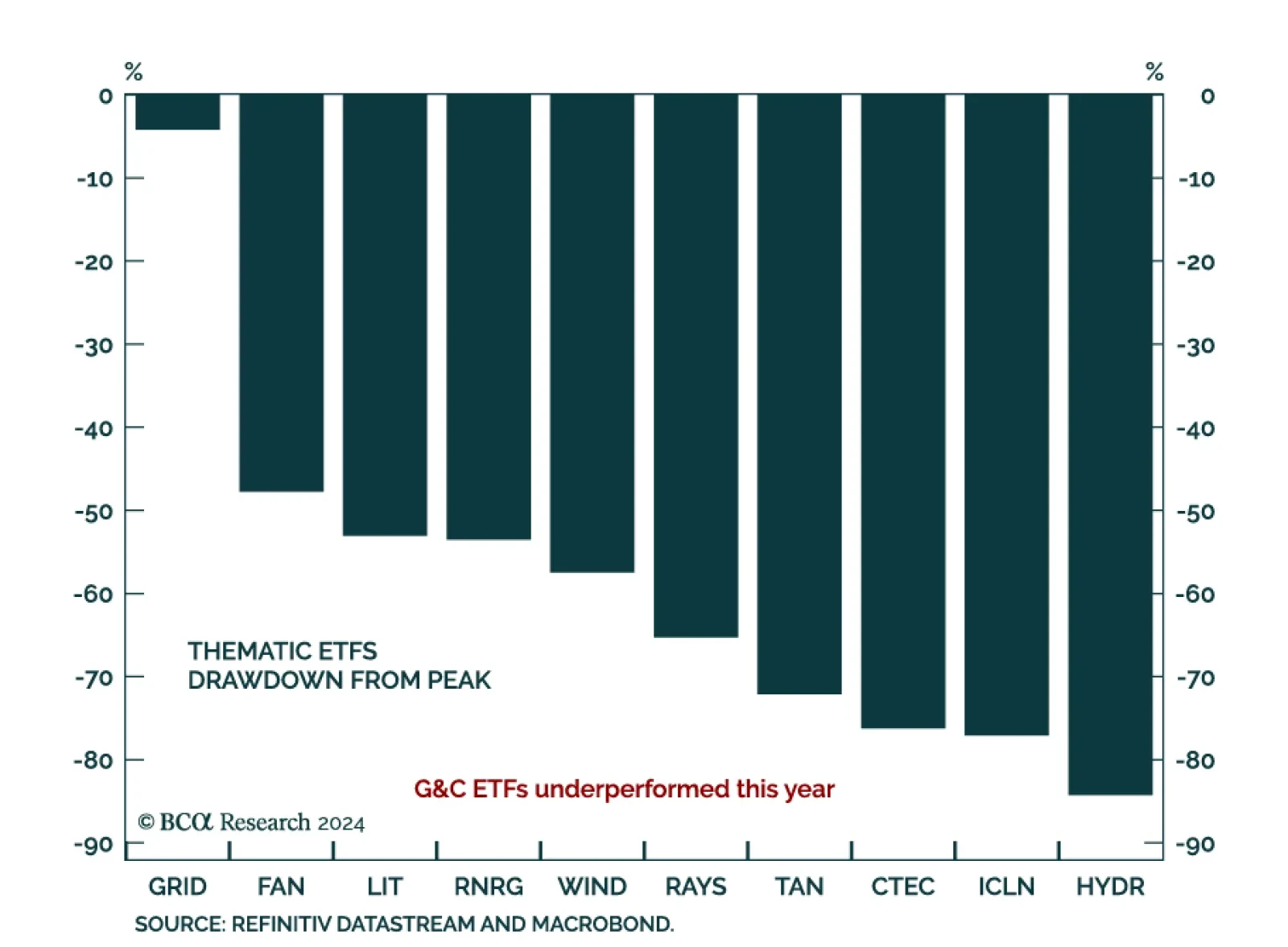

Our US Equity strategists investigated the underperformance of the Green and Clean (G&C) investment theme, in the context of an incoming US administration expected to be less friendly towards green initiatives. The G…

