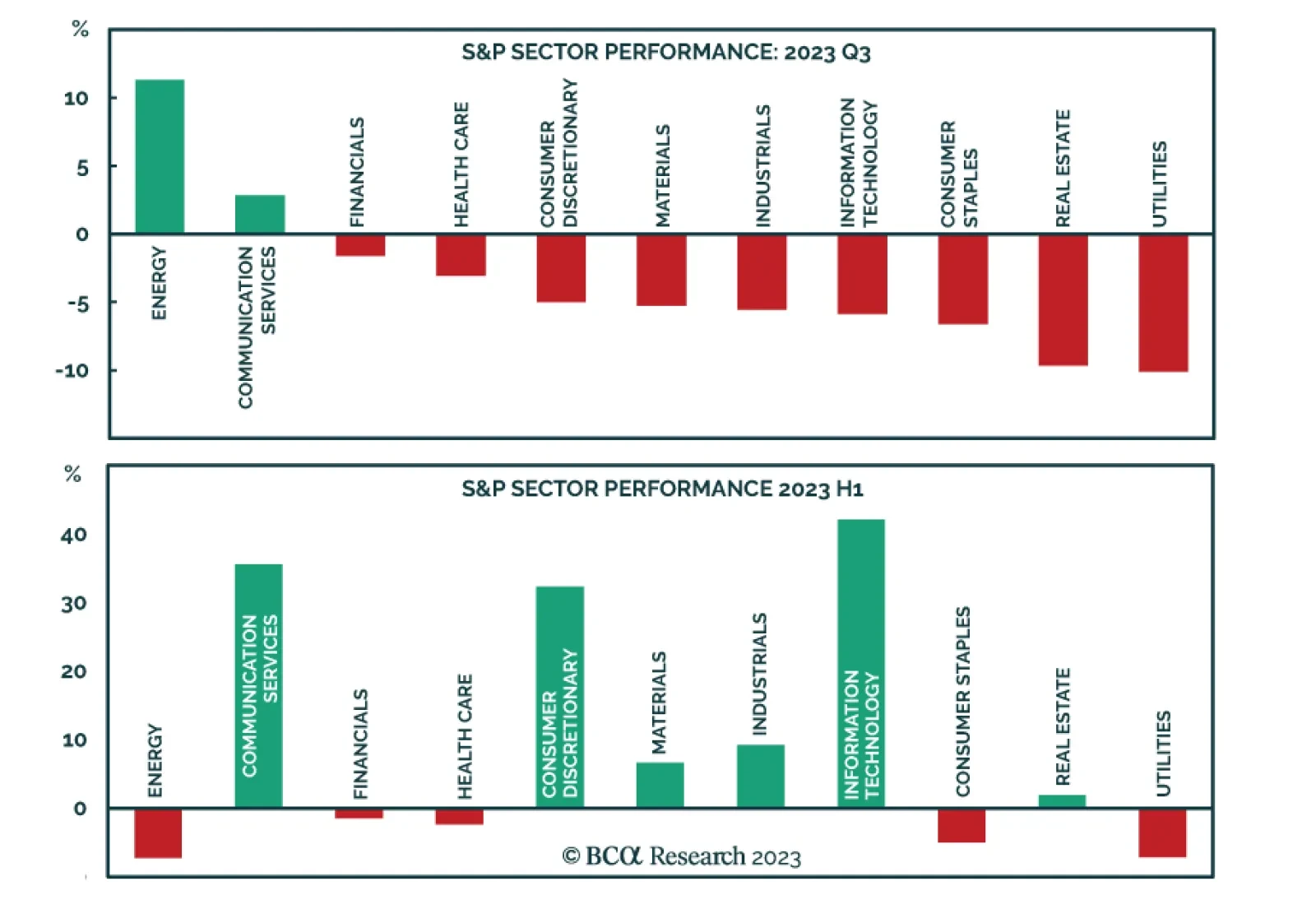

The S&P 500’s performance deteriorated significantly in Q3. After having soared by nearly 16% in the first half of the year, the index ended the third quarter with a 3.7% loss. True, a surge in AI winners drove the H1…

The “September Effect” was in full force again this year as the broad-based selloff continued. Nearly all major financial assets generated outsized returns last month. In particular, the “higher for longer…

