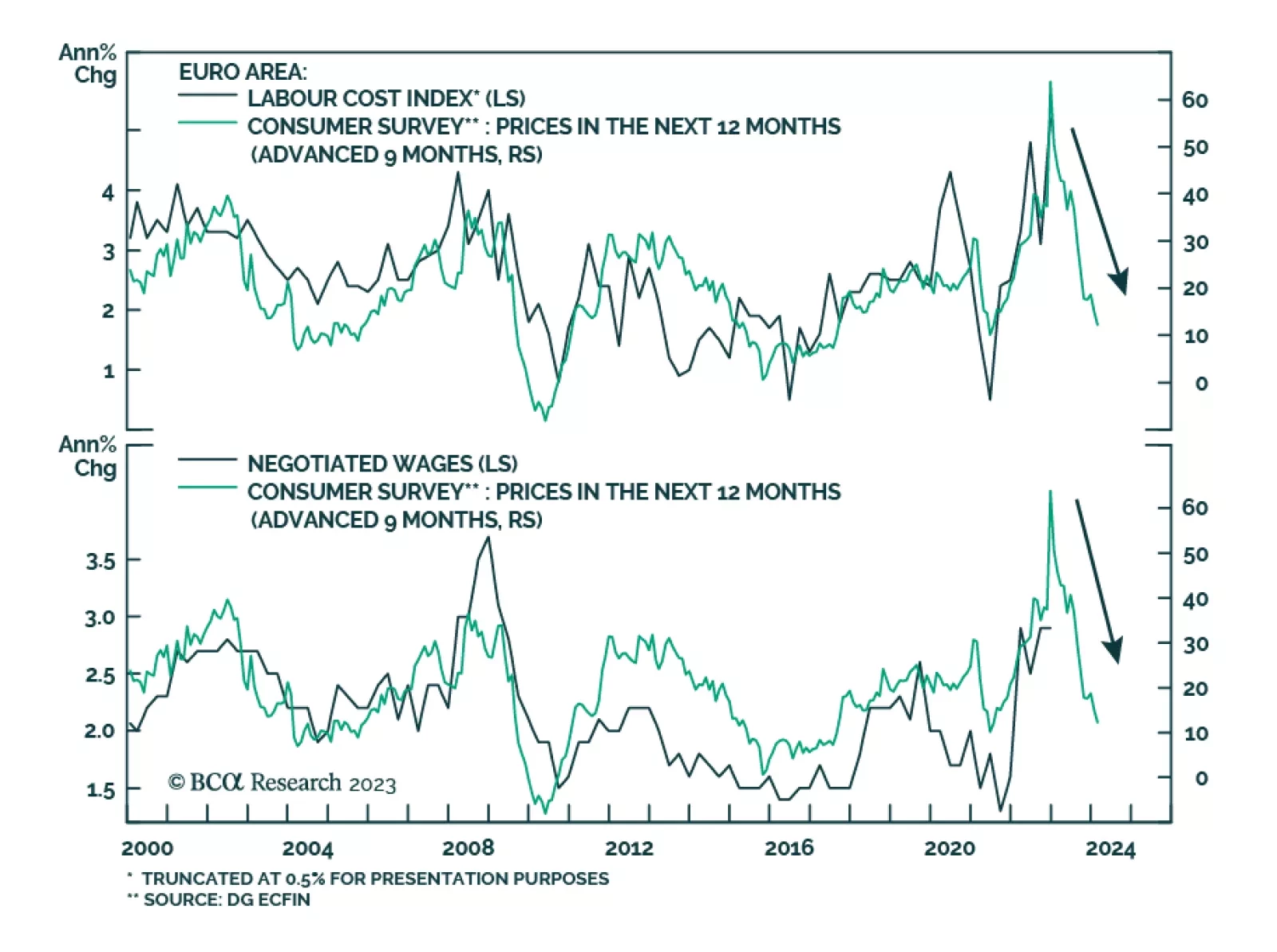

Eurozone households are becoming less concerned about the near-term outlook for inflation. The results of the latest ECB Consumer Expectations survey show a significant drop in median 12-month inflation expectations from 5.0% in…

