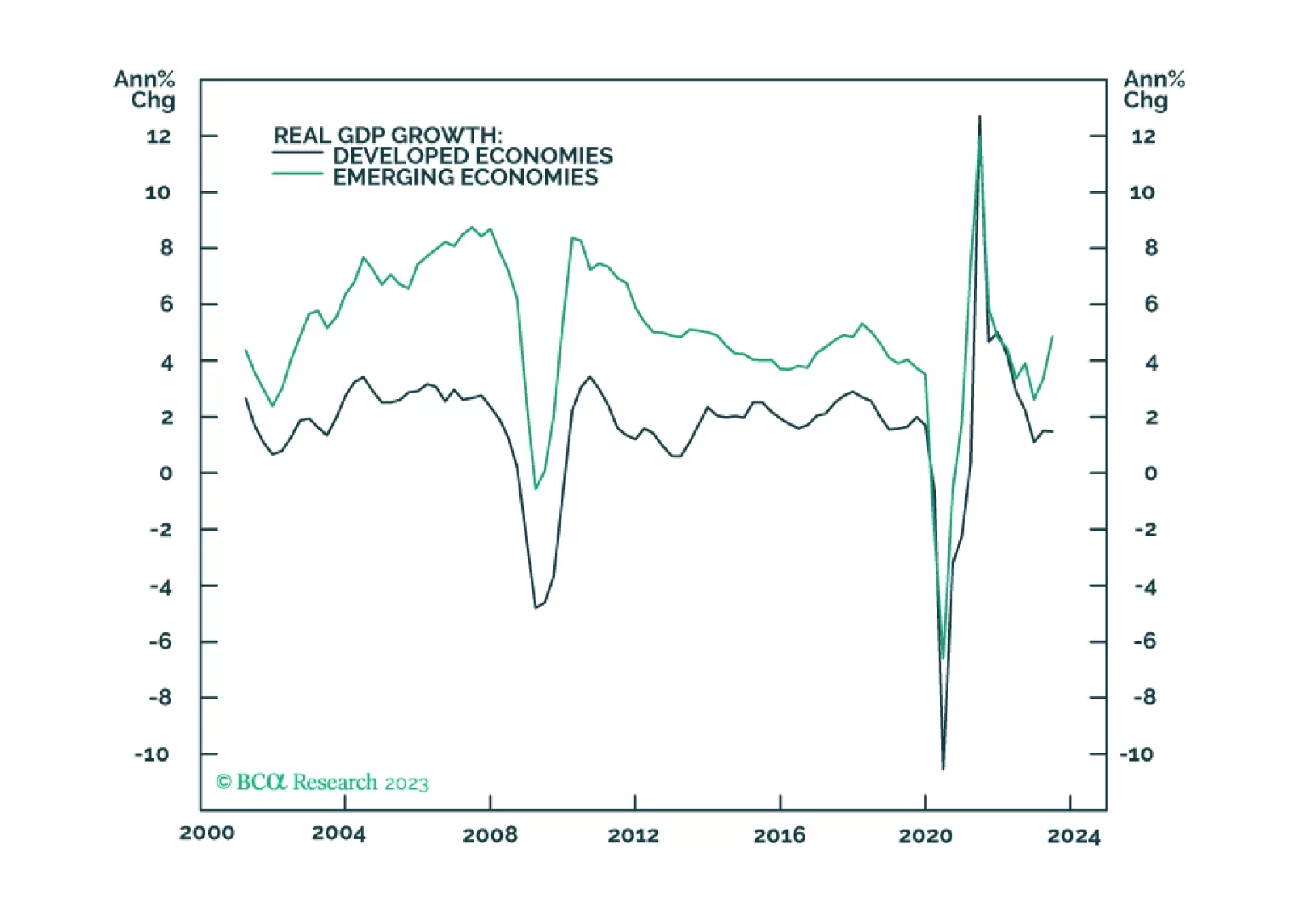

Global instability will continue in 2024 – whatever happens afterward. Slowing economies will exacerbate already high geopolitical risk and policy uncertainty stemming from the US election and foreign challenges to US leadership.…

Inflation won’t fall fast enough for the Fed to cut rates preemptively before recession arrives. The risk/rewards balance is unfavorable for risk assets. Stay overweight bonds versus equities.