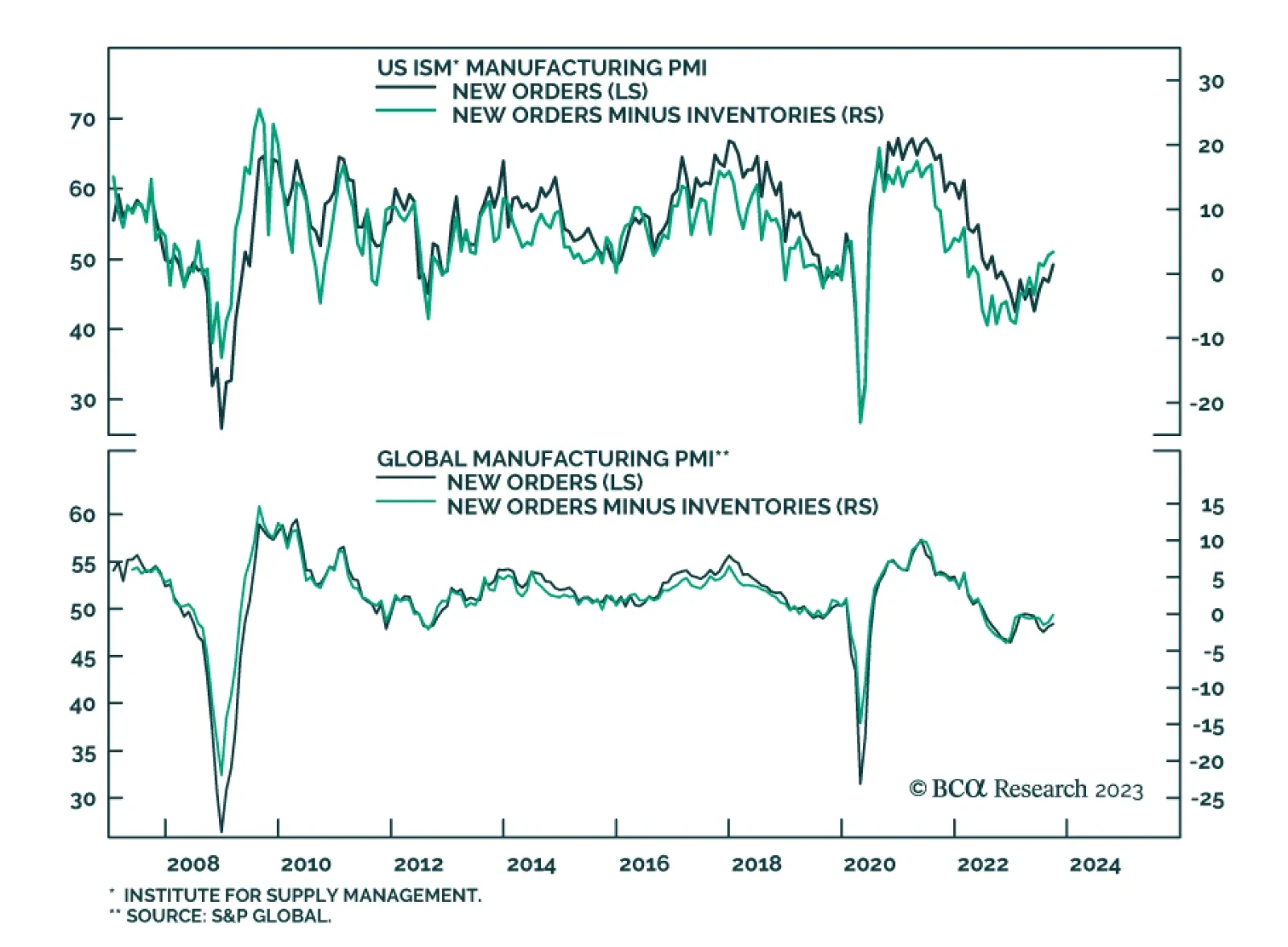

The Global Manufacturing PMI ticked up by a marginal 0.1 point to 49.1 in September, indicating that manufacturing activity deteriorated at a slightly slower pace than in August. However, several of the details of the report were…

