China has generated 41 percent of the world’s economic growth through the past ten years, al-most double the 22 percent contribution from the US. Now that the Chinese growth engine is failing, we explain why it is arithmetically…

The global economy will not enjoy an “immaculate disinflation” but will suffer a very maculate one due to China’s growth slowdown and restrictive monetary policy in the developed world. Investors should stay overweight low-beta…

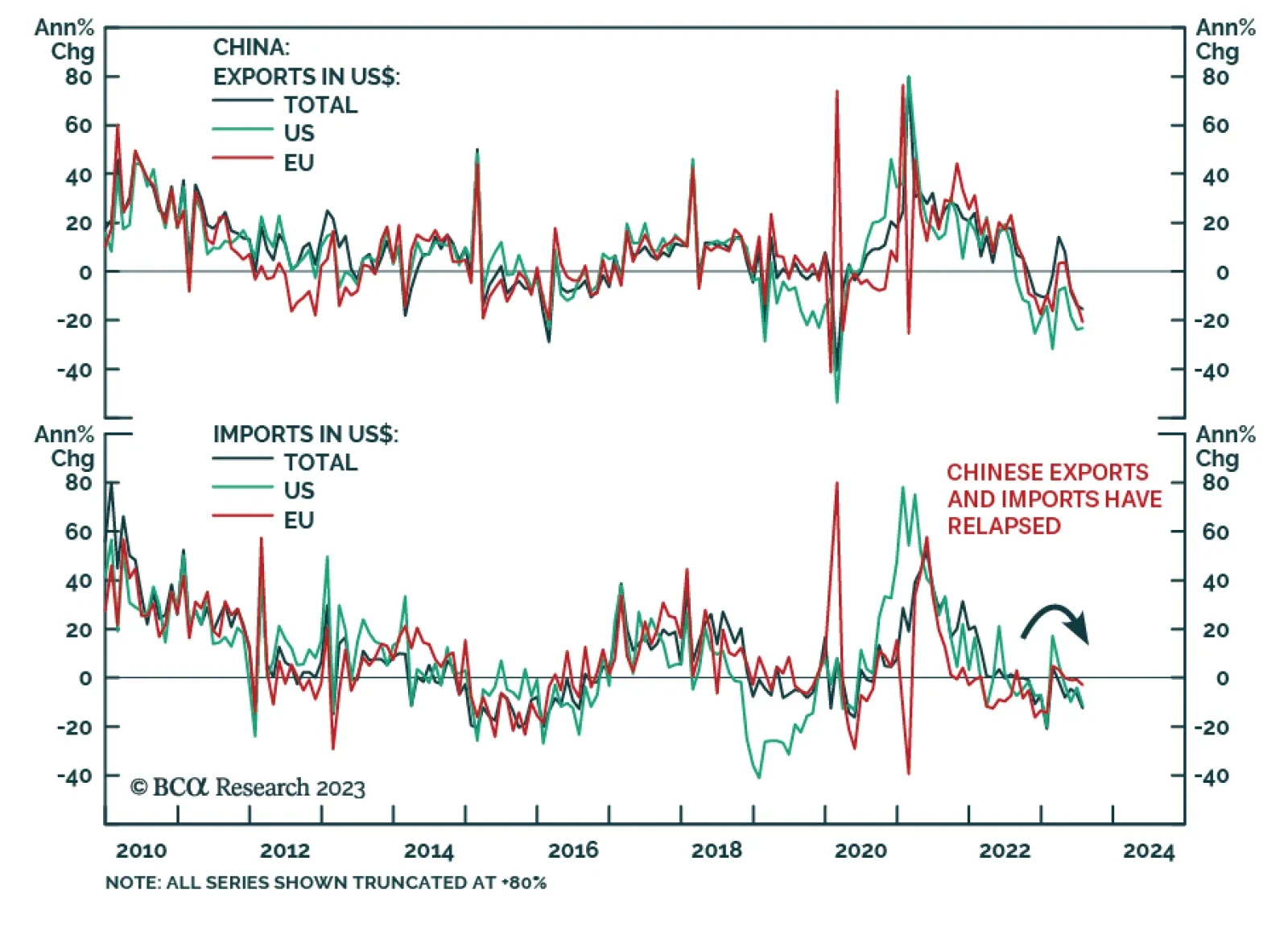

Chinese trade data continued to deliver a pessimistic signal about the global manufacturing cycle. The export contraction deepened to -14.5% y/y in US dollar terms in July – below expectations of a -13.2% y/y decline and…

August offers an opportunity to review our key views. European growth is turning the corner and inflation is improving, but does it guarantee an imminent breakout in European stocks?

