Highlights The current burst of inflation in developed economies is due to a (negative) supply shock rather than a (positive) demand shock. Consumer complaints of “poor buying conditions” mean that higher prices will cause…

Overweight The S&P movies & entertainment index has been on a tear recently likely due to receding fiscal uncertainty and the normalization process in the economy (third panel). This niche communication services sub-…

According to the University of Michigan, consumer confidence is softening; meanwhile, the ISM and NFIB surveys are all firing warning shots. However, we are still compelled to stick with our overweight S&P movies &…

Highlights Portfolio Strategy Despite the Fed’s supra natural powers, the deep rooted global growth slowdown will likely win the tug of war versus flush liquidity, especially if the trade war spat stays unresolved and the U.S.…

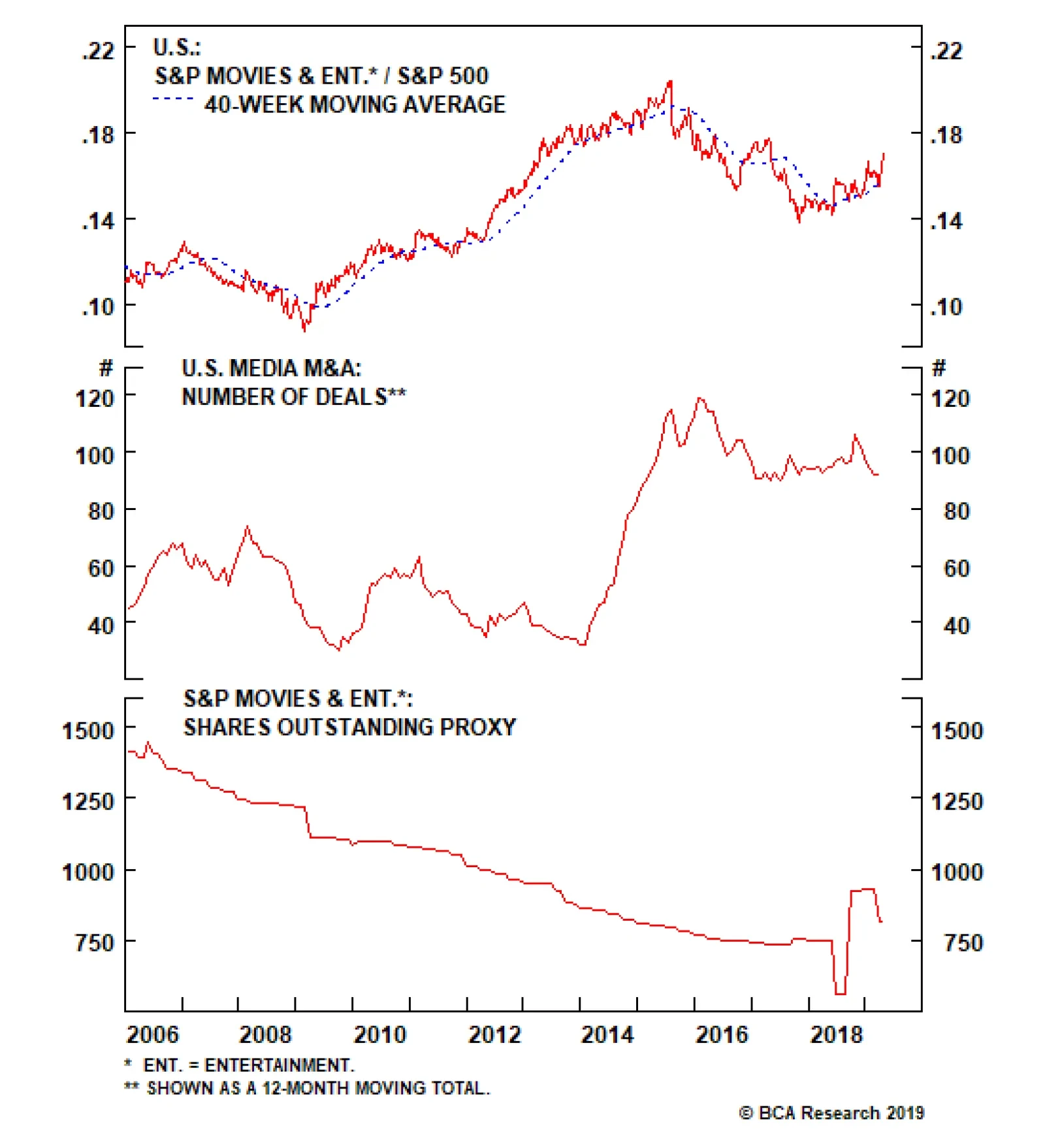

Core to our thesis is that content is king and Disney is the reigning consolidator. Notably, the company’s Avengers property, acquired via the $4 billion acquisition of Marvel a decade ago, just set the record for box…

