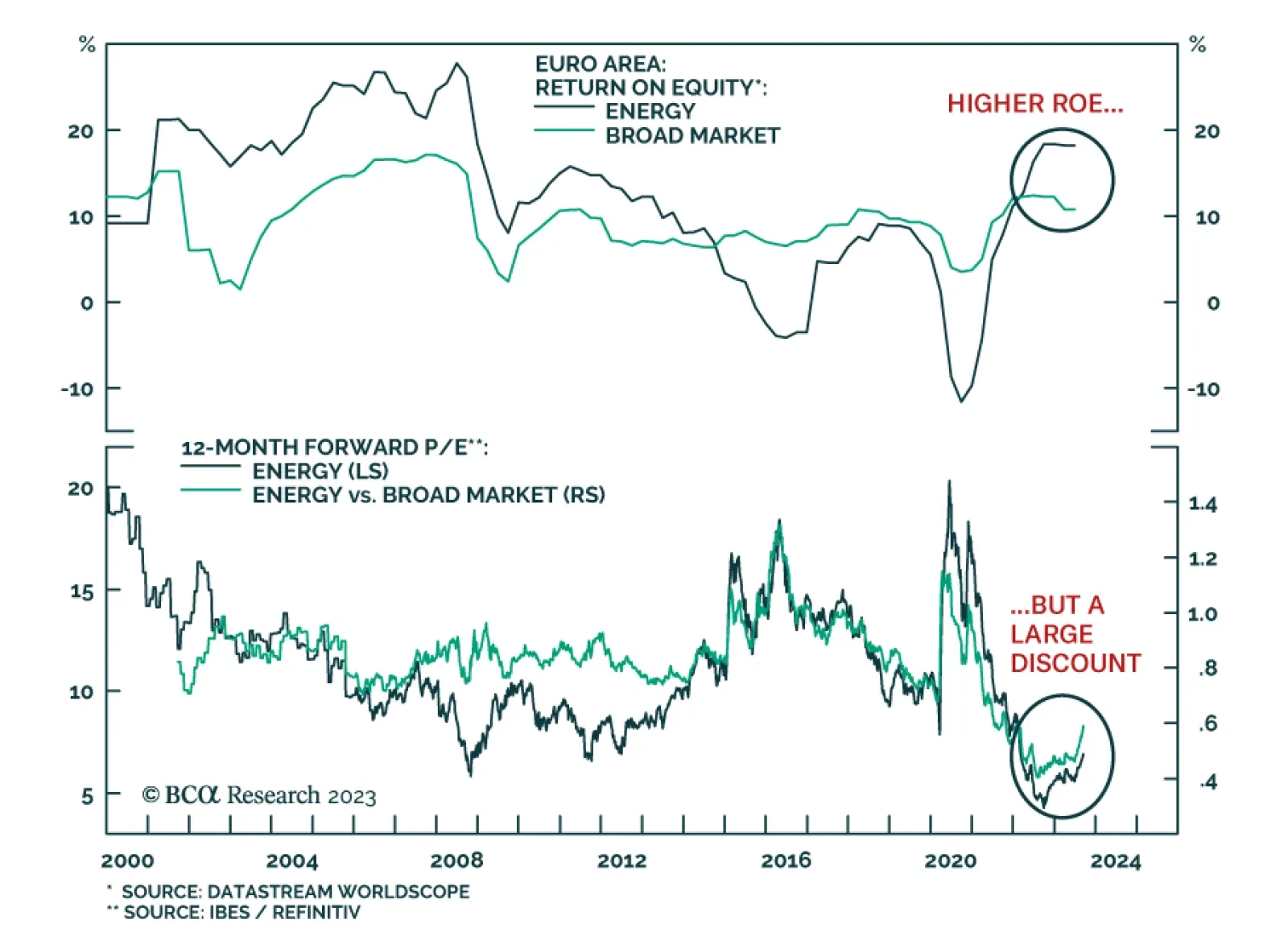

According to BCA Research’s European Investment Strategy service, energy stocks are an appealing overweight as a hedge against oil supply cuts. For now, the earnings of the energy sector continue to lag that of the broad…

European stocks and the euro continue to weaken; soon, they will test the bottom of their recent trading range. Which sectors can protect investors against this downdraft?

