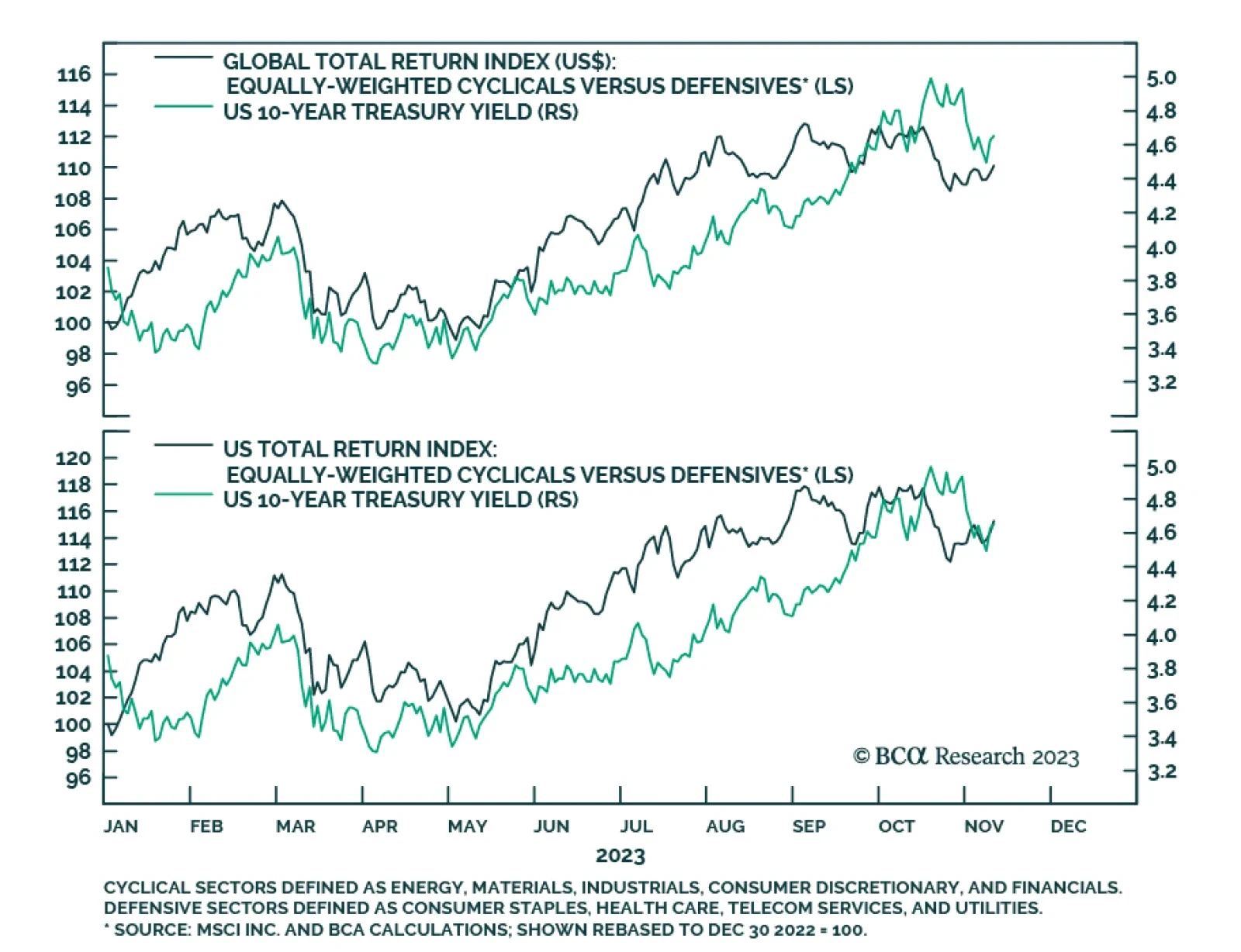

Our equally weighted global cyclical equity index has outperformed equally weighted defensives for most of this year. By October 17, this outperformance stood at about 12.6%. This outperformance is consistent with US Treasury…

