The Hamas attack against Israel, timed almost 50 years to the day after a similar surprise attack on Yom Kippur of 1973, has evoked parallels with the 1970s. Parallels not only with Middle Eastern geopolitics then and now, but also…

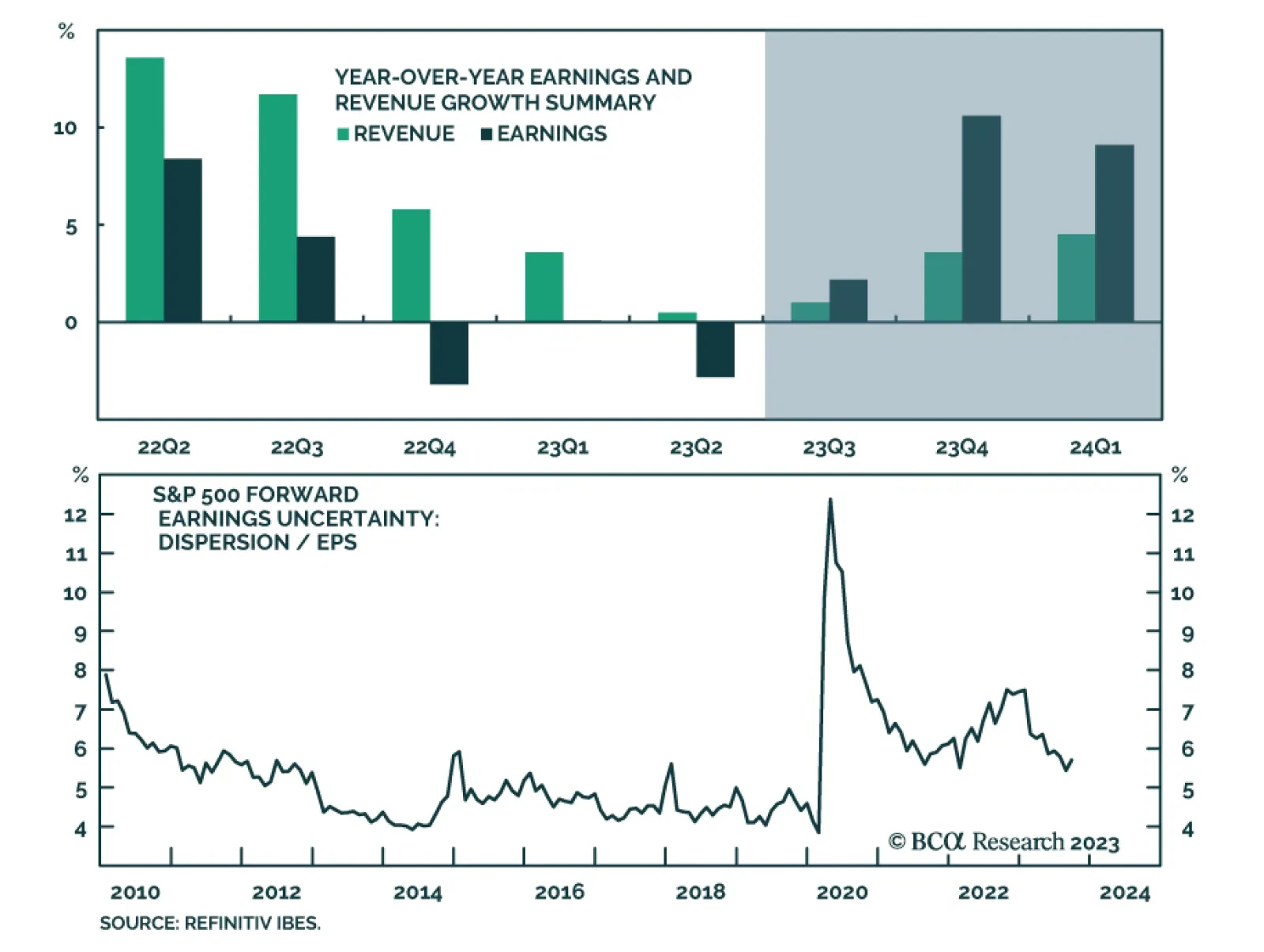

Friday the 13th marked the official start of the Q3-2023 earnings season. While the consensus is for modest earnings and sales growth, there may be some surprises in store for investors. Street Expectations According…

