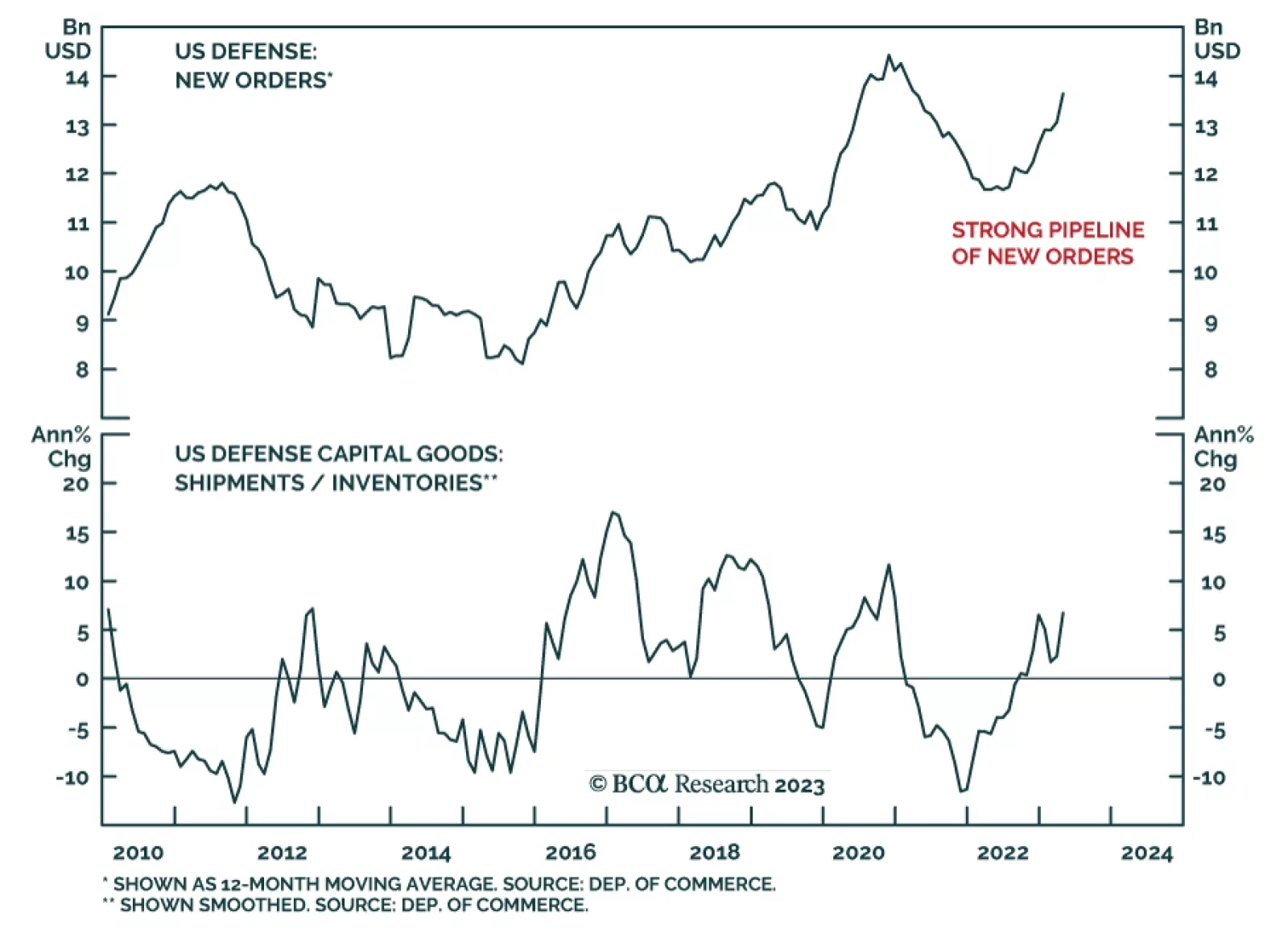

According to BCA Research’s US Equity Strategy service, despite temporary hurdles, the longer-term trends support an overweight in Defense. Global military spending is poised for significant increases as the world system…