What’s going on? The market-weighted stock market is up. But the equally-weighted stock market is not up. Neither is credit. Neither are industrial metal prices. Neither is the oil price, despite two waves of OPEC output cuts. We…

According to BCA Research’s US Investment Strategy service, the near-term consensus outlook has grudgingly improved but is still excessively bearish. Economic surprises will continue to boost stocks until a 2023 recession…

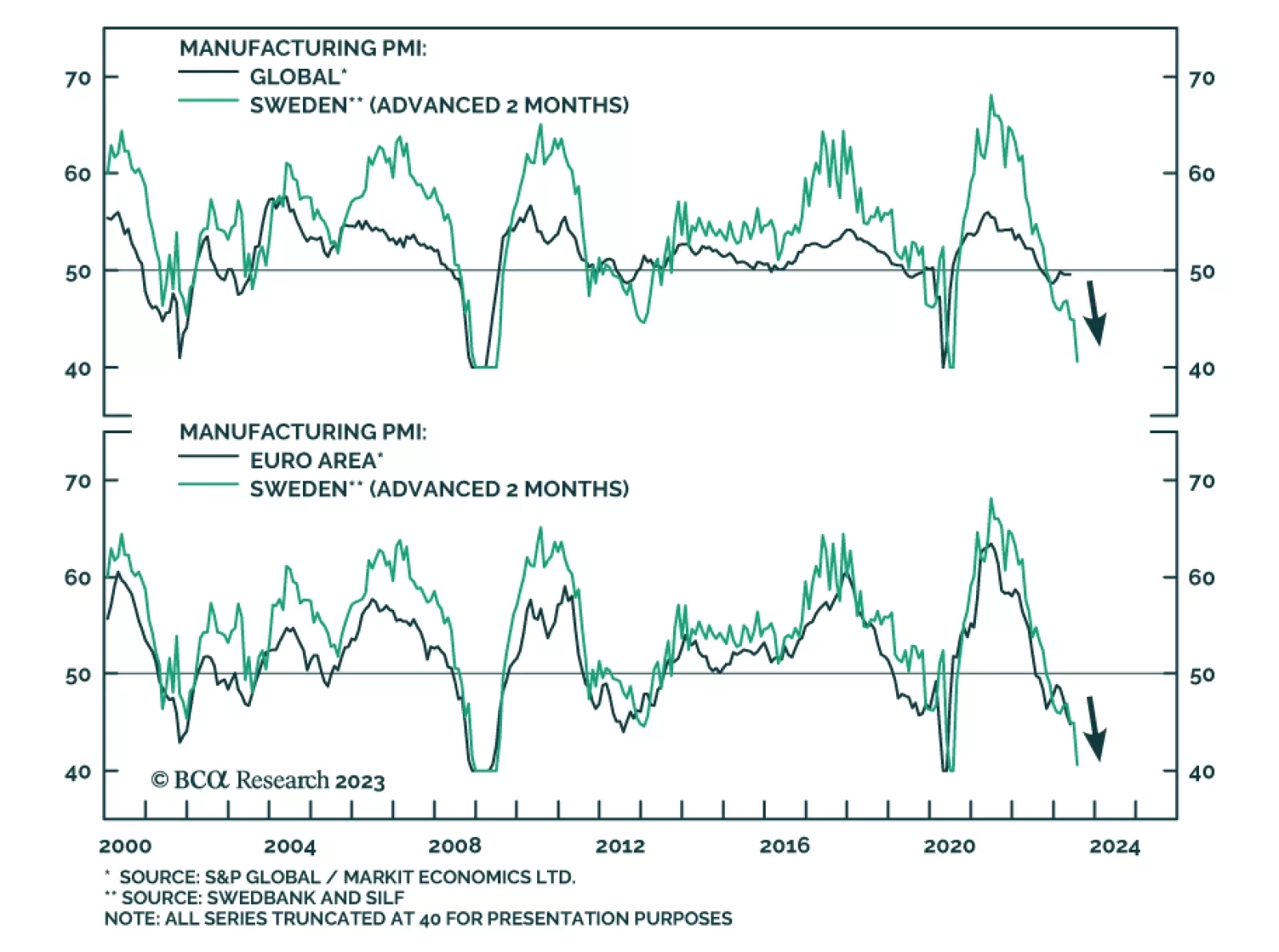

The Swedish manufacturing PMI declined to 40.6 in May, the lowest level since June 2020. This deterioration in Sweden’s manufacturing activity not only reflects the domestic economy, but it also highlights weaknesses in the…

