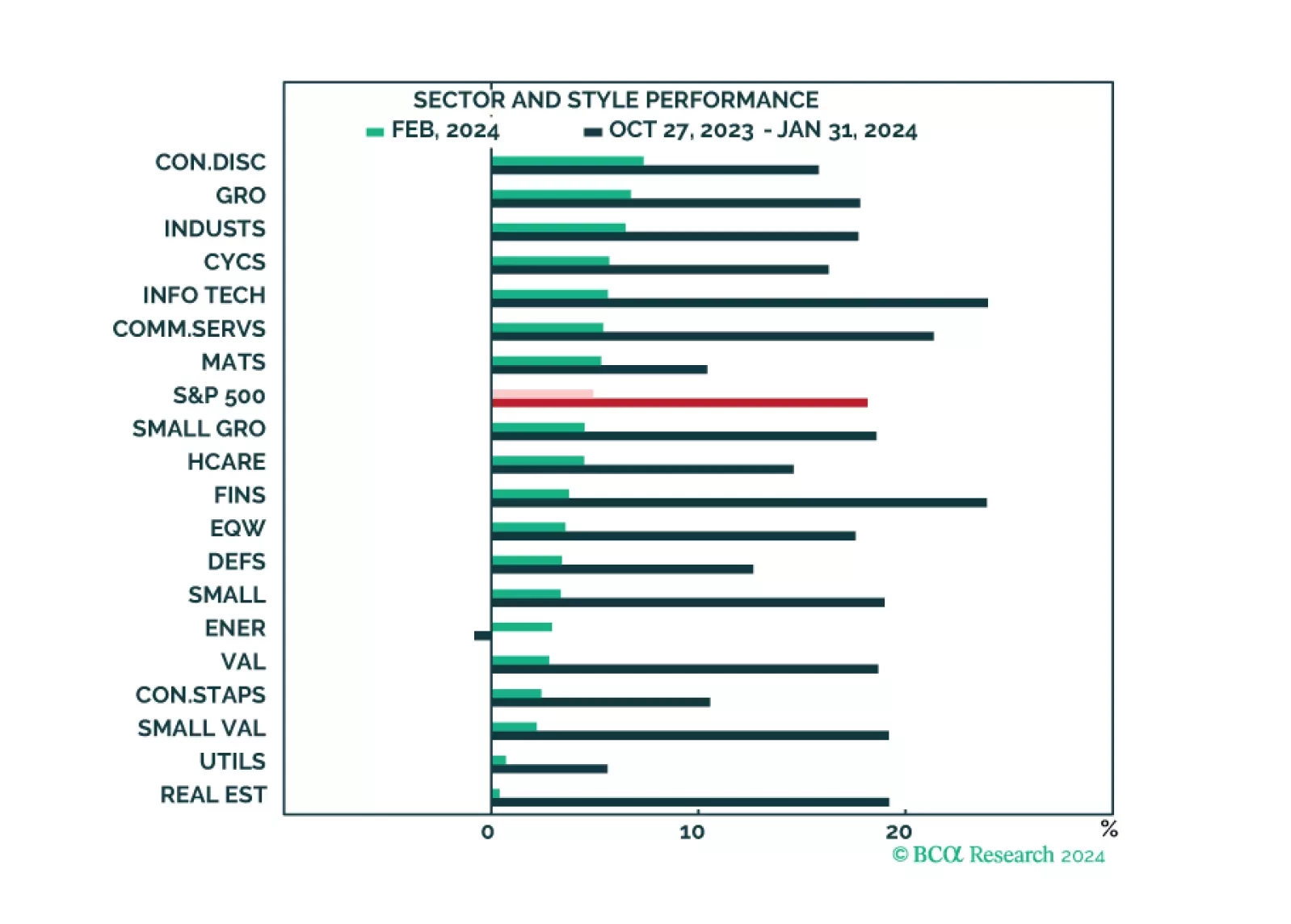

The market narrative continues to be dominated by the Magnificent Six, which drove both market performance and strong Q4 earnings results. While all sectors and styles have recently turned green, the rally is still mostly narrow.…