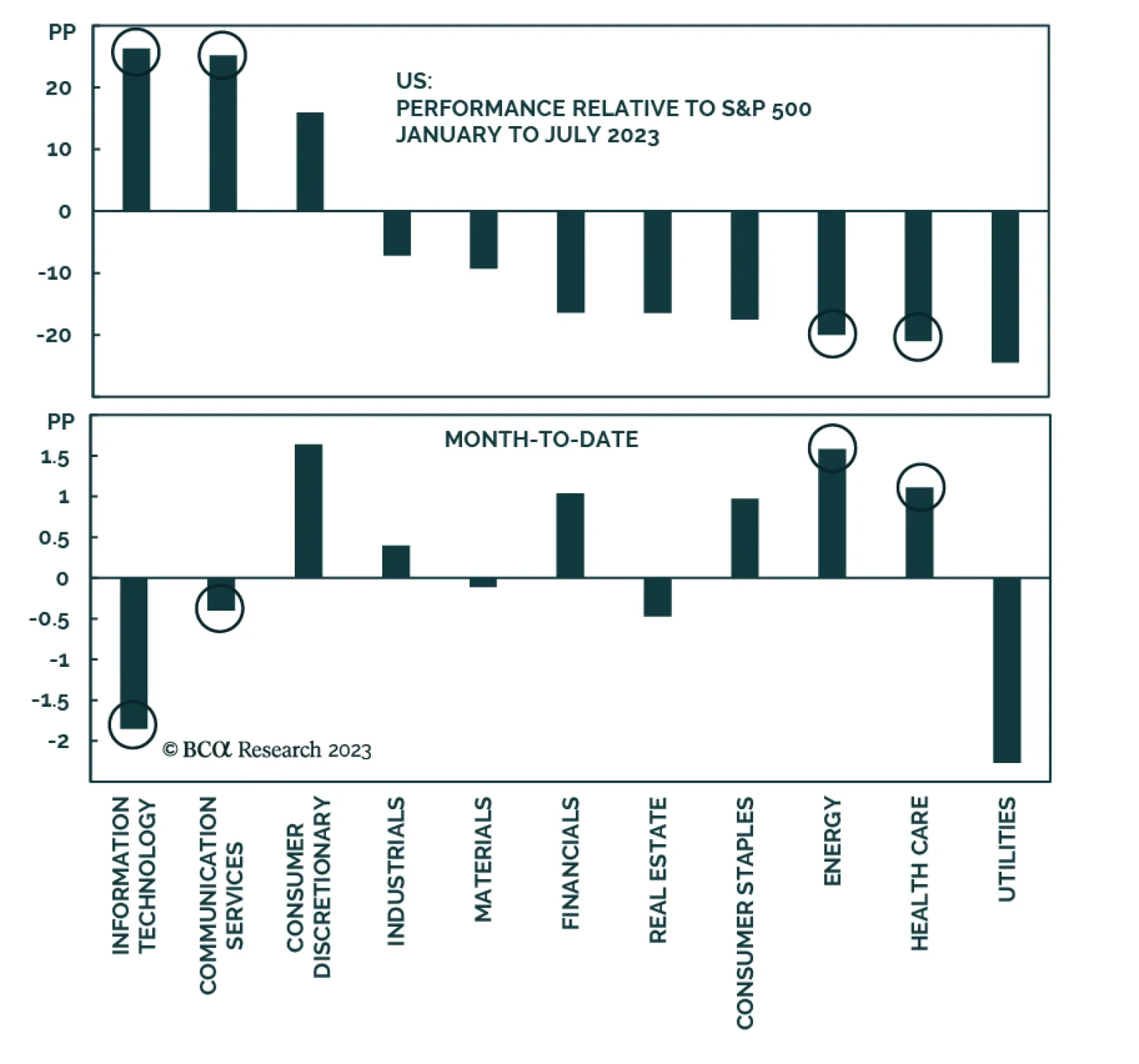

The S&P 500 rally broadened in July, lifting this year’s laggards. Surging long yields are altering the macroeconomic backdrop, as the market absorbs that monetary policy will stay restrictive for a long time. Yet, a move down in…

