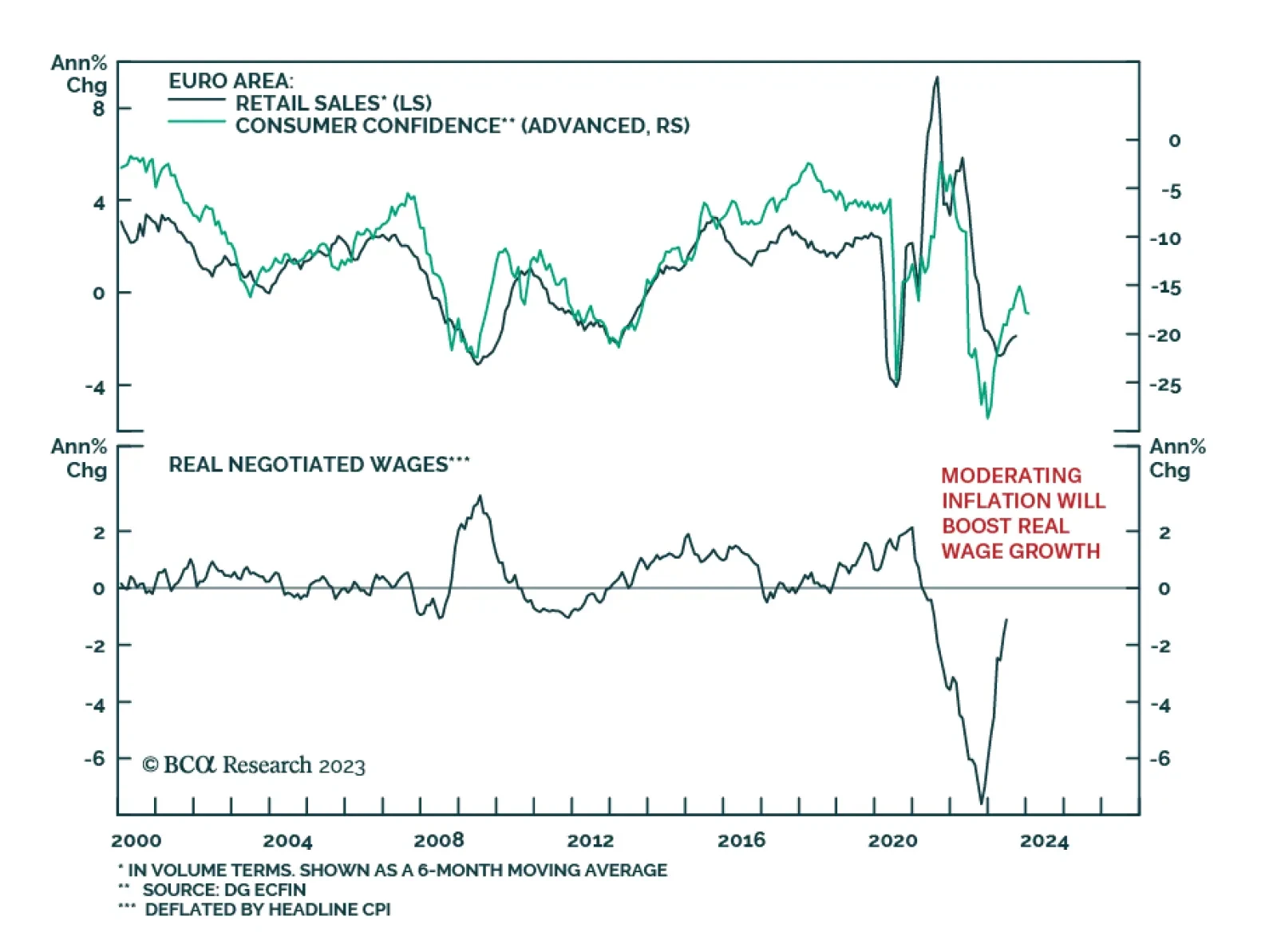

As expected, Euro Area retail sales continued to decline on both a month-over-month and a year-over-year basis in September. The 0.3% m/m drop is slightly below expectations of -0.2% m/m while the 2.9% y/y decline is not as bad…

