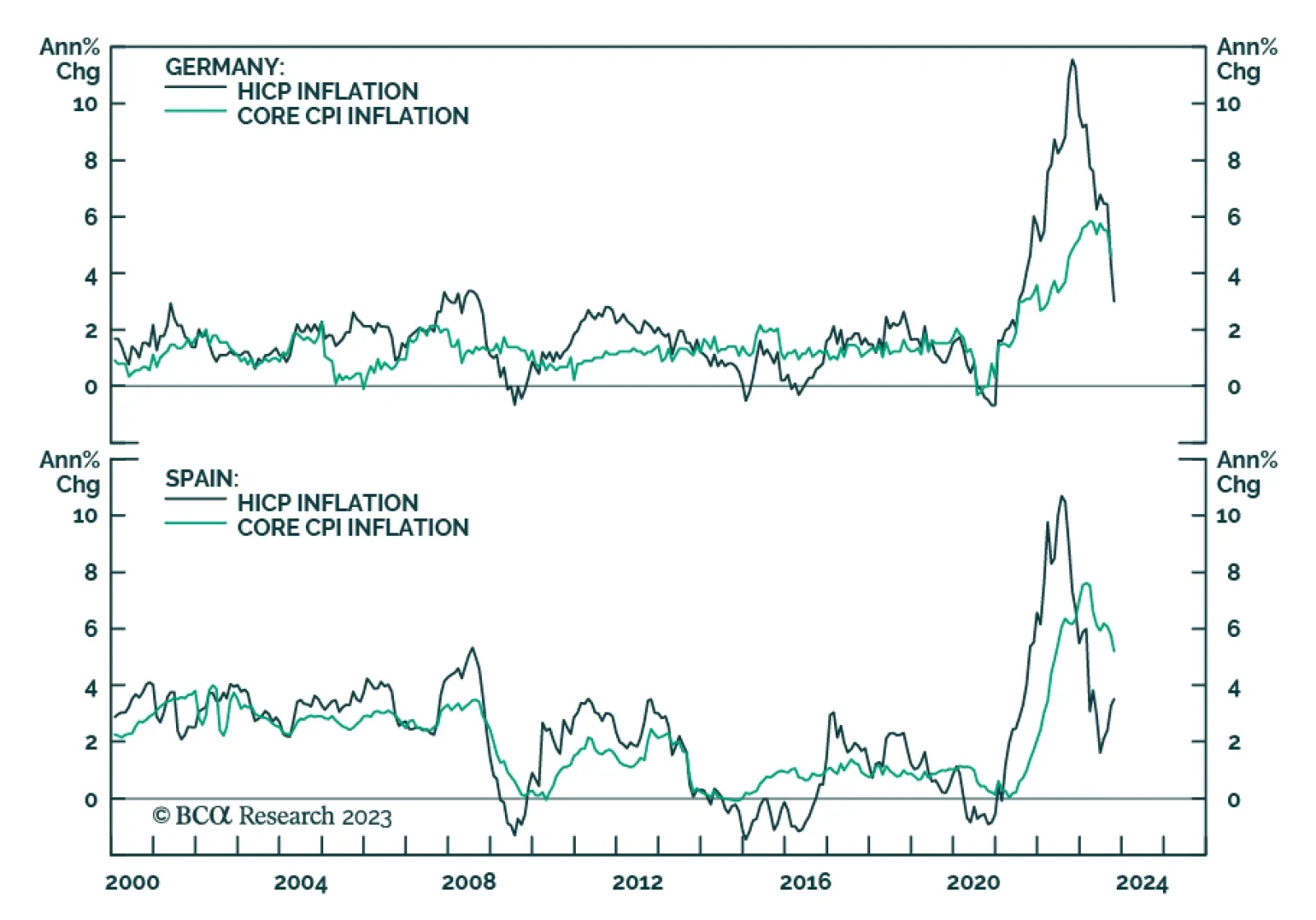

Eurozone economic data sent a positive signal on Monday. Preliminary CPI releases from Germany and Spain show price pressures continue to moderate. In Germany, the harmonized index declined by 0.2% m/m while the annual rate of…