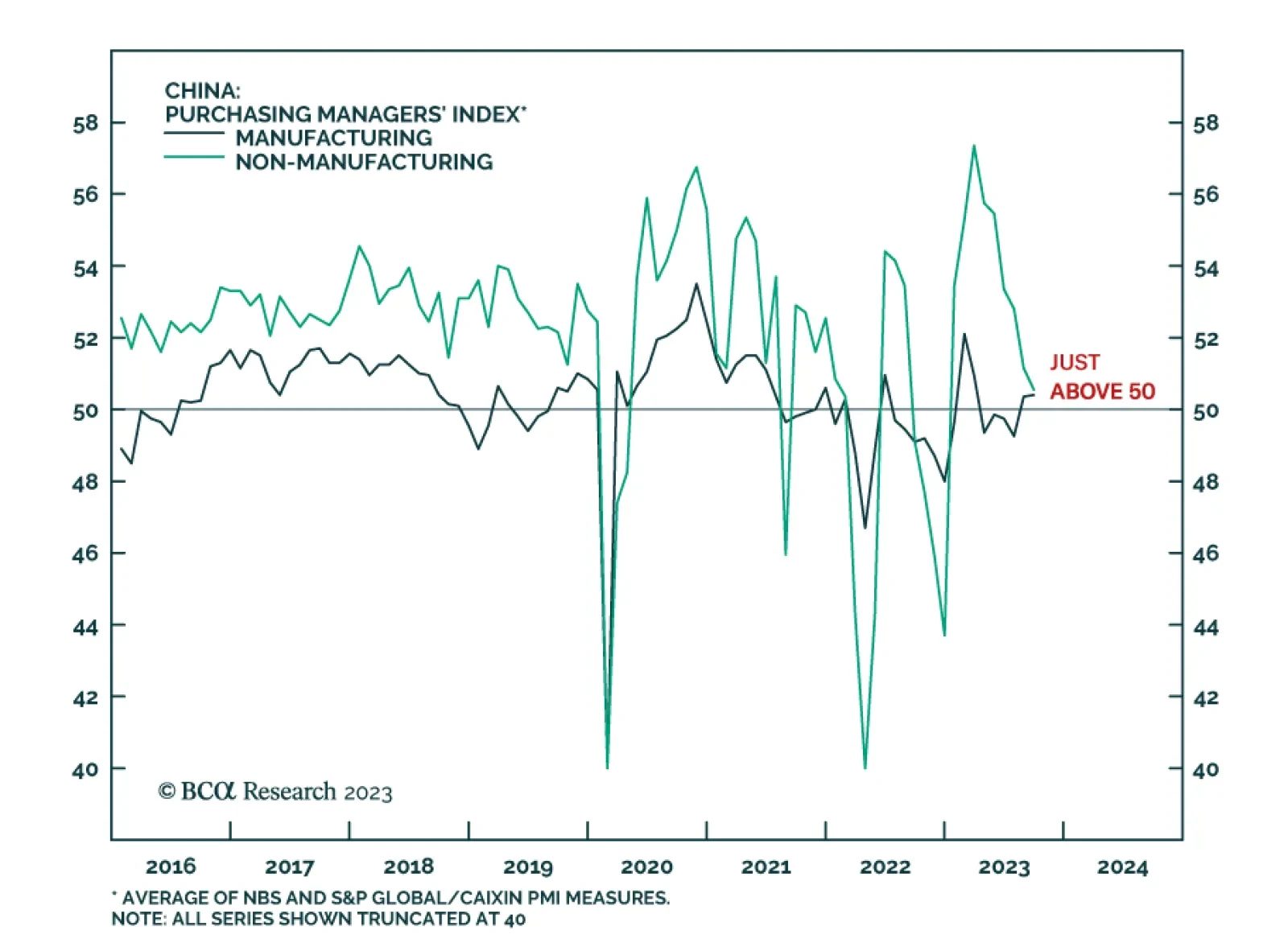

The Caixin and NBS PMIs sent mixed signals about Chinese economic conditions in September. The NBS results surprised to the upside on the back of slightly greater-than-anticipated increases in both the manufacturing (+0.5 to…

Aggressive monetary tightening has always led to recession, although the timing is uncertain. The effects of high interest rates are starting to be felt. Investors should stay risk off and buy government bonds as a safe haven…