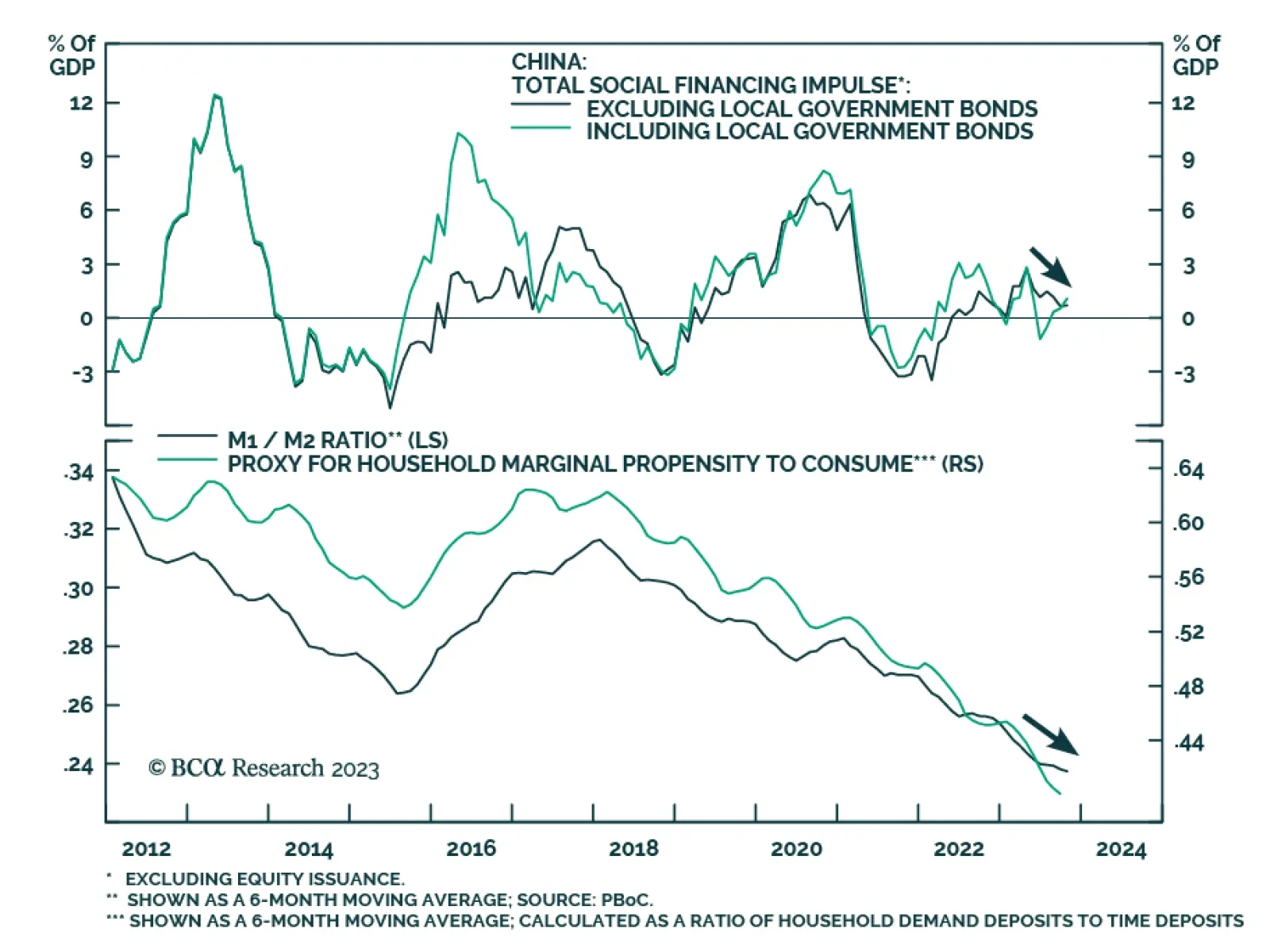

China's money and credit data remained weak in October. New total social financing amounted to RMB 1.85 trillion – less than the RMB 1.95 trillion anticipated and below the prior month's increase of RMB 4.12…

