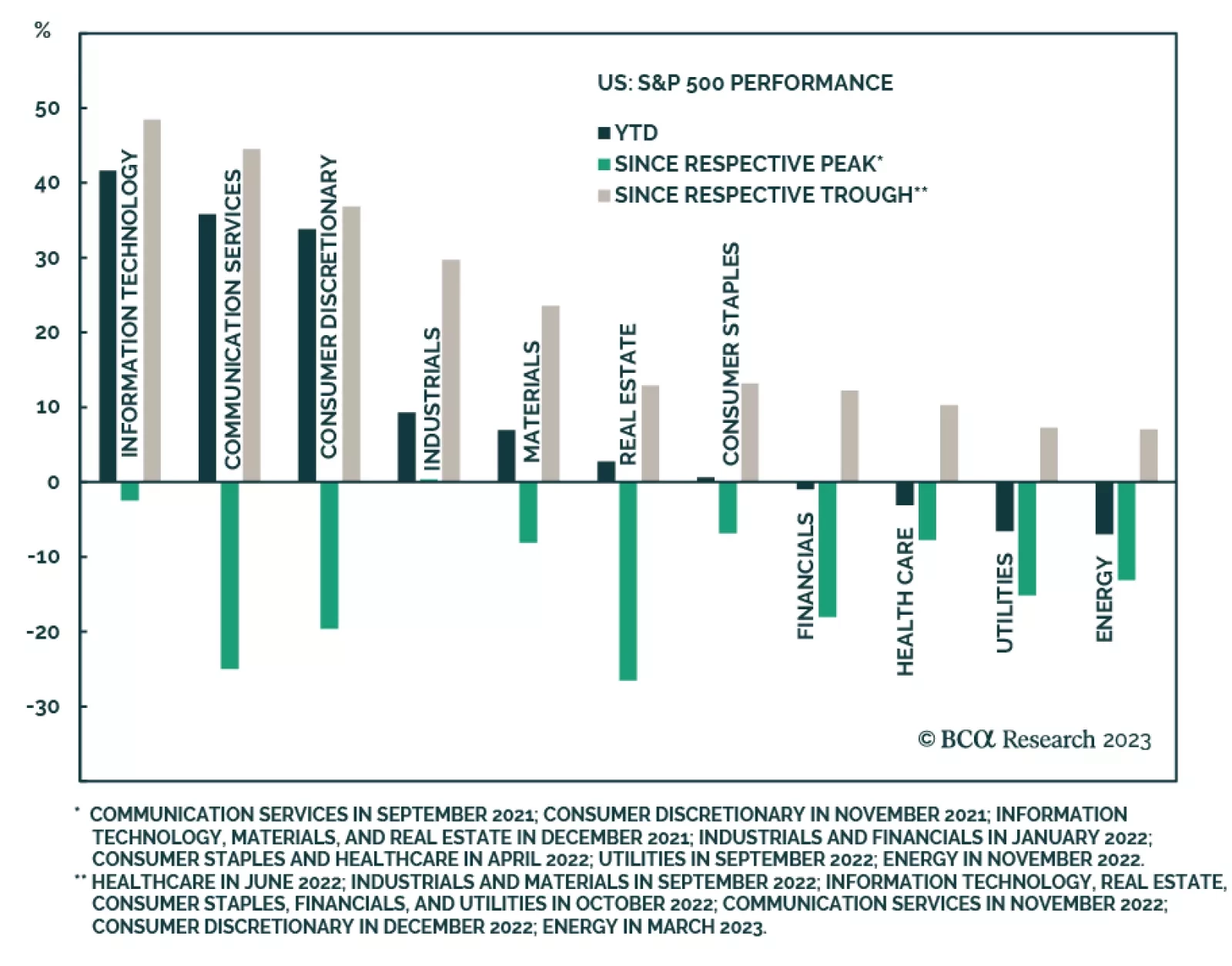

Seven of the 11 S&P 500 equity sectors are in the green on a year-to-date basis, led by those that benefitted from the AI frenzy: Information Technology, Communication Services, and Consumer Discretionary. In fact, the…

The world economy is likely already in recession, defined as world growth dipping to sub-2 percent. So far, the world recession has been China-led, but in the coming months it will change to being developed economy-led. Hence, while…

