The stock market’s pre-eminent growth sector is not US tech, it is French luxuries. No other sector can compare with French luxuries’ massive and sustained pricing power. The risk for French luxuries is not a China slowdown, the risk…

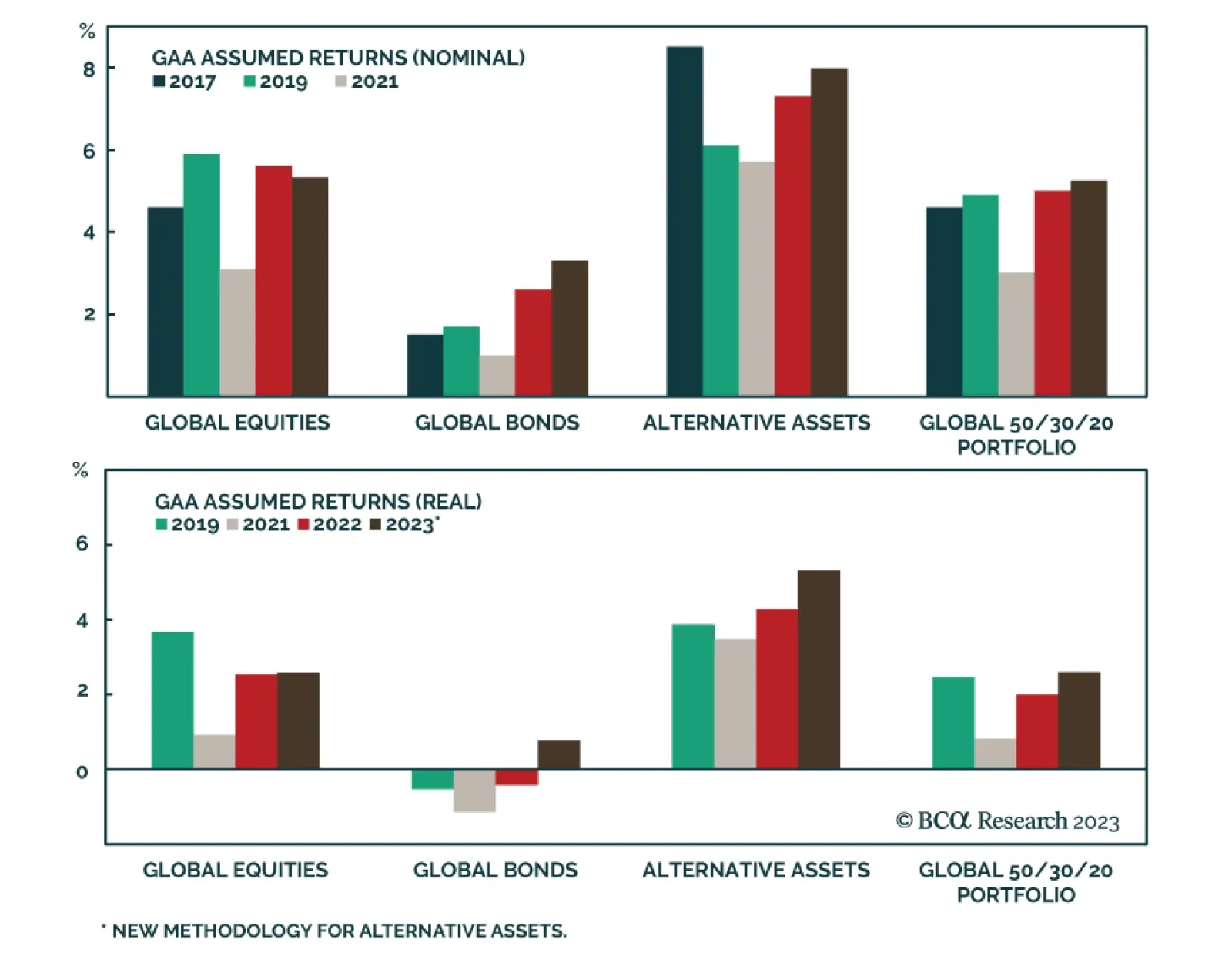

In a recent report, BCA Research’s Global Asset Allocation service updated its long-term return assumptions for a wide range of public and private assets. While still lower than the historical returns, the team’s…