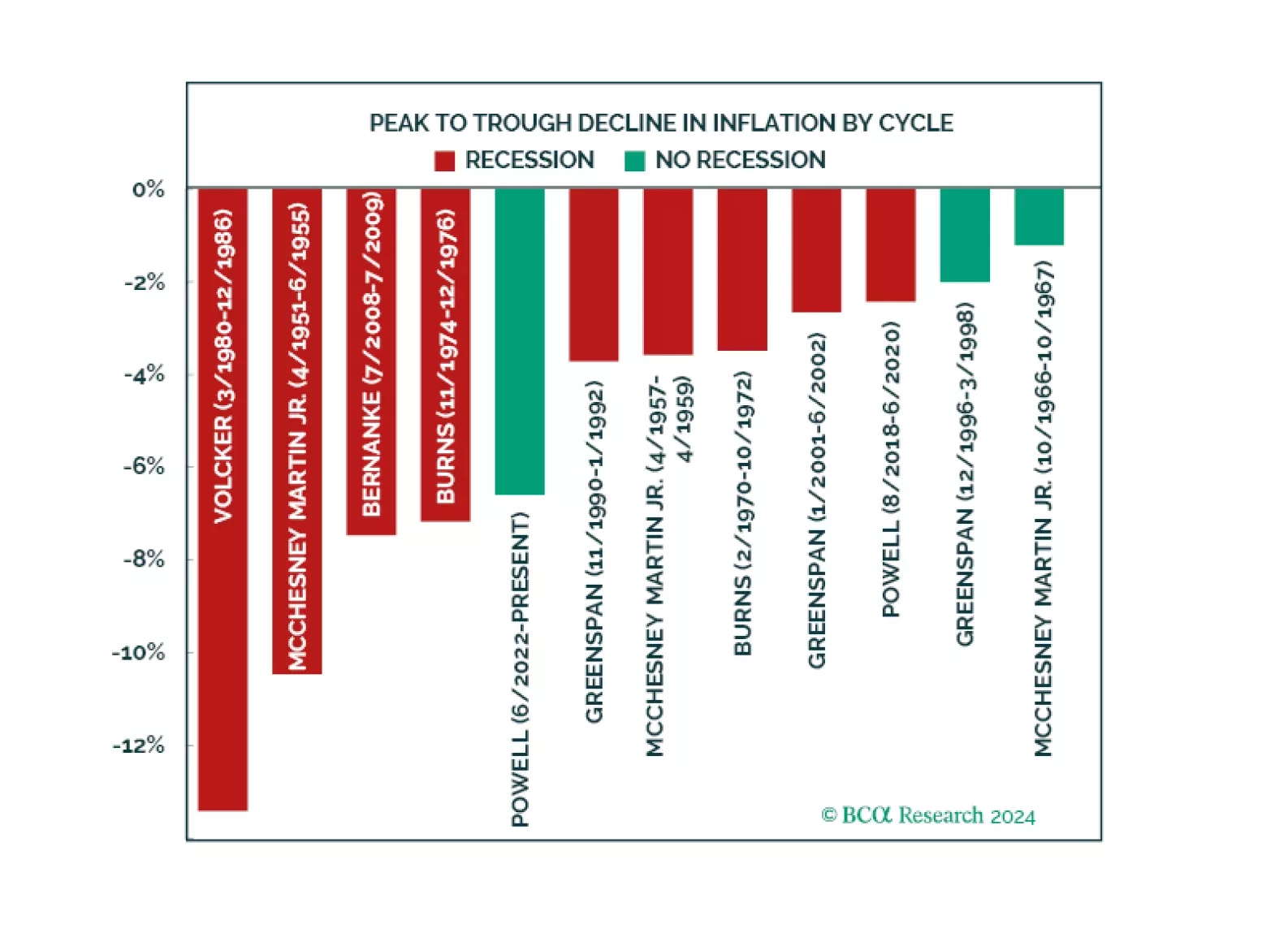

Can Powell achieve a soft landing? There are some indications he is doing it. We examine why our negative stance was wrong and analyze the four growth engines that kept recession at bay. Half of these forces remain while the other…

The global political system is destabilizing and the US will turn more hawkish in foreign policy, trade policy, or both, regardless of the election outcome. Tactically go long the dollar.