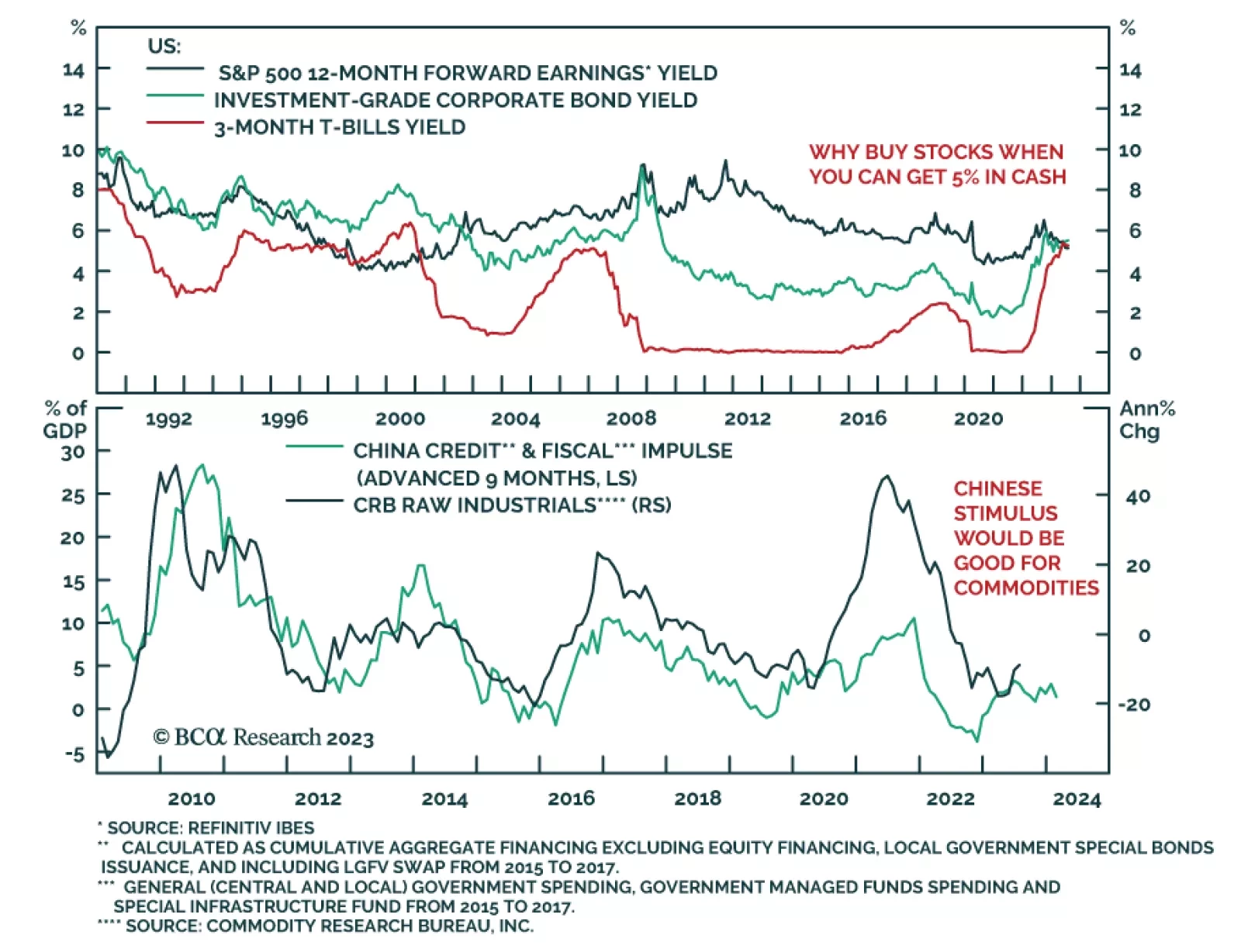

On a 12-month investment horizon, BCA Research’s Global Asset Allocation service recommends a defensive stance: Overweight government bonds, and underweight equities and credit. The US stock market trades on 19x forward…