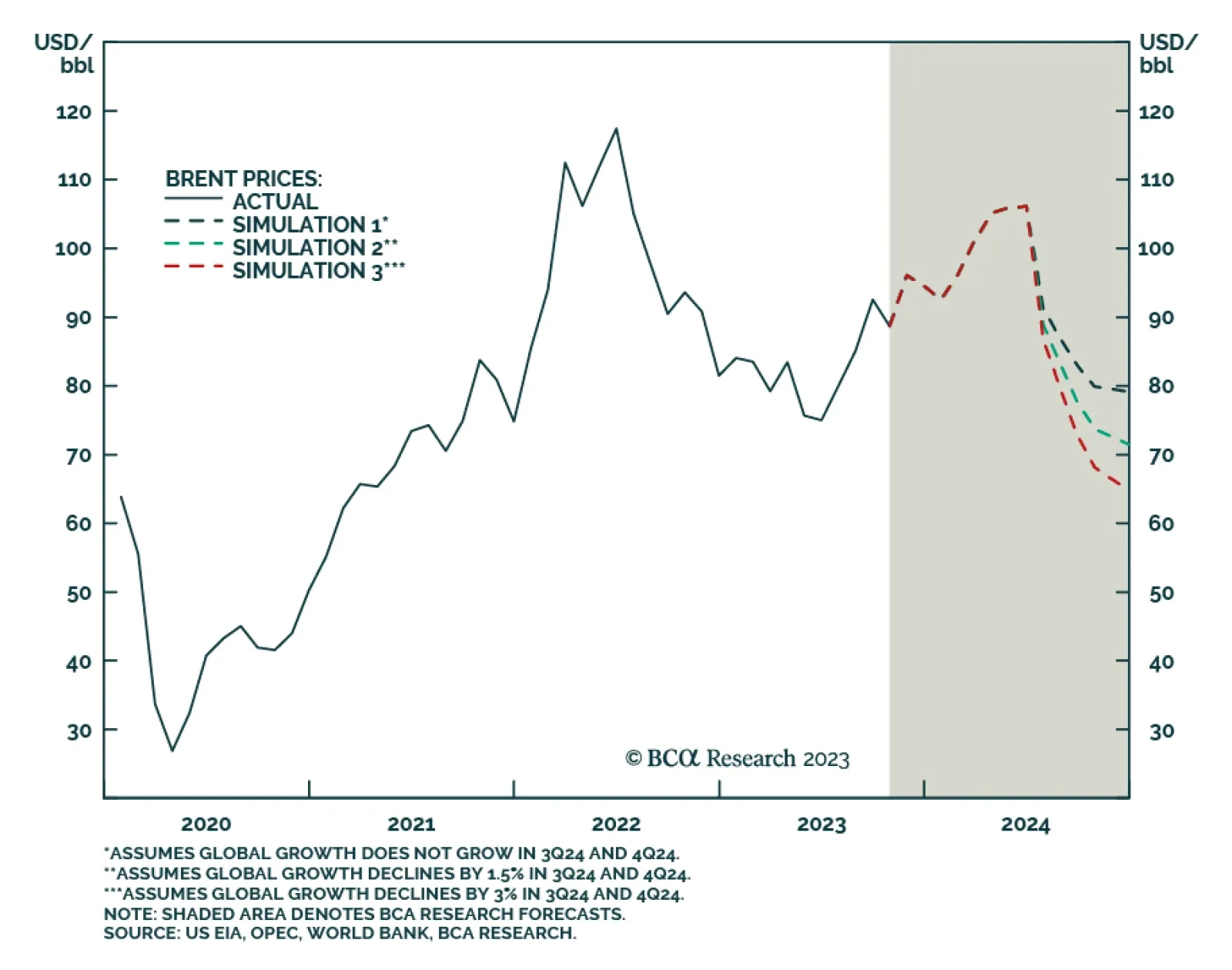

BCA’s Commodity & Energy Strategy service does not expect a global recession next year. In practical terms, this means they are more bullish on their oil-price outlook for 2024 than the consensus and also differ…