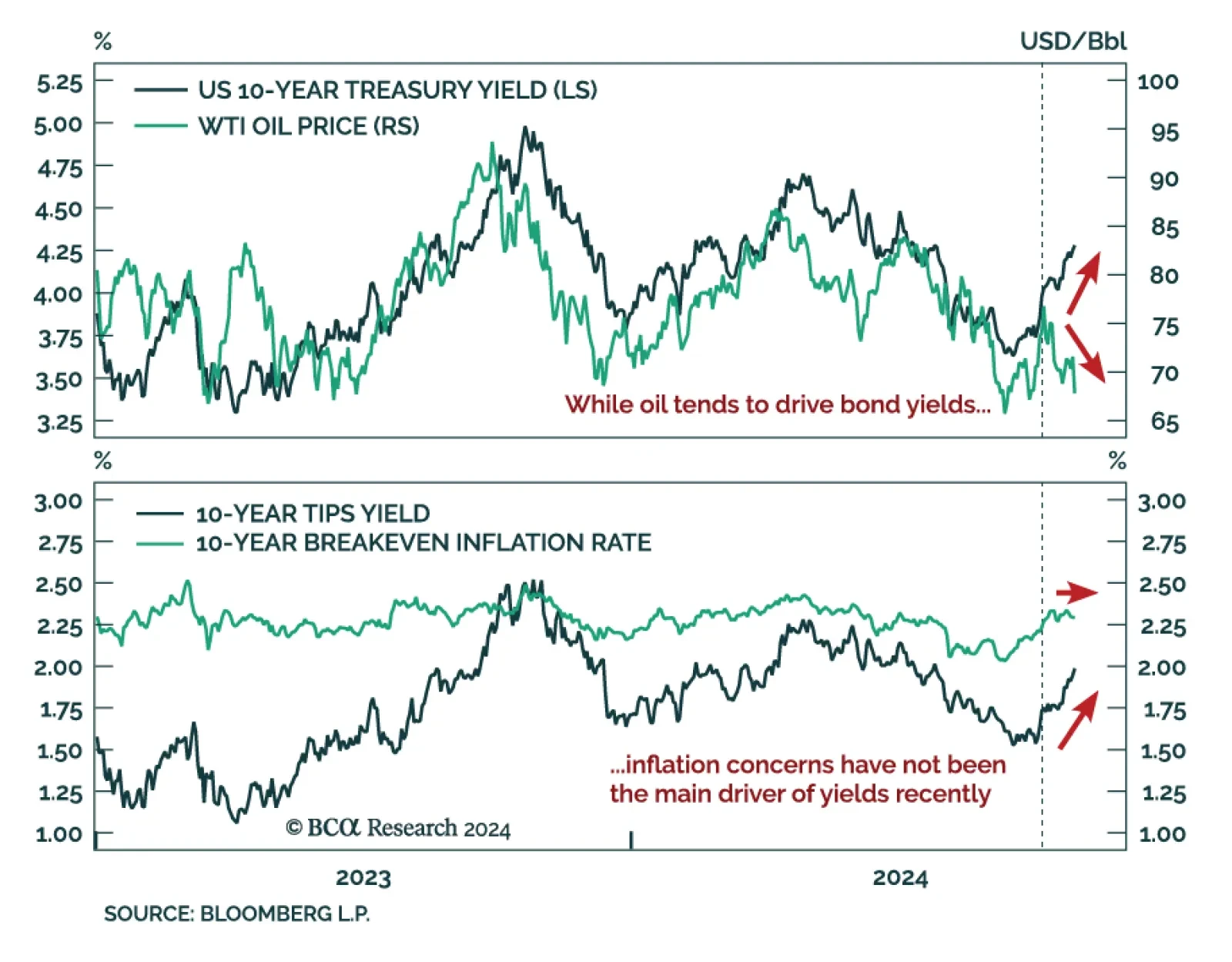

For the past two weeks, oil has sold off amid a global spike in yields. Oil prices and Treasury yields tend to be positively correlated, as oil prices are a fast-moving component of inflation, driving the inflation expectations…

