In Section I, we discuss why the rally in stock prices over the past month reflects the soft-landing view, and why that is not a likely economic outcome. US inflation is slowing, but target inflation remains elusive. Meanwhile,…

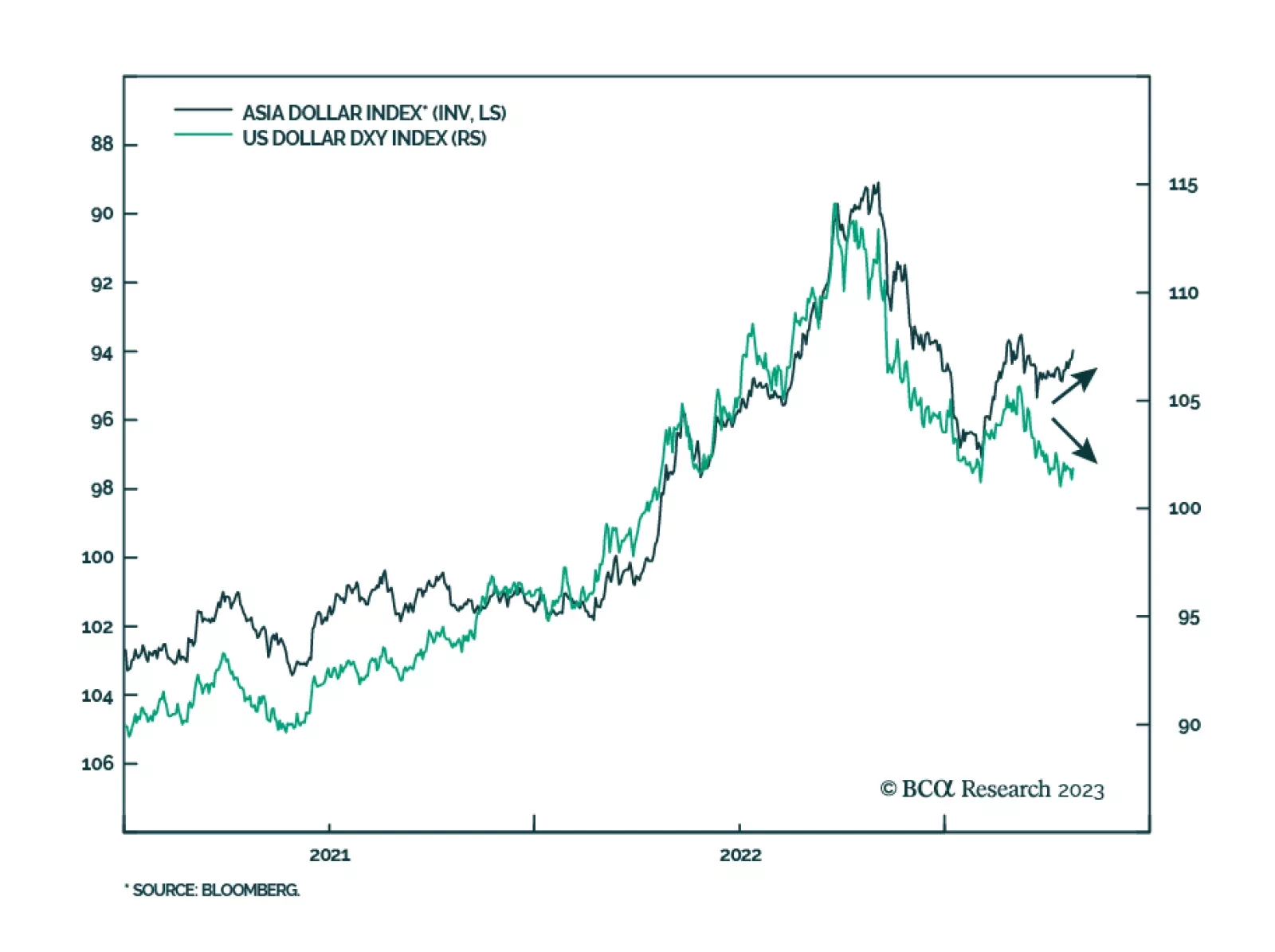

The performance of Asian currencies – proxied by the ADXY index – is typically a mirror image of the DXY index. This is not surprising. After all, Asian currencies benefit from broad-based dollar weakness. However…