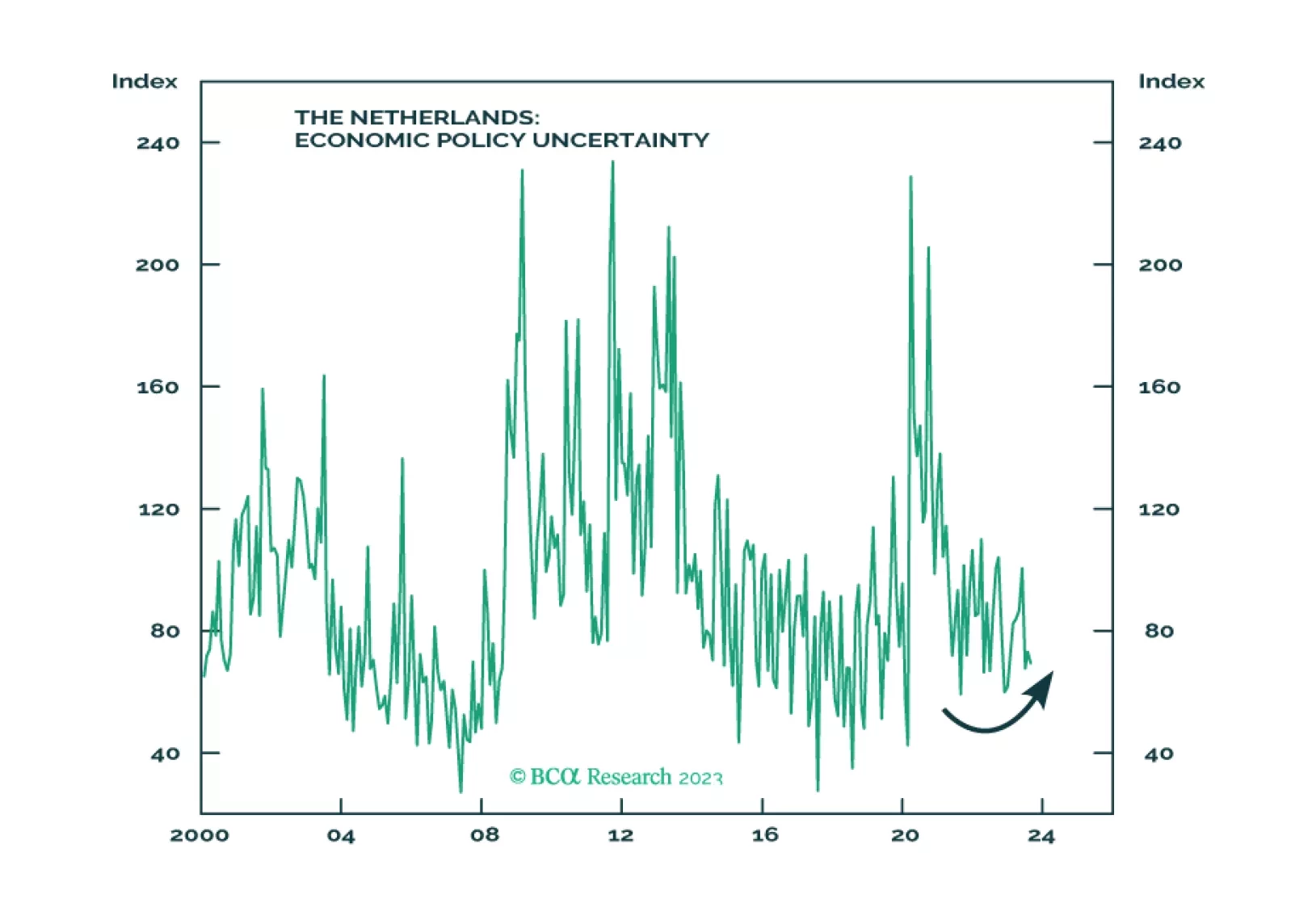

European markets have room to rebound in the coming weeks, however, a recession looms. What are the lessons from history that investors can use to position themselves under these conditions?