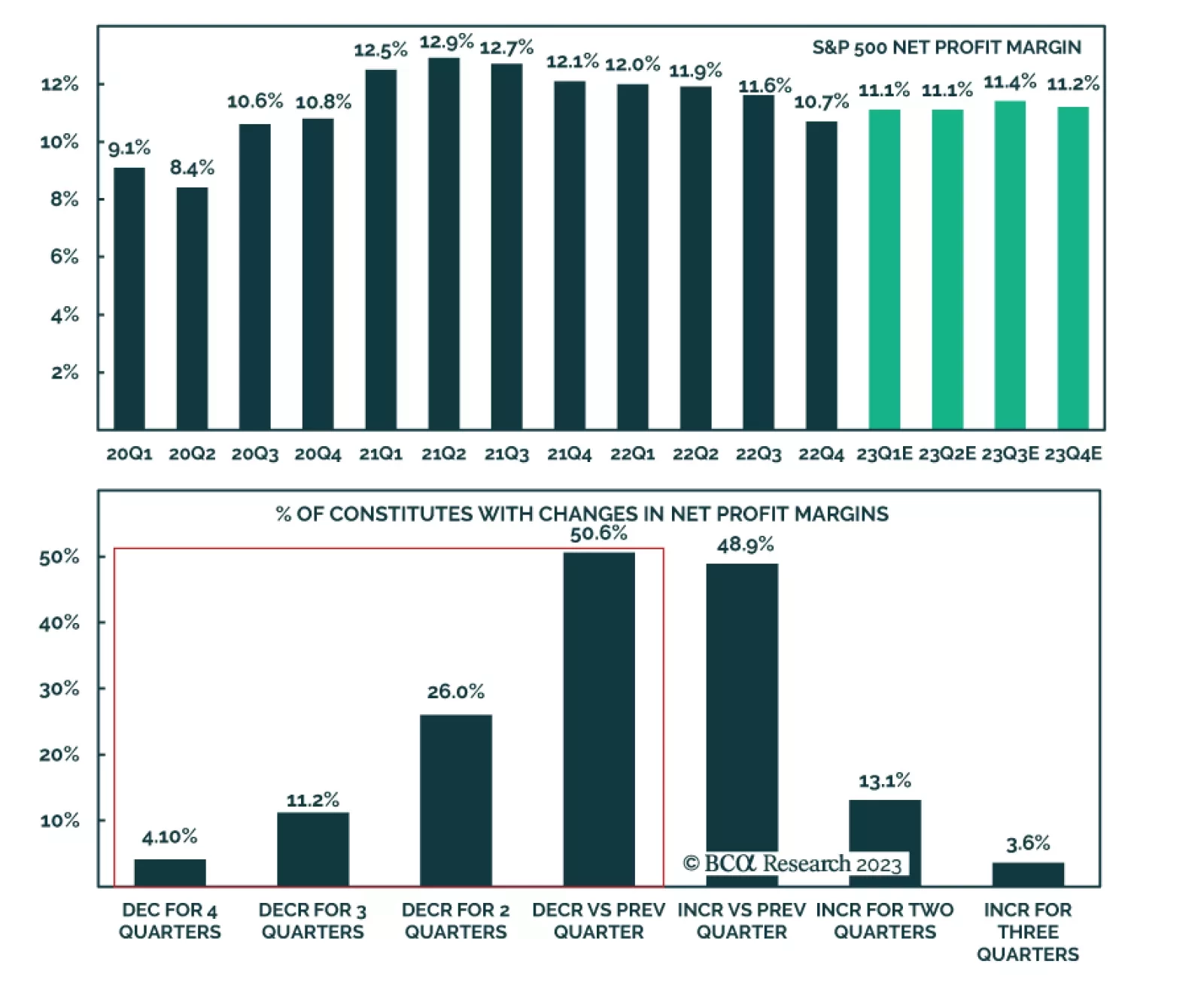

One of the most noteworthy developments of the Q1-2023 earnings season was that the net profit margin widened from 10.7% in Q4-2023 to 11.1%. This marked the first margin expansion since the 12.9% peak in Q2-2021. The year-end…

A major divergence has emerged between the performance of the S&P500 and the US equal-weighted stock index. Even though the S&P500 index has been grinding higher, the US equal-weighted index has failed to rally. Such a…

Market pricing of Fed rate expectations has moved closer in line with our US bond strategists’ expectations. According to the CME FedWatch tool, Fed funds futures are pricing in a 40% chance that the fed funds rate will be…