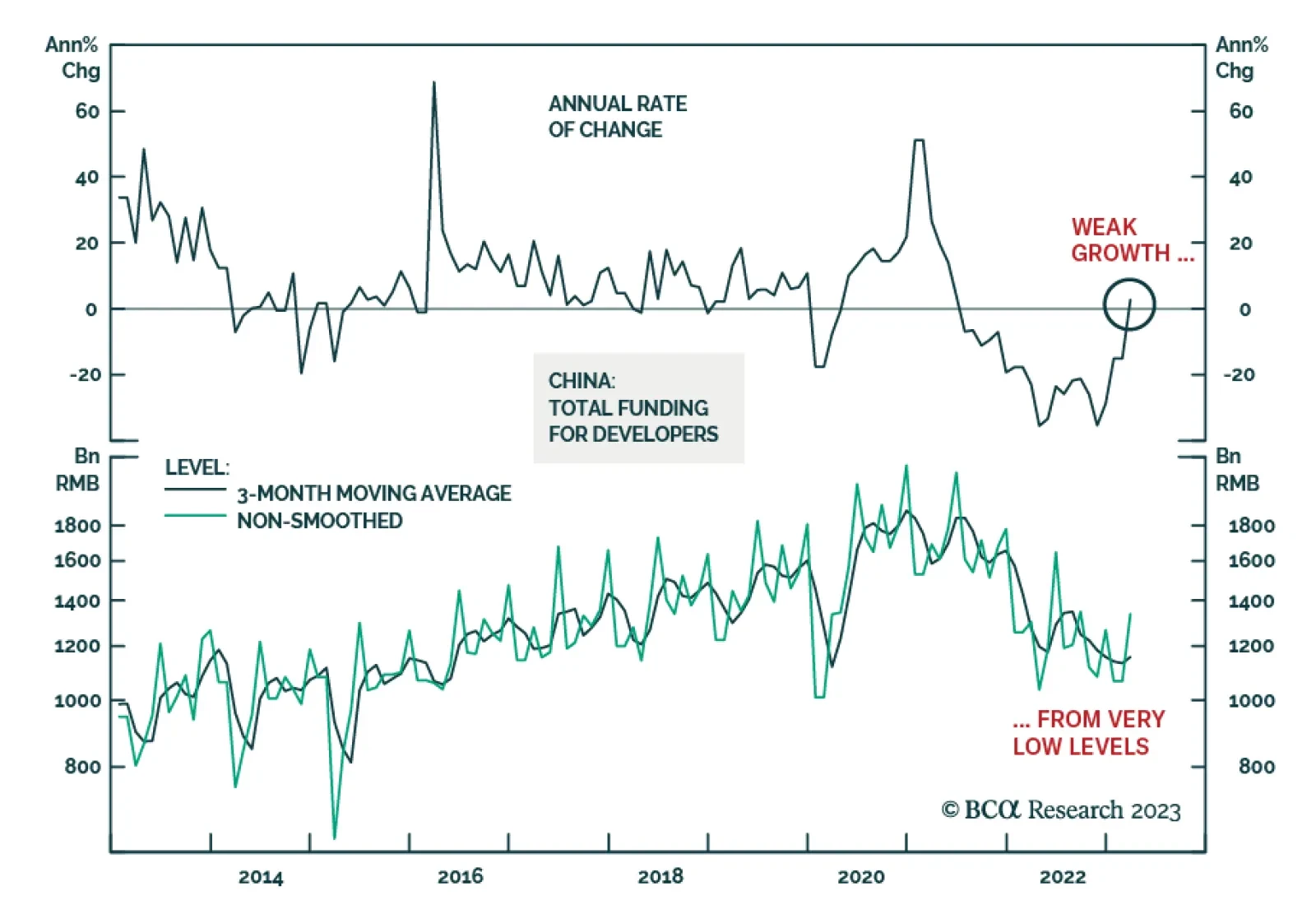

According to BCA Research’s China Investment Strategy service, China’s property market indicators show signs of stabilization, and further mild improvement in the coming months is likely. However, a strong recovery is…