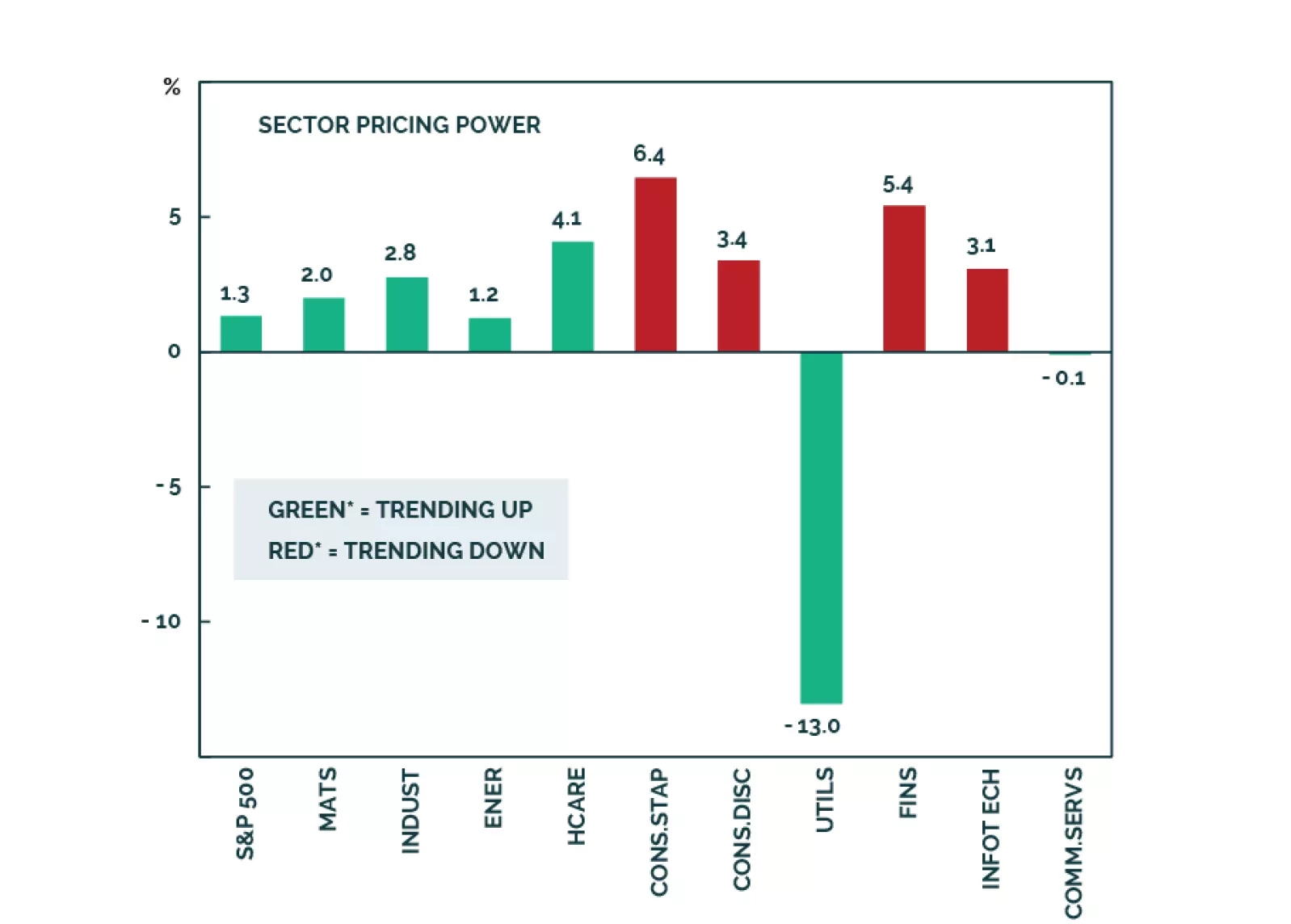

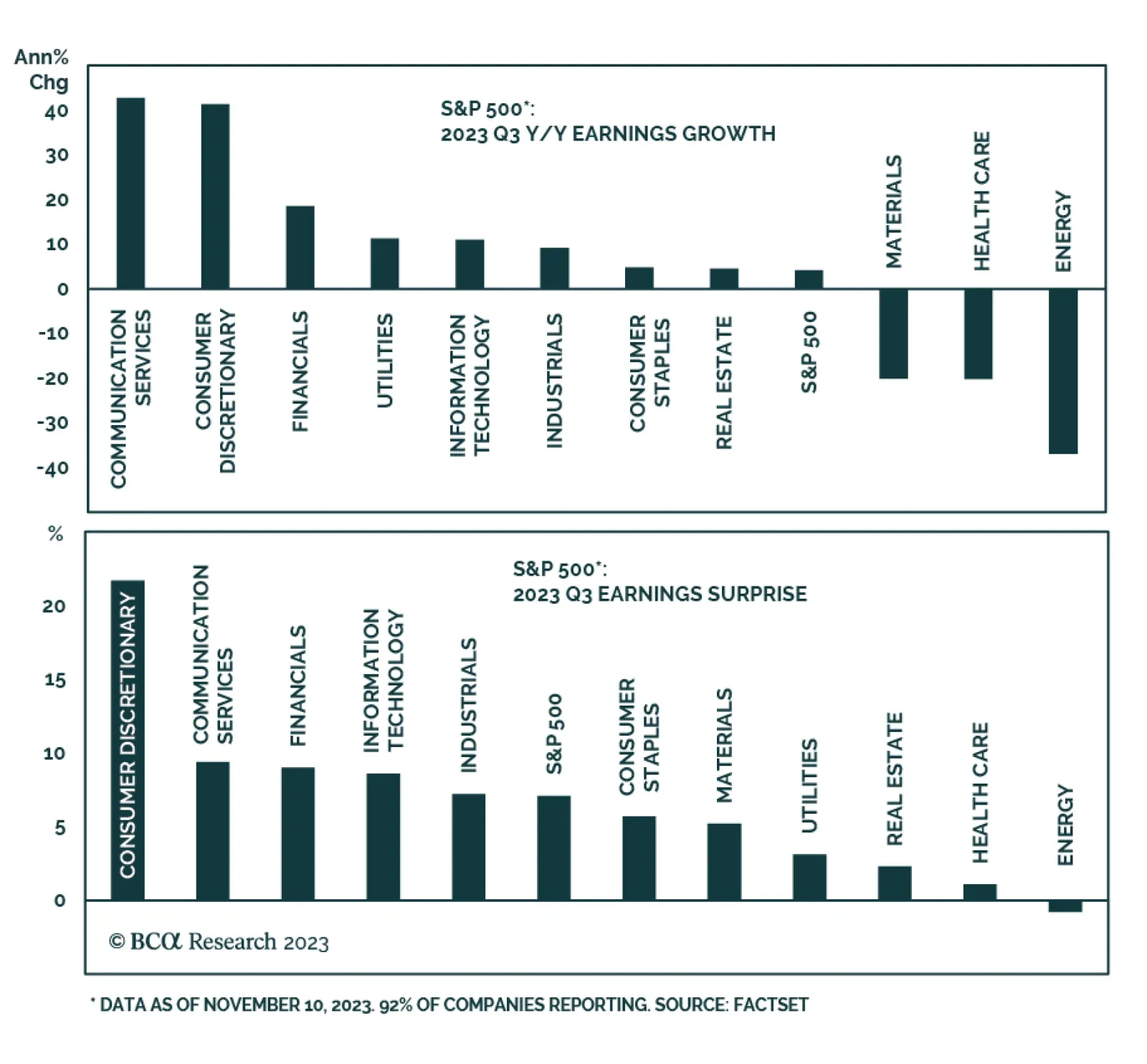

Q3 earnings commentary has been broadly positive, despite intensifying macro headwinds. Going forward, a negative growth outlook and geopolitical risks, are a threat to buoyant earnings expectations. We project that earnings growth…