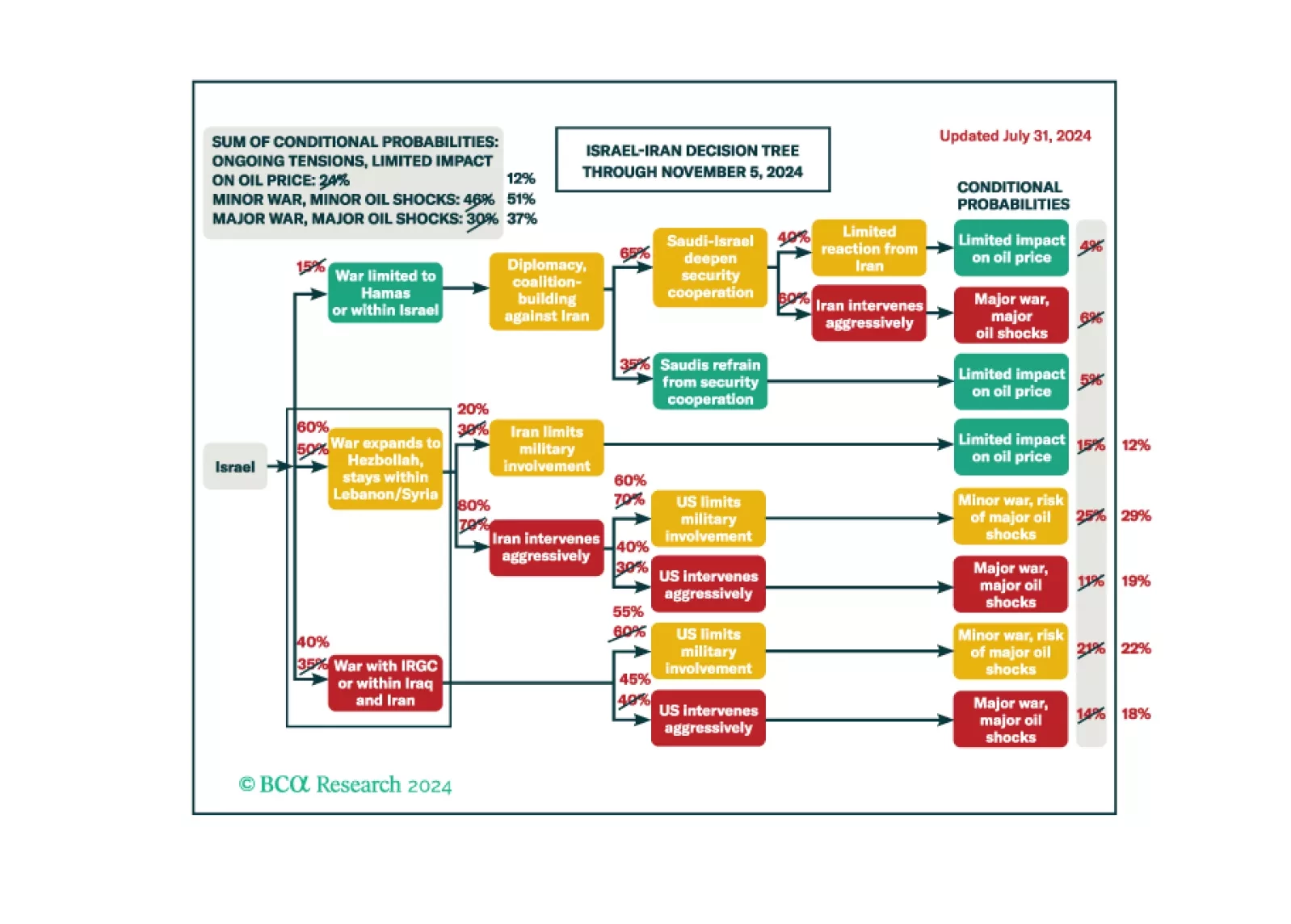

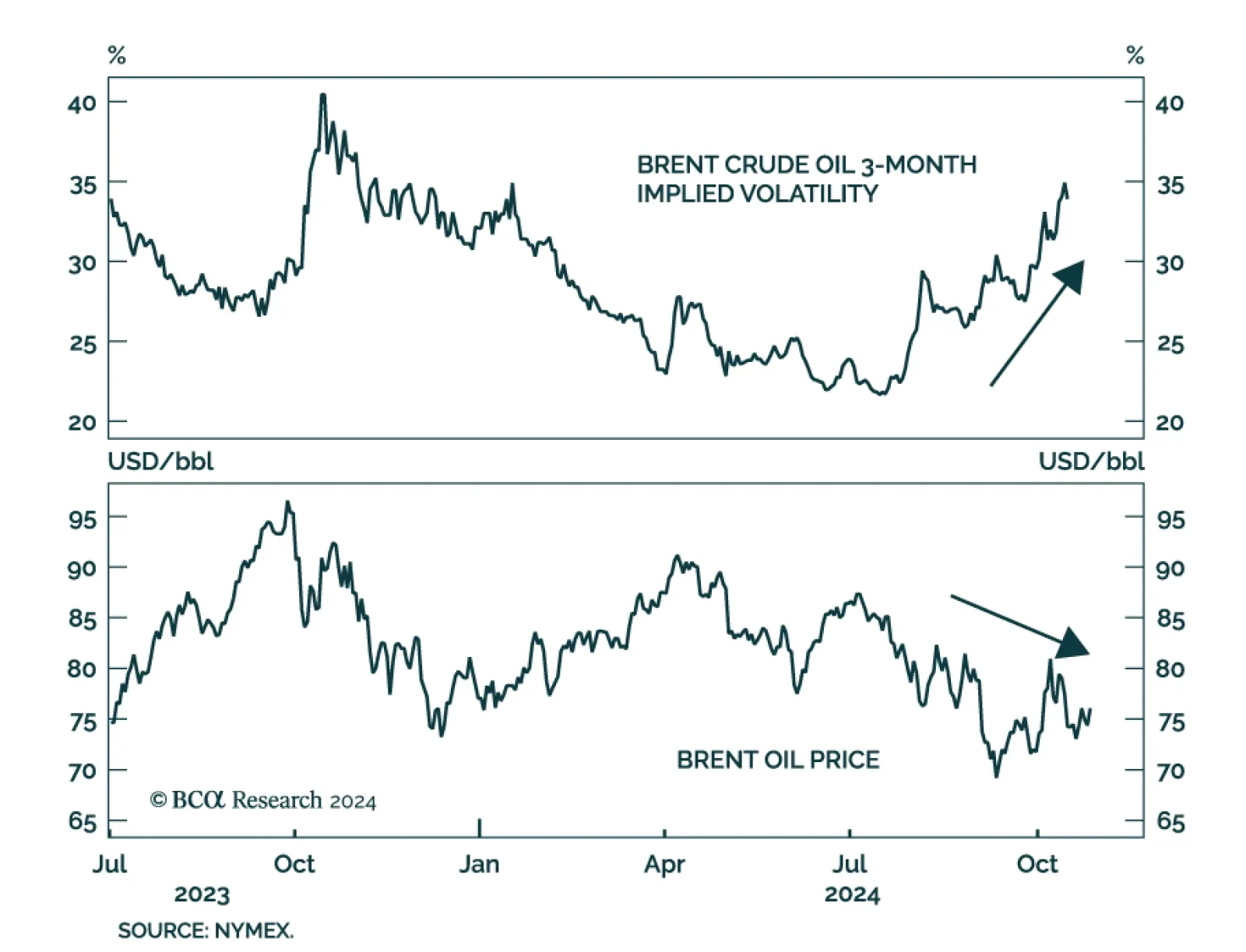

In a trendless yet volatile year for oil, Israel’s retaliatory attack on Iran this weekend is a reminder the outlook is fraught with geopolitical risks. Risks are usually expressed as a geopolitical price premium, but this…

