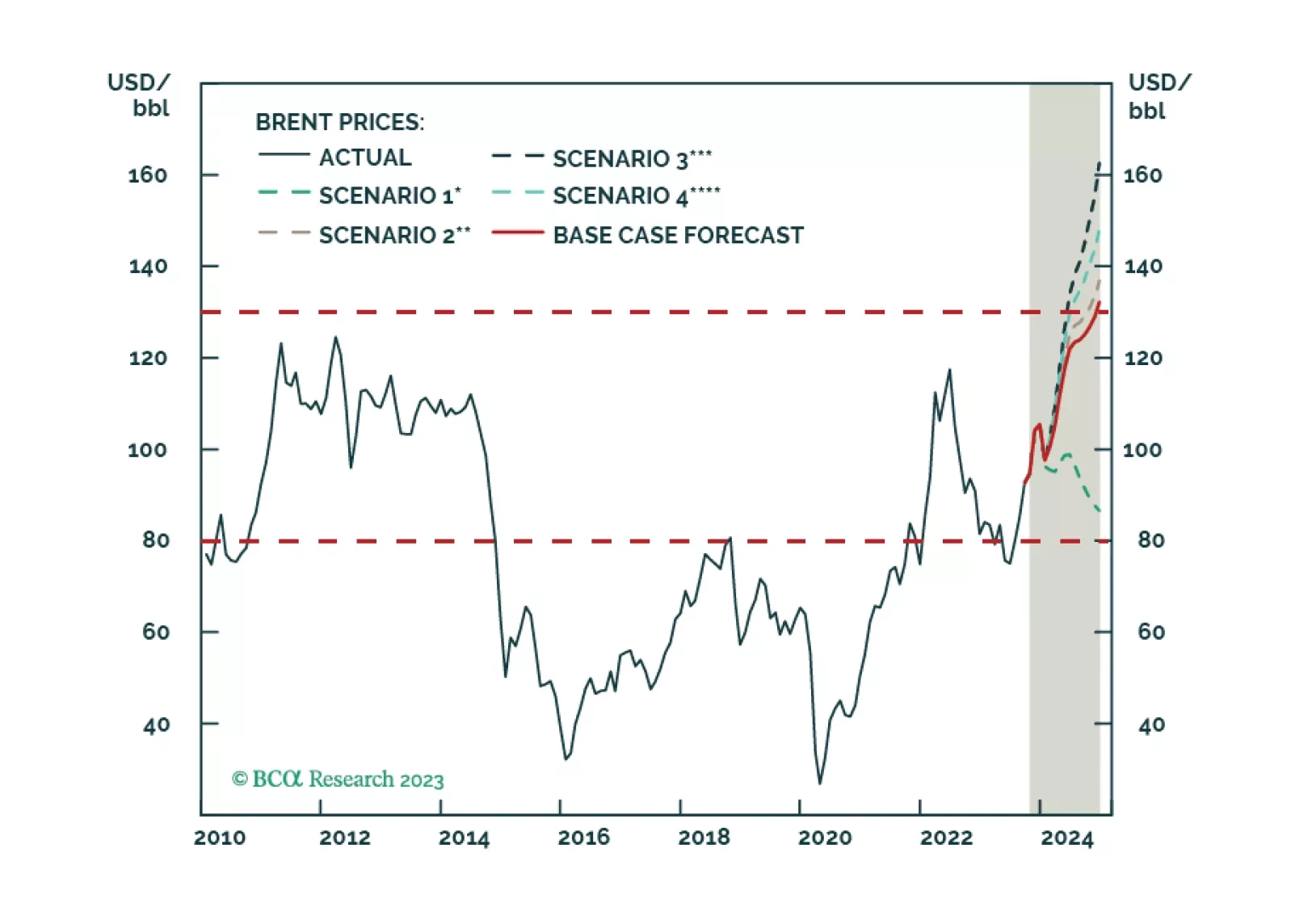

The US and core OPEC 2.0 are – wittingly or not – laying the groundwork for a price band with a floor and cap on oil prices – at $79/bbl and $130/bbl, respectively – “at least” to May 2024. This accommodates multiple goals for both…