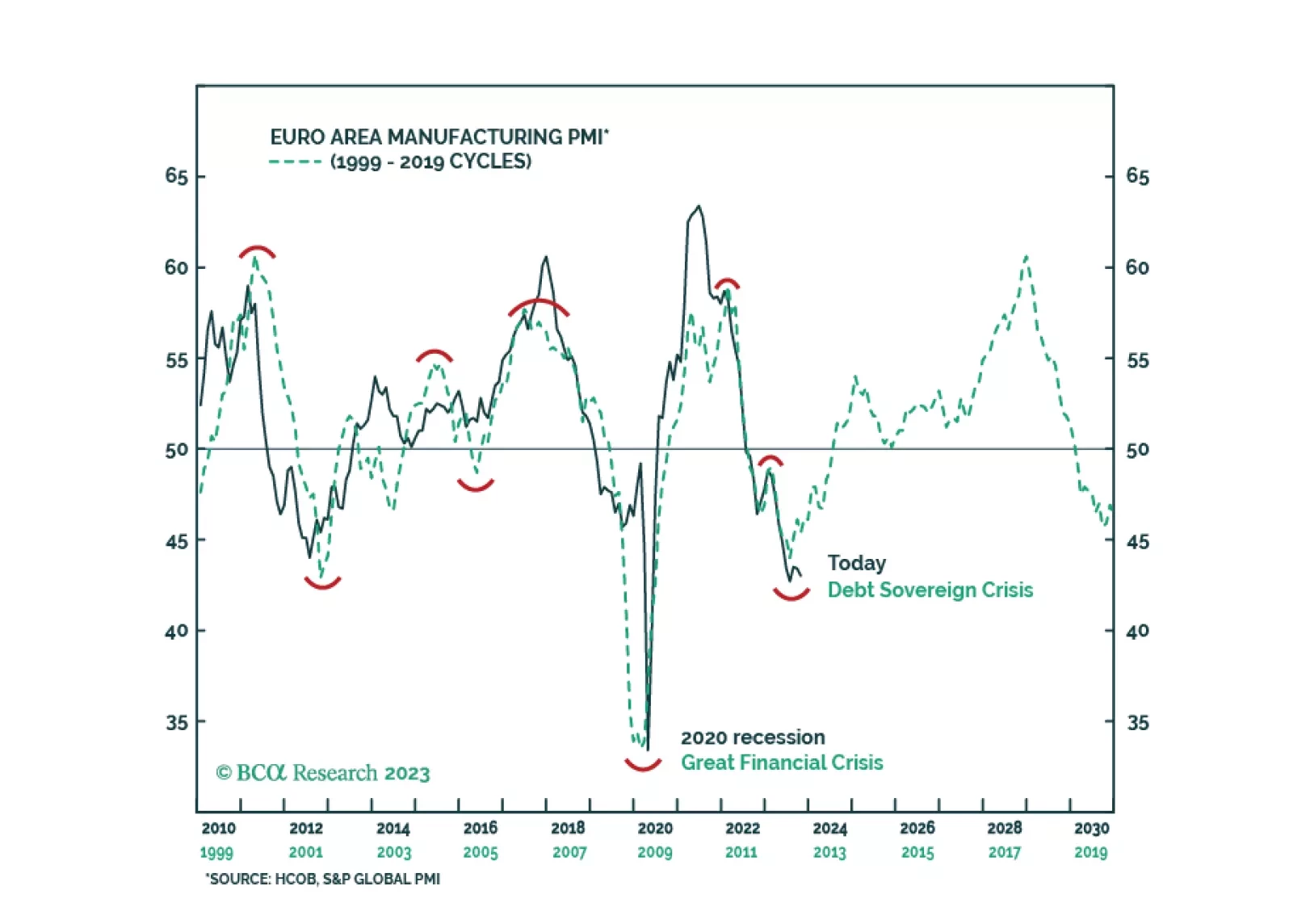

What will the next manufacturing cycle look like in Europe and how will risk assets perform? Lessons from the recent past.

