This year, we once again present our 2026 outlook as a retrospective from the future – a future in which the AI boom turned to bust.Next week, please join me for a Webcast on Wednesday, December 17 at 10:30 AM EST (3:30 PM GMT, 4:30…

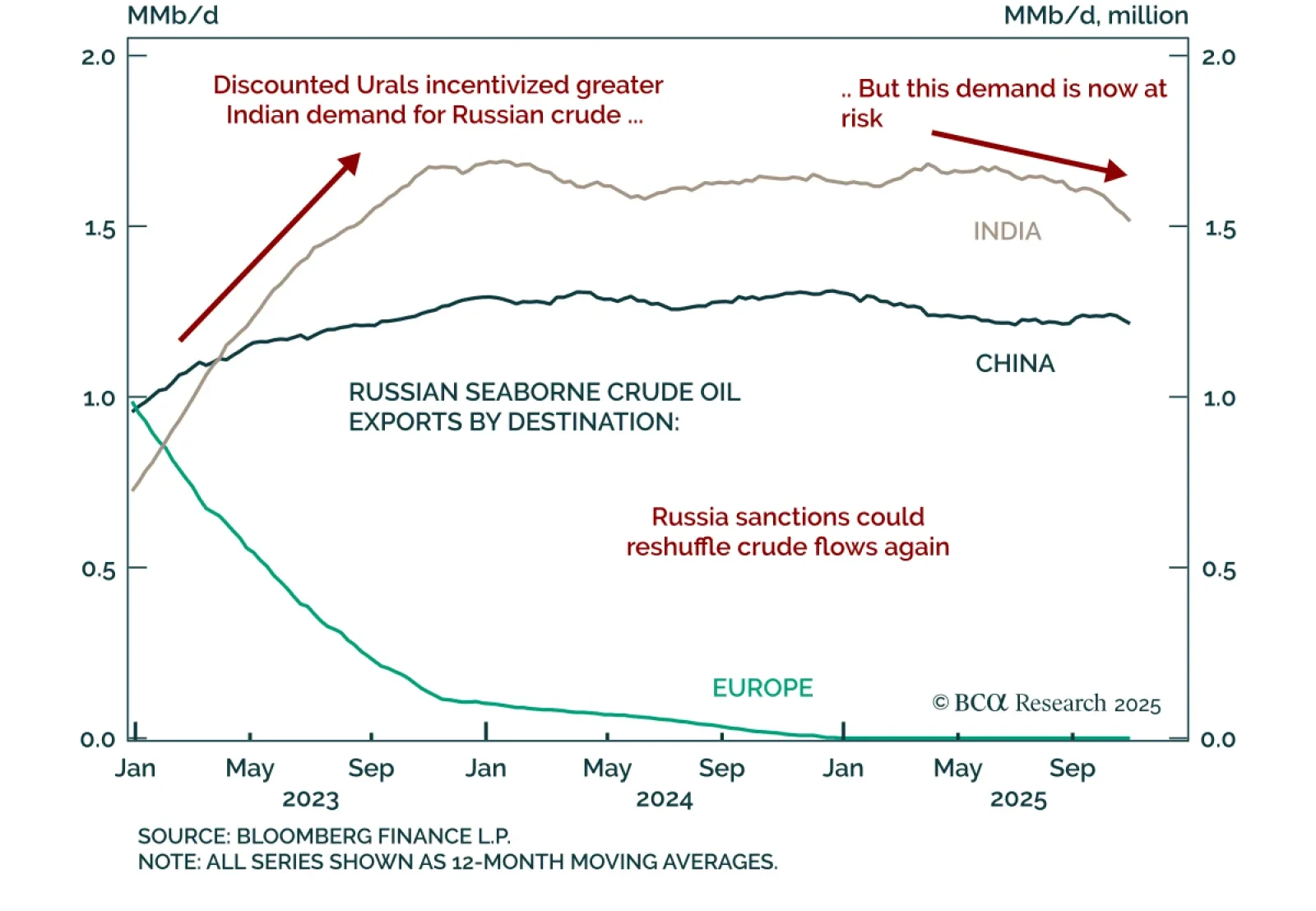

Our Commodity strategists advise staying short Brent, with a stop-loss at $73/bbl, as US sanctions on Russian crude are unlikely to meaningfully impact prices over a cyclical horizon. While new restrictions on Rosneft and Lukoil…