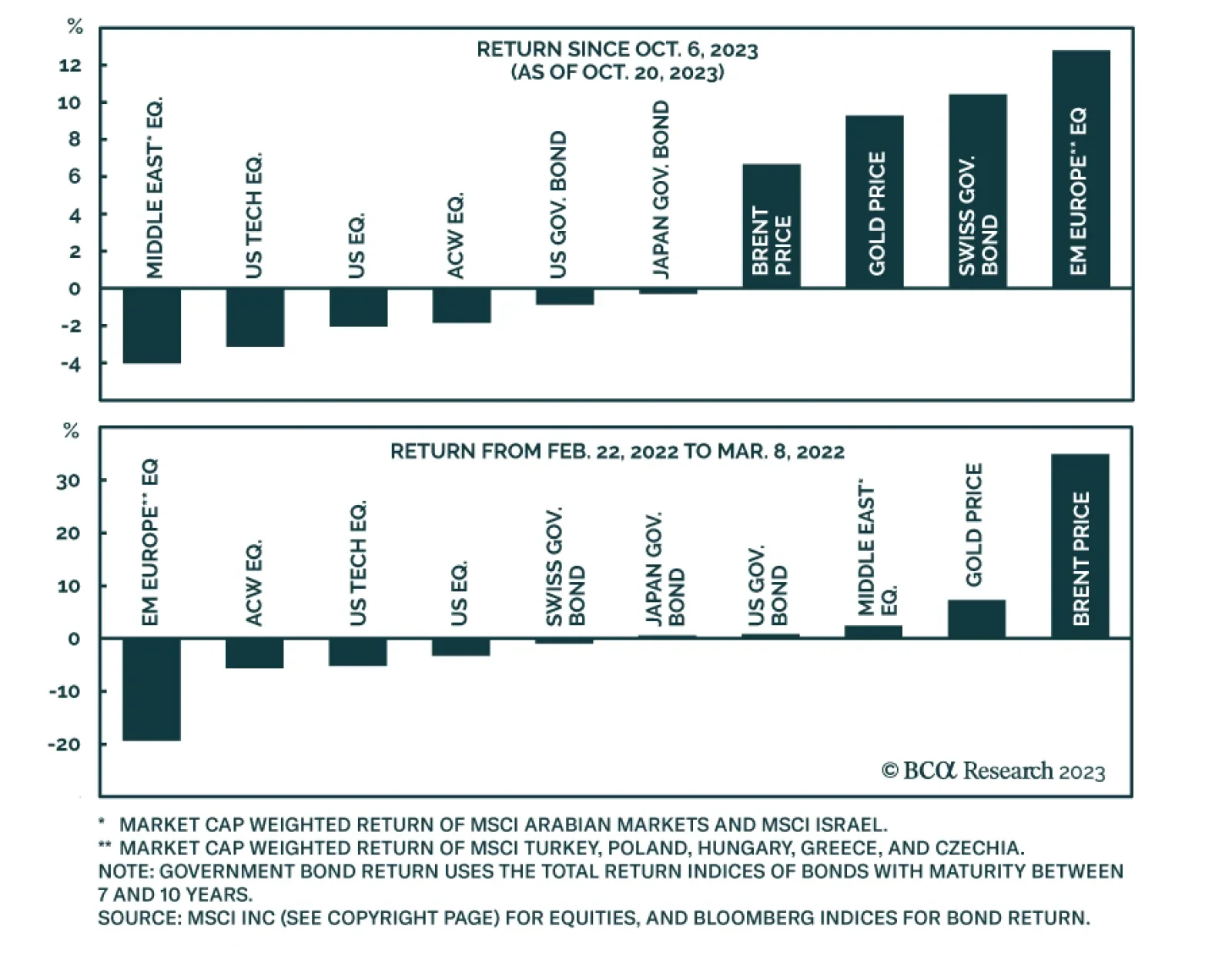

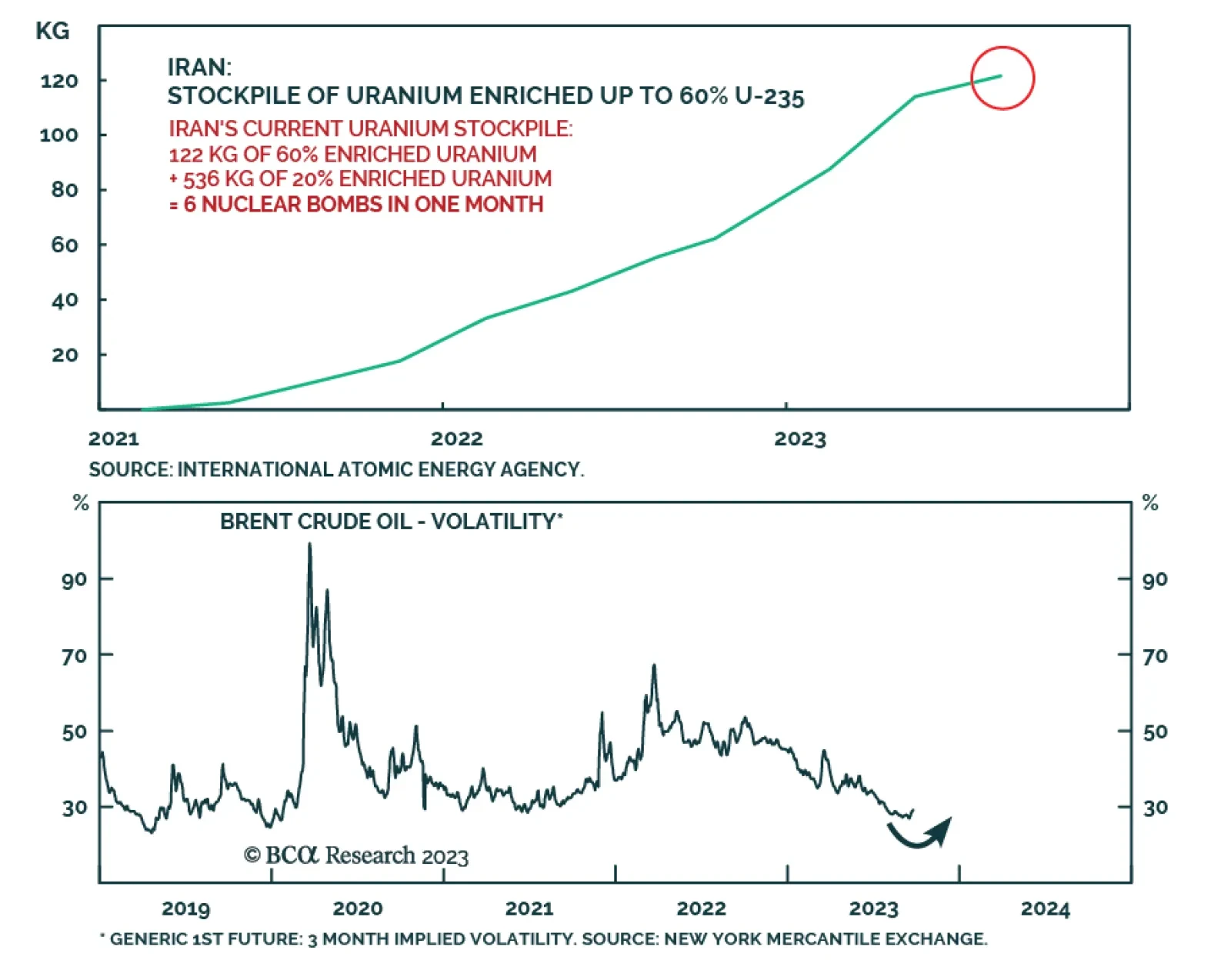

Geopolitical risk is returning to the market after a hiatus for most of 2023. Global investors are now realizing what our geopolitical strategists have argued all year: that the rise in geopolitical risk is a secular trend…

