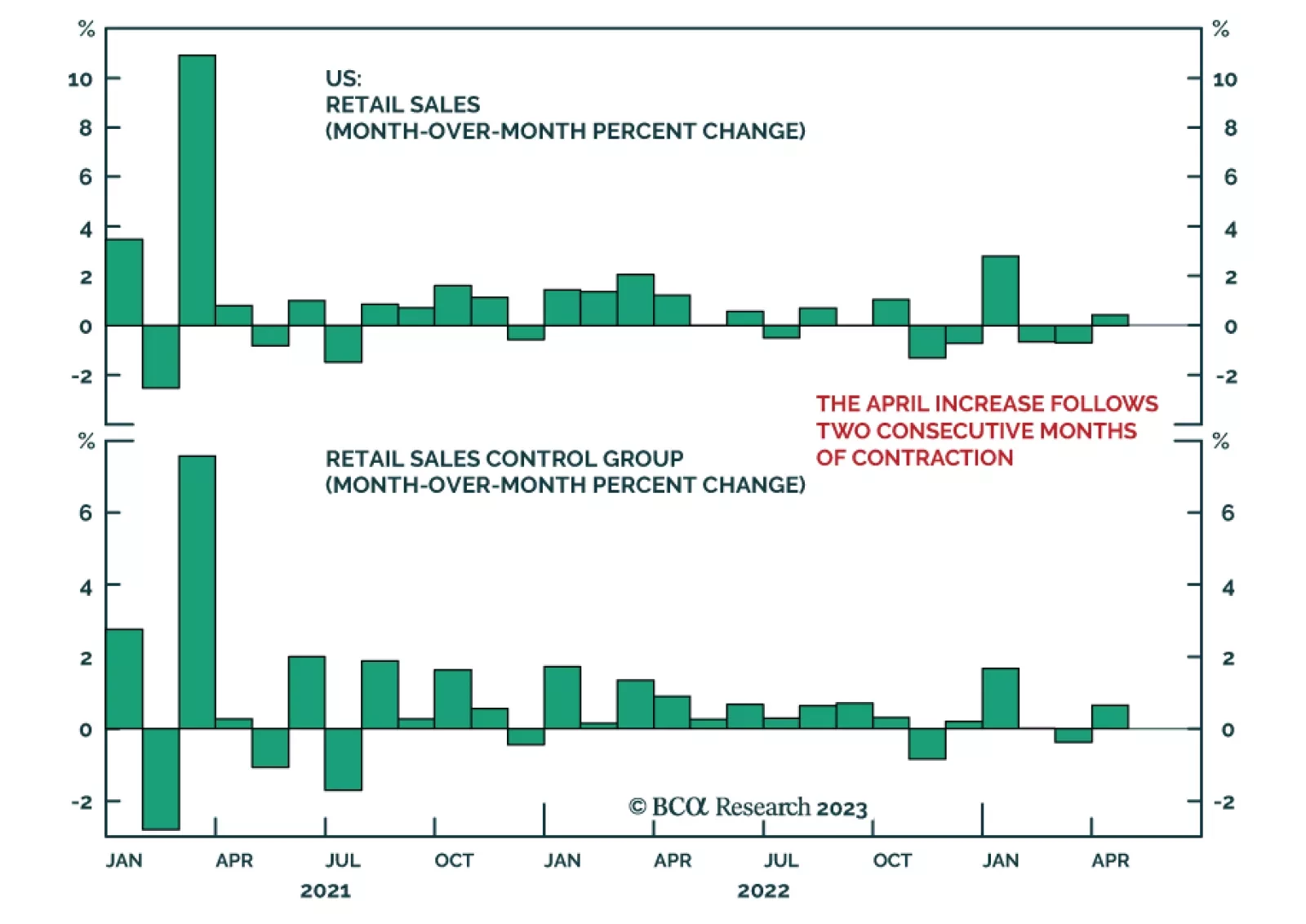

The US Retail Sales report painted a resilient picture of American consumers in April. Although the 0.4% m/m increase in overall retail sales fell below consensus estimates of a 0.8% m/m rise, the details of the report surprised…