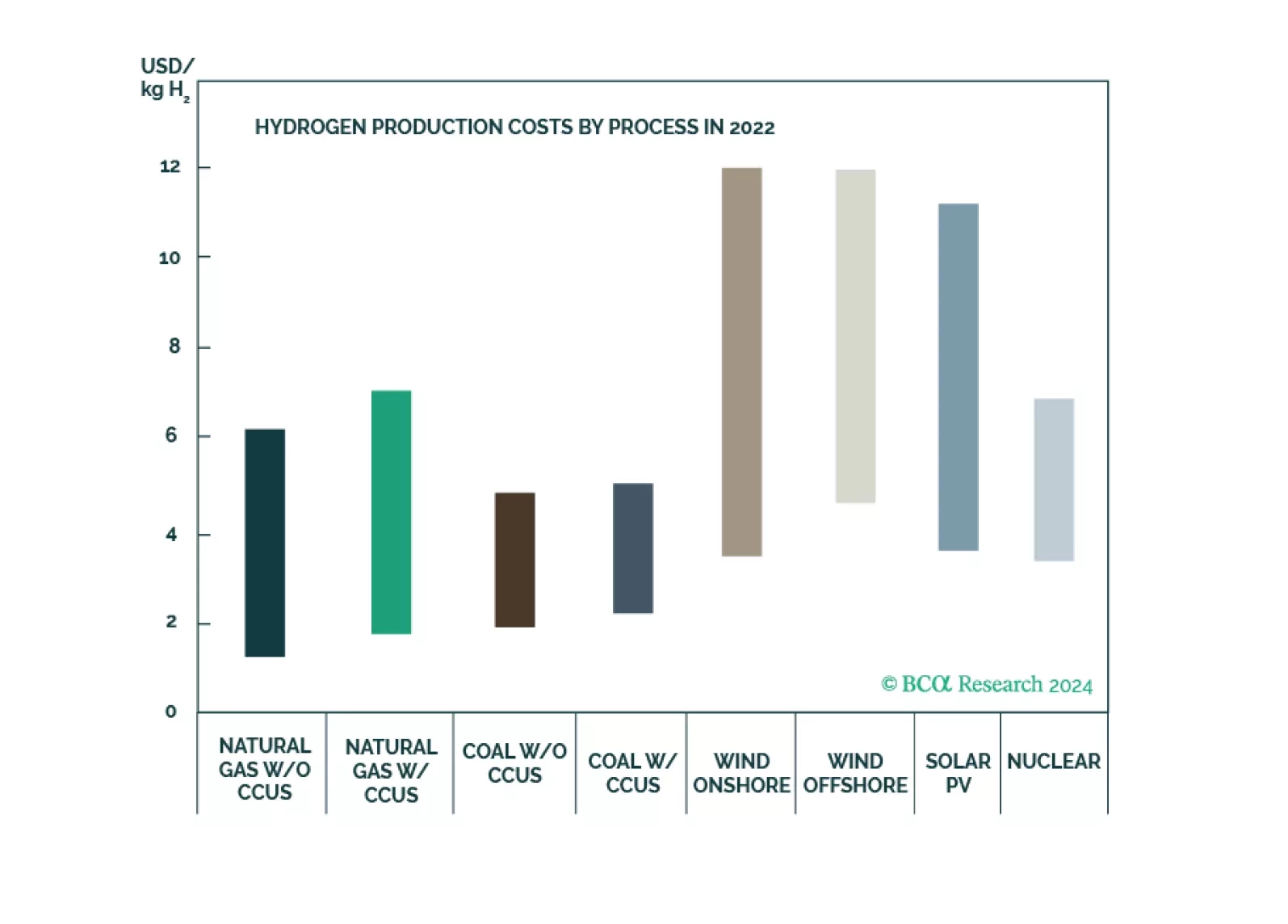

Naturally occurring hydrogen as a clean-energy source has the potential to satisfy significant energy demand growth at low cost. Oil and gas E+P companies and pipelines are ideally positioned to take a leading role in this clean-…

