The Q3 earnings season will shift into high gear this Friday as banks report their financial results for the quarter. Among the trends that we’ll be watching for is insight on the outlook for profit margins. As our US…

Taiwanese exports unexpectedly grew for the first time in just over a year in September – sending a positive signal about the global manufacturing cycle. The 3.4% y/y increase surprised anticipations of a moderation in the…

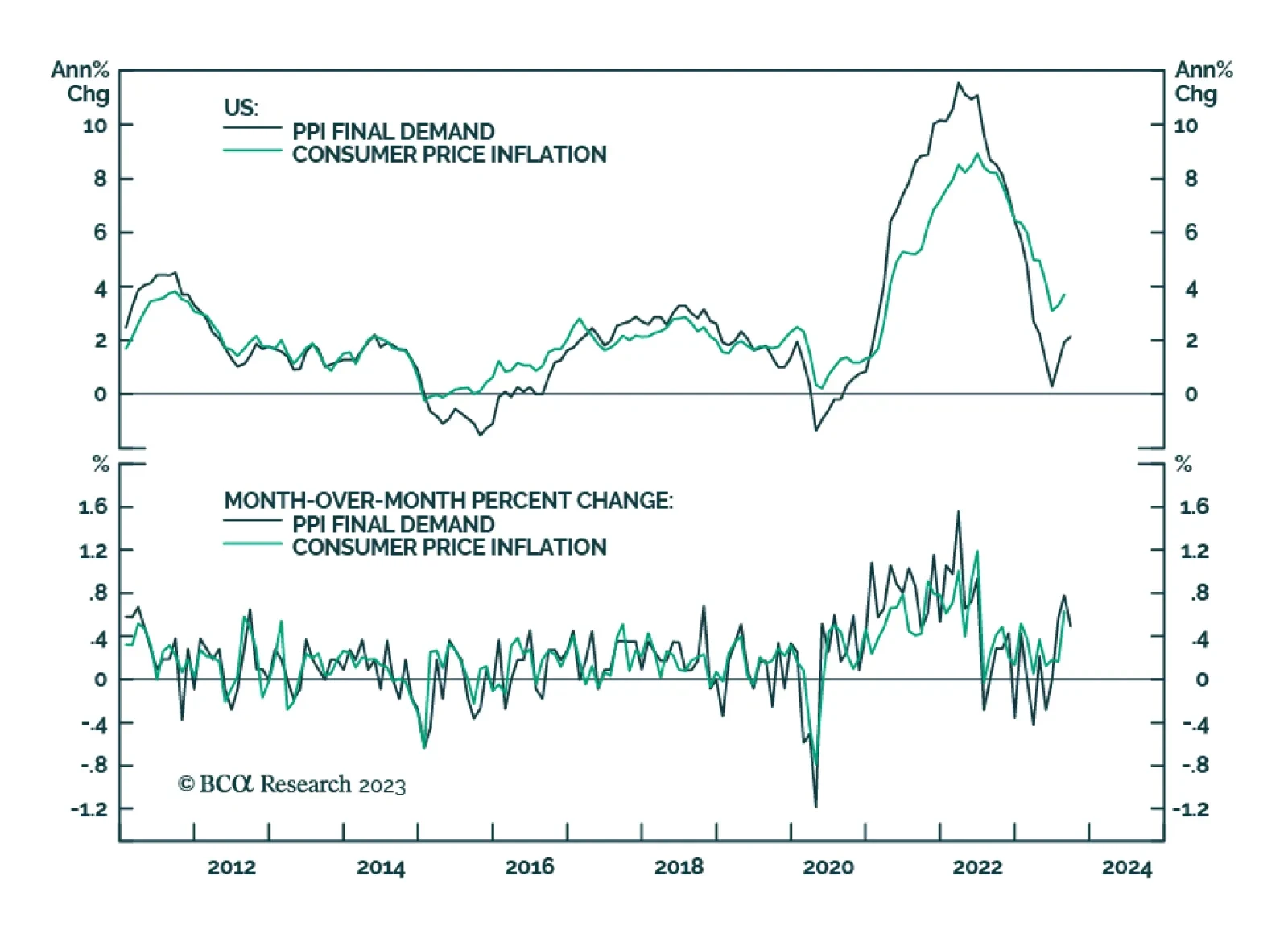

The US PPI report came in hotter-than-anticipated in September. Although the headline index decelerated from 0.7% m/m to 0.5% m/m, it remains above expectations of a more pronounced moderation to 0.3% m/m. In particular, a 3.3% m…