In our simulations of fairly deep global recessions averaging -1.5% in 2024 global GDP growth, we expect OPEC 2.0 to reduce output enough to offset lost demand. Even so, we find oil prices drop ~ $22/bbl – from ~ $100/bbl in 1H24 to…

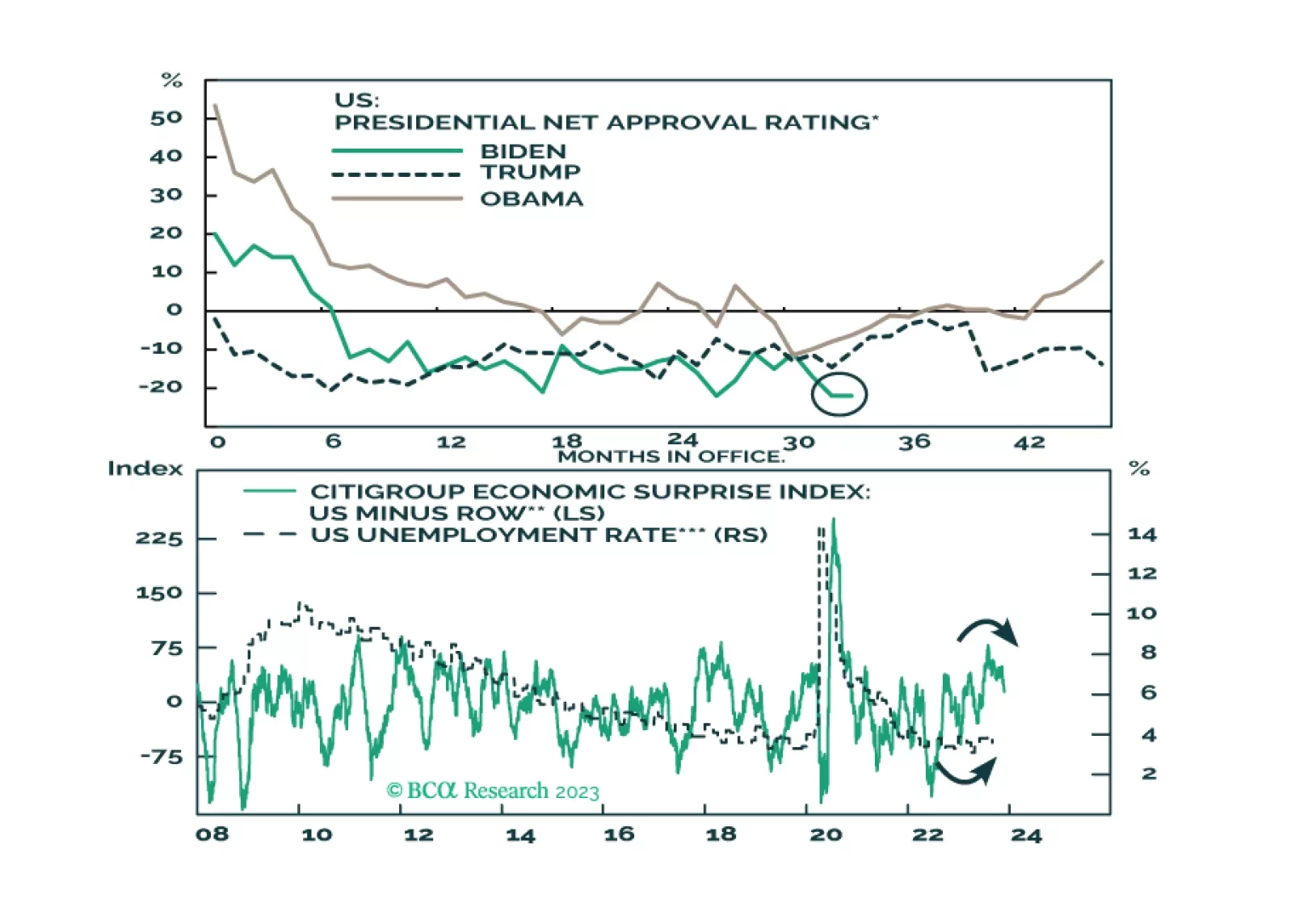

Our political forecasting scored wins in 2023 but we failed to capitalize on it adequately in our trade recommendations.