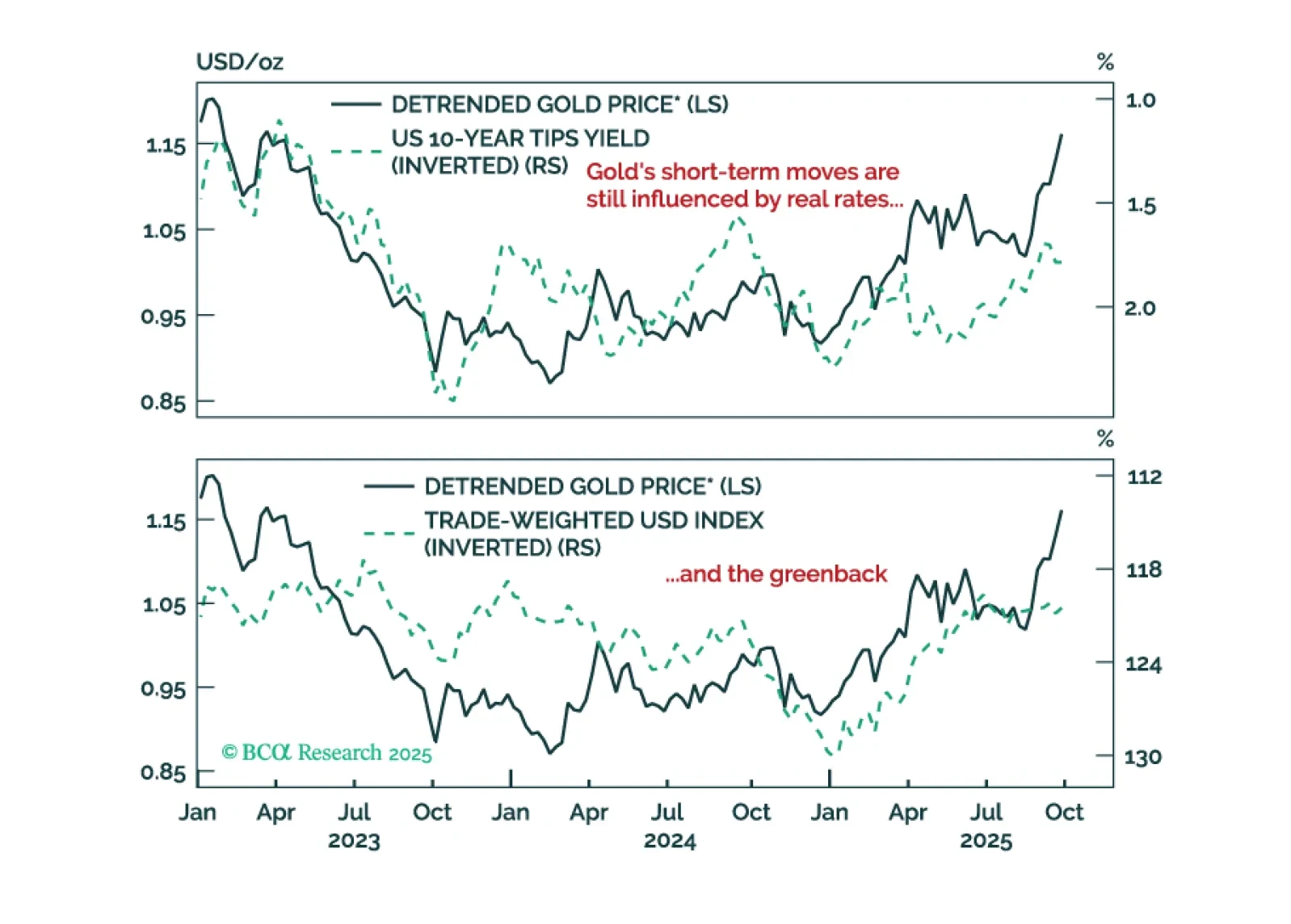

Commodity market breadth would need to improve for it to signal bullish conditions for the aggregate commodity complex. We maintain a defensive tilt within commodities, favoring precious metals over the more cyclically sensitive…