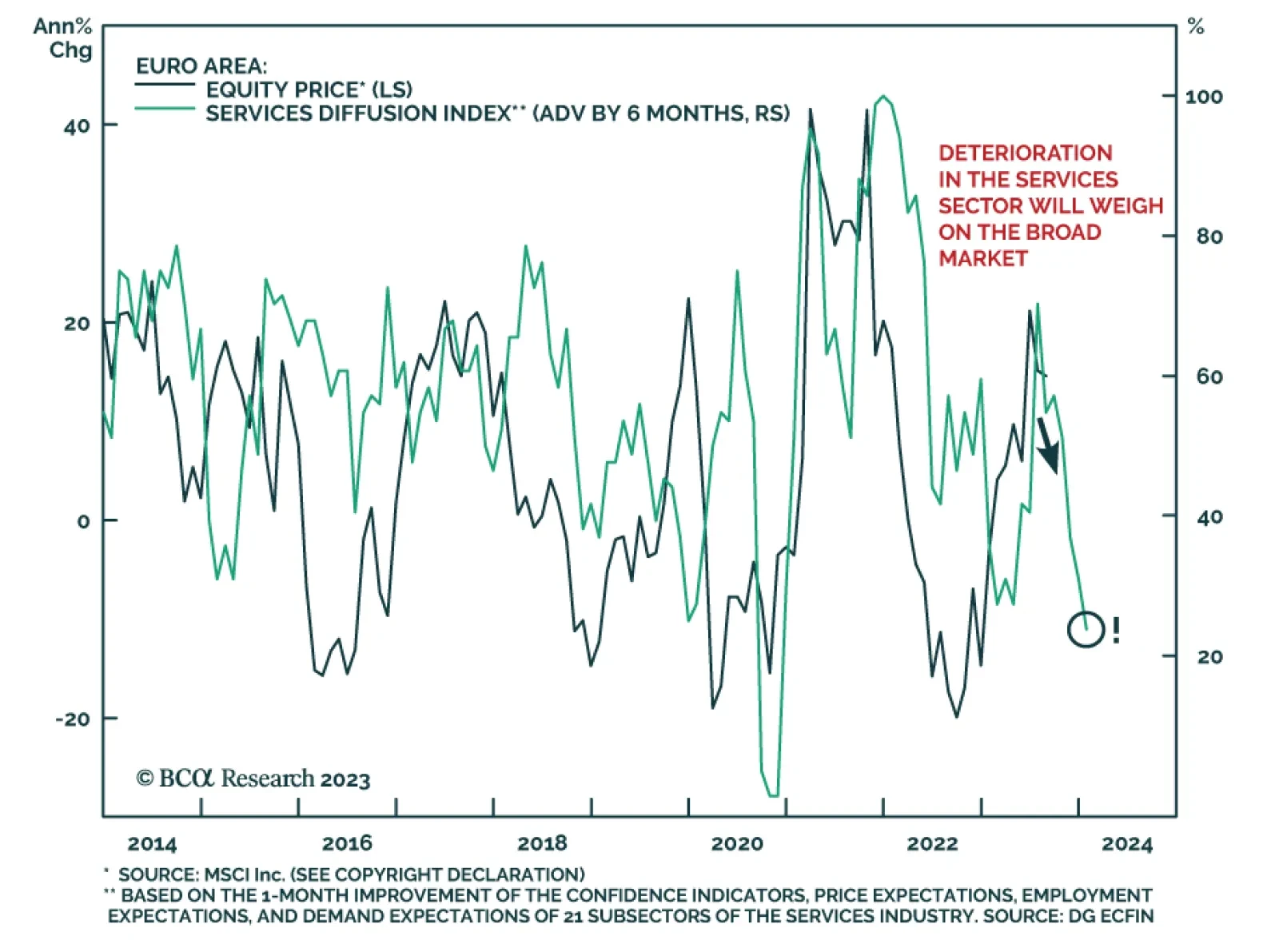

The Eurozone's economy remains soft. Yesterday we highlighted that M3 money supply fell by 0.4% y/y in July, a rate unseen since 2010. This decline was driven by a slowdown in private sector bank lending, which confirms broad…

Investors should underweight global equities and risk assets; overweight US stocks relative to global; and overweight defensive sectors versus cyclicals.

