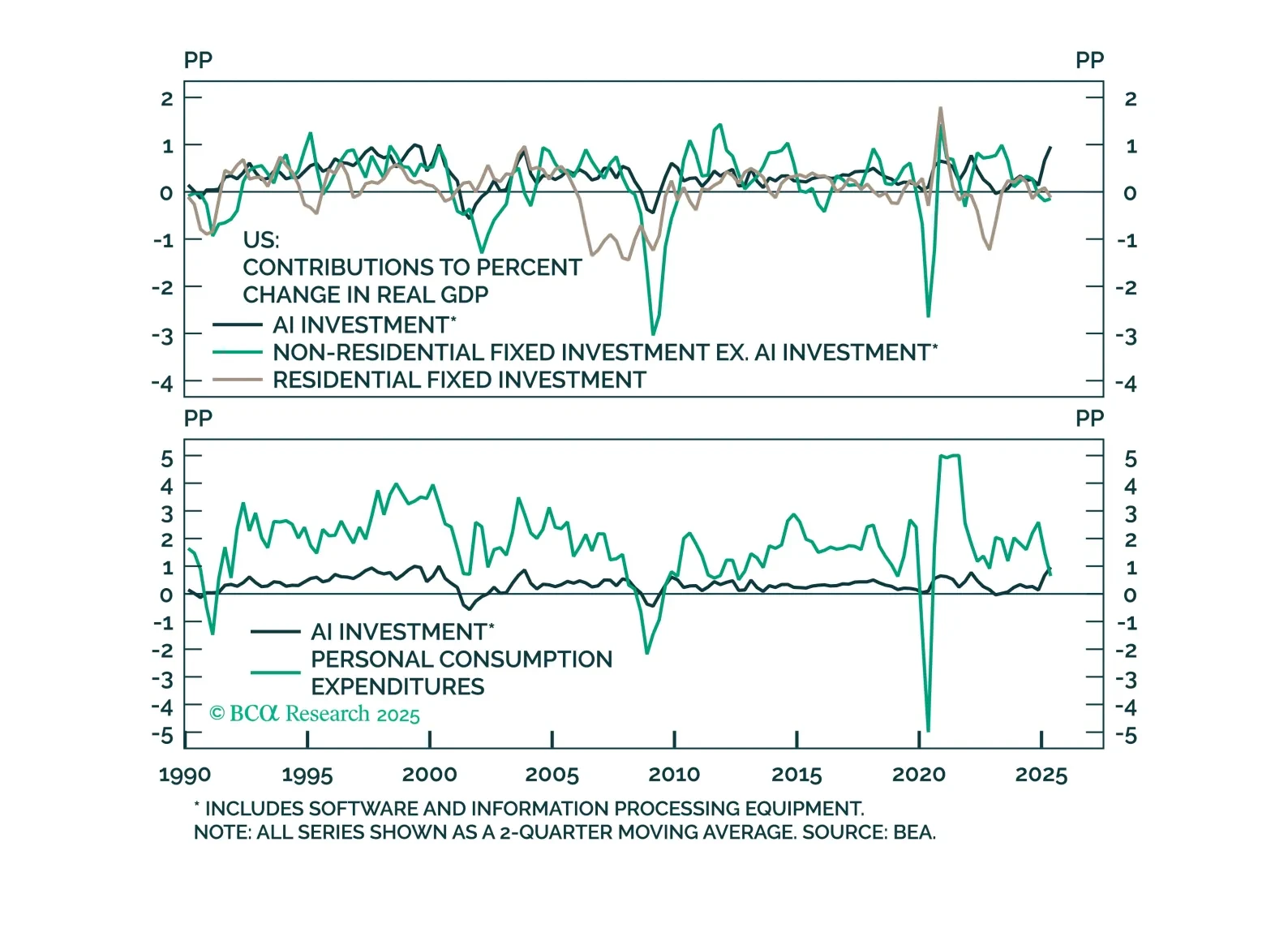

Over the first half of 2025, AI capex outpaced both consumption and all other investments in its contribution to US growth. Like all other capex cycles this one will end in tears. However, the indicators we track suggest that AI…