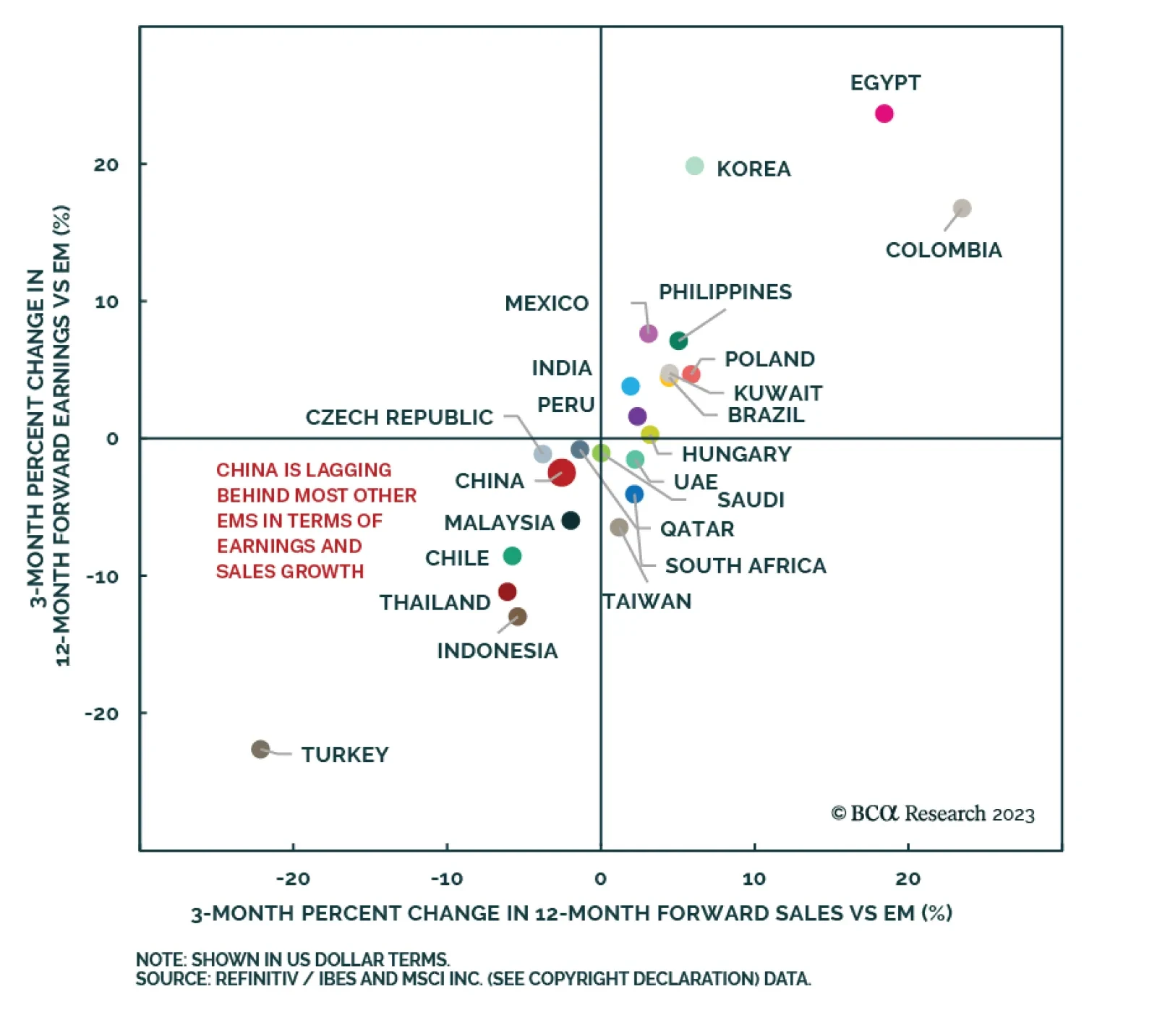

According to BCA Research’s Global Investment Strategy service, EM ex-China equities have potential to outperform China and DM in the remainder of the year. Relative to their own history and compared to other EMs,…