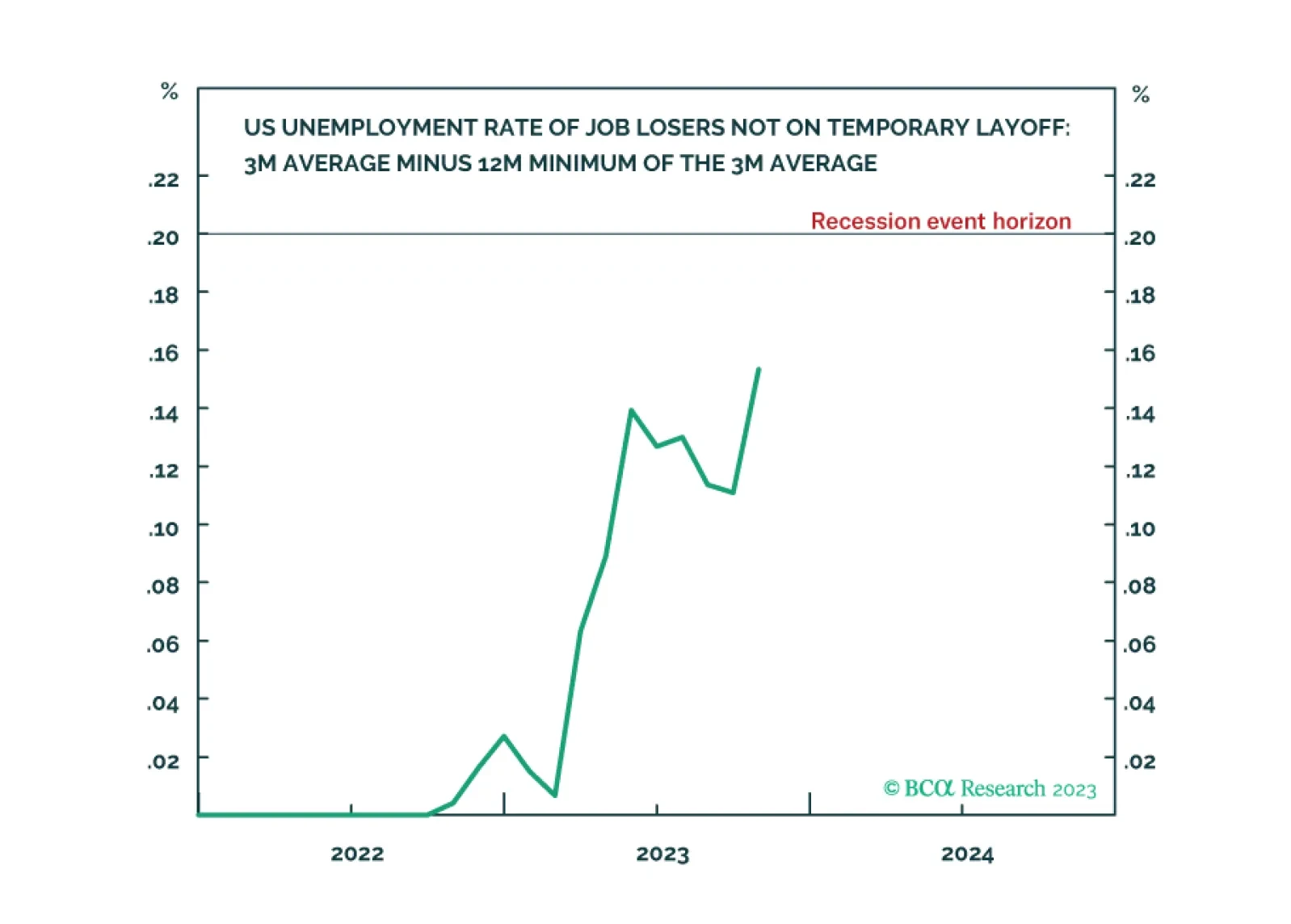

Following the October US jobs data, the ‘Joshi rule’ real-time US recession indicator increased from 0.11 to 0.15, meaning that it is fast approaching its event horizon of 0.20. We go through the investment implications. We also…