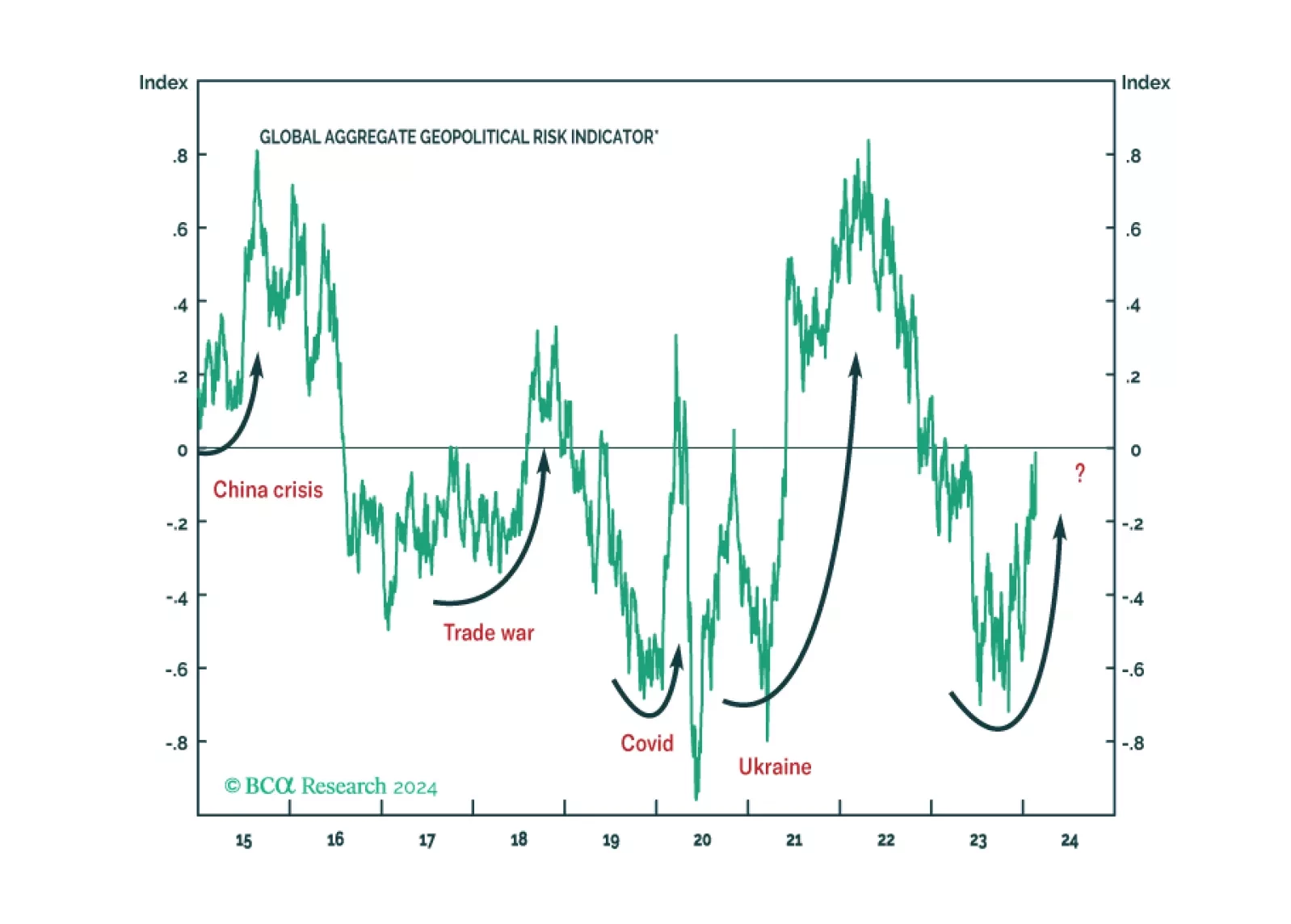

While 2024 will see various election risks, global geopolitical uncertainty is driven by the US election and its struggle with Russia, China, and Iran. The stock market can manage local domestic political risk. But it will correct…

Reported earnings for Q4-2023 were rather underwhelming and prone to issues that we have identified over the past few months: Growth is concentrated in just a few sectors and companies, while the profitability of a broad swath of the…