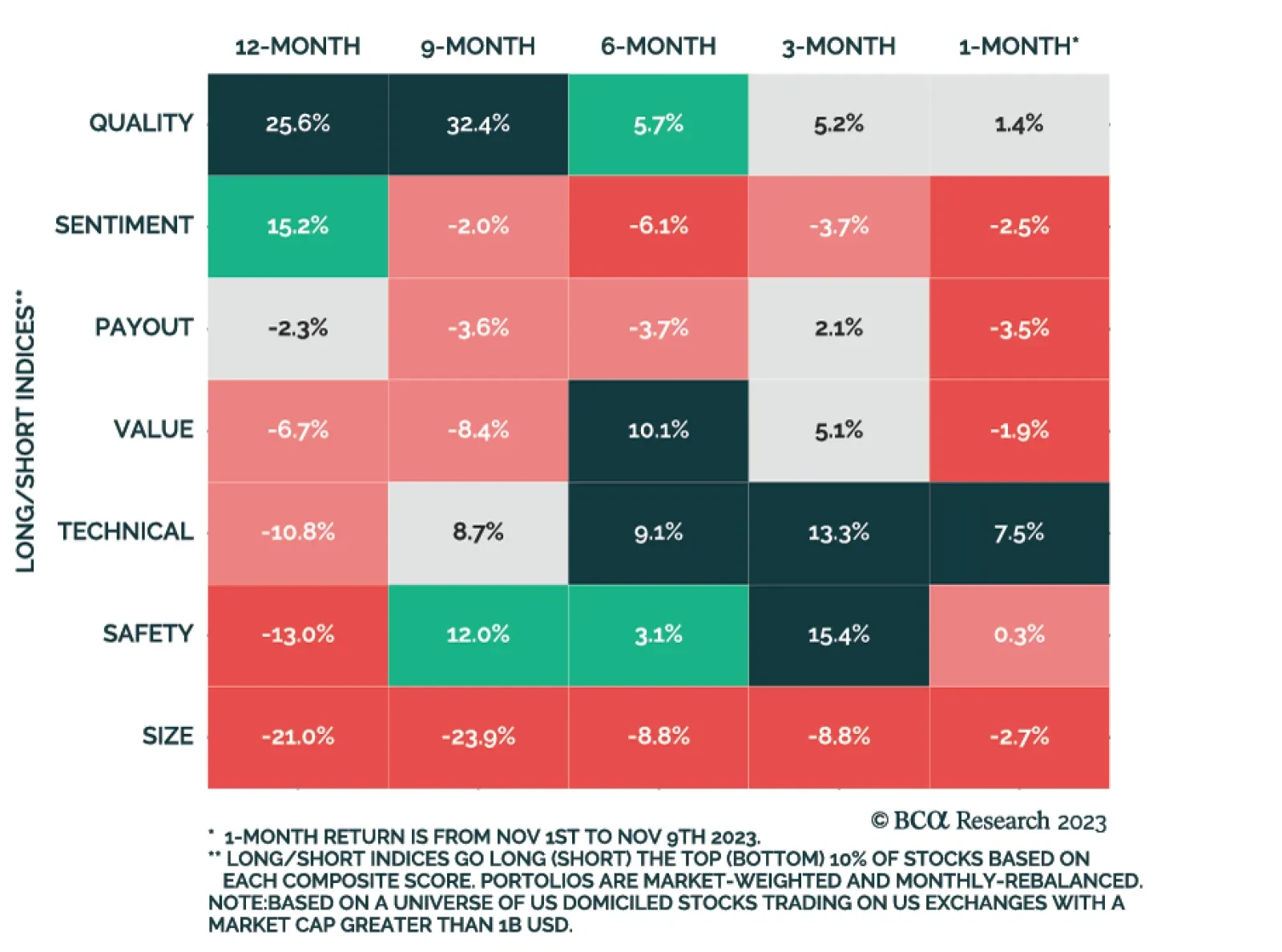

Analyzing the long/short performance of the Equity Analyzer Composite Factors gives insight into both what has been driving US large cap markets and how those drivers have evolved over the course of the year. The results…

The Q3 earnings season is nearing its end. By Friday, 92% of S&P 500 companies had already reported and thus far the results are positive. According to FactSet, the S&P 500's 4.1% y/y blended earnings growth rate is…