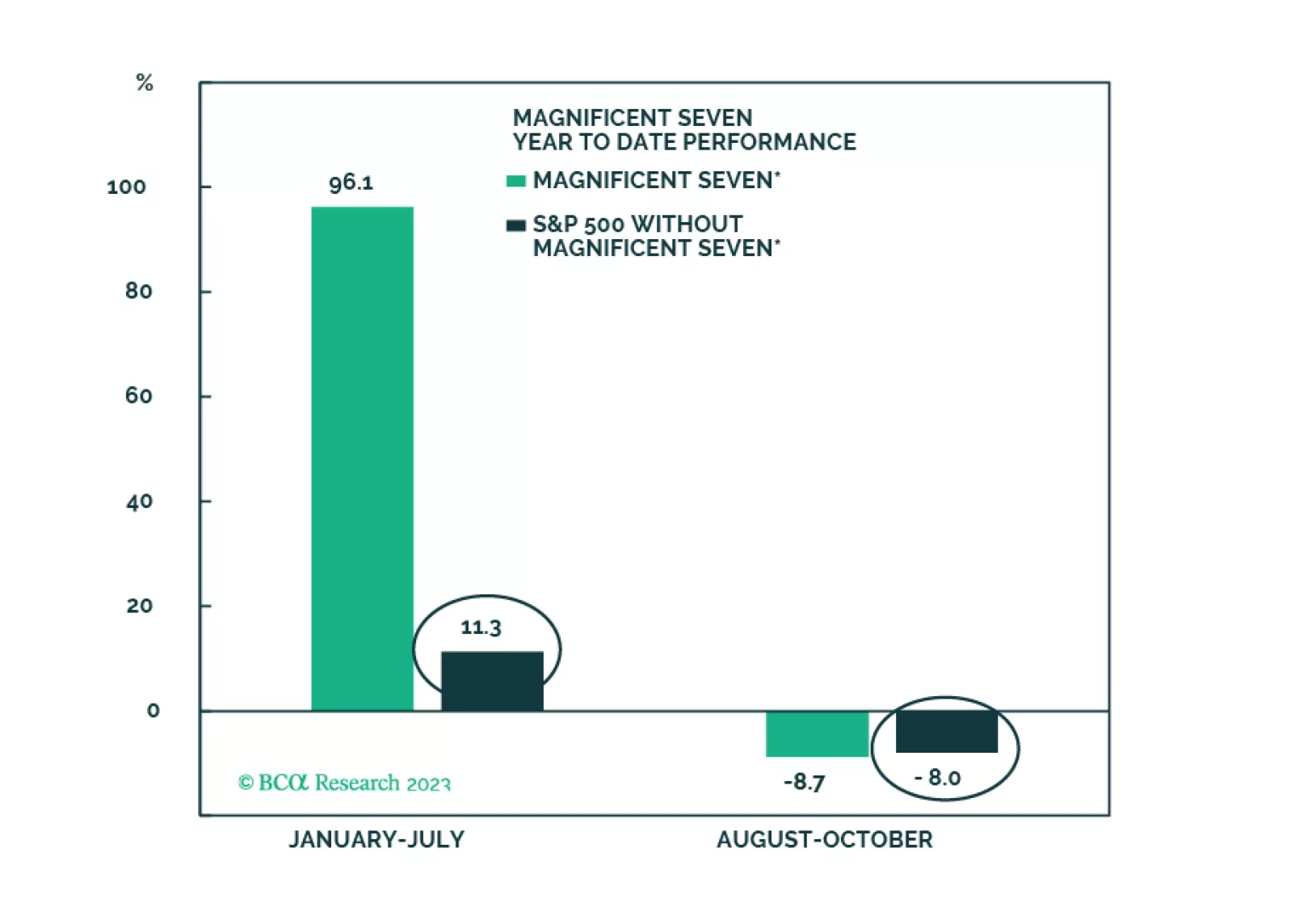

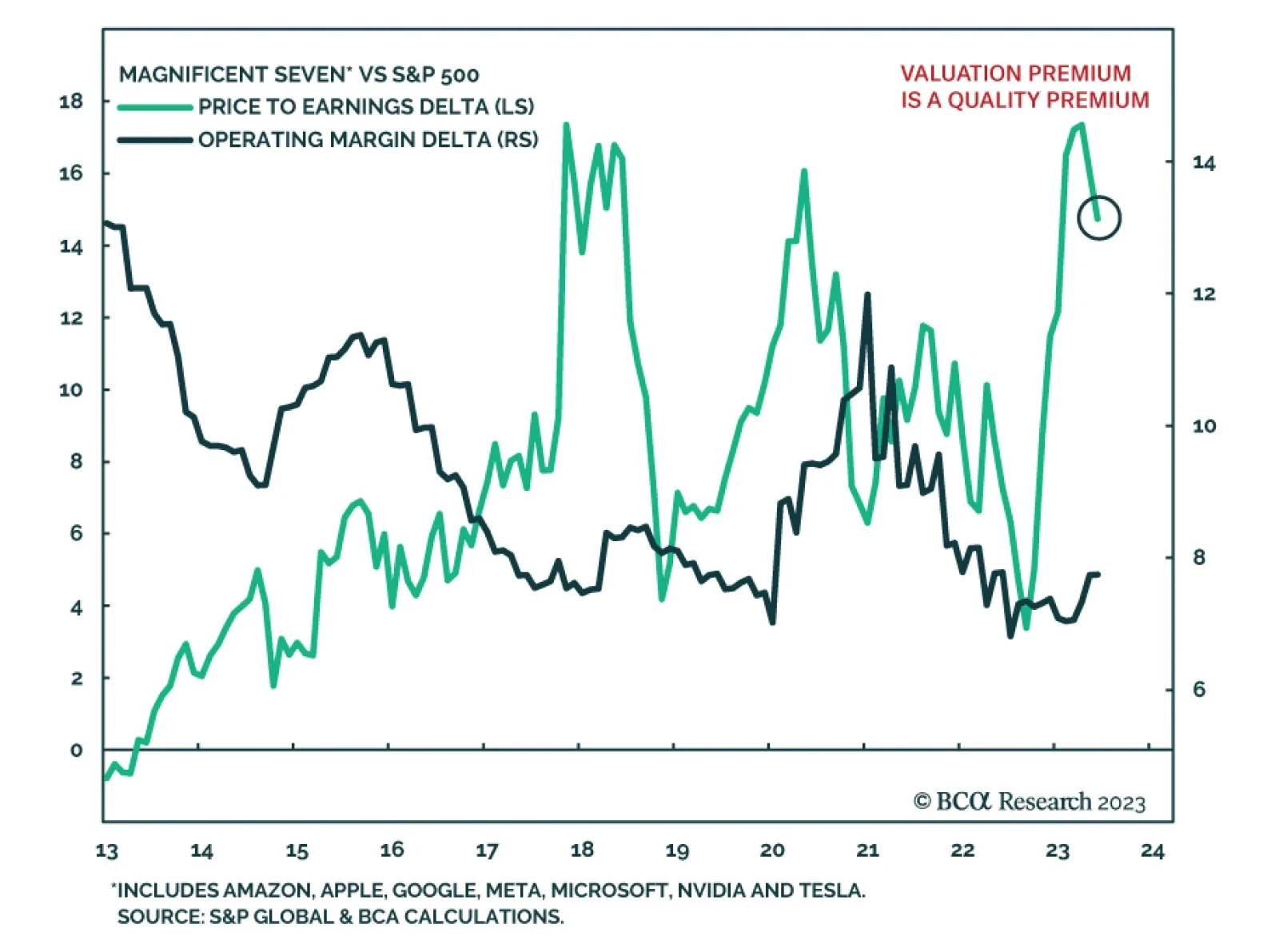

The Magnificent Seven constitute 26.7% of the S&P 500 and are the cohort responsible for the majority of S&P 500 returns this year. Fundamentals, and, specifically, the profitability of the group are behind the strong…