Overweight Last week we highlighted a number of reasons why the S&P movies & entertainment index had turned a corner, underscoring our upgrade to overweight.1 Core to our thesis is that content is king and Disney is…

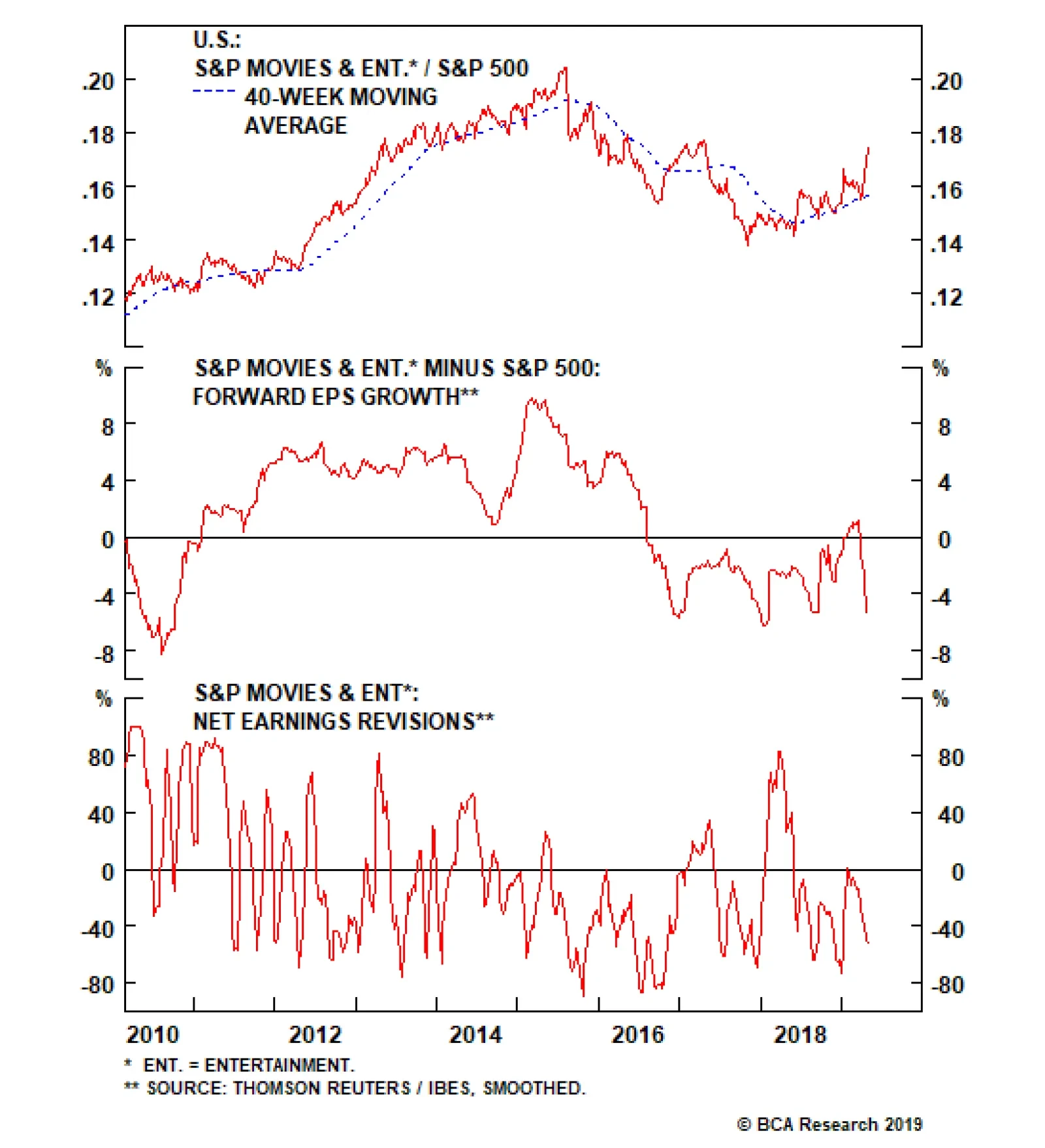

Factors have fallen into place to boost the recently rejigged S&P movies & entertainment index to an above benchmark allocation today. While the index’s 12-month forward EPS took a hit with the NFLX addition in…

