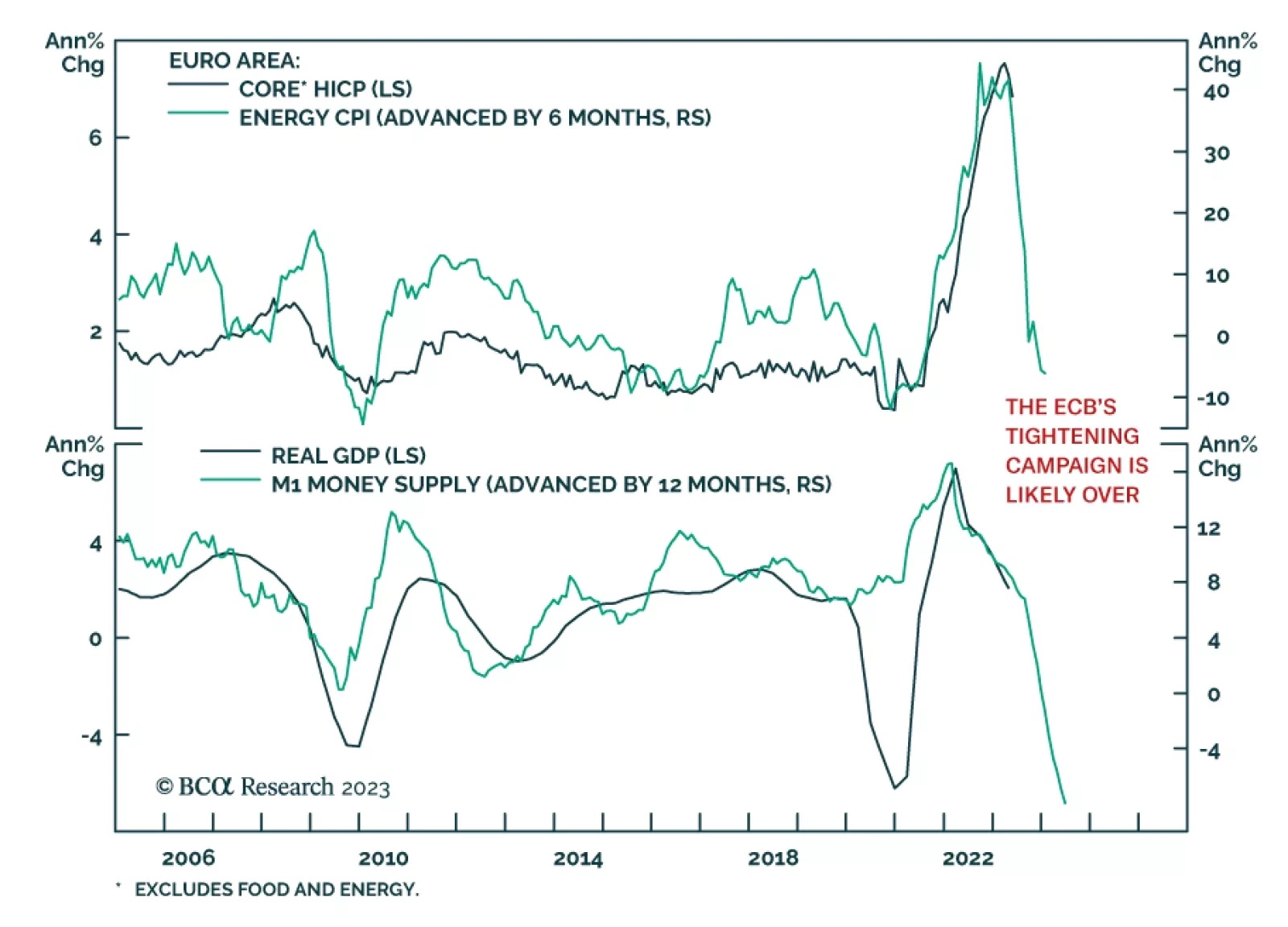

The Eurozone economy returned to expansion in the second quarter with real GDP rising by 0.3% q/q – beating expectations of 0.2% q/q. This follows an upwardly revised 0.0% in Q1 and a 0.1% contraction in Q4 2022. In…

The latest round of earnings calls from the systemically important banks suggested that the expansion is still intact. Households are still flush and still spending and consumer and business delinquencies remain remarkably low.