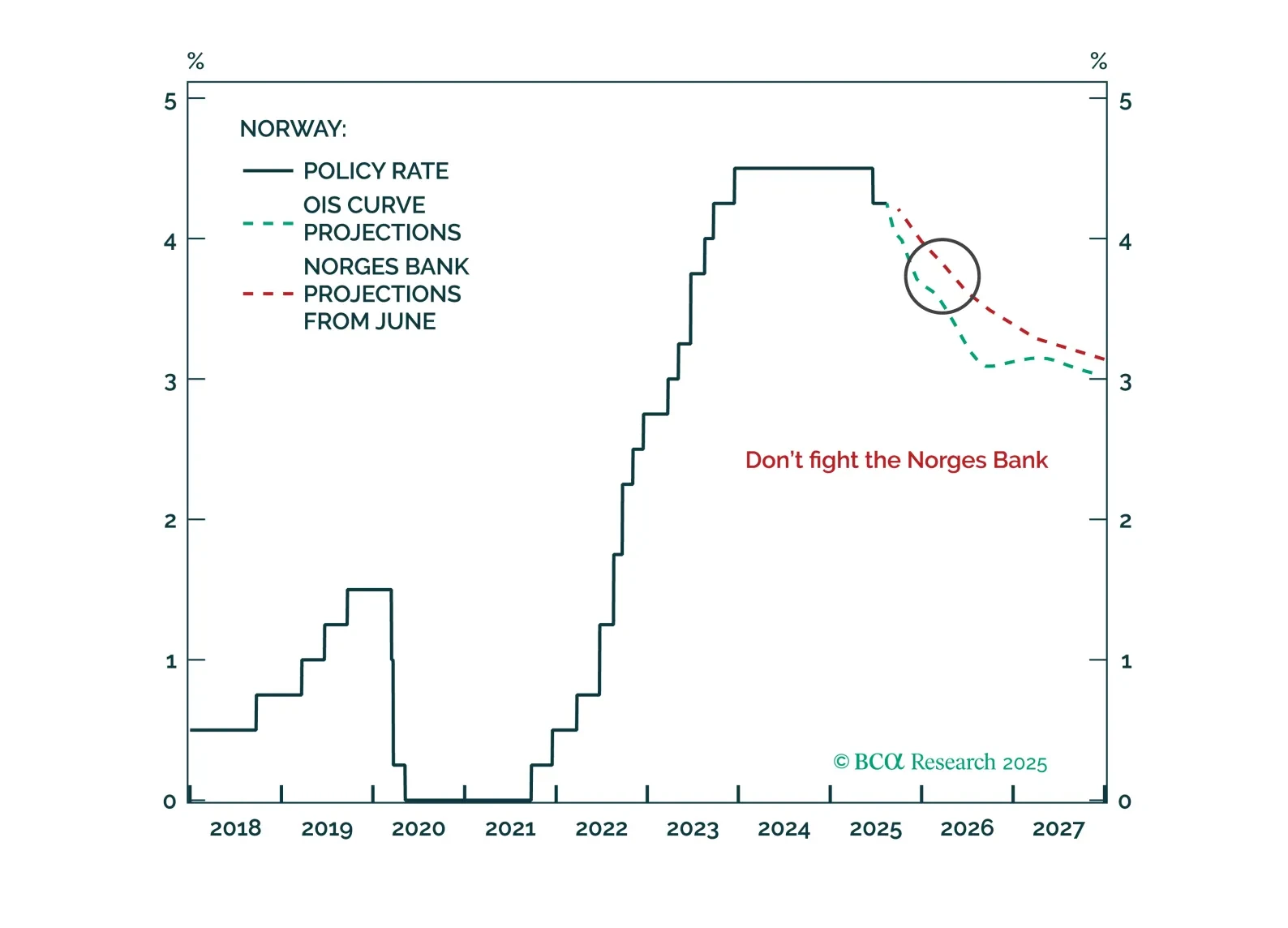

The Norges Bank will cut rates only once until year-end as the NOK weakens and inflation hovers around 3%. Expect aggressive easing next year as the economic recovery is delayed by weakness in the energy sector and the labor market…