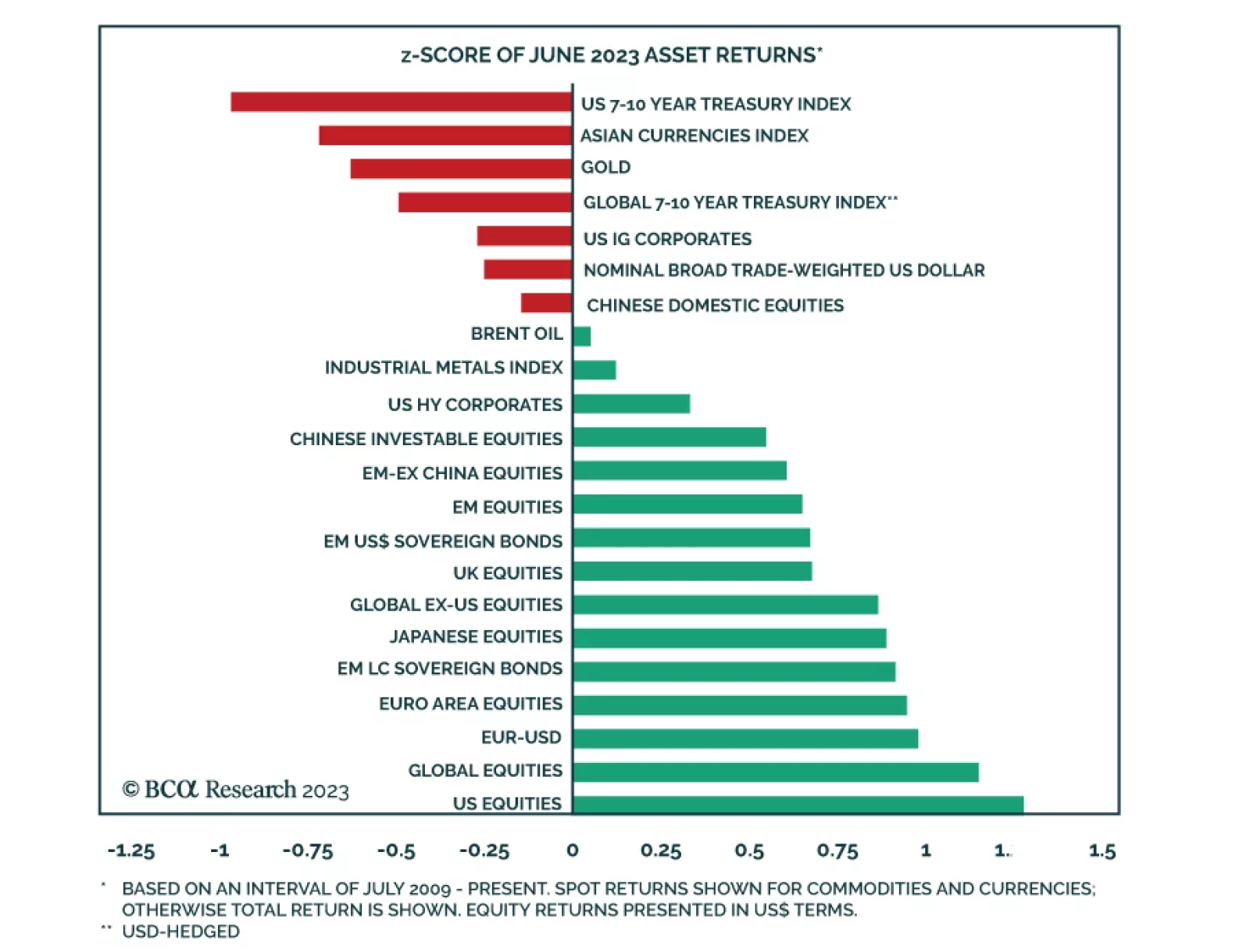

The performance of financial markets continued to improve in June, with most of the major financial assets we track generating positive abnormal returns. The US equity rally – which had been narrowly concentrated among…

Our recession indicator turned red in late December. Though it has informed our 12-month caution, we are sticking with our tactical equity overweight as we expect that the lagged effects of pandemic fiscal largesse may extend the lag…

Recession is on track to start around year-end. Stocks usually peak shortly before recession begins. So, position defensively but be prepared for a few more months of the rally.

