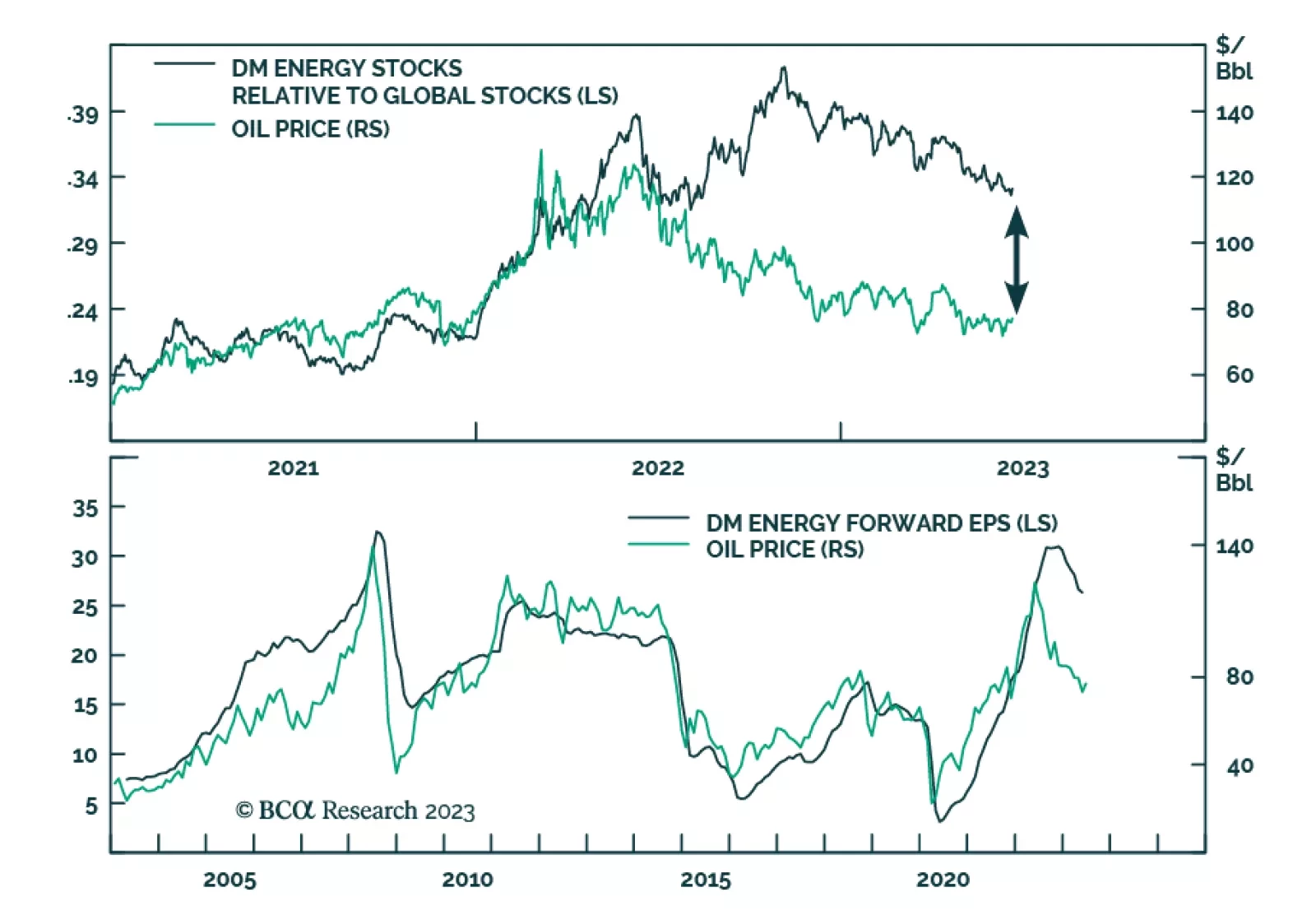

Oil Prices have gone through a dramatic boom bust cycle over the past 18 months. After rising almost 80% in the first quarter of 2022 following the war in Ukraine, Brent has fallen all the way back towards $70/bbl – where…