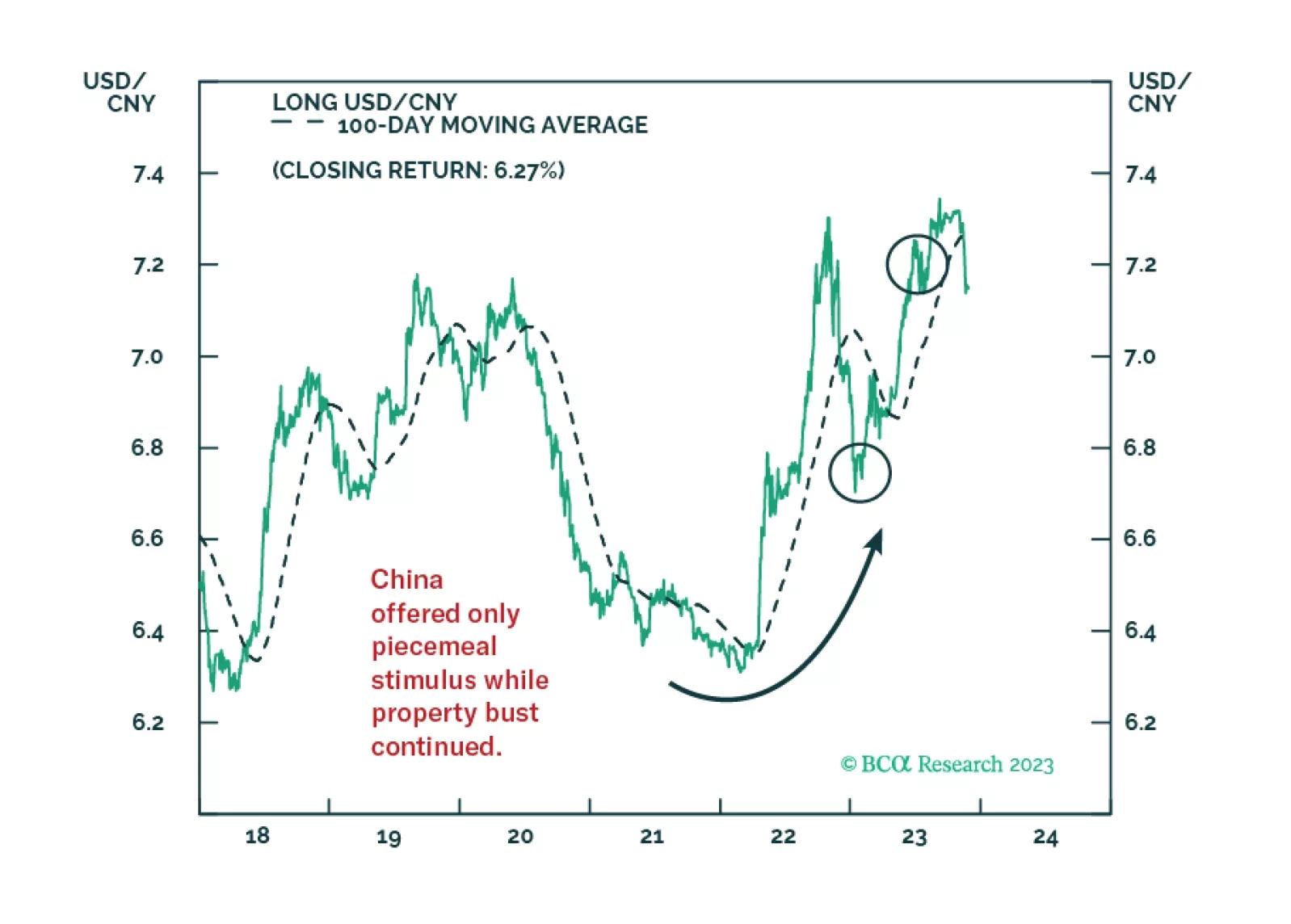

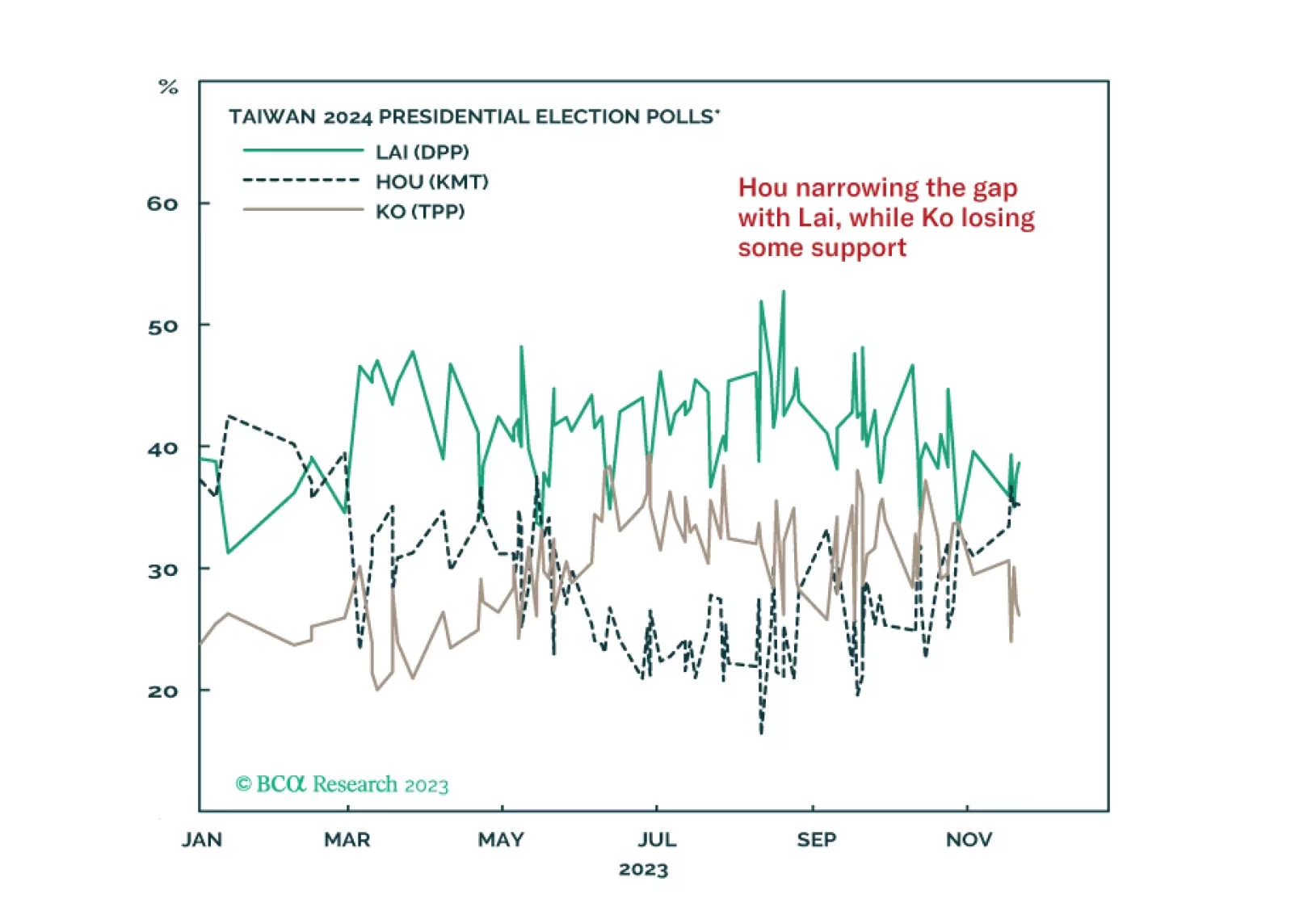

A series of notable events took place over the Thanksgiving holiday but none of them force us to change our fundamental assessments. The conflict in the Middle East is likely to escalate rather than de-escalate, while the Taiwan…