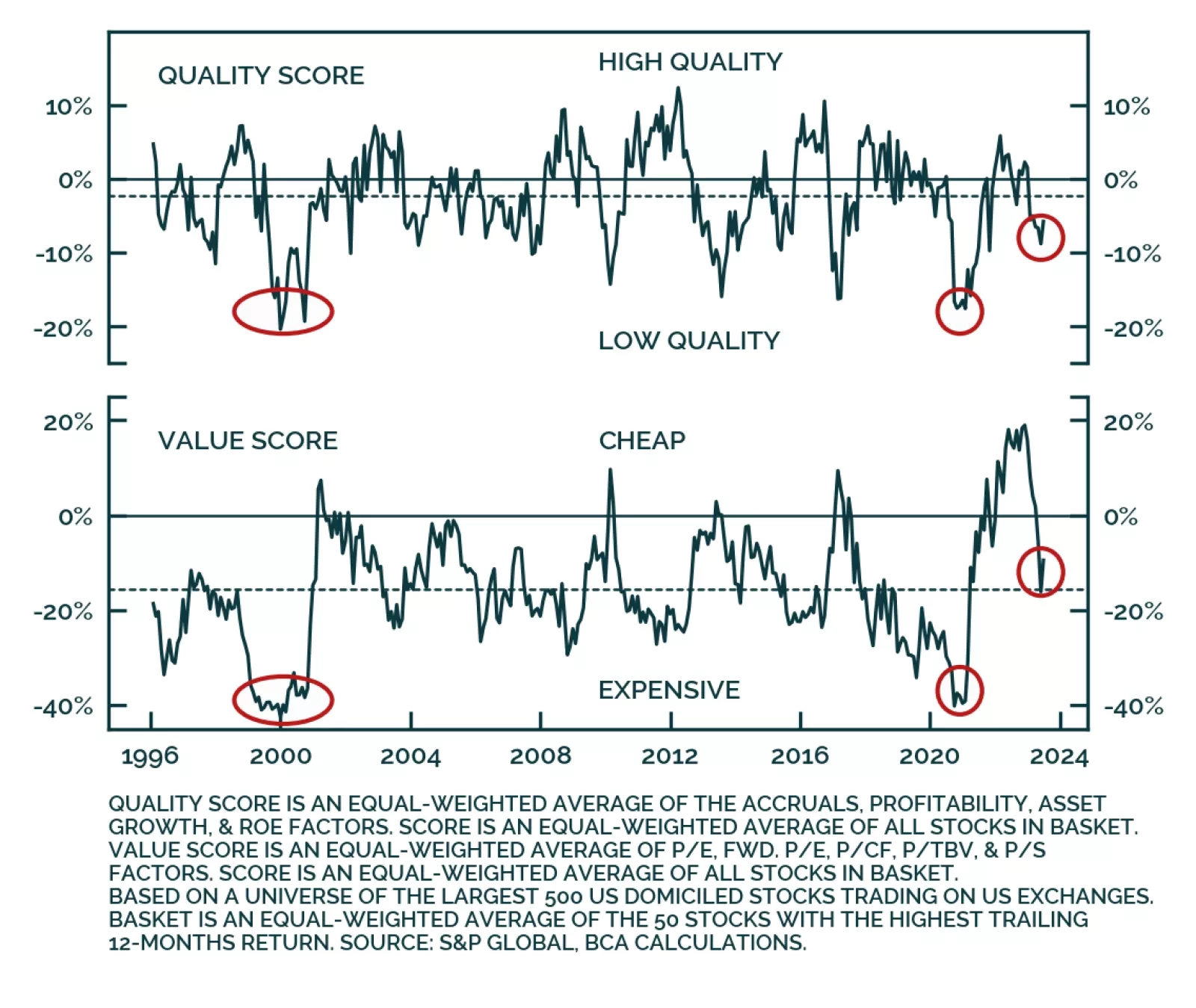

In June, the rally gained momentum and broadened due to positive economic data, particularly in the housing market. We expect cheaper cyclical sectors and styles to mark a change in leadership as the rally broadens, helped on by…

This chart breaks down the factor exposure of the top performers in the US large cap space relative to the largest 500 stocks in the US to see how the current market leaders compare to history relative to their peers. The values…

In this Strategy Outlook, we present the major investment themes and views we see playing out for the rest of 2023 and beyond.