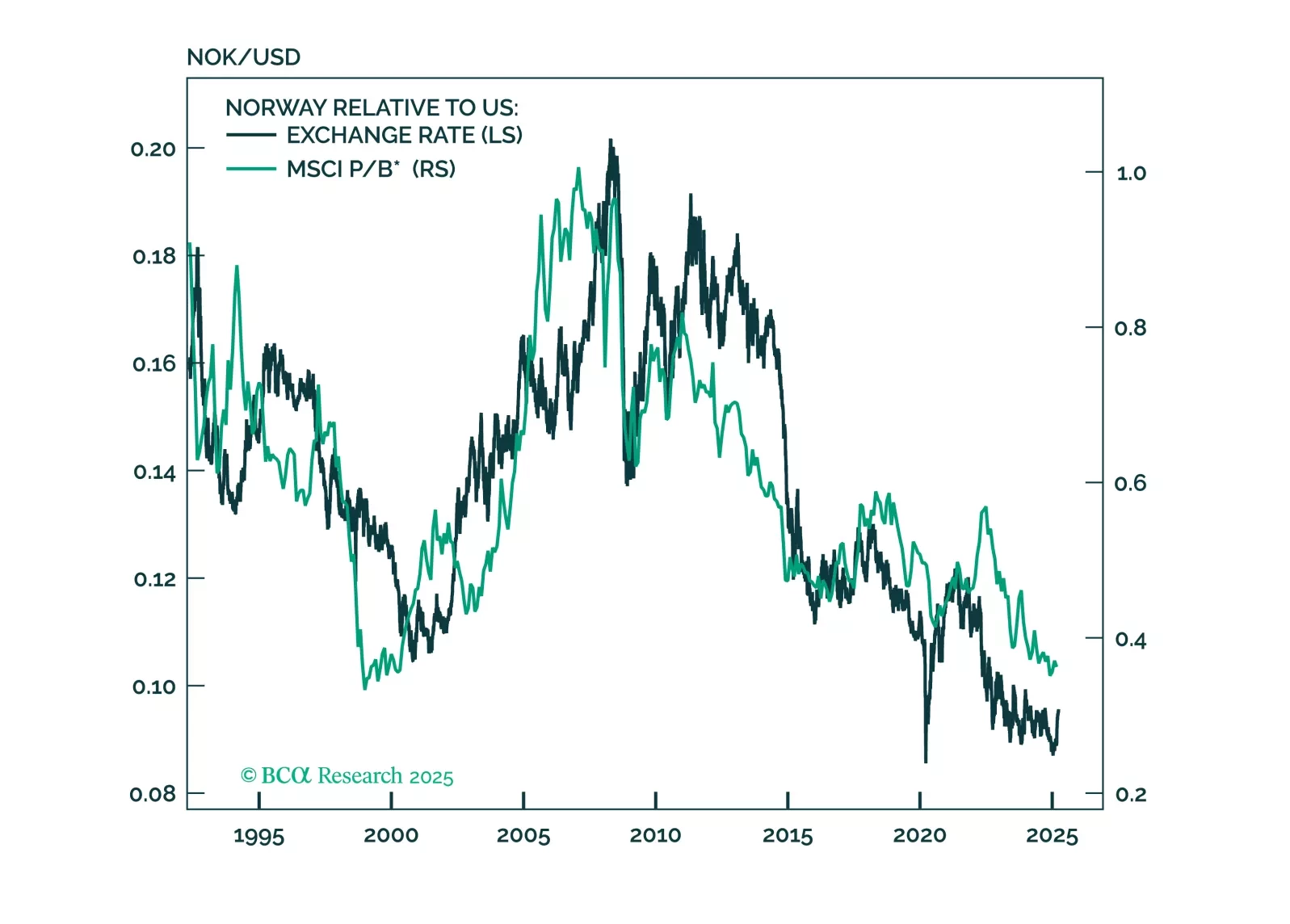

This report looks at investment implications, for Norwegian assets, given the recent meeting, from the Norges Bank.