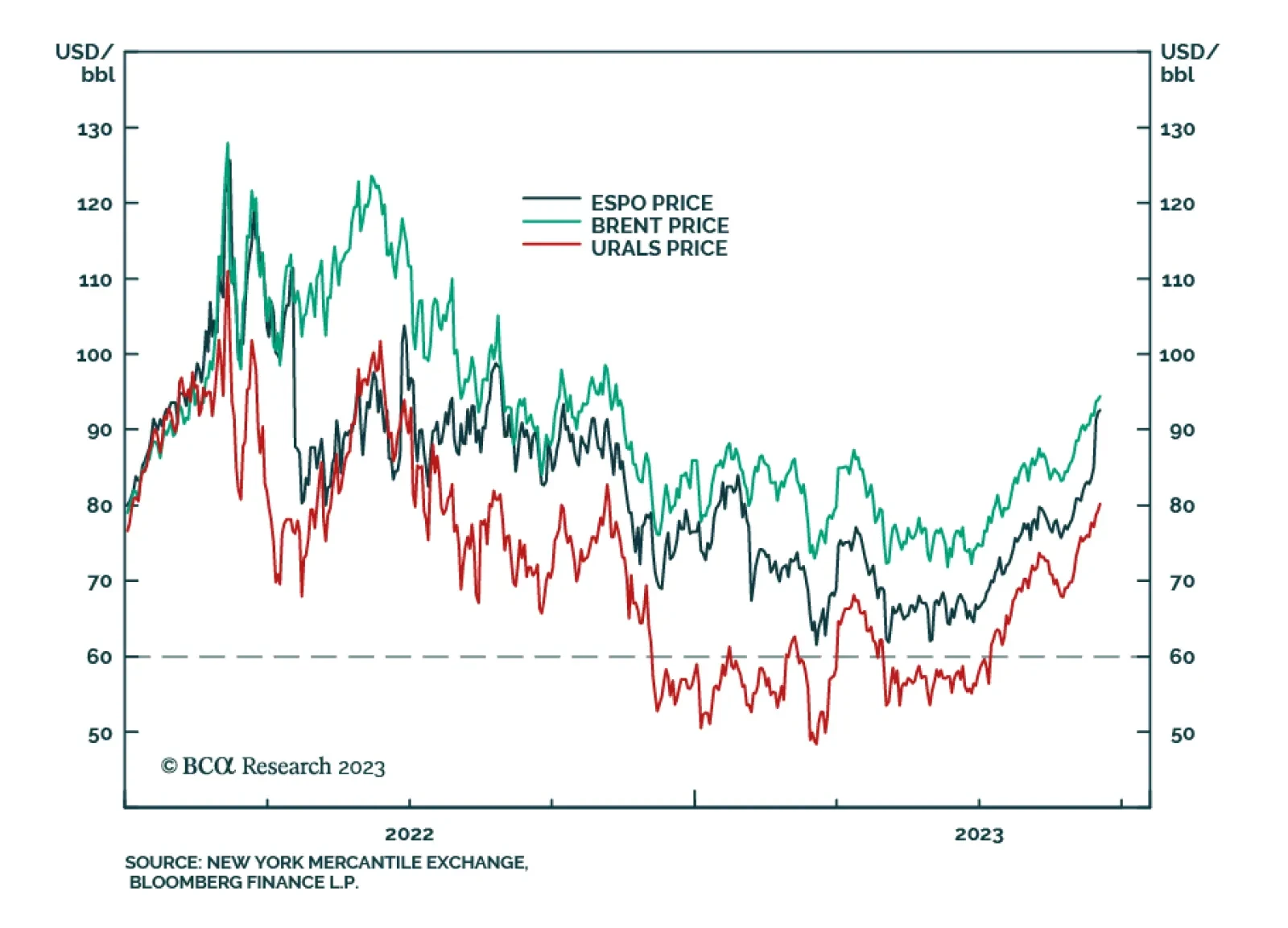

Our Commodity & Energy Strategy colleagues’ once-out-of-consensus call on crude oil prices – i.e., benchmark Brent prices averaging $94/bbl in 2H23 and trading above $100/bbl by December – now is the…

We continue to expect Brent crude to trade just above $101/bbl in 4Q23, and to average $118/bbl in 2024. Higher volatility looms. We expect Russia will cut oil production next year as part of a concerted effort to undermine Biden’s…

The biggest misunderstanding in the markets right now is that to keep expected inflation well-anchored at 2 percent, inflation must undershoot 2 percent for some time. This implies that interest rate futures curves are mispriced, and…