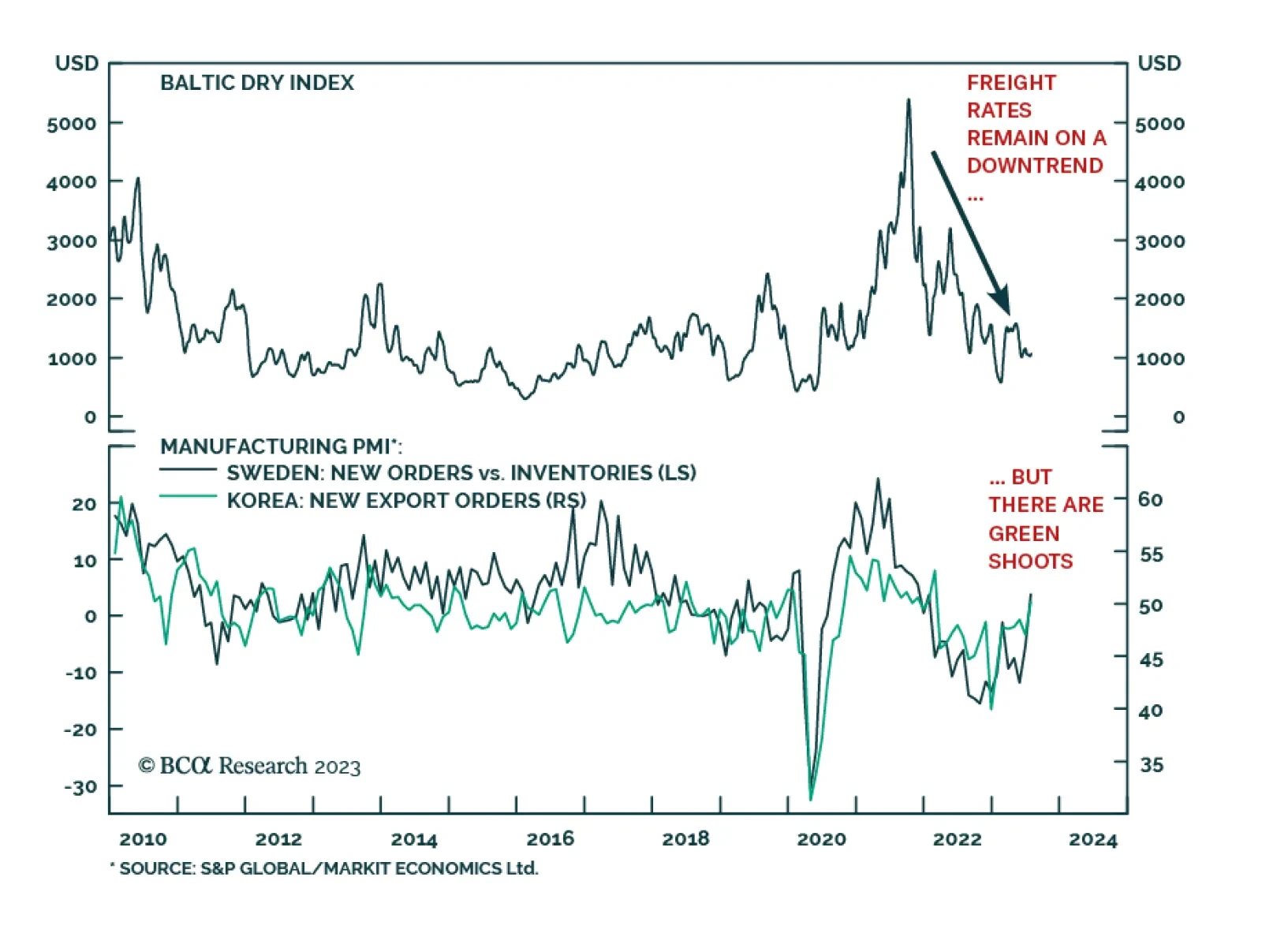

On Friday, shipping giant Maersk delivered a pessimistic outlook for global trade. Although the company raised its 2023 earnings forecast, the upgrade comes on the back of a better-than-anticipated performance in the first half…

The S&P 500 has had a rough start to August. The index’s selloff since the end of July has pushed it down by 2.4%. Notably, the weakness is broad-based with all S&P 500 sectors in the red over this period. This…

China’s extremely high savings rate is the real culprit behind its current economic woes. The authorities have been slow to stimulate the economy, and the risks of “Japanification” have increased. For now, the fact that China is…

The recent ‘Goldilocks’ stock market rally is predicated on the hope that developed countries really can kill inflation without killing their economies. But one important warning sign suggests that the rally has gone…