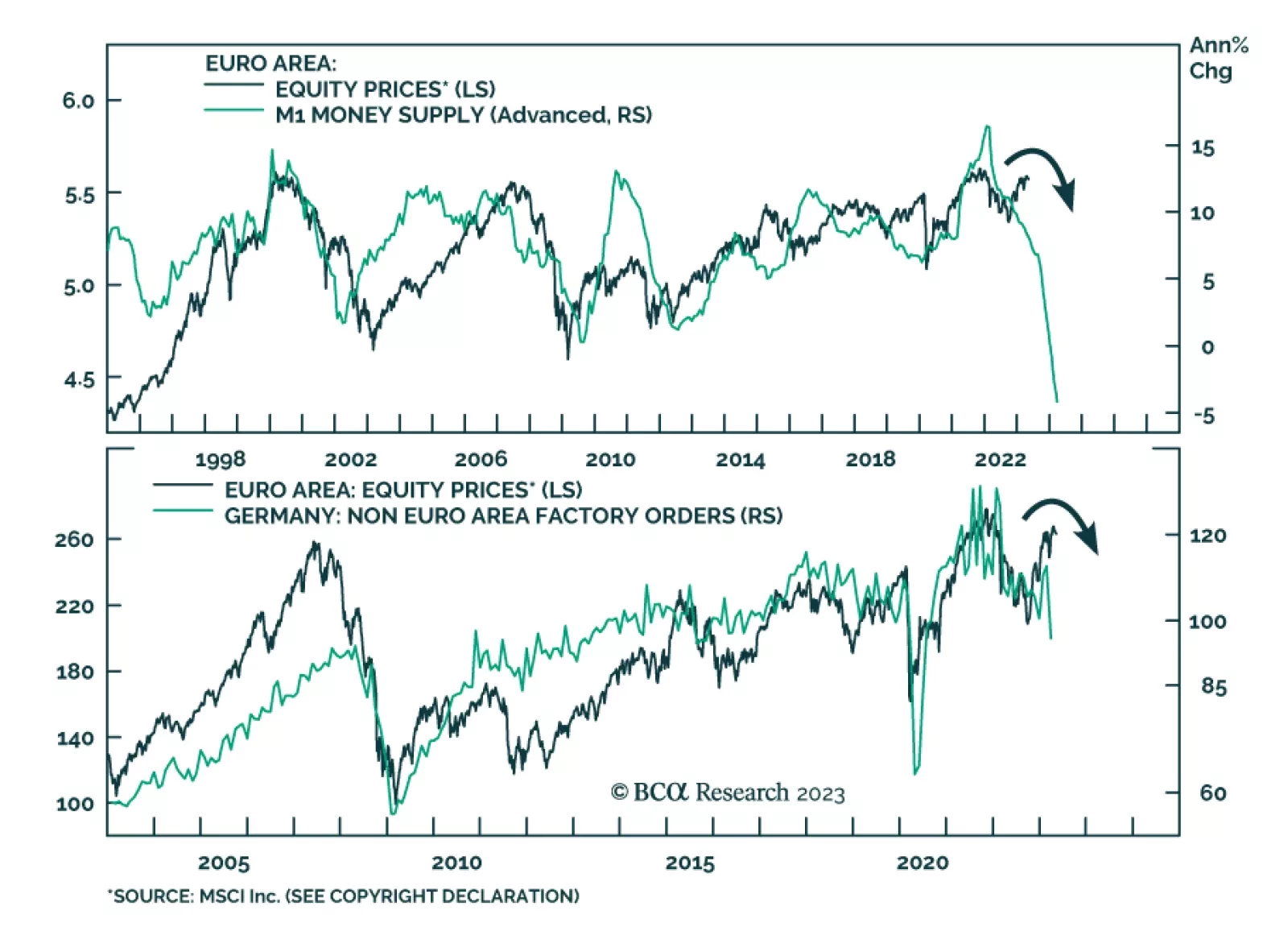

According to BCA Research’s European Investment Strategy service, a large set of variables points to some additional correction in European stocks over the coming months. The collapse in the Euro Area M1 is consistent…

The US banking system remains unsettled over two months after the failures of Silicon Valley Bank. The two weeks following regulators’ seizure of First Republic (FRC) have featured dizzying swings in the stock prices of…