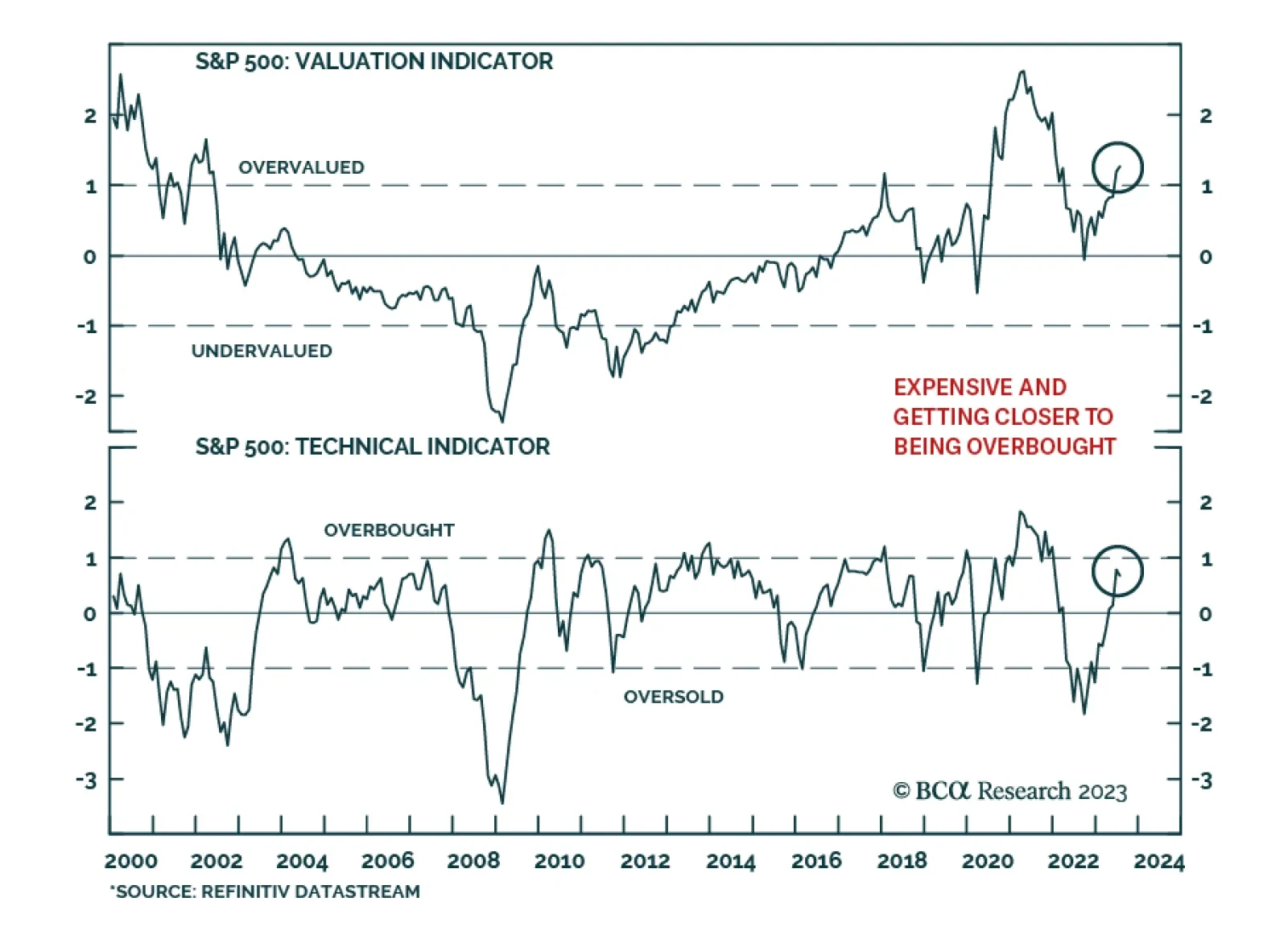

Investors remain cautious about the US economy and still have significant cash that needs to be put to work which could extend the rally further. Earnings rebound later in the year will be supported by rising sales growth and surging…