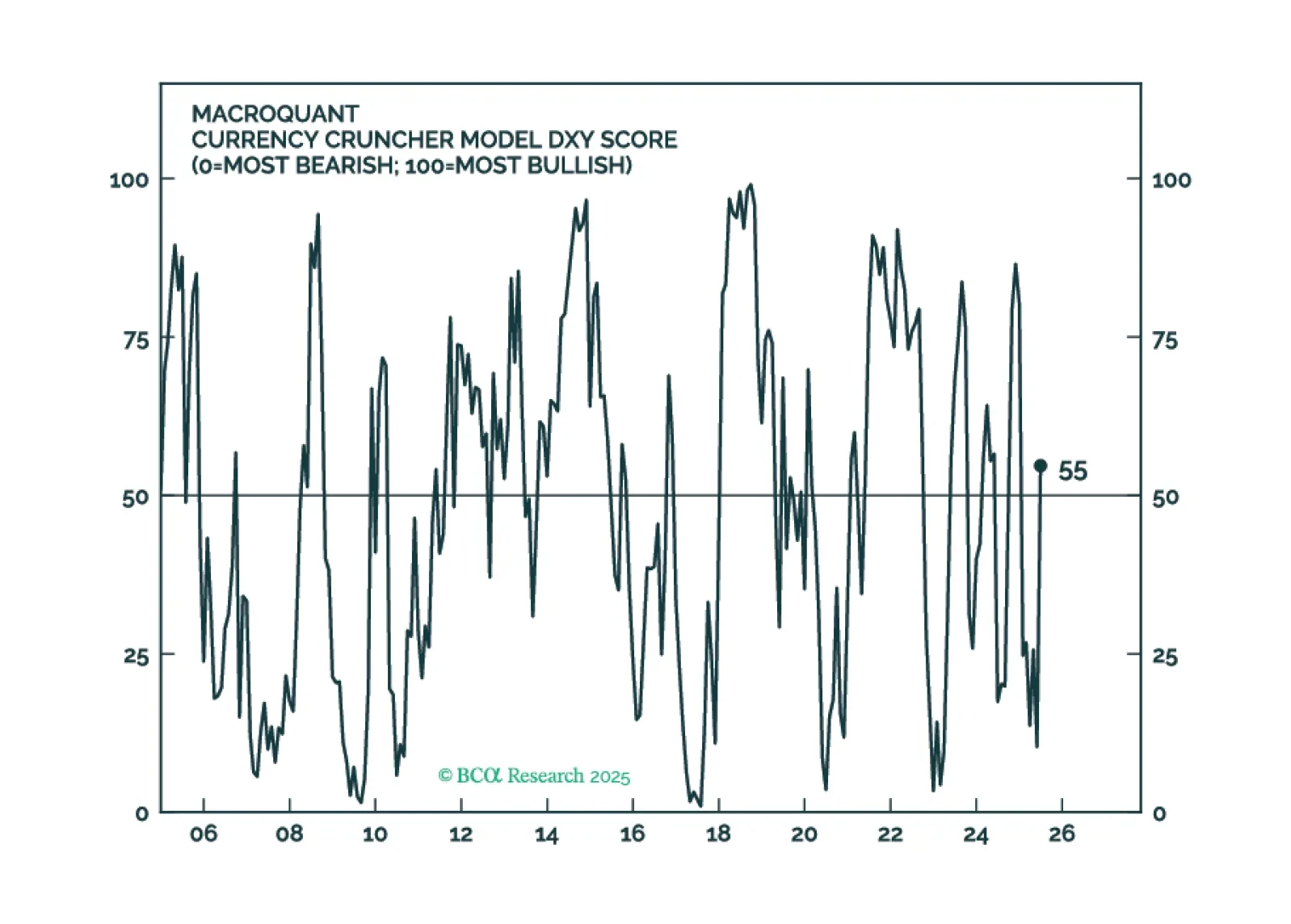

MacroQuant is recommending that equity investors keep their finger near the eject button but avoid pressing it for now. The model is warming up to the dollar again and sees scope for oil prices to rise.