Acute geopolitical risks, like a massive oil shock, may be abating. But structural geopolitical risk remains high and could upset a blithe market. Cyclical economic risks are underrated as the US slows down and China continues to…

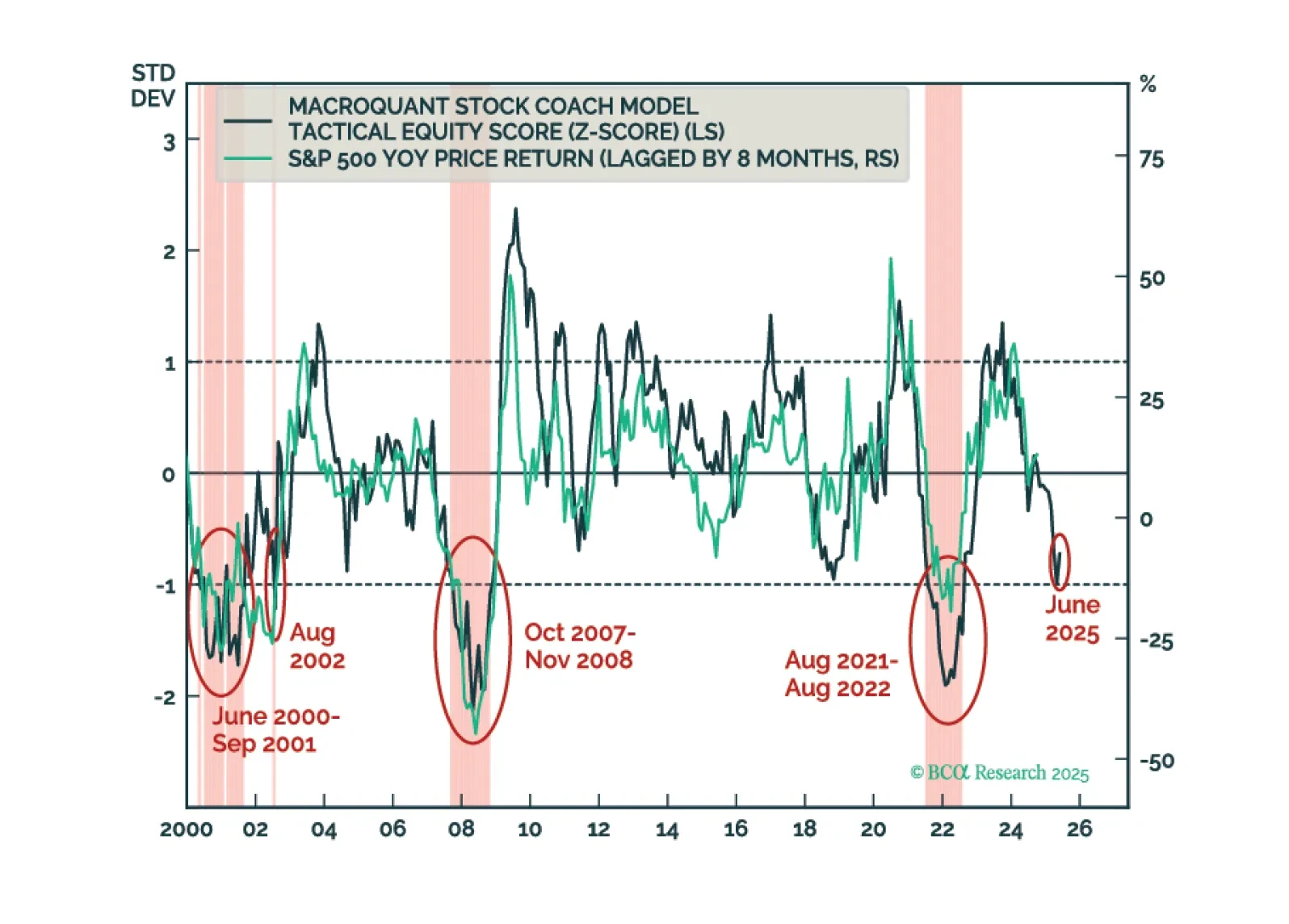

MacroQuant’s US equity z-score is dangerously close to the -1 threshold. Moves below that threshold have reliably coincided with equity bear markets in the past. As such, MacroQuant recommends an underweight on stocks, offset by an…