Downside risks to equities are building. Rates, the dollar, and energy prices will remain elevated into yearend. This trifecta makes a soft landing less likely than before and hurts corporate profits and multiples. However, high cash…

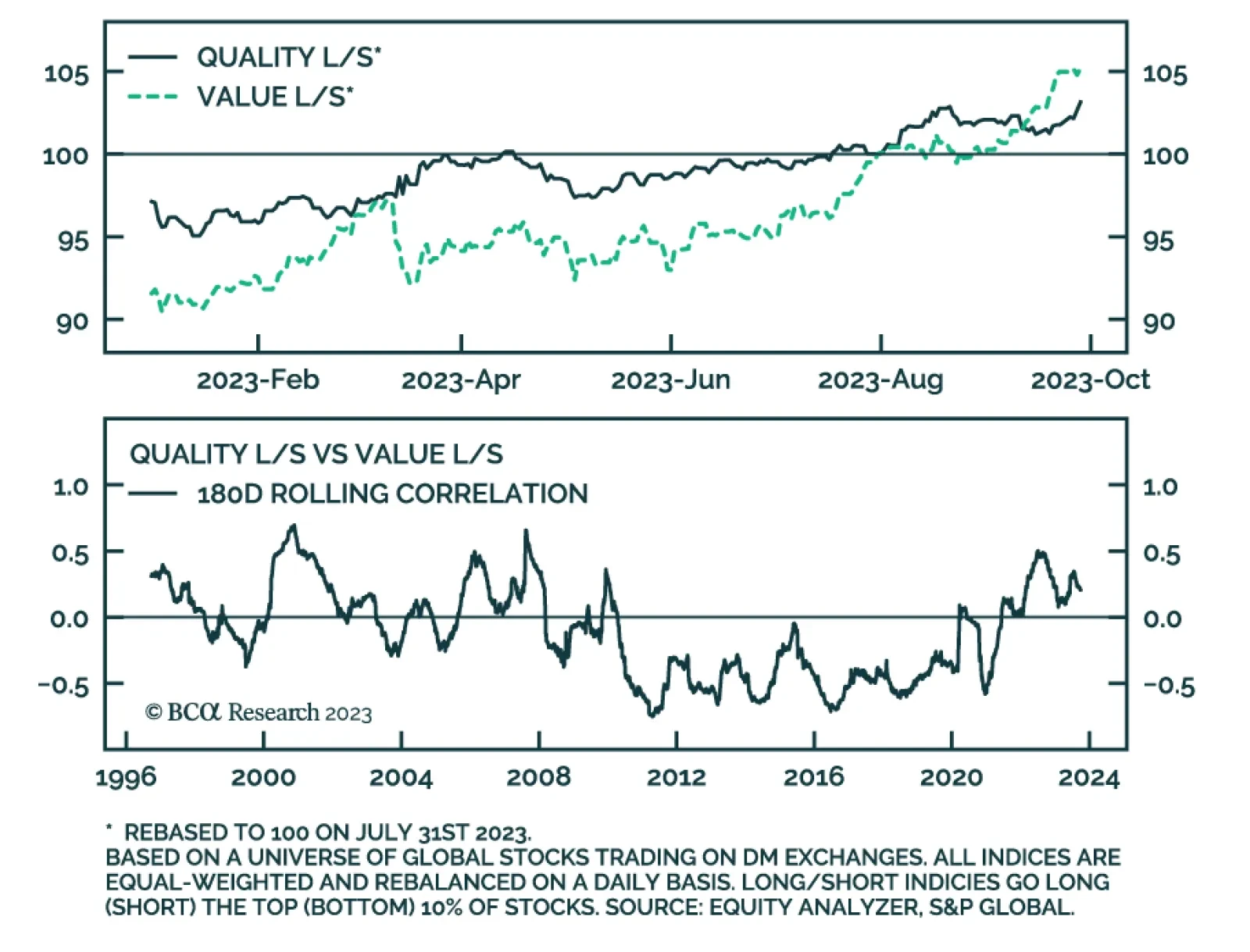

Our Equity Analyzer service is a stock selection platform powered by the BCA Score, a 30-factor stock ranking system. The model tends to benefit from periods of uncertainty due to its high-quality and low volatility tilt. The…