Microsoft has gone up in a worryingly near-perfect straight line with dimension 1.098. Take August off before making a big commitment to stocks. Plus: a new tactical trade is to go long USD/HUF.

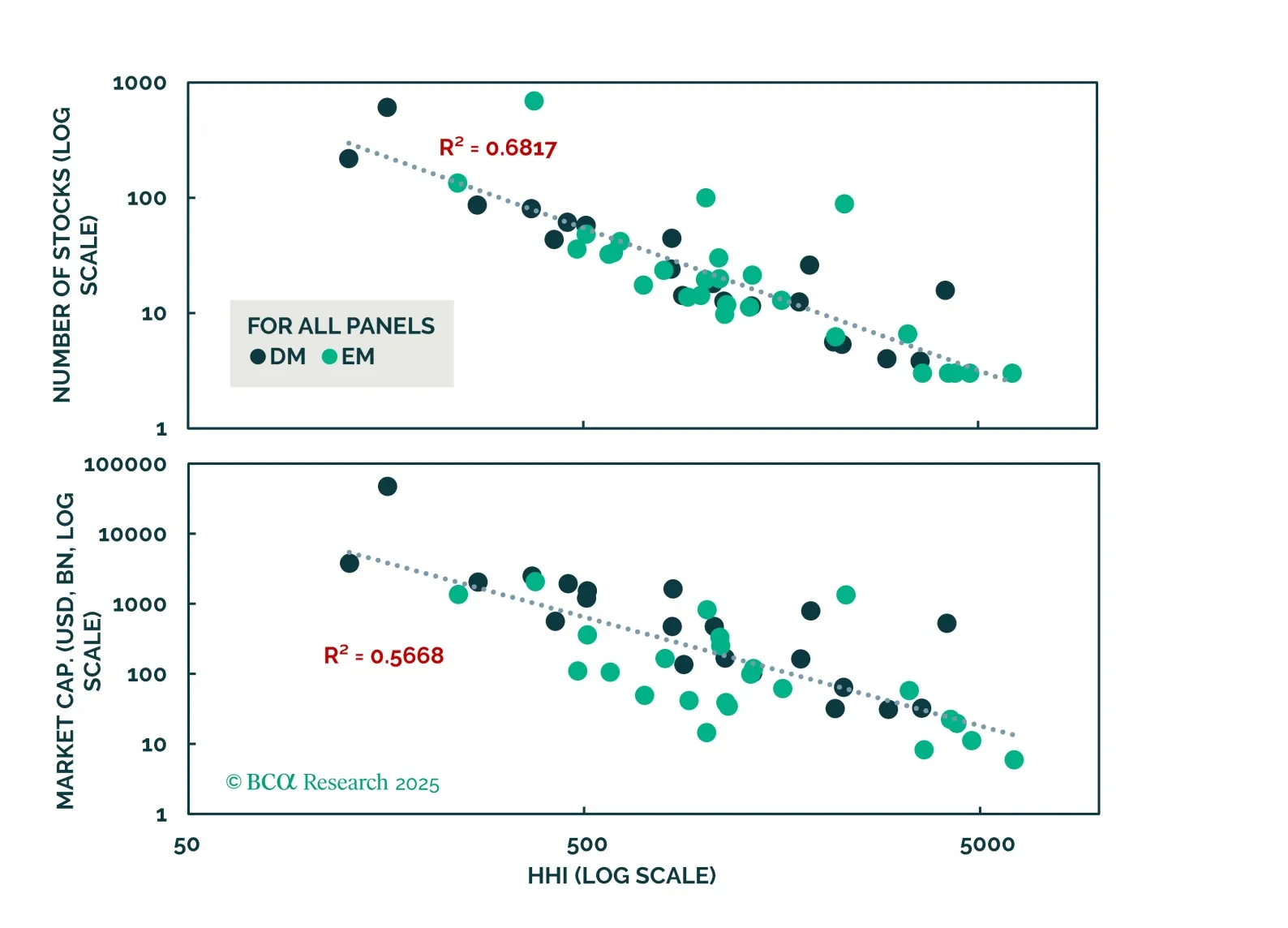