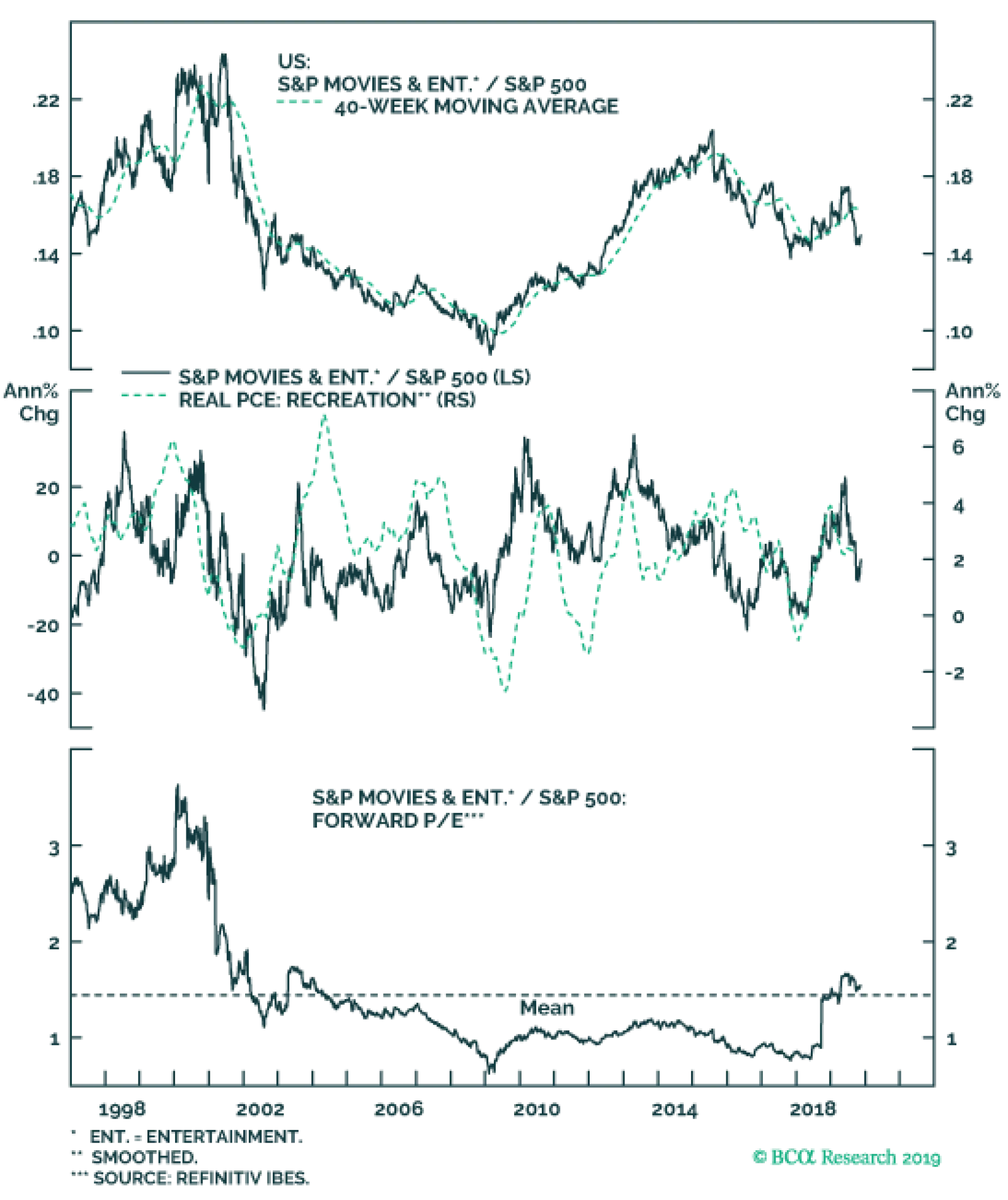

Overweight A number of macro factors have fallen into place that have warmed us to the S&P movies & entertainment index. Consumer confidence remains glued to multi-decade highs and there are high odds that the big…

Highlights Portfolio Strategy Disney’s recent streaming pricing disclosure and a favorable macro backdrop for recreation PCE argue that more gains are in store for the S&P movies & entertainment index. The price of credit…