In Section I, we note that the recent surge in long-maturity government bond yields is symptomatic of a sharp reduction in market expectations for a soft-landing economic outcome. This underscores that the US and other developed…

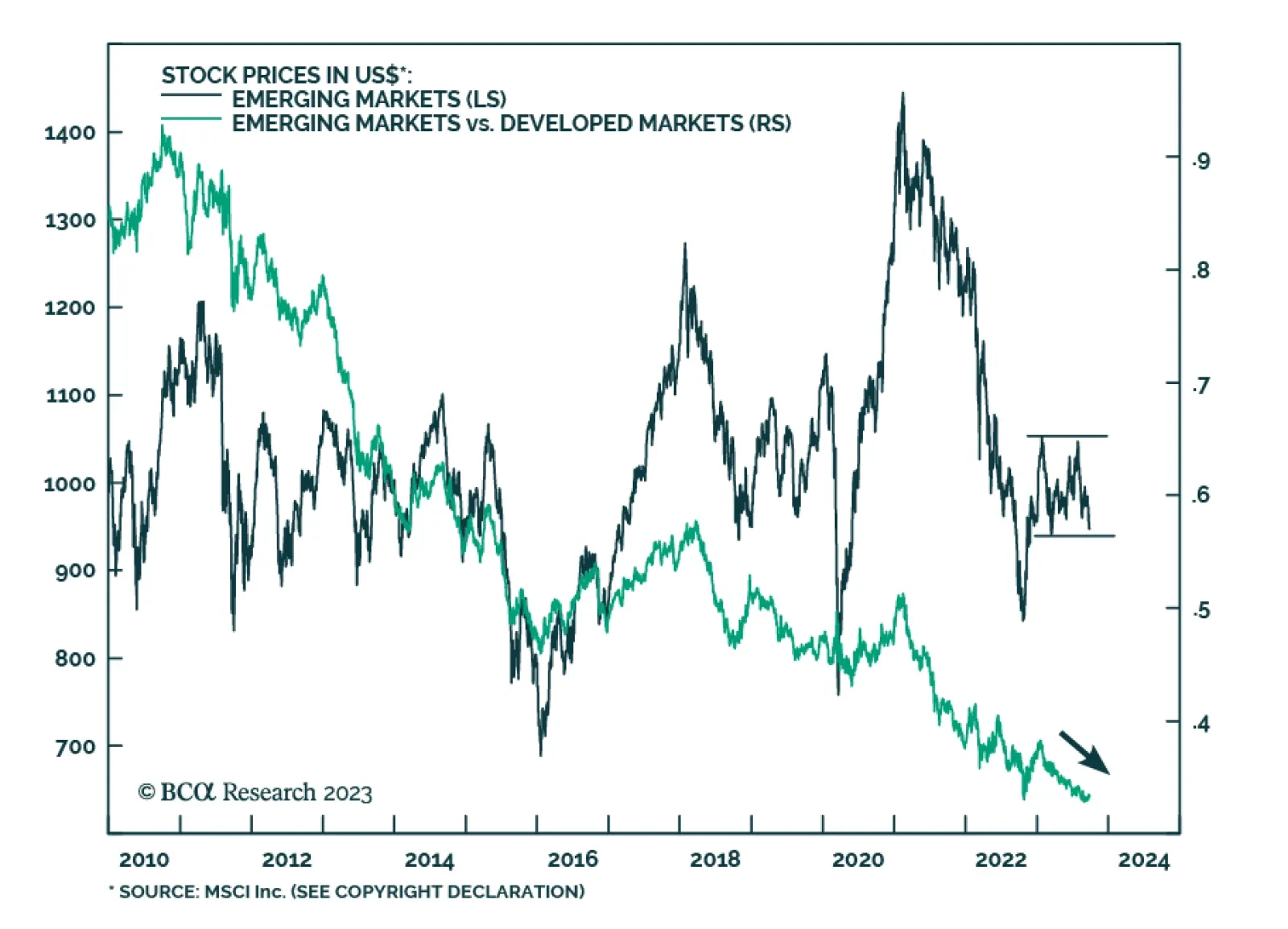

Emerging Market equities have been in a broad trading range all year. The MSCI index peaked on January 26, then bottomed in mid-March before recouping nearly all of its losses over the subsequent months. However, after nearly…