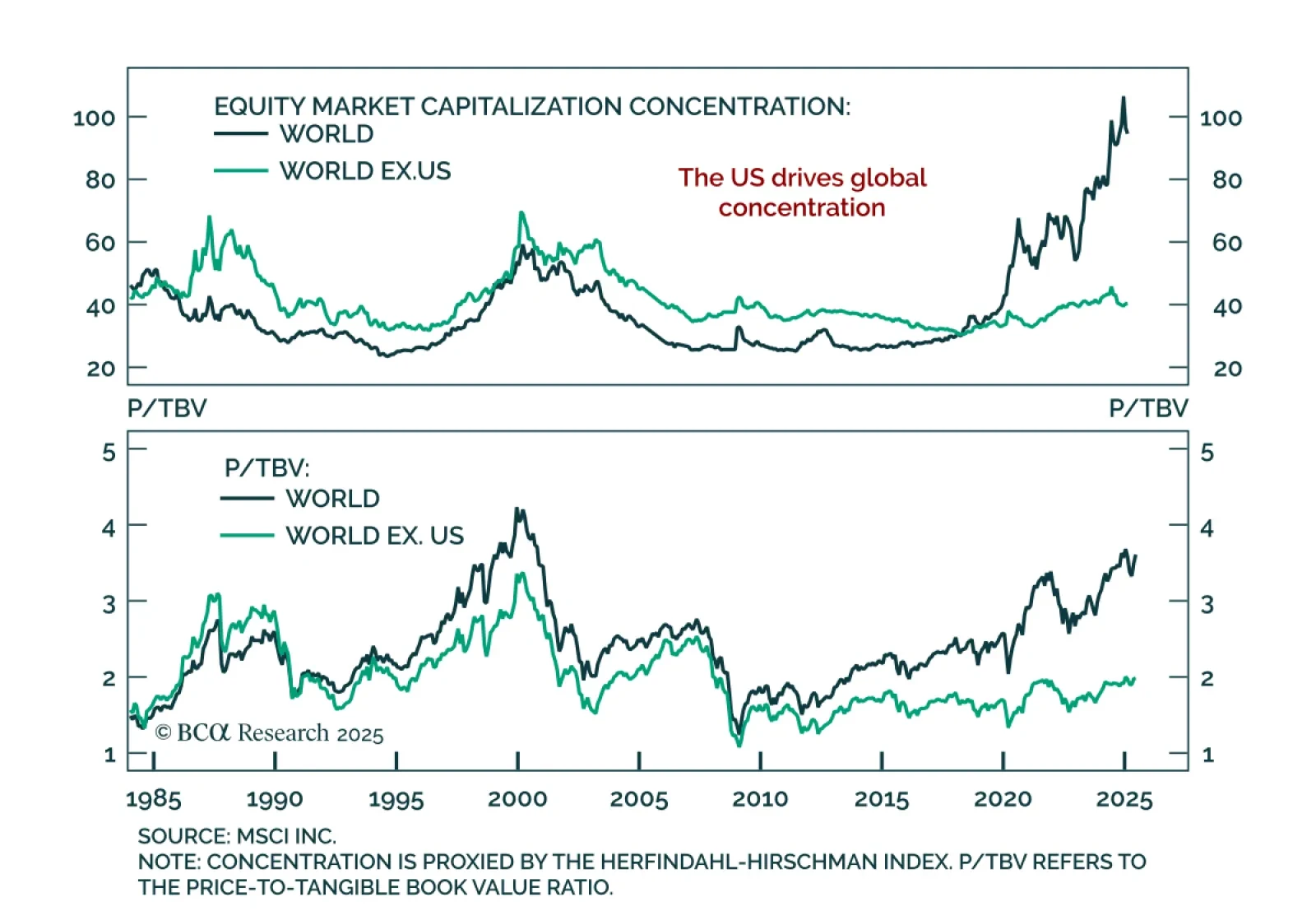

Our Global Asset Allocation strategists argue that equity market concentration is not a meaningful risk factor and does not help forecast returns. Cross-sectional concentration reflects index size, with smaller indices typically…

