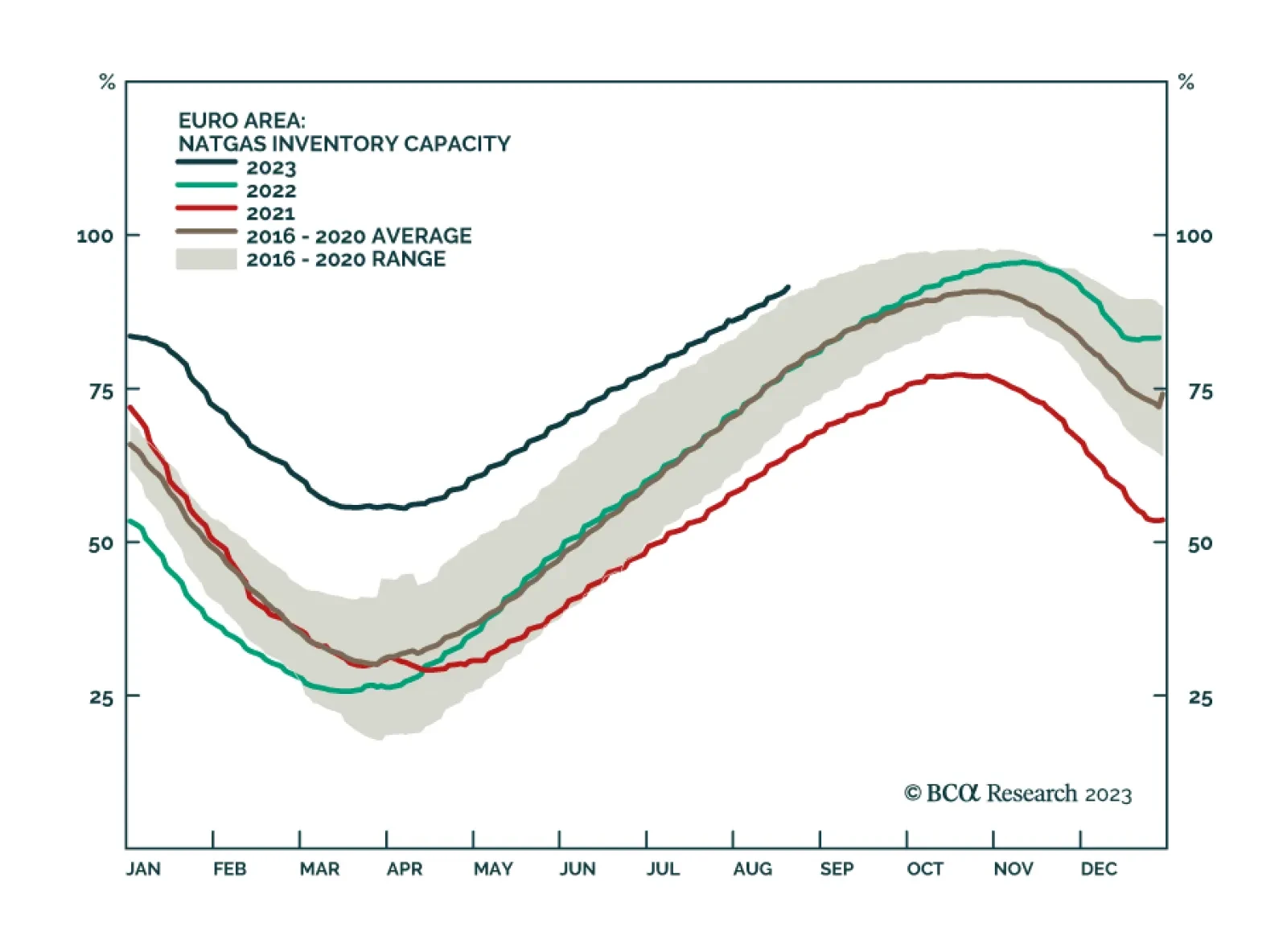

European natural gas prices have recently been trending higher with the Dutch TTF gaining 66% since late July. The proximate cause of the rally is supply concerns. The risk of strikes at Australian LNG plants are a threat to the…

2023 is shaping up as a record-breaking year for global oil demand, according to our colleagues BCA's Commodity & Energy Strategy (CES). By year end, they expect the world will be consuming a record 103.5mm b/d, an…