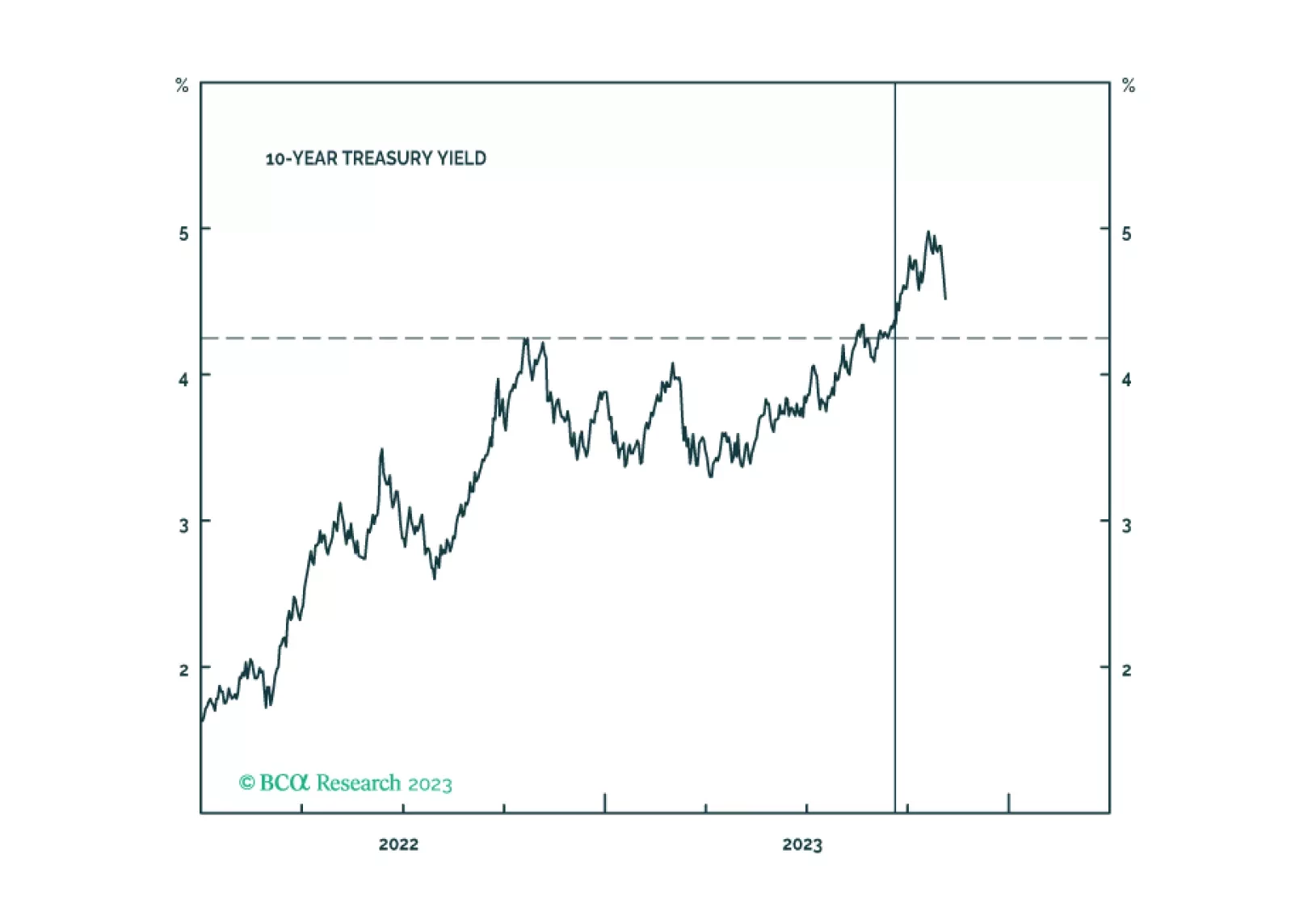

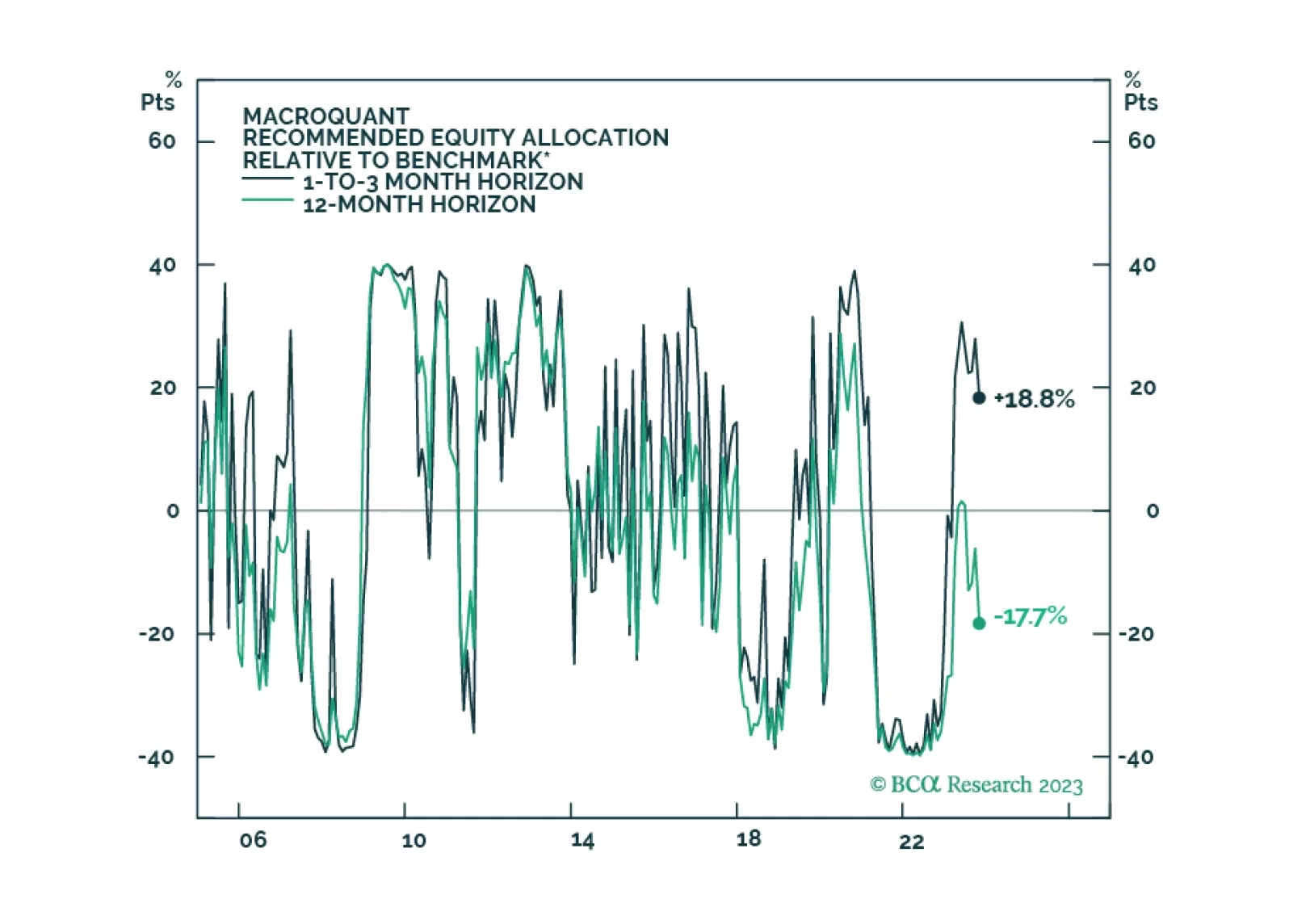

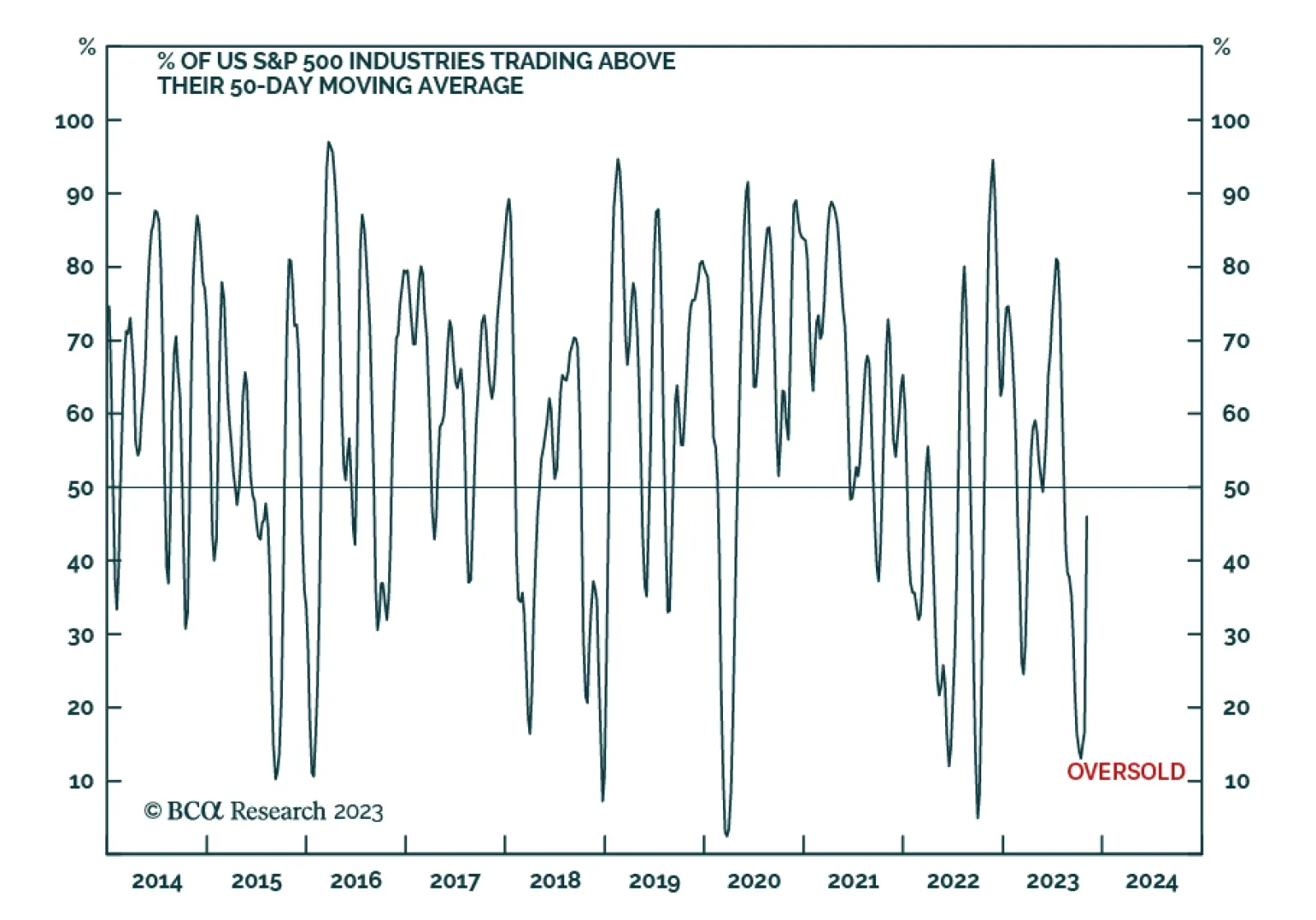

The Vicious Troika remains a long-term threat, but over the short term, rates will likely have another leg down on growth concerns, offering support to equities, which are now fairly valued and are no longer overbought. Longer-term…

The S&P 500's 5.9% rally last week marks the greatest weekly price gain since November 2022. This sharp increase comes after a 10.3% selloff between the start of August and late-October, which put the benchmark in…

We consider several uncertainties in this week’s report, from the interest rate outlook to the source of the mountain of cash households have amassed since the pandemic began. We have not adjusted our tactical asset-allocation…