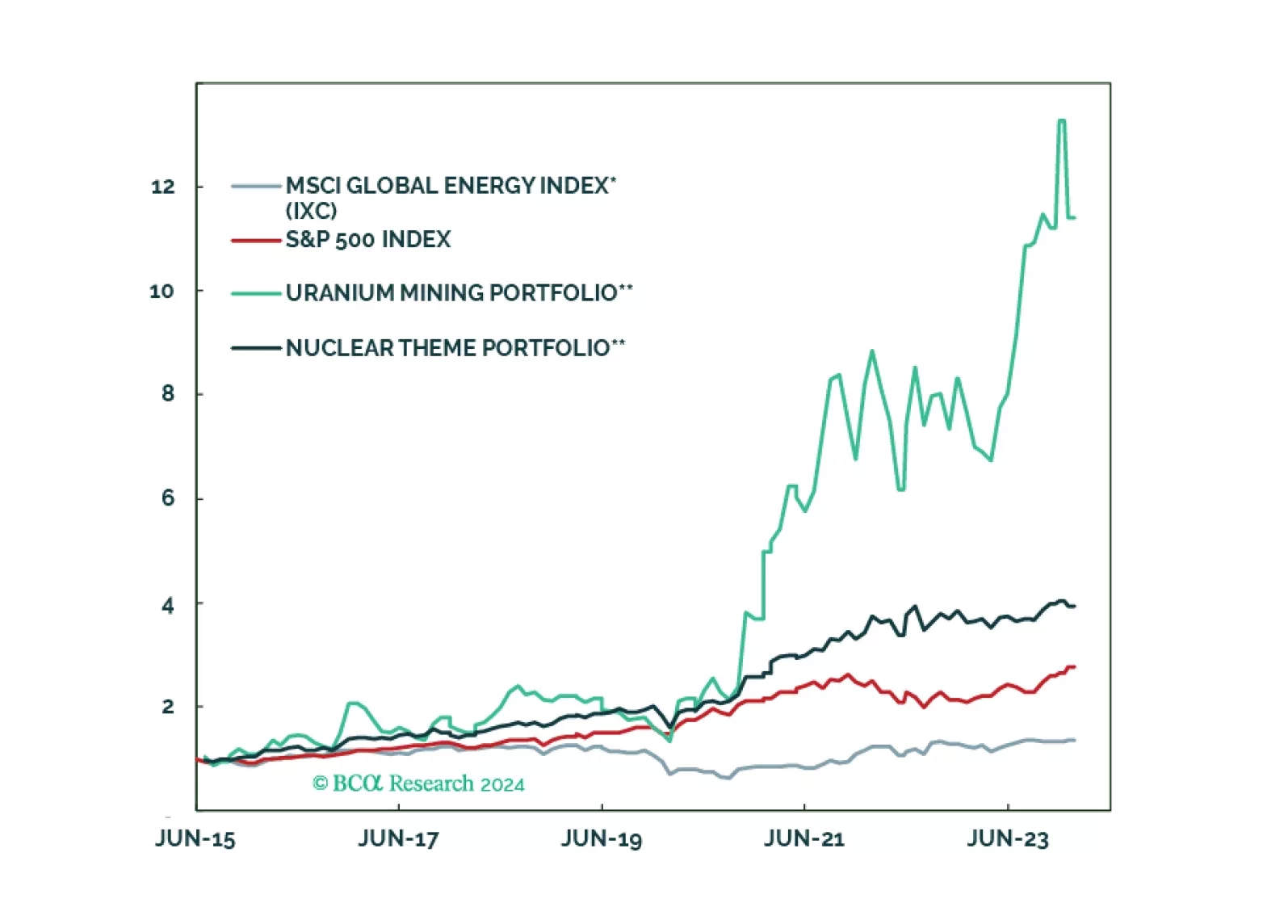

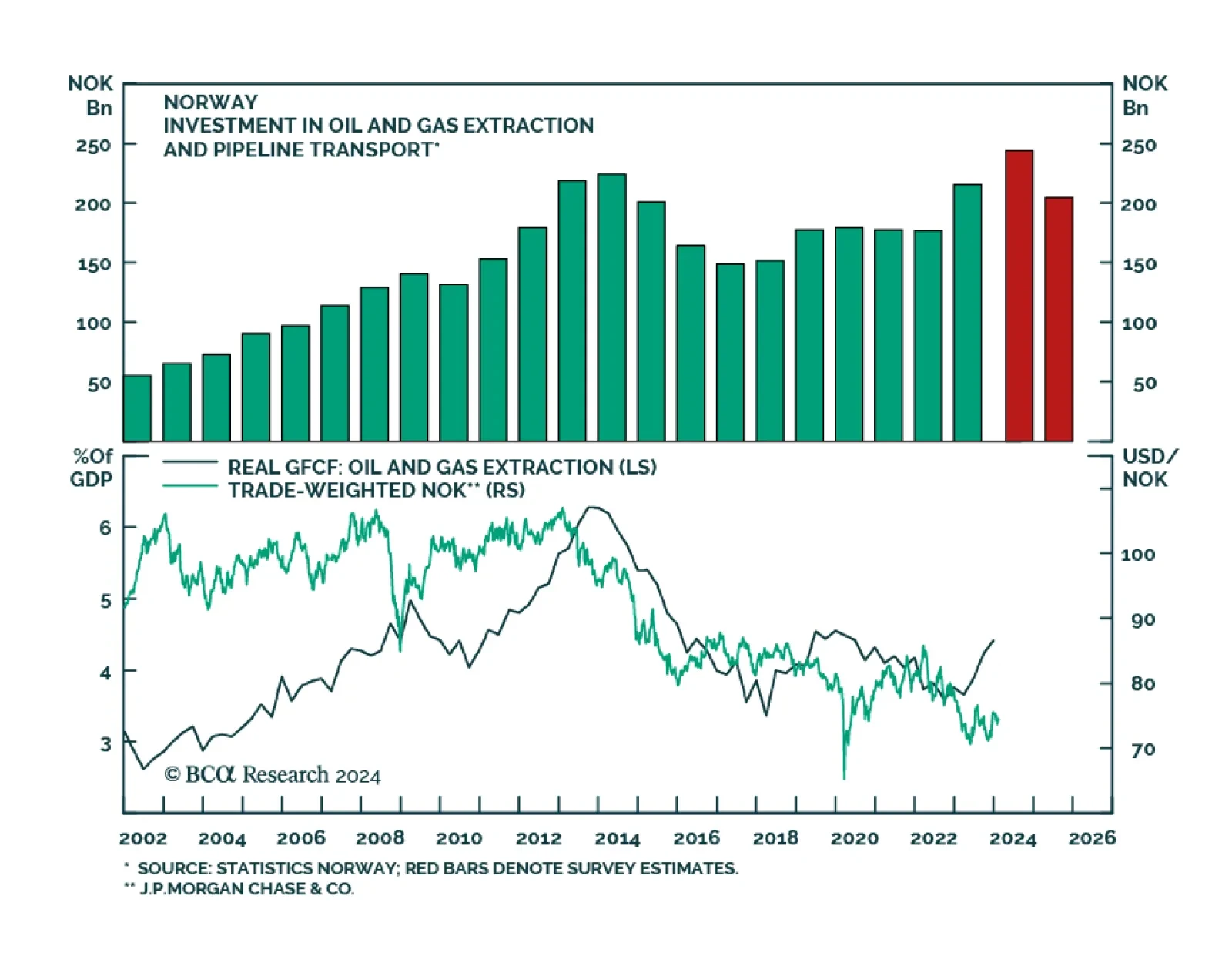

Energy security is a focus of many governments, especially since the onset of the Russia-Ukraine conflict. One producer that is benefitting from diversification away from Russian oil and gas is Norway. This is buffeting the trade…