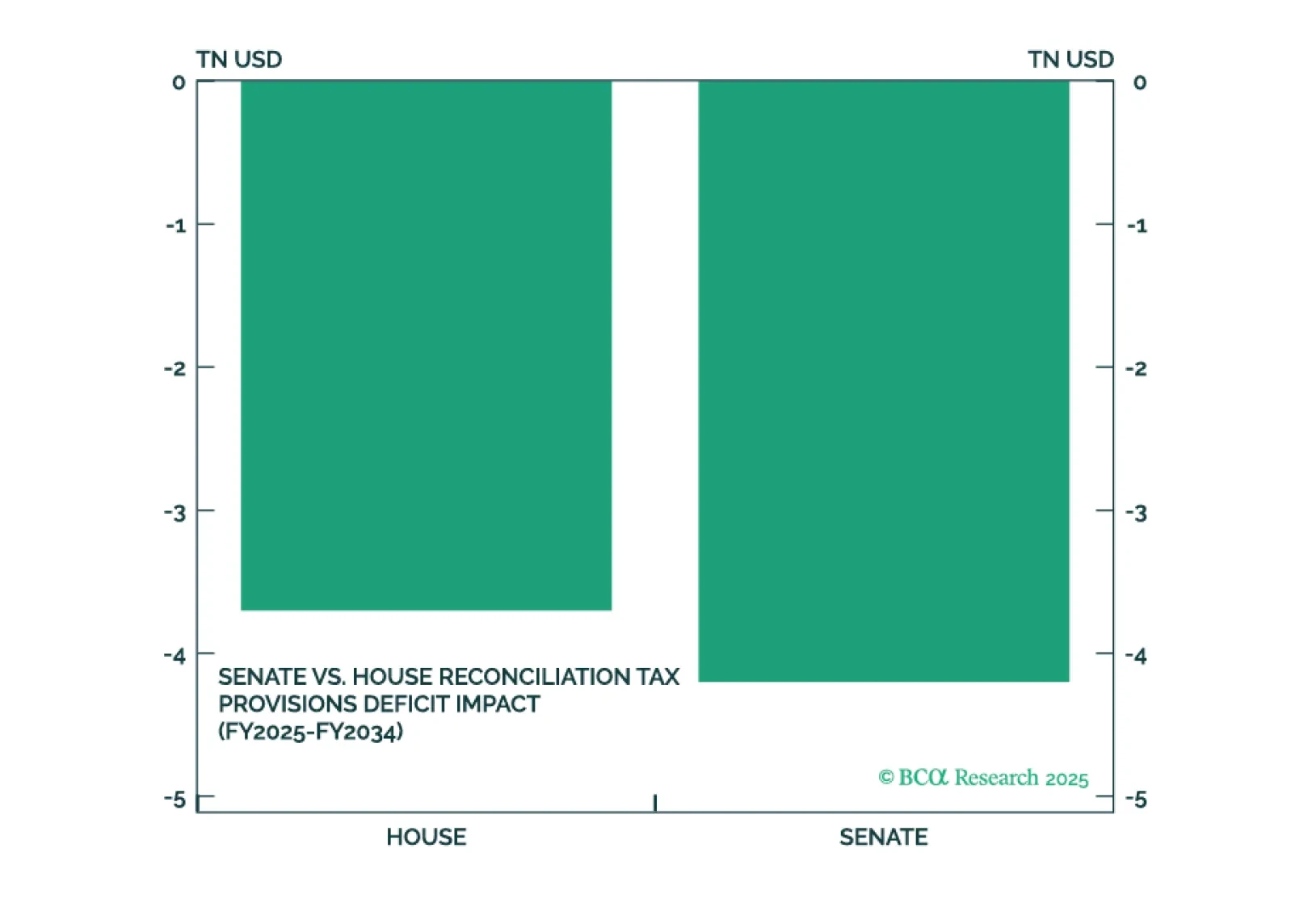

President Trump’s big beautiful bill will pass but faces near-term hurdles and will not tighten the government’s belt. It will combine with renewed tariff implementation to generate near-term risk for both the bond and stock market.…