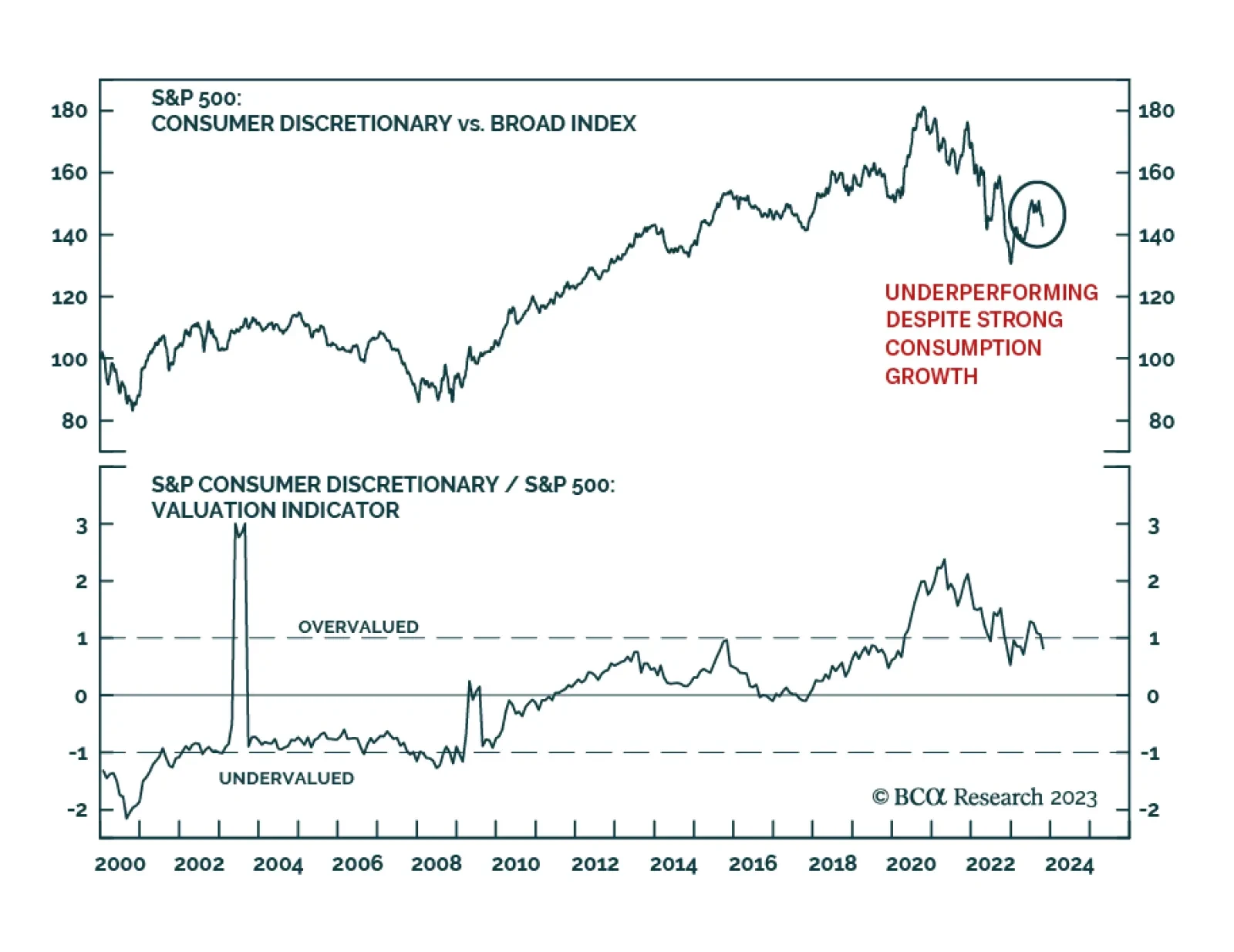

Recent US data reveals that consumer spending has been extremely robust in the US (see The Numbers). Personal consumption expanded by 4.0% q/q annualized in Q3, helping lift aggregate economic growth. Nevertheless, Consumer…

In a guest authorship of Section I, Doug Peta presents a synthesis of the recent views expressed in our US Investment Strategy and Bank Credit Analyst reports. Doug underscores that excess savings are unlikely to support US consumer…