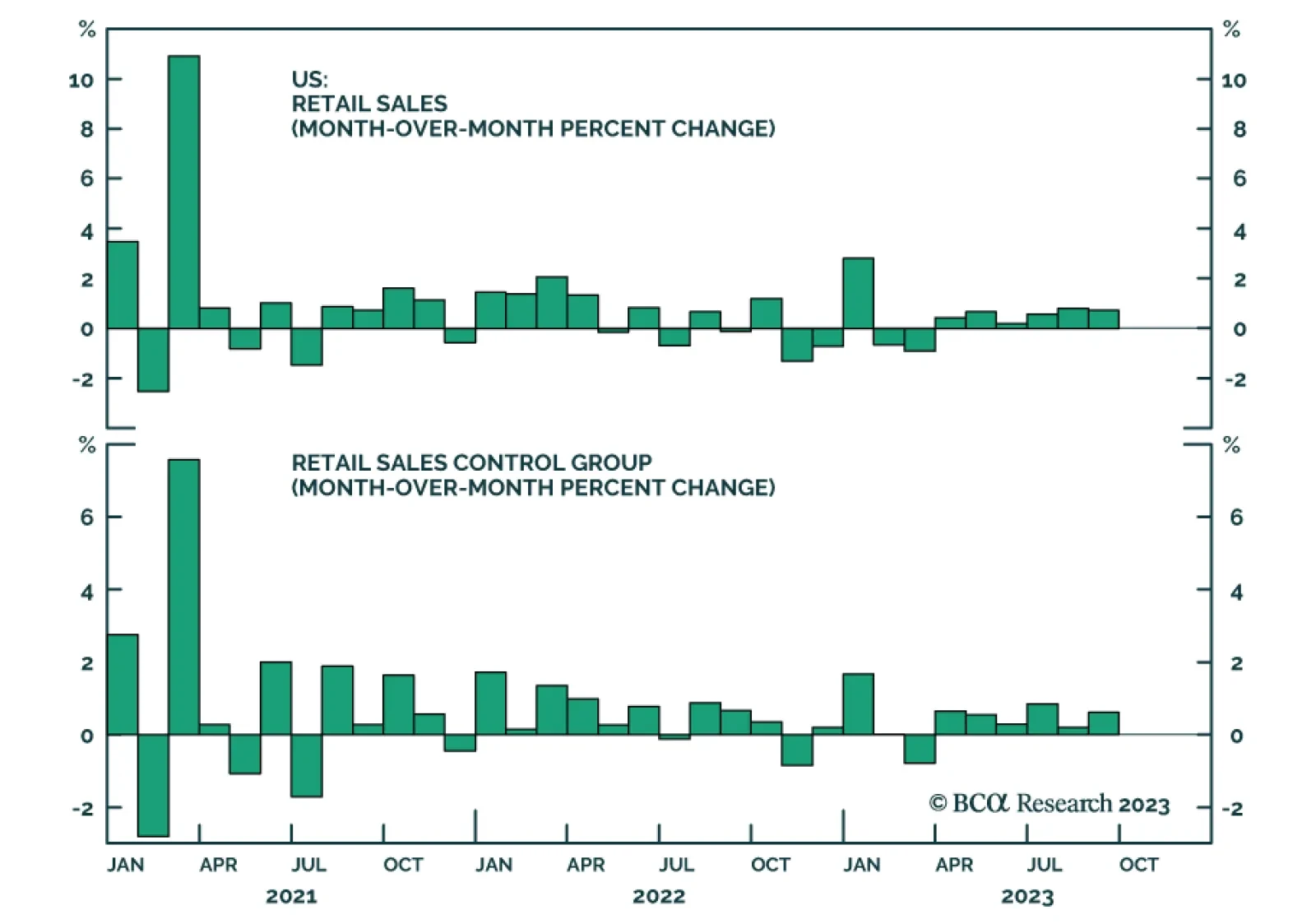

The US retail sales report delivered a sanguine update on US consumption. Overall spending increased by 0.7% m/m in September – above expectations of a 0.3% m/m rise and following an upwardly revised 0.8% m/m in August. The…

Q3-2023 is expected to mark the end of the earnings recession for the past three quarters, opening the door to positive earnings growth. Whether that would be sustainable or will sputter once the recession settles in as expected in…

More equity volatility is coming in the short run. Trump’s nomination looks to be smooth, which marginally reduces the incumbent party advantage and increases policy uncertainty.