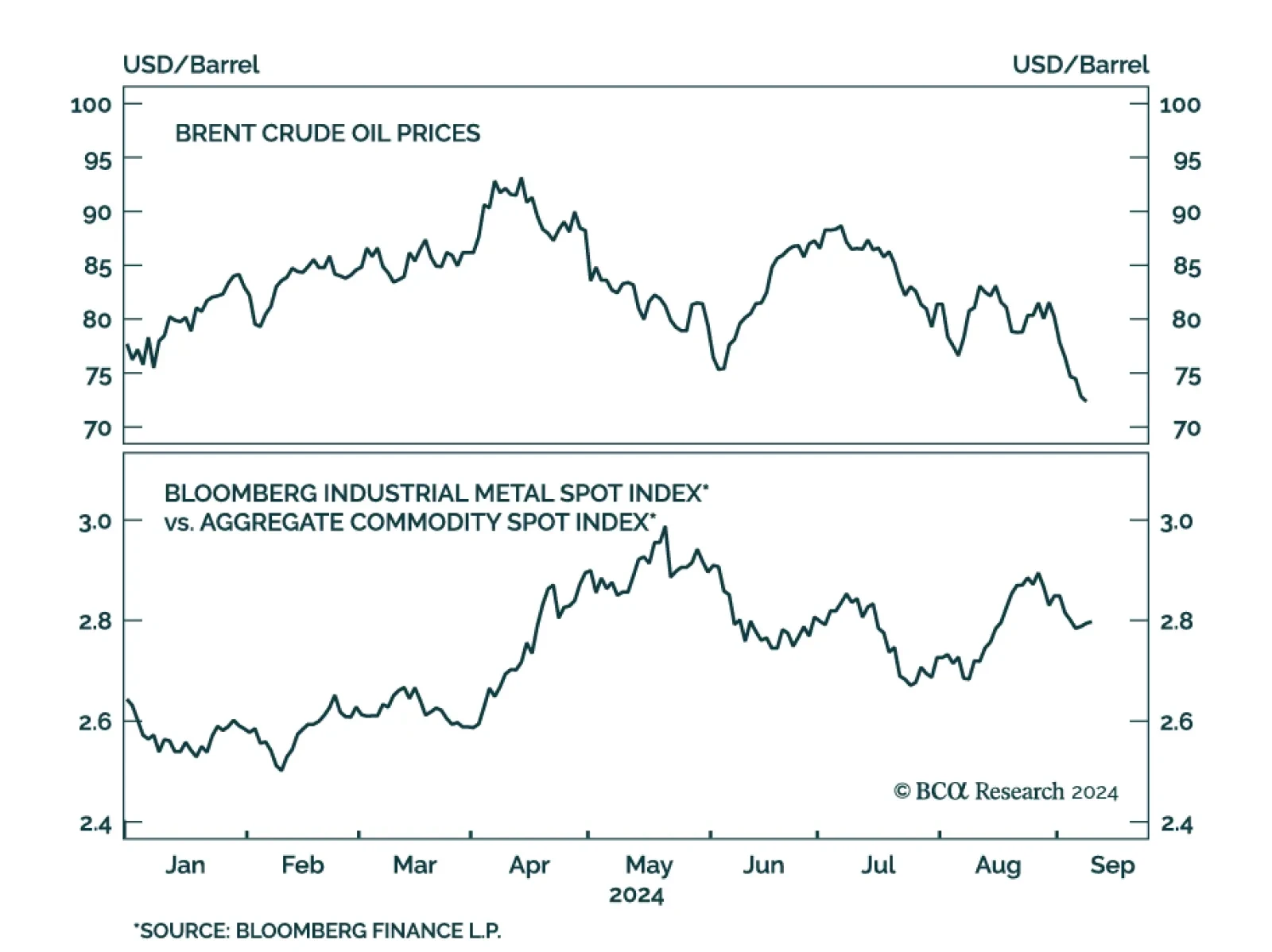

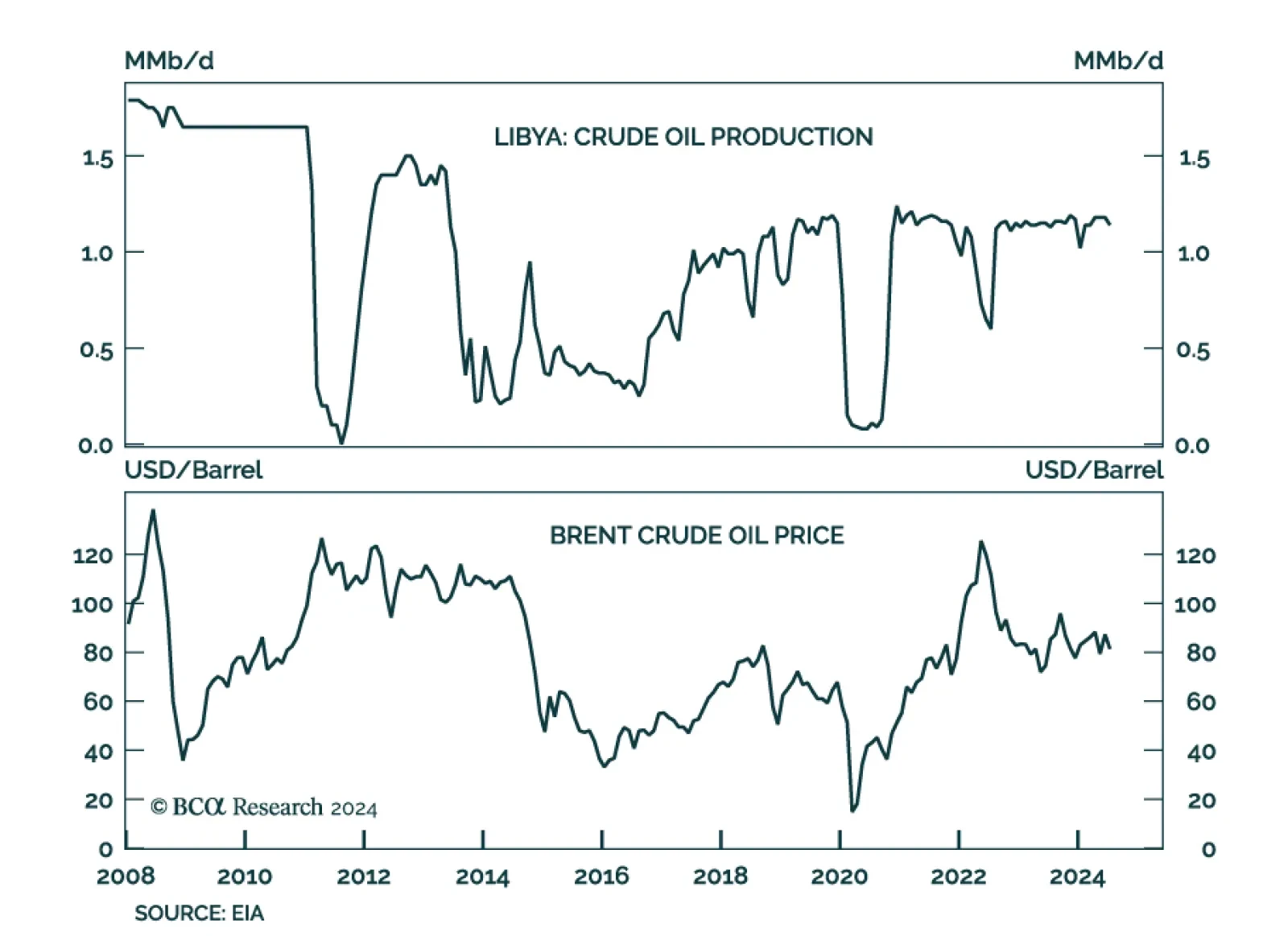

The decline in oil prices accelerated this month. Although Wednesday’s moves reversed Tuesday’s sharp daily declines, Brent and WTI have fallen 11% and 10% so far in September, and 30% and 33% from their April peaks…