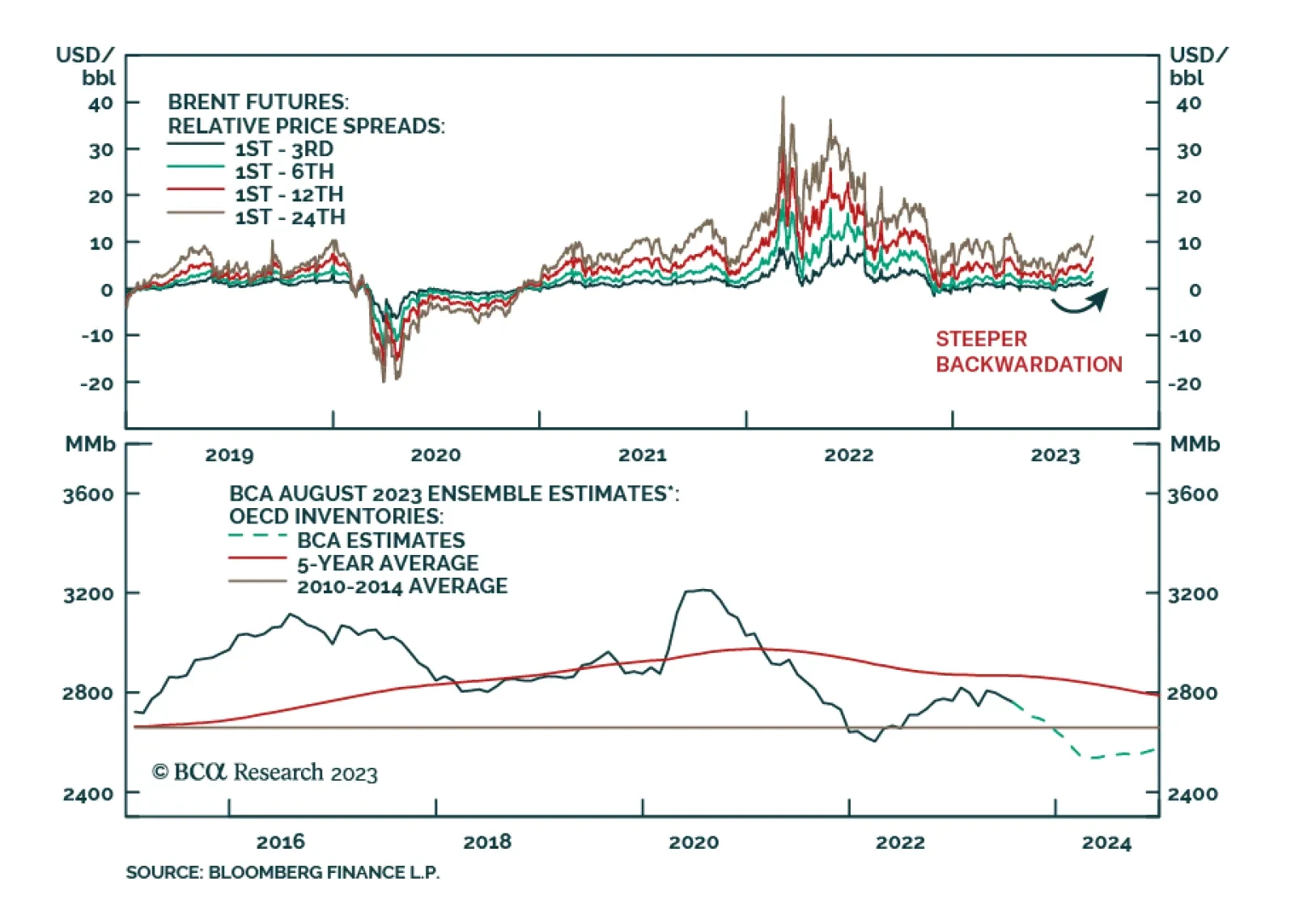

China’s reopening faltered and now it is applying moderate stimulus. OPEC 2.0’s production discipline is getting results, with oil prices climbing. The Fed will not be able to deliver dovish surprises in Q4 2023. Investors should…

Brent crude closed above $90/bbl on Tuesday for the first time since November. The rally comes after key OPEC+ members extended production curbs until the end of the year. Saudi Arabia reported that its 1mm b/d of output cuts…

The geopolitical backdrop remains negative despite some marginally less negative news. China’s stimulus is not yet large or fast enough to prevent a market riot. Two of our preferred equity regions, ASEAN and Europe, are struggling…