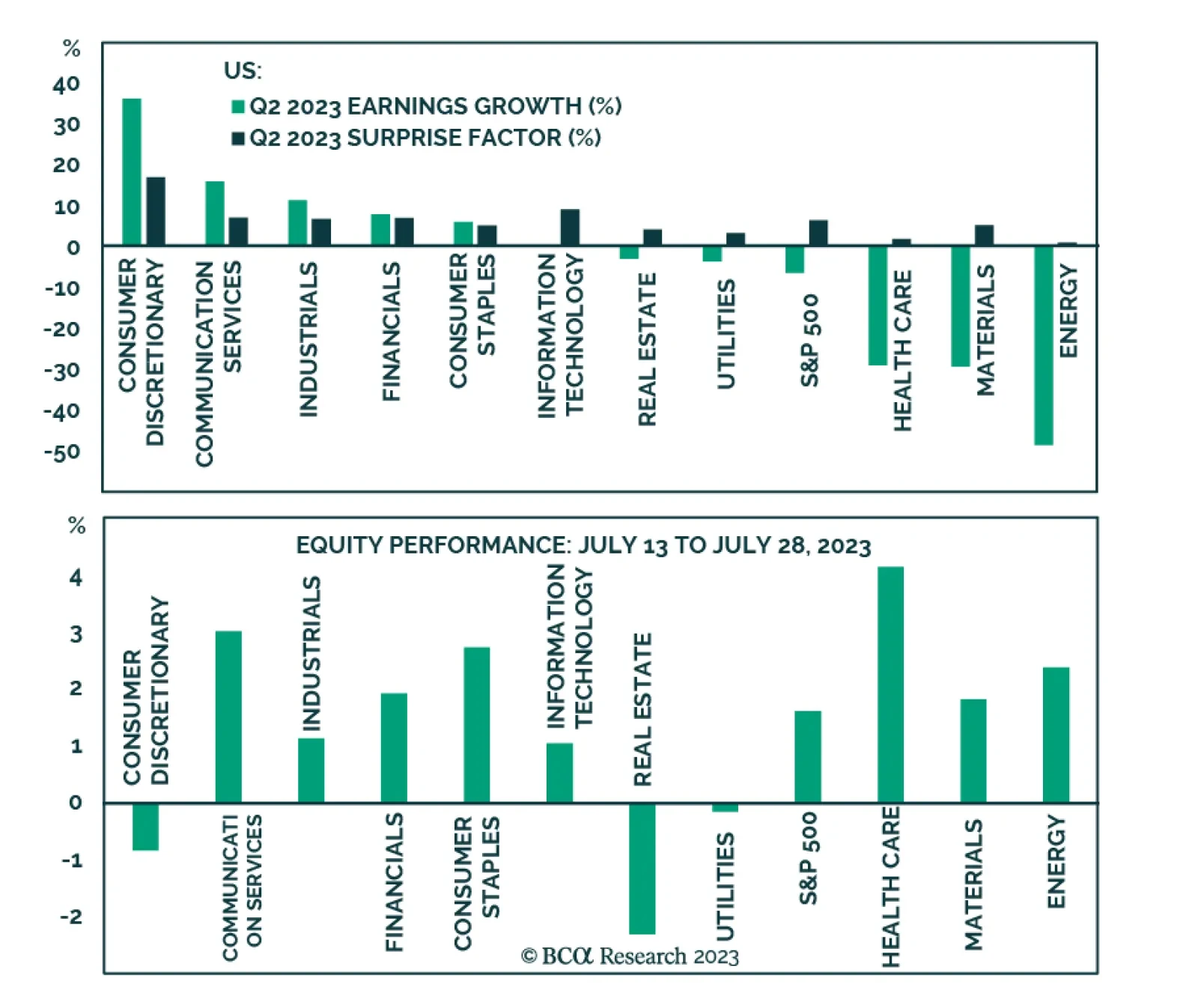

We are now midway through the Q2 2023 earnings season: 254 of the companies in the S&P 500 have reported. It’s therefore worthwhile to stand back and observe some of the emerging trends. According to Refinitiv IBES,…