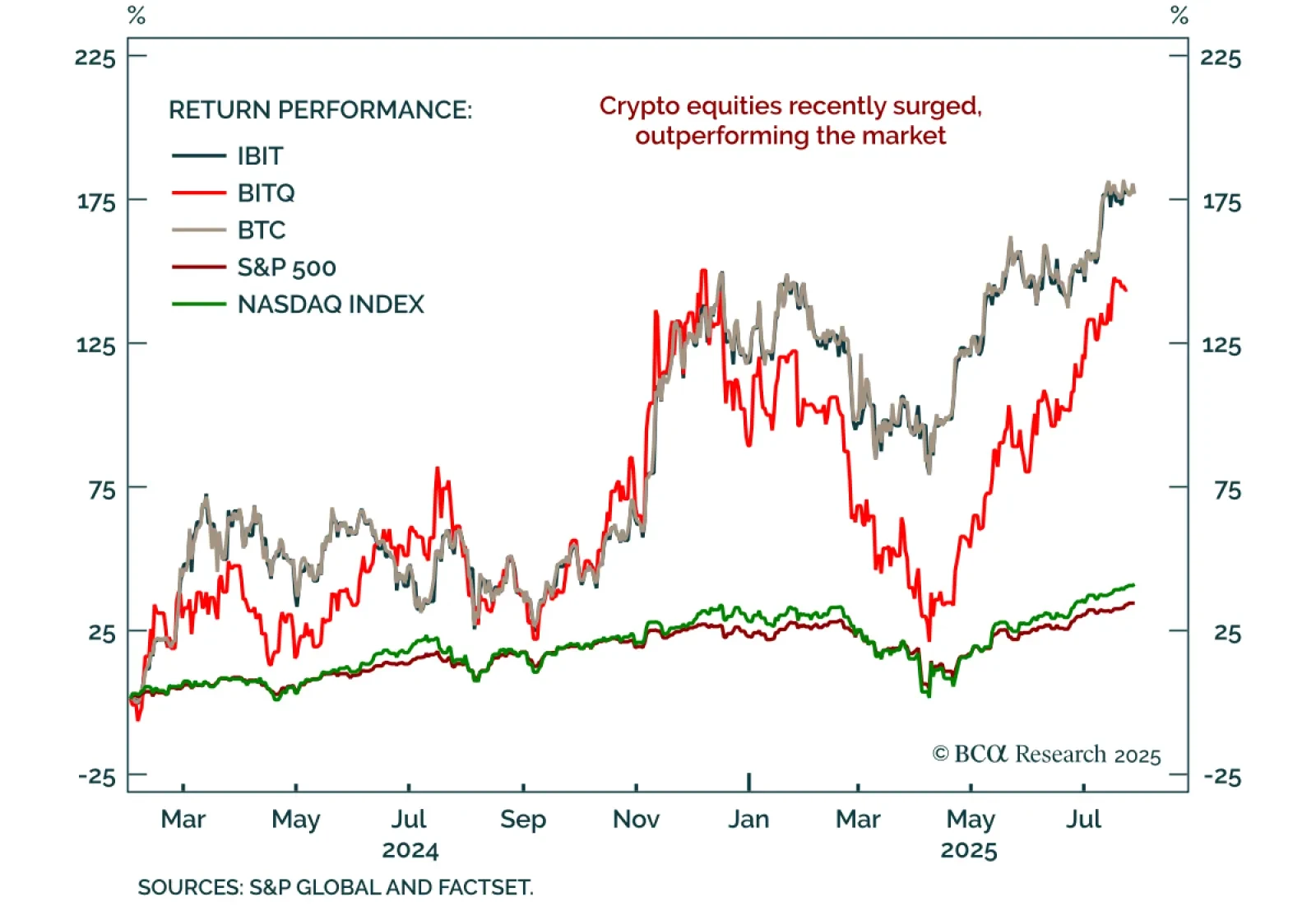

Our US Equity strategists recommend building long-term exposure to crypto equities through diversified ETFs, using pullbacks as entry points. The GENIUS Act establishes a regulatory framework for digital assets, setting the stage for…