We are increasing our gold price target to $2,200/oz, given the increasing risk of fiscal dominance in the US, rising geopolitical risk, the return of trading blocs and currency debasement risk. These risks also will increase…

Typically, emerging market equities outperform when the US dollar is soft. But that has not been the case in the past month. Although the broad trade weighted US dollar has relapsed, EM stocks have continued underperforming their…

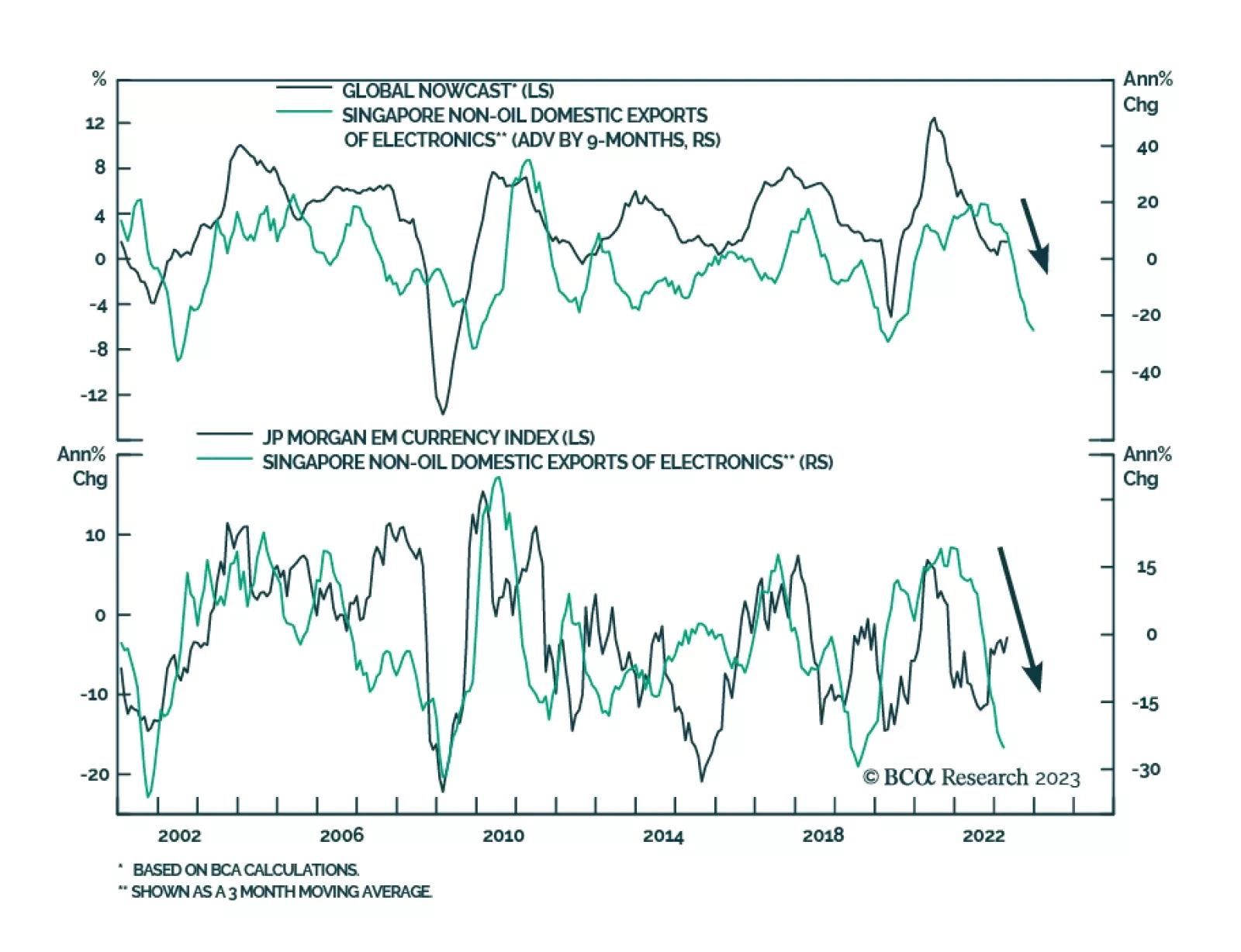

In a recent Insight we highlighted that Chinese exports unexpectedly rebounded in March. To the extent that Chinese export growth suggests that global demand for manufactured goods is recovering, it poses a risk to our view that…