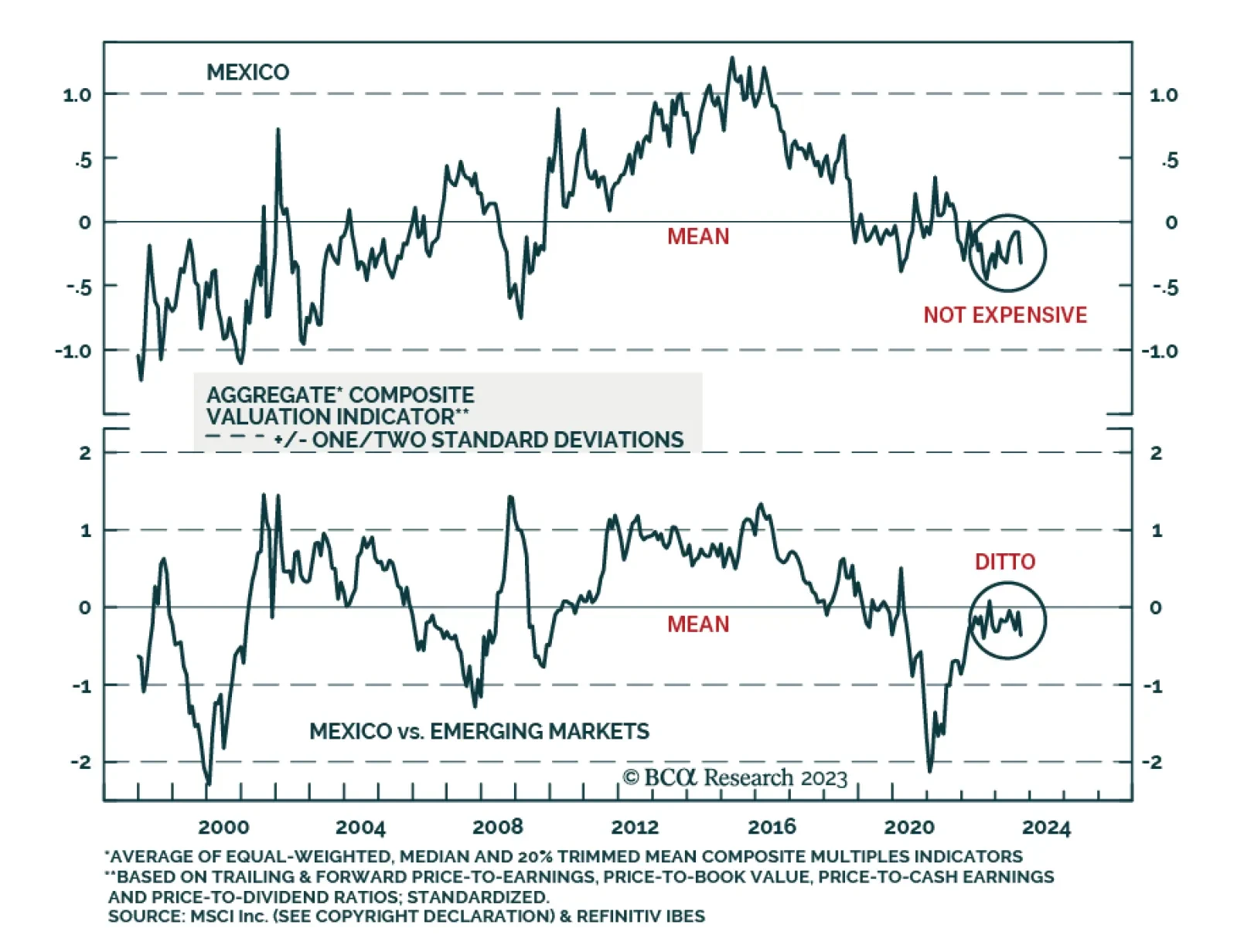

BCA Research’s Emerging Markets Strategy service remains overweight Mexican financial markets relative to their EM counterparts on a cyclical and structural basis. While Mexican markets will suffer in absolute terms with…