A narrow equity rally was the key characteristic of the US stock market in the first five months of the year. Despite concerns about the domestic economic situation due to ongoing monetary tightening, and poor external dynamics…

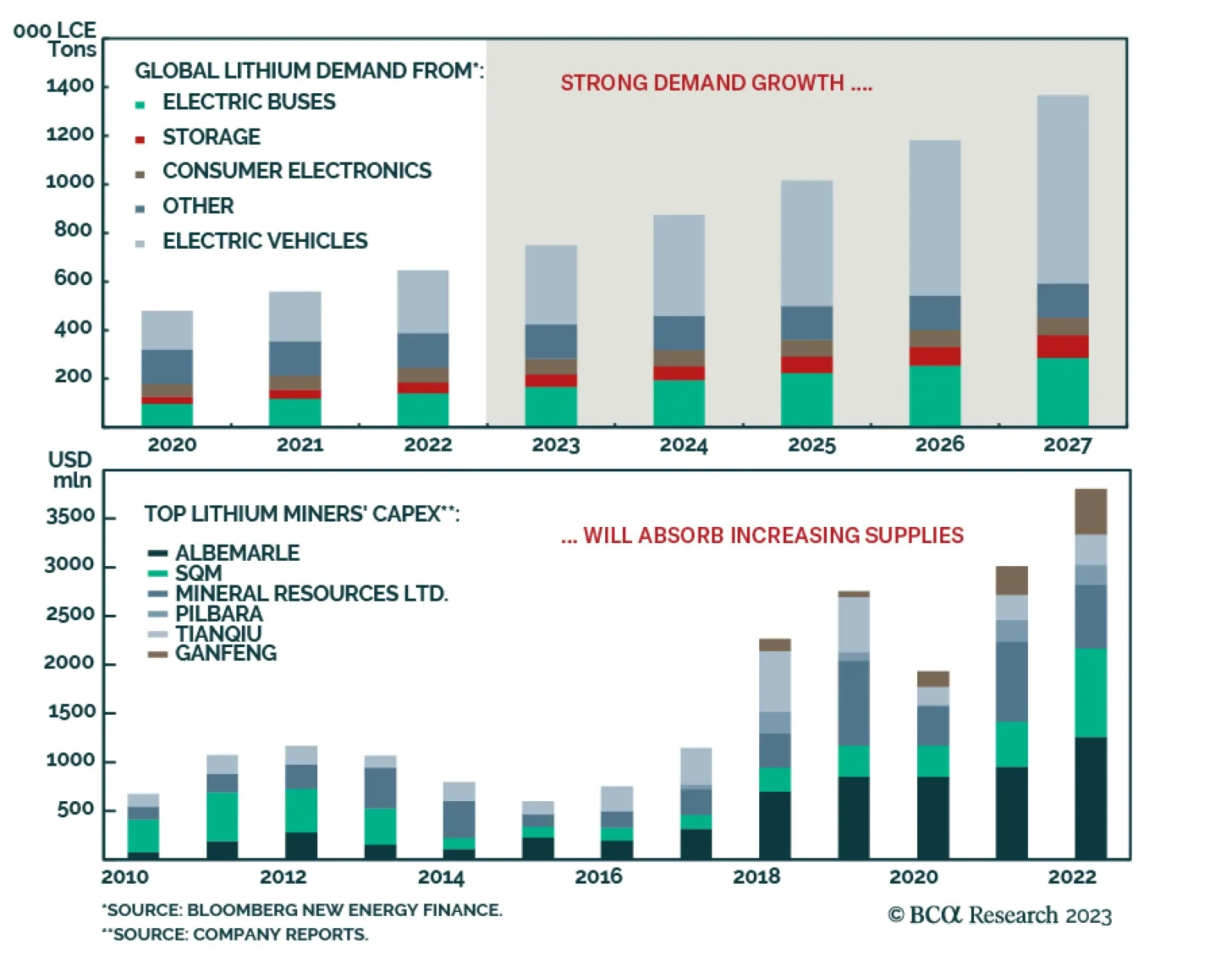

BCA Research’s Commodity & Energy Strategy service expects steady demand for EVs will be able to absorb increasing lithium supplies in the short-to-medium term. The team is getting long the LIT ETF at tonight’s…