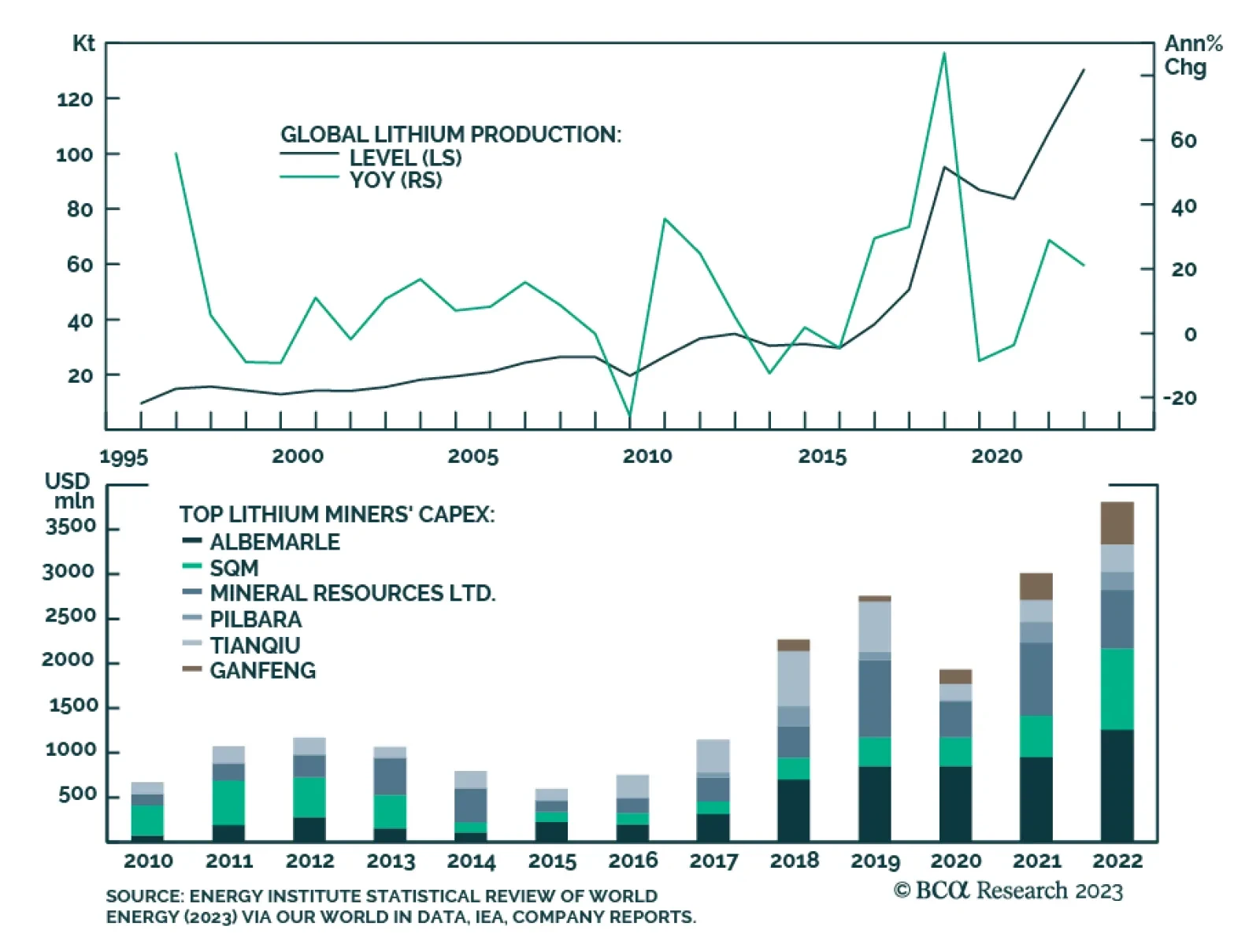

BCA Research's Commodity & Energy Strategy service concludes that lithium demand will rise over the long run. Lithium prices are continuing the selloff that began earlier this year, which was caused by strong…