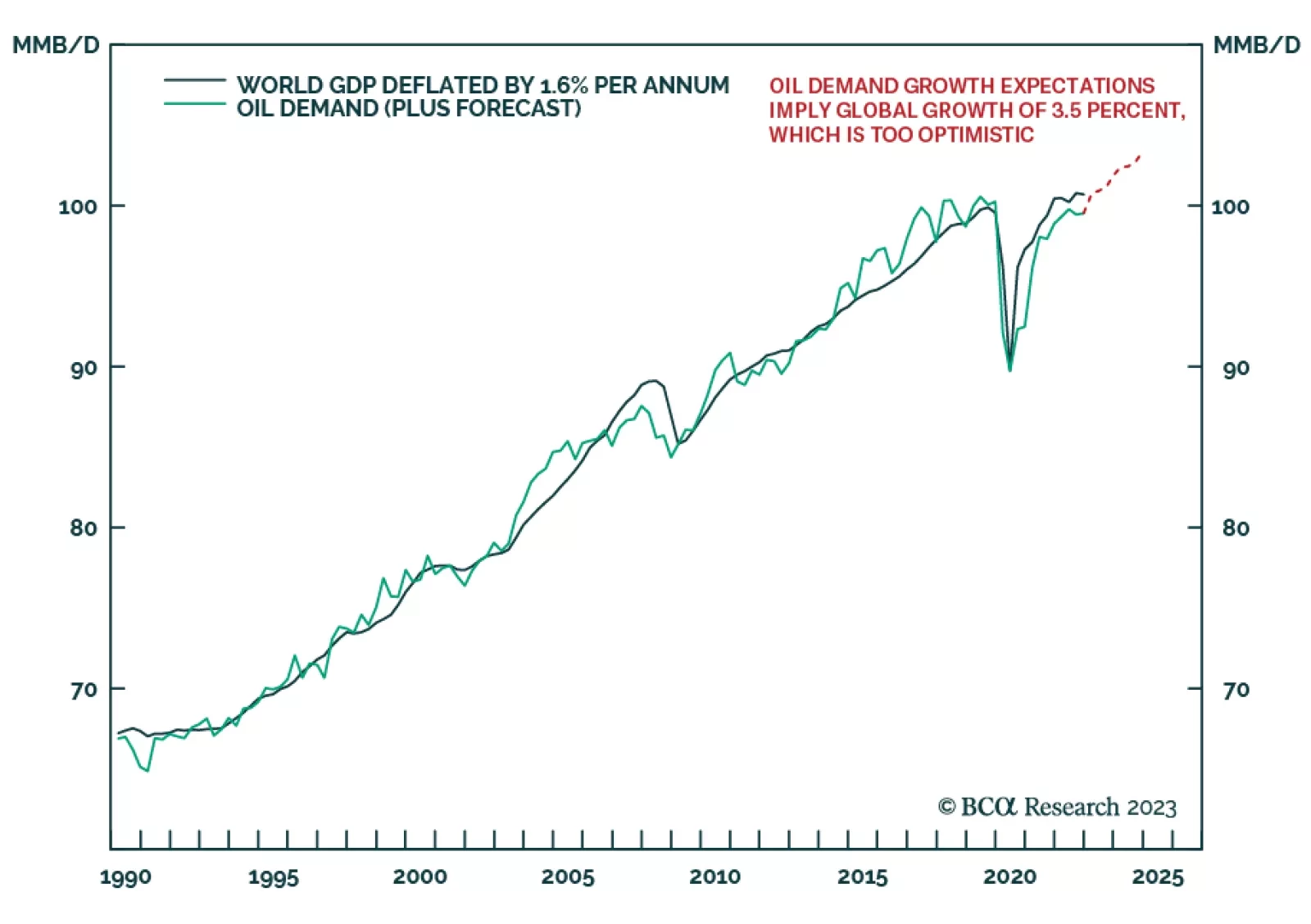

Our Counterpoint strategists believe that that the oil price has further downside, likely to a cycle low of $55 – because expectations for oil demand growth through 2023-24 are much too optimistic. Oil demand tracks…

The normalization of oil storage markets in the Northern Hemisphere; strong demand, aided by China stimulus this year; and continued production discipline supports our view Brent prices likely have bottomed, and will move higher from…