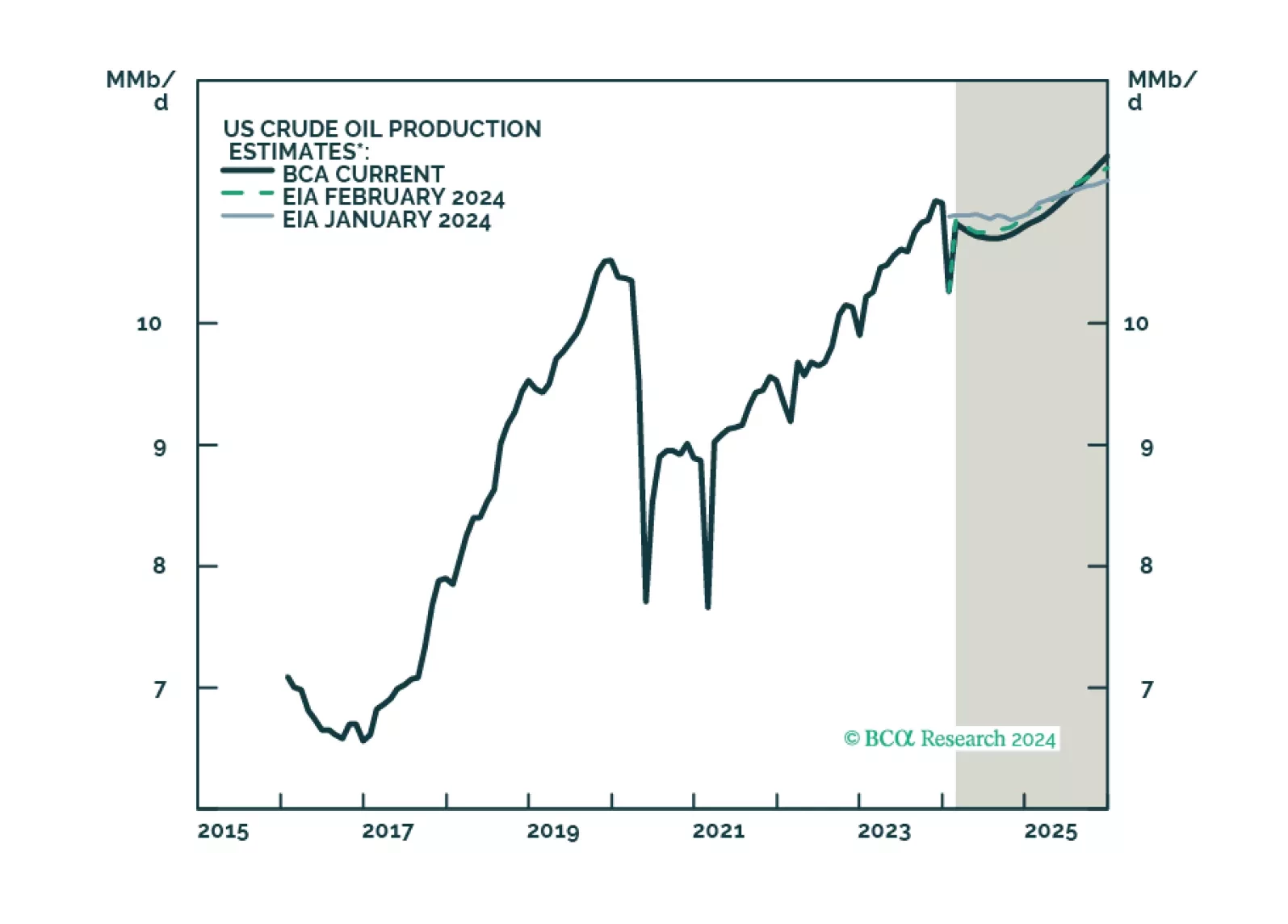

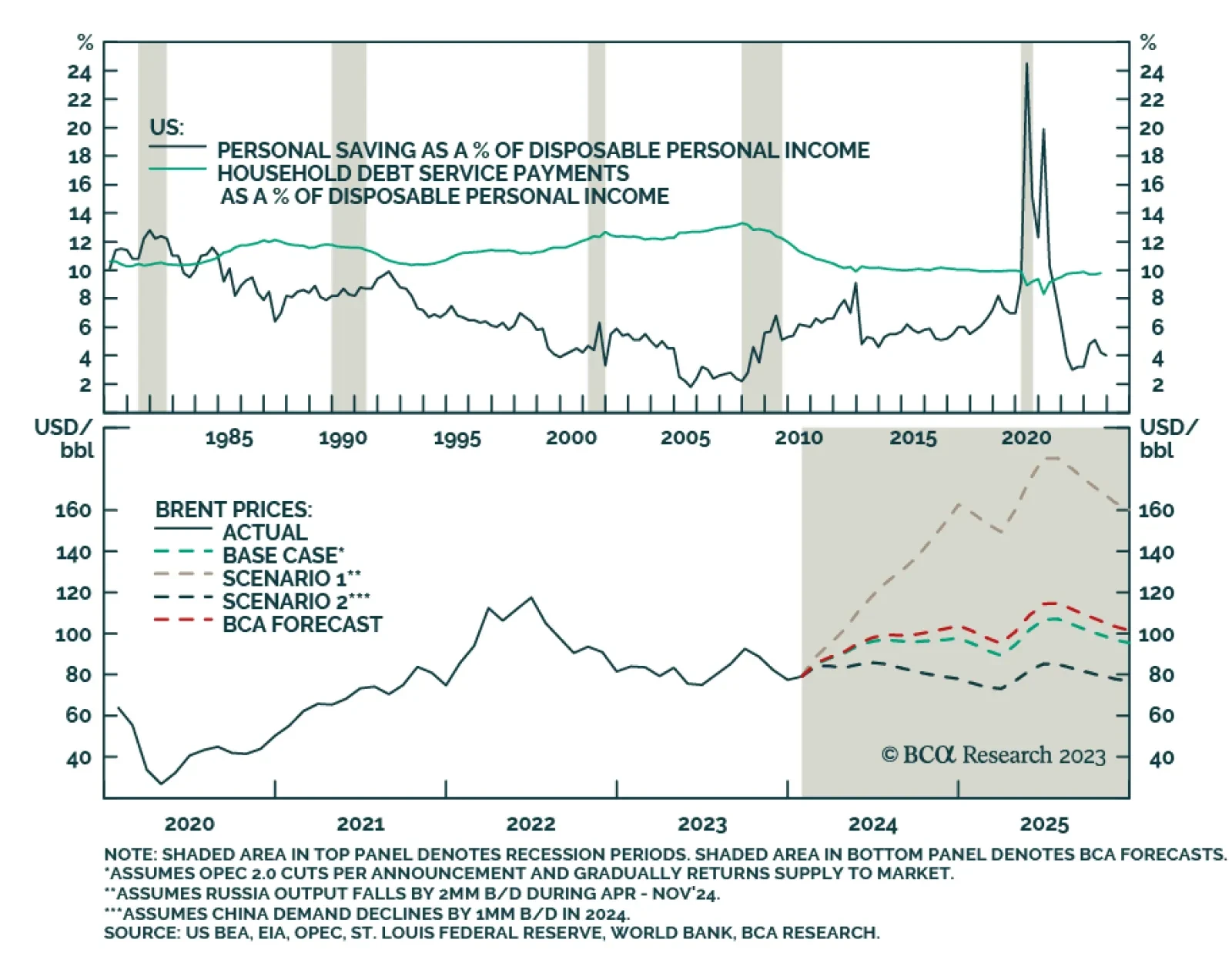

Our Commodity & Energy colleagues see oil markets balanced in the short run, which keeps their Brent price forecasts at $95/bbl and $105/bbl for 2024 and 2025. That said, they note the odds are increasing demand…

Energy markets are balanced in the short run, which keeps our Brent price forecasts at $95/bbl and $105/bbl