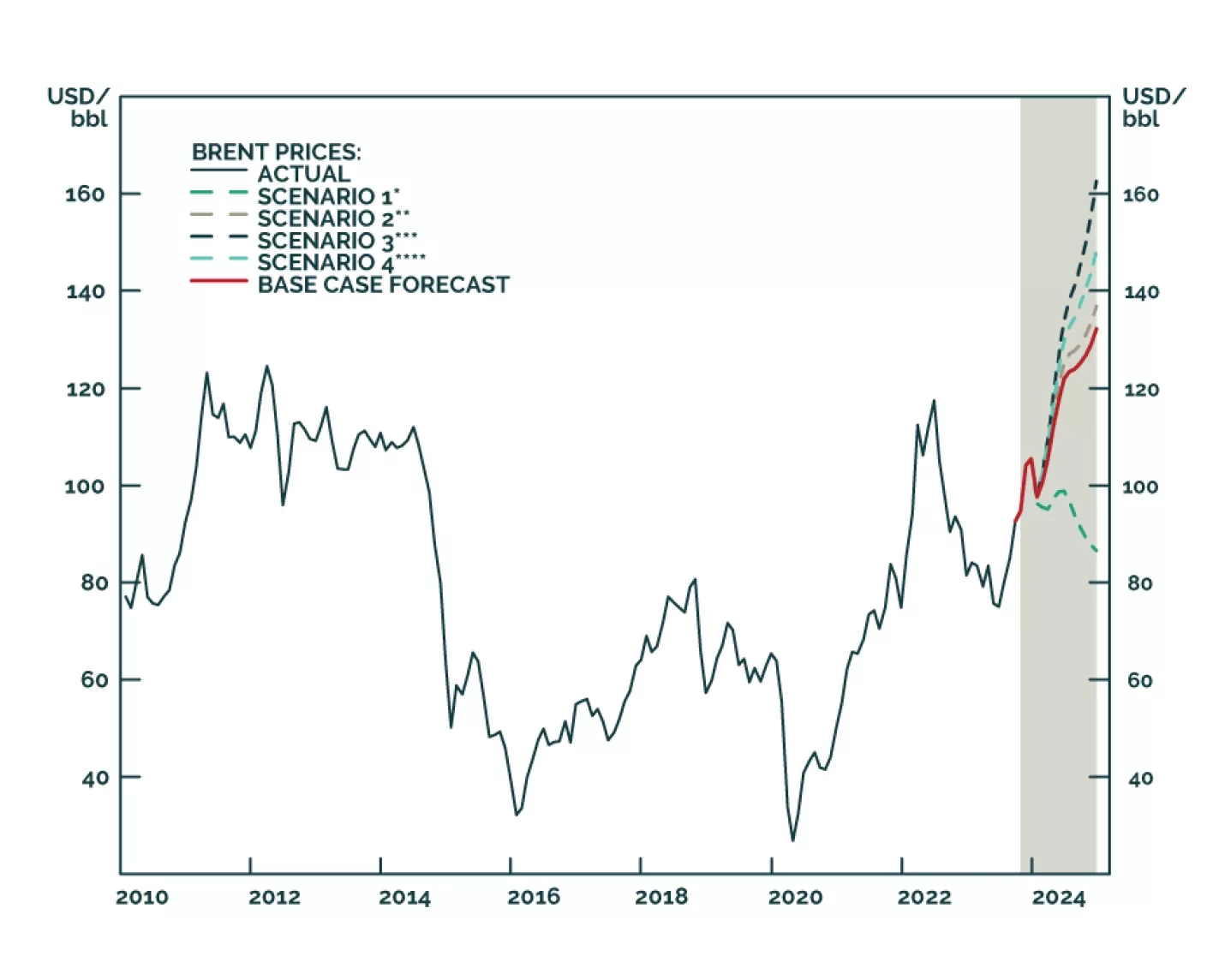

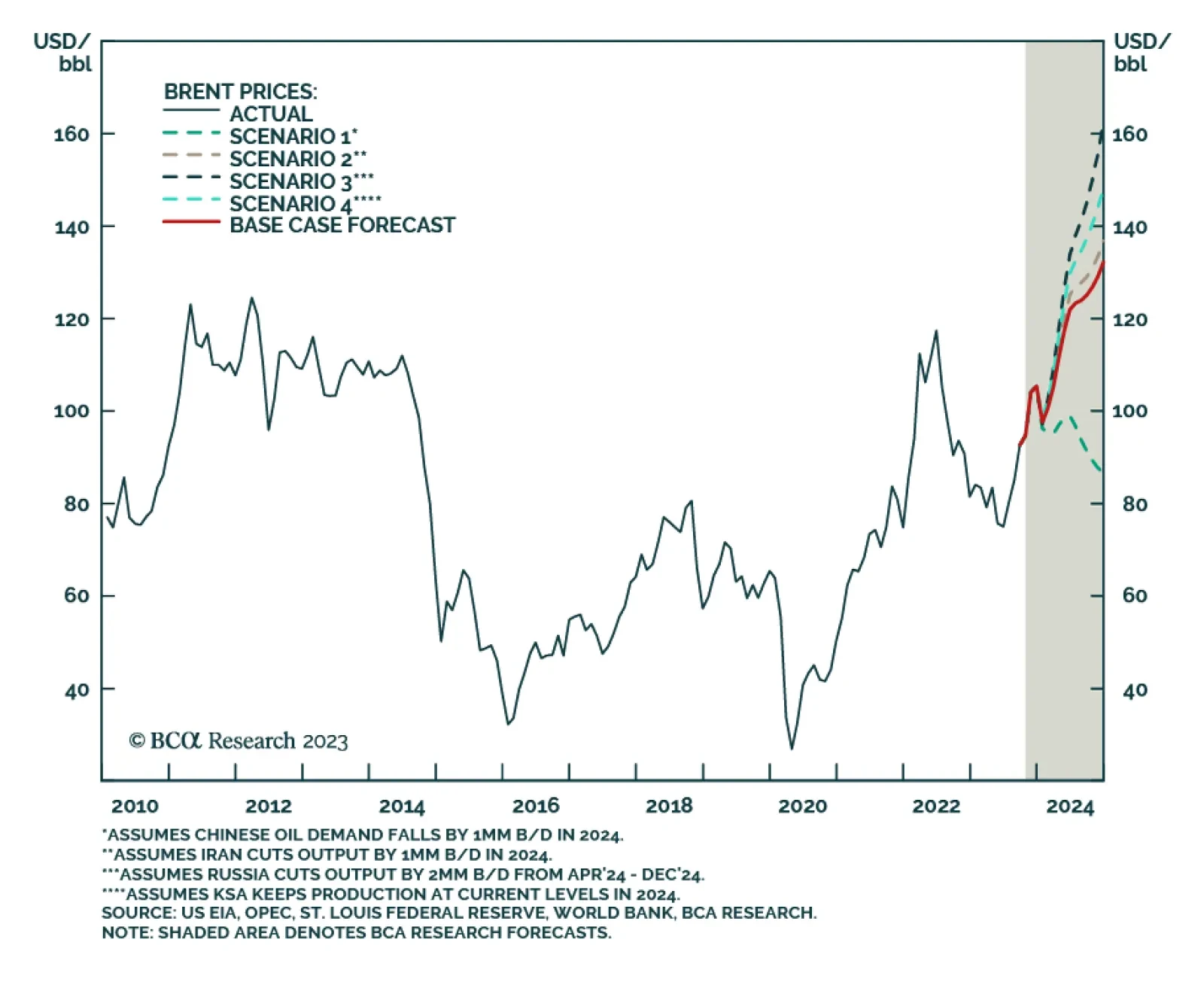

Our Commodity & Energy Strategy colleagues (CES) left their 2024 Brent crude oil price forecast unchanged at $118/bbl. This is not because nothing’s changed in the market. Rather, higher levels of…

Despite higher uncertainty, our Brent price forecasts remain unchanged at just over $101/bbl for 4Q23 and $118/bbl for next year. We remain long equity exposure to oil and gas producers via the XOP ETF, and commodity exposure via the…

US monetary policy is restrictive, as evidenced by a falling jobs-workers gap. The reason that unemployment has not risen is because labor demand still exceeds supply. That will change in the second half of 2024 when the US economy…