Yields remain the force dominating the evolution of markets. A peak in yields would help European assets rebound, but the war in the Middle East could push higher energy prices, with negative consequences for Europe.

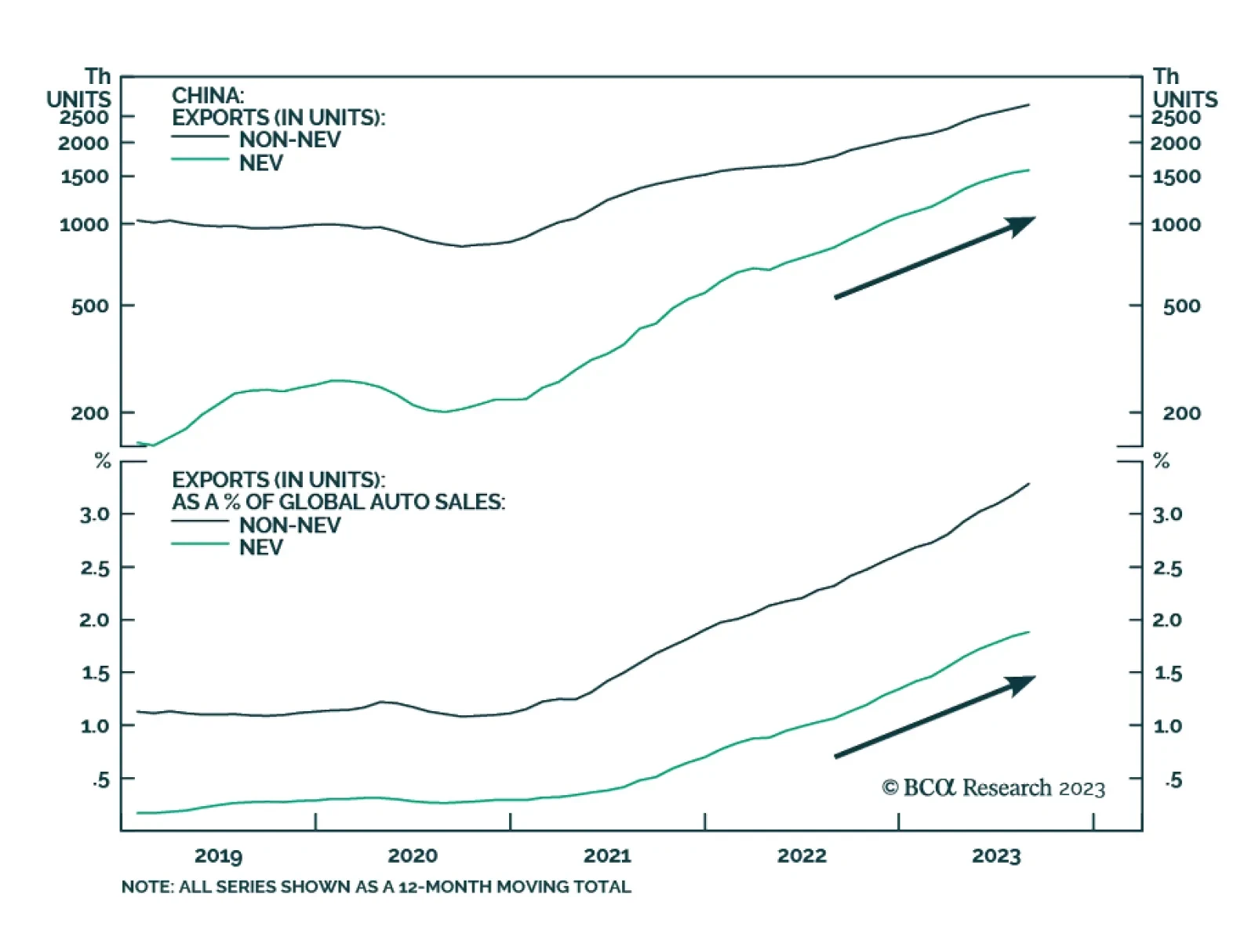

On the surface, the slower pace of contraction in Chinese exports in September is a positive signal for global trade. The 6.2% y/y drop in the dollar value of Chinese exports was not as bad as the 8% y/y decline anticipated or…