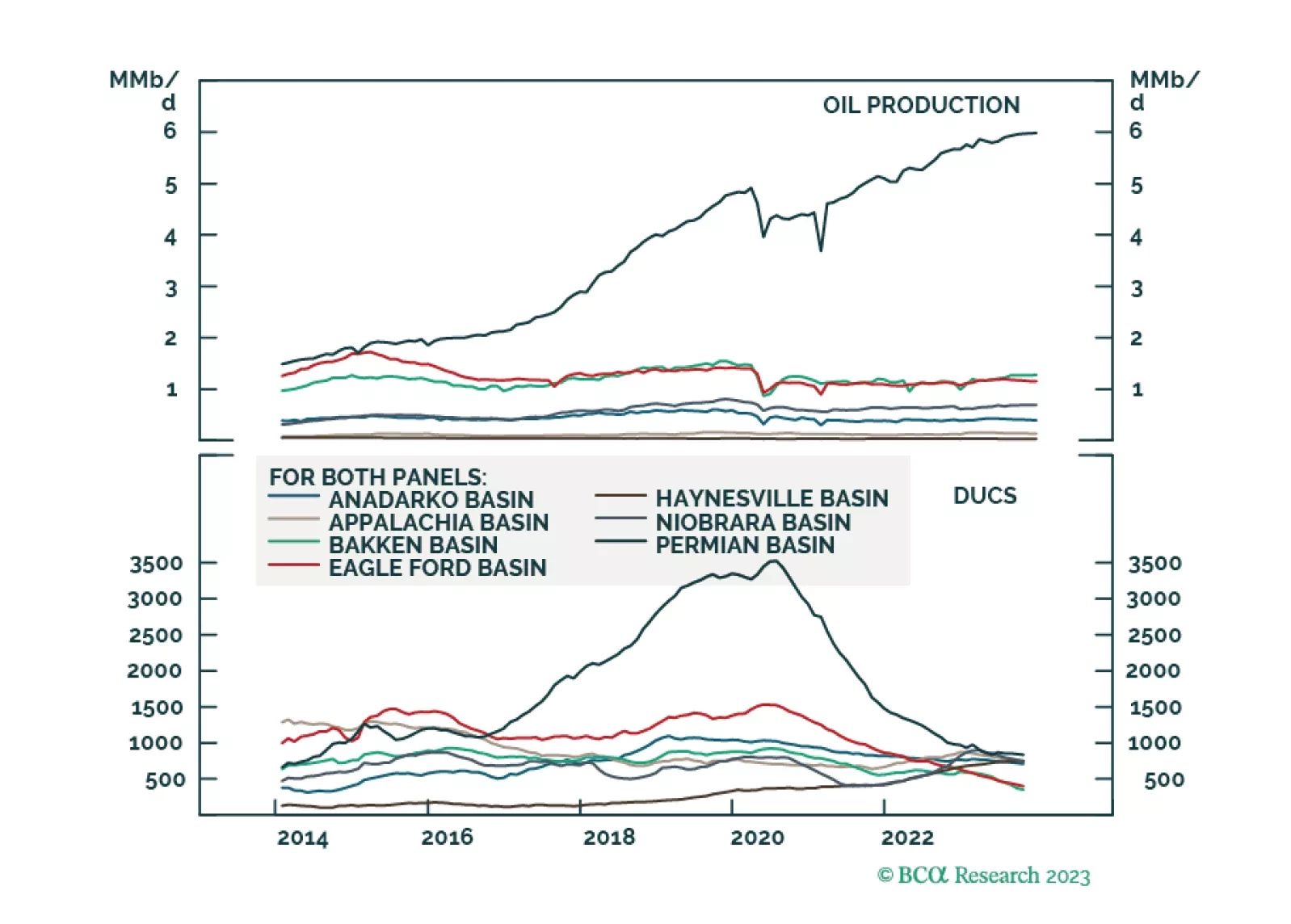

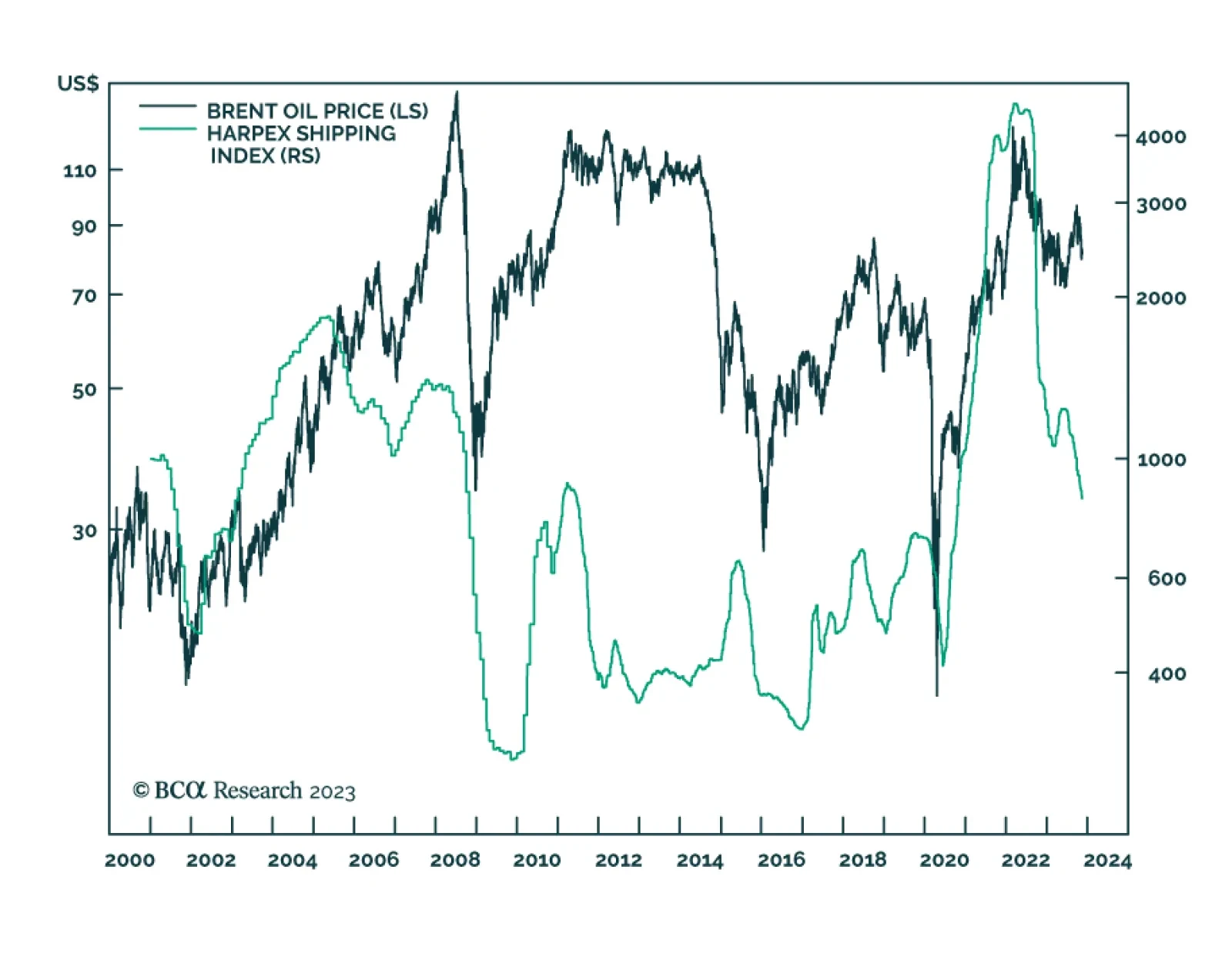

Oil prices have relapsed despite the supply cuts and the geopolitical volatility stemming from the Middle East. Odds are that global oil demand is downshifting. The chart above illustrates that there is a tight relationship…