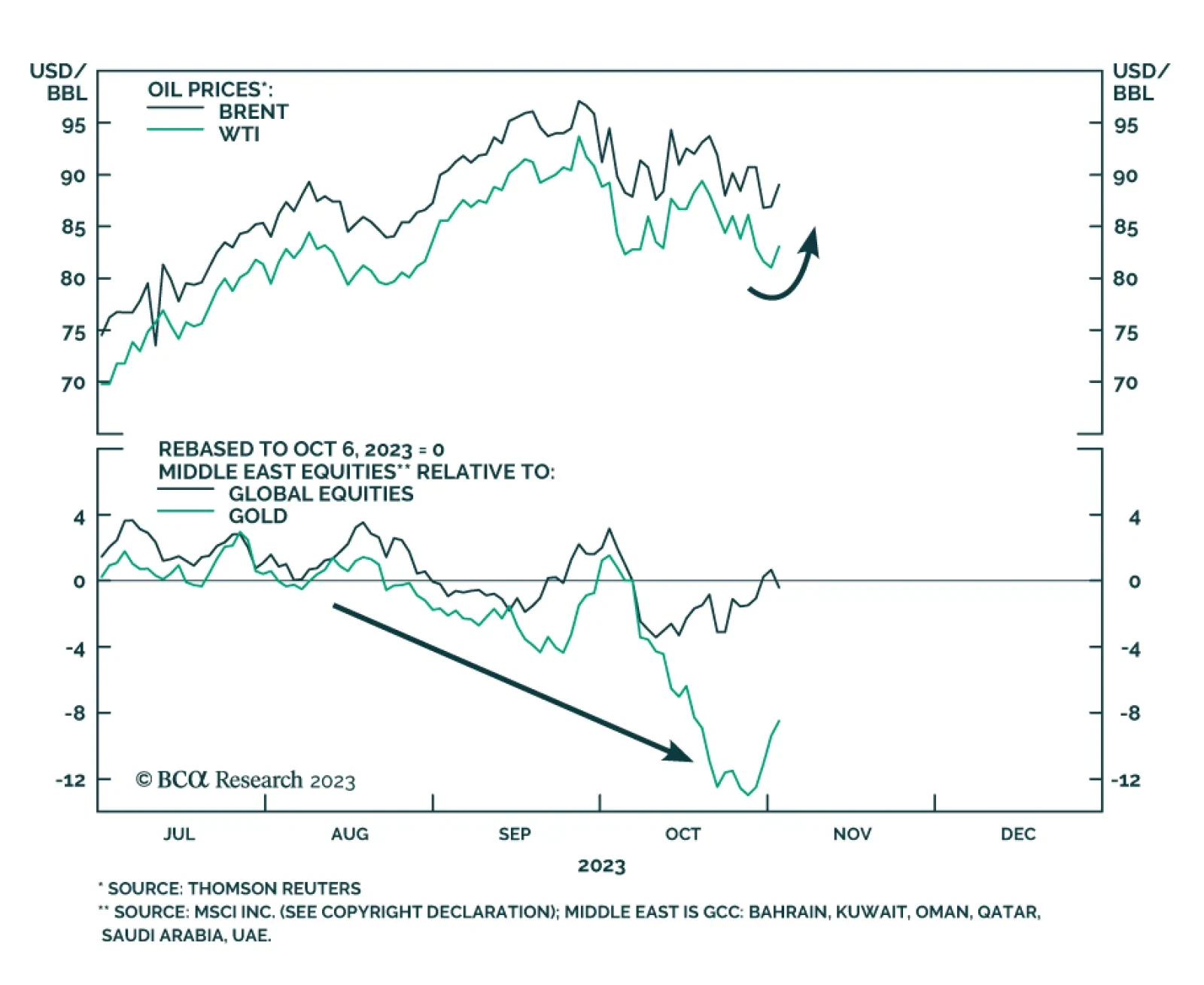

According to BCA Research's Geopolitical Strategy service, investors should reduce risk, increase allocation to safe havens, and brace for oil price volatility and supply disruptions stemming from the Middle East over the…