The sharp sell-off in long duration bonds (ticker TLT) has reached the collapsed 130-day complexity that implies a probable and playable rebound. More strategically, long-duration bonds yielding close to 5 percent are an excellent…

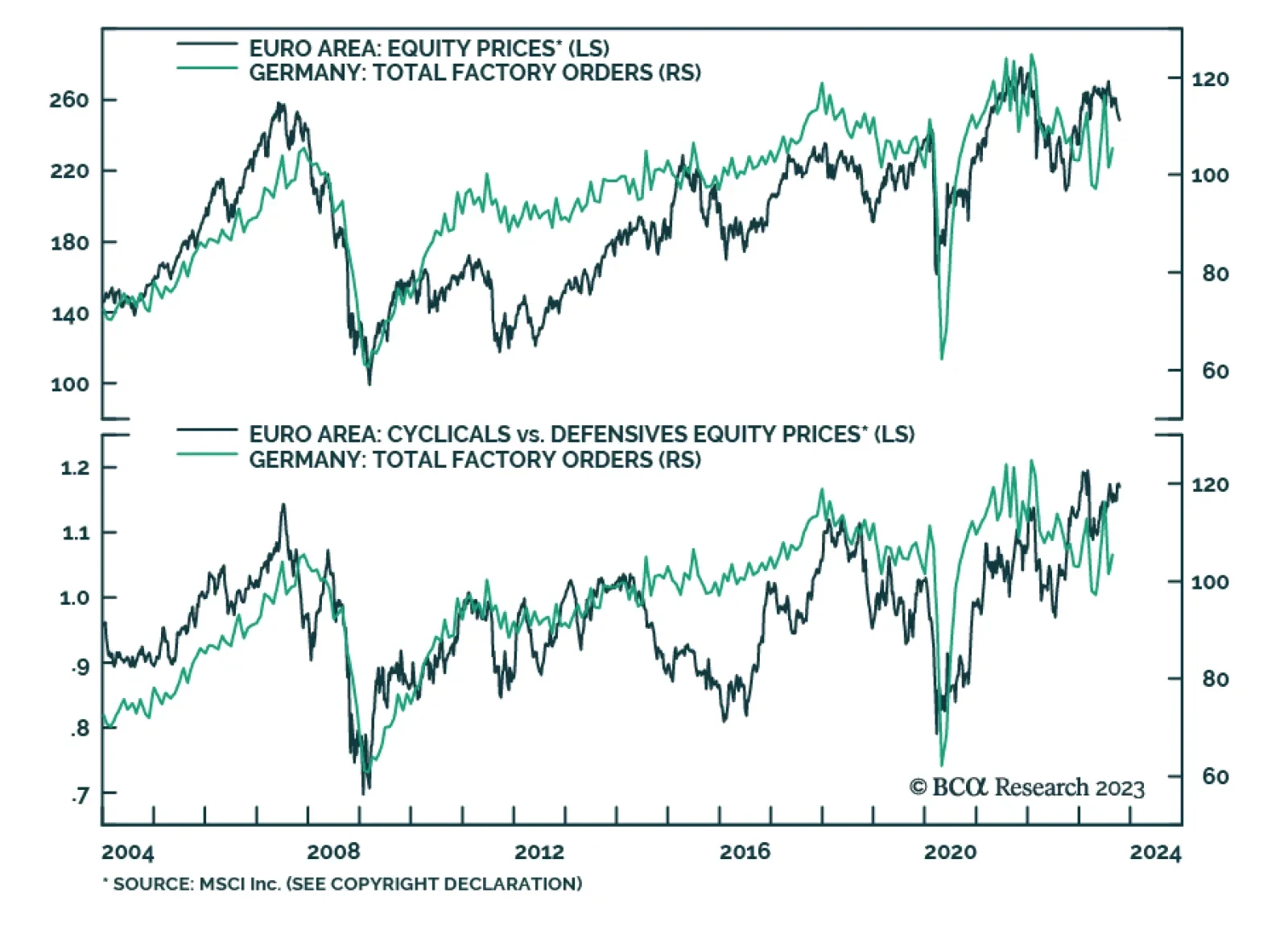

As we highlighted in a recent Insight, the stronger-than-anticipated improvement in German factory orders should be viewed with some degree of caution. Germany is the European economy most exposed to the global manufacturing…