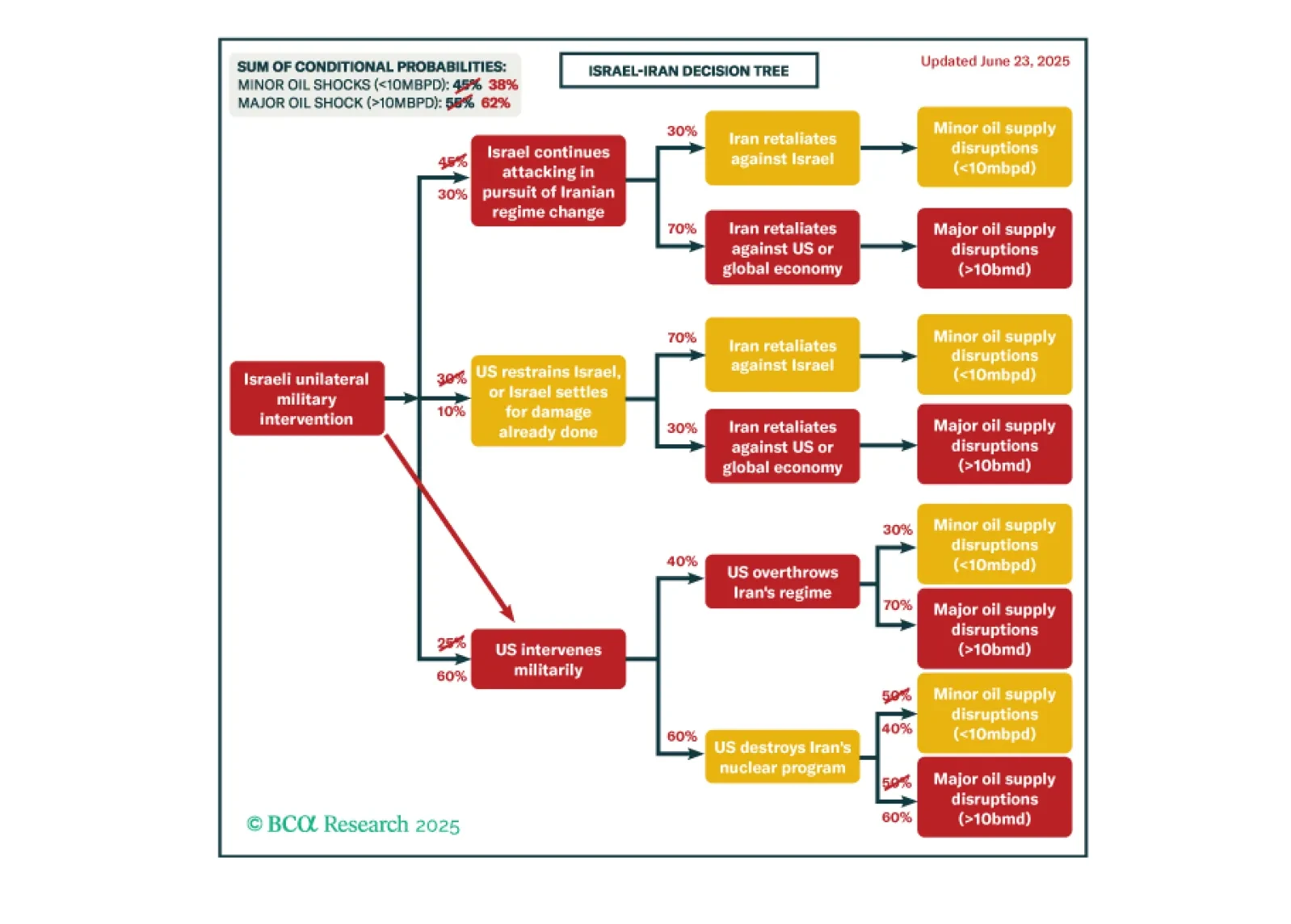

It is not yet clear that the Iran war is deescalating, despite the best efforts of global financial markets to dismiss its significance. True, Iran’s missile attacks on US military bases in Qatar and Iraq appear ineffectual as we go to…