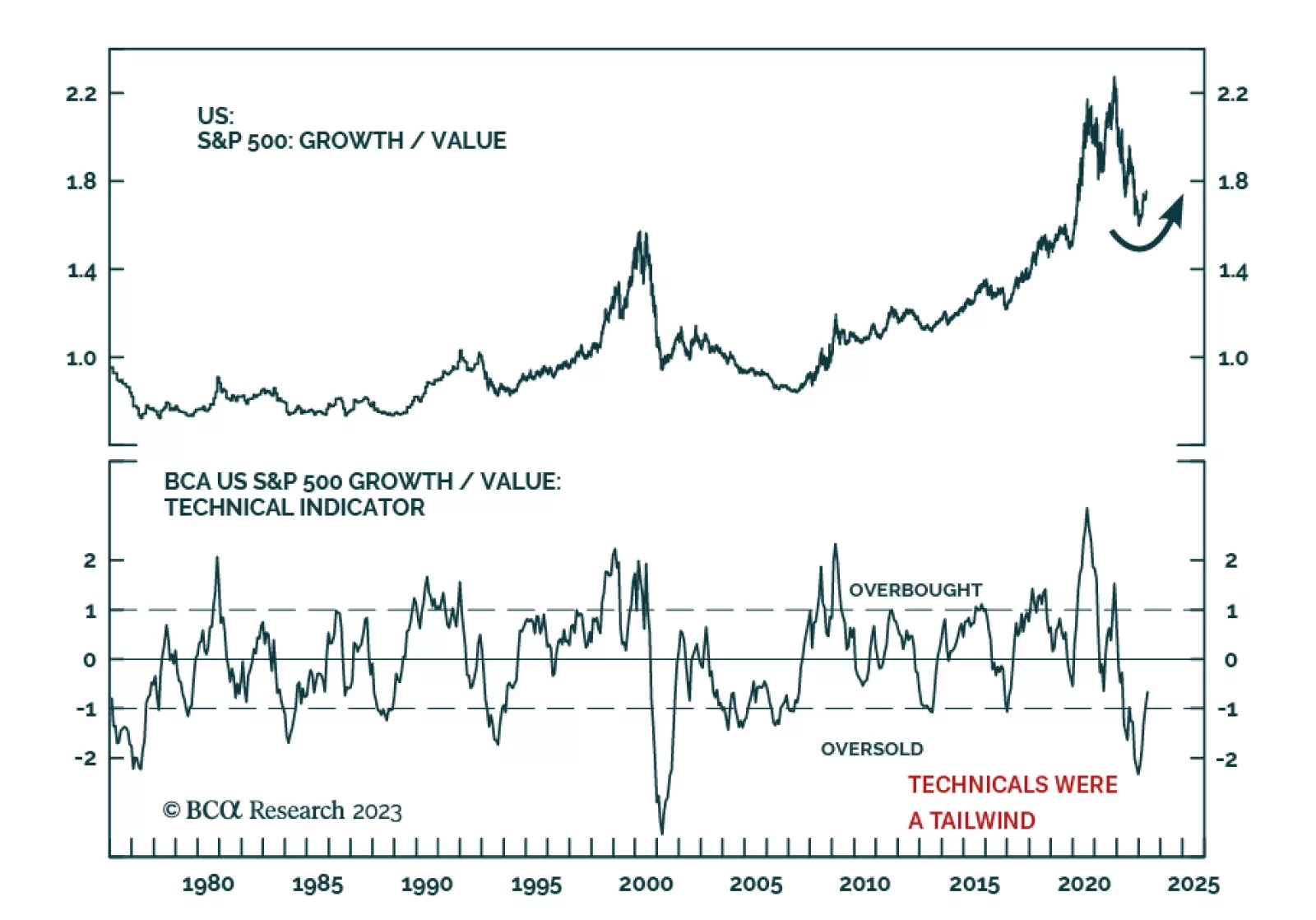

After a period of significant underperformance in 2022, US Growth stocks are regaining lost ground vis-à-vis Value. The S&P 500 Growth index has outperformed its Value counterpart by 7 percentage points since the start…