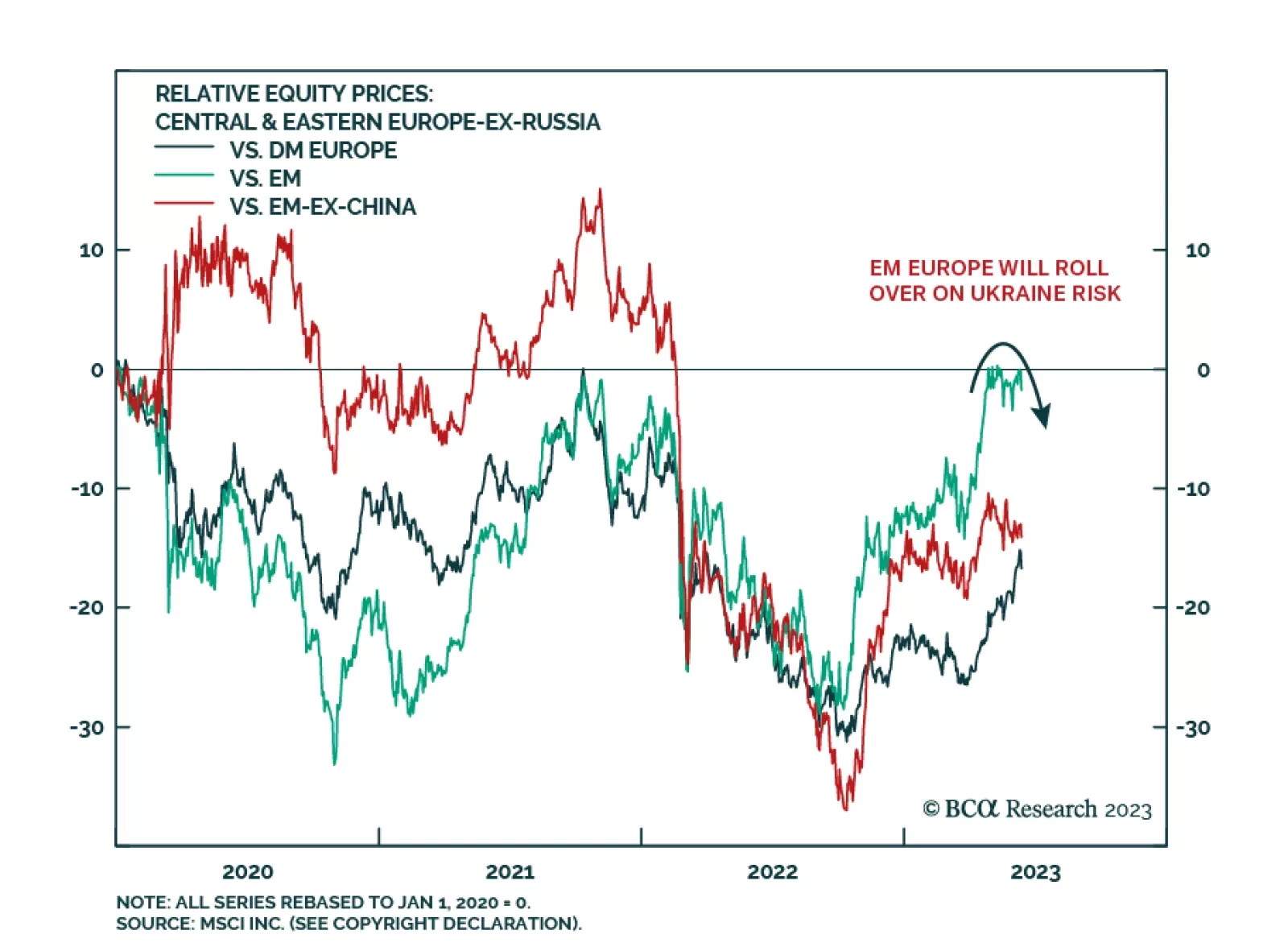

According to BCA Research’s Geopolitical Strategy service, geopolitical risk will rise before the Ukraine war is resolved, punishing eastern European emerging market assets on a relative basis. Ukraine’s…

Oil and metals reacted positively to the PBOC's 10 bp cut in the seven-day reverse repo rate, which will be part of the larger monetary and fiscal support needed to revive the economy. While deposit rates at state-owned banks have…

In response to the first-ever federal indictment of a former President, investors should focus on the state of the economy and not on Trump’s legal trouble. They should also use the current market rally to stock up on protection, as…

What’s going on? The market-weighted stock market is up. But the equally-weighted stock market is not up. Neither is credit. Neither are industrial metal prices. Neither is the oil price, despite two waves of OPEC output cuts. We…