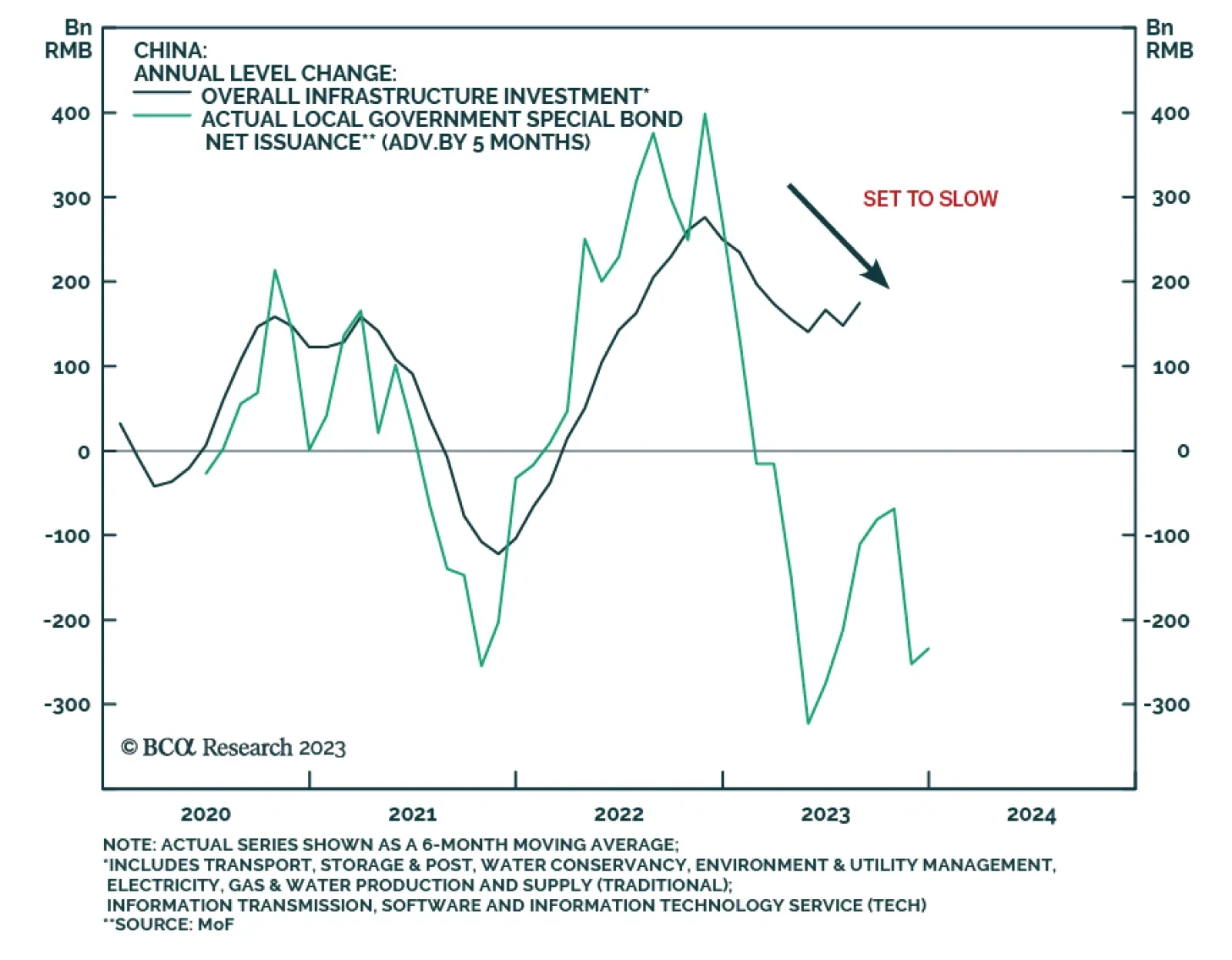

Dovish comments by several Fed officials contributed to a Treasury rally and improvement in sentiment towards risk assets on Tuesday. Globally, rumors that Beijing is planning to unleash more stimulus supported Chinese financial…

Households’ excess pandemic savings will eventually run out, but we continue to disagree with the widespread view that they’re already gone or entirely in the hands of the wealthy. Consumers’ demise continues to be greatly…

The market has been held hostage by surging rates. Zombie companies are “alive” and are multiplying – they are highly sensitive to surging borrowing costs. Underweight Utilities to reduce portfolio duration. Maintain neutral…