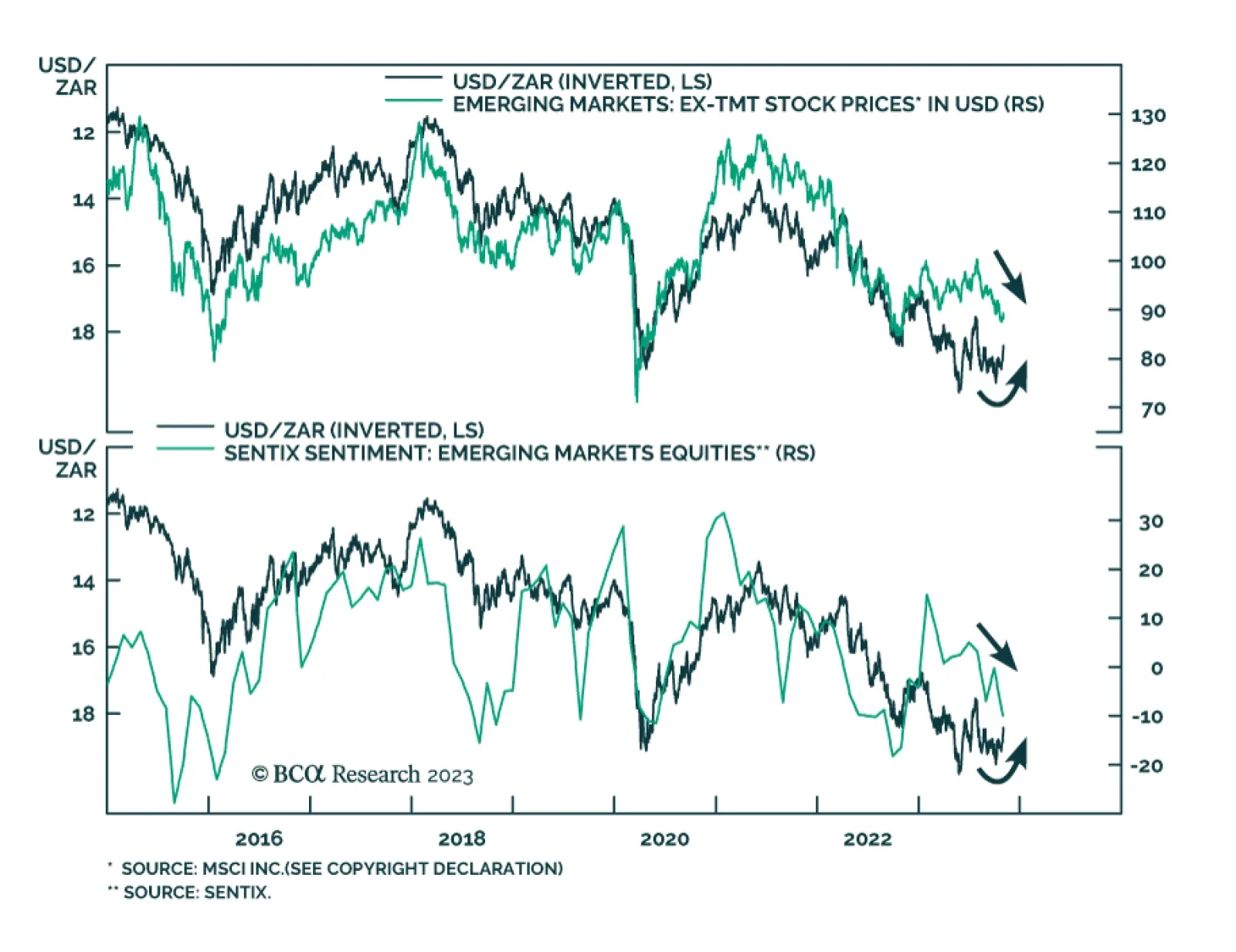

The South African rand is the best performing major currency since the DXY peaked on October 3. Considering that the rand acts as a proxy for global sentiment towards emerging markets, its recent strength raises the question…

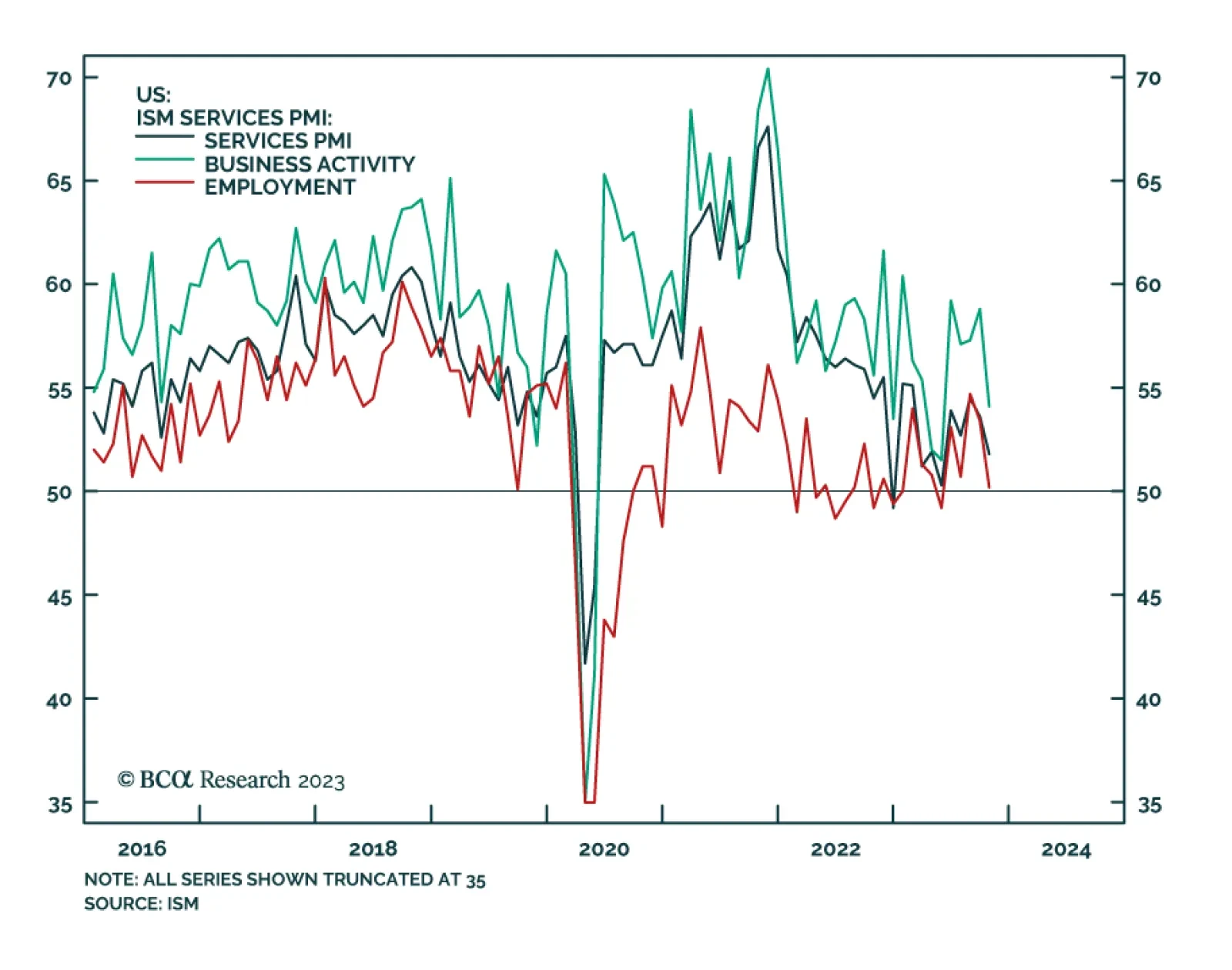

The US ISM PMI delivered a disappointing signal about service sector activity in October. The headline index fell from 53.6 to 51.8 – marking a sharp slowdown in activity and falling below expectations of a much more muted…

We are approaching another phase transition from boom to bust. Stocks should rally into year-end, but investors should look to reduce equity exposure early next year while increasing bond exposure.