President Erdogan and the Justice and Development Party emerged as the winner of the Turkish general election which was concluded yesterday. This victory means that their expansive policies of the past decade will continue, and…

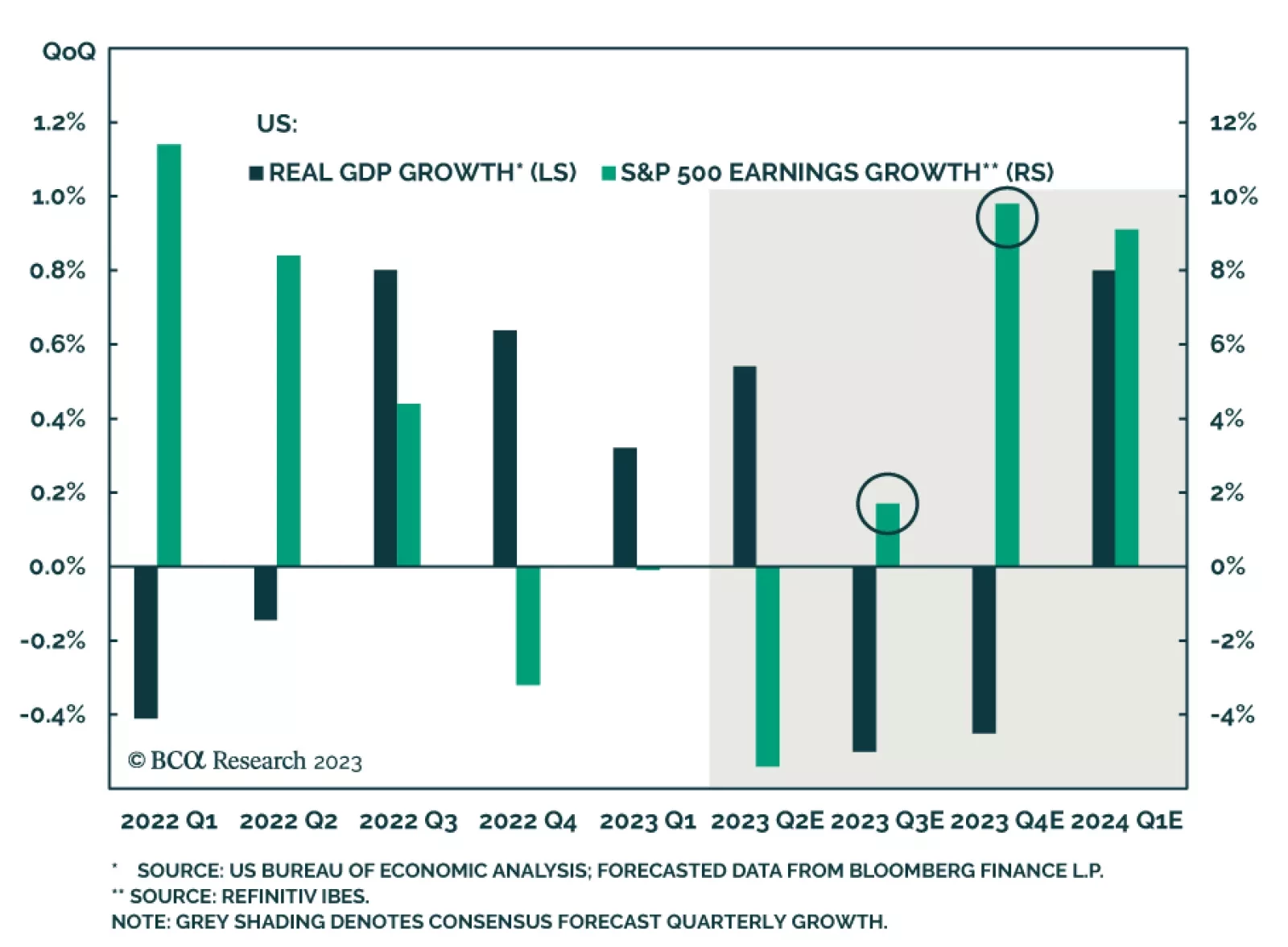

Once the debt ceiling soap opera ends, investors will likely turn their attention to some of the tailwinds supporting stocks. These include stronger earnings growth, diminished bank stresses, better housing data, early signs of an…