We will only move to a fully defensive stance if the “whites of the recession’s eyes” appear. So far, they have not. We will be increasingly looking to our MacroQuant model for guidance on when the next turning point in markets may…

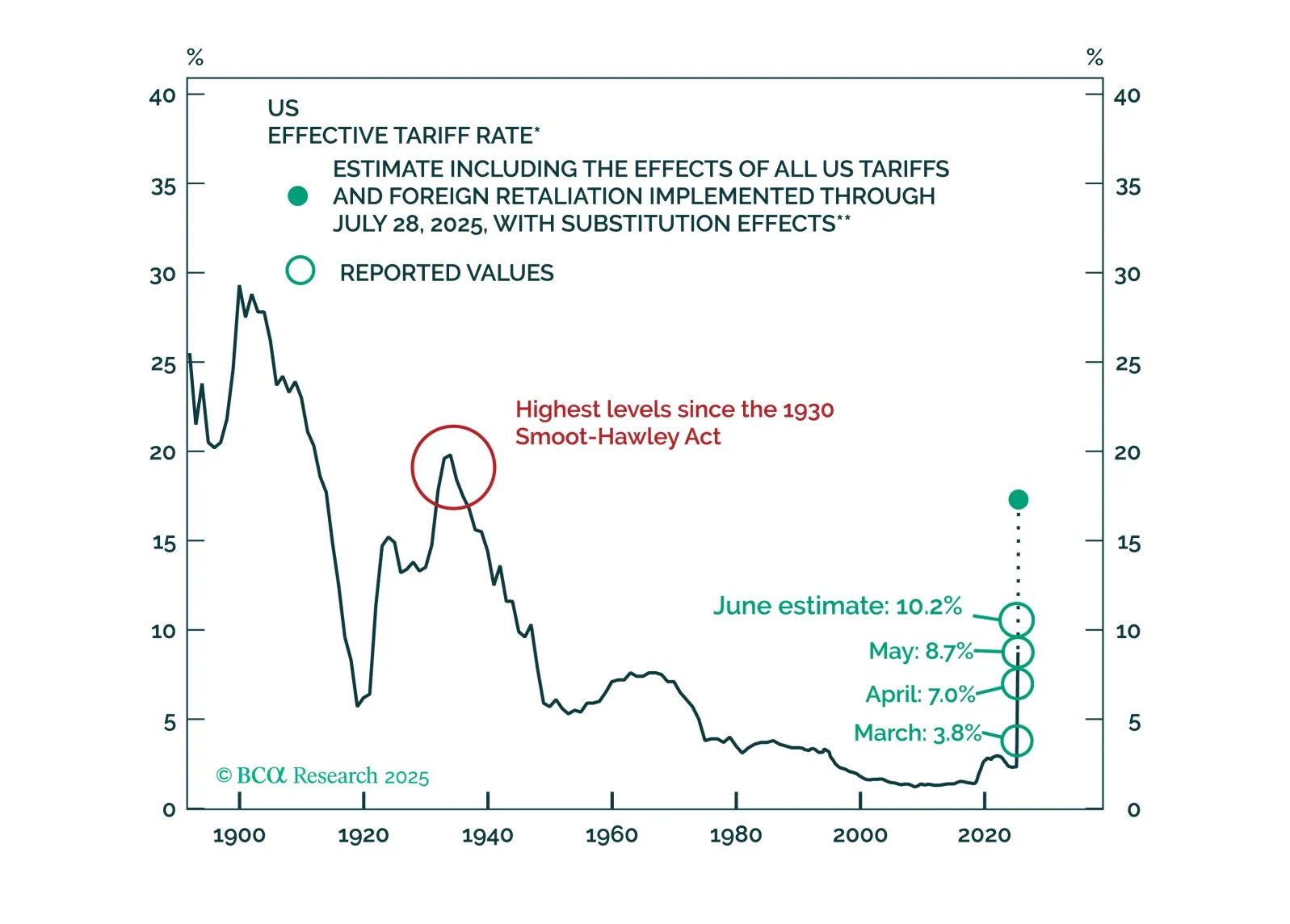

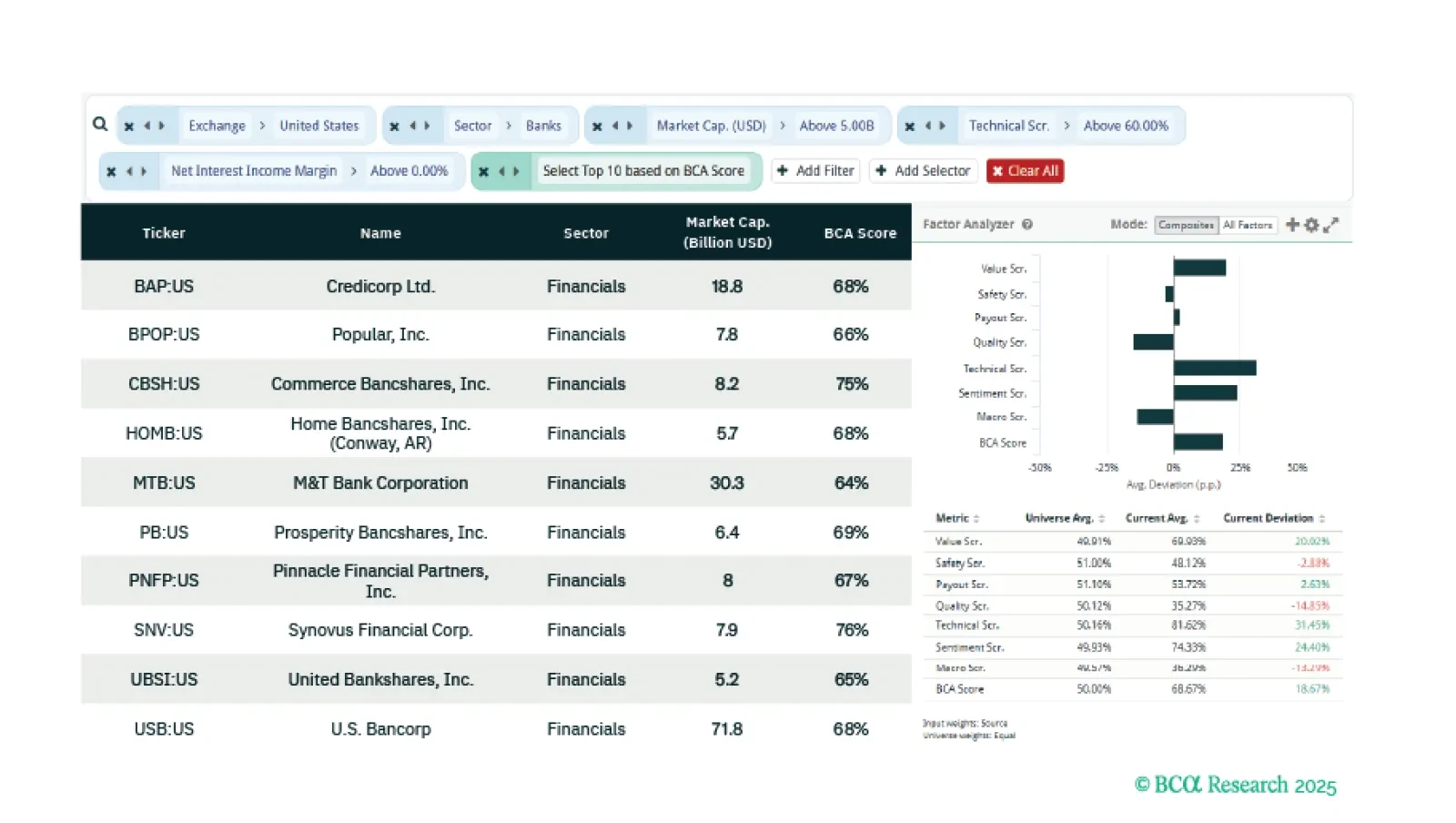

This week our three screeners identify: Equity plays on US banks, stocks that benefit from heightened US fiscal uncertainty, and a global Value and Technical basket of stocks.