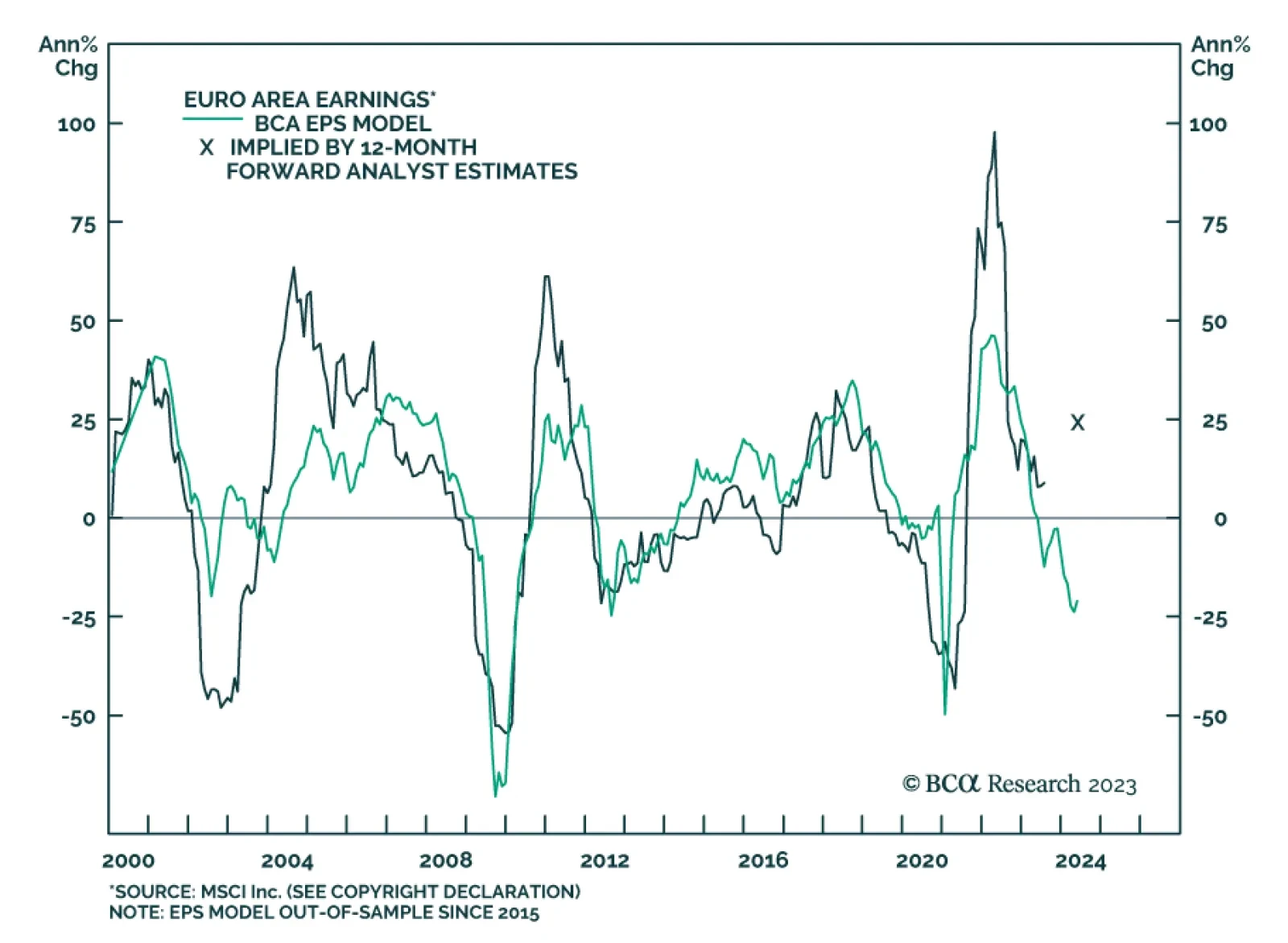

According to BCA Research’s European Investment Strategy service, the profit outlook for Eurozone earnings continues to deteriorate. The team’s earnings model for Eurozone equities continues to point to a deepening…