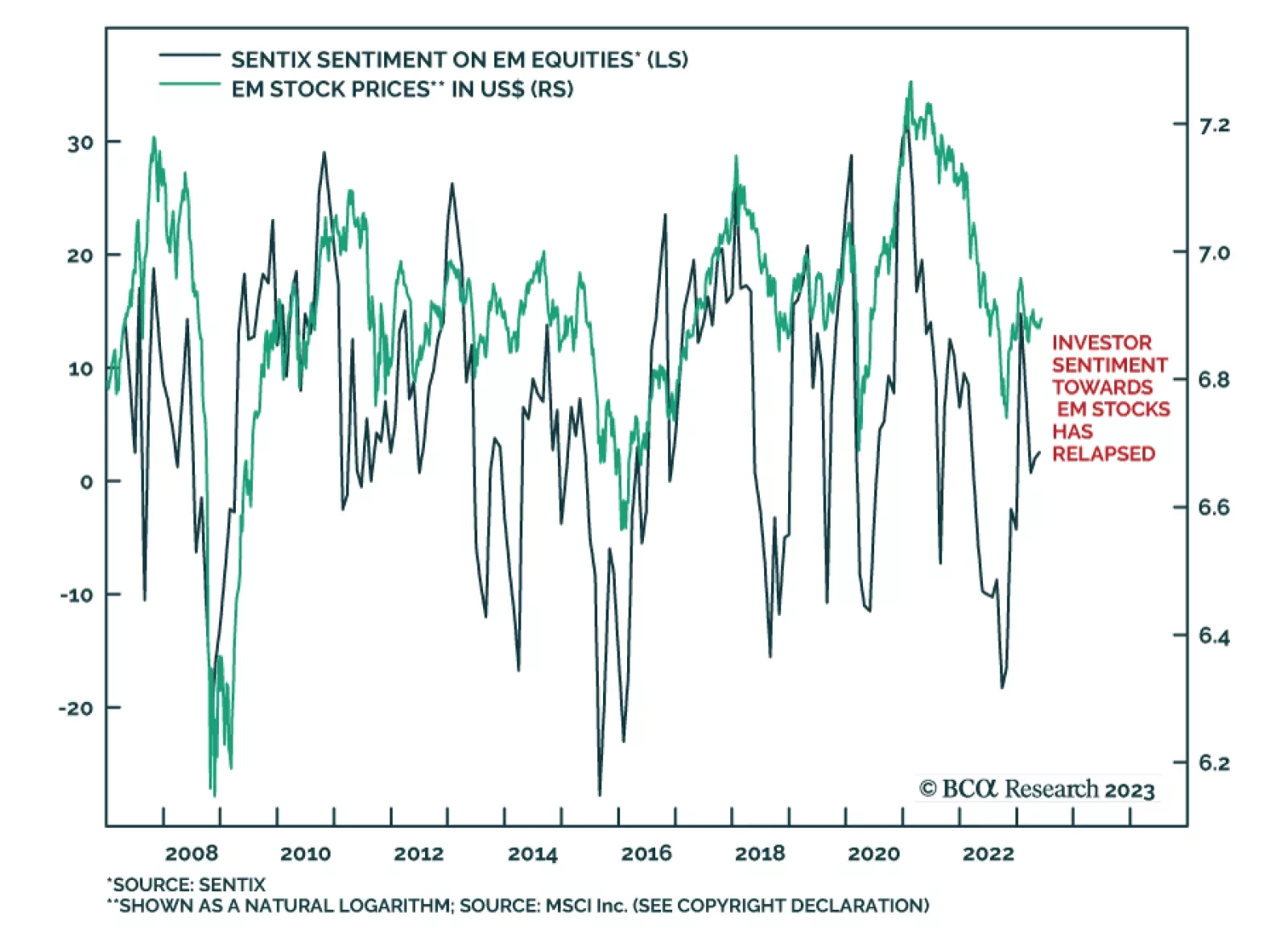

After a brief period of outperformance in late-2022/early-2023, Emerging Market stocks have been underperforming their Developed Market counterparts since January 19. While the DM equity benchmark is up 6.9% over this period, the…