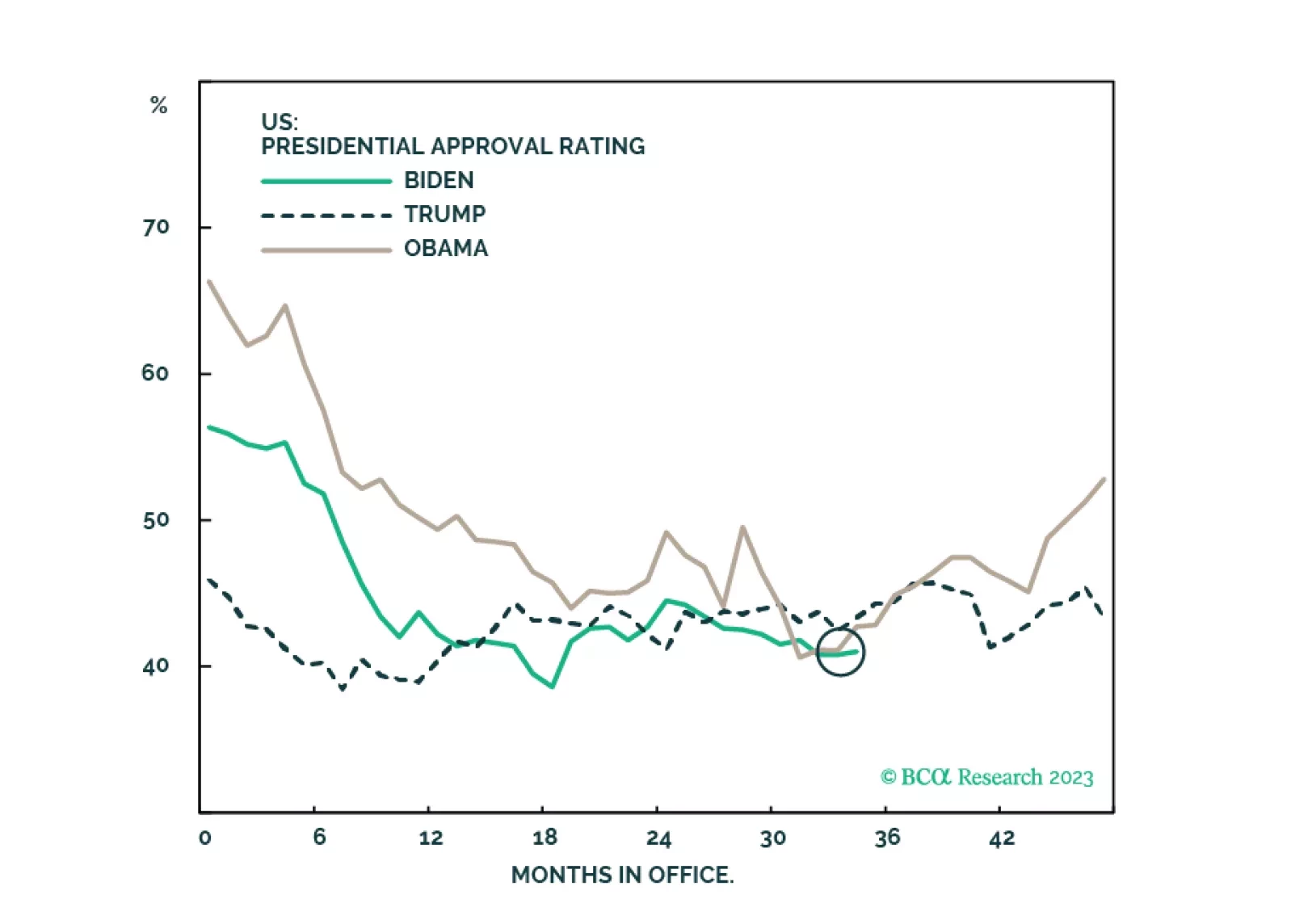

Results from Tuesday’s elections suggest that the Democrats are doing better than what their 2024 polling are showing. While the results are marginally positive for equities, investors should not overrate this off-year election,…