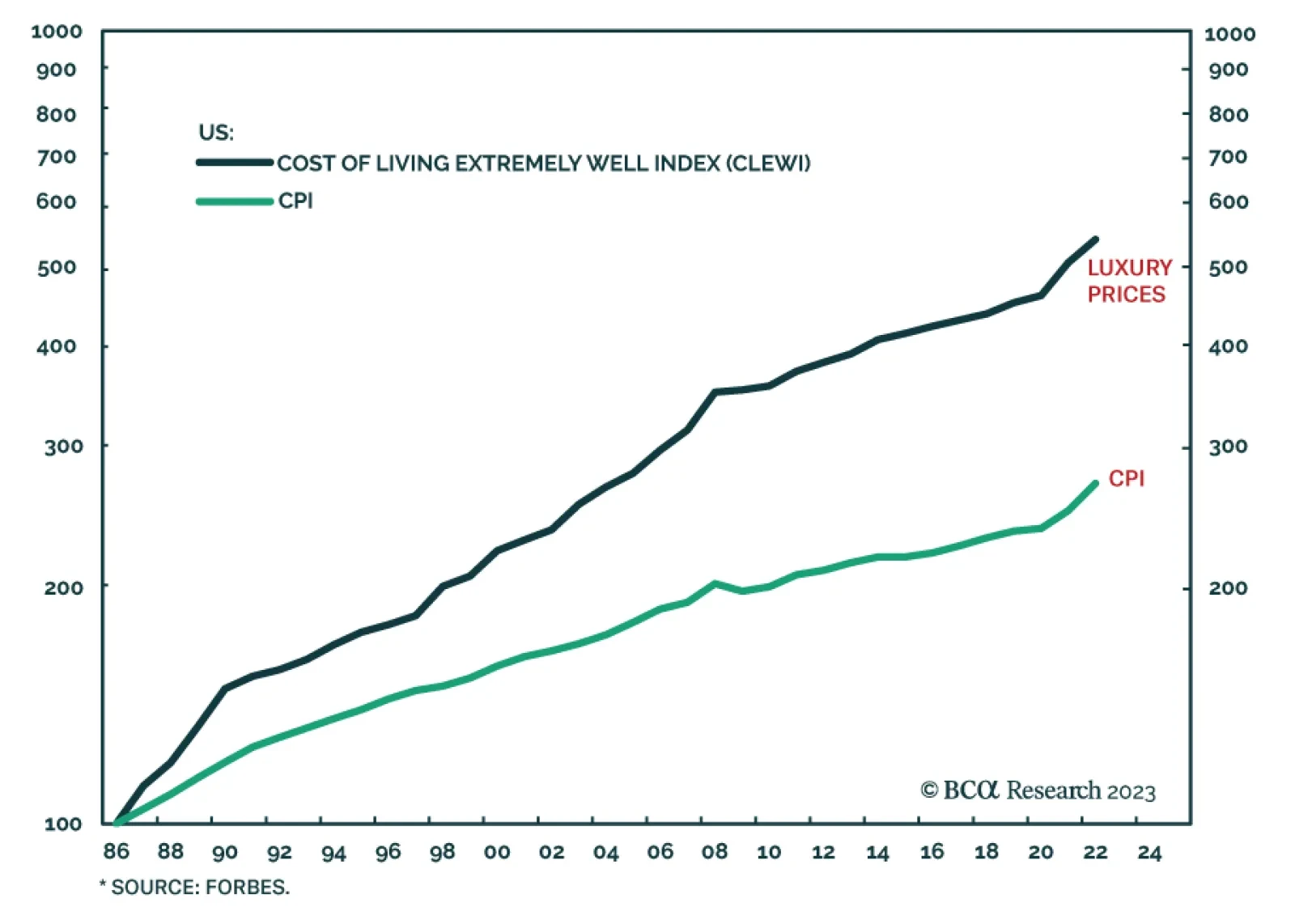

Although luxury goods producers are facing headwinds, the top end is still holding up well. Hermes, which represents the top-end of the luxury sector, reported a 16% increase in sales in the third quarter, of which half came…