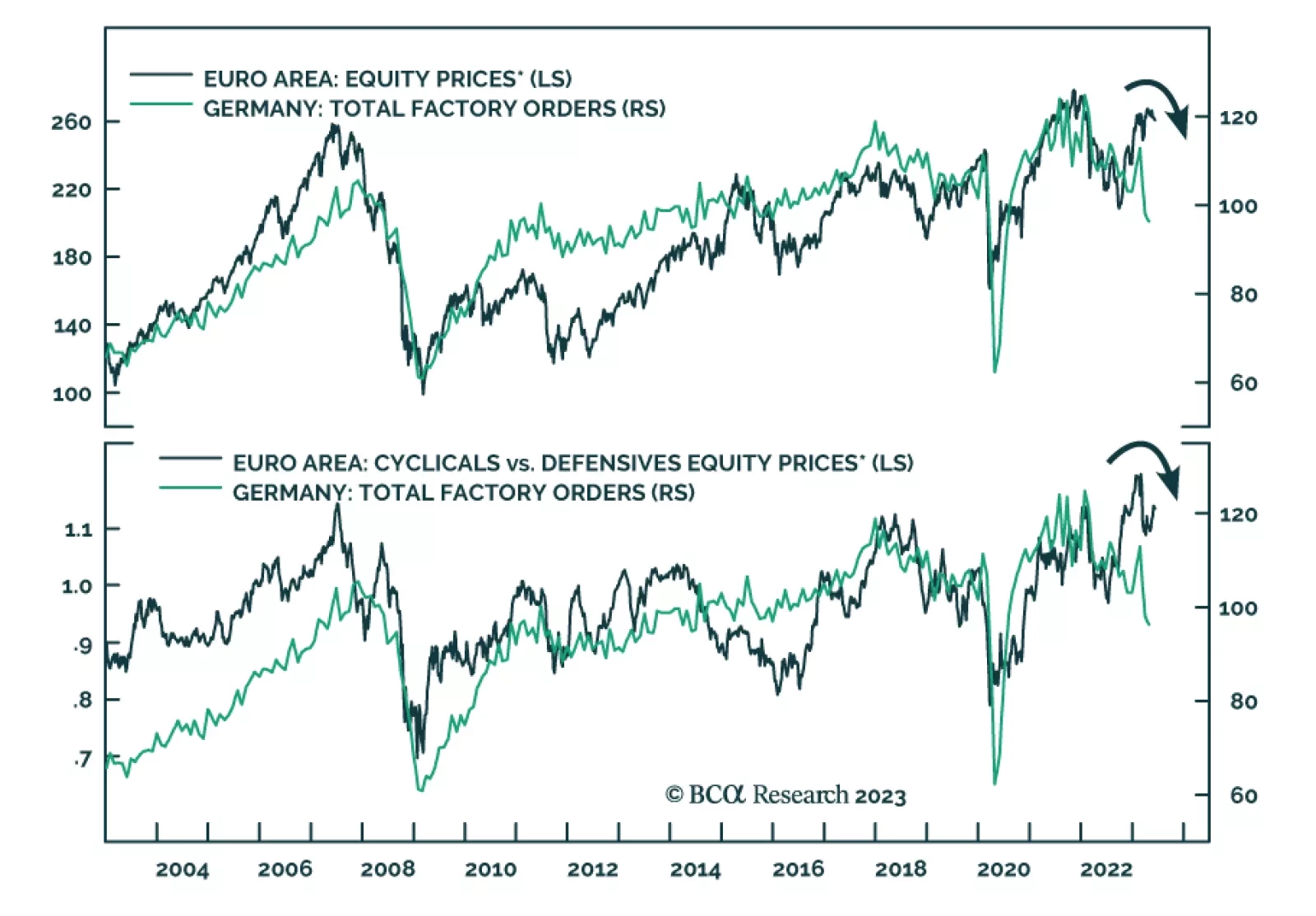

Tuesday’s German factory orders release sent a disappointing signal about industrial demand. Although the pace of decline eased from -10.9% m/m to -0.4% m/m in April, it fell below expectations of a 2.8% m/m increase. Both…