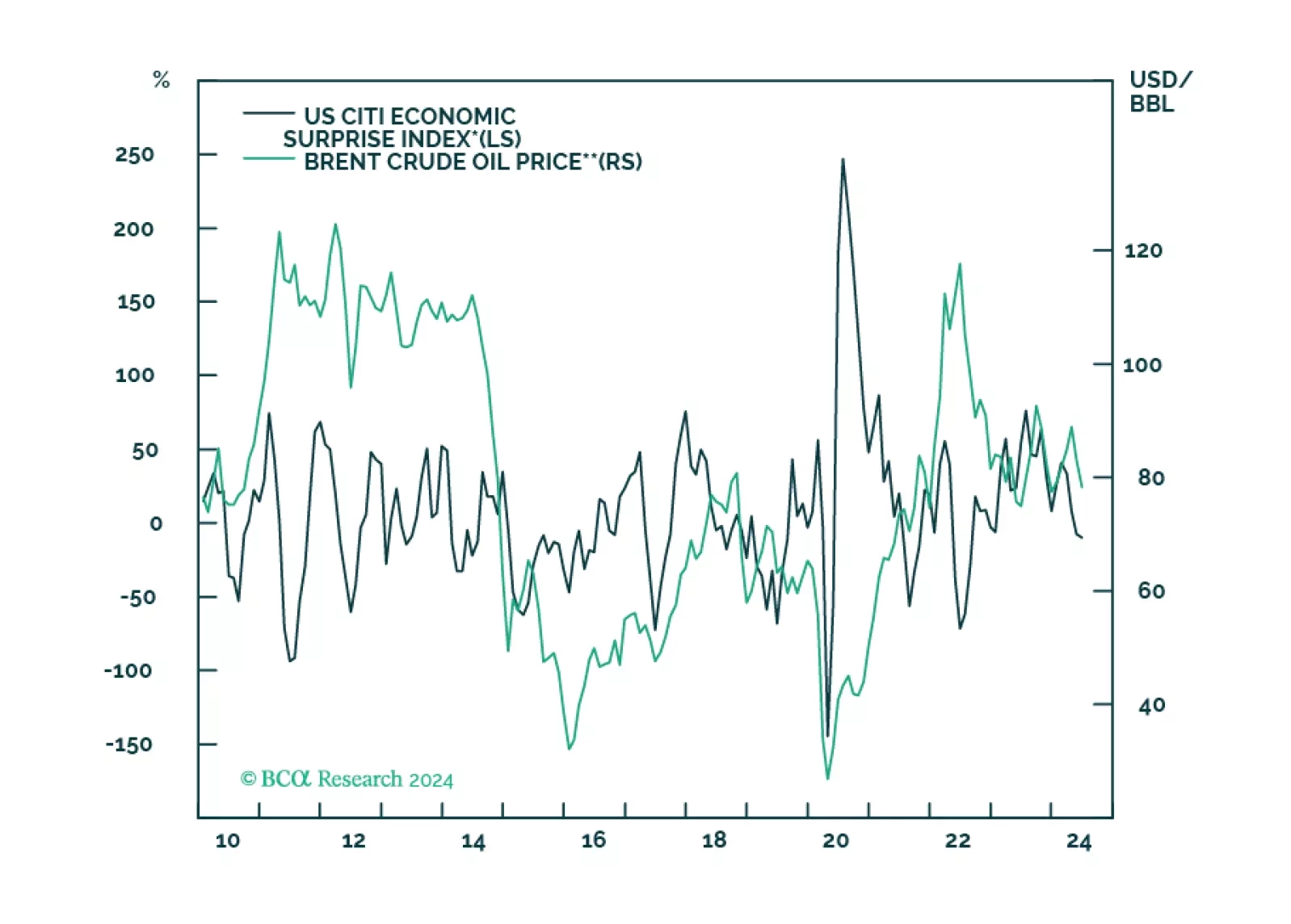

According to BCA Research’s Commodity & Energy Strategy service, oil markets are caught in a tug-of-war that has kept oil prices in a trading range since H2 2023. Bearish demand concerns are enforcing an upper limit on…