In Section I, we audit the market’s “soft landing” narrative in response to a meaningful challenge to our cautious stance from recent financial market developments. We acknowledge that US economic growth was stronger in the first…

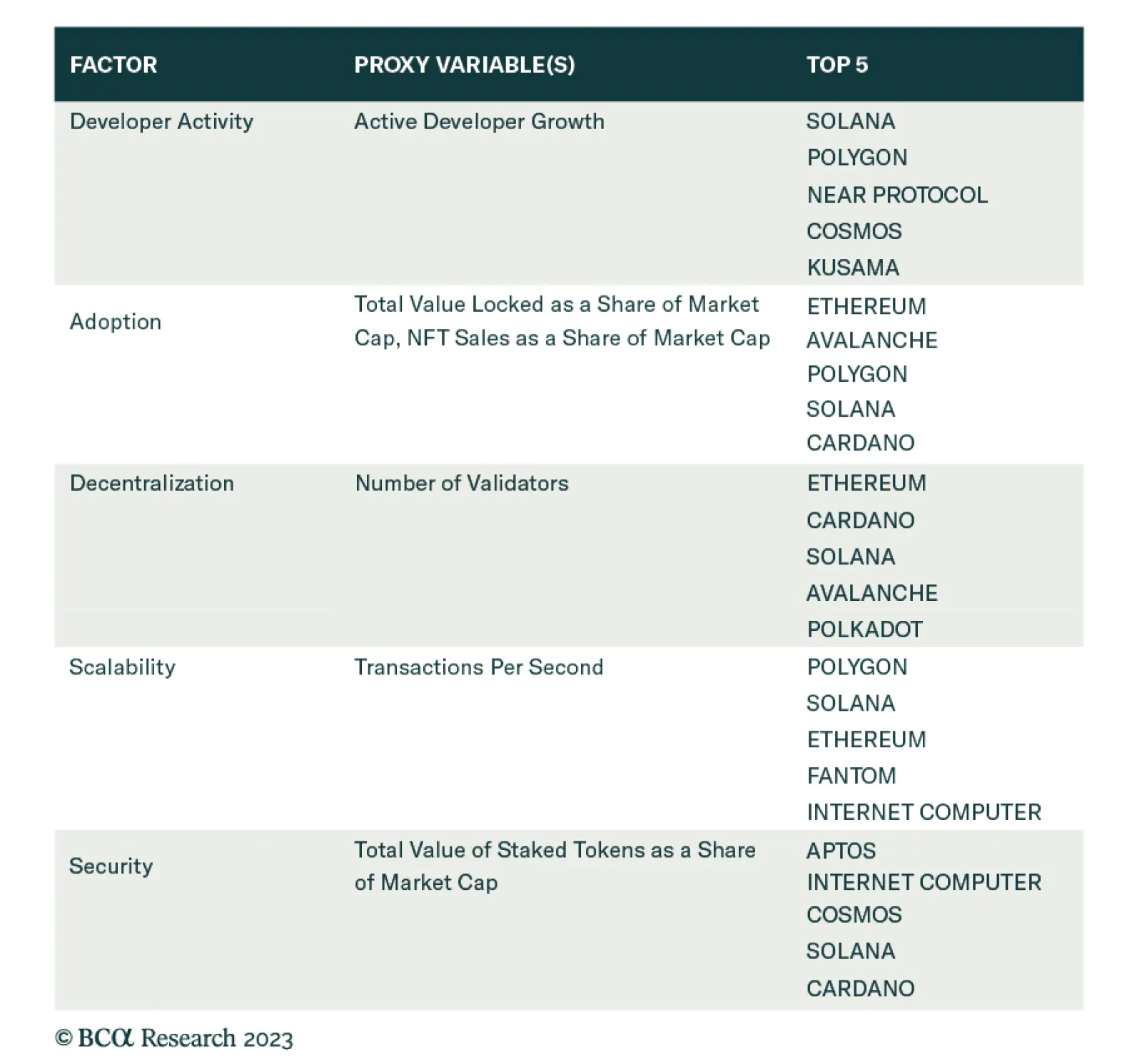

According to BCA Research’s Counterpoint service, the top five blockchains are Solana (SOL), Ethereum (ETH), Polygon (MATIC), Cardano (ADA), and Avalanche (AVAX). Investors should have a small (up to 5 percent)…