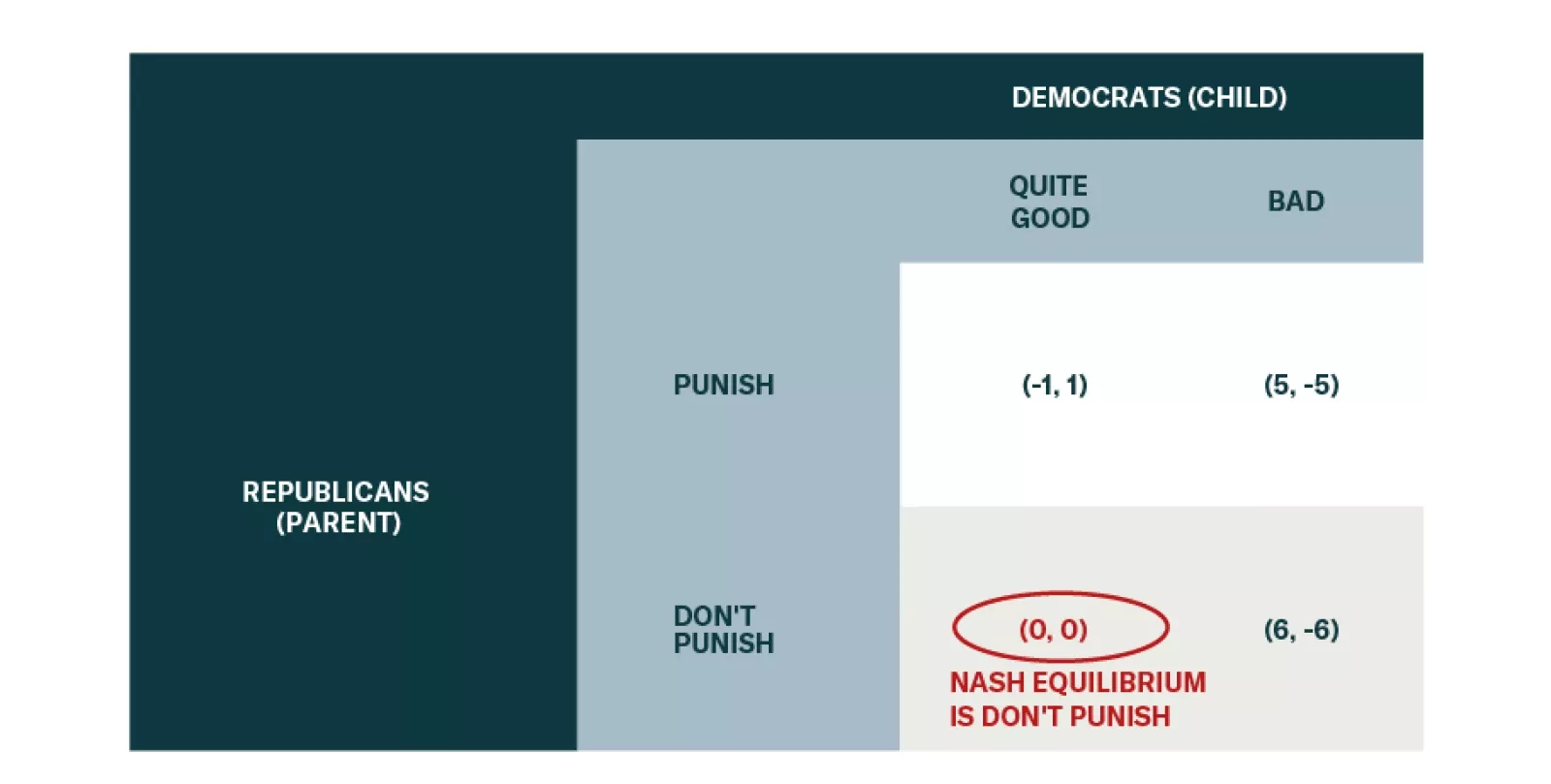

According to BCA Research’s Counterpoint service, in game theoretical terms, the debt ceiling standoff is the Parent-Child game, in which ‘the child’ can be good or bad, and ‘the parent’ can punish…

In Section I, we review the three possible economic scenarios over the coming year, and underscore that the “soft landing” scenario remains improbable. A “no landing” scenario could occur, but it would ultimately lead back to the…