in 2024 and 2025. Structurally, we see an upward bias to inflation, as geoeconomic fragmentation fundamentally alters supply…

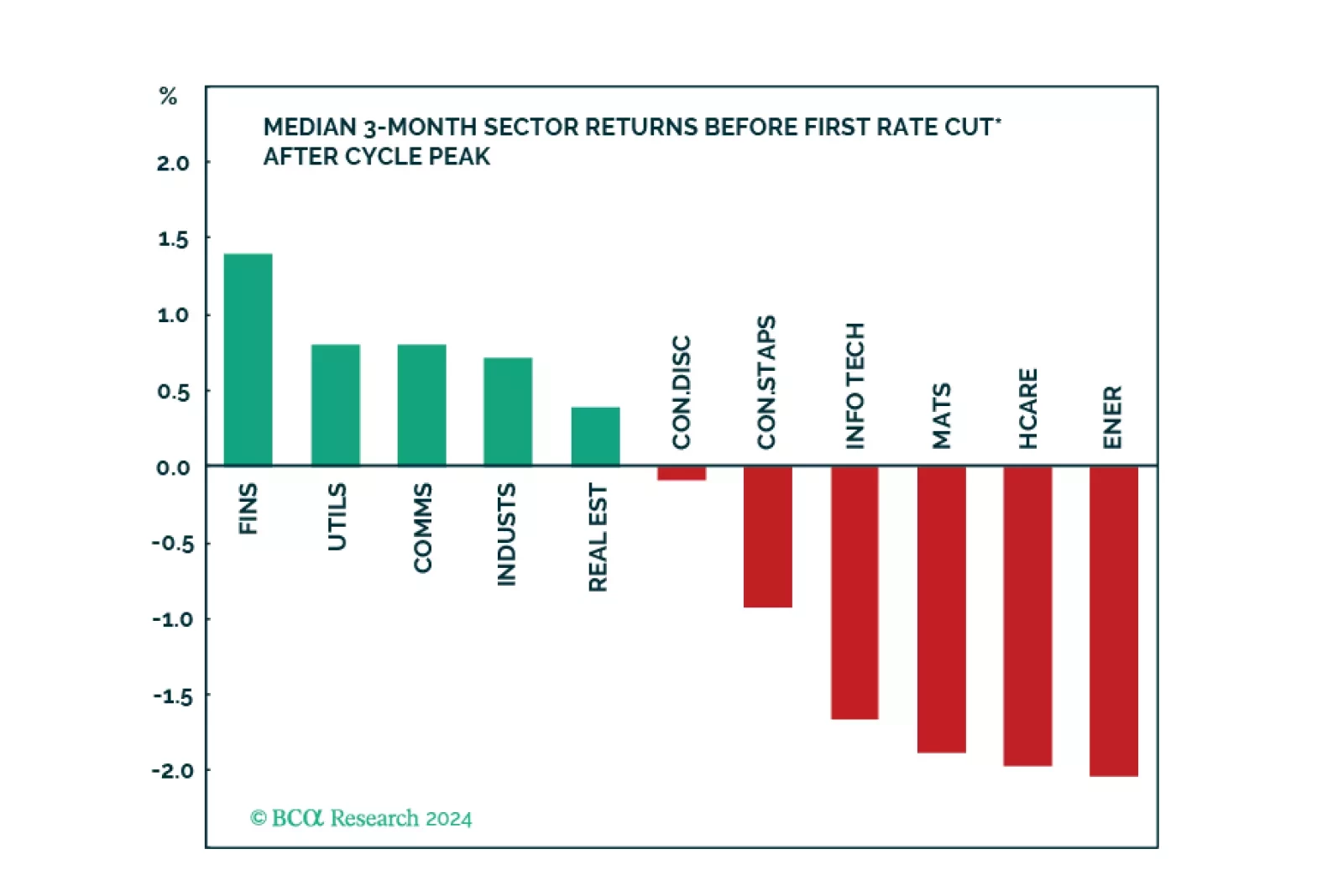

We created a sector selection scorecard based on performance of sectors under various macroeconomic regimes while taking into consideration revisions to expected earnings growth and valuations in a historical context. Our total…