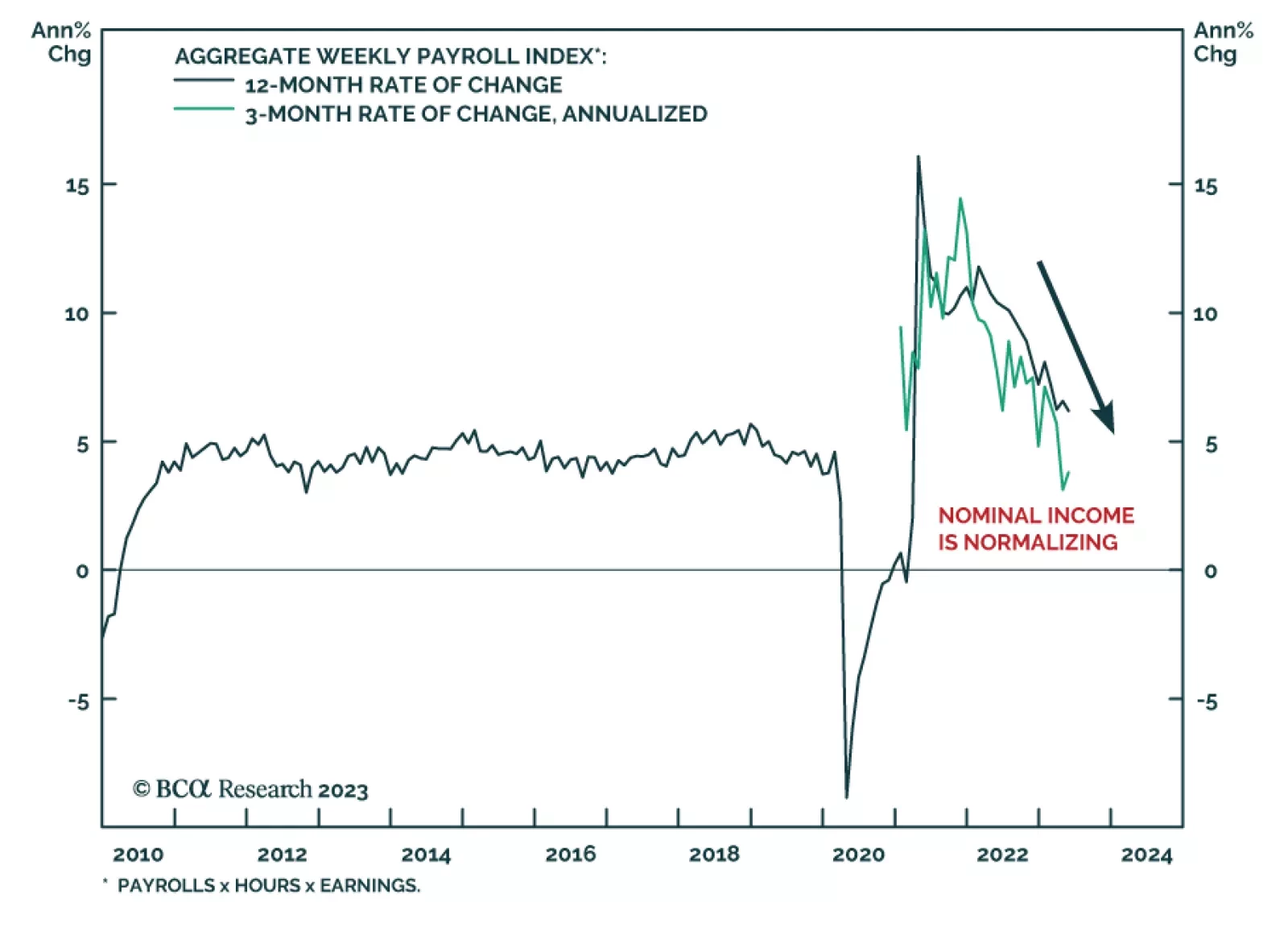

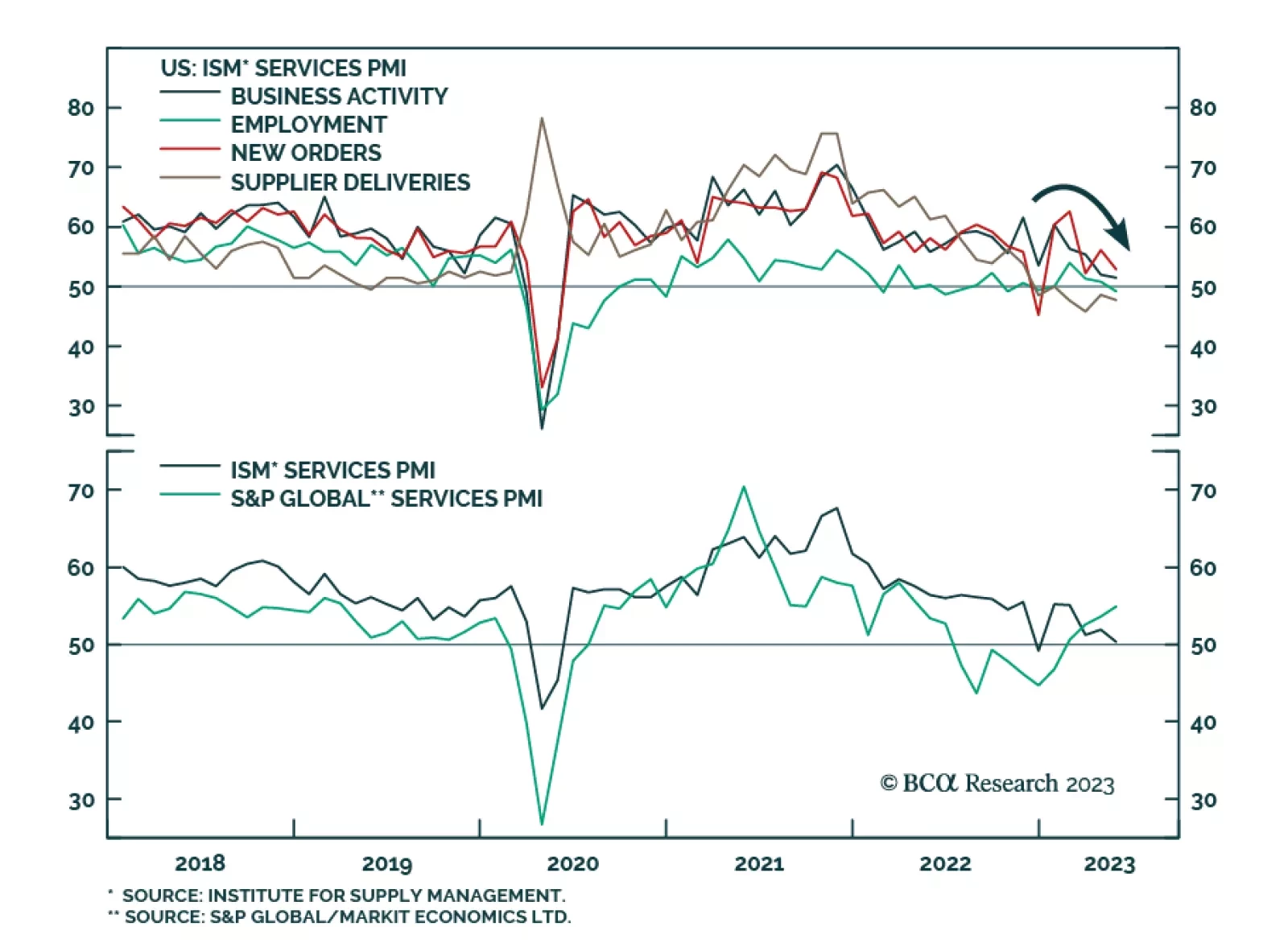

The ISM PMI sent a disappointing signal about US service sector activity in May. The headline index unexpectedly fell from 51.9 to 50.3 – the weakest level since December and surprising expectations of an improvement to 52.…

In response to client questions, we offer our view on the purported link between tech stocks and interest rates, the similarities between the S&L Crisis and the current banking turmoil and the near-term outlook for consensus…

The S&P 500 performance was flat in May if not for the strong performance of a small cohort of mega-caps, aided by exposure to AI. Earnings and sales growth are contracting but analysts expect a rebound into a yearend, which is…