US monetary policy is restrictive, as evidenced by a falling jobs-workers gap. The reason that unemployment has not risen is because labor demand still exceeds supply. That will change in the second half of 2024 when the US economy…

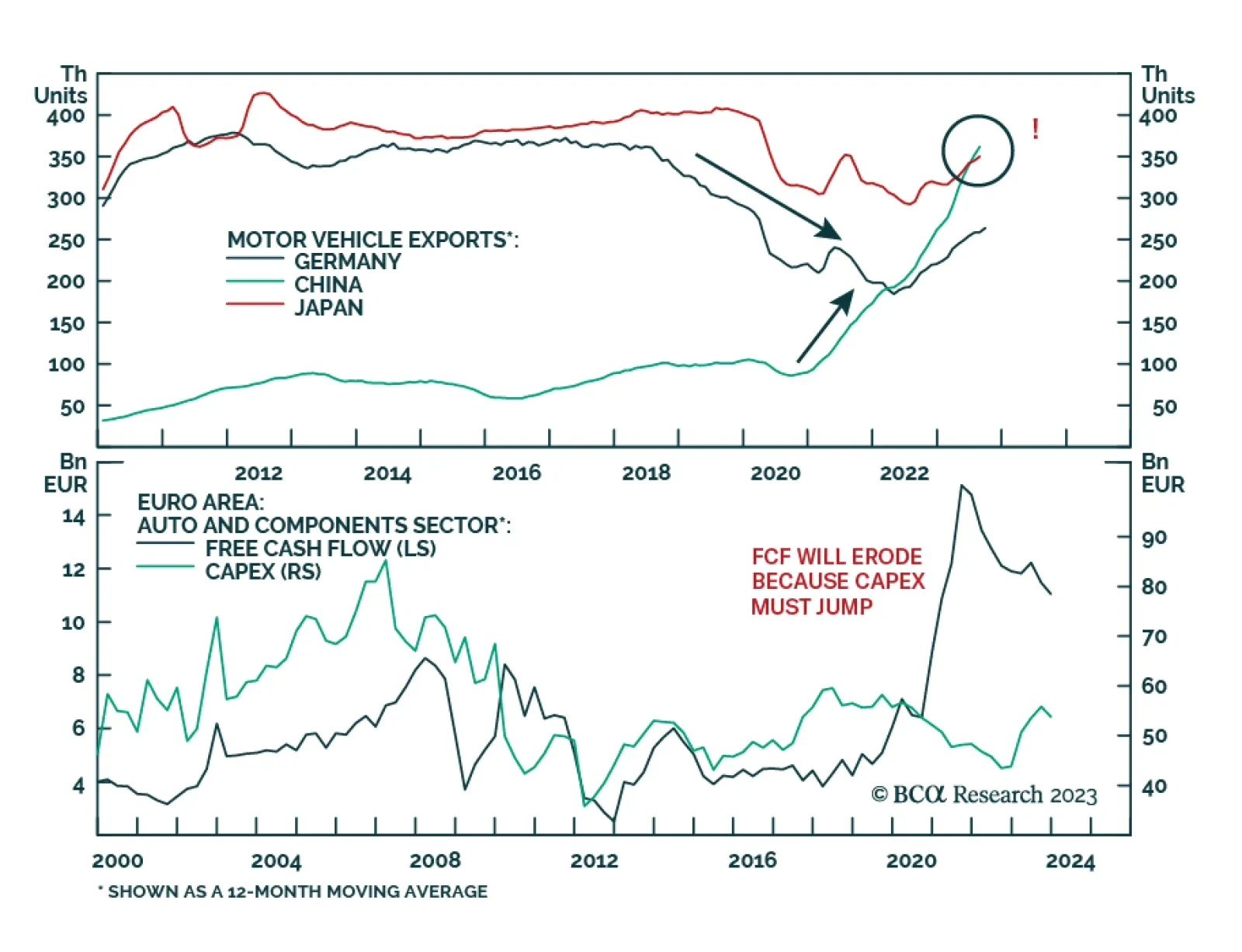

According to BCA Research’s European Investment Strategy service, European automobile and components stocks will suffer over the coming years. The European automobile and components equity sector is cheap, trading at a…