We continue to expect China to deploy stronger fiscal and monetary stimulus to avoid prolonged deflation brought about by a liquidity trap and sub-zero growth. All the same, a lower-growth risk has been added to our ensemble forecast…

The global economy will not enjoy an “immaculate disinflation” but will suffer a very maculate one due to China’s growth slowdown and restrictive monetary policy in the developed world. Investors should stay overweight low-beta…

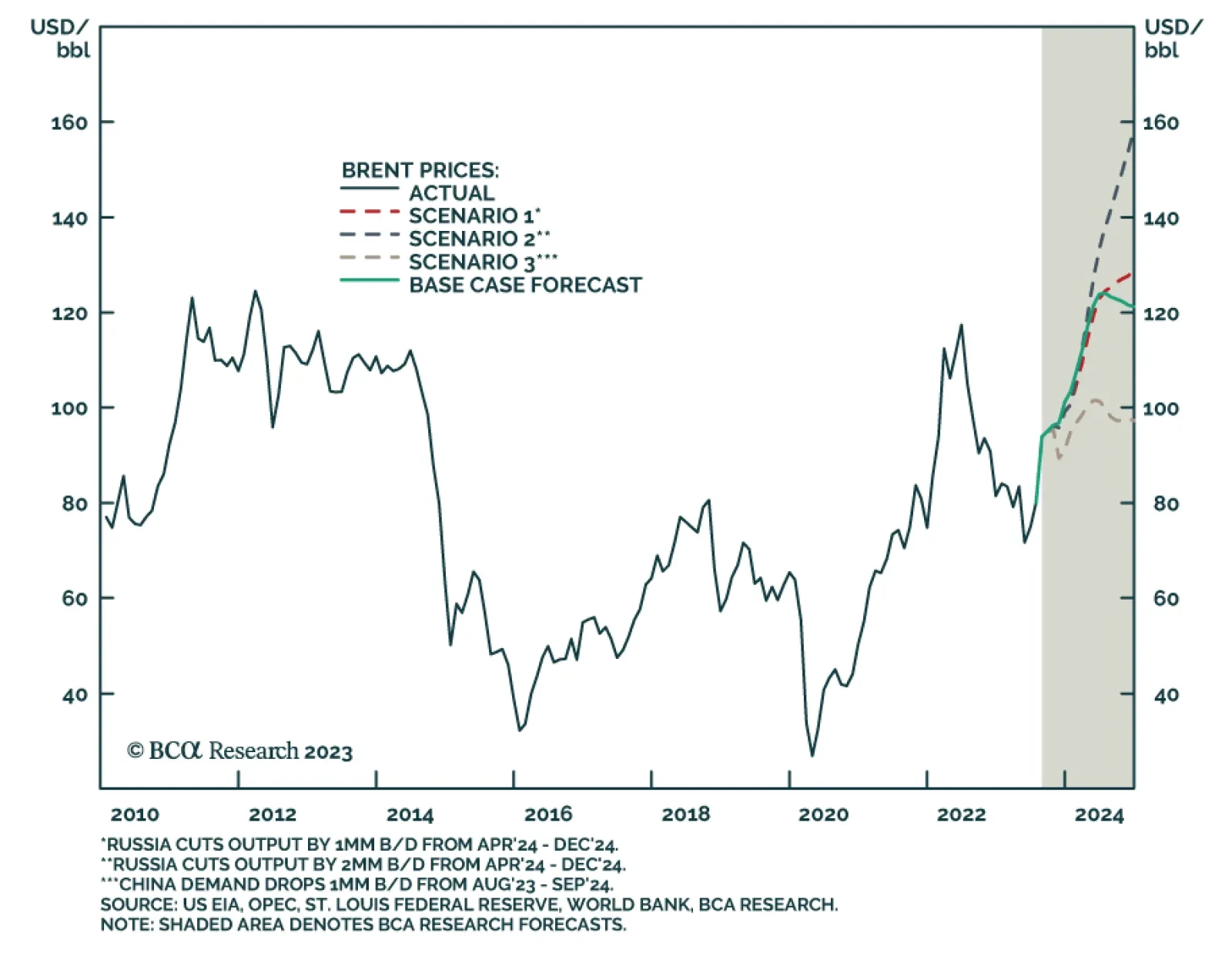

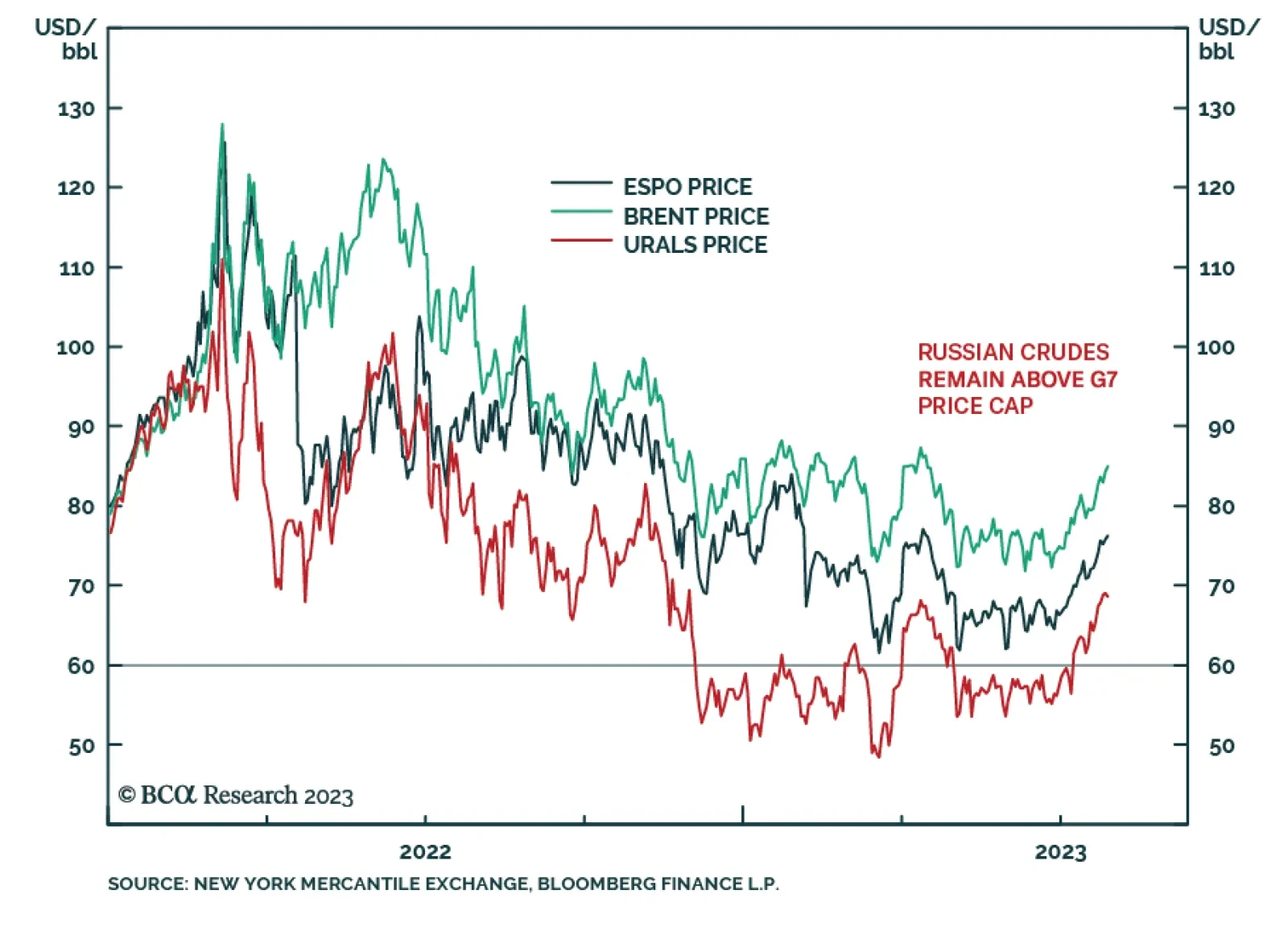

According to BCA Research’s Commodity & Energy Strategy and Geopolitical Strategy services, Russia is likely to cut oil production to pressure the West as a part of its war effort. This cut would push oil prices to…