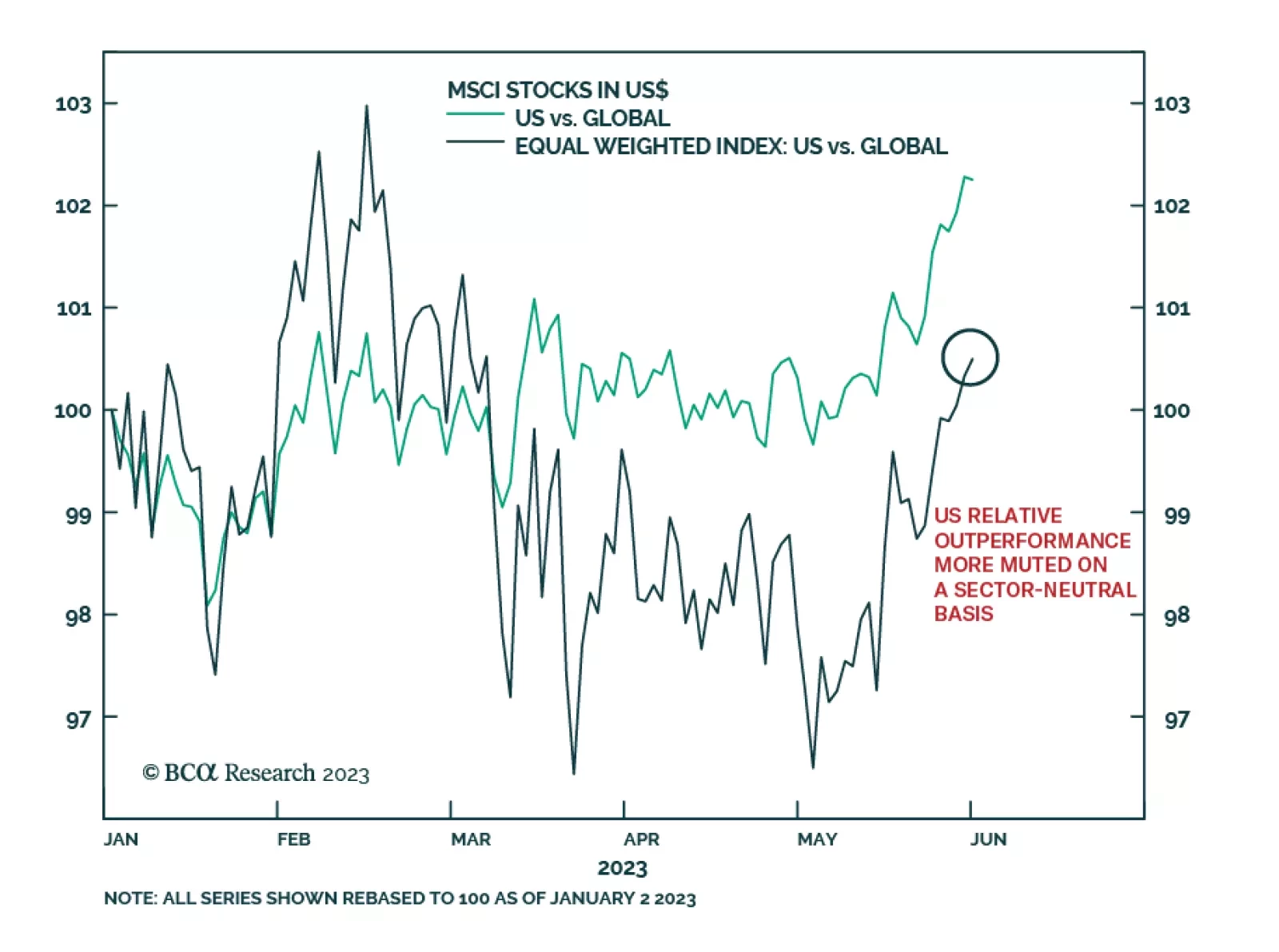

US stocks have outperformed their global peers on a year-to-date basis. The MSCI US index’s 7.5% gain since January 18 eclipses the ACW index’s 3.1% increase. This trend has recently become even more pronounced: while…