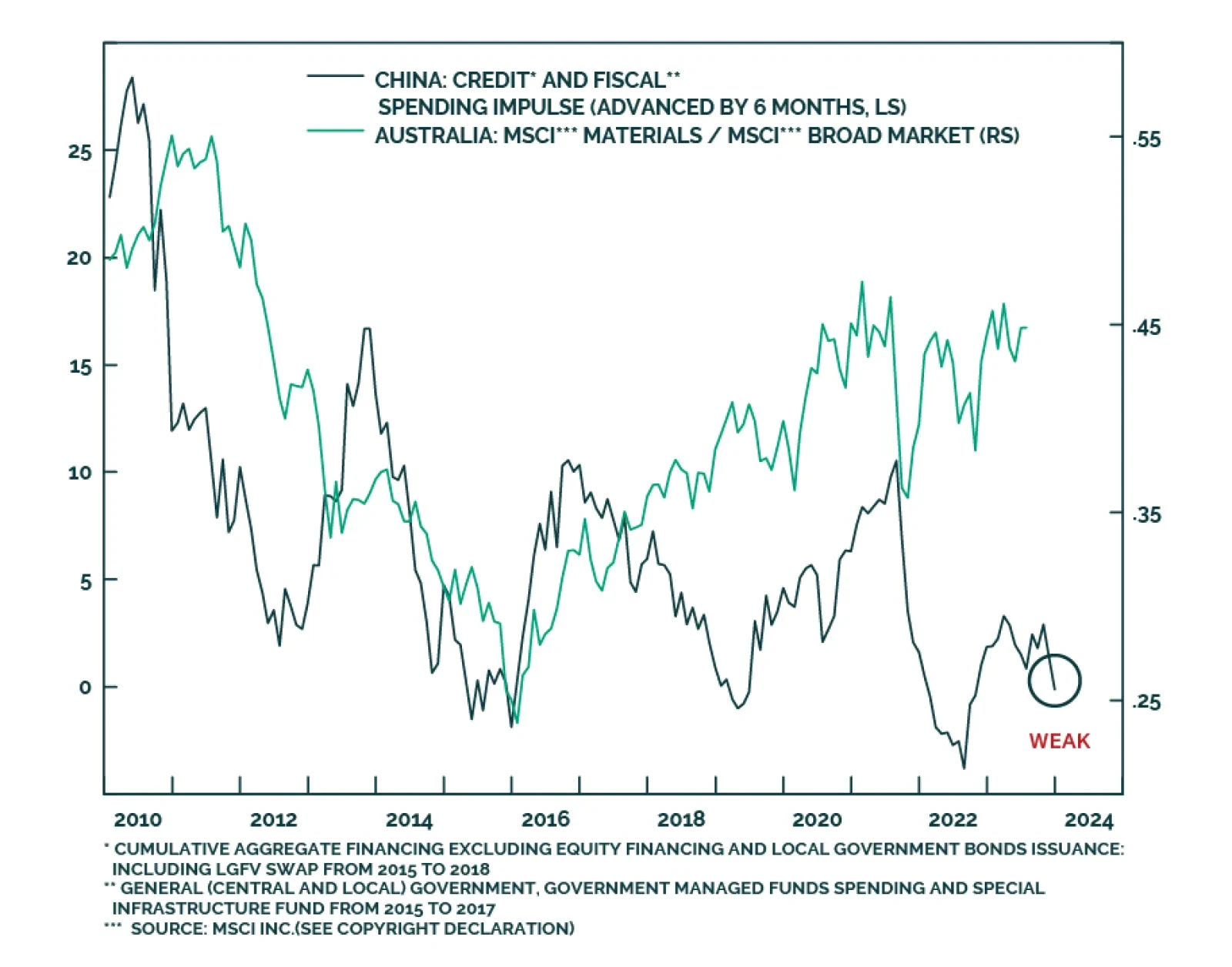

Australian material stocks have been in a broad trading range since the beginning of the year both in absolute terms and relative to the overall market. This stabilization follows a sharp rally in the fourth quarter of 2022 which…