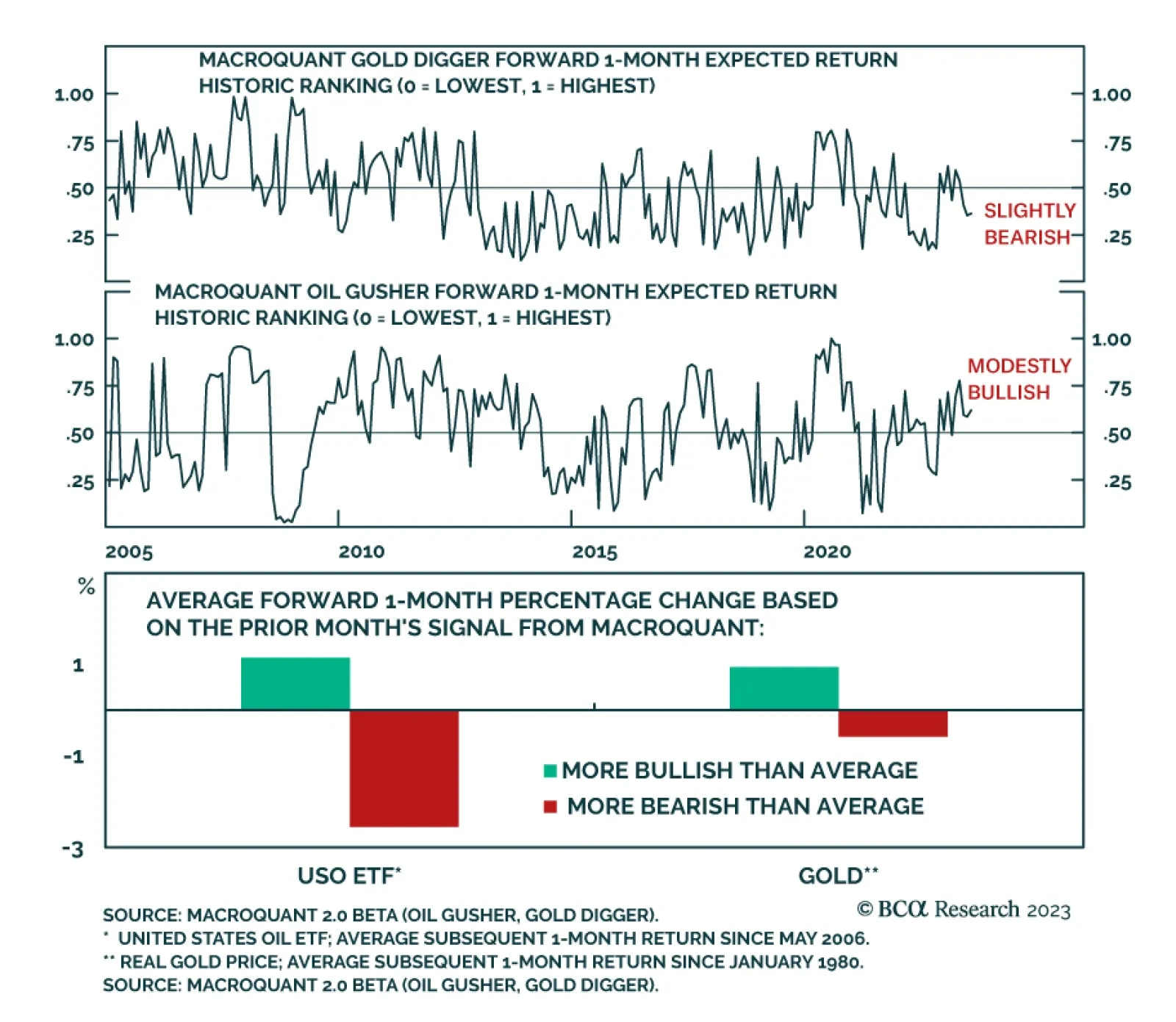

The Global Investment Strategy (GIS) service has been bearish on gold since the end of March, when it recommended a shift from neutral to underweight. Real gold prices are still quite elevated relative to their long-term history…

Both EV and Green Energy themes still hold strategic promise for investors, posing large upside, despite prevailing macro headwinds. While both themes have yet to claw back their pandemic peaks, a broadening of the rally supports a…

BCA Research’s Commodity & Energy Strategy service concludes that strong EM demand coupled with OPEC+’s production cuts will help boost oil prices in the coming months. EM oil demand growth continues to power…