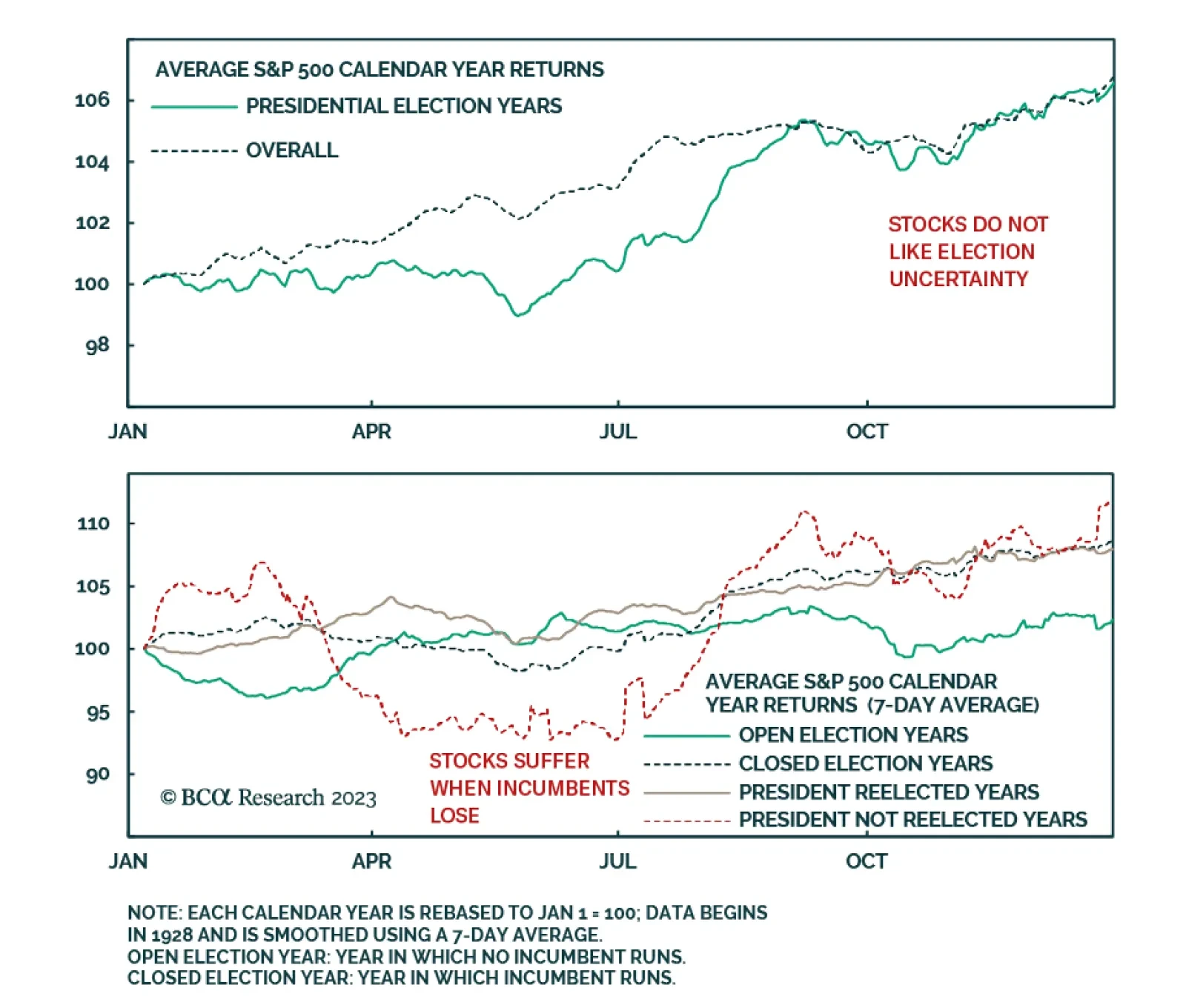

With the US presidential election approaching, our US political strategists are warning investors that stock markets are not immune to politics and geopolitics. Our colleagues have shown that out of 28 bear markets since the…

The ongoing profit contraction among Chinese industrial firms underscores that deflationary headwinds dominate the domestic economy. Although the annual pace of decline of industrial profits slowed from 8.3% y/y in June to 6.7% y…

Today’s Strategy Report chartbook presents the data underpinning our view that both inflation and growth are slowing, likely pointing to a recession beginning sometime in the first half of next year. We are tactically equal weight…

The profit outlook for the Eurozone continues to deteriorate. Find out what the drivers behind this deterioration are.