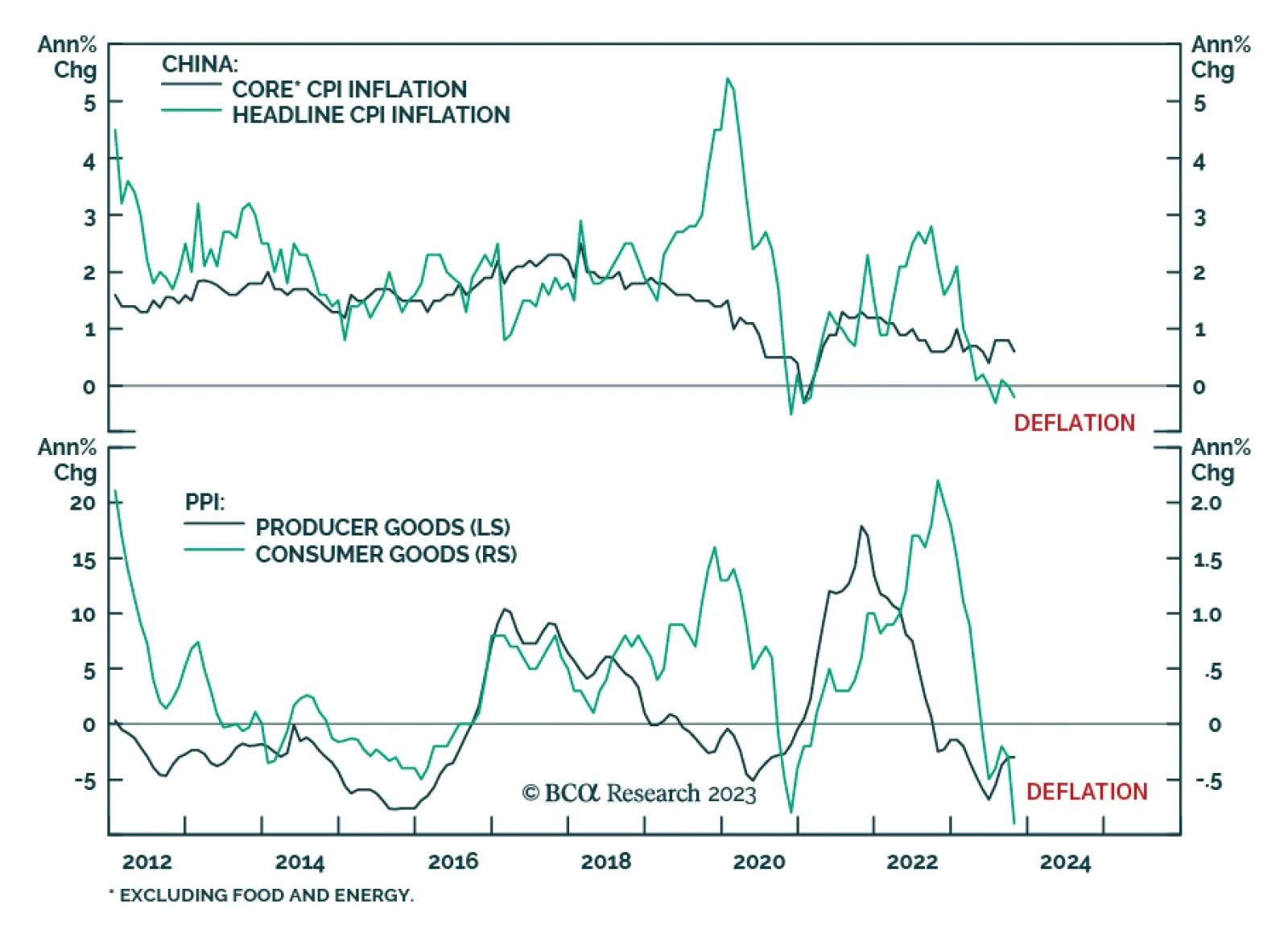

China's CPI and PPI inflation release for October indicates that deflationary pressures continue to dominate the domestic economy. After remaining unchanged in September, consumer prices declined by 0.2% y/y last month,…