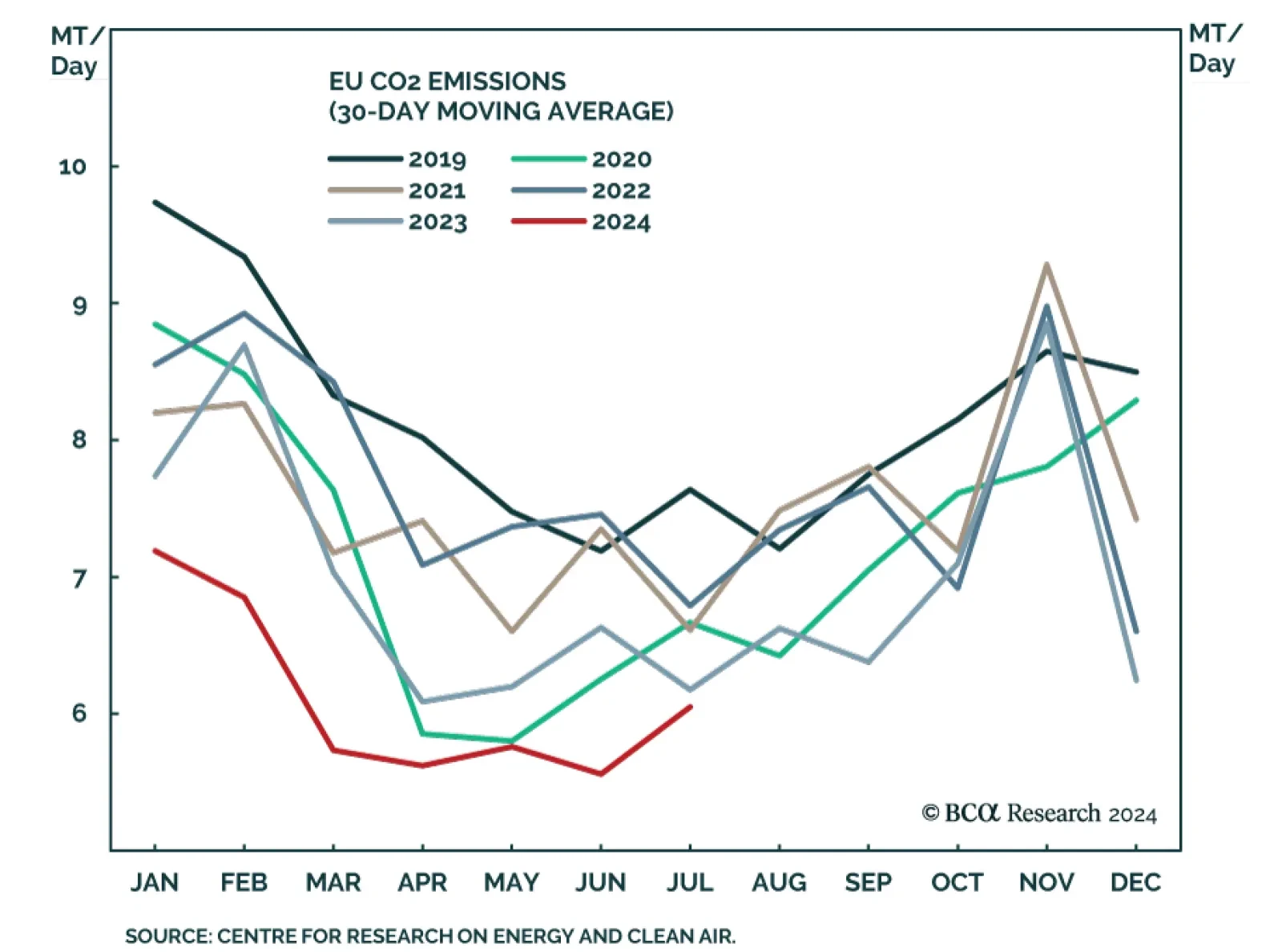

European regulatory carbon credits (EUAs) are becoming increasingly investable as an asset class. In a Special Report published last September, our Global Investment strategists agreed to the strategic bull case for EUAs, but…

We close our overweights to Energy and Aerospace & Defense. The macroeconomic backdrop is deteriorating for Energy. As for A&D, the good news is already priced in.

Highlights Alternative energy is priced to deliver spectacular long-term earnings growth, but this will be a very tough ask. While alternative energy will take a greater share of the energy pie, the pie itself is shrinking, as is its…

Highlights Higher copper prices will follow in the wake of China's surge in steel demand, which lifted Shanghai steel futures to an all-time high just under 5,200 RMB/MT earlier this month, as building and infrastructure projects…

Overweight Quarter-to-date the S&P energy services index is up 12% compared with the 2% rise in the broad market. While the steep rebound in oil prices primarily lies behind such stellar outperformance (top panel), our capex…