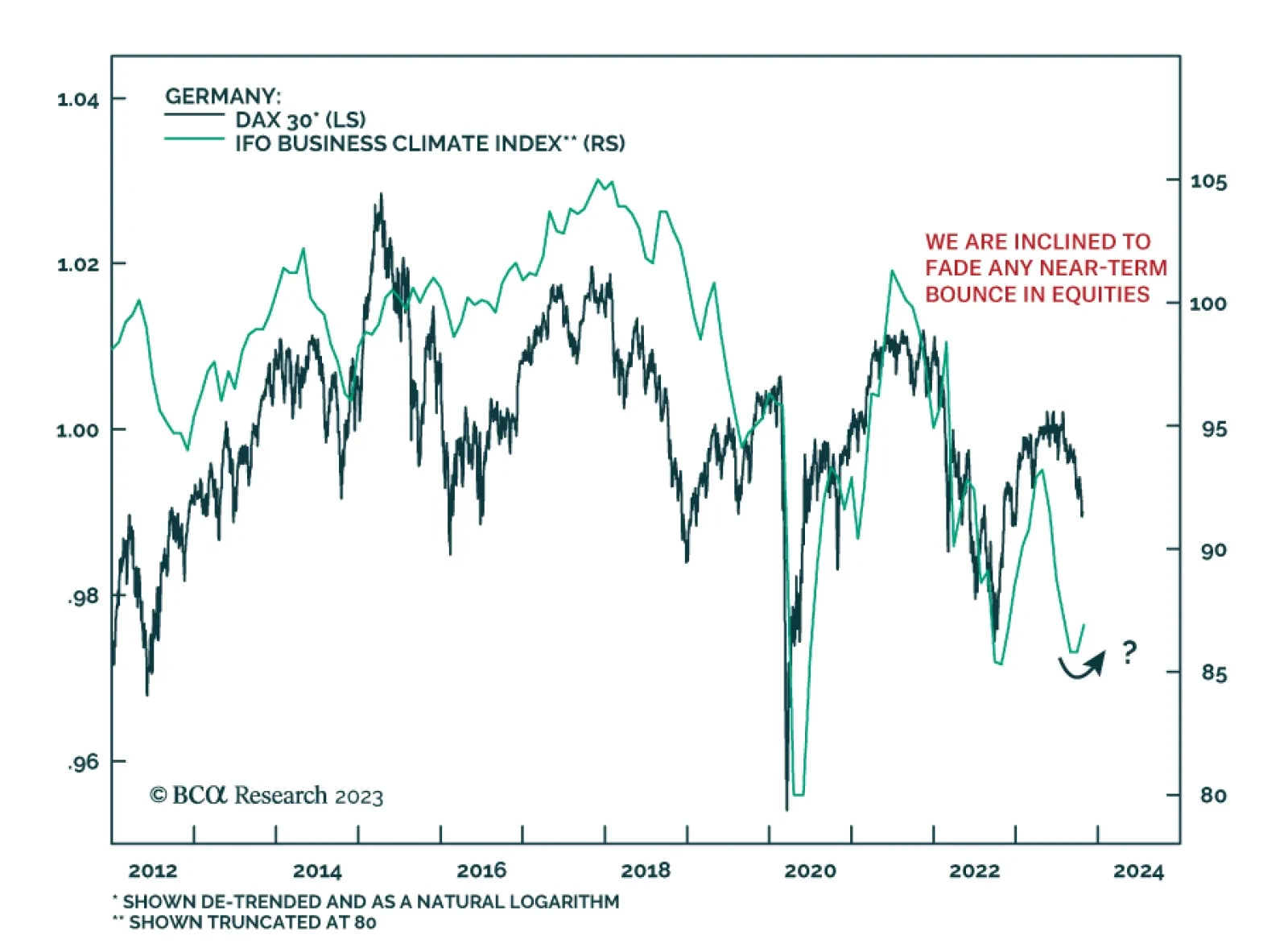

Results of the October German IFO survey corroborate the positive signal from the latest ZEW survey. The headline Business Climate Index increased for the first time since April, rising from 85.8 to 86.9, above expectations of 86…

China’s economic growth will stagnate, at best, rather than revive. Lower valuations of Chinese equities are justified, and share prices have more downside. The RMB will continue to depreciate versus the US dollar.