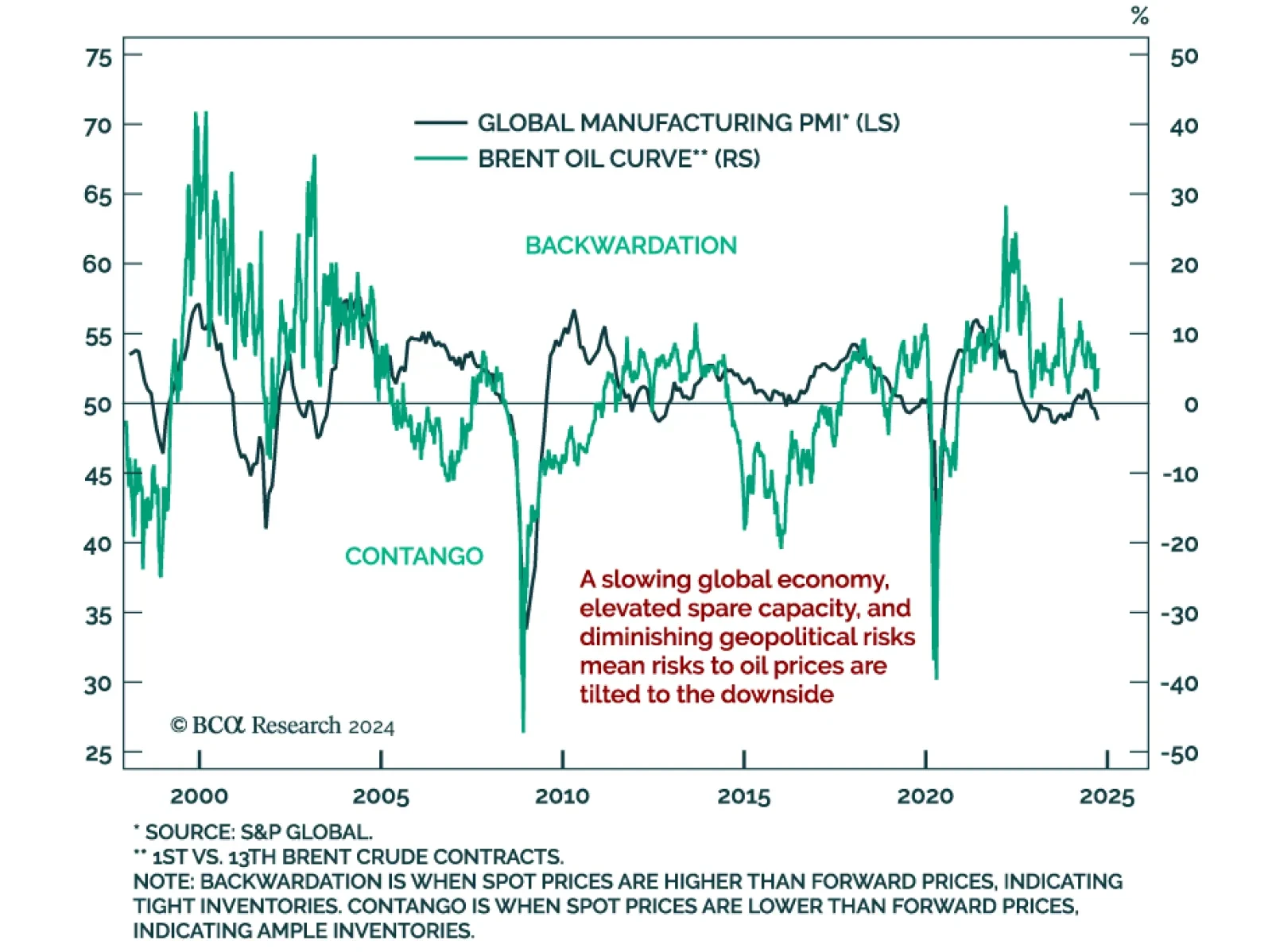

Crude prices have been trendless but volatile in 2024. Oil’s choppy price action illustrates the demand and supply tug-o-war in the market. Our bias is for crude prices to weaken on a six-to-nine months horizon. Good…

We maintain 37% odds of a major recessionary oil shock, 51% odds of minor shocks, and 12% odds of no shocks.