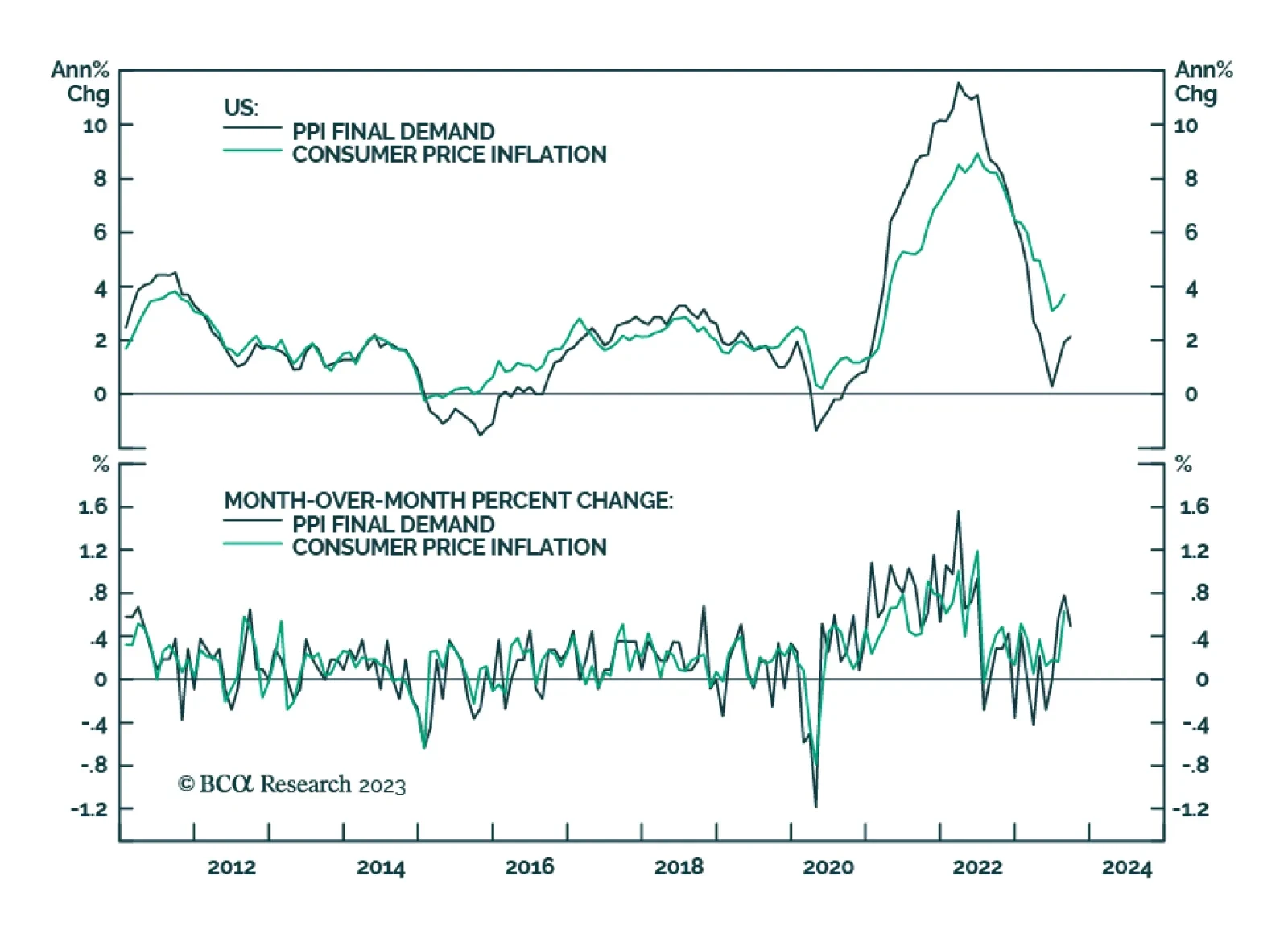

The US PPI report came in hotter-than-anticipated in September. Although the headline index decelerated from 0.7% m/m to 0.5% m/m, it remains above expectations of a more pronounced moderation to 0.3% m/m. In particular, a 3.3% m…

According to BCA Research’s Geopolitical Strategy service, volatility will remain the key dynamic in oil markets in the aftermath of the surprise Hamas attacks against Israel on October 7. Everything depends on whether…

Hamas’s attack on Israel raises the odds of a wider conflict in the Gulf, which would lead to higher oil prices. Given the response of oil prices Monday, markets appear to be relatively restrained in their assessment of a sharp…