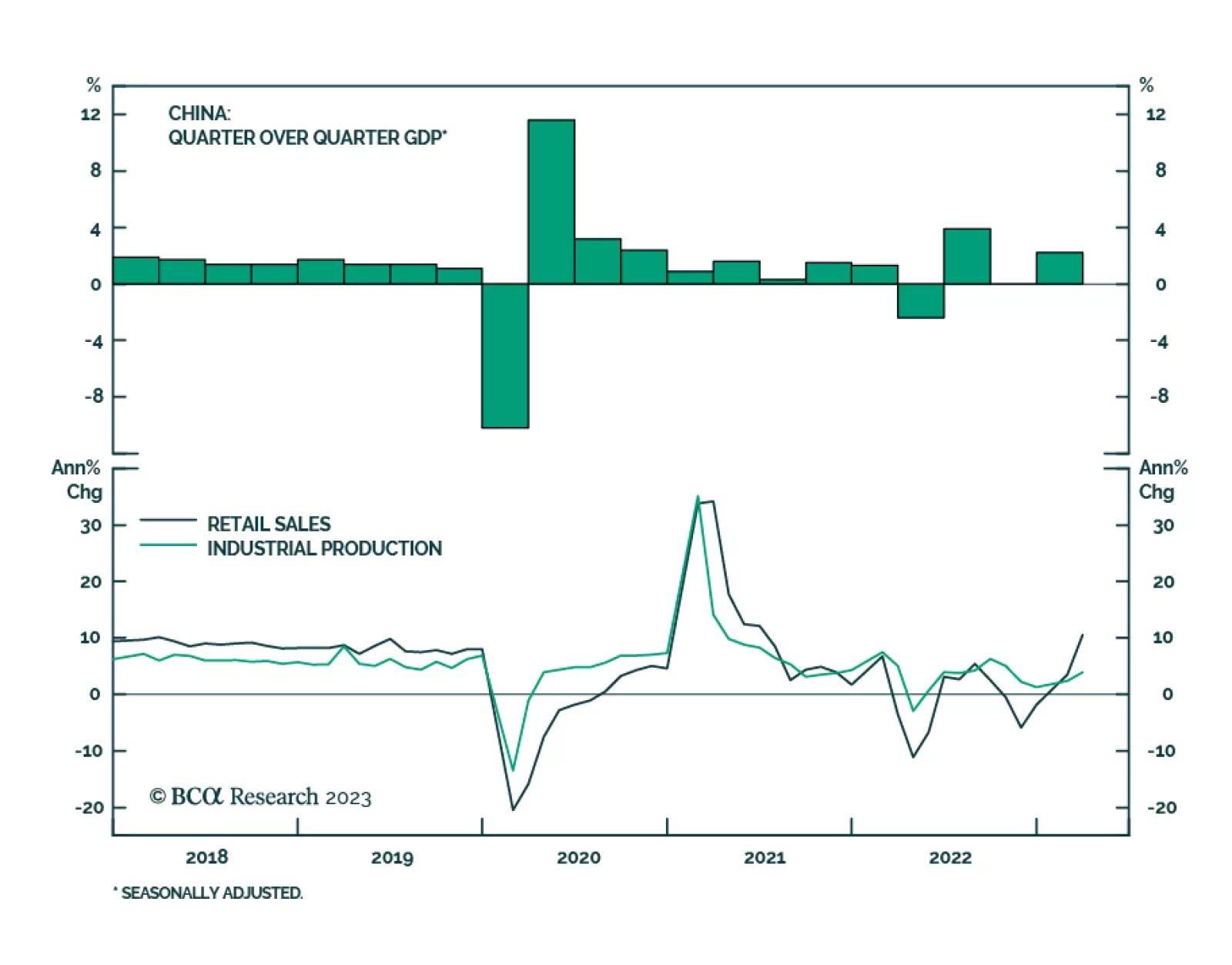

China’s economic data sent a positive signal about the domestic recovery following the dismantling of pandemic restrictions. GDP growth accelerated from 2.9% y/y in Q4 2022 to 4.5% y/y in Q1 2023, marking the fastest…