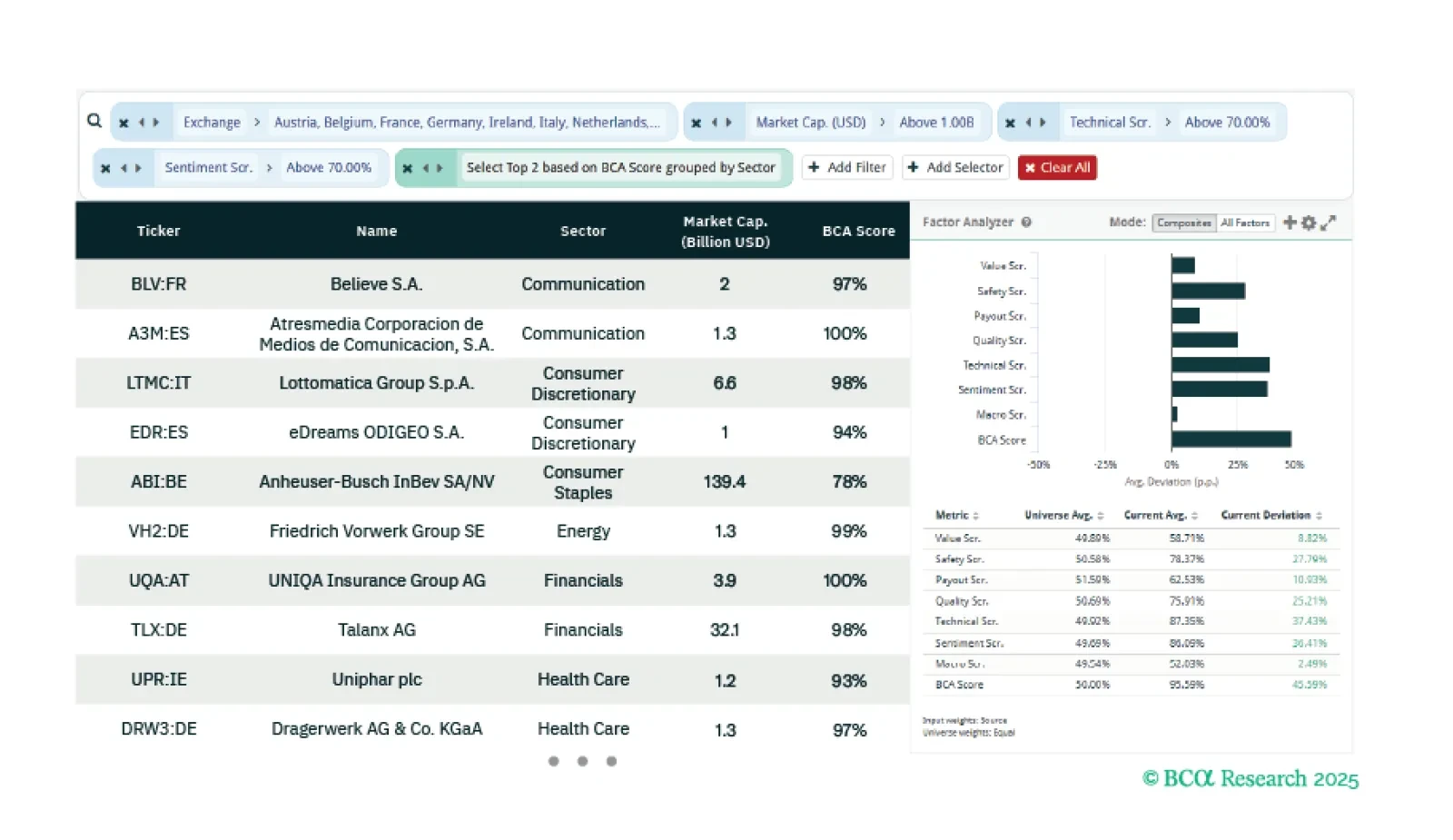

This week our three screeners explore: Equity trades across the Euro Zone focusing on Technicals and Sentiment; US Oil, Gas and Fuel stocks; and European Small Caps.