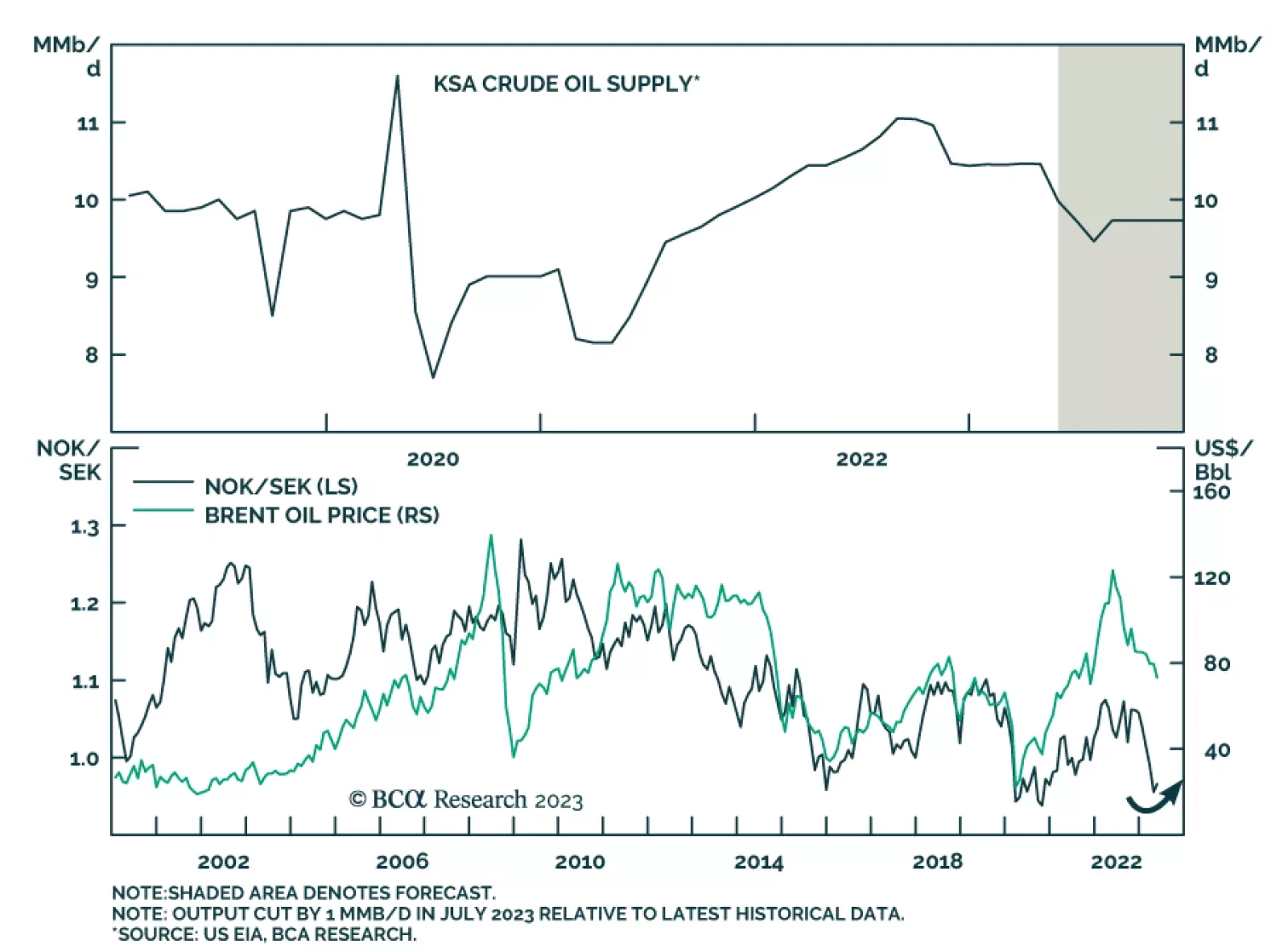

The price of Brent opened higher on Monday following news that the Kingdom of Saudi Arabia (KSA) will reduce output by an additional 1 million barrels per day in July – with an option for extensions. In addition, the OPEC 2…

Following this weekend’s OPEC 2.0 meeting, KSA announced a 1mm b/d crude output cut, slated for this July or August, as it attempts to support weak oil prices. The new output quotas, reduced to reflect members’ weak crude oil…