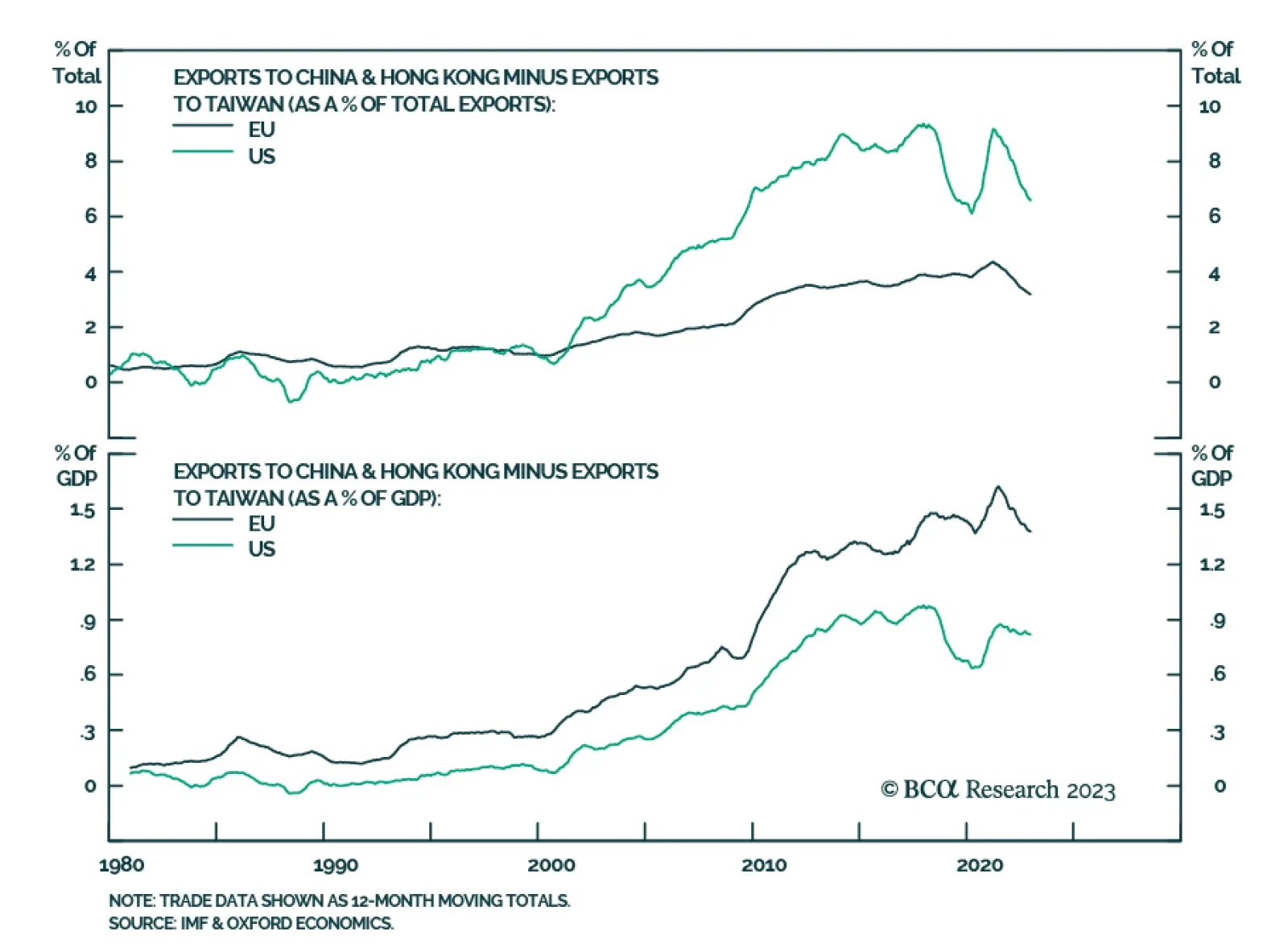

The reason why the EU will try to balance economic ties with China along with defense ties with the US for as long as possible is not strictly economic. Europe and the US are much more reliant on China than Taiwan for trade, but…