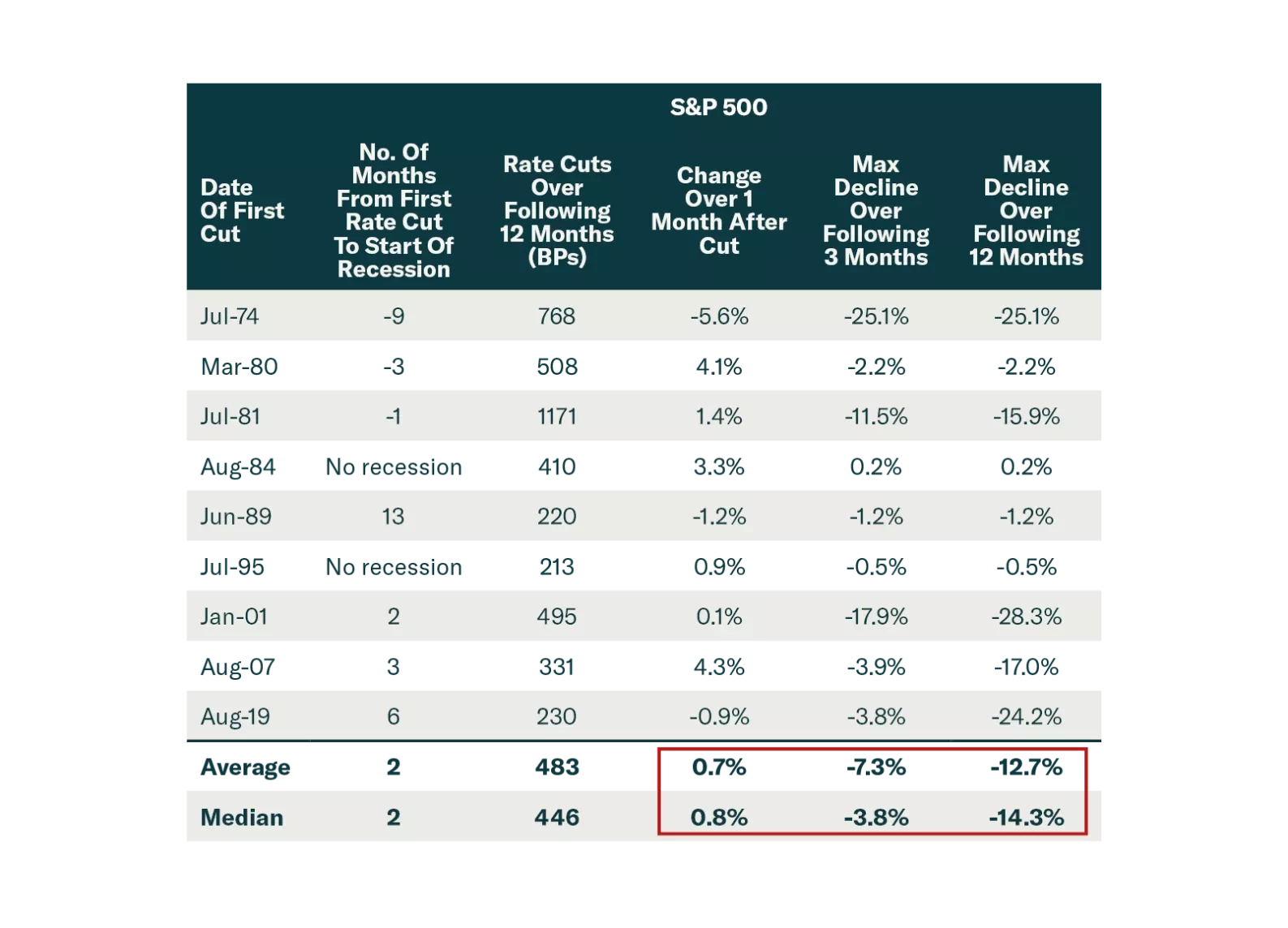

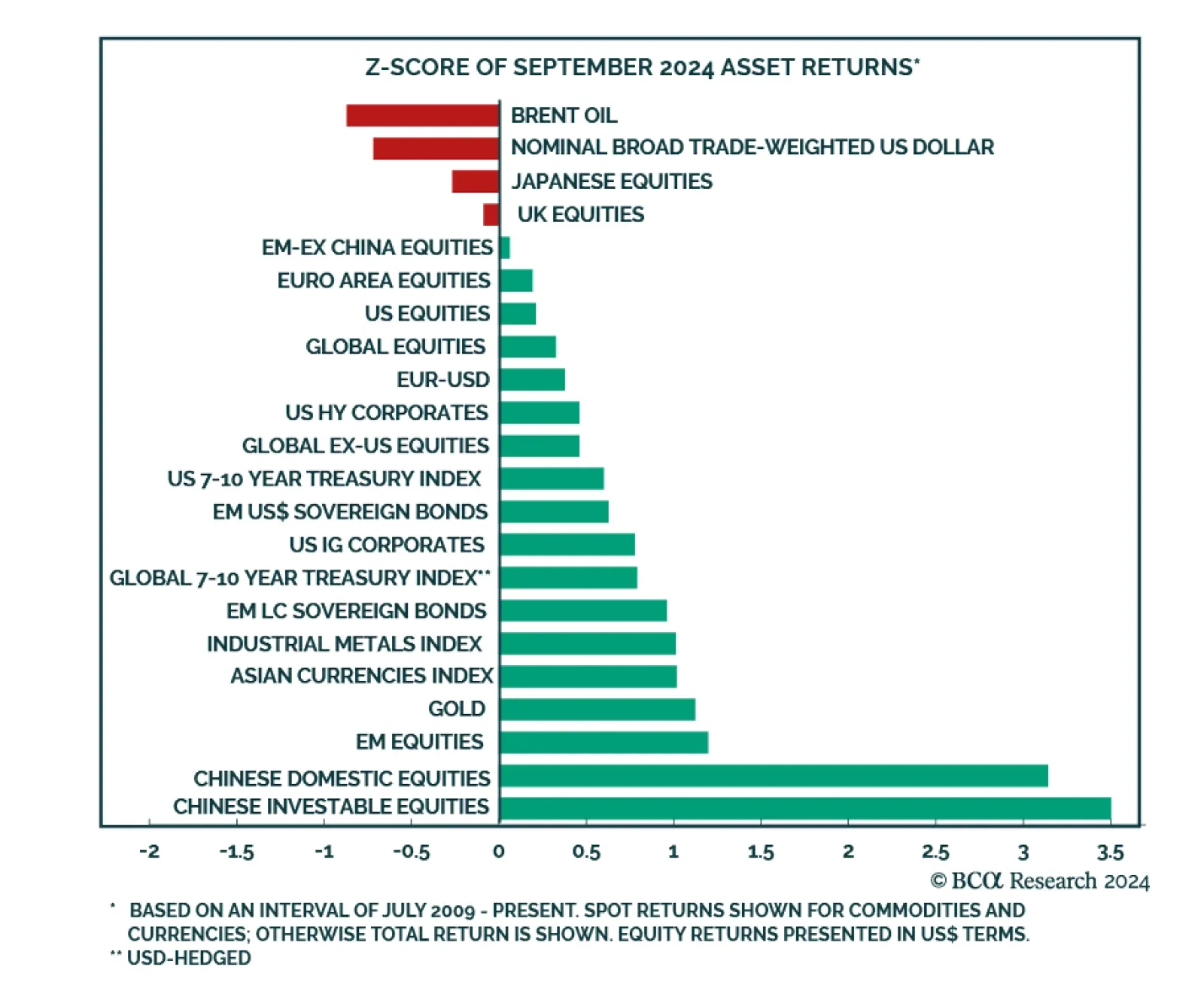

The Fed embarked on a new easing cycle with a bang and China delivered its largest stimulus since 2015, leading to a strengthening in the risk-on soft-landing narrative in September. Chinese and EM equities led the pack. We…

The market got excited by the 50 bps Fed cut and China stimulus. But these are a recognition that economies are slowing significantly. Stocks often rally after the first Fed cut, before falling sharply. Investors should stay…