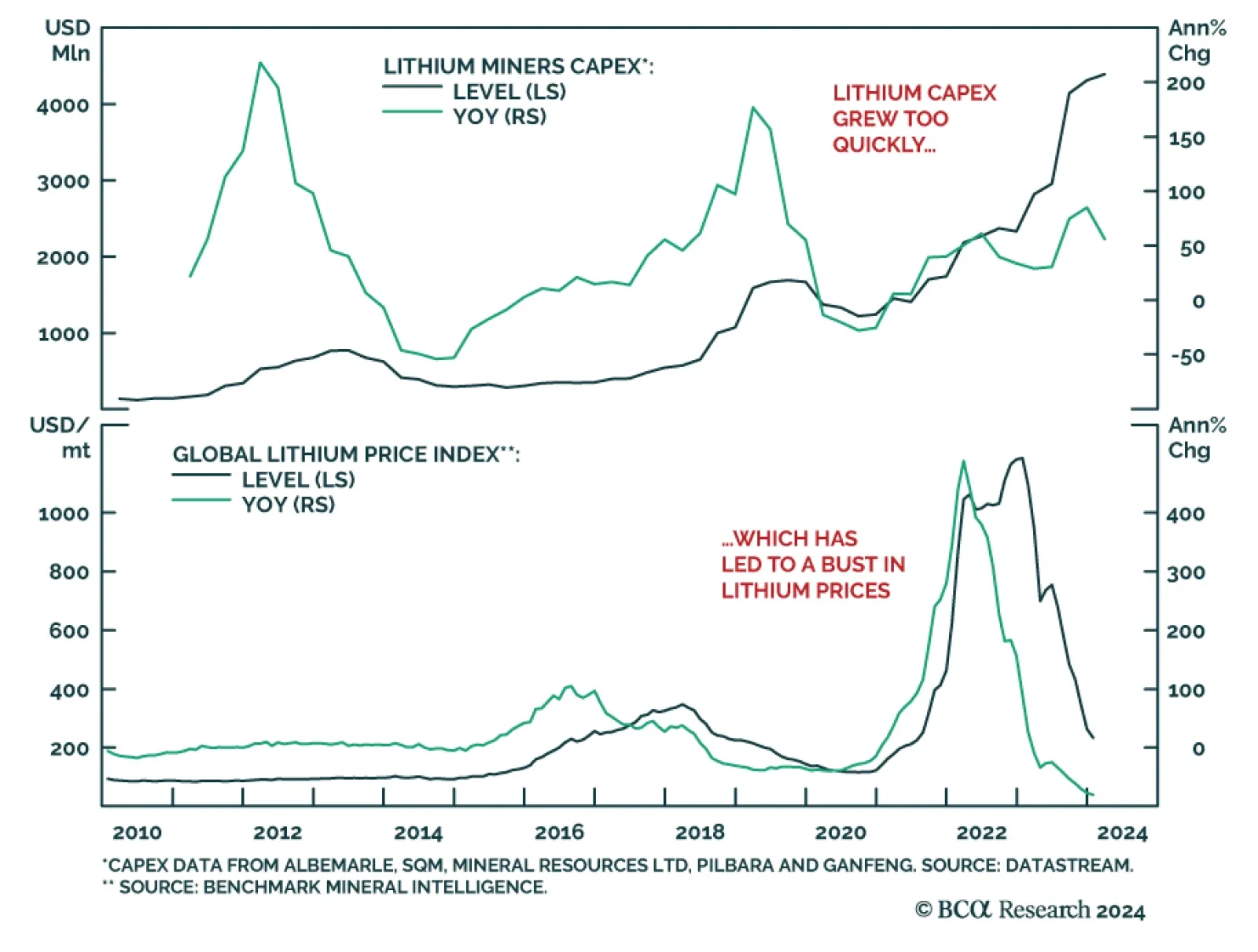

According to BCA Research’s Commodity & Energy Strategy service, after falling 80% over the past year, lithium prices will continue to trade lower. Lithium is critical for green technology and defense equipment,…