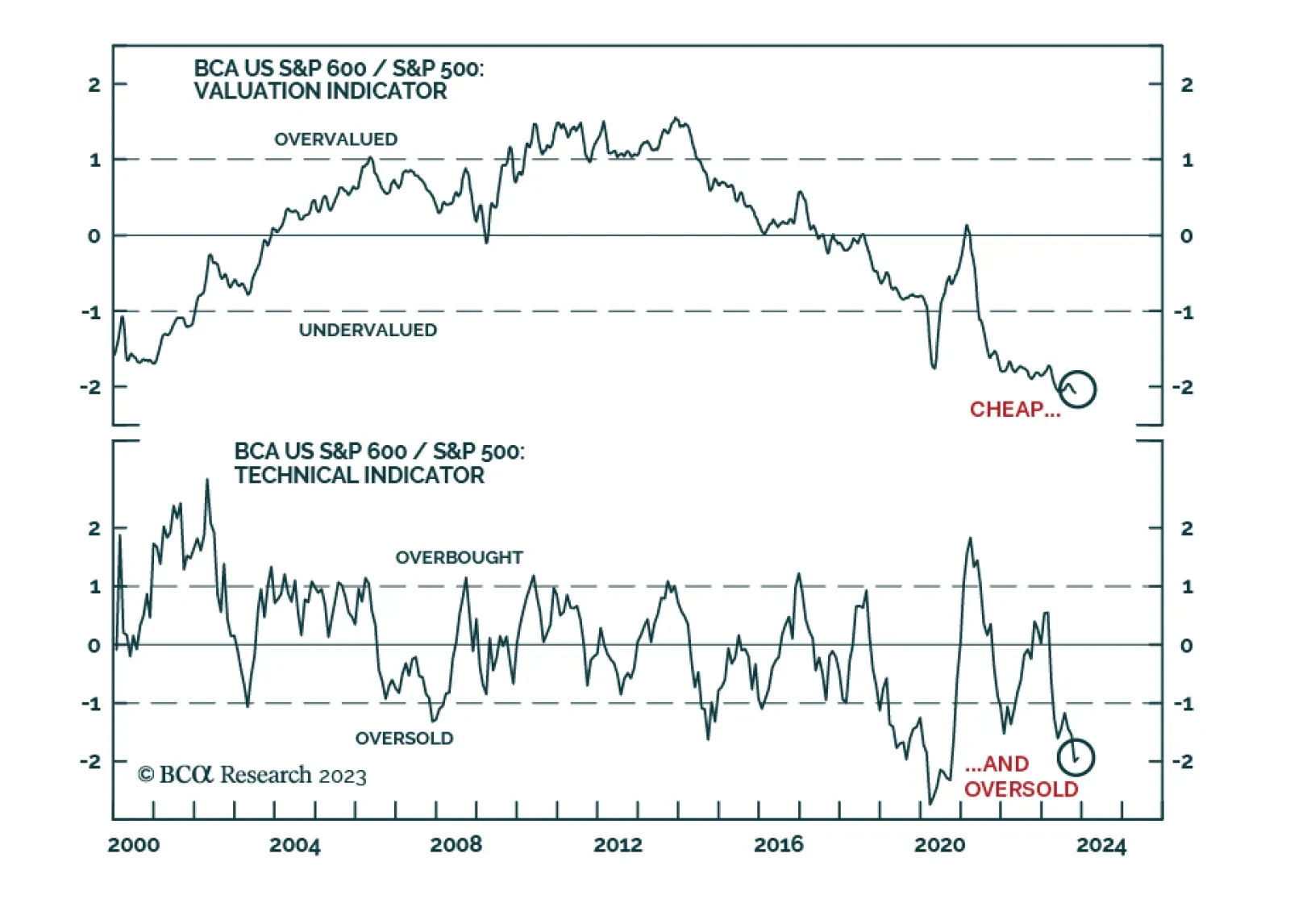

US small-cap stocks have underperformed significantly this year. While the S&P 500 price index is up 14.0% year-to-date, the S&P 600 has lost 2.5%. However, this underperformance has not been a straight line down. Small…