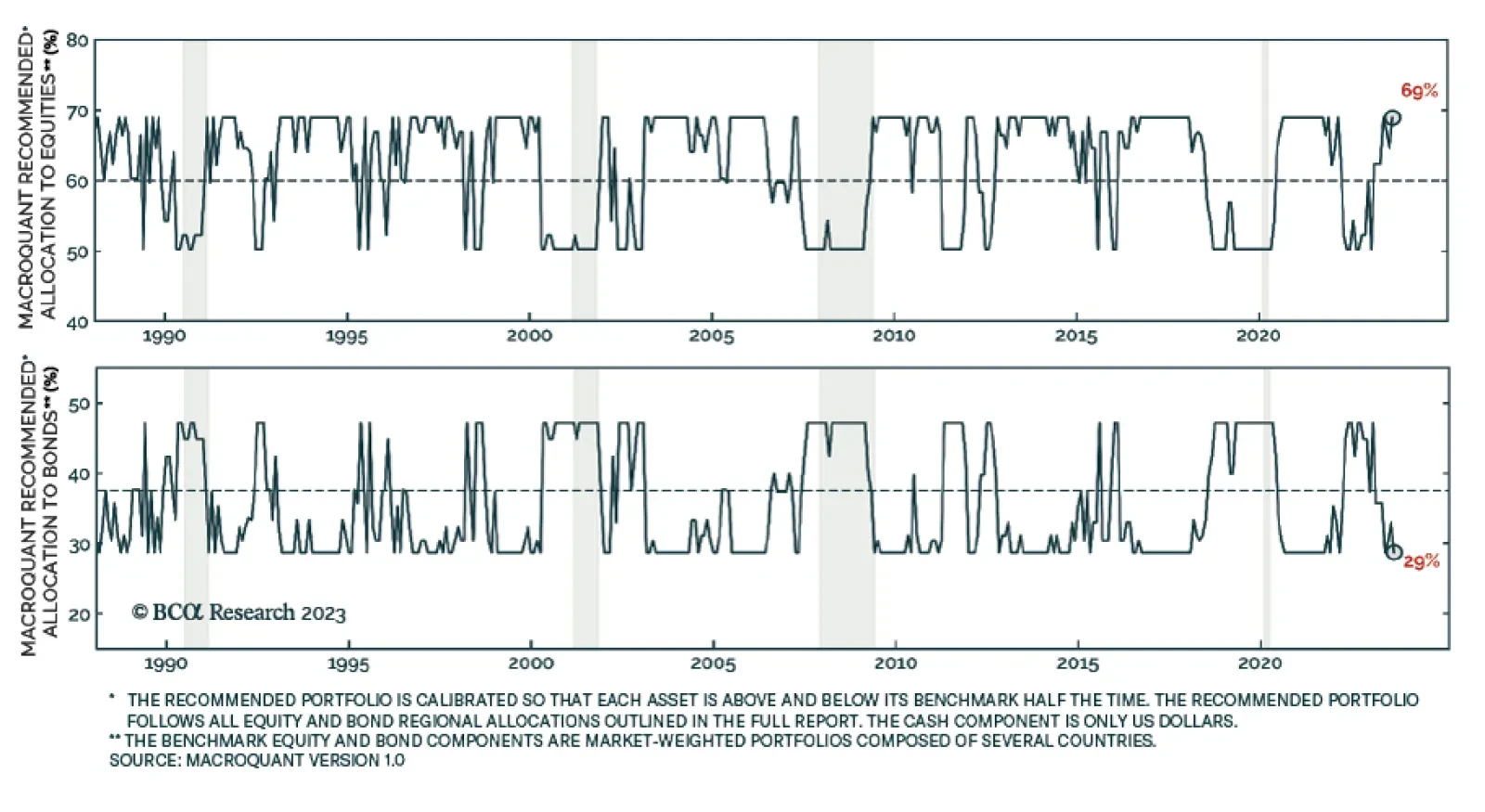

Our Global Investment Strategy service’s MacroQuant 1.0 model – which is calibrated to produce recommendations over a 30-day investment horizon – is currently overweight equities and underweight bonds and cash…

We unveil the ‘Joshi rule’ real-time recession indicator as a much better version of the Federal Reserve’s own ‘Sahm rule’. And we identify what would trigger these recession indicators in this week’s and future US jobs reports. Plus…