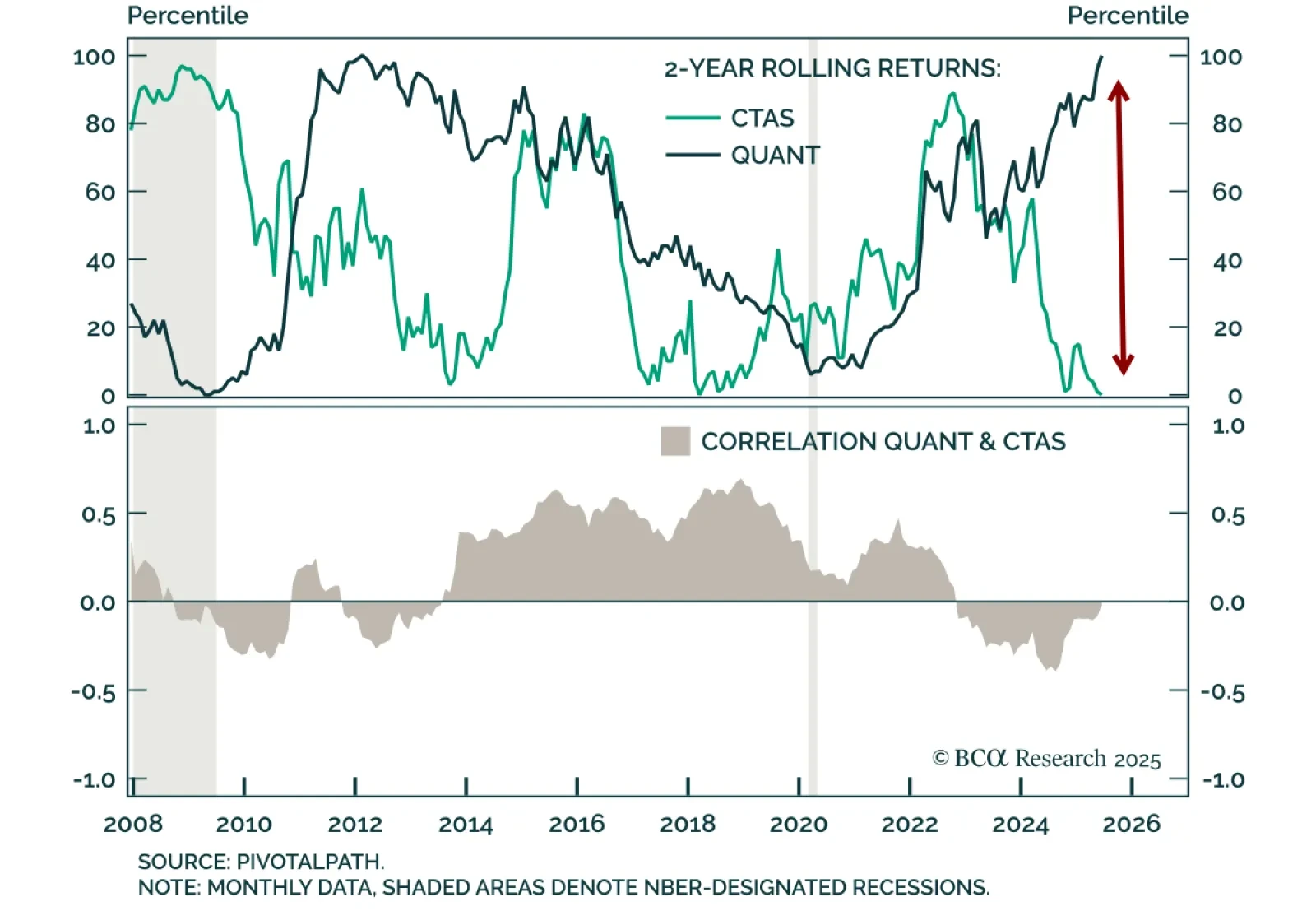

A historic divergence between systematic strategies is creating a compelling entry point into Managed Futures. Our Chart Of The Week comes from Brian Payne, Chief Strategist for our Private Markets & Alternatives team.…