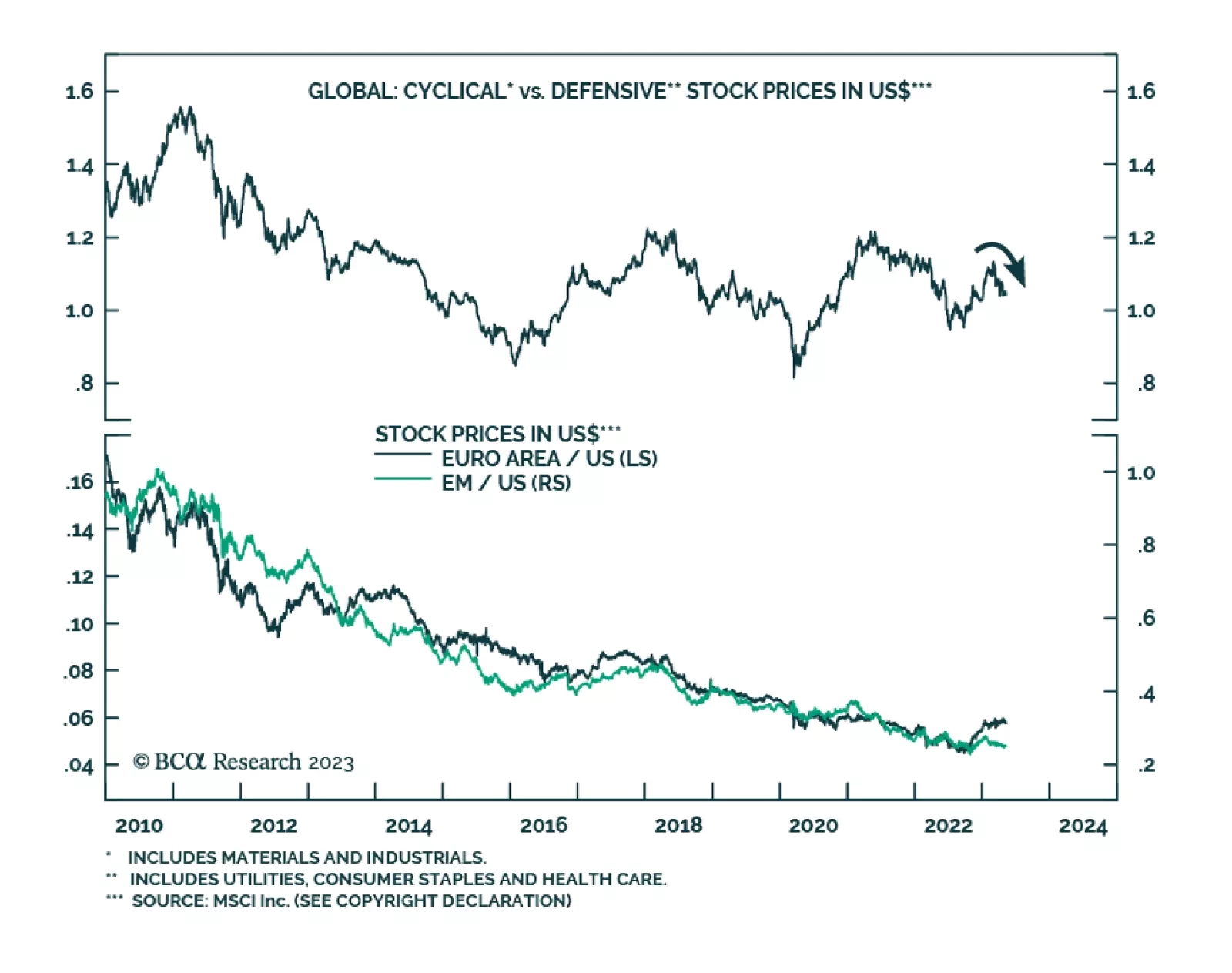

A restrictive policy by the ECB and a weak manufacturing sector will create headwinds for European stocks this summer. How should investors position their portfolios in this context?

Global equities are up 18% in USD terms since they bottomed in mid-October. On the surface, this is a positive signal that risk sentiment is improving. However, internal equity dynamics indicate that the rally is running out of…